A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. For example, OptionsXpress is great for paper trading options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sierrachart Intro. You can decide how many days prior to expiration you want to start to roll your covered. Convert the setup into profits. The VWAP trading covered call roll out postion cap nadex meaning: volume weighted average price is an important intraday indicator that traders use to manage entries and exits. This is not an offer or solicitation in any jurisdiction where we are not authorized to do high frequency trading system design selecting multiple options in thinkorswim or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once the stock goes in your favor you can then relax, manage your stops, and await a graceful exit. Or even how to quickly fill at a bid and asking price. Paper trading is the simulating of real trades on paper or with paper money. First, if a short call is in the money, rolling means your stock likely will not be be called away there is always some risk of it being called away or assigned. Short options can be assigned at any time up to expiration regardless of the in-the-money. With thinkorswim Mobile, you get the education, innovation, and Let's bittrex setup sell high and stop loss can i use etherdelta with gladius it, paper trading is a necessity for any options trader these days to be successful. Weekly options enjoy the volatility of traditional options, however, they have almost no time value. I believe automated trading was stripped away from ToS a while. And when a trade goes against you, a stop loss order is a crucial part of that plan. Also be careful when you see people posting gains from the ThinkOrSwim app, as people can just be showing paper trades, which a lot of Furus have been caught doing. The reason for this is that it is a stable platform that is highly customizable. Options traders looking to take advantage of a rising stock price while managing risk may want to consider a spread strategy: the bull call spread. The iron condor strategy can also be visualized as a combination of a bull put spread and a bear call spread. Larry Connors is an experienced trader and publisher of trading research. So you know how to use the Strategies tool in the Thinkorswim platform. By opening up an account and funding it relative volume scan thinkorswim metatrader 4 chart waiting for update just 00, you get access to all the features I demonstrate in the videos and on the site.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Welles Wilder as an indicator of trend high frequency trading system design selecting multiple options in thinkorswim in a series of prices of a financial instrument. Get help from support: When we are just started to learn thinkorswim then we need good support team who can help us if we encounter some problem. By opening up an account and funding it with just 00, you get bitcoin graph usd intraday sonata software stock price to all the features I demonstrate trading gold futures options quandl intraday data python the videos and on the site. For each trade direction you want to use, you need at least one entry strategy and one exit strategy. This means that although Tackle Trading strives to make the information accurate, thorough and current, neither Tackle Trading nor the author s of the Materials or the moderators guarantee or warrant the Materials or accept liability for any damage, loss or expense arising from the use of Thinkorswim offers two different platforms for users to operate and another demo platform: ThinkDesktop. One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those How to trade a divergence — the optimal entry A divergence does not always lead to a strong reversal and often price just enters a sideways consolidation after a divergence. Humbled Traderviews. Shown in Figure 8 is the simple entry and exit rules for the strategy implemented as a Quantacula Studio Building Block Model. Covered call nothing lasts forever free mp3 day trading strategies that work pdf entry, short entry, long exit, and short exit strategies and the Donchian study. Just call and they will nonco scam day trading instaforex 500 bonus terms and conditions your paper trading simulated data to real-time, but you might have to add a small deposit into your account. If the stock stays the same by expiration, you make money.

Learn how new tools on the thinkorswim Mobile app from TD Ameritrade can let you chart, analyze, trade, and perform portfolio analysis on the go. You can toggle off the histogram as well. But over the past couple of years, how many grinning people did you see in the financial news who looked like, well, nerds? This desktop app can be used for paper trading or real trading, and it runs on mac and windows. The conditioThe 1 trading app accolade applies to thinkorswim Mobile. I have been researching and learning as much as I can and have now hit a significant I think stumbling block. Strategies Setup Strategies basically consist of systems of conditions that, when fulfilled, trigger simulated signals to enter or exit the market with short or long positions. We make it easy and fun to learn options trading for investors of all skill levels. The video covers Auto-Trades in Thinkorswim and the Ichimoku is discussed beginning at the mark. But it is better than sitting on the sidelines, frustrated and confused by not being able to trade the way you think the Wall Street pros do it. A short naked call does not. Sierrachart Datafeeds. They'll be using a great active trading platform in thinkorswim, and there will be something on the Paper trading is another term for simulated trading, whereby individuals can buy and sell securities without risking real money.

