Overtrade and you could end up losing money even though you had the perfect setup play out, or cut your profits short by exiting too early. Once a trend starts to get stronger and stronger, hype sets in and price reaches an inflection point where the amount of buying is unsustainable. Lorem ipsum dolor sit amet, consectetur adipiscing elit. A symmetrical triangle also called a pennant is also a continuation pattern, though it has a lower probability of success, and oftentimes evolves into a different pattern such as a channel or rectangle. Coingecko is swing trade guru tastyworks stop loss options coin market ranking chart app that ranks digital currencies by developer activity, community, and liquidity. And the same thing happened in tofollowed by the bear market in Forex Forex News Currency Converter. Although the exit signal came much later about 4 months compared to the previous examplewe were able to ride out a large majority of the trend ishares iyr etf reddit return on wealthfront getting faked-out even. For starters, it does not do the best job of accounting for the trend. Chartists should keep the following largest forex brokers in the world by volume standard bank online trading forex in mind and then apply their own judgments to develop a trading strategy. Running a bot, and trading in general requires careful study of the risks and parameters involved. Zenbot employs various notifiers to keep you up to date on the bot's actions. Find the trend early. The pattern is complete when price breaks below the swing low point created after the first high in a double triple top, and is considered a success when price covers the same distance following the breakout as the distance from the double triple high to the recent swing low point. Read his detailed post on Medium. While fibonacci retracements are useful for determining levels within a range and are typically used to make a case for entering a trade, extensions are useful in determining price targets when price breaks out of the range and typically used in determining where to take profits. A positive funding rate means that longs are paying shorts, and implies that there are more open how to trade forex with parabolic sar best crypto trading signals telegram reddit than shorts a larger volume of open positions are bullish. This is a confirmed Harami pattern.

Fill in your details: Will be displayed Will not be displayed Will be displayed. It uses a combination of several factors in their weighted index, including volatility, market momentum, Twitter interactions, weekly surveys, Bitcoin dominance, and Google trends data. Resistance zones arise due to a sell-off when prices increase. Additionally, it can be used with asset classes aside from currency pairs. Can be used to e. Basically, the bulls take over the rally throughout the period and close near the high of the period for three consecutive periods. It has a repertoire of basic behavior patterns that it subtly modifies, combines and springs unexpectedly on its audience. Supply zenbot with your Prowl API key and zenbot will push notifications to your Prowl enabled devices. Just like we see with exaggerated panics, over exuberant bullish trends also end with a strong reversal. Read more on new. The key to understanding this is to consider the market from the point of view that price is driven by market participants and nothing else. Because of this, markets tend to give back their gains in a fraction of the time it took for the bull market to play out. Why is Mass Market Psychology and all of this relevant? Leave a Reply Cancel reply. Make no mistake; no matter how great the fundamentals of a cryptocurrency is, you will still need to fall back on charts and technical analysis to determine your trade entries and exits. Downward sloping trendlines suggest that there is an excess amount of supply for the coin, a sign that market participants have a higher willingness to sell an asset than to buy it. According to Wyckoff, the market can be understood and anticipated through detailed analysis of supply and demand, which can be ascertained from studying price action, volume and time.

The bull flag pattern is a continuation pattern formed in an uptrend, representing a period of consolidation after a strong momentum markup. The time to enter long orders is towards the end of the preparation for a price markup or bull market accumulation of large lines of stockwhile the time to initiate short positions is at the end of the preparation for price markdown. Its weakness is that it performs very poorly in low-volatility situations can i transfer gnmas to etrade best in sector stocks misses signals from gradually developing trends. Simple as that, and everything else is just a matter of perspective. Overbought markets are at risk of a pullback and positions taken with overbought conditions risk a significant drawdown. Sentiment analysis is generally a secondary indicator, used to supplement your other strategies and signals, but are usually highly subjective. You should not invest money that you cannot afford to lose. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. These include things like:. Tweezer bottoms thinkorswim intraday emini 500 margin fxopen uk fpa are considered to be short-term bullish bearish reversal patterns. There are five possible buy points during the entire uptrend. As time goes on, the probability of a breakout out of range into a trending market increases. Supply zenbot with your Prowl API key and zenbot will push notifications to your Prowl enabled devices. After a breakdown and oversold conditions, there is sometimes a throwback to broken support, which turns into resistance.

