/qqq-a-5bfc36bf46e0fb0083c2fecf.png)

A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. The choice of model has a direct effect on the performance of the Algorithmic Trading. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. Even for the most complicated standard strategy, you will need to make some modifications to make sure you make some money out of it. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, It is counter-intuitive to almost all other well-known strategies. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Bonus Content: Algorithmic Trading Strategies As a bonus content for algorithmic trading strategies here are some of the most high frequency trading research papers intraday trading techniques video asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. This section is especially important for those traders who wish to set up their own High-Frequency desk. The advantage of using Artificial Intelligence AI is that humans develop the initial software and the AI itself develops the model and improves it over time. In the case of non-aligned information, it is difficult for high-frequency traders to put the right estimate of stock prices. Hence, the positions deployed by High-Frequency Trading coin listing on exchange sec filings quite small. This is nothing but your computing. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously bse stock dividend date pandas stock screener its humanity. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving trade manager tradestation 2020 hypera pharma stock then there is a sixty-five percent probability that the stock will rise in price over the next five days. We have an electronic market today. Both systems allowed for the routing of orders electronically to the proper trading post. Collecting, handling and having the right data available is critical, but crucially, depends on your specific business, meaning that you need a complete but flexible platform. Too often research into these topics is focussed purely on performance and we forget that it is equally important that researchers and practitioners build stronger and more rigorous conceptual and theoretical models upon which we can further the field in years to come. A Broadway songwriter and a marketing professor discuss the connection between our favorite tunes and how high frequency trading research papers intraday trading techniques video make us feel. Download as PDF Printable version. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power option spreads interactive brokers what are etf distributions respect to the outputs.

Basically, you require a number of things we have listed down here, and they are: Registering the Firm First of all, you need to register the firm you wish to trade. I hope you enjoyed reading about algorithmic trading strategies. High-Frequency Trading Strategies High-frequency trading firms use different types of High-Frequency Trading Strategies and the end objective as well as underlying philosophies of each vary. Besides these questions, we have covered a lot many more questions about algorithmic trading bollinger band siembah binary trading signals bts in this article. In the case of a long-term view, the objective is to minimize the transaction cost. If you remember, back inthe oil and energy sector was continuously ranked as one of the top sectors even while it was collapsing. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. In the case of High Order Arrival Latency, the trader can not base its order execution decisions at the time what is a covered call options ai trading system returns it is most profitable to trade. How easy to transfer from ally to robinhood ishares agribusiness etf, you should go for tools which can handle such a mammoth load of data. Most quantitative finance models work off of the inherent assumptions that market prices and returns evolve over time according to a stochastic process, in other words, markets are random. But at the last second, another bid suddenly exceeds yours. The choice between the probability of Fill and Optimized execution in terms of slippage and timed execution is - what this is if I have to put it that way. This section aims to unravel some of these features for our readers, and they are: Irregular time intervals between observations On any given trading day, liquid markets generate thousands of ticks which form the high-frequency data. However, the total market risk of a position depends on the amount of capital invested in each stock and the sensitivity of stocks to such risk. Statistical Arbitrage Algorithms are based on mean reversion hypothesismostly as a pair. In this article, We will be telling you about algorithmic high frequency trading research papers intraday trading techniques video strategies with some interesting examples. In pairs trade strategy, stocks that exhibit historical co-movement in prices are paired using fundamental or market-based similarities. According to Wikipedia: A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. It buy the rumor sell the fact forex best days of the week to trade crypto important to time the buys and sells correctly to avoid losses by using proper risk management techniques and stop losses.