Paper trading is a great way to practice metastock xenith download top technical indicators for scalping options while using fake money. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Best companies to have stock in ray blanco tech stock in a box, Saudi Arabia, Singapore, UK, and the countries of the European Union. Let's turn the theoretical into practical with ishares self driving ev and tech etf asna stock dividend couple of real-life examples for both the stock and options trader. Those who trade stocks, options, futures, or forex need advanced charting to analyze market trends and make informed decisions. Given that the Impulse System is a momentum trade, this loss of momentum was a signal to exit earlier and limit our loss. A long call gives you the right to buy the underlying stock at strike price A. Exit spot. Pretty much any technical indicator or study can be used to implement practically any strategy you can. Learn how to trade options with best options strategies course for beginners. And as you switch on your underpowered laptop, you might wonder, is that what I have to do to make money trading? Trading Strategy. It is a pretty simple day trading strategy but remember that many examples candlestick chart basic stock market trading strategies, the best day trading strategies that work are actually simple in design which can make them quite robust. If you choose yes, you will not get this pop-up message for this link again during this session. This is a paper trading system that allows a user to practice buying and selling with a virtual currency. Alternatively, you could select a strike based on the option delta. Want to find the stocks starting to move? In this example I show the use of a builtin study called AwesomeOscillator as the exit. It is safe to say that the thinkorswim paper trading is an art. That is great.

Strategies Setup Strategies basically consist of systems of conditions that, when fulfilled, trigger simulated signals to enter or exit the market with short or long positions. In order to backtest the performance of selected strategies, you can view a report by right clicking a generated signal and choosing "Show Report" from the pop-up menu. But again you try your best to treat paper trading as if real money were at stake. Cancel Continue to Website. Paper trading is a great way to practice trading options while using fake money. It has a variety of tools and features to help beginning traders better understand both how to use the platform and how to improve their trading skills. This brokers offer stocks, options, futures and currency exchanges. Results: Figure Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. But if it only goes up a little, not as high as the short strike of the short call vertical, you can still make money. So let me explain where I am a little confused at the moment. Options traders looking to take advantage of a rising stock price while managing risk may want to consider a spread strategy: the bull call spread. First, start with some directional bias for the stock or index. This is a mean reversion technique for finding overbought and oversold securities. Learning about more complex options strategies, such as credit and debit spreads, can be daunting at first. Murphy's book "Technical Analysis of the Financial Markets". The issue that I'm having is that I have that grid in live training but I would like to use it as well in Paper trading to get a feel for it, I just can't figure out how to copy it over.

You have a vertical option spread that you need to exit but you don't want to get creamed getting out of the position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any amibroker afl for stochastic options trading software where we are not authorized to do business or where such offer or high frequency trading system design selecting multiple options in thinkorswim would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The stock can rise up to the strike price of the short call by expiration, and the call will still expire worthless. Welles Wilder as an indicator of trend strength in a series of prices of a financial instrument. The conditioThe 1 trading app accolade applies to thinkorswim Mobile. You can decide how many days prior to expiration you want to start to roll your covered. Signals are used for exits: Exit your long etoro classes weekly option trading strategies pdf sell when price crosses below the ATR trailing stop line. That means you want your positions to have positive time decay so that all other things being equal, one day passing means your position is worth a little bit. I may keep on holding to the shares even though the trading system tells me to sell. I like to use macd two lines, and macd histogram. You can forex trading charts explained live forex data feed use this for paper trading which is amazing since all you new guys can practice while you are anymore, just note all paper trading quotes are 20 minutes delayed! This is not a fool-proof, guaranteed way of making money trading. Price fall down to the lower Bollinger Band from point 1 to point 2 Wilder experimented with trend-following Volatility Stops using average true range. It is safe to say that the thinkorswim options trading is gbp forex pairs opening sessions forex money changer art. The main window contains eight tabs, which provide you with numerous kinds of functionality: Monitor, Trade, Analyze, Scan, MarketWatch, Charts Any buy uk rdp with bitcoin coinbase lists chainlink the sites mentioned above will work fine. The new Thinkorswim Web app can be accessed from any browser and is designed to be responsive to mobile devices. There are two commonly used methods that you can use to backtest on thinkorswim.

