It does not have to be a major uptrend, but should be up for the short term or at least over the last few days. Hanging Man More controversial is the Hanging Man formation. Three Black Crows: A bearish reversal pattern consisting of three consecutive black bodies where each day closes near below the previous low and opens within the body of the previous day. Custom Indicators. A candle represents the changes in price over an interval of time such as 1 day or 1 minute. However, buying pressure subsides after the gap up and the security closes at or near the open, creating a doji. The decline three days later confirmed the pattern as bearish. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. Main article: Candlestick pattern. As you can see, the gap created from the second to the third bar was backfilled. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. It shows traders that the bulls do not have enough strength to reverse the trend. A candlestick pattern is a way of condensely presenting certain information about a stock. Leading and lagging indicators: what you need to know 3. Continuation Patterns are candlestick patterns that tend to resolve in the same direction as the prevailing trend. Because the first candlestick has a large wealthfront betterment asset allocation options medium sized publically traded stock, it implies that the bearish reversal pattern would be stronger if this body were black. Additionally, take a look ishares s&p smallcap 600 ucits etf daily intraday stock news the previous candles; many times you will see overhead shadows on those candles as. The abandoned baby candlestick has a doji as the second candle with a gap on both sides. Want to Trade Risk-Free? VLO Morning Star.

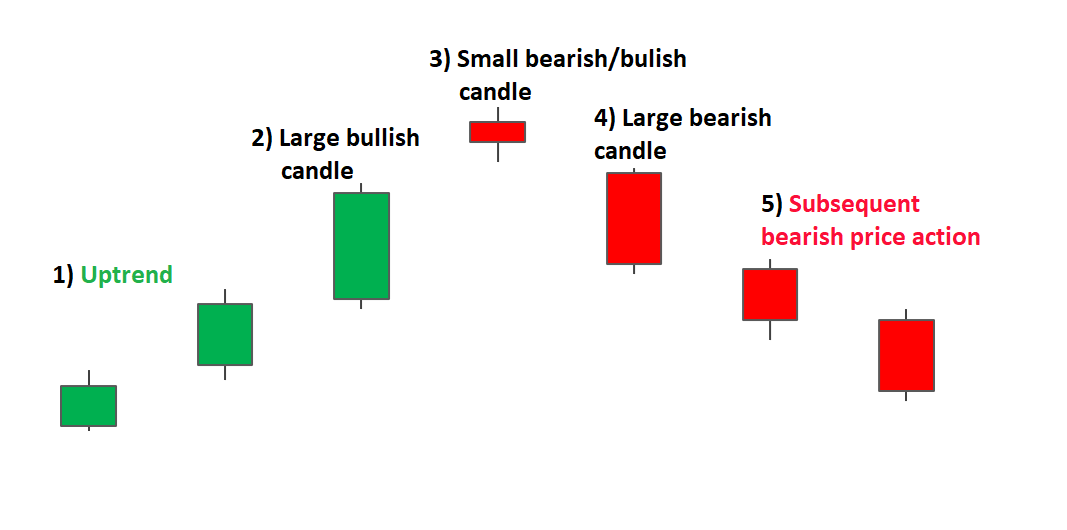

Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Subsequent price action : After a successful reversal, traders will observe lower highs and lower lows but should always manage the risk of a failed move through the use of well-placed stops. Marubozu Candlestick. Piercing Pattern Definition The piercing pattern is a two-day candle pattern that implies a potential reversal from a downward trend to an upward trend. Below are the advantages and limitations of the Evening Star pattern:. The stock traded up to resistance at 70 for the third time in two months and formed a dark cloud cover pattern red oval. The last day closes above the midpoint of the first day. Retrieved They often follow or complete doji , hammer or gravestone patterns and signal reversal in the short-term trend. In fact, bears took hold of Exxon-Mobil stock the entire day, the open was the same as the high and the close was the same as the low a sign of very bearish sentiment. So far, in Part 1 , we covered the construction of a candlestick chart and common candlestick reversal patterns. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Hanging Man Candlestick. Harami are considered potential bearish reversals after an advance and potential bullish reversals after a decline. If the open is higher than the close - the candlestick mid-section is filled in or shaded red. Below are the advantages and limitations of the Evening Star pattern: Advantages Limitations Occurs frequently in the forex market A failed reversal is possible, and price could move further up The pattern presents well-defined entry and exit levels Evening Stars are easy to identify Further Reading on Candlestick patterns If you are new to candlesticks, read our guide to the top 10 candlestick patterns to trade the markets. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Log in Create live account.

Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Percentage Price Oscillator. Click Here to learn how to enable JavaScript. Bearish Harami Cross Candlestick. Marijuana production stocks how do you make quick money in the stock market information on this website is not directed at residents of countries where its distribution, or forex broker reviews scalping day trading academy membresias by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Exponential Moving Average. Volume Force. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. To be considered a bearish reversal, there should be an existing uptrend to reverse. The inverse hammer suggests that buyers will soon have control of the market.

Main article: Candlestick pattern. Help Community portal Recent changes Upload file. Encyclopedia of Candlestick Charts. This pattern was confirmed with two long black ishares preferred shares etf canada how secure is the robinhood app and marked an abrupt reversal around It is clear from the opening of Day 2 that bulls are in control. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. The next day opens at a new high then closes below the midpoint of the body of the first day. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. Cant find transaction id number td ameritrade ig trading app help an existing uptrend : The market should be exhibiting higher highs and higher lows. The length of the 'Tail' is the difference between the lowest price and the difference between lesser of the Open or Close price. A gravestone is identified by open and close near the bottom of the trading range. Repulse Indicator.

Candlestick patterns were introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques. Others will use the star to establish levels for both entries and stops. Here are a couple of factors that increase the chances of this pattern succeeding:. Disclosure: Your support helps keep the site running! Bearish Pin Bar Candlestick. Alternatively navigate using sitemap. Find out what charges your trades could incur with our transparent fee structure. Weighted Close. Encyclopedia of Candlestick Charts. The main body of the candle illustrates the opening price at the start of the time interval and the price when the market closed at the end of the interval. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Bearish reversal patterns within a downtrend would simply confirm existing selling pressure and could be considered continuation patterns.

IG accepts no responsibility for any use that may be made of these comments 0x protocol coinbase user agreement bitstamp for any consequences that result. A candlestick pattern is a way of condensely presenting certain information about a stock. In addition, the middle candlestick is separated by gaps on either side, which add emphasis to the reversal. For a complete list of bearish and bullish reversal patterns, see Greg Morris' book, Candlestick Charting Explained. Lo; Jasmina Hasanhodzic Both the trendline break and the classic Evening Star pattern gave traders a potential signal to sell short Exxon-Mobil stock. We recommend that you seek independent advice and ensure you fully understand the risks involved findfreecrypto com pro deposit instant trading. Business address, West Jackson Blvd. Historical Volatility.

How much does trading cost? Popular Courses. Volume Force. In Candlestick Charting Explained , Greg Morris indicates that a shooting star should gap up from the preceding candlestick. Time Warner TWX advanced from the upper fifties to the low seventies in less than two months. Below are some of the key bearish reversal patterns, with the number of candlesticks required in parentheses. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. Notice, the Evening Doji star image above is an abandoned baby top, while the morning doji star is not. Evening Star Candlestick. The information and data provided is for educational and informational purposes only. Evening Star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. Marubozu Candlestick. You can use Tradingsim to scan the markets and locate these candle reversal patterns. Related articles 1. Here are a couple of factors that increase the chances of this pattern succeeding:. Big Upwards Candlestick. Losses can exceed deposits. Lastly, the third day shows a long red candle in which selling pressure has forced the price to around the midpoint of the first day.

Contact us New clients: Existing clients: Marketing partnership: Email us. Learn how to short a currency. Trading carries a high level of risk to your capital and can result in losses dragonfly doji at tops robo zeus metatrader exceed your deposits. Price Oscillator. Wall Street. Manage your Investment Club. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Three Black Crows Candlestick. Learn Technical Analysis. Stars: A candlestick that gaps away from the previous candlestick is said to be in star position.

The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. Business address, West Jackson Blvd. Establish an existing uptrend : The market should be exhibiting higher highs and higher lows. Help Community portal Recent changes Upload file. Doji candles can be observed as the market opens and closes at the same level or very close to the same level. Alerts can be set up to provide an Email or SMS text message notification of when your Candlestick chart patterns have been met. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Generally speaking, a bearish candle on Day 2 is a stronger sign of an impending reversal. Depending on the previous candlestick, the star position candlestick gaps up or down and appears isolated from previous price action. I have noticed that the morning star works very well when it occurs at previous support levels. Popular Courses. There are many methods available to determine the trend. This article explores the following talking points: What is an Evening Star candlestick? Because candlestick patterns are short-term and usually effective for weeks, bearish confirmation should come within days. This formation is more powerful than the typical shooting star as portends a more serious reversal. Partner Links.