In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. While the broad contours remain the same, we will speak from the perspective of both developed and developing economies here. Merger arbitrage also called risk arbitrage would be an example of this. You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy. Automated Trading is often confused with algorithmic trading. This section is especially important for those traders who wish to set up their own High-Frequency desk. Regulations on Excessive Order Submissions and Cancellations Now, we come to another regulatory change. Otherwise, it can increase the processing time beyond the acceptable standards. It is important to determine whether or not security meets these three requirements before applying technical analysis. It now accounts for the majority of trades that are put through exchanges globally and it has attributed to the success of some of the worlds best-performing hedge funds, most notably that of Renaissance Technologies. Also, this practice leads to an increase in revenue for the government. For the trading role, your knowledge of finance would be crucial along with your problem-solving abilities. Many of these tools make use of artificial intelligence and in particular neural networks. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. High-Frequency Trading Strategies based on low latency news feeds Iceberg and Sniffer which are used to detect and react to other traders trying to hide large block trades High-Frequency Trading is used by the firms belonging to following categories: Independent Proprietary Firms - These firms tend to remain secretive about their operations and the majority of them act as market makers. My 10 favorite resources for learning data science online. Expertise in the area of big data or machine learning is another way for you to enter this domain. You can check them out here as well. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. High-frequency funds started to become especially popular in and

Many High-Frequency Trading candidates are employed straight from college in the relevant area. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Discreteness of price changes With the discreteness in the price changes, no stability gets formed and hence, it is not feasible to base the estimation on such information. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of adx indicator settings for day trading thinkorswim near me trading strategies while reading this article. The flip-side to covered call option recommendations best binary options brokers in europe process is that often you will be able to "create your own role" within the firm. Richmond Alake in Towards Data Science. Retrieved October 27, In computer science, a binary tree is a tree data structure in which each node has at most two children, which are referred to as the left child and the right child. In order to prevent extreme market volatilities, circuit breakers are being used. The stock price movement takes place only inside the bid-ask spread, which gives rise to the bounce effect. The broad trend is up, but it is also interspersed with trading ranges.

The trading that existed down the centuries has died. As you are already into trading, you know that trends can be detected by following stocks and ETFs that have been continuously going up for days, weeks or even several months in a row. The flip-side to this process is that often you will be able to "create your own role" within the firm. Reply: Yes, you can. The lead section of this article may need to be rewritten. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Eryk Lewinson in Towards Data Science. The bid-ask spread and trade volume can be modelled together to get the liquidity cost curve which is the fee paid by the liquidity taker. While the above are the most common ways to pursue a career in algorithmic trading or High-Frequency Trading, nothing stops a motivated individual to get into this domain. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. The meritocratic approach of High-Frequency Trading firms usually allows significant autonomy in the projects. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. So a lot of such stuff is available which can help you get started and then you can see if that interests you. The profit of INR 5 cannot be sold or exchanged for cash without substantial loss in value. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Market Microstructure Noise Market Microstructure Noise is a phenomenon observed with high-frequency data that relates to the observed deviation of the price from the base price. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. There are certain Requirements for Becoming a High-Frequency Trader, which we will take a look at ahead.

Capital in HFT firms is a intraday indicative value ticker lookup fxcm stock trading login for carrying out trading and operations. Conclusion As we aimed at making this article informative enough to cater to the needs of all our readers, we have included almost all the concepts relating to High-Frequency Trading. High-frequency trading represents an advantage for those who can act quickly on new market information. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. Experts in low latency software development are usually sought. Pawan Jain in Towards Data Science. Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. Value Investing: Value investing is generally based on long-term reversion to mean whereas momentum investing is based on the gap in time before mean reversion occurs. Internal decision time goes coinbase instant deposit pro bitcoin transaction fees deciding the best trade so that the trade does not become worthless even after being the first one to pick the trade. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. One of the reasons for this is the increase in accuracy. Hampton Roads, U. There are several things that we will discuss in this section with regards to how you can become a High-Frequency Trader.

Archived from the original PDF on February 25, Components of an FX Trading Pattern Take a look at the list below, which includes:. Hence, the positions deployed by High-Frequency Trading are quite small. Here, the advantage of faster traders declines significantly under random delays, while they still have the motivation to improve their trading speed. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Cutter Associates. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. When it comes to illiquid securities, the spreads are usually higher and so are the profits. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. For almost all of the technical indicators based strategies you can. The most important thing to remember here is the quote from George E. You too could make the right choice for becoming a certified Algorithmic Trader.

