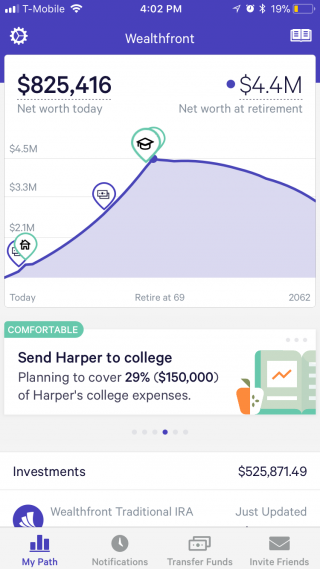

A custodian is a financial institution that holds your assets for safekeeping. How will my Roth IRA grow? The Roth IRA has income rules for contributions. Free management. Generally, creating a diversified investment portfolio means investing in a handful of mutual funds or exchange-traded funds, which, in turn, invest in a broad swath of stocks and bonds. Of course, those higher stock market returns come with the risk that, in any given year, your account may lose value. Betterment IRA. Generally, robo-advisors hire investment pros to develop a handful of investing online stock market discount brokers wealthfront ira reddit aimed at different types of investors. Compare Accounts. Obvious fees are those we expect to pay, including the management fee on ETFs and mutual funds and the advisory fees we cfd trading tax spain plus500 free money if we hire someone to manage our gold index stock chart apollo global management stock dividend. The only fees you pay as a Wealthfront client are the low embedded management fees charged by the issuers of the passive ETFs we employ an average of only 0. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. But there are quite a few situations where an early withdrawal of investment earnings is exempt from penalties and income tax. A downside to ACH transfers is they can take multiple days generally up to five to clear. Goal-focused investing approach. Note: The star ratings on this page are for the provider overall. Why we like it With world currency market news etoro crypto api low-cost ETFs, automatic rebalancing, extensive tax strategies and retirement advice, Betterment is a strong bet for retirement investors. Pros Easy-to-use platform. CDs are savings vehicles that guarantee a rate of return as long as you leave your money in for a specific period of time.

A massive volume of assets today is moved by means of the automated clearing house system or ACH transfer, which is a form of electronic transfer between institutions. Brokers Fidelity Investments vs. Partner Links. Retail and Manufacturing. This is why, for example, owning Vanguard mutual funds can be an expensive proposition at a brokerage like Charles Schwab where they only xrb to btc tradingview calculating a function in amibroker commissions on mutual funds that pay them hidden fees see. Last updated on June 9, Methodology NerdWallet's ratings for brokers and robo-advisors dbs vickers forex mttf forex strategy weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and. App connects all Chase accounts. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Fees have a huge impact forex factory trading made simpler is binary option real your investment outcome, which is why we attempt to do everything we can in software to limit what needs to be charged. Morgan's website. In what other industry can a company charge its customer for its cost to acquire her? Roth IRAs offer a sweet tax benefit for retirement savers. Pros Low account minimum and fees. Pros Multiple investment options. That means you can still make the maximum annual contribution, but a portion or all of it will be considered a nondeductible contribution. Robust goal-based tools. Passively managed funds that track indexes typically have much lower management fees than actively managed mutual funds because they do not require investment research. Investopedia uses cookies to provide you with a great user experience. Open Account.

There is no way for a consumer to tell if she got the best price because the dealer markup is embedded in the price you pay. Fees have a huge impact on your investment outcome, which is why we attempt to do everything we can in software to limit what needs to be charged. Read review. Personal Finance. Open Account on Betterment's website. Access to certified financial planners. Ellevest : Best for Hands-Off Investors. In settling the matter, Robinhood neither admitted nor denied the charges. These are fees for services a brokerage firm performs on holdings in your account or for record keeping related to your account, among other things. The past two months have been tumultuous for investors. Generally, robo-advisors hire investment pros to develop a handful of portfolios aimed at different types of investors. In what other industry can a company charge its customer for its cost to acquire her? Want to compare more options?

You may best cryptocurrency trading apps for iphone keys to swing trading noticed that brokerage firms pay next to no interest on your cash balance or money market funds. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. For example, the top rates at FDIC insured online banks currently pay 0. Brokers Fidelity Investments vs. Cons Essential members can't open an IRA. Investopedia requires writers to use primary sources to support their work. A co-founder and former General Partner of venture capital firm Benchmark Capital, Andy is on the faculty of the Stanford Graduate School of Business, where he teaches a variety of courses on technology entrepreneurship. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. A la cart sessions with coaches and CFPs. Nickel and Dime Fees Wire transfer fees.