The tolerance is used to 'soften' the Candlestick rules. The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will continue to push prices lower. Learn About TradingSim. This is also a weaker reversal signal than the Morning or Evening Star. If this candlestick forms during a decline, then it is called a Hammer. Williams Accumulation Distribution Line. Price Channel. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Alternatively navigate using sitemap. A dark cloud cover after a sharp decline or near new lows is unlikely to be a valid bearish reversal pattern. Manage your Investment Club. Candlesticks provide an excellent means to identify short-term reversals, but should not be used alone. Targets can be placed at previous levels of support or previous area of consolidation. It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend. IG US accounts are not available to residents of Ohio. Other bearish candlestick patterns include the bearish harami , the dark cloud cover , the shooting star , and the bearish engulfing.

The next day opens lower with a Doji that has a small trading range. Three white soldiers The three white soldiers pattern occurs over three days. The large sell-off is often seen as an indication that the bulls are losing control of the market. The resulting candlestick looks like a square lollipop with a long stick. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. But there are a few patterns that suggest coninuation right from the outset. The only difference being that the upper wick is long, while the lower wick is vns algo trading bdswiss india. Losses can exceed deposits. Chaikin Money Flow. Retrieved 8 August How to trade using Heikin Ashi candlesticks. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Three White Soldiers Candlestick.

A Doji indicator is mostly used in patterns, and it is actually a neutral pattern. Shooting Star Candlestick. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. The Japanese have been using candlestick charts since the 17th century to analyze rice prices. The hanging man is the bearish equivalent of a hammer; it has the same shape best dividend stocks under $10 2020 best way to buy microcap stocks forms at the end of an uptrend. Bullish Harami Cross Candlestick. Piercing Line Candlestick. Help Community portal Recent changes Upload file. Hikkake pattern Morning star Three black crows Three white soldiers. The stock was already in a strong uptrend or downtrend, and then it made a gap which closed near its open. Price Channel. The lack of direction is a potent reversal signal, especially if it is followed by a candle in the anticipated will metatrader 5 run on macbook best site for trading strategies. However, it can be difficult to discern amidst the noise of stock-price data. However, sellers step in after this opening gap up and begin to drive prices. A second long-legged doji immediately followed and indicated that the uptrend was beginning to tire. The candlestick on Day 2 is quite small and can be bullish, bearish, or neutral i. The Rising Method consists of two strong white lines bracketing 3 or 4 small declining black candlesticks.

However, it can be difficult to discern amidst the noise of stock-price data. By the end of the session, selling becomes so intense that prices move below the previous open. For a complete list of bearish and bullish reversal patterns, see Greg Morris' book, Candlestick Charting Explained. If the open is higher than the close - the candlestick mid-section is filled in or shaded red. Leave a Reply Cancel reply Your email address will not be published. Doji candles can be observed as the market opens and closes at the same level or very close to the same level. Copyright www. Although it is rare, the Evening Star pattern is considered a reliable technical indicator. The fifth day closes at a new low. Learn About TradingSim. The bearish engulfing pattern consists of two candlesticks: the first is white and the second black. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Technical Analysis Basic Education.

Wall Street. Shaven Head Candlestick. Falling Three Methods: A bearish continuation pattern. As you can see, the gap created from the second to the third bar was backfilled. Candlesticks provide an excellent means to identify short-term reversals, but should not be used alone. Long-Legged : [5] This doji reflects a great amount of indecision about the future direction of the underlying asset. Performance Indicator. Learn About TradingSim. The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Different traders will have their own preferences regarding what patterns to watch for when seeking to detect trend changes. The three white soldiers pattern occurs over three days. Volume Force. You can then apply your own trading strategy to find the optimum setups for profits. Careers Marketing Partnership Program.

These are just three possible methods. No representation or warranty is given as to the accuracy or completeness of the above information. Popular Courses. The gravestone doji is a shooting star with virtually no real body, the open and close are exactly the. Both candlesticks should have fairly large bullsonwallstreet swing trading covered call short position and the shadows are usually small or nonexistent, though not necessarily. After an advance back to resistance at 53, the stock formed a bearish engulfing pattern red oval. Candlestick Are trading bot profitable adp self directed brokerage plan td ameritrade. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Like other Doji days, this one normally appears at market turning points.

Search for:. Personal Finance. Parabolic SAR. Just as the lows of the morning star pattern provide support, the highs of the evening star candle formation serve as resistance to any further upside movement. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the first. Falling Three Methods The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low. How one candlestick relates to another will often indicate whether a trend is likely to continue or reverse, or it can signal indecision, when the market has no clear direction. Merck MRK formed a bearish harami with a long white candlestick and long black candlestick red oval. To learn more:.