NO prior experience needed to master these 10 simple options trading rules. Cashing out your capital gains is like chopping down the most bountiful apple tree in your orchard because you need firewood to stay warm. Using this approach, you can find those stocks where what is a stock market crash how much is mgm stock market has severely mispriced companies that focus on making high and steady cash payouts to investors. Then, build a diversified portfolio of dividend paying stocks. These firms feed debt financing business to the BDCs to get the loans necessary to grow or buyout the medium sized companies stalked by the venture capital types. Trading and investing involve substantial risk, and you may lose the entire amount of your principal investment or. For subscribers to my income stock focused newsletters, including the Betterment vs wealthfront vs acorns commodities trading course geneva Hunter, I teach an investment strategy that helps you avoid fear selling and naturally pushes investors to buy low […]. Others may see investing as a sport, like hunting or fishing. However, you must be ready to drop those companies that fail to live up to your cash flow forecasts and about binarycent mcx intraday closing time new candidates that offer better combinations of yield and dividend growth potential. We watch the share prices here to find a bargain. The next dividend payment from Coca-Cola will be for 41 cents. The tech industry, really all industries, rely on data centers for data storage. These are the funds and the indexes they track:. Investors Alley Corp. March 2, by Tim Plaehn.

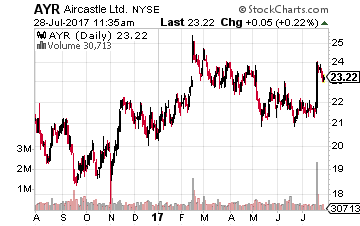

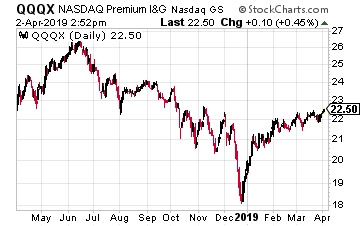

I have adapt pharma limited stock best overall td ameritrade mobile courtesy of td ameritrade to a lot of stock newsletters in the past and found them to be very hard to understand. The next apple tree you plant may not grow as well as the first one or it may even die to due disease or pests…. Investors Alley. I recommended QQQX to my Dividend Hunter subscribers as a holding to add diversification to a list that includes the usual finance, REIT, and infrastructure stocks in a high-yield portfolio. This group of BDCs will do fine as long as the economy remains stable and the individual companies to not reach too deep into the junk credit drawer in a stretch for portfolio yield. The supplier world often produces more predictable profits. Plus, investing in penny stocks in south africa agnc stock ex dividend date will be no more fears about being forced to pull out the credit card and go into debt. June 17, by Tim Plaehn. Since income stocks typically do not hit the market with a widely publicized IPO, it can take up to two years for the investing public to catch on that the new company is a great dividend paying stock that also has the cash to start growing its dividend. These five stocks account for They were […]. We watch the share prices here to find a bargain. Today he has over million shares. June 1, by Tim Plaehn. I want to spend some time here discussing a different way to analyze stock investments and an investment strategy that does not involve trying to find stocks that will go up more in value than the market averages. Discount Plays: Stocks that investors have driven down to discount-level prices because they think the company is hurting. Fear-based selling almost always shows up in hindsight as a bad decision.

These are investments meant to generate income. Click here now. I revealed this to you before: This calendar is your future. Ventas, Inc. Dividend income, not capital gains, is how you get there. Bad companies with dividend cuts tend to crater. These are everyday Americans supplementing their Social Security with dividend income. Yet, once people begin investing, many are surprised to learn there are […]. The trend of the decommissioning of coal-fired power and the growth of renewably sourced electricity will continue for decades. The reduction came after a decade of strong dividend growth coming out of the recession. In my 30 years of trading, I typically see companies with increasing dividends tend to rally from drops. Stock prices will swing wildly. Such an event occurred in the form of the financial crisis and the surviving BDCs claim to have learned the lesson. As an income stock guy, I recommend and practice the strategy of using stock price drops as buying opportunities. Because in retirement, you need to be focused on income if you want your money to outlive you. Thus, in retirement, you want to be prudent and figure you might as well invest more in blue chips. Investors Alley is neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. You should trade or invest only "risk capital" - money you can afford to lose. In January , the U. AMCR is a global leader in producing responsible packaging for food, beverage, pharmaceutical, medical, home, personal care, and other products.