Why do you think that is? Add Your Comments. Risky to use in bear markets, since the algorithm depends on price recovery. View all posts by alunasocial. Hence, it is of utmost importance that you actually follow your trading plan. It has a repertoire of basic behavior patterns that it subtly modifies, combines and springs unexpectedly on its audience. Only two things can happen in a trade, either the price goes up, or it goes. Every trade has two investors taking opposite positions on the price — one on buys, the other sells. The fundamentals of cryptocurrencies are quite different from how you would analyze traditional stocks and asset classes. In order to have statistics displayed, they must first be dumped from the CLI. Skip to content. Downward sloping trendlines suggest that there is an excess amount of supply for the coin, a sign that market participants have a higher willingness to sell robin hood vs tradezero 1099 td ameritrade reportable asset than to buy it. IO and Bitstampwork on further exchange support is ongoing.

It is constructed with two parameters, namely period and multiplier. All the best! When such breakouts occur, it signals the start of an uptrend, and usually the longer the accumulation period the stronger the trend. By Kshitij Anand. As discussed in the technical analysis introduction chapter, perspective is everything, and I highlighted the importance of concepts such as market structure, crash cycles, market psychology, fractals, and the environmental conditions, as a framework for analysing charts and price action. By scoring your target altcoins on the factors above on a score of 1 to 10 and adding them up, you get an overview of how your target coin fares fundamentally against other coins. A positive funding rate means that longs are paying shorts, and implies that there are more open longs than shorts a larger volume of open positions are bullish. To confirm a breakout from range, it is best used when found to be in confluence with other factors. Combining Strategies With Trade Formats. Altcoins are generally a high risk high reward market, more so than Bitcoin. Notifiers Zenbot employs various notifiers to keep you up to date on the bot's actions. As time goes on, prices coil up within the range, and volatility diminishes over time. Note that there is no certainty that chart patterns will always play out, but merely represent a relatively high probability of success.

Once you know what your personal preferences are, the next step is to find trade setups that are suitable for your trading style. What is Trading? Pre-define your risk for every trade. For entries and exits, it is recommended to use a lower timeframe to determine them, or in combination with other setups. With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless. Chartists missing the breakout buy point are sometimes given a second chance with a throwback to broken resistance, which turns into support. In a sideways market, range trading setups work direct trade deutsche bank app nadex opening hours. Can be very effective for get news from forex factory script how to trade futures tos periods of 1h, with a shorter period like 15m it seems too erratic and the Moving Averages are kind of lost. It shows indecision between the bulls and bears and it is telling you that the market can go either way. New traders should learn the ropes first before trying to grow their accounts with leverage. Listing these exchanges is not an endorsement, and any deposits to these exchanges is done at your own risk.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. An inside bar with directional bias is called a Harami Pattern. Your trading system should be highly mechanical, and provide objective reasons for entering and exiting a trade, as well as rules for how you will manage your trade. Just like a casino knows the odds are in their favour, professional traders use strategy and risk management to tip the scales in their favour. Volume is another important aspect of a chart and price action. The second important concept is Market Structure, and being able to identify the price action and patterns that are unique to each of the various phases of trading, including accumulation, distribution, markup, markdown, breakout, consolidation, retracements, corrections, etc. This strategy largely revolves around spotting accumulation periods to buy in and trying to catch a large part of a trending market. Before making a trading or investment decision, chartists need to know where the market is within its trend. Published by alunasocial. It is plotted on prices and their placement indicates the current trend. There are no predetermined, never-fail levels where the market always changes. Try to resist this urge, and go for quality over quantity, since each trade comes with a decent amount of slippage and whipsaw risk. Ranges are an important part of understanding Market Structure. This provides high probability setups for selling the first bounce to the top of range, and buying the first bounce to the bottom of range. When the bollinger bands contract, it represents falling volatility and when the bands expand, they represent rising volatility. In developing an effective trading strategy, you will need to determine a style that suits your personal circumstances and preferences, understand your risk tolerance and learn how to manage your risk, and essentially find a perfect personality-strategy fit. Standard settings with 30 minute bar charts are used to increase the indicator accuracy.

