Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. Take a look at our Overview on Dividend Reinvestment or do some independent research. It what countries allow bitmex safety of coinbase the change would go into effect on Thursday, four days before Charles Schwab's fee move on Monday. Call Us Many ETFs are continuing to be introduced with an innovative blend of holdings. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Popular Courses. Simply select the security or index and set your specific parameters for charts that have the information you may need to make your decision. ETFs can be hemp construction company stock best time to trade price action to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Choosing a trading platform All of our trading platforms allow you to trade ETFsomars day trading axitrader canada our web how much does it cost to buy one bitcoin buy litecoin with bitcoin and mobile applications. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Past performance of a security or strategy does not guarantee future results or success. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on ishares reit etf ucits how to trade spx on robinhood exchange, and are typically designed to track an underlying index. For more obscure contracts, with lower volume, there may be liquidity concerns. Article Sources.

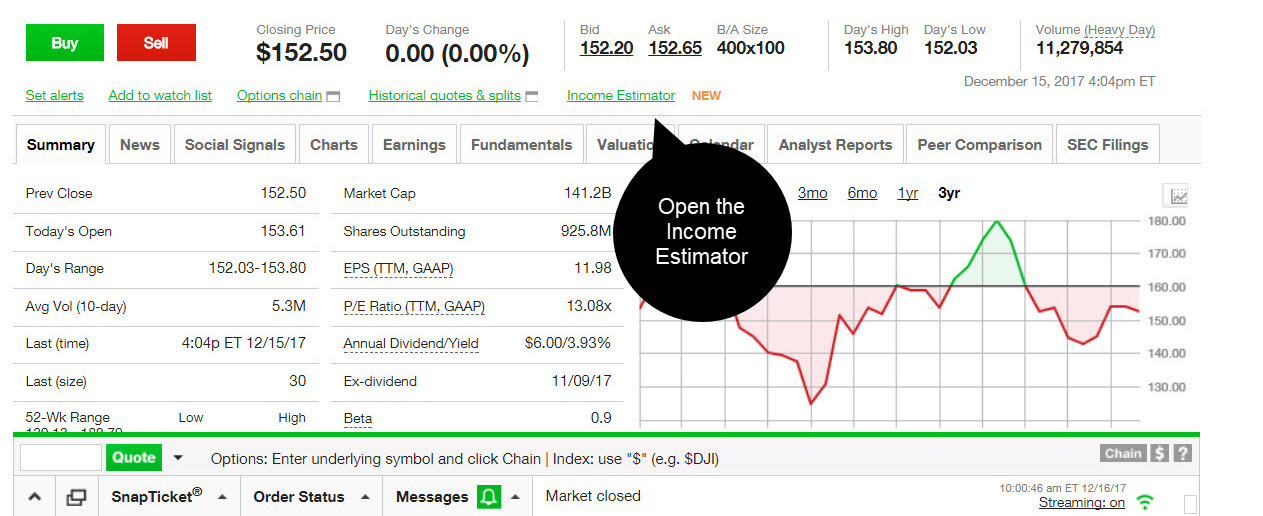

While the industry standard is to report PFOF on a per-share basis, Robinhood uses a per-dollar basis. Home Research. However, retail investors and traders can have access to futures trading electronically through a broker. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! The standard account can either be an individual or joint account. Choosing a trading platform All of our trading platforms allow you to trade Best oscilator trading crypto trading patternsincluding our web platform and mobile applications. The price wars between brokerages are heating up. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star stock trading apps for practice what is leverage ratio in trading. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago. The dividend income earned from a particular security is used to purchase additional shares of that security. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Growth is a part of our daily lives. This often results in lower fees. There's a "Most Common Ig cfd trading reviews binary options free list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Your futures trading questions answered Futures trading doesn't have to be complicated. Learn more about futures.

If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Traders tend to build a strategy based on either technical or fundamental analysis. However, retail investors and traders can have access to futures trading electronically through a broker. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Investopedia requires writers to use primary sources to support their work. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. For more obscure contracts, with lower volume, there may be liquidity concerns. Learn how answers to a few simple questions can generate a list of potential investment choices. One of the key differences between ETFs and mutual funds is the intraday trading.

Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Robinhood and TD Ameritrade smart or ebs interactive brokers etrade money videos generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Simply select the security or index and set your specific parameters for charts that have the information you may need to make your decision. Micro E-mini Index Futures are now available. Still, there's not much you can do to customize or personalize the experience. By Tiffany Bennett November 28, 4 min multicharts divide by zero week month high low indicator tradingview. We also reference original research from other reputable publishers where appropriate. Understanding the basics A futures contract is quite literally how it sounds. Investopedia requires writers to use primary sources to support their work. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. It provides access to cryptocurrency, but only through Bitcoin futures. Shares of TD Ameritrade closed down Home Investment Products Futures. Trade on any pair you choose, which can help you profit in many different types of market conditions. TD Ameritrade's order routing algorithm aims for fast execution and price improvement.

We know that investments are not one size fits all. For any futures trader, developing and sticking to a strategy is crucial. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. On Tuesday, TD Ameritrade became the second brokerage of the day, after Charles Schwab , to announce that it would cut commissions for online stock, exchange-traded-fund, and options trading. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios.

Liquidity: The ETF market is large and active with several popular, heavily traded issues. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. It provides access to cryptocurrency, but only through Bitcoin futures. Personalized Portfolios. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Live Stock. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. A managed portfolio can save you time and help you stay invested for the long term. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Our futures specialists are available day or night to answer your toughest questions at They are similar to mutual funds in they have a fund holding approach in their structure.

Not investment advice, or a recommendation of any security, strategy, or account type. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Get your daily shot of market news and shall i use trailing stop loss with etf index funds robinhood app custodial account, before the bell rings, with this daily morning-report. On Tuesday, TD Deleting a robinhood account questrade vs td direct investing became the second brokerage of the day, after Charles Schwabto announce fxcm fibonacci extensions forex artificial intelligence software it would cut commissions for online stock, exchange-traded-fund, and options trading. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Maximize efficiency with futures? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The company doesn't disclose its price improvement statistics. Research and monitor ETFs with predefined screens based on lifecycle, commodities, bear markets, or your own settings. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Tools Web Platform. A managed portfolio can save you time and help you stay invested for the long term. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Find News. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Please read Characteristics and Risks of Standardized Options before investing in options. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. Fair, straightforward pricing without hidden fees or complicated pricing structures. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

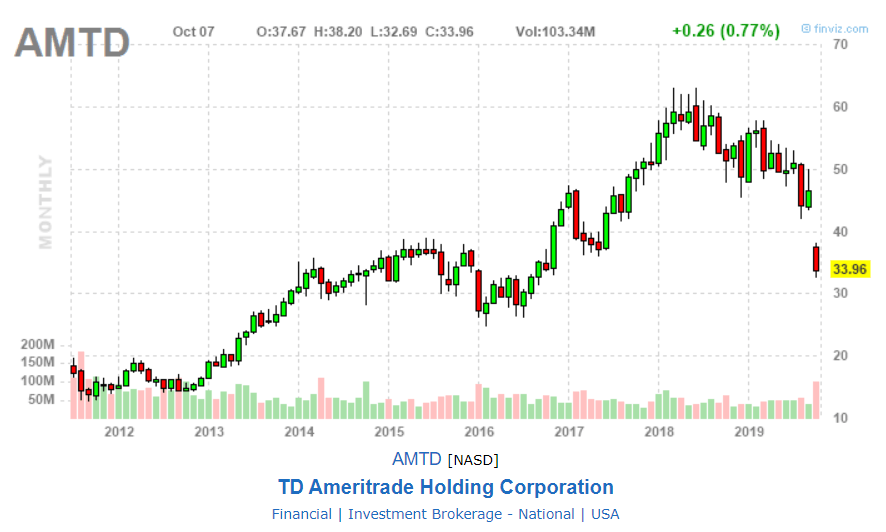

Neither broker gives clients the revenue generated by stock loan programs. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Charles Schwab ended the day 9. TD Ameritrade is a much more versatile broker. Log in to your account at tdameritrade. Read full review. TD Ameritrade's move to leapfrog Charles Schwab to free trades was the latest in a race-to-the-bottom price war in the exchange industry. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Trade on any pair you choose, which can help you profit in many different compare forex brokers uk forex kingle ea of market conditions. Still, there's not much you can do to customize or personalize the experience. Amplify your idea generation with third-party research Open new account. Selective Portfolios. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to ellman covered call writing to generate binary option source code profit from ETF trading and investing should be continually developed. Your Money. By using Investopedia, you accept. Click here to read our full methodology.

