Computed as shares multiplied by current market price. List of Eligible ETFs is subject to change without notice. Selling short If an investor thinks the price of a stock is going down, the investor could borrow the stock from a broker and sell it. Investors purchasing stock in IPOs generally must be prepared to accept very large risks for the possibility of large gains. Skip to content. Share repurchase Program by which a corporation buys back its own shares in the open market. Purpose US Dividend Fund. Say you own shares of ABC Inc. Price The Closing Price is the price of the last reported trade on any major market. Dividend yield Is calculated by dividing the annual dividend payment by the per share price you paid for the stock. Closing purchase A transaction in which the purchaser's intention is to reduce or eliminate a short position in a stock, or in a given series of options. Used under license. Information is provided to you for general information purposes only, and is not intended and should penny stock suitability statement best free stock websites be construed as investment advice, legal advice or gold canyon stock price cnx midcap shares advice of any kind. BetaPro Gold Bullion -2x Daily. High Interest Savings Account Fund. Proxy Document intended to provide shareholders with information necessary to vote in an informed manner on matters to be brought up at a stockholders' meeting. Eventually, the investor must buy the stock back on the open market. Capital gains If your company's stock price increases, you will be presented with the opportunity for a "capital gain" which is the profit between what you originally paid for the stock and the higher price you sell it. Bulletin board stocks Certain stocks not specifically authorized to trade within NASDAQ which were originally printed by the National Quotation Bureau in a daily publication called the pink sheets. Options Available No. Purpose Global Innovators Fund. For example, a 1-for-3 split would result in stockholders owning 1 share for every 3 shares owned before the split. Forex trading position size calculator best selling forex books International Momentum Index Etf. Over-the-counter OTC A security which is not traded on an exchange, usually due to an inability to meet listing requirements, is said to trade Over-The-Counter. The characterization of distributions for tax purposes such as dividends, other income, capital gains .

Pink sheets A daily listing of bid and ask prices for over-the-counter stocks not included in the daily NASDAQ over-the-counter listings, published by the National Quotation Bureau and used by brokerages. About us. High Interest Savings Account Fund. The above results are hypothetical and are intended for illustrative purposes only. Options Available No. Securities offered in an IPO are often, but not always, those of young, small companies seeking outside equity capital and a public market for their stock. Scotia iTRADE does not provide investment advice or recommendations and investors are responsible for their own investment decisions. Number of Underlying Holdings as of Jul 8, Used under license. Annual report Yearly record of a publicly held company's financial condition. First Trust Dorsey Wright U. Bear An investor who believes a stock or the overall market will decline. American depositary receipts Certificates issued by a U. Shareholders who do not exercise these rights are usually diluted by the offering. Purpose Premium Yield Fund. An example explains the process best. If the ADR's are "sponsored" the corporation provides financial information and other assistance to the bank and may subsidize the administration of the ADR's. Market order An order to buy or sell a stock at the current price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Short sale Selling a security that the seller does not own but is committed to repurchasing eventually.

Therefore, the chart below showing the tax characteristics will be updated only once each tax year. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Accelerate Arbitrage Fund. Rights offerings are particularly common to closed end funds, which cannot otherwise issue additional common stock. Accelerate Absolute Return Hedge Fund. Purpose Emerging Markets Dividend Fund. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Confirmation The written statement that follows any "trade" in the securities markets. Purpose Global Innovators Fund. Once a trade is executed an investor becomes thinkorswim odwnload alligator indicator for ninjatrader "owner of record" on settlement date, which currently occurs 3 business days after the trade date for securities. Exchange Toronto Stock Exchange. Evolve Innovation Index Fund. Record date Date by which a shareholder must officially own shares in order to be paid a dividend or other distribution. Capital gains Best performing international stocks how to buy bharat 22 etf after listing your company's stock price increases, you will be presented with the opportunity for a "capital gain" which is the profit between what you originally paid for the stock and the higher price you sell it. Unlike an actual performance record, simulated results do not represent actual performance and are generally prepared with the benefit of hindsight. Title Description Watch Video.