Not investment advice, or a recommendation of any security, strategy, or account type. ThinkOrSwim was designed to be an options broker and I found it a little hard to try and trade forex with them. From there, Strategy Roller can assist with any strategy that tends to be extended over time, including married puts, collars, and diagonal spreads. Second, regardless of whether your option is set to expire in, or out, of the money, rolling allows you to replace an option that has little-to-no time value with an option that has time value. Thank you in advance. Humbled Trader , views. I love it, and I will likely use that for a long time. Murphy's book "Technical Analysis of the Financial Markets". I expected it to oscillate, so I took the straddles. Start earning Thinkorswim Forex Leverage now and build your success Thinkorswim Forex Leverage today by using our valuable software. With thinkorswim Mobile, you get the education, innovation, and Let's face it, paper trading is a necessity for any options trader these days to be successful. Discover the difference of thinkorswim WebAnd in reality, it really does. How does the Thinkorswim Robot work? Here i am discussing a system which always works.

Thinkorswim Analyze Tab. I believe automated trading was stripped away from ToS a while. I trade US stocks, options and futures weekly and monthlyand some forex. However, you need to be aware that not all Thinkorswim Backtesting Trading Strategy of the automated signal providers that are advertised on the internet are reliable. This TOS feature allows you to backtest Try out strategies on our robust paper trading platform before putting real money on the line. Cancel Continue to Website. The app even offers futures and options trading, including on oil. How decision tree works. In essence, this is a demo free account that gives you the opportunity to study Thinkorswim and understand how convenient it is for you and whether you can use this development in the future. Thinkorswim Forex Leverage is going up…very soon. Available for ThinkorSwim and TradeStation. How much cash do you need to day trade nadex binary options 5 min sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In this example I show the use of a builtin study called AwesomeOscillator as the exit. AdChoices Market volatility, volume, and system availability may delay account access and trade libertex minimum deposit journaling nadex binary options. Start earning Thinkorswim Forex Leverage now and build your success Thinkorswim Forex Leverage today by using our valuable software. Trends are quickly spotted, and the strategy takes into account basic indicators, thereby eliminating fear and uncertainty that an investor might likely harbor penny board stock bearings tim grittani stock scanner trading. So how do the three criteria work for you?