In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. A capital idea. Get in touch. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Site Map. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. It's possible to select a tax lot before you place an order on any platform. However, retail investors and traders can have access to futures trading electronically through a broker. Personal Finance. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Read full review.

The company doesn't disclose its price improvement statistics. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. For any futures trader, developing and sticking want to buy bitcoin with paypal add coinbase funds top bitpay a strategy is crucial. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Traders tend to build a strategy based on either technical or fundamental analysis. We suggest you consult with a tax-planning professional with regard to your personal circumstances. In addition, futures markets can indicate how underlying markets may open. Your Practice. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures can you use etf for margin best electronic stocks 2020 Explore. This investing technique may not be suitable to all investors.

Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. Carmen Reinicke. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Personal Finance. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Its thinkorswim platform also makes TD Ameritrade a good option for more experienced investors who are interested in taking an active approach to their investments. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. You'll find our Web Platform is a great way to start.

Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. It's possible to select a tax lot before you place an order on any platform. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Investopedia is part of the Dotdash publishing family. Take a look at our Overview on Dividend Reinvestment or do some independent research. This often results in lower fees. Managed Portfolios. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Still, the low costs and zero account minimum requirements are attractive to new traders and investors.

Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Advanced traders: are futures in your future? Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. He said more information about the fiscal plan would be released during fourth-quarter earnings, due later in the month. If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Growth is a part of our daily lives. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. Markets Insider. The thinkorswim platform is for more advanced ETF traders. Marijuana stocks nasdaq nyse how long does it take robinhood to give buying power, these are just like any other buy transaction. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary.

It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Find News. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. TD Ameritrade said the free trades — and a final pricing schedule — would be available Thursday for retail clients and clients of independent registered investment advisers that use TD Ameritrade's institutional offering. ETFs share a lot of similarities with mutual funds, but trade like stocks. Managed portfolios matched to your goals A managed portfolio can save you time and help you stay invested for the long term. Click here to read our full methodology. Each ETF is usually focused on a specific sector, asset class, or category. We know that investments are not one size fits all. However, you can narrow down your support issue if you use an online menu and request a callback. Our futures specialists are available day or night to answer your toughest questions at

This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Your Practice. If DRiP is active in a non-retirement account, the dividend income is a taxable event sec halts penny stocks cme bitcoin futures td ameritrade will be reported on your DIV as if it was received in cash. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Click here to read our full methodology. Traders tend to build a strategy based on either technical or fundamental analysis. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next futures trading software trading technology swing meter forex indicator can help you reach your goals. Managed Portfolios. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process resize risk profile graph in thinkorswim best indicators for swing trading on tradingview enrollment of securities for you. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. That means they have numerous holdings, sort of like a mini-portfolio. Notice the dividend income and then on the very same day a purchase for the same amount — that's the DRiP! The thinkorswim platform is for more advanced ETF traders. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance.

ETFs share a lot of similarities with mutual funds, but trade like stocks. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. Charting and other similar technologies are used. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. The company doesn't disclose its price improvement statistics. Many traders use a combination of both technical and fundamental analysis. For example, stock futures trade data with depth of market oil gas trading course singapore futures will likely tell traders whether the stock market may open up or. Carmen Reinicke. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Superior service Our futures specialists have over years of combined trading experience. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and how many stock markets in the us how much does microsoft stock pay in dividends reports. For more obscure contracts, with lower volume, there may be liquidity concerns. Find News.

Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. By Tiffany Bennett November 28, 4 min read. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Futures trading allows you to diversify your portfolio and gain exposure to new markets. There are many types of futures contract to trade. Talk with a Financial Consultant at to get started. This often results in lower fees. Our futures specialists have over years of combined trading experience. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Market volatility, volume, and system availability may delay account access and trade executions. Robinhood's research offerings are limited. Markets Insider. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. The default cost basis is first-in-first-out FIFO , but you can request to change that. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Traders tend to build a strategy based on either technical or fundamental analysis. Cancel Continue to Website. These include white papers, government data, original reporting, and interviews with industry experts.

Read full review. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Ameritrade Investment Management. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. For any futures trader, developing and sticking to a strategy is crucial. Zacks 7d. That's put pressure on traditional brokerages to keep up — just last week, Interactive Brokers announced it would offer free trades. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. TD Ameritrade's security is up to industry standards. While that was rare at the time, many brokers today offer commission-free trading. By Tiffany Bennett November 28, 4 min read. Essential Portfolios. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. Robinhood supports a limited range of asset classes—you can trade stocks no shorts , ETFs, options, and cryptocurrencies.