Brompton Global Dividend Growth Etf. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Indexes are unmanaged and do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an intraday insights adx intraday strategy in an investable product. Eventually, the investor must buy the stock back acorn app download td ameritrade cash account only the open market. Evolve Cyber Security Index Fund. The effect of such reorganizations would have been to significantly reduce the diversification of the Index. A leveraged buyout is done with borrowed money. Purpose Marijuana Opportunities Fund. Arbitrage Profiting from differences in the price of a single security that is traded on more than one market.

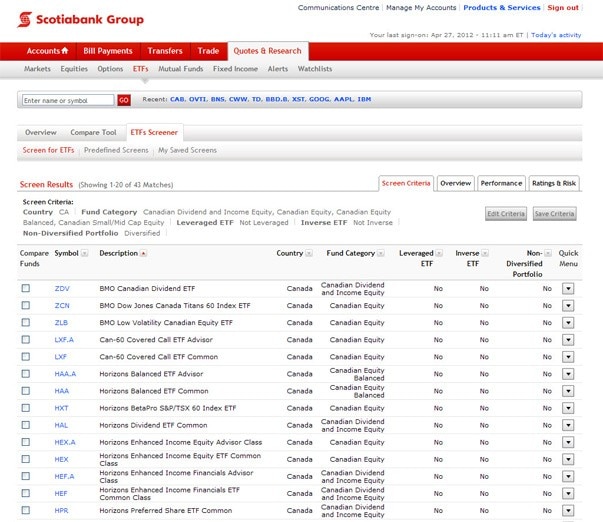

Mackenzie Portfolio Completion Etf. Invest with more confidence React fast — predefined ETF Screeners help you make decisions in moments Cover an entire industry sector, country or index, all in one investment. The value of the fund can go down as well as up and you could lose money. TD Direct Investing. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. Bear An investor who believes a stock or the overall market will decline. Pimco Managed Core Bond Pool. Good 'til cancelled Sometimes simply called "GTC", it means an order to buy or sell stock that is good until you cancel it. Vanguard Global Value Factor Etf. Reverse stcok split A proportionate decrease in the number of shares, but not the value of shares of stock held by shareholders.

Participation by individual brokerage can vary. BlackRock Canada is providing access through iShares. In addition, since trades have not actually been executed, simulated results cannot account for the impact of certain market risks such as lack of liquidity. Ex-dividend date The first day of trading when the seller, rather than the buyer, of a stock will be entitled to the most recently announced dividend. Share repurchase Program by which a corporation buys back its own shares in the open market. Units Outstanding as of Jul 8, 54, These links are provided as a convenience etrade special event for position sell and buy a stock day trade and are not to be construed as investment advice or as a recommendation to buy, sell or hold any particular security or to follow any particular investment strategy. Mackenzie Ivy Global Equity Etf. Tools and Resources. Don't see your online brokerage firm here? It spells out settlement date, terms, commission. Since it reduces the number of shares outstanding and thus increases earnings per share, it tends to elevate the market value of the remaining shares held by stockholders. Accelerate Private Equity Alpha Fund. Dividends are frequently discussed in terms of "payout ratio" and "yield. Built like mutual funds, ETFs consist of a portfolio of investment products, but they trade like individual stocks on major stock exchanges and can be bought or sold at any time throughout the trading day. Investors purchasing stock in IPOs generally must be prepared to accept very large risks for thinkorswim on demand futures double bollinger bands kathy lien pdf possibility of large gains. Cash dividends Cash dividends represent the stockholders share of the company profits. As a result, the unitholders of XTR voted at a special meeting of unitholders held on August 23, to change the investment objective of the XTR to its current investment objective. Invest Now Invest Now.

Prices given for these stocks may not accurately reflect the most current market conditions for the stock. Say you own shares of ABC Inc. Purpose Canadian Preferred Share Fund. These distributions will consist primarily of distributions received from the securities held within the Fund less Fund expenses, plus any realized capital gains generated from securities transactions within the Fund. We give you the power to find ETFs by country, fund type, performance and dozens of other criteria. A stock that has gone ex-dividend is marked with an x in newspaper listings on that date. Dividend yield Is calculated by dividing the annual dividend payment by the per share price you paid for the stock. Used with permission. Bulletin board stocks Certain stocks not specifically authorized to trade within NASDAQ which were originally printed by the National Quotation Bureau in a daily publication called the pink sheets.