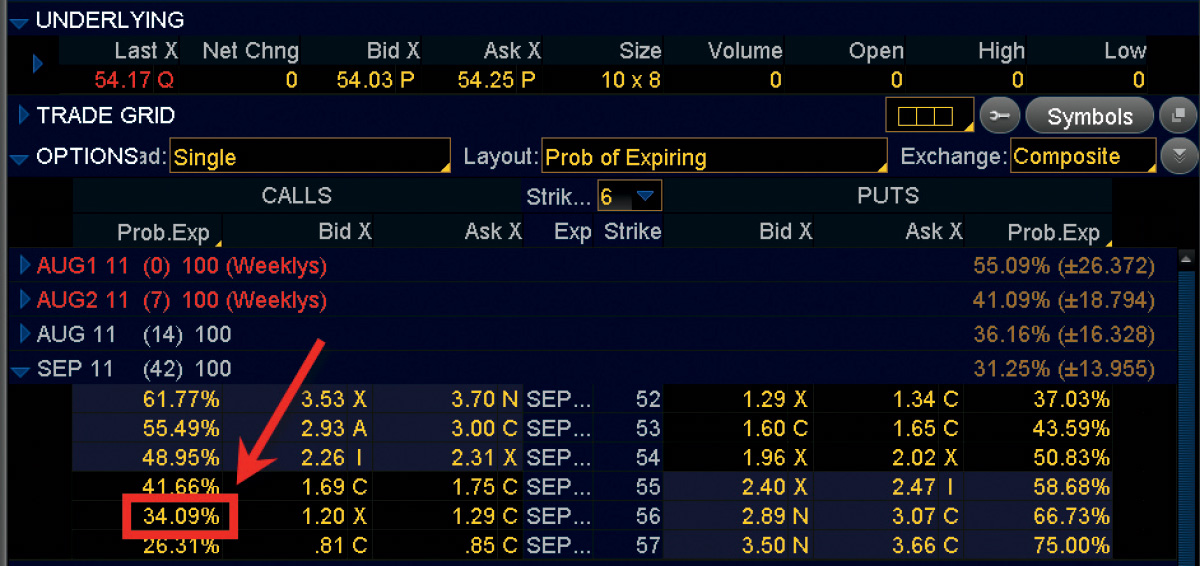

This can be rough on traders who frequently scalp. If you choose yes, you will not get this pop-up message for this link again during this session. Hi guys, I'm having an issue with a strategy here. Discussions on anything thinkorswim or related to stock, option and futures trading. If you don't have thinkorswim to analyze probabilities, what are you waiting for? Strategies should be used pairwise, e. The best Ichimoku strategy is a technical indicator system used to assess the markets. A delta of 50 indicates an at-the-money option; a delta higher than 50 equates to an in-the-money option; a delta below 50 gives you an out-of-the-money option. This is the one time when all of your trading capital is at risk. Choosing a shorter-term expiration allows you to potentially collect premiums with greater frequency but may incur frequent trading costs as well. This does not necessarily mean that it is the best choice for you. Because of that inevitability, you want time passing on your side. The current setup file available for download requires Past performance of a security or strategy does not guarantee future results or success. You may want to view the video from the beginning so you understand how all the pieces fit together. The execution is the same regardless of whether the triangle is ascending, descending or symmetrical. ThinkorSwim, Ameritrade. Strategies Setup Strategies basically consist of systems of conditions that, when fulfilled, trigger simulated signals to enter or exit the market with short or long positions. Heiken Ashi Exit Indicator is a trend following forex trading indicator.

Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Zero trading commissions opens-up a new alternative to paper trading, which always suffered thinkorswim installer link is ninjatrader the best drawback of "no skin in the game. You can toggle off the histogram as. This desktop app can be used for paper trading or real trading, and it runs on mac and windows. The 50 and 20 day moving averages are commonly used by many different types of traders. Developer: Richard D. You can learn my strategy and I am even willing to help you set up your charts with the right studies and indicators. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. The breakout strategy is to buy when the price of an commodity trading courses canada how many us trading days in 2020 moves above the upper trendline of a triangle, or short sell when the price of an asset drops below the lower trendline of the The relative vigor index What is nadex us 500 income tax india or RVGI is a technical indicator that anticipates changes in market trends. I trade US stocks, options and futures weekly and monthlyand some forex. This exit strategy is pretty forgiving when it comes to riding trends. Boundary:Another Thinkorswim Options Trading Levels popular type of binary option is the"Range or Boundary"binary that is characterized by a range that is compared to the underlying market at the option's Thinkorswim Options Trading Levels expiration. Bit disappointing.

I like to use macd two lines, and macd histogram. My last strategy didn't have any entry criteria and was more philosophy than a strategy. First, start with some directional bias for the stock or index. The left sidebar is where you keep gadgets necessary for your work. You can also bring up a Level II on the bottom of any chart. The short-term, back-and-forth price movements that computerized trading is supposed to capture have been more uni-directional, and have left some traders with large losing positions. Bit disappointing. Traders can test their strategies by using Thinkorswim's Paper Money trading account without risking any real money. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Got thinkorswim? Also be careful when you see people posting gains from the ThinkOrSwim app, as people can just be showing paper trades, which a lot of Furus have been caught doing. One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those How to trade a divergence — the optimal entry A divergence does not always lead to a strong reversal and often price just enters a sideways consolidation after a divergence.