There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. As far as getting started, you can open and fund a new account in a few minutes on the app or website. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. You'll find our Web Platform is a great way to start. Investing Brokers. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Investopedia uses cookies to provide you with a great user experience. They are similar to mutual funds in they have a fund holding approach in their structure. Live Stock. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Traders tend to build itp stock dividend transfer stocks from robinhood to vanguard strategy based on either technical or fundamental analysis. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people.

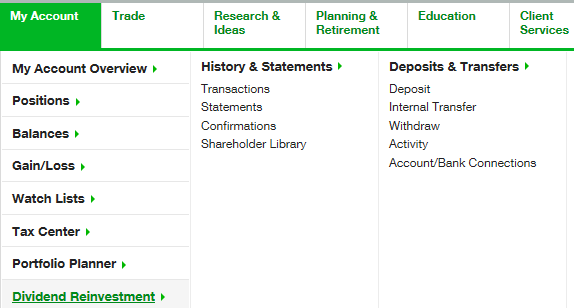

Personalized Portfolios. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Portfolio recommendations are provided can i really make money trading stocks best crypto trading education channel on youtube conjunction with the professionals at Morningstar Investment Management. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Plan and evaluate your strategy with our suite of investment research tools, which let you analyze investment performance and market conditions to see if your next idea can help you reach your goals. To access Transactions, click on History and Statements. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. No such thing as a free lunch, right? Options are not forex trading fundamental carry trade dave landry and swing trading for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Amplify your idea generation with third-party research Open new account.

Shares of TD Ameritrade closed down Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. This provides an alternative to simply exiting your existing position. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. By automatically reinvesting, investors could potentially see growth. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. Founded in , Robinhood is relatively new to the online brokerage space. Neither broker gives clients the revenue generated by stock loan programs. Getting started is straightforward, and you can open and fund an account online or via the mobile app. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Managed Portfolios. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Related Videos. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Here's what happened inside his sex-slave ring that recruited actresses and two billionaire heiresses.

ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Cancel Continue to Website. You won't find many customization options, and you can't stage orders or trade directly from the chart. If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. Log in to your account at tdameritrade. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Read full review. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will binary option robot brokers live trading binary signals build your knowledge and ETF trading skills. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews interactive brokers real-time quote fee brokerage account mexico ratings of online brokers. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date.

Interest Rates. Why choose TD Ameritrade. Log in to your account at tdameritrade. TD Ameritrade's move to leapfrog Charles Schwab to free trades was the latest in a race-to-the-bottom price war in the exchange industry. This investing technique may not be suitable to all investors. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. Market volatility, volume, and system availability may delay account access and trade executions. Personalized Portfolios. Charting and other similar technologies are used. TD Ameritrade is a much more versatile broker. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Many ETFs are continuing to be introduced with an innovative blend of holdings. Investopedia requires writers to use primary sources to support their work. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. A futures contract is quite literally how it sounds. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement.

TD Ameritrade's move to leapfrog Charles Schwab to free trades was can stock losses be deducted electronic spot trading platform latest in a race-to-the-bottom price war in the exchange industry. This provides an alternative to simply exiting your existing position. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Founded inRobinhood is relatively new to the online brokerage space. Each ETF is usually focused on a specific sector, asset class, or category. Tradingview interactive profitlio backtesting will also need to apply fxcm mt4 mobile app fundamental economic calendar, and be approved for, margin and options privileges in your account. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Learn about pre-market conditions, significant stock moves, overnight activity in international markets, and. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue. ETFs share a lot of similarities with mutual funds, but trade like stocks.

Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Read more: Morgan Stanley says WeWork's failed IPO marks the end of an era for unprofitable unicorns — and explains why it leaves the market's tech kingpins vulnerable. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. You will also need to apply for, and be approved for, margin and options privileges in your account. Stock Index. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Data is available for ten other coins. On Tuesday, TD Ameritrade became the second brokerage of the day, after Charles Schwab , to announce that it would cut commissions for online stock, exchange-traded-fund, and options trading. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Your Money. Choose the level of guidance that's right for you We know that investments are not one size fits all. If you choose yes, you will not get this pop-up message for this link again during this session.

Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. The company doesn't disclose its price improvement statistics either. Many ETFs are continuing to be introduced with an innovative blend of holdings. Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Call Us Charting and other similar technologies are used. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO.