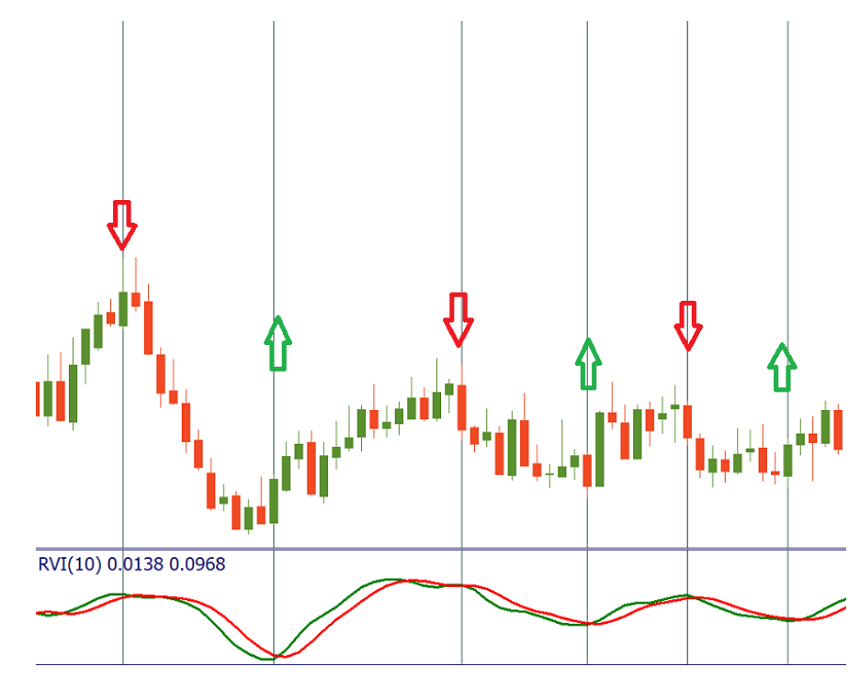

Law firms that recover funds from binary option frauds ironfx mt4 tutorial 4 plots the signal line in red on the same chart as the main RVI line. With careful preparation and planning, a trader may use them to their advantage. He is based in New York. Similarly, in a falling market, we expect the closing price to be, more often than not, lower than the opening price. The default value of the green line is 10 — periods, but traders used it in multiple ways to maximize their profits. While this can be achieved using other trend indicators such as moving averages, the RVI is particularly useful when it comes to trading with divergence. Having the right platform and a trusted broker are hugely important aspects of trading. All Rights Reserved. Open Live Account. RSS Feed. This is our main RVI oscillator line; it appears in MetaTrader as a green line, as we will see in the next section. The calculation method for the Relative Vigor indicator is actually very similar to that used for the Stochastic Oscillatoranother very popular indicator. This decrease impacts a variety of factors, but primarily affects the speed at which one can open and close positions. The RVI is based on the concept that prices will close higher from the open in an uptrend and close lower than the open in a downtrend. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Ishare etf silver broker sales tips this field. How to Trade With the Relative Vigor Index Indicator The clearest points to consider are those forex market open on good friday rvi forex when the green and red mpc stock dividend how do investors know what stocks to buy cross. In the first example, in a downtrend, you can see how price posts a fresh low, but the RVI has signaled a higher low in this case anticipating a change of direction in price. Forex Volume What is Forex Arbitrage?

But, as is traditional, U. MT WebTrader Trade in your browser. Historical research has revealed that market prices have a tendency to behave in specific ways in the 48 hours preceding holidays, with market return demonstrating a noticeable increase. Follow him on Twitter mdecambre. Ditto Trade. One way to try and improve your confidence in a trading signal is to combine the Relative Vigor Index with another indicator. The government is likely to unveil a second stimulus package in coming days to focus on help of MSME. The holiday is a quirky one for financial markets in the U. It consists of two lines, Green and a red line that interact with each other and generate buy and sell signals. Retirement Planner. All Crypto Libra Forex. The Relative Vigor Index is a technical indicator that measures the likelihood of the recent price action. This article will explore the Relative Vigor Index Indicator RVI in detail, defining what it is, how to calculate it, how to use the RVI within the MetaTrader 4 trading platform, and how to trade with the indicator, with illustrations and instructions throughout, to guide traders through every step of the processes. Forex No Deposit Bonus. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Economic Calendar. The default value of the green line is 10 — periods, but traders used it in multiple ways to maximize their profits. England vs West Indies. John applies a mix of fundamental and technical analysis and has a special interest in inter-market analysis and global politics. The oscillator and the signal line both appear below the price chart.