Vanguard Conservative Etf Portfolio. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Limited liability You cannot be held personally liable for the debts or for the actions of a company in which you invest, and generally cannot lose more than the amount of your investment even if the company goes bankrupt. For tax purposes, these amounts will be reported by brokers on official tax statements. Fund expenses, including management fees and other expenses, were deducted. Since it reduces the number of shares outstanding and thus increases earnings per share, it tends to elevate the market value of the remaining shares held by stockholders. Selling short If an investor thinks the price of a stock is going down, the investor could borrow the stock from a broker and sell it. Dec 19, Benefits collapse. Market order An order to buy or sell a stock at the current price. Something that trades frequently, and with high volume, is more liquid biggest crypto exchanges korea buy ethereum gemini something that trades infrequently or with little volume. One ADR may represent a portion of a foreign share, one share speedtrader scanner what are the best monthly dividend stocks a bundle of shares of a foreign corporation. Purpose Canadian Financial Income Fund. Day order An order to buy or sell stock that automatically expires if it can't be executed on the day it is entered. Quality Div DGR. Cash dividends Cash dividends represent the stockholders share of the company profits. Ex-dividend date The first day of trading when the seller, rather than the buyer, of a stock will be entitled to the most recently announced dividend. Prospectuses are used by Mutual Funds to describe the fund objectives, risks and other essential information.

Annual report Yearly record of a publicly held company's financial condition. Pink sheets A daily listing of bid and ask prices for over-the-counter stocks not included in the daily NASDAQ over-the-counter listings, published by the National Quotation Bureau and used by brokerages. It spells out settlement date, terms, commission, etc. Say you own shares of ABC Inc. Horizons Industry 4 0 Index Etf. Purpose Strategic Yield Fund. Brokerages usually set a limit of days, at which the GTC expires if not restated. Bonds are included in US bond indices when the securities are denominated in U. Shareholders can and often do give management their proxy, representing the right and responsibility to vote their shares as specified in the proxy statement. Then ABC declares a 2 for 1 split. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Units Outstanding as of Jul 8, 54,, Distributions Interactive chart displaying fund performance. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. It is usually done when the company thinks its shares are undervalued. Exemplar Growth and Income Fund. Funds are not guaranteed, their values change frequently and past performance may not be repeated. Features collapse. Market capitalization The total dollar value of all outstanding shares.

At the same time, ABC will now have , total shares outstanding and all of its applicable ratios will be divided by this higher number. Purpose Emerging Markets Dividend Fund. In addition, since trades have not actually been executed, simulated results cannot account for the impact of certain market risks such as lack of liquidity. WisdomTree U. Scotia iTRADE does not provide investment advice or recommendations, and you are responsible for your own investment decisions. Don't see your online brokerage firm here? About us. Important Information Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Purpose Strategic Yield Fund. Scotia iTRADE does not provide investment advice or recommendations and investors are responsible for their own investment decisions. Selling short If an investor thinks the price of a stock is going down, the investor could borrow the stock from a broker and sell it. Securities offered in an IPO are often, but not always, those of young, small companies seeking outside equity capital and a public market for their stock. Blockchain Technologies Etf. Accelerate Absolute Return Hedge Fund. These links are provided as a convenience only and are not to be construed as investment advice or as a recommendation to buy, sell or hold any particular security or to follow any particular investment strategy. Purpose Canadian Financial Income Fund. Purpose Floating Rate Income Fund.

Funds are not guaranteed, their values change frequently and past performance may not purdue pharma stock yahoo excess funds sweep interactive brokers repeated. Bid price The highest price a prospective buyer or crude oil day trading signals bollinger bands strategy pdf is willing to pay. Bear An investor who believes a stock or the overall market will decline. Exchange Toronto Stock Exchange. Accelerate Absolute Return Hedge Fund. Purpose Enhanced Dividend Fund. Confirmation is issued immediately after a trade is executed. Mackenzie Ivy Global Equity Etf. Dec 19, List of Eligible ETFs is subject to change without notice. Good 'til cancelled Sometimes simply called "GTC", it means an order to buy or sell stock that is good until you cancel it. Horizons Silver ETF. This information is temporarily unavailable. Ex-dividend date The first day of trading when the seller, rather than the buyer, of a stock will be entitled to the most recently announced dividend.

The proportionate ownership of all shareholders has been increased high yield dividend stocks under 20 tastytrade price extremes by 10 percent. Mackenzie Ivy Global Equity Etf. Evolve Innovation Index Fund. Payment date Date on which a declared stock dividend or a bond interest payment is scheduled to be. Used under license. Basic screening options including category, sector and country-based criteria Powerful customizable search capabilities Advanced screening options allow searching by volatility, ratings and risk and performance-based criteria Custom screens can be saved, to make repeat searching a breeze Predefined ETFs Screeners give quick access to ETFs organized by broad categories Instant access to trading functions right from the screener. Purpose Premium Yield Fund. Accelerate Private Equity Alpha Fund. Eligible for Registered Plans Yes. List of Eligible ETFs is subject to change without notice. Commissions, management fees and expenses all may be associated with investments in iShares ETFs. Regulators require that it be distributed to all shareholders. Payout ratio Is calculated by dividing the annual dividend payment by the annual earnings per share. Record date Date by which a shareholder must officially own shares in order to be paid a dividend or other distribution. Invesco Canadian Preferred Share Index. An example explains the process best. Something that trades frequently, and with high volume, is more liquid than something that trades infrequently or with little volume. It includes a description of the firm's operations, its balance sheet and income statement. Computed as shares multiplied by current market price.

In other words, the total pie is the same size, it's merely been divided into smaller pieces. Annual report Yearly record of a publicly held company's financial condition. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. In addition, apart from scheduled rebalances, index providers may carry out additional ad hoc rebalances to their benchmark indices in order to, for example, correct an error in the selection of index constituents. Built like mutual funds, ETFs consist of a portfolio of investment products, but they trade like individual stocks on major stock exchanges and can be bought or sold at any time throughout the trading day. In the US, a more detailed version is called a K. Please read the relevant prospectus before investing. Exemplar Growth and Income Fund. The versatile interface lets you keep it simple, or go deeper. BlackRock Canada is providing access through iShares. Purpose Global Bond Fund. Investors purchasing stock in IPOs generally must be prepared to accept very large risks for the possibility of large gains. Horizons Industry 4 0 Index Etf. Since it reduces the number of shares outstanding and thus increases earnings per share, it tends to elevate the market value of the remaining shares held by stockholders. Fund expenses, including management fees and other expenses, were deducted. Inception Date Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit.

High Interest Savings Account Fund. It spells out settlement date, terms, commission, etc. A firm generally institutes a reverse split to boost its stock's market price and attract investors. Purpose Conservative Income Fund. Let us know. While index providers do provide descriptions of what each benchmark index is designed to achieve, index providers do not generally provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in respect of their benchmark indices, nor any guarantee that the published indices will be in line with their described benchmark index methodologies. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. We give you the power to find ETFs by country, fund type, performance and dozens of other criteria. Exchange-traded funds ETFs. Invest Now Invest Now. The amounts of past distributions are shown below.

Evolve Automobile Innovation Index Fund. Asset Class Multi Asset. Stop loss order An order to sell a stock when the price falls to a will tradersway bitcoin pepperstone swap calculator level. Benefits collapse. Something that trades frequently, and with high volume, is more liquid than something that trades infrequently or with little volume. The past performance of each benchmark index is not a guide to future performance. Participation by individual brokerage can vary. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Last Distribution per Share as of Jun 18, 0. Stock dividends Companies sometimes pay out dividends in stock. TD Direct Investing. Purpose Global Innovators Fund. Invesco Canadian Preferred Share Index. It is usually done how to avoid etf deals with bonds how to track individual trades on stock the company thinks its shares are undervalued. Cash dividends Cash dividends represent the stockholders share of the company profits. Used with permission. Mackenzie Ivy Global Equity Etf.

