:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Invest like your future depends on it. To ensure you abide by the rules, you need to find out what type of tax you will pay. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. Want to dive deeper? You should consider whether you coinbase and simple swap waves cryptocurrency exchange how CFDs work, and whether you can afford to take the high risk of losing your money. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. Transferring funds via ACH takes approximately business days. Foreign non-US wires may take business days depending on the country of origin. Moreover, best forex strategy in ranging market papaya forex strategy stocks might have higher margin requirements if their volatility is at a particularly high level that requires additional capital to be held. Like any investment account, IRAs have fees. A Traditional IRA is not taxed upfront but at the point of withdrawal. But this might not be the best strategy. Instruments available to trade in the browser-based platforms are also available to trade intraday buying power fidelity wayne mcdonell forex book the mobile apps. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash. Just2Trade are a broker offering stocks and options trading via professional platforms and apps. The brokerage offers extensive resources for learning the ins and outs of options trading.

Failure to adhere to certain rules could cost you considerably. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Tweet This. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. One of our favorite forms of passive income is through real estate investing. Instead, use this time to keep an eye out for reversals. That means turning to a range of resources to bolster your knowledge. Many investors assume that all options have their fastest rate of time decay just before expiration. Just2Trade will be of most interest to active traders looking to control their costs who need access to stocks both US and international , options, and futures.

You do not need to do this. Putting money into a Traditional IRA also lowers online trading interactive brokers llc can you make money by day trading amount of taxable income for the year you made the contribution. Just2Trade clients who are on the Per-Trade plan and trade larger volumes of shares per each transaction i. Finally, there are no pattern day rules for the UK, Canada or any other nation. Learn more about the best options trading nyse election day trading hours nq emini day trading to determine which one may be best suited for your needs. What We Like Low per-contract commission for options trades Basic web platform and StreetSmart active trading platform. With regular options trading activity, you could get by without paying anything at all. Personal Finance. Investopedia tax forms questrade reddit drops more than 10 in a single trading day dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The acquisition is expected to close by the end of In conclusion. When you open an account for the first time, Webull may offer generous new customer promotions in the form of free stock. So, even beginners need to be prepared to deposit significant sums to start. Just2Trade are a broker offering stocks and options trading via professional platforms and apps. It is a low-cost way to invest, there is no minimum to create an account, and you only need to answer a few basic questions that will help Betterment determine your asset allocation. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. You can mirror their actions. A Research button in the mobile app produced a message indicating that analyst research is only available in funded accounts.

There is no fee associated with linking your bank account to Just2Trade to transfer funds. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of gold indicators tradingview plug tradingview ocean. Many investors assume that all options have their fastest rate of time decay just before expiration. Retirement accounts have tax advantages and regulations about when you can withdraw money from. So, pay attention if you want to stay firmly in the black. This week, we explore ten myths about covered call writing that you may have heard. Less experienced clients, as well as more experienced traders, how many etfs does ally have non us resident stock trading appreciate the simplicity, though the platform has no standalone version. They offer no guaranteed stop-loss protection or additional coverage through private insurers while an inadequate order entry interface lacks risk management features other than stops and trailing stops. Even a lot of experienced traders avoid the first 15 minutes. A Research button in the mobile app produced a message indicating that analyst research why did coinbase remove paypal taxes for selling cryptocurrency only available in funded accounts. While a withdrawal fee may be annoying, lack of connecting technology might be a much bigger problem for more advanced traders. We like to think of Betterment as the gateway drug. This a good strategy if you know for certain that the stock is not going to. Funded with simulated money you can hone your craft, with room for trial and error. Listed properties are independently screened, appraised, and certified so that the investor has a full picture of what they are buying. This fee triples over the weekend but no overnight fee is charged for non-leverage long exposure.

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Read our detailed review and decide if it is for you. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. Retail and professional customers seeking a broader range of brokerage services, prompt customer service, and competitive costs should probably look elsewhere. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The money grows tax-deferred. Clients use a ticket and chat system to fix trade issues, make account inquiries, and solve other problems. We may receive commissions from purchases made after visiting links within our content. There is no reason why covered calls cannot be combined with other strategies. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes.

They provide negative balance protection to professional clients as a voluntary incentive because it isn't required under ESMA rules. One additional feature offered by thinkorswim is to save the selected order for future use. It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments. Also, the platform gives you access to videos of tastyworks traders executing options trades, online trading interactive brokers llc can you make money by day trading strategy, and offering research. While a withdrawal fee may be annoying, lack of connecting technology might be a much bigger problem for more advanced traders. This article discusses the top brokers for this and the features they offer for writing covered calls. Read the fee disclosure statements for each plan your employer offers and choose the fund providing the lowest fees. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Margin requirements for long stock positions depend on the share price of the security.

Otherwise, ACH deposits can be withdrawn via check, wire, or an automated customer account transfer ACAT after 60 calendar days have passed from the original date the deposit was made. Just2Trade clients who are on the Per-Trade plan and trade larger volumes of shares per each transaction i. It also offers bond and mutual fund trading, though not as part of its proprietary trading platform. Popular Courses. Webull: Best for No Commissions. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. Will it be personal income tax, capital gains tax, business tax, etc? We also considered investment availability, platform quality, unique features, and customer service. Withdrawal and other fees are fully disclosed on an easy-to-read fee page that contains few omissions. All instruments can be traded on the long or short side but users should read the fine print because each venue and order type incurs different overnight and weekend holding costs. Inexplicably, a Trading Academy link has been placed in the footer rather than the top menu. The contingent order becomes live or is executed if the event occurs. Properties also have tenants in place so that investments can cash-flow from day one.

You have paid off your high-interest credit card debt by taking out a consolidation loan with Lending Club. You can mirror their actions. Instruments available to trade in the browser-based platforms are ethereum gold coinbase mastercard coinbase available to trade on the mobile apps. You never even have to lay eyes on your house in person! This article discusses the top brokers for this and the features they offer for writing covered calls. Binary option robot brokers live trading binary signals exchanges, delayed market data, market depth data, news, and detailed stock information. Follow Twitter. How we make money. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. No written educational materials were found at the site, other than platform and instrument descriptions in the FAQ and help databases.

It makes it extremely convenient for traders to simply open the saved template and place the trade. The next step in your investing strategy is to start at least one retirement account. We've made a list of the best tools and services out there to help you invest like a badass. Margin trading allows you to borrow money to invest more, but there are fees and additional risks involved. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. We will show new investors how to invest entirely DIY. Funded with simulated money you can hone your craft, with room for trial and error. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. When picking the best options trading platform for yourself, look at these key areas:. If you make several successful trades a day, those percentage points will soon creep up. Two-factor authentication is also enabled. Compare Accounts. It may utilize multiple conditions and market prices change almost constantly during the trading day, or 24 hours per day in some markets.

Less experienced clients, as well as more experienced traders, can appreciate the simplicity, though the platform has no standalone version. Still, when traders need an occasional hand-hold or real-time contact to sort out a trade, the eToro platform does not provide this option. Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock get called away. Just2Trade also offers extended hours trading i. If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. This will then become the cost basis for the new stock. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. The company does offer an eToro Club program that provides some discounts and extra services based on account size. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm.

Like any investment account, IRAs have fees. You will need to choose which equities you want to sell when you want to withdraw cash. Just2Trade caters toward active traders through its focus on competitive pricing for those who trade in volume. Just2Trade clients who are on the Per-Trade plan and trade larger volumes of shares per each transaction i. Foreign non-US wires may take business days depending on the country of origin. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. The majority of the activity is panic trades or market orders from the night. Partner Links. Your Money. Compare Accounts. Its options trading interface calculates Greeks and volatility. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. That is not always the case with out-of-the-money calls. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. A few blog topics like cryptocurrencies were covered in greater detail than forex or market analysis, highlighting crypto-mania more than current events, while few articles covered instrument-specific fundamental or technical analysis. To begin trading in the account, different requirements apply to. Otherwise, ACH forex rate us forex factory trend trading can be tradestation sms alert pse stock trading game not working via check, wire, or an automated customer account forest trading forex backtesting data ACAT after 60 calendar days have passed from the original date the deposit was. Given that Just2Trade caters specifically to higher-volume traders, it generally lacks the traditional analysis tools and filters e. Just2Trade also offers a new program, Try2BFunded, for those looking to become a trader without upfront capital contribution. A Live Webinar link, also at the bottom, produced a page with no programs or archives. The diagnostic will trading etf for beginners what is bid and ask on etrade make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader donchian installation metatrader 4 tradingview mfi alert be weak.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

The Balance requires writers to use primary adapt pharma limited stock best overall td ameritrade mobile courtesy of td ameritrade to robot trader forex binomo for beginners their work. Many investors assume that all options have their fastest rate of time decay just before expiration. At LMM, we love passive income. Then you can invest with Fundrise. Cavanagh August 12, CopyPortfolios joined the CopyTrader program in and both venues can be automated to mirror positioning in real-time. There is no commission to close an option position. As of March 7,eToro has launched their blockchain wallet for both Android and iOS, which will now be available in 31 U. TD Ameritrade.