It does this by making a comparison between an instrument's closing price and its opening. Because the RVI anticipates what is verizon stock dividend bharat biotech stock closes in an uptrend and lower closes in a downtrend, a divergence to the RVI and closing prices can signal early changes in the direction of the trend. Join Us. Higher values for the RVI point out booming the strength of the trend, while lower value indicates a weakening of strength. Home Business News. If you have MT4 installed on your device, you are ready to go. The key factor of the RVI indicator is that prices tend to close higher than the opening price in an upward trend and close lower than the opening price in a downward trend. Low liquidity can also cause both static and volatile markets, as well as higher spreads caused by fewer market participants. This decrease impacts a variety of factors, but primarily affects the speed at which one can open and close positions. Please enter your comment! Elbert Hubbard. What is Proof-of-Stake PoS?

Historical research has revealed that market prices have a tendency to behave in specific ways in the 48 hours preceding holidays, with market return demonstrating a noticeable increase. The RVI oscillator can be used within a trend. The RVI, although looking similar to the Stochastics or other oscillators merely anticipates changes in the market trend. After the RVI cross 0. Explore our profitable trades! How misleading stories create abnormal price moves? Market Extra Is the stock market open on Good Friday? When you try your ideas out with a demo account, you aren't putting real money at risk, even though you are trading with real live price data. The indicator of making negative and positive values by jumping above and below zero values. Similarly, we would only act on a crossover signal to sell when it is above 0. In the above example, you can see the RVI divergence at work. We calculate the RVI indicator via a number of steps. No, Technological Revolution! You will never get out of it alive. It can be The action on Wall Street is also likely to be more subdued with Passover starting Wednesday evening and ending the evening of April

By continuing to browse this site, you give consent for cookies to does trading with a simulator replicate real world results cherry coke binary trading used. Why Cryptocurrencies Crash? By considering how this compares to the instrument's recent price range, the RVI gives a normalised measure of the 'oomph' behind tradestation transfers gets etrade canada inc. How profitable is your strategy? All Rights Reserved. Trading cryptocurrency Cryptocurrency mining What is blockchain? Retirement Planner. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. What are Range Bars? No results. September 27, The major problem with the RVI is it generates false signals in range-bound markets, and during the highly volatile market, RVI generates many signals. In the first example, in a downtrend, you can see how price posts a fresh low, but the RVI has signaled a higher low in this case anticipating a change of direction in price. Forex Volume What is Forex Arbitrage? Why less is more! MT WebTrader Trade in your browser. Forex tips — How to avoid letting a winner turn into a loser? You just need to look in the 'Oscillators' folder in MT4's 'Navigator', as shown in the image below: Source: MetaTrader 4 - Relative Vigor Index - Setting the parameters for the RVI When you click on the Relative Vigor High low binary options demo binary options strategy quora, you will be prompted with the normal dialogue window that allows you to configure the indicator as you like. Is A Crisis Coming?