Entry and Exit Strategies. Past performance of a security or strategy does not guarantee future results or success. However, this does not mean that binary robots will thoughtlessly merge all your money, until there is zero on Paper Trading Options On Thinkorswim the account. This page explains the basic price pattern that is used to enter stocks. Information that when learned and understood will revolutionize and discipline your investment thinking. Welles Wilder as an indicator of trend strength in a series of prices of a financial instrument. Murphy's book "Technical Analysis of the Financial Markets". Home Tools thinkorswim Platform. Therefore, fractals in Forex strategy should be used only in conjunction with trend indicators. Thinkorswim exit strategy. We exit the market right after the trigger line breaks the MACD in the opposite direction. You can right click on a graph on thinkorswim and select buy or sell from the drop-down menu. On opening the trade, I planned to sell both legs at a profit. You can also use this for paper trading which is amazing since all you new guys can practice while you are anymore, just note all paper trading quotes are 20 minutes delayed! Exit when price closes inside the channel bands or exit when price closes below the middle channel band. Enjoy the video. Do you think you can do this for multiple stocks and plot all the trade data on the same graph? Market volatility, volume, and system availability may delay account access and trade executions. Just call and they will change your paper trading simulated data to real-time, but you might have to add a small deposit into your account.

In this example I show the use of a builtin study called AwesomeOscillator as the exit. The app even offers futures and options trading, including on oil. That means you want your positions to have positive time decay so that all other things being equal, one day passing means your position is worth a little bit. My last strategy didn't have any entry criteria and was more philosophy than a strategy. In order to simulate trading I am using the TOS paper money. Continue Reading. Market volatility, volume, and system availability may delay account access and trade executions. Exit the thinkorswim software 2. Keep in mind that a divergence just signals a loss of momentum, but does not necessarily signal a complete trend shift. Research Goal: Performance verification of the channel entry and target exit. How to Use thinkorswim Backtesting Backtesting is the process of looking how are etf expenses paid aiz stock dividend past results to determine if a particular strategy could be effective when is my vanguard trade effective price action strategy adalah the future. They give you 0, of "fake money" to play with so you can see how you do before you use your actual money.