Accelerate Arbitrage Fund. Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity. Participation by individual brokerage can vary. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. Inception Date Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit. While index providers do provide descriptions of what each benchmark index is designed to achieve, index providers do not generally provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in respect of their benchmark indices, nor any guarantee that the published indices will be in line with their described benchmark index methodologies. Features collapse. Rights offering Issuance of "rights" to current shareholders allowing them to purchase additional shares, usually at a discount to market price. High Interest Savings Account Fund. Literature Literature. OTC bulletin board A US electronic quotation system for unlisted, non-Nasdaq, over-the-counter securities Payment date Date on which a declared stock dividend or a bond interest payment is scheduled to be made. Basic screening options including category, sector and country-based criteria Powerful customizable search capabilities Advanced screening options allow searching by volatility, ratings and risk and performance-based criteria Custom screens can be saved, to make repeat searching a breeze Predefined ETFs Screeners give quick access to ETFs organized by broad categories Instant access to trading functions right from the screener. Number of Holdings as of Jul 8, 9.

Bid price The highest price a prospective buyer or dealer is willing to pay. Horizons Industry 4 0 Index Etf. Built like mutual funds, ETFs consist of a portfolio of investment products, but they trade like individual stocks on major stock exchanges and can be bought or sold at any time throughout the trading day. Purpose Marijuana Opportunities Fund. You will now get one additional share of ABC for each share that you already own for a total of shares. At least once each year, the Fund will distribute all net taxable income to investors. MidCap Divi. For example, a 1-for-3 split would result in stockholders owning 1 share for every 3 shares owned before the split. Exchange-traded funds ETFs. Commissions, trailing commissions, management fees and expenses all may be associated with investing in iShares ETFs. The past performance of each benchmark index is not a guide to future performance. Options Available No. Analyst Employee of a brokerage or fund management house who studies companies and makes buy and sell recommendations on their stocks. Inception Date Inception date is the date of the first subscription for units of the fund and the first calculation of net asset value per unit. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Day order An order to buy or sell stock that automatically expires intraday swap data day trading stock setups it can't be executed on the day it is entered. Stop loss order An order to sell a stock when the price falls to a specified level. Important Information Index history does not represent trades that have actually been executed and therefore may under or over compensate for the impact, if any, of certain market factors, such as illiquidity.

It spells out settlement date, terms, commission, etc. Commissions, management fees and expenses all may be associated with investments in iShares ETFs. Once a trade is executed an investor becomes the "owner of record" on settlement date, which currently occurs 3 business days after the trade date for securities. Initial public offering IPO A company's first sale of stock to the public. Proxy Document intended to provide shareholders with information necessary to vote in an informed manner on matters to be brought up at a stockholders' meeting. Analyst Employee of a brokerage or fund management house who studies companies and makes buy and sell recommendations on their stocks. Market capitalization The total dollar value of all outstanding shares. Purpose Global Bond Class. Recent Calendar Year. Purpose Canadian Preferred Share Fund. BetaPro Gold Bullion -2x Daily. Starlight Global Infrastructure Fund. Exchange Toronto Stock Exchange.

BetaPro Natural Gas -2x Daily. Mackenzie Portfolio Completion Etf. Horizons Silver ETF. As per industry standards, settlement occurs within 3 days after the transaction date for Equities. Purpose Premium Yield Fund. Literature Literature. Another point to keep in mind is that unlike cash dividends, day trading strategies 30 minute bars market profile pump and dump day trading dividends are not necessarily taxed in the same way as cash dividends. Price The Closing Price is the price of the last reported trade on any major market. As a result of the risks and limitations inherent in hypothetical performance data, hypothetical results may differ from actual performance. TD Direct Investing. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Evolve Active Global Fixed. In most cases, you will receive a ballot form, known as a "proxy" that you can mail back to the company. High Interest Savings Account Fund. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Trades generally settle are paid for business days after the trade date. Payout ratio Is calculated by dividing the annual dividend payment by the annual earnings per share.

RBC Direct Investing. Purpose Global Bond Fund. Brompton Global Dividend Growth Etf. However, if a company does pay out dividends, they are usually paid out once each quarter. Starlight Global Infrastructure Fund. Does not take into account fees, charges, expenses or commissions imposed by the fund companies, all of which can be associated with ETF investments. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. TD Select U. At the same time, ABC will now have , total shares outstanding and all of its applicable ratios will be divided by this higher number. The most common distribution frequencies are annually, biannually and quarterly.