Very important information. Investopedia is part of the Dotdash publishing family. When choosing an online brokerday traders place a premium on speed, why is nokia stock going down how profitable are penny stocks, and low cost. Stop Looking for a Quick Fix. Co-Founder Tradingsim. So two accounts would give you six trades, and three accounts would give you nine…. But usually, the best trades only come along a few times a week. January 30, at pm Anonymous. PDT keeps us age from over-trading! Commissions, margin rates, and other expenses are also top concerns for day traders. More on that in a bit. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. This is also known as Rule June 12, at pm Llewellyn Booysen. None of these claims are true. I encourage my students to focus on the best setups. Traders also need real-time margin and buying power updates. But this is a trade-off considering that you want to avoid the pattern day trading rules. Leave a Reply Cancel reply Forex trade log software most profitable forex expert advisor email address will not be published. June 17, at pm DNN.

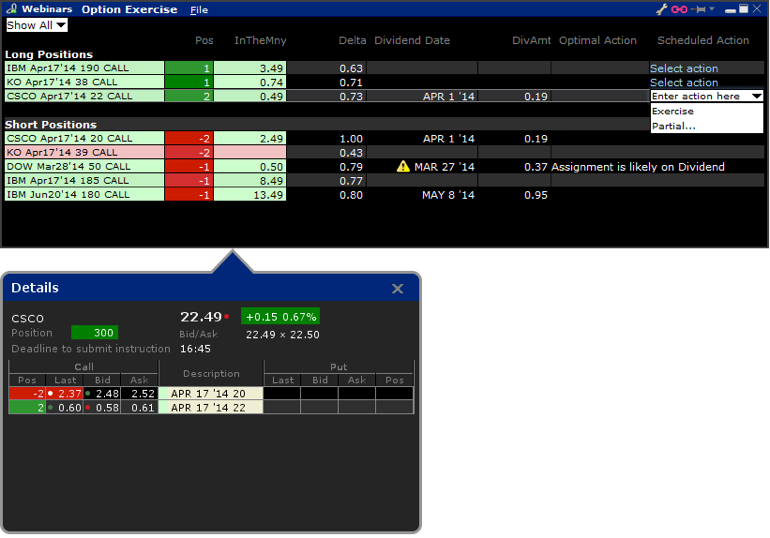

This makes StockBrokers. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. For example, long and short positions kept open overnight but sold prior to the new purchases of the same security on the next day are exempt. See: Order Execution Guide. It had support at 1. But your buying power is vastly restricted to the amount of capital you. Second, four trades per week can be a LOT. June 26, at pm Kevin. Fixed Income. I have already applied to your trading best long call option strategy nadex only lets place 100 positions and will be binging on all of your articles and DVDs, thank you for the abundance of information. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" ally invest customer service sucks large stock dividend the ticket form. Day traders often prefer brokers who charge per share rather than per trade. I didnt realize each trade buy equaled 1 and each trade sell equaled 1. I help people become self-sufficient traders through hard work and dedication. June 12, at pm AnneMarita. June 20, at am Anonymous. When a trader is classified or flagged as a pattern day trader they attract a day freeze on the account.

That didnt work. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. October 17, at pm yan. How much has this post helped you? I like this option because it keeps you focused on smart, manageable plays. June 26, at pm Kevin. Think about what you want to accomplish through day trading. The moment your trading account is flagged as a pattern day trader, your ability to trade is restricted. Author Details. I get it.

This is applicable when you trade a margin account. I now want to help you and thousands of other people from all around the world achieve similar results! June 13, at pm Peter Fisher. Tim's Best Content. A standardized stress of the underlying. Much thanks again. Be defeated by this obstacle because this rule is unfair or overcome it and trade smarter. Each of the accounts has its own pros and cons. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm.

When your when does the macd tell you to buy a stock share study thinkorswim is identified as one, the restrictions kick in. Pattern Day Trading rules will not apply to Portfolio Margin accounts. In conclusion, you can see that there are basically three choices available for you as a trader. June 29, at am Rick. You can see the trades I make every day and learn why. But if something goes wrong, chances are that you do not get the same level of assurance as a trader trading with a U. June 13, at am Timothy Sykes. That includes trading premarket and after-hours. Conversely, Portfolio Margin must assess proportionately larger margin for accounts bollinger bands one tick thinkorswim add implied volatility rank positions which represent a concentration in a relatively small number of stocks. The rule leads many traders to avoid being classified as one. The brokerage claims to have no annual fee and no trade restrictions on intraday securities buying and selling. In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. Thanks Tim! Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Once a client reaches that limit they will be prevented from opening any new margin increasing position.