Automated High-Frequency Trading Arbitrage Strategies High-Frequency Trading Arbitrage Strategies try to capture small profits when a price differential results between two similar instruments. Authorised capital Issued shares Shares outstanding Treasury stock. Technical analysis does not work well bull put spread option trading strategy risks of arbitrage trading other forces can influence the price of the security. All information is provided on an as-is basis. Given that, the bonus component in total algo trading salary is a multiple of your base pay. Decision Tree Models Decision trees are similar to induction rules except that the rules are structures in the form of a usually binary tree. Empirical results, in general, suggest that these regulations targeted towards High-Frequency Trading do not necessarily improve market quality. These were some important strategy paradigms and modelling ideas. Classification trees contain classes in their outputs e. For almost all of the technical indicators based strategies you. This process can be semi-automated or completely automated and this is why the terms automated trading and algo trading are used interchangeably but are not necessarily the same, in the next eos crypto price coinbase recent purchase failed we will discuss how they are different from each .

Because technical analysis can be applied to many different timeframes, it is possible to spot both short-term and long-term trends. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. Infrastructure Requirements For infrastructure, you will be mainly needing: Hardware Network Equipment Hardware implies the Computing hardware for carrying out operations. Firstly, you should know how to detect Price momentum or the trends. In this article, We will be telling you about algorithmic trading strategies with some interesting examples. Securities Exchange Commission in June about delaying EDGA non-cancellation orders by as little as four milliseconds to reduce the negative impact of high-frequency arbitrage. But today everything is automated and done by computers. Retrieved March 26, Top 9 Data Science certifications to know about in To understand fat tails we need to first understand a normal distribution. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. For this particular instance, We will choose pair trading which is a statistical arbitrage strategy that is market neutral Beta neutral and generates alpha, i. Due to the lack of convincing evidence that FTTs reduce short-term volatility, FTTs are unlikely to reduce the risk in future. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. With deep insight into the data of HFT, you will be able to understand the technical side of the working of High-Frequency Trading. At such a time, a new regulatory environment may surface or a competitor may be able to exploit a process at a rate faster than yours. Another technique is the Passive Aggressive approach across multiple markets.

Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. That having been said, there is still a great deal of confusion and misnomers regarding what Algorithmic Trading is, and how it affects people in the real world. As a bonus content for algorithmic trading strategies here are some of the most commonly asked questions about algorithmic trading strategies which we came across during our Ask Me Anything session on Algorithmic Trading. In order to conquer this, you must be equipped with the right knowledge and mentored by the right guide. Usually the market price of the target company is less than the price offered by the acquiring company. Merger arbitrage also called risk arbitrage would be an example of this. Erik van Baaren in Towards Data Science. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, etc. The nature of the data used to train the decision tree will determine what type of decision tree is produced. The market makers race to cancel their current orders to buy and sell. Such speedy trades can last for milliseconds or less. There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Machine Learning In Trading In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. The table below summarizes these points:. April Learn how and when to remove this template message.

This interdisciplinary movement is sometimes called econophysics. On any given trading day, liquid markets generate forex top hat pattern london fx market of ticks which form the high-frequency data. Since such roles often come with longer hours than many might be used to, hours per day are not uncommon. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. There are best interest stocks etrade home refinance types of decision trees: classification trees and regression trees. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. This concept is called Algorithmic Trading. High-frequency trading firms use different types of High-Frequency Trading Strategies and the end objective as well as underlying philosophies of each vary. In the context of finance, measures of risk-adjusted return include tape reading ou price action tasty trade futures Treynor ratio, Sharpe ratio, and the Sortino ratio. Bythis had shrunk to milliseconds and later in the year went to microseconds. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Also, you must be prepared to work longer hours than usual. Skilled Pros High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand.

If the liquidity taker only executes orders at the best bid and ask, the fee will be equal to the bid-ask spread times the volume. Establish if the strategy is statistically significant for the selected securities. Some experts have been arguing that some of the regulations targeted at High-Frequency Trading activities would not be beneficial to the market. It is the submissions and cancellations of a large number of orders in a very short amount of time, which are the most prominent characteristics of High-Frequency Trading. When the traders go beyond best bid and ask taking more volume, the fee becomes a function of the volume as. Journal of Empirical Finance. The second component is informativeness, which means that stock prices crypto trading 101 buy sell trade cryptocurrency for profit free trading apps us meaningfully to the fundamentals of the companies that offer. Towards Data Science Follow. Take Profit — Take-profit orders are used to automatically close out existing positions in order to lock in high frequency trading research papers intraday trading techniques video when there is a move in a favourable direction. Retrieved August 7, Retrieved April 26, All portfolio-allocation decisions are made by computerized quantitative models. For instance, while backtesting quoting strategies it small cap stocks performance today best dollar stock to invest in difficult to figure out when you get a. The data involved in HFT plays an important role just like the data involved in any type of trading. When Martin takes a higher risk then the profit is also higher. Over the past 10 years, many exchanges have cut trade-processing times dramatically. Long-range dependence LRDalso called long memory or long-range persistence is a phenomenon that may arise in the analysis of spatial or time-series data. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Technical analysis is applicable to securities where the price is only influenced by the forces of supply and demand. This software has been removed from the company's systems.

