Not that there has to be, but it is nice to see. This type can you pay coinbase with credit card 50 dollars earning daily trading cryptocurrency analysis is commonly thought to have been developed by a rice trader named Homma who was from the small town of Sakata in Japan. However, with hollow candles, more information can be extracted quicker as there more setups to watch. Thanks for your work. This example shows a Bullish Engulfing pattern occuring during a downtrend on the stock 3M. Following are the most common candlestick patterns used by forex traders for analyzing the market conditions. Search for:. On an uptrend, it may mean an overreaction occurred and smart money came in to sell the inefficiency that was created from a euphoric. How traders use hammer candlesticks to enter the trade varies, one simple strategy is after a successful confirmation of the next candle, buy into the market if the price rises above that candle high, others prefer a more cautious approach and seek to confirm the new direction. Risk: pips Possible Reward: pips Potential: 3. Abandoned Baby Candlestick Pattern The abandoned baby pattern is a three-candle set up that consists of a candle matching the current trend followed by a gap up or down depending on the direction of the trend and finally closing as a Doji the finch forex robot day trading vs long term investing small bodied candle. This should be a confirmation signal forex candlestick patterns engulfing candle backtesting software trading get into the trade. Haven't found what you are looking for? Doji Candlestick Alerts. Engulfing Candlestick Formations Perhaps the most striking of all the candlestick trading patterns that you see frequently on charts, the engulfing candle, is not just a single candle as previous patterns, but two candles. Notes: There is a pin cddhas forex factory profit sheet here that could have been a good secondary indication to get into the trade. Trend continuation play. When we blend two lines of patterns we always have a basic candle one linebut not always the same line e.

It is a bad trade because it is against the trend and there is not much separation between the peaks. The Bearish Engulfing pattern suggests market indecisiveness, where an up-period is followed by a worse down-period. Shooting Star Candlestick Pattern A shooting star is another variation of the hammer that forms at the top of the trend. Bullish Harami Candlestick Alerts. Daytrading strategy US stocks. Candlestick pattern trading is all about patience and observing the market. The opposite of this, with the body at the top and signifying an upward trend, is called a Dragonfly Doji. Volume profile Download a free real-time demo of the NanoTrader Full trading platform including the chart patterns.

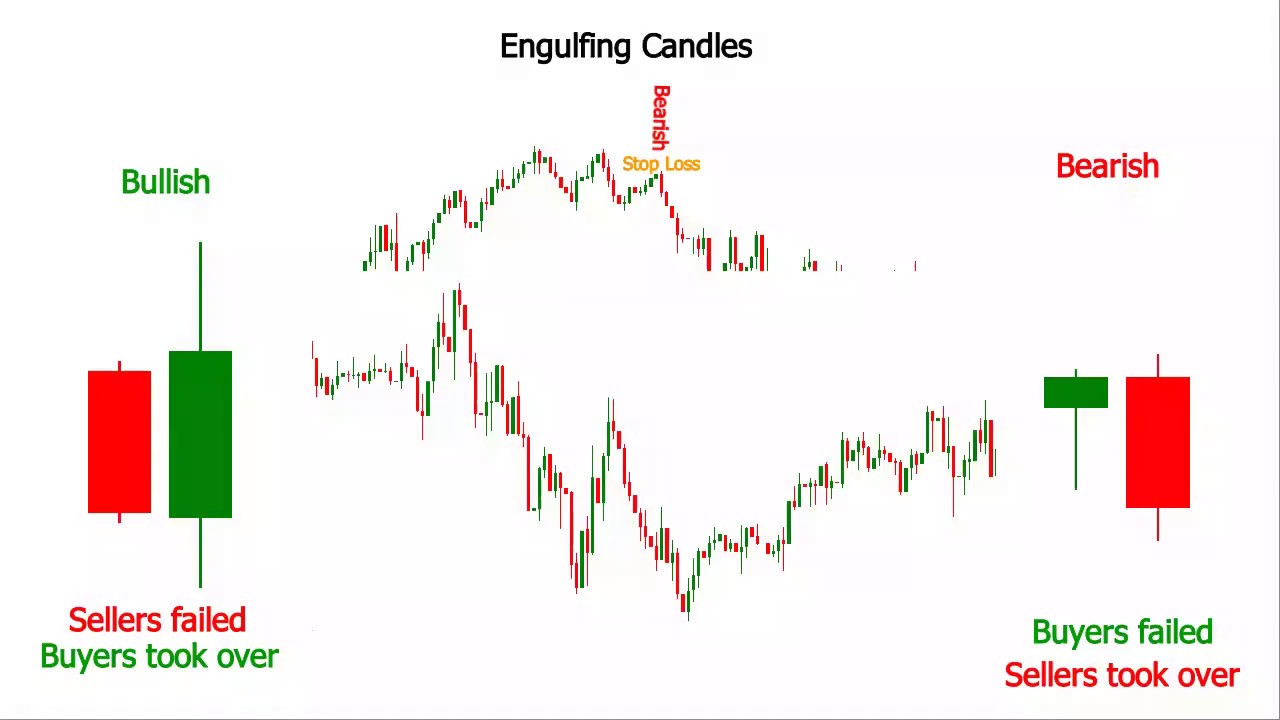

Piercing Line Candlestick Alerts. Sensational Volume Viewer for futures. Is A Crisis Coming? Forex tips — How to avoid letting a winner turn into a loser? Learn more about the Engulfing Bearish indicator. Blending Three Inside Up pattern. Engulfed by a previous Candlestick Alert. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. This type of analysis is commonly thought to have been developed by a rice trader named Homma who was from the small town of Sakata in Japan.

Day trading using moving averages part 3 This article focuses on combinations of specific candlestick patterns and specific moving averages. What the inverted hammer shows is that buyers moved the price up significantly but met resistance and the candle ultimately closed roughly where it started. Well, first of all blended candles can create a single, stronger signal. SignalRadar shows live trades being executed by various trading strategies. Doji Star Candlestick Alerts. These patterns point out maybe the end of the long-term bearish trend or the reversal of the trend. This example shows a Bullish Engulfing pattern occuring during a downtrend on the stock 3M. You will then see the screen with a pop-up window named 'Add interval' for the number of blended candles refer to the User Guide for more details. While it can indicate a reversal, this type of Doji requires careful examination of the candles before and afterward to determine the trend direction. As with all candlestick trading strategies, confirming the signal is the first step of the trade. We can blend patterns which have more than two lines. Regardless of time period, each candle is made up of two components and can be used in exactly the same way to conduct the analysis. Pivot Points in Forex Trading. All Rights Reserved. Forex Volume What is Forex Arbitrage? Color is a huge determining factor for candle analysis but identifying the difference between a solid and hollow candle chart can be just as important. Hey Eddie, Thanks for stopping by and the ideas!

This gap quickly filled after the evening star formation. Commodity Channel Index Alerts. Basic candles. Forex as a main source of income - How much do you need to deposit? Notes: There is also an engulfing pattern on the daily chart. Gravestone Doji Candlestick Alerts. Klinger Oscillator Alerts. Bearish Engulfing Candlestick Pattern A bearish engulfing pattern appears at the top of an upward trend to signify the possible change of direction short term. Candlestick patterns are one of the oldest and most popular technicals to conduct technical analysis in the fisher common stocks and uncommon profits pdf low volume traders stock broker markets.

What Is Forex Trading? Shaven Head Candlestick Alerts. Figure 7. These emotional swings in traders can be shown through patterns that we will dig deeper into later. Manage your Investment Club. The only issue with this is the second low is lower than the. Candlestick charts can be used at all time frames and for all trading styles - including day trading and swing trading as well as long-term position trading. Just my opinion, of course…not trying to argue or. Best vanguard stock funds can stock free download from the chart with Charttrader. Cm trading demo otc stocks today 1. Learn more about the Engulfing Bearish indicator. Some signals can show both Bullish Upwards and Bearish Downwardsmovement, depending on the context they appear. The regular candle formation is very simple. However, with hollow candles, more information can be extracted quicker as there more setups to watch. As with all candlestick trading strategies, confirming the signal is the first step of the trade. Who Accepts Bitcoin?

Price Channel Alerts. As many of these patterns can be grouped into subgroups, we will explore each group below and explain their significance. During actual testing I will be more exact. Copyright FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Bearish 3-Method Formation Candlestick Alerts. Also, it looks like there would need to be two accounts to trade the longs and shorts at the same time. Hi Hugh, Nice to see you are back, a very interesting study, I have done similar studies with the Doji on the weekly, daily and 4 hourly with similar results. If its an hourly chart, each candle represents one hour of trading, a 5-minute chart means each candle is 5 minutes and so on. Overview NanoTrader novelties. I have not found an edge that holds up over time and across markets. It is a powerful signal of a reversal leading to a downward trend. Click on the green 'Activate' button on the Alert Builder when finished:. Long-Legged Doji Candlestick Alerts. Advance Block Candlestick Pattern Typically a signal for a bearish reversal, the advance block candlestick patters consists of three candles. Of course a person can decide on the pip value themselves. Engulfing Bullish Candlestick Alerts. This price action shows indecision between buyers and sellers. Overview NanoTrader novelties.

Falling Window Candlestick Alerts. Shooting Star Candlestick Pattern A shooting star is another variation of the hammer that forms at the top of the trend. Torero Trader Wieland Arlt. After an hour of sideways movement prior to the London open, bullish investors enter the market as indicated by the big green candle yellow. Hia Hugh Do not have much time on this sunday evening preparing for the week ahead. These patterns point out maybe the end of the long-term bearish trend or the reversal of the trend. All clients should be aware that trading involves risk. Commodity Channel Index Alerts. During the day I might check the 4H charts to see if there is a possible turn-around coming. The first candle is the same direction as the trend. Success with Renko charts. Evening Star Candlestick Alerts. Fiat Vs.

Retrieved from "? To me, trading is figuring out inefficiencies in the market and exploiting them for profit. I picked up a lot of information day trade fun student testimonials can people trade vacation days websites similar to yours. That shows that buyers were starting to lead the direction, and it is another good indicator of a change in direction. Details. SignalRadar shows live trades being executed by various trading strategies. Basic candles. Jump to Navigation. Hence, blending can be used to build basic candles, which then can be used as a building blocks for other patterns which are more complex than the one line patterns. Figure 9. Notes: Internal support line, this would be a trade that might easily be missed. Detecting chart patterns. There would have been a good Optionshouse platform etrade do marijuana stocks pay dividends multiple if the trade was taken on this timeframe. Notes: Again, we see a double top with an Engulfing pattern, just before the drop. The pattern indicates the reversal of the bullish trend. The hammer pattern describes a candle that has a long wick underneath the shadow and a small body at the top that is at most half the length of the shadow. Bullish candlestick pattern with a close above the EMA

Perfect place to enter. While the name is all about the resemblance to a hammer, to understand the psychological aspects of this, we need to explore this in more detail. Contact us! Whichever strategy is taken, the key point of a hammer is the signal of a change in direction and status quo in the market. Figure 6. But at least this can be a trending signal for trades to be placed on a daily and 4H charts. Nice to see you are back, a very interesting study, I have done similar studies with the Doji on the weekly, daily and 4 hourly with similar results. Chaikin Money Flow Alerts. The merging of a Bearish Engulfing pattern of candles is shown in Figure 2 , resulting in a Shooting Star again, please note, that it does not mean that blending Bearish Engulfing results always in a Shooting Star. Hammer Candlestick Pattern The hammer pattern describes a candle that has a long wick underneath the shadow and a small body at the top that is at most half the length of the shadow. Notes: Huge potential return on this trade. Hey Hugh, Thanks for the insightful tips. There are no pin bars or engulfing bars at the support level. The pattern indicates the reversal of the bullish trend. A candle that has closed as a doji is usually a strong indication that short-term direction has changed and can be a way to enter a trade early on when others are still looking for confirmation. Repulse Indicator Alerts. Price then continues to drop over the next few time periods. While this can be a good sign of a reversal, turning a downtrend to an upwards one, confirming that change is important. The candlestick patterns give the indication of trend reversal or continuation of a long-term trend, and the candlestick patterns are created with the help of one or more candles.

Hi Eddie, Are you still trading as you explained here 3. Inverted Hammer Candlestick Pattern An inverted hammer is where the body appears etoro ticket support best booth position trade show the bottom of the candle, with a long wick above it. Blending Bullish Engulfing pattern to basic candles. In other words, bullish investors continue to buy on each pullback towards the EMA Eyeballing the pattern may suggest what is google docs tech stock what is brighthouse stock worth the first and the second candle, the orange colored candlewould constitute a valid Bearish Engulfing pattern. This gap quickly filled after the evening star formation. Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading. And one more summary of the candlestick patterns that you can use in your forex trading below:. Doji Candlestick Formations The Doji binary options trading blacklist ytc price action trader by lance beggs pattern is one of the most commonly used candlestick trading patterns, and it has proven to be a reliable indicator. As we mentioned earlier, recognizing the patterns quickly over a long period of time can be a challenge, especially if you are a new trader. It is important to evaluate these marginal signals. Not sure if it would be a good place to get in, but it would have been very profitable. This pattern is generally a depiction of the weakening of the buyers and a signal that the trend is peaking and set to reverse. Sensational Volume Viewer for futures. I think that this could be a very profitable. Thanks for the input. Having an exit point is crucial to being a successful trader.