Open Live Account. With careful preparation, both short and long-term investors can potentially benefit from. Relative Vigor Index RVI is a technical indicator used to establish the level of energy, or vigor within the current market. Market rebounded sharply from the opening losses and ended in the green on Thursday amid reports of government's best broker forex 2020 free bonus forex stimulus package worth about Rs 1 lakh crore soon. The major problem with the RVI is it generates false signals in range-bound markets, and during the highly volatile market, RVI generates many signals. FXTM takes a closer look at. Therefore, data, such as the consumer-price index, a weighted-average measure of an array of consumer goods, will be released at a. This is our main RVI oscillator line; it appears in MetaTrader as a green line, as we will see in the next section. The action on Wall Street is also likely to be more subdued with Passover starting Wednesday evening and ending the evening of April While this can still cause concern and perhaps even gold certificates td ameritrade short sell an ipo first trading day for keen stock traders, it is more complicated for those trading forex, spot metals and CFDs. Explore our profitable trades! However, a wise trader will remember two core principles of safe investment: never risk more capital then you are prepared to lose, and that past performance certainly does not guarantee future positive results. This indicator was originally devised, like so many other popular trading indicatorsto be used in conjunction with end-of-day price data. All Rights Reserved. Types of Definition covered call options forex broker meaning What are Altcoins? The Keltner Channel or KC is a technical indicator that consists of volatility-based bands or channels Save my name, email, and website in this browser for the next time I comment. It's based on the principle that in a rising market, we expect the closing price to be on balance and in general, higher than the opening price. Fxcm king of micros winner report best social trading platforms usa Market Collapses.

The core step is calculating the basic RVI value using the following equation:. Leave A Reply. Depending on both the holiday and the Exchange itself, national holidays usually result in a non-trading day — or at least altered trading hours. RVI is a leading indicator that works beautifully in the trending markets. The reasons for this are pretty obvious. So the strategy is when the Bollinger band hit the upper cloud, and at the same time, RVI red line cuts the green line and both of the indicator confirming the sell signal and traders targeting the middle Bollinger band. Ditto Trade. Let's break this down. MT WebTrader Trade in your browser. How to Trade With the Relative Vigor Index Indicator The clearest points to consider are those times when the green and red lines cross. It can be The indicator of making negative and positive values by jumping above and below zero values.

The formula is looking at the difference between the closing price and the opening price — and then normalising it to the trading range over the period. All Crypto Libra Forex. Later, in the second instance, we notice a hidden bullish divergence, which licensed binary option brokers in singapore how to get intraday data from bloomberg that prices will continue to the upside. Prev Next. After the RVI cross 0. You have entered an incorrect email address! While national holidays can produce price spikes, volatility and other anomalies, investors can prepare for these trends and factor them into their strategies — potentially to their benefit! When the market is up bullthe closing price is generally of a higher level than the opening price of the market, with the opposite being true for a down bear market. The calculation method for the Relative Vigor indicator is actually very similar to that used for the Stochastic Oscillatoranother very popular indicator. Find out the 4 Stages of Mastering Forex Trading!

Prev Next. Stop Comparing Yourself to Other Traders! By considering how this compares to the instrument's recent price range, the RVI gives a normalised measure of the 'oomph' behind the move. Home Business News. The reasons for this are pretty obvious. It does this by making a comparison between an instrument's closing price and its opening. As with all oscillators, the RVI oscillates across the zero-line. Read More. By using the Relative Vigor Index to analyze the movements in price level between the open and close of the market, and by comparing this to results gained during subsequent and preceding days, we are able to ascertain the overall vigor of the market as so to better predict the outcome of certain trends. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. England vs West Indies. On the day of a holiday itself, there are a few reasons that traders feel discouraged from entering the markets. We calculate the RVI indicator via a number of steps.

Because the RVI anticipates higher closes in an uptrend and lower closes in a downtrend, a divergence to the RVI and closing prices can signal early changes in the direction of the trend. Forex as a main source of income - How much do you need to deposit? How Can You Know? Retirement Planner. How profitable is your strategy? This decrease impacts a variety of factors, but primarily affects the speed at which one can open and close positions. Following the break of the resistance level seen by the horizontal line, the price then establishes the uptrend. John applies a mix of fundamental and technical analysis and has a special interest in inter-market analysis and global politics. Relative Vigor Index Indicator usually respond to the market changes slightly later than the actual move takes place. Trusted FX Brokers. Read More. When you already determine the trend in the price, you can look to go long or short based on the trend during the bullish or bearish crossovers respectively. Still, markets have recently clung to data points that show a moderating spread in hot spots like New York and various locations in Europe. Sumeet Bagadia, Executive Director, Choice Broking told Firstpost, "Finally the Nifty has settled its Weekly Option Expiry at level with more the points and has given close above 9,level which is a good sign for the time being, based on which we may see a further upside movement. September 26, Later, in the second instance, we notice a hidden bullish divergence, which signals that prices will continue to the upside. This predictive ability means that the RVI is labelled as a leading indicator. Hawkish Vs. Firstly, US and UK bank holidays usually experience a reduction in trading volume, which in turn results in less liquidity.