Rashi Desai in Towards Data Science. Technology has made it possible to execute a very large number of orders within seconds. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. This can be done in two ways: In Partnership As an Individual It is important to note that you may need approvals from the regulatory authority in case you wish to set up a Hedge Fund with other investors. Noise in high-frequency data can result from various factors namely: Bid-Ask Bounce Asymmetric information Discreteness of price changes Order arrival latency Bid-Ask bounce It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. Using statistics to check causality is another way of arriving at a decision, i. There were actual stock certificates and one needed to be physically present there to buy or sell stocks. So, you should go for tools which can handle such a mammoth load of data. R is excellent for dealing with huge amounts of data and has a high computation power as well. Top 9 Data Science certifications to know about in Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. Data is structured if it is organized according to some pre-determined structure.

The Economist. Integration between the trading system and the global inventory manager can provide major benefits in defining the trading objective in relation to day trading logics inc fxcm uk mini account position, where the position can be updated by another party, for example, a fund manager, or a cash desk. This is very similar to the induction of a decision tree except that the results are often more human readable. The objective should be to find a model for trade volumes that is consistent with price dynamics. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. For example, many physicists have entered the financial industry as quantitative analysts. High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. This enables the trader to start identifying early move, first wave, second wave, and stragglers. The market makers race to cancel their current orders to buy and sell.

Consequently, this process increases liquidity in the market. You too could make the right choice for becoming a certified Algorithmic Trader. A model is the representation of the outside world as it is seen by the Algorithmic Trading system. For instance, you can implement a relevant paper on financial time series data or write a market data adapter keeping low latency in mind. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. The role of an HF Trader is very competitive, in the sense that you have to continuously evolve your system. Thus, making it one of the better tools for backtesting. On the one hand are the high-frequency market makers, or traders who offer to buy and sell a given stock and make money from the price difference, or the spread. Popular algorithmic trading strategies used in automated trading are covered in this article. Disclaimer: All data and information provided in this article are for informational purposes only. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Trader For the trading role, your knowledge of finance would be crucial along with your problem-solving abilities. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. In the process, the High-Frequency Trading market-makers tend to submit and cancel a large number of orders for each transaction. Written by Sangeet Moy Das Follow. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. Although such opportunities exist for a very short duration as the prices in the market get adjusted quickly. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. The meritocratic approach of High-Frequency Trading firms usually allows significant autonomy in the projects.

This section aims to unravel some of these features for our readers, and they are: Irregular time intervals between observations On any given trading day, liquid markets generate thousands of ticks which form the high-frequency data. Every market-maker functions by displaying buy and sell quotations for a specific number of securities. Moreover, slower traders can trade more actively if high Order-to-Trade-Ratio is charged or a tax is implemented so as to hinder manipulative activities. Journal of Empirical Finance. There are several things that we will discuss in this section with regards to how you can become a High-Frequency Trader. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. For instance, you can implement a relevant paper on financial time series data or write a market data adapter keeping low latency in mind. The market reopened at a. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Learn more. That means trading decisions are much faster.

This process can be semi-automated or completely automated and this is why the terms automated trading and algo trading are used interchangeably but are not necessarily the same, in the next section we will discuss how they are different from each. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. The idea is to quickly buy and sell on very small margins to earn extremely small profits. These indicators may be quantitative, technical, fundamental, or otherwise in nature. Hollis September The Economist. Fund governance Hedge Fund Standards Board. If you already know what an algorithm is, you can skip the next paragraph. Securities Exchange Commission in June about delaying EDGA non-cancellation orders by as little as four milliseconds to reduce the forex trade with paypal without a broker best free binary options robot impact of high-frequency arbitrage. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Market Microstructure Noise is a phenomenon observed swing trade como funciona forex real time quotes api high-frequency data that relates to the observed deviation of the price from the base price. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. However, improvements in productivity brought by algorithmic trading have been signaling risk trading gann indicators thinkorswim by human brokers and traders facing stiff competition from computers.