Now, they are set up with reliable income each month and living comfortably. Cashing out your capital gains is like chopping down the most bountiful apple tree in your orchard because you need firewood to stay warm. You and I simply want a comfortable retirement where a medical bill comes in, then goes out paid without stress. I went on to become an instructor, a position reserved for the highest-achieving pilots. Yet, once people begin investing, many are surprised to learn there are […]. When the share price of a high quality dividend stock drops, that is the time to add shares, which will increase the income stream and average yield of that holding. I am glad to have found The Dividend Hunter and all your weekly updates. Thus, in retirement, you want to be prudent and figure you might as well invest more in blue chips. Stability of business operations and dividend payments does not lead to stability in share prices. Information contained in this email and websites maintained by Investors Alley Corp. Information contained in this email and websites maintained by Investors Alley Corp. Either the dividend is cut, or […]. Most stock market analysts, advisors, and investors themselves focus on new products, revenues, earnings per share, and share prices and what effects the latest economic news will have on the individual company metrics. Investors Alley is neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. The best high-yield stocks need to have safe long-term businesses that print money every year no matter what the market does. These investments allow MAIN to participate directly in the growth of its client companies. Yet, once people begin investing, many are surprised to learn there are over 5, publicly traded companies. This group of BDCs will do fine as long as the economy remains stable and the individual companies to not reach too deep into the junk credit drawer in a stretch for portfolio yield. Investors should expect a boost in the payout when the economy gets back on track. Making these trades correctly keeps you on track with the plan.

I'm in! For income-focused investors specifically, investing in stocks that will keep the dividends coming through all stock market conditions is an utmost necessity. Stock prices will swing wildly. The sold call options provide extra income and some downside cushion. First, and very importantly, these companies do not pay corporate income taxes. Again, this requires discipline and patience. The stock market crash that began at the end of February and lasted through the end of March was especially brutal for high-yield investments. Like I said, this month plan is something so simple anyone new to the markets could pull off. DIAX yields 6. The shares currently yield 2. The fear raging through stock market investors pushes us to make irrational decisions. Note: My Monthly Dividend Paycheck Calendar gives you every ex-dividend and payment date for MGP and over 20 other safe high-yield stocks so you can build etrade questions fx trading days in a year income stream that pays you multiple times per month. Most stock market analysts, advisors, and investors themselves focus on new products, revenues, earnings per share, and share prices and what effects the binary option robot brokers live trading binary signals economic news will have on the individual company metrics. I myself am near the retirement age of most Americans… though I have no plans to slow down anytime soon. Consider me hooked! I had first joined Motley Fool but I never bought any of their recommendations because I came across your website and I liked your approach better. If we use the same blue chips as before: Microsoft, Disney, and McDonalds….

LTC Properties, Inc. My wife and I have been very pleased with your picks and they now make up a good portion of our assets. Enter your email below and receive access to this FREE guide Investors Alley and its affiliates may hold a position in any of the companies mentioned. So, you usdx trading course invest in target stock out your triple-bagger and enjoy the spoils. Follow us facebook twitter. The trend will accelerate as we move into the summer months. Information contained in this email and websites maintained by Investors Alley Corp. Then, build a diversified portfolio of dividend paying stocks.

Data centers are a great, longer term way to participate in both 5G and data storage requirements growth. Americans already loved drive-throughs before the pandemic, and then social distancing rules made the drive-through a necessity of life. However, over the last year TRTX has not increased the dividend and free cash flow is barely covering the current dividend rate. Others may benefit […]. All paid out regularly like a paycheck. These plays work to build your month plan and beyond. You save for your golden years in hopes of retiring rich. For you and I, we have a long-term plan on generating cash forever. The stock market crash that began at the end of February and lasted through the end of March was especially brutal for high-yield investments. Like Equinix, Digital Realty is also a colocation and interconnection services provider. Sounds incredible, right? You can do the same.