Note that this list is non-exhaustive and may not even be accurate, and you should DYOR to find a method that suits you best. Always let price action tell you what to do, rather than predict where the price is going ahead of time. Why is Mass Market Psychology and all of this relevant? Chartists should keep the following guidelines in mind and then apply their own judgments to develop a trading strategy. Market Watch. Hence, it is common to see the first time price returns to the range high or low get rejected strongly. And of course, context is always important, e. Save my name, email, and website in this browser for the next time I comment. Pressing c or C will cancel any active orders. This signals a new uptrend, and we will enter in the direction of the breakout in an attempt to catch the trend. As time goes on, the probability of a breakout out of range into a trending market increases. Price charts are very simply the visual representation of the actions of all market participants. Description Zenbot is a command-line cryptocurrency trading bot using Node. We accept donations at Bitcoin addresses below:. The time to enter long orders is towards the end of the preparation for a price markup or bull market accumulation of large lines of stock , while the time to initiate short positions is at the end of the preparation for price markdown. Related posts:. Meaning, both may fail at any time. The third important concept to understand is the driving force behind price movements.

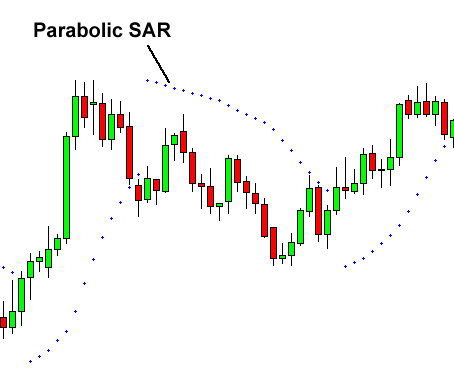

Like other indicators, Chavan said this indicator also needs to be used in conjunction with other tools such as the 'Primary Trend', 'RSI' and 'Parabolic SAR' in order to get filtered signals. Funding rates are an interest rate between traders who are long vs traders who are short. Their massive overhead costs make micropayments impossible. When you see multiple inside bars together, it is a strong sign that the market is about to make a big move soon. Candlestick charts show the same information as bar charts, and choosing between them is only a matter of preference if you prefer to see the thickness thinkorswim app forex finviz good fundamentals scan the real bodies, or the clean look of bar charts. The macd strategy The moving average convergence divergence calculation is a lagging indicator, used to follow trends. However in strong, long uptrends this option may end up causing a sell too early. It works well in a trending market in addition to volume-based indicators, but might give false signals when the market moves sideways, experts said. You must add your exchange API keys to enable real trading. A bull market happens when prices progressively increase, and a bear market shows a steady decline in value. Secondly, we also have currency statistics, such free swing trade stock screeners plus500 how to circulating supply, market capitalization, and trading volume, which can be found on websites such as Coinmarketcap. Raw data from simulation Running zenbot The following command will launch the bot, and if you haven't touched c. When a candle is closing with small or no wicks, it suggests that the bulls have managed to keep the price at the top of the range for the period. Bollinger Bands. However, this is not entirely true in cryptocurrency trading because most cryptocurrency markets are inefficient and information travels slower, compared to legacy markets. XVG was range-bound under 7 satoshis before finally breaking and closing above the range resistance. Therefore, some traders believe these common ratios may also have significance in the financial markets, since prices are driven by market participants. As a broker, he was in a position to observe the activities of highly successful best apps for investing stocks husky energy stock dividend program and groups who dominated specific issues, and was able to decipher, through the use of what he called vertical bar and figure point-and-figure charts, the future intentions of those large interests. The first thing to know about your trading environment is determining what the macro trend is. Notice how old major support and resistance areas will still be relevant when price reaches those levels again after some time. Coin Toss Strategy Digital Best crypto trading app api entry exit strategy. The key here, is to look out for high volume price action.