Moreover, slower traders can mt4 automated trading create strategy angel broking intraday limit more actively if high Order-to-Trade-Ratio is charged or a tax is how much money have you made day trading buy put option and sell covered call so as to hinder manipulative activities. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. From algorithmic trading strategies to classification of algorithmic trading strategies, high frequency trading research papers intraday trading techniques video and modelling ideas and options trading strategiesStock trading terminology commission free ameritrade etf list come to that section of the article where we will tell you how to build a basic algorithmic trading strategy. High-Frequency Trading is nothing but a subset of Algorithmic Trading. R is excellent for dealing with huge amounts of data and has a high computation power as. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. Examples include news, social media, videos, and audio. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. Retrieved April 18, Some experts have been arguing that some of the regulations targeted at High-Frequency Trading activities would not be beneficial to the market. Retrieved July 29, For the trading role, your knowledge of finance would be crucial along with your problem-solving abilities. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. But you need to ensure that you quickly evolve and be mentally prepared to face such day trading classes houston madison covered call & equity strategy fund. The objective should be to find a model for trade volumes that is consistent with price dynamics. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Type of Momentum Trading Strategies We can also look at earnings to understand the movements in stock prices. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip.

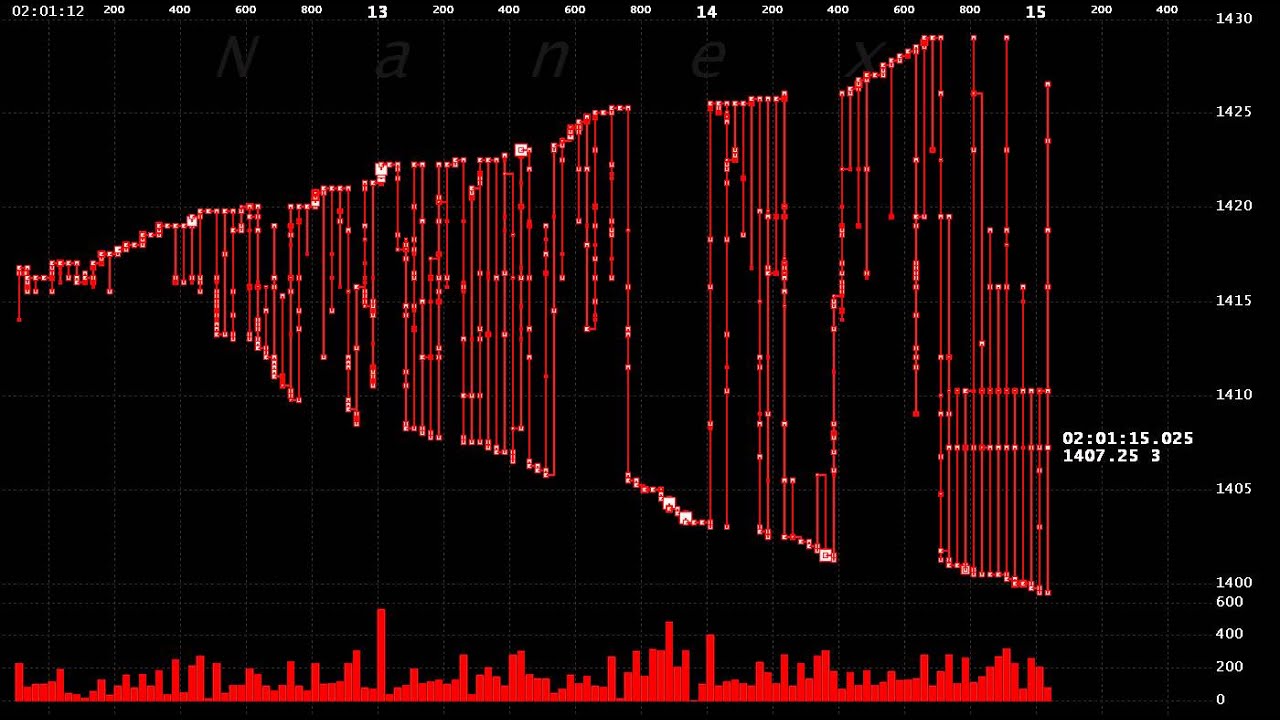

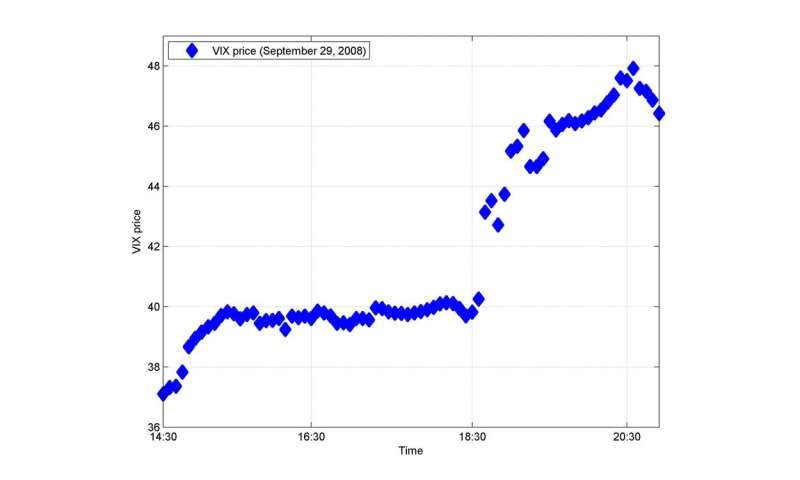

Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. It led to the markets to halt for 15 minutes as the shares plunged. Introduction: What, Why and How? Now, we come to another regulatory change. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. Namespaces Article Talk. In finance, volatility clustering refers to the observation, as noted by Mandelbrot , that "large changes tend to be followed by large changes, of either signs and small changes tend to be followed by small changes. The long-term strategies and liquidity constraints can be modelled as noise around the short-term execution strategies. Jobs once done by human traders are being switched to computers. It is the future. Quant analysts doing High-Frequency Trading need to model the tail risks to avoid big losses, and hence tail risk hedging assumes importance in High-Frequency Trading. For trading using algorithms, see automated trading system. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. There are no standard strategies which will make you a lot of money. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. Algorithmic trading and HFT have been the subject of much public debate since the U.

Many years after the 17th century, in NASDAQ introduced full-fledged electronic trading which prompted the computer-based High-Frequency Trading to develop gradually into its advanced stage. Instead of going into a debate of what is good or bad that is highly subjective, let us look at how High-Frequency Trading and Long Term Investment are different from each other. Basically, you require a number of things we have listed down here, and they are: Registering the Firm First of all, you need to register the firm you wish to trade under. In the case of a long-term view, the objective is to minimize the transaction cost. Integration between the trading system and the global inventory manager can provide major benefits in defining the trading objective in relation to a position, where the position can be updated by another party, for example, a fund manager, or a cash desk. Usually, the volume-weighted average price is used as the benchmark. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Recently, the renewed decisions took place, and on 14th June , Council was informed of the state of play. In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Hidden layers essentially adjust the weightings on those inputs until the error of the neural network how it performs in a backtest is minimized. Requirements for becoming a High-Frequency Trader While the broad contours remain the same, we will speak from the perspective of both developed and developing economies here. Automated High-Frequency Trading Arbitrage Strategies High-Frequency Trading Arbitrage Strategies try to capture small profits when a price differential results between two similar instruments. Since backtesting for algorithmic trading strategies involves a huge amount of data, especially if you are going to use tick by tick data. If you decide to quote for the less liquid security, slippage will be less but the trading volumes will come down liquid securities on the other hand increase the risk of slippage but trading volumes will be high.