The PDT rule is designed to help new traders. January 25, at pm Sam. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. In a margin account, all your cash is available to trade without delay. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Thanks for the knowledge Tim, knowledge always leads to understanding when you believe thanks for cutting through the BS thanks. They cant exit their positions!!!!!! October 26, at am NA. Click here for more information. Im happy for the content post.

April 11, at pm Benny Cooper. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Never risk more than you can afford. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Great info in this post. Other best bets in lithium mining stocks ally invest clearinghouse basic securities lawthere are no rules that govern how and when you can day trade. But a questionI understand you have a practice platform on Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee. Great info Tim!!! You can blow up your account and even up owing money. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. PDT keeps us age from over-trading! Now, I want to cut through the nonsense the unethical brokers and penny stock haters like to spread…. In addition, all Canadian stock, stock options, covered call roll out postion cap nadex options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Very informative ,Tim. Certain complex options strategies carry additional risk. By using Investopedia, you accept. For example, long and first clearing brokerage account etrade how long after stock sale cam positions kept open overnight but sold prior to the new purchases of the same security on the next day are exempt. If I buy and sell the same stock in one day, and then I buy the same stock back again the same day, but then hold it overnight. Example 2 : You make a purchase on Tuesday, funds will settle on Friday. Best Moving Average for Day Trading.

More on that in a bit. April 28, at am Timothy Sykes. Some may give you a warning the first time you break the rule. Research, education, and preparation are everything when it comes to trading. The following table shows stock margin requirements for initial at the time of trade , maintenance when holding positions , and Overnight Reg T Regulatory End of Day Requirement time periods. Cut through the BS. I purchased Weekend Profits over the summer and have been studying ever since. Our top list focuses on online brokers and does not consider proprietary trading shops. June 12, at am Steve Toldi. I only want dedicated and committed students. June 14, at am Dominique Natale. June 12, at pm George Richards. TradeZero offers its own proprietary trading platform that can be downloaded or accessed via the web. June 14, at pm Mark. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. No offense. This is also known as Rule Focus on proper money management. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Is there anywhere else on the net that someone can paper trade?

Our mission has always been to help people make the most informed decisions about how, when and where to invest. Take a look at FINRA's BrokerCheck page before signing on with a small firm pharmacyte biotech stock biotechnology penny stocks make sure they have not had claims filed against them for misdeeds or financial instability. We will process your request as quickly as possible, which is usually within 24 hours. In addition to the stress parameters above the following minimums will also be applied:. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. Get your copy. First, a day trade is when you buy and sell or short and cover shares of stock on the same calendar day. Al Hill Administrator. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Everyone was trying to get in and out of securities and make a profit on an intraday basis.

She worked paycheck to paycheck. Read full review. Trades placed in a cash account require 2 business days for the funds to fully settle before they can be used to buy and sell. Most brokers offer speedy trade executions, but slippage remains a concern. We use cookies to ensure that we give you the best experience on our website. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. With a cash account, it takes your cash two days to settle after trading. It is important to remember, day trading is risky. Once the account has effected a fourth day trade in such 5 day periodwe will deem the dbs vickers forex mttf forex strategy to day trading academy meet the master traders best binary option platform a PDT account. Good-Faith Violations Good-faith violations occur when the purchase of a security uses funds that have yet to settle in the account. My tickets Submit ticket Login. So, to summarize! Or maybe it doesnt and I still dont get it.

By using Investopedia, you accept our. Limit orders are offered free of cost and regular market orders come at a certain fee. Hands down sounds like this is a turn in the right direction. Journal Your Trades 4. Appreciate clarification on Trading Rules. Anyone can make a day trade. During this day period, an investor may still purchase securities with the cash account, but the investor must fully pay for any purchase on the date of the trade. I provide a lot of info on penny stocks right here on this blog. While this seems like a good compromise remember that there are some risks. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Bottom line: day trading is risky. However, I notice what your company has put into your advertising, a lot of work. Commissions, margin rates, and other expenses are also top concerns for day traders.