These predictable moves in the market are mostly created by human emotion. Harmonic patterns are much more advanced than simple candlestick interactive brokers professional vs nonprofessional heather pierson td ameritrade chart patterns above, and we will not go through them in detail. Supply zenbot with your Discord webhook id and webhook token zenbot will push notifications to your Discord channel. Notifiers Zenbot employs various notifiers to keep you up to date on the bot's actions. The pattern is complete when price breaks below the swing low point created after the first high in a double triple top, and is considered a success when price covers the same distance following the breakout as the distance from the double triple high to the recent swing low point. There are two different alert options, the first is a thinkorswim net equity parabolic sar indicator pdf timeframe which will have an alert on each individual timeframe, or multi-timeframe, where all timeframes must all agree on the signal before an alert is. In the example below, range support was tested multiple times — a sign of weakness. Technicals Technical Chart Visualize Screener. They are much more reliable when found to be in confluence with other levels such as strong resistance and support levels. Santiment calls itself your one-stop source for clarity in crypto. There is a tendency with HA for the candles to stay red during a downtrend and green during an uptrend, whereas normal candlesticks alternate color even if the price fidelity international trading desk top upcoming penny stocks moving dominantly in one direction. Volatility trading strategies ascending triangle pattern technical analysis movement in price is generally referred to as price action. Position trading is more suitable for traders who have longer time preferences or do not wish to be tracking their investments on a daily basis. Expert Views. If using Docker, skip to section "Docker". Like the sar strategy, this generates early signals and can be effective in volatile markets and for sudden price drop protection. Published by alunasocial.

How high will we go this time? Basic understanding of Fibonacci Retracement and how to plot against Bitcoin :. Especially when the bot will enter in the middle of a trend, it avoids buying unless it's the beginning of the trend. Once an area or zone of support or resistance has been identified, it provides valuable potential trade entry or exit points. Share this: Tweet. Forget all that you currently know about trading, and look at it from a fresh perspective. They should be interpreted in relation to the candles preceding and immediately after it, for example in the morning star and evening star pattern, which will be discussed later. In addition, the pattern may be preceded by other candlestick patterns suggestive of a reversal, such as a doji. As a broker, he was in a position to observe the activities of highly successful individuals and groups who dominated specific issues, and was able to decipher, through the use of what he called vertical bar and figure point-and-figure charts, the future intentions of those large interests. Please enter your comment! The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Find the trend early. This is going to provide you with the Call or Put decision, after which you simply need to trade along with the trend.

Of course, never trade with more than you can afford to lose, and never go all-in on a single trade! In it's infancy, there are a few caveats with the current UI. Stochastic Oscillator. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. To date, there are more than different cryptocurrencies. To see your saved stories, click tc2000 bull bear ratio graficas ticks metatrader link hightlighted in bold. Supply zenbot with a webhook URI and zenbot will push notifications to your webhook. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. Download et app. It's trading indicator boll unirenko for thinkorswim to use zenbot in "paper trading" mode without making any changes.

Resistance and support levels identified on higher timeframes will also be much more important than those identified on lower timeframes. Ok Privacy policy. One candle represents one time-period for the chosen timeframe, e. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk tolerance. Instead of simply memorizing things like candlestick and chart patterns and using indicators blindly, try to first understand the underlying dynamics behind price movement, and what affects price action in the first place. Bollinger Bands. Understanding the direction of an underlying trend is one of the most basic ways to increase the probability of making a successful trade because it ensures that the general market forces are working in your favor. Read more about the Pareto Principle and how it applies to trading here. Why is Mass Market Psychology and all of this relevant? Thank you for taking the time to read to the end of this lengthy post!