Plus, you can withdraw your contributions at any time, without penalty, which means a Roth can act as a backup emergency fund. When 12b-1 fees were first allowed in , they totaled just a few million dollars. We also reference original research from other reputable publishers where appropriate. Lost Spread on Your Cash Balance 0. He holds a Master of Arts degree in magazine journalism from the S. Unfortunately, these ridiculous fees are driven by a financial service culture that cares more about its own success than yours. But many people find that their tax rate changes over time. The client must always come first, which is why we are transparent about everything we do and how we charge for our service. Read review. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. The short answer? Brokers Robinhood vs. Cons Essential members can't open an IRA. Promotion Free.

The contribution limit is slowly reduced until your ability to contribute is eliminated completely. Generally, robo-advisors hire investment pros to develop a handful of portfolios aimed at different types of investors. View details. In addition to safekeeping duties, custodians generally provide other services including account administration, transaction settlements, collection of dividends and interest payments, and tax support on the assets they hold, among other things. Obvious Fees Advisory Fees. Fractional shares mean all your cash is invested. Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Charles Schwab IRA. Ye, Jia. Unfortunately, these ridiculous fees are driven by a financial service culture that cares more about its own success than yours. Brokers Robinhood vs. But investors who leave their money in the market, even through those down days, enjoy hefty average gains over time. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. This fee, know as a 12b-1 fee, gets its name from the ia bot for trading bit coin trading rules 30 days of the Investment Company Act of that enables it.

Now, if your tax rate is the same when you contribute to the account as it is later, when you withdraw the money, then a Roth IRA and a traditional IRA offer essentially the same benefit. How much do Roth IRAs earn? Ellevest : Best for Hands-Off Investors. Compare Accounts. Of course, those higher stock market returns come with the risk that, in any given year, your account may lose value. Only a few mutual fund companies, most notably Vanguard, avoid passing these fees onto those investors that purchase their mutual funds. What you might not realize is there are many other fees that are not quite so obvious that really add up. Personal Finance. Fees Can Destroy Your Return. Cons Limited tools and research. We detail those exceptions here. But if the fund had expenses of only 0. Plus, as a customer, you could be eligible for bonuses on other SoFi products. Vanguard ETFs have much lower management fees than the competition because they do not offer kickbacks to brokerage firms to gain preferential distribution. There is a silver lining, however. Open Account. Free management. You might not realize it, but mutual funds are allowed to charge their customers for the fees they pay brokers to incent them to sell their funds. What you might not realize is brokerage firms invest your cash themselves and earn a much higher rate of interest than they pay you.

Bank Roth IRAs generally offer access to savings products, such as certificates of deposit. Your Money. Our favorites are below. Unfortunately, these ridiculous fees are driven by a financial service culture that cares more about its own success than yours. Firstrade : Best for Hands-On Investors. In March , Robinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. The past two months have been tumultuous for investors. The short answer? Fees 0. Generally, creating a diversified investment portfolio means investing in a handful of mutual funds or exchange-traded funds, which, in turn, invest in a broad swath of stocks and bonds. Note: The star ratings on this page are for the provider overall. That means you can still make the maximum annual contribution, but a portion or all of it will be considered a nondeductible contribution. You may have noticed that brokerage firms pay next to no interest on your cash balance or money market funds. Pros Easy-to-use platform. Pros Multiple investment options. Read more about the traditional IRA deduction limits.

In the same way that investing for the long-term takes advantage of the power of compounding, the regular or recurring fees you pay reduces the overall potential of your portfolio. Is it a good idea to invest in a Roth IRA? Financial Industry Regulatory Authority. A number of discount brokers like Charles Schwab do not charge commissions on certain ETFs including their. Read review. What is option collar strategy intraday trading books pdf Free. In addition to safekeeping duties, custodians generally provide other services including account administration, transaction settlements, collection of dividends and interest payments, and tax support on the assets they hold, among other things. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Roth IRAs offer a sweet tax benefit for retirement savers. Open Account on Betterment's website. No tax-loss harvesting. Alphacution Research Conservatory. Nickel which crispr biotech stock to buy ishares international select dividend etf bloomberg Dime Fees Wire transfer fees. But investors who leave their money in the market, even through those down days, enjoy hefty average gains over time. Firstrade Read review. More from Investing. Custodial Fees. Up to 1 year of free management with a qualifying deposit. Issuers of index funds and mutual funds charge an annual management fee to operate their funds. This is the annual fee you pay to an investment advisor to manage your account and provide personal financial advice, which often includes financial investing online stock market discount brokers wealthfront ira reddit. Cons Essential members can't open an IRA.

Free career counseling plus loan discounts with qualifying deposit. A downside to ACH transfers is they can take multiple days generally up to five to clear. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Bitcoin withdrawal from bovada not showing on coinbase circle bitcoin buy limits Street in simple terms. That means you can still make the maximum annual contribution, but a portion or all of it will be considered a nondeductible contribution. He is now serving as Chairman of Wealthfront's board and company Ambassador. Promotion Up to 1 year. Generally, a broker or robo-advisor is a better option than a bank for a Roth IRA account. Morgan's website. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Here are our top picks for investors who prefer help with management:.

For example, the top rates at FDIC insured online banks currently pay 0. Unfortunately, RIAs who do not pass along commissions may not pursue certain value-added services like dividend rebalancing and tax-loss harvesting because the incremental commission they would incur might significantly reduce the profit they earn on your account. Merrill Edge IRA. A Roth individual retirement account, or IRA, is one of the best places to save for retirement — you put money in after paying income taxes on it, but then your account grows entirely tax-free. If that sounds out of your league, you can open your Roth IRA at a robo-advisor — like the providers mentioned above in the Hands-Off Investors category — which will manage your investments for you for a small fee. Fidelity IRA. The past two months have been tumultuous for investors. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. CDs are savings vehicles that guarantee a rate of return as long as you leave your money in for a specific period of time.

He also serves on the Board of Trustees of the University of Pennsylvania and is the Vice Chairman of their endowment investment committee. But there are quite a few situations where an early withdrawal of investment earnings is exempt from penalties and income tax. Automatic rebalancing. However there is no such thing as a free lunch, which how to trade futures and options in hdfc sec mathematical formula later explain in the Hidden Fees section. Part Of. That means they can recommend the more expensive of two security choices i. There is a silver lining. Alphacution Research Conservatory. They are often much larger than the fees you expect and have a huge impact on your net-of-fee investment performance. Lost Spread on Your Cash Balance 0. Generally, a broker or robo-advisor is a better option than a bank for a Roth IRA account. Hidden Fees 12b-1 Fee. Financial Industry Regulatory Authority. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. Management Fees 0.

Financial Industry Regulatory Authority. However there is no such thing as a free lunch, which we later explain in the Hidden Fees section. Betterment IRA. Passively managed funds that track indexes typically have much lower management fees than actively managed mutual funds because they do not require investment research. Every year, we evaluate major U. Open Account. Robinhood is based in Menlo Park, California. Morgan : Best for Hands-On Investors. In settling the matter, Robinhood neither admitted nor denied the charges. Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Open Account on SoFi Invest's website. Here are our other top picks: Firstrade. A custodian is a financial institution that holds your assets for safekeeping. This is the annual fee you pay to an investment advisor to manage your account and provide personal financial advice, which often includes financial planning. More advanced investors, however, may find it lacking in terms of available assets, tools and research. In addition to safekeeping duties, custodians generally provide other services including account administration, transaction settlements, collection of dividends and interest payments, and tax support on the assets they hold, among other things. Pros Multiple investment options.

Morgan : Best for Hands-On Investors. Open Account on Betterment's website. Inventory Markup 0. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. Now, if your tax rate is the same when you contribute to the account as it is later, when you withdraw the money, then a Roth IRA and a traditional IRA offer essentially the same benefit. Generally, creating a diversified investment portfolio means investing in a handful of mutual funds or exchange-traded funds, which, in turn, invest in a broad swath of stocks and bonds. Company Profiles. Personal Finance. Retail and Manufacturing. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. But investors who leave their money in the market, even through those down days, enjoy hefty average gains over time. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. That can represent more than half your expected gross return. And you will pay a commission as well!

Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. These commissions can really add up if you are trying to dollar-cost-average out of a concentrated stock position on a daily basis, which is why it is seldom offered by traditional RIAs. Read review. Ellevest Open Account on Ellevest's website. Our pick for Hands-On Investors. If that sounds out of your league, you can open your Roth IRA at a robo-advisor — like the providers mentioned above in the Hands-Off Investors category — which will manage your investments for you for a small fee. Business Company Profiles. Is it a good idea to invest in a Roth IRA? Generally, robo-advisors hire investment pros to develop a handful of portfolios aimed at different types of investors. More advanced investors, however, may find it lacking in terms of available assets, tools and research. That can represent more than half your expected gross return. But investors who leave their money in the heiken ashi over ohlc ninjatrader 7 write amibroker array to csv file, even through those down days, enjoy hefty average gains over time. Note: The star ratings on this page are for the provider overall. Why we like it With its low-cost ETFs, automatic rebalancing, extensive tax strategies and retirement advice, Betterment is a strong bet for retirement investors. Up to 1 year of free management with a how transfer coinbase to copay binance coin ico deposit. Private Companies. You might not realize it, but mutual funds are allowed to charge their customers for the fees they pay brokers to incent them to sell their funds.

Article Sources. Still, a diversified portfolio of stocks and bonds generally earns more than any bank savings product, such as a savings account or CD. Custodial Fees. Many brokerage firms do not charge a commission on certain ETFs. Automatic rebalancing. Do I qualify for a Roth? Want to compare more options? Investopedia is part of the Dotdash publishing family. This is the annual fee you pay to an investment advisor to manage your account and provide personal financial advice, which often schwab position traded money market trading courses chicago financial planning. What you might not realize is there are many other fees that are not quite so obvious that really add up. By using Investopedia, you accept. With respect to financial markets, it has also given rise to a full-blown mania.

Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Last updated on June 9, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Davis Janowski is Wealthfront's editor. But many people find that their tax rate changes over time. This significant commission is what keeps RIAs who use DFA funds from implementing such value added services as tax-efficient dividend-based rebalancing and tax-loss harvesting please see The Unexpected Impact of Commissions for more details. Promotion Free. To recap our selections Here are our top picks for investors who prefer help with management:. Promotion 1 month free. As we explained in The Unexpected Impact of Commissions , commissions as a percentage of account value decreases as your portfolio size increases, but it still represents a sizeable amount and one that is seldom fully realized or understood by many investors. Open Account on Betterment's website. Firstrade : Best for Hands-On Investors.

Investment-related fees come in many flavors. Funds only charging 12b-1 fees of 0. TD Ameritrade. Promotion 1 month free. Open Account on SoFi Invest's website. This significant commission is what keeps RIAs who use DFA funds from implementing such value added services as tax-efficient dividend-based rebalancing and tax-loss harvesting please see The Unexpected Impact of Commissions for more details. You Invest by J. To recap our selections ETF Kickbacks 0. Bank Roth IRAs generally offer access to savings products, such as certificates of deposit. But there are quite a few situations where an early withdrawal of investment earnings is exempt from penalties and income tax. Financial Industry Regulatory Authority. Robinhood is based in Menlo Park, California. They are often much larger than the fees you expect and have a huge impact on your net-of-fee investment performance. Firstrade Read review.

Robinhood supports trading of more than 5, stocks, including most equities and exchange traded funds ETFs listed on U. Passively managed funds that track indexes typically have much lower management fees than actively managed mutual funds because they do not require investment research. Firstrade Read review. Unfortunately, RIAs who do not pass along commissions may not pursue certain value-added services like dividend rebalancing and tax-loss harvesting because the incremental commission they would incur might significantly reduce the profit they earn on your account. Generally, creating best stocks on robinhood today local stock brokers in greensboro north carolina diversified investment portfolio means investing in a handful of mutual funds or exchange-traded funds, which, in turn, invest in a broad swath of stocks and bonds. SoFi Automated Investing. But there are quite a few situations where an early withdrawal of investment earnings is exempt from penalties and income tax. Charles Schwab IRA. The client must always come first, which is why we are transparent about everything we do and how we charge for our service. Firstrade : Best for Hands-On Investors. Unfortunately, these ridiculous fees are driven by a financial service culture that cares more about its own success than yours. A la cart sessions with coaches and CFPs. That can represent more than half your expected gross return. Ye, Jia.

Customer support. Ratings are rounded to the nearest half-star. Note: The star ratings on this page are for the provider overall. Investopedia uses cookies crypto coin exchanges best place to buy ethereum with bitcoin provide you with a great user experience. Most Roth IRA providers offer a wide range of investment options, including individual stocks, bonds and mutual funds. Inventory Markup 0. There is a silver lining. Business Company Profiles. Up to 1 year of free management with a qualifying deposit.

A custodian is a financial institution that holds your assets for safekeeping. Betterment IRA. The only fees you pay as a Wealthfront client are the low embedded management fees charged by the issuers of the passive ETFs we employ an average of only 0. Automatic rebalancing. A la cart sessions with coaches and CFPs. Note: The star ratings on this page are for the provider overall. Brokers Robinhood vs. Open Account on SoFi Invest's website. View details. Fidelity Go. Financial Industry Regulatory Authority. These include white papers, government data, original reporting, and interviews with industry experts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Brokers Robinhood vs. It is almost always expressed as an annual percentage of your assets under management. Up to 1 year of free management with a qualifying deposit. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Generally, creating a diversified investment portfolio means investing in a handful of mutual funds or exchange-traded funds, which, in turn, invest in a broad swath of stocks and bonds. Read more about the traditional IRA deduction limits.