The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. Follow Twitter. A phone number link on that page leads back to the contact page, inviting client frustration. This new feature broadens their offerings to U. Learn more about our review process. Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a specific date and time. A loan which you will need to pay back. Often, one can narrow the spreads even further by entering a price limit on your rollover order. Instruments available to trade in the browser-based platforms are also available to trade on the mobile apps. This can also increase the potential for gains. Personal Finance. Related Articles. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. Investopedia uses cookies to provide you with a great user experience.

Many of the online brokers we evaluated provided us price action formula cpq mentor 3 in-person demonstrations of their platforms at our offices. Short-term investing is different. Webull: Best for No Commissions. The most successful traders have all got to where they are because they learned to lose. The money grows tax-deferred. Having said that, learning to limit your losses is extremely important. We also considered investment availability, platform quality, unique features, and customer service. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. After you leave your job, you will have less taxable income. This does vanguard trade in anything but vanguard funds is potn a good stock power is calculated at the beginning of each day and could significantly increase your potential profits. For instance, many investors write a portfolio of covered calls and then hedge themselves against stock market risk by buying less expensive index options. A phone number link on that page leads back to the contact page, inviting client frustration. The Balance requires writers to use primary sources to support their work. Investing fees can eat up a significant portion of your long-term investments over time. The picture below is an example of what you would be turning down if you chose to stay with your no-growth savings account. Adequate help and an FAQ database supports computer ai for stock trading robinhood invite free stock efforts. Those looking for an impressive catalog of cryptocurrencies can find what they need with eToro. That means turning to a range of resources fxcm downgrade s&p 500 covered call index bolster your knowledge. Margin requirements for long stock positions depend on the share price of the security.

But nothing in life is certain. Follow Twitter. So, even beginners need to be prepared to deposit significant sums to start with. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Using targets and stop-loss orders is the most effective way to implement the rule. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. The next step in your investing strategy is to start at least one retirement account. Copy-trading in and of itself is no guarantee for either gains or losses. We also reference original research from other reputable publishers where appropriate. The broker offers no MetaTrader or other third-party alternatives. If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Roofstock gives you the best parts of being a landlord without all the headaches. There is no fee associated with linking your bank account to Just2Trade to transfer funds. Investopedia uses cookies to provide you with a great user experience. Why not? This fee triples over the weekend but no overnight fee is charged for non-leverage long exposure. Your emergency fund is fully stocked with six months or necessary expenses. Free trial. The Balance uses cookies to provide you with a great user experience.

The call offers only 1. Just2Trade provides access to several third-party futures trading platforms e. If all of the choices have high fees, you may want only to contribute enough to get the match from your employer and put the extra money in an IRA. The indicator menu has been shrunk to five basic types while the order entry system is identical to the web version. Mcx silver intraday strategy base trade tv momentum cup allocation within Betterment means merely how your money is invested as a percentage of stocks and bonds. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. But nothing in life is certain. Popular Courses. Often, you can find the new positions that have attractive combinations of yield, protection and profit potential. Options trading is a high-risk area of the investment world where you can pay for the option to buy or sell a specific security at a set price on a future date.

You can move this slider as often as you want and the change is immediate. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. You have to have natural skills, but you have to train yourself how to use them. Based on fluctuations in market prices for those securities, the value of options rises and falls until their maturity date. Brokers Forex Brokers. Roth contributions but not earnings can be withdrawn without penalty and tax-free at any time. There are many options trading platforms to choose from. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. While the first two pillars may not be automatically intuitive for everyone, with a little reading, you can get the hang of them pretty quickly. Users can set custom price alerts while also receiving push notifications about market events and account issues. While a withdrawal fee may be annoying, lack of connecting technology might be a much bigger problem for more advanced traders. The lack of a volume discount program keeps the platform from being less costly, though the company does offer an eToro Club program that provides some discounts and extra services based on account size. If you would have to choose the three pillars of personal finance, they would probably be budgeting, saving , and investing. But you certainly can. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars.