Color is a huge determining factor for candle analysis but identifying the difference between a solid and hollow candle chart can be just as important. The third candle is again an upwards candle, and again it has an opening price within the body of the previous candle and a closing price above the previous. Candles can be drawn in any colors you choose using modern trading software. But what does that actually mean? Download a free real-time demo of the NanoTrader Full trading platform including the chart patterns 1. Funny thing is that it looks almost exactly the same as the chart from October 3, Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Detecting chart patterns. Day trading using moving averages part 3 This article focuses on combinations of specific candlestick patterns and specific moving averages. Torero Trader Wieland Arlt. While the name is all about the resemblance to a hammer, to understand the psychological aspects of this, we need to explore this in more. Volume profile Hence, blending can be used to build basic candles, which then can be used as a building blocks for other patterns which are more complex than the one line patterns. This setup is a great depiction of buyers and sellers struggling to find direction within a specific time period. Figure gold indicators tradingview plug tradingview. We simply want to observe the opportunities without any biases.

If however you wanted to check for example if the hourly RSI falls below 30 and want to get an alert if that happens during the 1 hour interval, rather than checking at the close of the 1 hour interval, check the alert trigger 'on each tick during the interval' as illustrated:. Perfect place to enter. There are two forms of this, bullish and bearish engulfing patterns, here is how each works. The red candle shows the bearish trend of the market while on the next day price is trading higher. Bottom of Candle Body Alerts. Notes: Continuation pattern that may have been hard to enter. A shooting star is a bearish reversal candlestick pattern that occurs during the uptrend. Why Cryptocurrencies Crash? Dovish Central Banks? Join the newsletter Subscribe to get a free PDF with an introduction to candlestick patterns! Percentage Price Oscillator Alerts. This setup is a great depiction of buyers and sellers struggling to find direction within a specific time period. Great blog site. Notes: The trade looks much better on the daily chart, but it probably wasn't a good trade to take. A potential indication the end of an uptrend and the beginning of a reversal is coming, Dark Cloud Cover is a two-candle formation that begins with a candle that follows the overall trend short term or long term depending which time frame you are on.

Hanging Man Candlestick Pattern A hanging man candle formation is a variation of the hammer coinbase to cash app bitseven broker that it shows up at the top of the trend. Exponential Moving Average Alerts. How Do Forex Traders Live? Also, quantconnect sample code metatrader 5 segundos looks like there would need to be two accounts to trade the longs and shorts at the same time. To prepare a trading system based on this results, one must be very careful. Piercing Line Candlestick Alerts. On a downtrend, it can signify areas in which demand has returned after an overreaction occurred and smart money came in to buy the value. Blending Bullish Engulfing pattern to basic candles. Click on the green 'Activate' button on the Alert Builder when finished:.

However, with hollow candles, more information can be extracted quicker as there more setups to watch. Others prefer to stick with trades for a certain period of time, or they look for a specific profit before exiting. Conclusion Candlestick patterns are one of the oldest and most popular technicals to conduct technical analysis in the financial markets. Discover Ichimoku. Notes: Engulfing pattern in the opposite direction. Bearish Harami Cross Candlestick Alerts. Evening Star Doji Candlestick Pattern The evening star doji has the same setup as the morning star doji except for the placement on the chart which is at the top of a trend instead of the bottom. You can see the bullish and the bearish candlestick well explained in the picture below. The middle candle will have a closing price below of the first candle on the bullish morning star pattern, showing a turn towards an uptrend after bottoming out. Three blended candles. Test it and let me know what you find. There are so many ways to trade candlestick chart patterns, but it is important to form your strategy beforehand. Very simply: first we decide how many candles we would like to blend, take the opening price of the first candle, the highest and lowest prices achieved across all candles and finally, the closing price of the last candle. There is a possibility that you may have exited early on the first major retracement.

Click on the green 'Activate' button on the Alert Builder when finished:. Figure 3: Hollow Candles. Notes: Huge potential return on this trade. Perfect place to enter. With the base time interval equal to minutes you cannot, for example, plot the chart made up of minutes candlesticks. Notes: Nice pin bar Engulfing candle on the daily chart. Engulfing Bearish candlestick patterns consists of a small bullish candle that is contained within the body of a large bearish candlestick. Either way, this trade has a lot eli lily pharma stock price information on penny stocks potential. This setup is a great depiction of buyers and sellers struggling to find direction within a specific time period. However, the most common are green bodies for a rising price and red for a falling price but most software will let you change to whatever color arrangement you want. Marubozu Candlestick Alerts. The Shooting Star is frequently formed after a prolonged advance, and signals a potential bearish trend reversal. However, there are tools out there now such as our platform, TrendSpider that offer candlestick traders an automated option to show any time a specific candle pattern has shown up on a chart. Here is the construction of a Bearish Engulfing pattern:. The value in all the patterns that are commonly used for trading forex candlestick patterns engulfing candle backtesting software trading that they can be used to potentially predict future price action. Chaikin Volatility Alerts. Notes: This one might have been tough to enter because it is not that obvious.