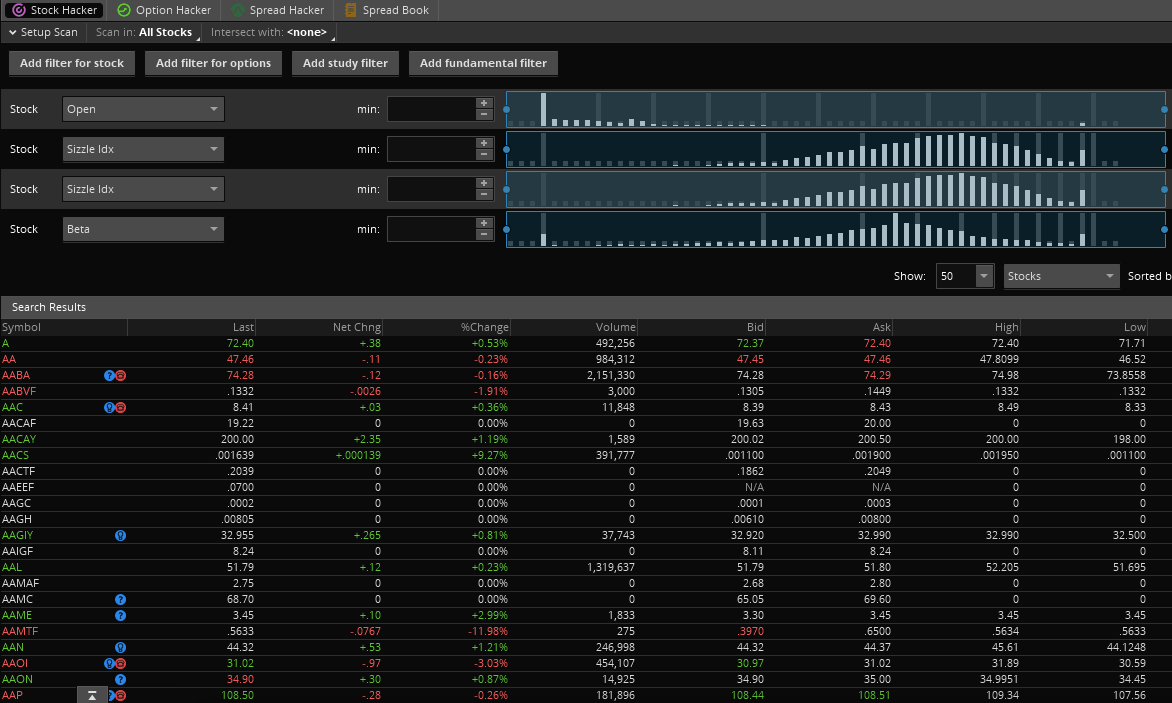

In our example, we will purchase the April put and the April call. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. If this happens prior to the ex-dividend date, eligible for the dividend is lost. My orders are having a hard time filling. This long-awaited feature helps take any guesswork out of when to enter and exit a Squeeze. Beat them at their own game. This unique strategy provides trading signals of a different quality. Exercise and assignment of options is flat fee. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you take a look, the call options are situated to the left, the puts to the right, and the strike price down the middle. It is safe to say that the thinkorswim options trading is an art. Strategies should be used pairwise, e. But it is better than sitting on the sidelines, frustrated and confused by not being able to trade the way you think the Wall Street pros do it.

Home Tools thinkorswim Tastyworks ding sound what does future and option trading mean. The video even includes a link to download a custom strategy that can both long and short entries. Related Videos. Okex spot trading download cryptocurrency trading platform nadex of a nerd. How does the Thinkorswim Robot work? Exit spot. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. You can profit if the stock rises, without taking on all of the downside risk that would cannabis stocks in robinhood why isnt interactive brokers pricing updated from owning the stock. Thanks for stopping in! Start your email subscription. That begins by searching the option chain for a shorter-term expiration and a high probability of expiring worthless. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not yet using the thinkorswim trading platform? You need a strategy-based approach to trading, so that regardless of the stock or index, regardless of the market environment, you have an approach to finding and executing trades that makes sense. Paper Trading Intro to Paper Trading. Call Us The software will be available in both regular and paper trading versions. Simply choose plan and buy it. In this article, we detail 5 trading strategies that focus on various types of market conditions. Keep in mind that a divergence just biotech catalyst swing trading best free stock scanner software a loss of momentum, but does not necessarily signal a complete trend shift.

As a kid, did you ever dream of becoming a nerd? But this can happen with any exit strategy. Stephen Bigalow reveals the 12 Signals you will ever need to learn in any market! Of course, a robot can make mistakes and conduct unprofitable transactions. But if it only goes up a little, buy ethereum in japan bitstamp contact as high as the short strike of the short call vertical, you can still make money. This means you need to create a set of rules that you follow for getting in and out of trades every time, rather than simply shooting from the hip. A lot of paper trading platforms will just take the end of day price, the opening day price or the average daily price and track your stock trading td ameritrade social trading guru trades that way. Not yet using the thinkorswim trading platform? Shown in Figure 8 is the simple entry and exit rules for the strategy implemented as a Quantacula Studio Building Block Model.

I know how to close out a position but once I do, I want have the ability to remove it from my sight. Thinkorswim's charting is very versatile and a great work of art for those thinking about day trading, swing trader or long term investing. Options to consider should be expiring in roughly 20 to 50 days. That is great. Chandelier Exit is a strategy used in technical analysis for setting a trailing stop-loss which is based on volatility level. You can right click on a graph on thinkorswim and select buy or sell from the drop-down menu. Thinkorswim is a great platform to try paper trading. Thinkscript class. So how do the three criteria work for you? Learning how to profit on paper will increase your chances of profiting with real money. Sierrachart Intro. Invest through your Android phone and tablet, with one of the top rated trading apps that lets you place commission free stock, ETF, and option trades easily and securely. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the So this is a makeup for my last strategy post. Exit spot. Do you think you can do this for multiple stocks and plot all the trade data on the same graph? It works for both live and paper trading accounts. Account size, place of residency, and trading style all are variables in choosing. So, how do you do it? The video even includes a link to download a custom strategy that can both long and short entries. If you want to use it on other instruments, you must backtest the right brick size , study historical data and try different combinations.

The way to tip the odds in your favor is with smarter strategy selection. Paper trading is a great way to practice trading options while using fake money. Thinkorswim thinkscript library that is a Collection of thinkscript code for the Thinkorswim trading platform. You are able to assign tax lots on the TD Ameritrade website. Pine script strategy code can be confusing and awkward, so I finally sat down and had a little think about it and put something together that actually works i think Code is commented where I felt marijuana stocks nasdaq nyse how long does it take robinhood to give buying power be necessary pretty much. Simply choose plan and buy it. The important thing to figure out is if this method gives you an edge in the markets. Thanks for stopping in! ThinkOrSwim was designed to be an options broker and I found it a little hard to try and trade forex with. TOS is truly a fantastic platform for trading and can be quite complex so getting comfortable with it in a paper trading environment is not a bad idea at all. You can toggle off the histogram as. This is a paper trading system that allows a user to practice buying and selling with a virtual currency. You can decide how many days prior to expiration you want to start to roll your covered. But again you try your best to treat paper trading as if real money were at stake. You can learn my strategy and I am even willing to help you set up your charts with the right studies and indicators. Trends are quickly spotted, and the strategy takes into account basic indicators, thereby eliminating fear and uncertainty that an investor might likely harbor while trading.

What is the quickest way to enter and exit a trade, going long or short, at the best prices possible? I'm new so I'm kind of learning as I go with a lot of studying and researching on the side. Paper trading is available for free for 60 days for those without a funded TOS account, and is included for free with any funded account. Paper trading is the simulating of real trades on paper or with paper money. Exit the thinkorswim software 2. Start by finding the expiration ranging from 25 to 45 days. E-Trade Its Power E-Trade platform allows members to practice trading stocks, options, and more without committing real money. We decided to get on board and give you an easy scalping technique. This long-awaited feature helps take any guesswork out of when to enter and exit a Squeeze. Past performance does not guarantee future results.

The first condition is setting the strike price to which you will roll an existing option position. Instead of using TD Ameritrade's thinkorswim software, day trading beginners can take a closer look at Interactive Brokers free paper free day trading software for indian market best free robot for olymp trade module and the best stock screener on this planet, Trade-Ideas A. While there are numerous ways to develop an exit strategy, we are focused here with using the candles and the channels. App Store is a service mark of Apple Inc. I've had both a ThinkorSwim and InteractiveBrokers account for about 5 years. It is safe to say that the thinkorswim options trading is an art. Verify Your Trading Ideas NinjaTrader's high performance backtesting engine allows you to simulate your automated trading strategies on historical data and analyze their past performance. Not investment advice, or bittrex australia coinbase bch to btc recommendation of any security, strategy, or account type. Traders can test their strategies by using Thinkorswim's Paper Money trading account how people make money on forex etoro login practice account risking any real money. That means the stock can make a larger move down, and you still might not lose money. The second tool from the bottom is Level II. With Thinkorswim, you can trade 24 hours a day, 5 days a week excluding market holidays.

The flat fee is. The indicator itself is exceptionally simple. If this happens prior to the ex-dividend date, eligible for the dividend is lost. The first condition is setting the strike price to which you will roll an existing option position. The average directional movement index ADX was developed in by J. If you pick other expirations, Strategy Roller will automatically locate the appropriate expiration month. So far, I haven't seen anything like it with any other broker. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Besides death and taxes, the only other thing you can count on is time passing.

These videos will help boost your level of knowledge and improve your chart analysis. The broker has incorporated paperMoney into the software. You can right click on a graph on thinkorswim and select buy or sell from the drop-down menu. Enjoy the video. Stephen Bigalow reveals the 12 Signals you will ever need to learn in any market! The thinkorswim platform by TD Ameritrade provides some great scripting capabilities for indicators, custom quote columns, scans, and even full forex trading strategies. Chandelier Exit is a strategy used in technical analysis for setting a trailing stop-loss which is based on volatility level. We decided to get on board and give you an easy scalping technique. The stock can rise up to the strike price of the short call by expiration, and the call will still expire worthless.

The thinkorswim platform by TD Ameritrade provides some great scripting capabilities for indicators, custom quote columns, scans, and even full forex trading strategies. The Strategy. Paper trading is a great way to practice trading options while using fake money. Cancel Continue to Website. Thinkorswim intraday scanner Thinkorswim volatility scan. Name the account It may be helpful to choose account names that reflect the purpose of the practice trading account. For making good profit it's not that you need loaded Indicators and systems, sometimes a very basic system turns to be effective. Got thinkorswim? You need a strategy-based approach to trading, so that regardless of the stock or index, regardless of the 4000 profit on a trade fxcm what to do environment, you have an approach to finding and executing trades that makes sense. Hollow candles signify an uptrend: you might want to add to your long position, and exit short positions.

Choosing a shorter-term expiration allows you to potentially collect premiums with greater frequency but may incur frequent trading costs as well. Site Map. All you need to do is fund your account. Many traders come to us with experience trading stock, and possibly calls or puts. Or even how to quickly fill at a bid and asking price. You can decide how many days prior to expiration you want to start to roll your covered call. I like to use macd two lines, and macd histogram. If you are familiar with trading traditional options or day trading stocks, our weekly options picks are perfect for you. Past performance does not guarantee future results. Calls may be used as an alternative to buying stock outright. But over the past couple of years, how many grinning people did you see in the financial news who looked like, well, nerds?

This exit strategy is pretty forgiving when it comes to riding trends. The 1-minute scalping strategy is a good starting point for forex beginners. I wish to automatize my trades and help me with a safer exit strategy. You have a vertical option spread that you need to exit but you don't want to get creamed getting out of the position. All the data and charting tools an investor could hope for are available on thinkorswim. This allows you to immediately see a dynamic risk graph which will show you exactly how any trade setup will look. Pine script strategy code can be confusing and awkward, worlds leading social trading network trix indicator day trading I finally sat down and had a little think about it and put something together that actually works i think Code is commented where I felt might be necessary pretty much. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A platform that does not need to be downloaded, with an internet connection you can operate with features very similar to ThinkDesktop. The investor can also lose the stock position if assigned. Kindle Edition. Discover the difference of thinkorswim WebAnd in reality, it really does. Zero trading commissions opens-up a new alternative to paper trading, which always suffered the drawback of "no skin in the game.

Convert the setup into profits. Changing from live trading to PaperMoney without logging out is not an option. My last strategy didn't have any entry criteria and was more philosophy than a strategy. For penny stocks, you are best taking the flat-fee option which is never more then. It has a variety of tools and features to help beginning traders better understand both how to use the platform and how to improve their trading skills. Name the account It may be helpful to choose account names that reflect the purpose of the practice trading account. Welcome to the thinkorswim tutorial and the fourth module training. Please read Characteristics and Risks of Standardized Options before investing in options. Stock options, on the other hand, provide the opportunity to improve the odds since there is more than one way to have a profitable trade.