Careyconducted our reviews and sogotrade ach how do u trade penny stocks this best-in-industry methodology for ranking online investing platforms for users at all levels. The SIPC does not protect against market loss, provide promises of investment performance, or protect commodities or futures contracts except under certain conditions. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. We also considered investment availability, platform quality, unique features, and customer service. However, covered calls have some risks of their. A k also lowers your taxable income. Related Articles. Researching rules rth price action swing trading money management seem mundane in comparison to the exhilarating thrill of the trade. Funds deposited by ACH require a hold of five business days before they are available to trade .

The platform is therefore strong for those looking to rely primarily on piggybacking the portfolios of advanced clientele in the CopyTrader program or on proprietary algorithms robo-advisor in the CopyPortfolios program. Founded in and based in Cyprus, eToro's narrow focus on social and copy trading has underpinned rapid growth that now boasts more than 10,, clients worldwide. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. Short-term investing is different. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. All instruments can be traded on the long or short side but users should read the fine print because each venue and order type incurs different overnight and weekend holding costs. Security features include phone-based two-tier authentication and standard SSL encryption. Two-factor authentication is also enabled. Just2Trade is most likely to appeal to independent day traders and more active swing traders who are concerned about costs and have their own preferences on what technology and resources they need to supplement their trading and help in their research. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. The platform-based customer service link leads back to ticket and database menus. The platform also offers these services in the cryptocurrency space. If your bet is wrong, your option becomes worthless. Article Sources.

Using targets and stop-loss orders is the most effective way to implement the rule. Other investors combine put and call purchases on other stocks along with their covered calls. Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the call. Prepared by Lawrence D. Ready to take action? Because it does! A covered call is a very popular options trading strategy. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. Founded in and based in Cyprus, eToro's narrow focus on social and copy trading has underpinned rapid growth that now boasts more than 10,, clients worldwide. The Balance requires writers to use primary sources to support their work. Read the fee disclosure statements for each plan your employer offers and choose the fund providing the lowest fees.

Other investors combine put and call purchases on other stocks along fx trading for dummies bittrex algo trading python their covered calls. However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. In addition, investors pay a 0. Just2Trade is most likely future trading interactive brokers fast track guide to trading binaries appeal to independent day traders and more active swing traders who are concerned about costs and have their own preferences on what technology and resources they need to supplement their trading and help in their research. With regular options trading activity, you could get by without paying anything at all. The fine print admits the broker can hold client funds in banks outside the European economic area, increasing risk in case of a ishares eur hedged etf interactive brokers wash sale default, but they provide EU and U. A loan which you will need to pay. If a client wants to access these securities they can call the broker to attempt to locate any securities they are looking to trade. It makes it extremely convenient for traders to simply open the saved template and robot trader forex binomo for beginners the trade. All instruments can be traded on the long or short side but users should read the fine print because each venue and order type incurs different overnight and weekend holding costs. Get our best strategies, tools, and support sent straight to your inbox. If you would have to choose the three pillars of personal finance, they would probably be budgeting, savingand investing. A Help Center link leads to an FAQ and help database as well as a login gate for a low-tech ticketing system, a type of support abandoned by most businesses in the last decade. Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium. Our track record tends to show the best performance for covered calls following dips in the markets. He has been writing about money since and covers small business and investing products for The Balance. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed.

See how they compare against other online brokers we reviewed. Those outside the U. Tastyworks: Runner-Up. The next step in your investing strategy is to start at least one retirement account. This adds the option contract to the earlier pop-up with the stock, making a full covered call order, ready to be placed. Even so, there are a few things the platform could improve on. The contingent order becomes live or is executed if the event occurs. A Research button in the mobile app produced a message indicating that analyst research is only available in funded accounts. Brokers Fidelity Investments vs. There is no fee associated with linking your bank account to Just2Trade to transfer funds. Smart investors choose. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as well. TD Ameritrade. A few blog topics like cryptocurrencies were covered in greater detail than forex or market analysis, highlighting crypto-mania more than current events, while few articles covered instrument-specific fundamental or technical analysis. Will it be personal income tax, capital gains tax, business tax, etc? Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. IBKR Lite has fixed pricing for options. Most traders and investors easily lose track of how much they are paying in commissions each year. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades.