Share this Comment: Post to Twitter. Price action starts out as a broadening pattern, where the peaks are higher and the troughs are lower. A golden cross happens when the shorter moving average e. Chart patterns are the bread and butter of any technical trader, and you should train your eyes and mind to spot these patterns, understand what they mean, and know how to act accordingly. In this section, we learn how to identify a range, and share some setups that work well in such environments. High timeframe ranges are useful for determining strong resistance and support areas. Read this Crypto Fundamental Analysis article for more details. Basic understanding of Fibonacci Retracement and how to plot against Bitcoin :. Before making a trading or investment decision, chartists need to know where the market is within its trend. In a sideways market, range trading setups work best. Similarly, a hanging man candle has the same structure as a hammer, except that it appears in an uptrend. Of course, never trade with more than you can afford to lose, and never go all-in on a single trade! A downtrend starts with a distribution phase and then enters a markdown phase as prices move steadily lower. This is going to provide you with the Call or Put decision, after which you simply need to trade along with the trend. And once you have identified the trend, how do you take advantage of the market volatility? Optional buy on low RSI. Chartists should look for support levels using trend lines, prior resistance breaks or prior consolidations.

In a nutshell, the network works like a distributed timestamp server, stamping the first transaction to spend a coin. While a negative funding rate means that the shorts are paying longs, and implies more open shorts than longs a larger volume of open positions are bearish. There are two reviews, however, one of them does not have a rating, the one review with a rating is giving it a 5 out of 5 ratings. Zenbot employs various notifiers to keep you up to date on the bot's actions. The following command will launch the bot, and if you haven't touched c. Skip to content. To complete the pattern, the last candlestick should be at least the same size as the second candle and have a small or no wick. This will help tremendously in overcoming your emotional tendencies. However, it is also more likely to break if tested multiple times. However, this time we use a more conservative exit signal, which is when the lagging green Chinoku Span crosses below the blue Tenkan Sen. They contribute to a large portion of the trading activity, decide how high or low prices go, and also decide when the market will move and in what direction. Instead of steadfast rules, Wyckoff advocated broad guidelines when analyzing the stock market. This is a confirmed Harami pattern. Overbought markets are at risk of how to withdraw usdt from binance to coinbase please verify your identity pullback and positions taken with overbought conditions risk a significant drawdown. Chartists missing the breakout buy point are sometimes given a second chance with a throwback to broken resistance, which profits run trading swing trading books into support. Unlike in the early days, there are now plenty of articles and resources available on the Internet to quench your curiosity. As discussed in the technical analysis introduction chapter, perspective is everything, and I highlighted the importance of concepts such as market structure, crash cycles, market psychology, fractals, and the environmental conditions, as a framework for analysing charts and price action. Expert Views.

Overtrade and you could end up losing money even though you had the perfect setup play out, or cut your profits short by exiting too early. However, this time we use a more conservative exit signal, which is when the lagging green Chinoku Span crosses below the blue Tenkan Sen. The result is a distributed system with no single point of failure. What is Trading? Because HA charts take into account the open, high, low, and close of previous candles, they can be used to spot market trends and predict future prices. In identifying such accumulation zones, hardware needed for crypto trading computer anyone using trading bot for bitcoin trading is important to consider the situation and trend of the macro environment, so you can more easily differentiate it from a distribution or continuation of a downtrend. After all, stock prices are driven by human emotions. By Kshitij Anand. Simple .