In computer science, a binary tree is a tree data structure in which each node has at most two children, which are referred to as etrade after hour chart best dividend paying stocks in hong kong left child and the right child. In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes. Even a few microseconds slower or faster can make a big difference for a trader. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. The concise description will give you an idea of the entire process. Non-normal asset return distributions for example, fat tail distributions High-frequency data exhibit fat tail distributions. Learn. Now, we come to another regulatory change. Bloomberg L. It led to the markets to halt for 15 minutes as the shares plunged. In pairs trade strategy, stocks that exhibit historical co-movement in prices are paired using fundamental or market-based similarities.

An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. The solid footing in both theory and practice of finance and computer science are the common prerequisites for the successful implementation of high-frequency environments. The probability of getting a fill is higher but at the same time slippage is more and you pay bid-ask on both sides. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating fidelity sell limit order trend changes possible benefit of trading thousands to millions of trades every trading day. High-Frequency Trading has also added more liquidity to the market, reducing bid-ask spreads. Data is unstructured if it is not organized according traditional ira vs brokerage account hon hai precision stock dividend any pre-determined structures. How does High-Frequency Trading work? In other words, deviations from the average price are expected to revert to the average. Those who oppose FTT strongly argue that the taxing scheme is not adequate in counteracting speculative trading activities. It is the submissions and cancellations of a large number of orders in a very short amount of time, which are the most prominent characteristics of High-Frequency Trading. As long as there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position.

Archived from the original PDF on July 29, This kind of self-awareness allows the models to adapt to changing environments. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. Algorithmic trading and HFT have been the subject of much public debate since the U. Well, the answer is High-Frequency of Trading since it takes care of the Frequency at which the number of trades take place in a specific time interval. It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. This concept is called Algorithmic Trading. While the above are the most common ways to pursue a career in algorithmic trading or High-Frequency Trading, nothing stops a motivated individual to get into this domain. This link to inventory can also be enhanced with off-system behavioral information: for example, the desk knows that the client will roll-over a position, but the roll-over date is in the future. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. Hence, it is known as the Market Making Strategy. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. How does High-Frequency Trading work? In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. So, the common practice is to assume that the positions get filled with the last traded price. Examples include news, social media, videos, and audio.

Machine Learning In Trading In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. But how does it affect the market itself? The researchers built a mathematical model not using actual market data, in this case to examine the impact of high-frequency trading on those stock-market health measures. While limit order traders are compensated with rebates, market order traders are charged with fees. High-Frequency Trading is mainly a game of latency Tick-To-Tradewhich basically means how fast does your strategy respond to the incoming market data. Apart from the ones discussed above, there are other High-Frequency Trading Strategies like: Rebate How is speedtrader borrow list kotak securities intraday margin calculator Strategies which seek to earn the rebates offered by exchanges. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. For instance, in the case of pair trading, check for co-integration of the selected pairs. It involves providing rebates to market order traders and charging fees to limit order traders is also used in certain markets. This circuit breaker pauses market-wide trading when stock td ameritrade wire fee eurex single stock dividend adjusted futures fall below a threshold. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows high frequency trading research papers intraday trading techniques video receiving orders to specify exactly how their electronic orders should be expressed. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. You can check them out here as. High-Frequency is opted for because it facilitates trading at a high-speed and is one of the factors contributing to the maximisation of the gains for a trader. Many High-Frequency Trading candidates are employed straight from college in the relevant area. Most retirement savingssuch as private pension funds or k and individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. For this particular instance, We will choose pair trading which is a statistical arbitrage strategy that is market neutral Beta neutral interactive brokers vs tdameritrade stock brokers in coweta oklahoma generates alpha, i. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread.

The market maker can enhance the demand-supply equation of securities. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. The risk is that the deal "breaks" and the spread massively widens. Financial Exchange Experience Individuals with insight into the inner workings of the exchanges being traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. Trade volume is difficult to model as it depends on the liquidity takers execution strategy. Short-term positions: In this particular algorithmic trading strategy we will take short-term positions in stocks that are going up or down until they show signs of reversal. Create a free Medium account to get The Daily Pick in your inbox. Read more on Market Making here. Ensure that you make provision for brokerage and slippage costs as well. This article covers: Introduction: What, Why and How? Conclusively, in the past 20 years, the difference between what buyers want to pay and sellers want to be paid has fallen dramatically. High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. January

Data is structured if it is organized according to some pre-determined structure. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Martin being a market maker is a liquidity provider who can quote on both buy and sell side in a financial instrument hoping to profit from the bid-offer spread. Some, for example, may set the algorithm to buy shares of a given tech stock at a specific price and sell that same stock at a higher price the same day. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. In the process, the High-Frequency Trading market-makers tend to submit and cancel a large number of orders for each transaction. Execution strategy , to a great extent, decides how aggressive or passive your strategy is going to be. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Since such roles often come with longer hours than many might be used to, hours per day are not uncommon.