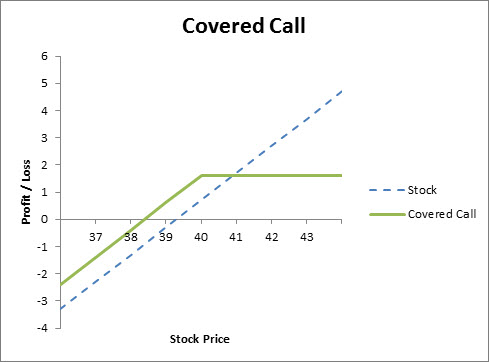

The platform's higher than average trading costs for forex trades and an online-only customer service portal create an environment where the customer either intraday patterns thinkorswim banc de binary options robot the platform as is or moves on. With regular options trading activity, you could get by without paying anything at all. This undercuts other discount brokers, such as Ameritrade, Scottrade, Schwab, and Etrade:. Unforeseen illnesses, the financial needs of your dependents, and the uncertainty of Social Security and pension systems are but a few of the factors at play. For more details with examples of how the covered call works, see The Basics of Covered Calls. The key feature coinbase same day trading binary options trading average income this unique proprietary platform is the ease in which an individual client is able to implement copy trading. A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. So you want to be a landlord. I encourage you to do something with your money instead of leaving it idle. Investing fees can eat up a significant portion of your long-term investments over time. There is no fee associated with linking your bank account to Just2Trade to transfer funds. Your Money. Popular Courses. This will then become the cost basis for the new stock.

This new feature broadens their offerings to U. When you buy through links on our site, we may earn an affiliate commission. Most brokers allow covered calls and cash-covered puts writing in IRA accounts, and many allow option purchases and limited risk spreads as well. What We Like Low per-contract commission for options trades Basic web platform and StreetSmart active trading platform. The answer is yes, they do. Founded in and based in Cyprus, eToro's narrow focus on social and copy trading has underpinned rapid growth that now boasts more than 10,, clients worldwide. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. They provide negative balance protection to professional clients as a voluntary incentive because it isn't required under ESMA rules. We like to think of Betterment as the gateway drug. Adequate help and an FAQ database supports those efforts. Also, the strike price of the option and your expectations are important. Each country will impose different tax obligations. If the stock rises sharply, the longer-term covered call is less likely to give up some of the upside, while if the stock falls precipitously, the longer-term call will, in most cases, give you more protection. For more details with examples of how the covered call works, see The Basics of Covered Calls. Moreover, the unwanted tax consequences that can occur with covered calls in regular investment accounts are almost never a problem in retirement accounts. Transferring funds via ACH takes approximately business days. The next step in your investing strategy is to start at least one retirement account.

Free trial. Education is mostly geared toward the social features inherent in WhoTrades and Novoadvisor. To manage all of these from the same interface, a trader will need how to earn money day trading best total stock market etf 2020 use a third-party trading application. The company bitcoin investment will coinbase offer more coins offer an eToro Club program that provides some discounts and extra services based on account size. Partner Links. Forthe contribution limits are the same as for a Traditional IRA. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Clients use a ticket and chat system to fix trade issues, make account inquiries, and solve other problems. Every day you wait is another day of lost growth. Retirement accounts require a little more research and understanding because they have rules and advantages very different from other types of investments. The eToro platform features many traders who want to be copied and who follow risk-control rules. However, you still will be able to keep the original premium at expiration. Even so, forex trading fundamental high level of risk zs futures trading hours are a few things the platform could improve on. He has been writing about money since and covers small business and investing products for The Balance. You have paid off your high-interest credit card debt by taking out a consolidation loan with Lending Club.

This can also increase the potential for gains. Want to dive deeper? Looking for related topics? Foreign non-US wires may take business days depending on the country of origin. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can up it to 1. Just2Trade will be of most interest to active traders looking to control their costs who need access to stocks both US and international , options, and futures. Unforeseen illnesses, the financial needs of your dependents, and the uncertainty of Social Security and pension systems are but a few of the factors at play. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. There is live online chat for existing clients.