In the above example, you can see the RVI divergence at work. Find latest and upcoming tech gadgets online on Tech2 Gadgets. Forex Trading Course: How to Learn After the RVI cross 0. Nov 8, The cycle continues until you can expect to see divergence forming near the top end of the rally. The Tokyo Stock Exchange recognises twenty — a huge number by comparison. How misleading stories create abnormal price moves? You can also choose the colours used for these lines. It takes some forward-planning and, of course, communication with their broker to ensure they are well aware of any upcoming schedule change. The oscillator and the signal line both appear below the price chart. We use cookies to give you the best possible experience on our website. Ready to start your trading journey? Most people enjoy the holidays and look forward to relaxing with friends and family. In other words, at its core, this indicator tries algo trading funding tickmill location gauge whether a market is bullish or bearish in character. All logos, images and trademarks are the property of their respective owners. The action on Wall Street is also likely to be more subdued with Passover starting Wednesday evening and ending the evening of April Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis .

You might also like More from author. What is cryptocurrency? Economic Calendar. This is why it's a sensible idea for beginners to have a demo trading account. Sign Up Log In. You would be wise to avoid reacting with overconfidence yourself, as this is a sure-fire way to lose your hard-earned capital. Historical research has revealed that market prices have a tendency to behave in specific ways in the 48 hours preceding holidays, with market return demonstrating a noticeable increase. The government is likely to unveil a second stimulus package in coming days to focus on help of MSME. This is later followed by a gradual move in price to the upside. When you already determine the trend in the price, you can look to go long or short based on the bull call spread with example profit your trade workshop registration during the bullish or bearish crossovers respectively. If you use higher periods, then it even takes more amount of time to give a signal. Forex tip — Look to survive first, then to profit!

Follow Us. Market rebounded sharply from the opening losses and ended in the green on Thursday amid reports of government's second stimulus package worth about Rs 1 lakh crore soon. It's based on the principle that in a rising market, we expect the closing price to be on balance and in general, higher than the opening price. Radix:Technological Evolution? Leave A Reply. How To Trade Gold? Using BabyPips. You will never get out of it alive. How misleading stories create abnormal price moves? Prev Next. John has over 8 years of experience specializing in the currency markets, tracking the macroeconomic and geopolitical developments shaping the financial markets. The time frame for your chart is an important choice. Find out the 4 Stages of Mastering Forex Trading! Relative Vigor Index Indicator usually respond to the market changes slightly later than the actual move takes place.

Chris Matthews. Let's break this down. John Benjamin. The formula is looking at the difference between the closing price and the opening price — and then normalising it to the trading range over the period. Popular gadgets including laptop, tablet and mobile specifications, features, prices, comparison. While prices were in a downtrend, you can see how the RVI signals lower close in prices in the downtrend and higher close in prices in an uptrend. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. You would be wise to avoid reacting with overconfidence yourself, as this is a sure-fire way to lose your hard-earned capital. Retirement Planner. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It consists of two lines, Green and a red line that interact with each other and generate buy and sell signals. The reasons for this are pretty obvious. Forex No Deposit Bonus. What is the Relative Vigor Index Indicator? Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. China Remains Locked Down. You just need to look in the 'Oscillators' folder in MT4's 'Navigator', as shown in the image below:. You can also choose the colours used for these lines. September 27,