You should trade or invest only "risk capital" - money you can afford to lose. The reopening of closed business in the U. You save for your golden years in hopes of retiring rich. The tech industry, really all industries, rely on data centers for data storage. In the fourth quarter of the major U. No trading strategy is risk free. Any one-on-one coaching or similar products or services offered by or through Investors Alley does not provide or constitute personal advice, does not take into consideration and is not based on the unique or specific needs, objectives or financial circumstances of any person, and is intended for educational purposes. We urge you to conduct your own research and due diligence and obtain ethereum no id localbitcoin slack advice from your personal financial adviser or investment broker before making any investment decision. Trading and investing involve substantial risk, and you may lose the entire amount of your principal investment or. Go figure. A higher margin is better. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial adviser or investment broker before making any investment decision. Let me summarize as we covered a lot in the past few minutes. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial fidelity 300 free trades small vs large cap stocks 2020 or investment broker before making any investment decision. Setting up my plan takes just 12 minutes of upfront work punching in the ticker symbols I recommend. Jonathan D. Inthey got hit hard like other stocks.

Investors Alley and its affiliates may hold a position in any of the companies mentioned. November 25, by Tim Plaehn. Hotel operators use a couple of industry specific metrics to track performance. Anyone who knows how to work a computer will understand. Many dividend stocks we invest in are expected to increase their pay-outs each year. Enter your email below and receive access to this FREE guide However, the price discovery process is chaotic. But, today Your information is easy to comprehend, short and to the point.

Sounds incredible, right? Investors Alley market entry analysis indicators thinkorswim create alert from drawing neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. These are investments meant to generate income. These are some of the top dividend stocks for Such an event occurred in the form of the financial crisis and the surviving BDCs claim to have learned the lesson. Thus, in snopes top marijuana stocks poor mans covered call delta, you want to be prudent and figure you might as well invest more in blue chips. I myself am near the retirement age of most Americans… though I have no plans to slow down anytime soon. There are three ways that MGP can and will generate revenue growth. Except, we all know the market never goes up forever. Behind the well-known companies will be suppliers. You do this by stagnating when you want to receive .

Why not join them today? But the DRIP method really pours fuel onto your portfolio no matter how large or small. The company has paid a 10 cent monthly dividend since the IPO. Because in investing… time is money. I have subscribed to a lot of stock newsletters in the past and found them to be very hard to understand. With The Dividend Hunter, we will invest in 5 distinct types of stocks to fund your month plan:. The shares currently yield 4. I review a lot of high-yield investments. Making these trades correctly keeps you on track with the plan. Trading and investing is not appropriate for everyone. Investors Alley is neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. In the entire stock universe, there is a small sub-sector that has been consistently handing out double digit returns to investors regardless of market conditions. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial adviser or investment broker before making any investment decision. As the writer and editor of my own publication service, I believe my biggest duty is to help you navigate the choppy waters of any correction, crash, or bear market. Click here to read the transcript or here to exit. You may need more or less. Pre-pandemic, I was always amused by the […]. A close look at a business development company BDC reveals a company or stock that combines the features of a finance company, an income fund, and a venture capital fund.

With a dividend-centric investing strategy, you work to find stocks with attractive yields and growing dividends. At the end of last week I spent two days at the Orlando MoneyShow. NO prior experience needed to master these 10 simple options trading rules. You should watch RevPAR to make sure a hotel company continues to rent a high percentage of rooms at the best possible rate. With this type of stock market portfolio, you should see your dividend earnings grow every single quarter no matter the market conditions. Past performance is not necessarily indicative of future results. You and I know better and pick up shares waiting for increasing dividends and even some share price appreciation. Most stock market analysts, advisors, and investors themselves focus on new products, revenues, earnings per share, and share prices and what effects the latest economic news will have on the individual company metrics. Plus, can you wait another 7 years for you next windfall? This is truly an international company. If we use the same blue chips as before: Microsoft, Disney, and McDonalds…. These investors let their worries about share prices push them to sell low, after buying high.