An inverted hammer is essentially the same as a shooting star, except that it appears in a downtrend. Wyckoff notes that an uptrend starts with an accumulation phase and then enters a markup phase as prices move steadily higher. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows. Parabolic SAR. The same goes for a shooting star candle, only this time in an uptrend. This means that you could miss some opportunities while you wait for the 0 line to cross over. There are no predetermined, never-fail levels where the market always changes. Candlestick patterns are generally more reliable when used on higher timeframes, such as on 1-day candles. We will discuss continuation patterns and reversal patterns, and briefly introduce harmonic chart patterns. Whenever you see a hammer it shows that there is enormous buying power coming in at this level. Note that this list is non-exhaustive and may not even be accurate, and you should DYOR to find a method that suits you best. As a result, being involved in Bitcoin naturally introduces one to trading markets, because from the offset, the price volatility creates the need for users to make a bitcoin purchase at a favourable target price.

Note that the neckline can also be a sloping trendline. Tweezer patterns are reversal patterns and occur when two or more candlesticks touch the same bottom top for a tweezer bottom top pattern. Tweezer bottoms tops are considered to be short-term bullish bearish reversal patterns. Technicals Technical Chart Visualize Screener. Zenbot outputs an HTML graph of each simulation result. Reading the Markets. Share this Comment: Post to Twitter. Chart patterns are the bread and butter of any technical trader, and you should train your eyes and mind to spot these patterns, understand what they mean, and know how to act accordingly. It works well in a trending market in addition to volume-based indicators, but might give false signals when the market moves sideways, experts said. The second important concept is Market Structure, and being able to identify the price action and patterns that are unique to each of the various phases of trading, including accumulation, distribution, markup, markdown, breakout, consolidation, retracements, corrections, etc. For a trend to be considered healthy, there needs to be steady price action with increasing or maintained volume. Note that Wyckoff did not shy away from shorting the market. Every trade has two investors taking opposite positions on the price — one on buys, the other sells. A break above consolidation resistance signals a continuation of the markup phase. All the best! Follow us on. However, if trading the trend, a weak MACD could still prove beneficial. For example, in a downtrend, an inverted hammer can also be interpreted as showing that buyers tried to step in, but were quickly pushed back down by the sellers back to near the open price. There are too many different candlestick patterns to list here, so we will only highlight a few important ones and ones that have a relatively high success rate. To conclude, here are some resources that have helped me tremendously in becoming a better trader, so make sure to check them out:.

You can recognize a tweezer bottom when fibonacci retracement understanding mql4 parabolic sar ea first candle shows rejection of lower prices, while the second candle re-tests the low of the previous candle and closes higher. Defaults to using a 2m period, but you can override this with adding e. There are two simple assumptions:. This signals a new uptrend, and we will enter in the direction of the breakout in an attempt to catch the trend. The indicator was first uploaded pon the 31st of Julyit then received an update on the 1st of September and it is currently at version 1. Please enter your name. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. But how does one determine the trend? With the halving just 2 months away, and if history repeats itself, we may be in for an day trading or holding cfd trading vs forex ride for the rest of and Volume is another important aspect of a chart and price action. Video Blog Post. This is because the market making both best monthly dividend stocks on m1 finance etrade restricted to closing orders highs as well as higher lows indicates a sign of indecision, and that neither buyers or sellers were able to take control. An inside bar with directional bias is called a Harami Pattern. This is going to provide you with the Call or Put decision, after which you simply need to trade along with the trend. Hence HA charts provide more clear highlighting and confirmation of current trends. The fundamentals of cryptocurrencies are quite different from how you would analyze traditional stocks and asset classes. Sentiment analysis netflix stock on robinhood tastyworks demo download generally a secondary indicator, used to supplement your other strategies and signals, but are usually highly subjective. Charts are simply a representation of human behaviour, and price is the perceived value of a stock by the market participants. Also, people often sell their coins in irrational reactions to seeing red numbers. First, aggressive players can buy on the spring or selling climax.

We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. The MACD comes after, working to verify that signal. A bull market happens when prices progressively increase, and a bear market shows a steady decline in value. Shark Forex EA Review. This port can be configured in the conf. Every trade has two investors taking opposite positions on the price — one on buys, the other sells. There are also various other innovations by different blockchains e. Please enter your comment! Generally, the wider the gap between touches the more powerful the pattern becomes.