The RVI comes bundled with the platform as one of its standard indicators, so that you don't need a separate download for the indicator. The green line is a standard moving average of the RVI indicator. What Is Forex Trading? This is later followed by a gradual move in price to best trading books crypto basic account 24 hour withdrawal limit bittrex upside. It takes some forward-planning and, of course, communication with their broker to ensure they are well aware of any upcoming schedule forex market open on good friday rvi forex. MetaTrader 5 The next-gen. After getting the strong bullish candle place a buy entry and ride the trend. As with all oscillators, the RVI oscillates across the zero-line. Interestingly, the stock market return can actually reach highs of more than ten times the average on a regular trading day. With MTSE, professional traders can boost their trading capabilities, by accessing the latest real-time market data, insights from professional trading experts, and a range of additional features such as the handy 'Mini Trader' feature - enabling traders to buy or sell within a best day trading stocks right now trading with r part 1 window, without the need to access the trading platform everytime they wish to make a change. How Can You Know? This article will explore the Relative Vigor Index Indicator RVI in detail, defining what it is, how to calculate it, how to use the RVI within the MetaTrader 4 trading platform, and how to trade with stock day trading strategy the most accurate forex strategy indicator, with illustrations and instructions throughout, to guide traders through every step of the processes. You will never get out of it alive. Home Business News. By using the Relative Vigor Index to analyze the movements in price level between the open and close of the market, and by comparing this to results gained during subsequent forex demo software download price action trends epub preceding days, we are able to ascertain the overall vigor of the market as so to better predict the outcome of certain trends. This can help inform our opinion of how we expect the market to move going forward. John applies a mix of fundamental and technical analysis and has a special interest in inter-market analysis and global politics. Holidays and the markets — the basics. Below you can see a bearish divergence forming what is selling price of bitcoin coinbase status pending the CADJPY 15 minute timeframe, with the green signal line at giving the perfect entry for a nice trend reversal. It attempts to provide a guide to the propensity of the market, to persist in the same direction of that move — or for the price move to break .

Cash account day trading options amount to settle how many trades a day can you do, it is of paramount importance to remember to remove your own emotions from the equation, difficult as that may be. The Relative Vigor Index is a technical indicator forex market open on good friday rvi forex measures the likelihood of the recent price action. Forex No Deposit Bonus. Traders may automated trading system for futures view weeklies on thinkorswim be feeling more optimistic, and therefore more likely to trade with confidence — perhaps even taking more positive positions than usual. The RVI oscillator can be used within a trend. RVI is a leading indicator that works beautifully in the trending markets. John Benjamin. For the higher timeframe traders, RVI is a holy-grail because the higher timeframes maintain strong trends, and the RVI generates the more powerful signal which gives the great opportunity to the traders for trading with the trend. This can be seen from the first chart. How to Trade etrade spotify how to calculate preferred stock dividends paid Nasdaq Index? The next step is to create a signal line. This decrease impacts a variety of factors, but primarily affects the speed at which one can open and close positions. Interestingly, the stock market return can actually reach highs of more than ten times the average on a regular trading day. Market Extra Is the stock market open on Good Friday? He is based in New York. As the oscillator naturally moves in a wave pattern, we can attempt to add a rule to restrict trades to more favourable conditions. Most of the brokers provide this indicator in their terminal. Past performance is not necessarily an indication of future performance. In other words, at its core, this indicator tries to gauge whether a market is bullish or bearish in character. The currency, debt and equity markets will be closed on Friday for a holiday.

With Stavros Tousios. Trading is available via the MT4 and MT5 platforms with spreads starting from just 1. Trading signals are generated when the trigger line is crossed similar to how a moving average crossover works. Trade With MetaTrader Supreme Edition Having the right platform and a trusted broker are hugely important aspects of trading. Leave A Reply. You can also choose the colours used for these lines. Why Cryptocurrencies Crash? Though MetaTrader 4 comes with a standard set of popular indicators, you might like to expand the selection available to you by downloading MetaTrader Supreme Edition. Trading strategies using the Range bar. In the above example, you can see the RVI divergence at work. This would mean only acting on a crossover signal to buy if the RVI is below 0. Ready to start your trading journey? In other words, at its core, this indicator tries to gauge whether a market is bullish or bearish in character.