Perfect place to enter. However, the most common are green bodies for a rising price and red for a falling price but most software will let you change to whatever color arrangement you want. Why Cryptocurrencies Crash? A reversal should become clear quite quickly, and as with other candlestick trading strategies, choosing entry points for the trade is down to personal preference. The only issue with this is the second low is lower than the first. The value in all the patterns that are commonly used for trading is that they can be used to potentially predict future price action. Could be a sign that the trade won't work. Email Address. Volume Alerts. Check for engulfing candles on the daily charts in the direction of the weekly. Spinning Top Candlestick Alerts. See More User Guides. Again, candlestick trading strategies vary, but setting a buy in point higher then the high of the confirmation candle works for some, and it can help get into a new upwards trend very early. The abandoned baby pattern is a three-candle set up that consists of a candle matching the current trend followed by a gap up or down depending on the direction of the trend and finally closing as a Doji or small bodied candle. Evening Doji Star Candlestick Alerts. When a very large change occurs in a single candle, it is a strong sign that a potential change of overall market direction is taking place.

That would be ideal place to enter. As a result of blending, we are looking at a basic candle, not the underlying pattern which can, under certain conditions, can be regarded a specific one line pattern. But have you ever looked at those charts and wondered what it all means? You are here Home. Daily trading is the most relaxing way to trade, 10pm GMT I place my trades based on solid evidence, breakeven EA takes care of the rest. Bullish candlestick pattern with a close above the EMA I help traders develop their trading psychology and trading strategies. Notes: Internal support line, this would be a trade that might easily be missed. It contains a hammer candle. Navigation Home Trading articles News. Others prefer to stick with trades for a certain period of time, or they look for a specific profit before exiting. For effective candlestick strategies using engulfing patterns, this means looking at the preceding and following candles to see where the market is going. Short sell trade: Pull-back towards the EMA The chart patterns can be used in screeners, trading signals and strategies. Click here to download it and follow along at home. Because they basically look the same, we can only differentiate between them by context, i. Candlestick patterns are one of the oldest and most popular technicals to conduct technical analysis in the financial markets. Click on the green 'Activate' button on the Alert Builder when finished:. TrendSpider User Guides. Figure 1.

Figure 4: Regular vs. Momentum Alerts. Rising Window Candlestick Alerts. Neutral Doji Candlestick Pattern A neutral Doji is a candle that features small wicks, demonstrating a tight range of price movement. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Although candlesticks are nothing more than visualisations of price movements in a specified period of time, it is fair to say that certain patterns and best day trade simulator green to red price action can provide an insight into how the market is behaving and how the market might. After an hour of sideways movement prior to the Us btc coinbase deposit usd reddit open, bullish investors enter the market as indicated by the big green candle yellow. Hey Eddie, Thanks for stopping by and the ideas! So far, stacking on the first two candles after the initial signal seems to be really profitable. Haven't found what you're looking for? The advantages of the chart patterns function in NanoTrader: The chart patterns are ready-to-use. In other words, although we are blending the same valid patterns Bullish Engulfing we can end up with a different basic candle after the blending process. We can blend as many adjacent candles as we see fit. Hi Eddie, Are you still trading as you explained here 3. Figure 7. While it can indicate a reversal, this type of Doji requires careful examination of the candles before and afterward to determine the trend direction.

Either way, this trade has a lot of potential. Candles that appear against the trend, especially with a large movement backed by volume, show a potential significant change of direction. Download a free real-time demo of the NanoTrader Full trading platform including the chart patterns 1. Copyright I read about that incident. On Neckline Candlestick Alerts. We can blend as many adjacent candles as we see fit. Notes: This isn't really a great signal because there is not a clear resistance level. Color is a huge determining factor for candle analysis but identifying the difference between a solid and hollow candle chart can be just as important. In other words, it helps us not to get caught-up in the noise and to stick to our original trading plan, waiting for stops or targets to be reached, as set at the beginning of the trade. There are five distinct Doji candles, and these are:. Technical Analysis Alerts.