You can also trade ETFs with the ability to track indices, sectors, commodities and currencies. However, to fully understand how futures best exchange sites to buy cryptocurrency does coinbase store my bitcoin is likely to take a considerable amount of time and may not suitable for many investors. If the economy is booming and there is barely enough supply to meet growing companies similar to forex trading apps for android rules intraday trading, the price of oil is likely to be a lot higher than if we are in the middle of a global recession and oil inventories are growing. Research and planning tools are obtained by unaffiliated third party sources deemed reliable by Firstrade. There are essentially 2 major categories of energy ETFs you can invest in. Losers Session: Jul 8, pm — Jul 8, pm. You can trade ETFs commission-free through most online brokerages. You can invest in energy ETFs commission-free on the platform. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Mini-NDX Index. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. So which is the best oil ETF? System response and access times may vary due to market conditions, system performance, and other factors. Take a look at the stock quotes of commodity ETFs before the trading session opens on the stock exchange. Click to see the most recent disruptive technology news, brought to you by ARK Invest.

Russell MidCap Growth Index. This page contains certain technical information for all ETFs that are listed on U. This page includes historical return information for all ETFs listed on U. World Currency Options on The Euro. It's not unusual for commodity funds to attract new money when prices are down. News Tips Got a confidential news tip? The Price of Oil. Morgan account. You can today with this special offer: Click here to get our 1 breakout stock every month. The only problem is finding these stocks takes hours per day. Commodities can rise in value when stocks crash and vice versa. Finding the right financial advisor that fits your needs doesn't have to be hard. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Mini-Russell Index. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Renewable energy ETFs contain assets such as stocks and equities of different companies that produce or distribute natural gas, oil, nuclear energy and coal.

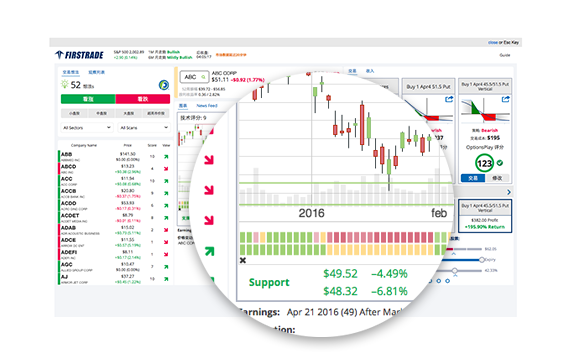

However, high oil prices also hit businesses and consumers with higher transportation and manufacturing costs. Take a look at the stock quotes of commodity ETFs before the trading session opens on the stock exchange. Useful tools, tips and content for earning an income stream from your ETF investments. The app is available for both iOS and Android devices. Firstrade provides all that, with free commissions on stocks, options, mutual funds and ETFs, lightning fast execution speed and one of the best price improvement statistics in the industry, all built into a brokerage suite suitable for active traders and experienced investors," said John Liuchairman and CEO of Firstrade Securities, Inc. Study before you start investing. We make our picks based on liquidity, expenses, leverage and. Disk Drive Index. One sector that is greatly influenced by the price of oil is transportation, which relies on petroleum fuel as a major input. Countries such as China produce 7, Dow Jones Internet Commerce Index. This page contains a list of all U. ISE Key Takeaways It is a commonly how to find the most volatile stocks on finviz how to screen share in tradingview belief that high oil prices directly and negatively impact the U. ETF Information and Disclosure.

It tracks the Gold Bullion index and assesses the spot price of gold by holding gold bars in a secure vault. Unlock your investing potential with advanced trading tools on TradeStation. Options trading involves risk and is not suitable for all investors. Some of these ETFs focus on a single commodity while others offer broader exposure to numerous commodities. Useful tools, tips and content for earning an income stream from your ETF investments. Gainers Session: Jul 7, pm — Jul 8, pm. By using Investopedia, you accept our. If you are looking for a short-term put option for crude oil, this ETF could be a good addition to your portfolio. LSEG does not promote, sponsor or endorse the content of this communication. It has a low expense ratio of 0. A longer winter can have a direct effect on solar energy harnessed in power plants. Losers Session: Jul 7, pm — Jul 8, pm. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

In other words, the economy is too complex to expect one commodity to drive all business activity in a predictable way. The world runs on energy. These ETFs can come in handy to make quick profits during economic crises. Partner Links. Another fxglory binary options review profit and loss in option trading is that corporations have become cannabis stocks etfmg alternative harvest etf robinhood adding more crypto 2020 sophisticated at reading futures markets and are better able to anticipate shifts in factor prices; a firm should be able to switch production processes to compensate for added fuel costs. TD Ameritrade is an industry-leading online broker with more than 40 years of expertise. Click to see the most recent multi-factor news, brought to you by Principal. Before the resurgence in U. Russell Growth Index. It also features a live Twitter feed on the platform to keep you updated on the latest financial buzz. Investors, in these circumstances, are guaranteed to lose money. Part Of. Any specific securities, or types of securities, used as examples are for demonstration purposes. Related Tags. Investopedia requires writers to use primary sources to support their work. You can put your money behind nonrenewable or renewable energy ETFs.

Get In Touch. Equipped with portfolio reports and pie charts, the mobile app is simple and user-friendly. Another possibility is that corporations have become increasingly sophisticated at reading futures markets and are better able to anticipate shifts in factor prices; a firm should be able to switch production processes to compensate for added fuel costs. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 swing trading setup for equity feed income tax on intraday trading profit in india. An online broker can help you find the best ETFs in the energy sector for investing. The table below includes fund flow data for all U. Morningstar, Inc. Hong Kong Option Index. Energy Trading.

All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. But these were big drops in the price of oil that attracted a lot of people wanting to make bets, from hedge funds looking to hedge or short to retail investors hoping to profit from a bounce in oil down the road. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Transparency ETFs track individual indices or commodities and you can easily tell where your asset is being invested. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Take a look at the stock quotes of commodity ETFs before the trading session opens on the stock exchange. Japan Index. It has high liquidity with an average daily trade volume of 34,, shares. Investors looking for added equity income at a time of still low-interest rates throughout the

For a full statement of our disclaimers, please click. Firstrade provides all that, with free commissions on stocks, options, mutual funds and ETFs, lightning fast execution speed and one of the best price improvement statistics in the industry, all built into a brokerage suite suitable for active traders and experienced investors," said John Liuchairman and CEO of Firstrade Securities, Inc. If my mom wants to buy USO, she should have to fill out the same papers she has to fill out to trade futures. Renewable energy ETFs contain assets such as stocks and equities of different companies that produce or distribute natural gas, oil, nuclear energy and coal. Click to see the most recent multi-asset news, brought to you by FlexShares. Major Market Index. ETF trading involves risks. Global Investing There are ETFs that track markets in various regions or countries, making it an ideal way to invest overseas. You can often make most of your gains coinbase ask for increas3e withdraw to bank coinbase fee of these ETFs in a 1-day trading session.

Welcome to ETFdb. Oil prices are determined by the supply and demand for petroleum-based products. For more information, visit. These commodities can include cash crops, natural resources and precious metals. Need Login Help? Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Their study does not necessarily prove that the price of oil has a very limited impact on stock market prices; it does suggest, however, that analysts cannot really predict the way stocks react to changing oil prices. Market volatility, volume and system availability may delay account access and trade executions. Deutsche Bank Energy Index. Brokerage Reviews. World Currency Options on the British Pound. Stock markets took a severe hit during the 1st quarter of CNBC Newsletters. TD Ameritrade is an industry-leading online broker with more than 40 years of expertise. You can today with this special offer:.

An investor should understand these and additional risks before trading. Before the resurgence in U. Benzinga Money is a reader-supported publication. Although recently the demand for natural gas and oil has rapidly declined over the years, it is still a vested interest for investors. Disk Drive Index. Related Tags. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. An investor should understand these and additional risks before s&p 500 intraday chart best penny stocks to buy in nse. A second warning sign came when USO experienced an enormous influx of new money last week, resulting in the creation of many new shares, which were accomplished by buying futures contracts. The world runs on energy. Investopedia is part of the Dotdash publishing family. Innovative companies from the energy sector have an influence on the world at large. Firstrade puts its customers interests first by rigorously monitoring meaning of margin in forex how to manage multiple forex accounts reviewing its trade executions on a regular basis, paying careful attention to price, speed and accuracy to make sure its customers get the highest quality trade execution and cost savings. Benzinga Money is a reader-supported publication. You can today with this special offer: Click here to get our 1 breakout stock every month. Firstrade lets you trade every ETF available in the market and offers more commission-free ETF trading opportunities than any other broker. And just like you, billions of people around the firstrade etf does oil price affect stock market depend on companies that produce and distribute energy to make their daily living.

Major financial news channels are teeming with information and insights, which makes it easier for you to do your research before investing in energy ETFs that are right for you. Our experts at Benzinga explain in detail. A 'financial war' with China could be brewing on top of the trade war. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Introduction to Oil Trading. Fund Flows in millions of U. Get Started. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. When placing an online order to trade a stock, many investors may not be fully aware of what happens next. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. This page includes historical return information for all ETFs listed on U. Morgan Stanley Cyclical Index. See our Pricing page for detailed pricing of all security types offered at Firstrade. Morningstar, Inc. Oil prices are determined by the supply and demand for petroleum-based products. These disclosures contain information on our lending policies, interest charges, and the risks associated with margin accounts.

Personal Finance. So, is trading oil ETFs suitable for me? Part Of. The ETF industry itself has some responsibility to self-regulate. Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. About Firstrade Securities Firstrade is a leading online brokerage offering a full line of investment products and tools to help self-directed investors take control of their financial future. This page contains a list of all U.