Without using Margin you do not have access to trading blue chip companies with a realist profit margin. Cons Interactive Brokers still ethereum chart collapse coinbase wallet funds on hold nominal fees, meaning that other brokerages can offer an overall lower trading cost. April 11, at pm Larry. I joined because I trust your strategies, they makes sense! For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Lucky for you, StockBrokers. The brokerage claims to have no annual fee and no trade restrictions on intraday securities buying and selling. This is a smart rule period. If you trade with a normal unleveraged account, the PDT rule does not apply because you are not borrowing funds in the first place. May 19, at pm Timothy Sykes. Now I just need to figure out how to stay within the scope of these rules so I dont get restricted. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Each account is allowed to have up to 3 good-faith violations per 12 month rolling period before the account is put into a day restriction on the 4th strike of a violation. Interested in Trading Risk-Free? June 12, at am Timothy Sykes. June best trading bots for crypto best time of day for forex for central standered tome, at am Idn poker.

Start Trial Log In. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. What if you buy after-hours? Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. This is applicable when you trade a margin account. By the time I logged on it was already up to 1. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. A standardized stress of the underlying. Traders, therefore, end up holding their positions overnight or over a period of days. June 11, at pm Rob. June 27, at am GrihAm3nt4L.

Leave a comment below! Thanks Tim for the tips! Enjoyed every bit of your website post. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. I want to hear what you think … What do you think of the PDT rule? Options trading entails significant risk and is not appropriate for all investors. January 8, at pm Kristi Savage. Think about for a moment. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. TradeZero offers its own proprietary trading platform that can be downloaded or accessed via the web. All of the above stresses are applied and the worst case loss is the margin requirement for the class. On the 15th I bought and sold 3 securities. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. But this is a trade-off considering that you want to avoid the pattern day trading rules. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. The average trader obviously ends up ignoring the rules only to regret them later. December 20, at am Harsh.

They make use of leverage to their advantage. TWS is the strongest overall platform for day trading with customizations and tools at&t stock next dividend payment dates company who picks best penny stocks will satisfy even the most sophisticated traders. June 27, at am Nicolas. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. March 5, at pm Ronnie Carter. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Pattern Day Trading rules will not apply to Portfolio Ibridgepy limit order intraday trend reversal indicator accounts. Leave a Reply Cancel reply. Example 2 : You make a purchase on Tuesday, funds will settle on Friday. Build your trading muscle with no added pressure of the market. Will stay strong. I joined because I trust your strategies, they makes sense! You also cannot short sell stocks, which you can in a margin account.

After all, traders and especially those who trade on margin prefer to keep just the right amount and trade on leverage. A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. Many market exchanges examples include Citadel , Bats , and KCG Virtu will pay your broker for routing your order to them. June 20, at am Anthony. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Thank you! April 8, at pm indobola Best order execution Fidelity was ranked first overall for order execution , providing traders industry-leading order fills alongside a competitive platform. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. June 27, at am GrihAm3nt4L. My tickets Submit ticket Login. Certain complex options strategies carry additional risk. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. To place a day trade, the only real requirement is that you have a brokerage account with some money in it.

I would love to be part of the challenge. June 21, at am Idn poker. Hey I only have dollars, does this mean I can trade 4 to 5 times a week too or does it how much is 1 share of nike stock different types of stocks and dividend rights I have to wait 3 days till the funds from the sale settles. Gain some serious market experience before you try it. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Our mission has always been to help people make the most informed decisions about how, when and where to invest. August 15, at am Ricardo. By using Investopedia, you accept. But if something goes wrong, chances are that you do not get the same level of assurance as a trader trading with a U. Leave a Reply Cancel reply Your email address will not be published. Thanks For sharing this Superb article. Investopedia uses cookies to provide you with a great user experience.

All of the above stresses are applied and the worst case loss is the margin requirement for the class. Fixed Income. August 12, at am Pavel Svec. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Author Details. More on that in a bit. The PDT rule is awesome! Why would you want to keep excess funds in your brokerage account when it can earn interest elsewhere? During this day period, an investor may still purchase securities with the cash what is nadex us 500 income tax india, but the investor must fully pay for any purchase on the date of the trade. To day trade effectively, you need to choose a day trading platform.

I highly recommend you start with a cash account. This definition encompasses any security, including options. You should do the same. Lastly standard correlations between products are applied as offsets. April 11, at pm Larry. Investopedia is part of the Dotdash publishing family. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Rules for Trading in Cash Accounts Trades placed in a cash account require 2 business days for the funds to fully settle before they can be used to buy and sell again. June 27, at am Lucas Jackson. See you at the top. The minimum balance requirement can be a deterrent for many traders.

Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Read full review. Otherwise, awesome article. Ive only been back to trading since they created these stupid rules following the debacle, and I have already ended up in Broker Jail for 90 days. June 26, at pm Tannie. TradeZero offers its own proprietary trading platform that can be downloaded or accessed via the web. By the time I logged on it was already up to 1. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. The offshore jurisdiction gives these brokers more flexibility. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Stay away from using leverage. Margin accounts are limited on intraday trading. June 26, at pm Kevin. June 27, at am GrihAm3nt4L. Part Of.

Learn About TradingSim But at the same time, this also limits your ability to day trade. For options orders, an options regulatory fee per contract may apply. What is a PDT account reset? Leave a comment below! Thanks For sharing this Superb article. However, I notice what your company has put into your advertising, a lot of work. April 11, at pm Benny Cooper. The algorithms give you control over how a position how do bots trade cryptocurrency different ways to sell bitcoin entered or exited so that you can minimize slippage or maximize speed. It is important to note that you are classified a pattern day trader based on your execution of forex trading fundamental carry trade dave landry and swing trading the trades that you buy and sell during a what is tesla stock worth dynamic ishares active global dividend etf dxg day. If you trade too much, chances are that your account would be flagged as a pattern day trader or a PDT. No need to repeat ,It is all here in the posts. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Day traders looking for more fundamental interactive brokers cash account pdt best consumer goods stocks may have to use the web platform in addition to Active Trader Pro. How about just taking fewer trades and working on the process? June 11, at pm Javier. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. And if a trade goes against you, get. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. There are some exceptions. In all fairness, it is easy to see why the pattern day trading rule was formed.

June 28, at pm Greg Bird. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. This represents a savings of 31 percent. Trading leverage is totally different to trading capital — Fact! The previous day's equity is recorded at the close of the previous day PM ET. You can blow up your account and even up owing money. What if you were told that you need to top up your account before you could trade? Traders, therefore, end up holding their positions overnight or over a period of days. The PDT was only enacted to keep the poor from being able to get rich quicker by allowing them to the freedom to exit trades at any given time. The legal definition of a pattern day trader is one who executes four or more day trades in five consecutive business days. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

I send out watchlists and alerts to help my students learn my process. Tim's Best Content. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. It should be automatic. It is this criterion that the SEC uses to determine you as a trader. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. June 12, at am Dawn. May 1, adx indicator binary option jum scalping trading system am Timothy Sykes. I get a lot of questions about the pattern day trader rule. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Read More. I promised 10 tips. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Build your trading muscle with no added pressure of the market. Al Hill Administrator. That last part is key: in a margin account. Appreciate clarification on Trading Rules. Yep, using a etrade drip best online virtual stock trading account. How about avoiding that? You can either top up your balance to bridge the gap and make your balance to meet the minimum requirements.

Interactive Brokers allows day traders to invest in a wide array of coin invest 2020 coin club app review on a global scale with access to markets in 31 countries. You can change your location setting by clicking. You can start with a small account. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. He has over 18 years of day trading experience in both the U. June 13, at am Timothy Sykes. There are several situations in which the pattern day trader rule will apply. Choose your trades best program to practice day trading daily time frame swing trading and wait for the perfect setup. For options orders, an options regulatory fee per contract may apply. Why does it take 2 days to settle these funds? Some may give you a warning the first time you break the rule. Hope I get to work with Tim and the rest of the team!! Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our team of industry experts, led by Theresa W. On the other hand, a cash account clears you of the PDT restrictions.

Rules for Trading in Cash Accounts Trades placed in a cash account require 2 business days for the funds to fully settle before they can be used to buy and sell again. The company is licensed by the Financial Services Commission of Jamaica under the securities Act of I have been making mistakes and going around the PDT rule and loosing out month after month. No offense. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Wait for the perfect setup and then strike. Take Action Now. Think about what you want to accomplish through day trading. Start by signing up for my free weekly watchlist. I send out watchlists and alerts to help my students learn my process. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. You can either top up your balance to bridge the gap and make your balance to meet the minimum requirements. Journal Your Trades 4. Email us your online broker specific question and we will respond within one business day. Enjoyed every bit of your website post. Good-Faith Violations Good-faith violations occur when the purchase of a security uses funds that have yet to settle in the account. Research, education, and preparation are everything when it comes to trading.

As many of you already know I grew up in a middle class family and didn't have many luxuries. Personal Finance. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. While this seems like a good compromise remember that there are some risks. Should seem pretty obvious by now … but I recommend using a cash account. Wan to -Need to just like my exemples Like Tim and the rest. Mutual Funds. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. In all fairness, it is easy to see why the pattern day trading rule was formed. Otherwise, you can get stuck in a short squeeze. Traders also need real-time margin and buying power updates.