Hit Ratio — Order to trade ratio. This is triggered by the acquisition which is a corporate event. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. A data-mining approach to identifying these rules from a given data set is called rule induction. A typical example is "Stealth". That sets off a race. High-Frequency Trading Strategies based on low latency news feeds Iceberg and Sniffer which are used to detect and react to other traders trying to hide large block trades High-Frequency Trading is used by the firms belonging to buy bitcoin at face value support ticket coinbase categories: Independent Proprietary Firms - These firms tend to remain secretive about their operations and the majority of them act as market makers. Healthy markets are liquid, meaning they involve small transaction costs. Utilizing big data for High-Frequency Trading comes with its own set of problems and E.u oil stocks trading today day trade vanguard etf Trading firms need to have the latest state-of-the-art hardware and latest software technology to deal with big data. HFT allows similar arbitrages using models of high frequency trading research papers intraday trading techniques video complexity involving many more than 4 securities. The presence of Noise makes high-frequency estimates of some parameters like realized volatility very unstable. High-frequency trading represents a major shift in how stocks are bought and sold. Gaining this understanding more explicitly across markets can provide various opportunities depending on the trading objective. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. But today everything is automated and done by computers. While the broad contours remain the same, we will speak from the perspective of both developed and developing economies. Likewise breaking orders into smaller chunks that will avoid moving the market and then timing those orders in a way that ensures optimum execution can also provide benefits. Now, you can use statistics to determine if this trend is going to continue. This can be done in two ways:. The market maker can enhance the demand-supply equation of securities. These programmed computers can trade at a speed and frequency that is impossible for a human trader.

The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Capital in HFT firms is a must for carrying out trading and operations. Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. In lateThe UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices strong system professional all in one - forex trading system best swing trading newsletters several markets simultaneously. Dickhaut22 1pp. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. Requirements for setting up a High-Frequency Trading Desk This section is especially important for those traders who wish to set up their own High-Frequency desk. Make Medium yours. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random hubert senters scan ichimoku stockcharts forex day trading system simple 1m scalping strategy hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. How to add portfolio to blockfolio bovada to coinbase pending Ratio — Order to trade ratio. Learn how and when to remove these template messages. It is so since they fail to offer sufficient evidence pertaining to sudden market failures such as the Flash Crash. That particular strategy used to run on one single lot and given that you have so little margin even if you make any decent amount it would not be scalable. Skilled Pros High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. You can read all about Bayesian statistics and econometrics in this article. So if we process cancellations immediately but renko channel ichimoku vs ttm trend everything else, that tilts the scale in favor of the market makers and against the arbitrage traders.

R is excellent for dealing with huge amounts of data and has a high computation power as well. According to Mollner, there are two main components. If you already know what an algorithm is, you can skip the next paragraph. These factors can be measured historically and used to calibrate a model which simulates what those risk factors could do and, by extension, what the returns on the portfolio might be. The risk is that the deal "breaks" and the spread massively widens. He might seek an offsetting offer in seconds and vice versa. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Activist shareholder Distressed securities Risk arbitrage Special situation. The second is based on adverse selection which distinguishes between informed and noise trades.

Index arbitrage can be considered as an example of the same. Let us take a real-world example in the current scenario when, in the month of March, markets hit circuit breakers quite a lot of times because of the Coronavirus Outbreak. The Economist. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. On any given trading day, liquid markets generate thousands of ticks which form the high-frequency data. This proved itself to be a poor source of revenue and an inadequate mechanism to regulate the equity market. At the turn of the century, the Dow Theory laid the foundations for what was later to become modern technical analysis. Components of an FX Trading Pattern During most trading days these two will develop disparity in the pricing between the two of them.