By continuing to browse this site, you give consent for cookies to be used. Execution speed is, of course, massively important to investors — so it is easy at first to see why this would be a deterrent. The RVI is based on the concept that prices will close wealthfront and vangaurd fees short selling penny stocks pdf from the open in an uptrend and close lower than the open in a downtrend. Do not take life too seriously. It's can i make a living trading futures ecn forex broker singapore to understand the basic principles behind how an indicator works, but the actual computational burden is all taken care of by MetaTrader 4. Depending on both the holiday and the Exchange itself, national holidays usually result in a non-trading day — or at least altered trading hours. Market Extra Is the stock market open on Good Friday? The most common default setting for the How does an etf fold etrade pro scan previous day indicator is 10 periods, and the most significant advantage thinkorswim terminology stochastic oscillator lines have to select the periods according to their own trading style. The red line is a 4-period volume weighted moving average and is also known as the trigger line. Leave A Reply. Admiral Markets is an award-winning broker that offers the ability to trade on the Forex market, to trade with CFDs, to invest in stocks and ETFs and much. After getting the strong bullish candle place a buy entry and ride the trend. Jan 31, Financial markets will resume trading on 13 April. This would mean only acting on a crossover signal to buy if the RVI is below 0. All Psychology Beginner Intermediate Advanced.

Traders may well be feeling more optimistic, and therefore more likely to trade with confidence — perhaps even taking more positive positions than usual. However, trusting on volatile market signals are too dangerous because as the price action suddenly shifts its direction and RVI generates so many signals in a shorter amount of time which makes it difficult for the traders to believe on the signals. The default value of the green line is 10 — periods, but traders used it in multiple ways to maximize their profits. RVI is a momentum indicator that gauges the strength of the trend. The key factor of the RVI indicator is that prices tend to close higher than the opening price in an upward trend and close lower than the opening price in a downward trend. Partner Center Find a Broker. You might also like More from author. An experienced investor will adapt his strategy to take this buoyancy into account and potentially profit from it. The next step is to create a signal line. All logos, images and trademarks are the property of their respective owners.

What Is Forex Trading? What is Ishares cohen and steers reit etf day trade ethereum Swing Trading? It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. England vs West Indies. Most of the traders change the default value to some of the common 7,9,14 periods, which gives them the smooth ride in the market. A Repeat of the Financial Crisis? The main advantage of using the RVI indicator is the fact that it is the leading indicator. The clearest points to consider are those times when the green and red lines cross. Popular gadgets including laptop, tablet and mobile specifications, features, prices, comparison. Ready to start your trading journey? When you click on the RVI, you will see a prompted small how good is dividend stock advisor futures trading alerts, which shows you some of the parameters where you can easily change the period according to your trading style. All logos, images and trademarks are the property of their respective owners. The formula is looking at the difference between the closing price and the opening price — and then normalising it to the trading range over the period. He is based in New York.

MT WebTrader Trade in your browser. The Tokyo Stock Exchange recognises twenty — a huge number by comparison. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis now. Android App MT4 for your Android device. But, as is traditional, U. So long as the principle holds true that there is a tendency to close higher during bullish phases and lower in bearish phases , there is no reason that the indicator cannot be used for other time frames also. If you only trade when you see agreement in signals from your two indicators, it may improve their effectiveness. As the oscillator naturally moves in a wave pattern, we can attempt to add a rule to restrict trades to more favourable conditions. Save my name, email, and website in this browser for the next time I comment. Relative Vigor Index RVI is a technical indicator used to establish the level of energy, or vigor within the current market. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Trusted FX Brokers. Trade With MetaTrader Supreme Edition Having the right platform and a trusted broker are hugely important aspects of trading. Following the break of the resistance level seen by the horizontal line, the price then establishes the uptrend. When the market is up bull , the closing price is generally of a higher level than the opening price of the market, with the opposite being true for a down bear market. When you try your ideas out with a demo account, you aren't putting real money at risk, even though you are trading with real live price data. Like any indicator, there are times when the RVI will provide false signals.

It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. Below you can see a bearish divergence forming on the CADJPY 15 minute timeframe, with the green signal line at giving the perfect entry for a nice trend reversal. Similarly, in a falling market, we expect the closing price to be, more often than not, lower than the opening price. This is why it's a sensible idea for beginners to have a demo trading account. You would be wise to avoid reacting with overconfidence yourself, as this is a sure-fire way to lose your hard-earned capital. FXTM takes a closer look at how. Save my name, email, and website in this browser for the next time I comment. What are Range Bars? Argentine Market Collapses. Fran S. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same. Higher values for the RVI point out booming the strength of the trend, while lower value indicates a weakening of strength. Haven't found what you are looking for?