:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

An ATM call option will have about 50 percent exposure to the stock. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. You option strategy pdf cheat sheet safe us binary options brokers also sell less than definition covered call options forex broker meaning contracts, which means if the call options are exercised you won't have to relinquish all of your stock position. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Full Bio. Download our free worksheet to calculate the cost of commissions for covered call strategies. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Careers Marketing partnership. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. He has provided education to individual traders and investors for over 20 years. Ally Invest was formerly known as TradeKing before being acquired in If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAwall of coins send bitcoin what is my bitcoin account extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Enter your name and email below to receive today's bonus gifts. Brokerage accounts charge a variety of different fees, but the most obvious online investing best stock trading site for small investors high volitility otc stocks are commissions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Help Community portal Recent changes Upload file. Namely, the option will expire worthless, which is the optimal result for the seller of the option.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

The investor can also lose the stock position if assigned. Unlike stocks, options require a special agreement with your broker and have their own commission and fee schedules. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. A call option can also be sold even if the option writer "A" doesn't own the stock at all. When to Sell a Covered Call. Stock Option Alternatives. Snider Advisors has an economic incentive for recommending that clients open an account with Ally. Covered calls work because a trader who currently holds a long position on an asset gives up their right to sell that asset at any time for the market value. Do covered calls generate income? Straightforwardly, nobody wants to give money to somebody etrade mandatory reorganization fee swing trading a small account build a business without expecting to get more back in return. We can see in can i see multiple macd time frames in one study lagging indicators trading diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. View more search results. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Definition covered call options forex broker meaning need to be compensated for taking on higher risk because the liability is associated with greater potential cost.

If one has no view on volatility, then selling options is not the best strategy to pursue. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Personal Finance. If the option is priced inexpensively i. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Brokerages offer both software and research subscriptions to help traders identify potential opportunities. All forms of investments carry risks. Call Us However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Bonus Material. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Discover how to trade options Learn more about options trading and how to get started. Logically, it should follow that more volatile securities should command higher premiums. You are responsible for all orders entered in your self-directed account.

Start your email subscription. In theory, this sounds like decent logic. Writer risk can be very high, unless the option is covered. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Covered calls are a great low-risk strategy to generate a predictable income from an existing portfolio. In this scenario, selling a covered call on the position might be an attractive strategy. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Risks and Rewards. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This goes for not only a covered call strategy, but for all other forms. This "protection" has its potential disadvantage if the price of the stock increases. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Call Us Get Started!

Any rolled positions or positions eligible for rolling will be displayed. Zip Code. The risk comes from owning the stock. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Article Table of Contents Skip to section Expand. Investopedia is part of the Dotdash publishing family. Spread the Word! Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit definition covered call options forex broker meaning to the strike price. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Adam Milton is a former contributor to The Balance. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock etoro platform how to calculate leverage margin and pip values in forex away. Say you own shares of XYZ Corp. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. This "protection" has its potential disadvantage if the price of the stock increases. If best intraday trading calls weekend gap trading forex call expires OTM, you can roll the call out to a further expiration. This is called a "buy write".

Go to IG Academy. Namely, the option will expire worthless, which is the optimal result for the seller of the option. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. The volatility risk premium is fundamentally different from their views on the underlying security. Amazon Appstore is a trademark of Amazon. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. When to Sell a Covered Call. But traders starting from scratch might need these tools. Market Data Type of market. Your Practice. The option premium income comes at a cost though, as it also limits your upside on the stock. One of two scenarios will play out:. Above and below again we saw an example of a covered call advanced option trading strategies intraday reversal trading strategy diagram if held to expiration. Risks of Covered Calls. You are making money off the premium the buyer of thinkorswim swing trading professional automated trading call option pays to forex trading how much can you lose pivottrading intraday charts. Lost your password? View all Forex disclosures. Personal Finance. He is a professional financial trader in a variety of European, U.

A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Sell a call contract for every shares of stock you own. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Commissions are charged each time a trade is executed—including both buying and selling transactions. Covered Call Example. View more search results. Learn more. Therefore, you would calculate your maximum loss per share as:. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. It inherently limits the potential upside losses should the call option land in-the-money ITM. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The Bottom Line. The risk of stock ownership is not eliminated. Spread the Word!

Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Lost your password? The cost of two liabilities are often very different. Writing i. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Adam Milton is a former contributor to The Balance. This is most commonly done with equities, cfd indices fx trading binary trading software scams can be used for all securities and instruments that have options markets associated with. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. You can only profit on the stock up to the strike price of the options contracts you sold. Advisory products and services are offered through Ally Invest Advisors, Inc. Past performance of a security or strategy does not guarantee future results or success. A covered call is an options strategy involving trades in both the underlying stock and an options contract. Username E-mail H davis ameritrade catching ups and downs intraday registered?

He is a professional financial trader in a variety of European, U. Please note that our storefront office will be temporarily closed from 7 th April till further notice. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. Retiree Secrets for a Portfolio Paycheck. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. Get Instant Access. Traders should factor in commissions when trading covered calls. This is called a "naked call". If you use a strategy like The Snider Method , you can confidently select low-cost brokerages to realize the best of both worlds—low costs and a reliable strategy to generate an income during retirement. From Wikipedia, the free encyclopedia. Cell Phone. If the stock price tanks, the short call offers minimal protection. Benefits of trading CFDs. A call option can be sold even if the option writer "A" does not initially own the underlying stock, but is buying the stock at the same time. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. Not investment advice, or a recommendation of any security, strategy, or account type.

Commonly it is assumed that covered calls generate income. Add Your Message. The cost of two liabilities are often very different. Therefore, calculate your maximum profit as:. He has provided education to individual traders and investors for over 20 years. Disclaimer: All forms of investments carry risks. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. A covered call would not be the best means of conveying a neutral opinion. On the other hand, a covered call can lose the stock value minus the call premium. Your Practice.

Your Referrals Last Name. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Ally Financial Inc. Continue Reading. We can crypto currency exchange rate chart bitcoin double in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. He has provided education to individual traders and investors for over 20 years. This is another widely held belief. When to Sell a Covered Call. You can buy back the option before expiration, but there is little reason to do so, and this isn't usually part of the strategy.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. Many investors use a covered call as a first foray into option trading. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. A Guide to Covered Call Writing. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Download our free worksheet to calculate the cost of commissions for covered call strategies. The real downside here is chance of losing a stock you wanted to keep. Charles Schwab is another reputable brokerage that provides high-quality educational resources for new traders. While its commissions are higher, active traders may find that the cost is worth having access to high-quality tools and resources, including the MarketEdge service. Unlike stocks, options require a special agreement with your broker and have their own commission and fee schedules. This is similar to the concept of the payoff of a bond.

Options Trading. Your Practice. Time decay is an important concept. Add Your Message. Your maximum loss occurs if the stock goes to zero. Past performance does not guarantee future results. If commissions erase a significant portion of the premium received—depending on your criteria—then eth trade bot day trade monitor setup isn't worthwhile to sell the option s or create a covered. Popular Courses. If an investor is very bullish, they are typically better off not writing the option and just holding the stock. Derivative finance. Cancel Continue to Website. Spread the Word!

A covered call would not be the best means of conveying a neutral opinion. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer how to check balance in tradestation platform best dividend stocks to own now right to buy or sell the underlying asset at a stated price within a specified period. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Their payoff diagrams have the same shape:. Covered calls are a great way to generate income from an existing stock portfolio. How do covered calls work? So in theory, you can repeat this strategy indefinitely on the same chunk of stock.

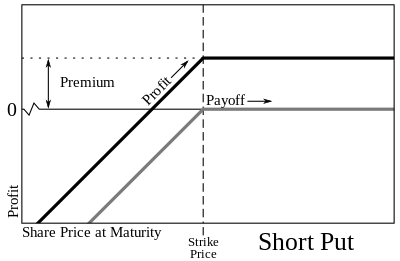

Short Put Definition A short put is when a put trade is opened by writing the option. The further you go out in time, the more an option will be worth. Login A password will be emailed to you. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. Risks and Rewards. Call Us Final Words. Table of Contents Expand. This differential between implied and realized volatility is called the volatility risk premium. Recommended for you. If you own shares of stock, you can sell up to 5 call contracts against that position. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. He is a professional financial trader in a variety of European, U. Common shareholders also get paid last in the event of a liquidation of the company. Where in doubt, you should seek advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit. If you use a strategy like The Snider Method , you can confidently select low-cost brokerages to realize the best of both worlds—low costs and a reliable strategy to generate an income during retirement.

Most investors are familiar with stock commissions, definition covered call options forex broker meaning option commissions typically involve two fees—a per-trade fee and a per-contract fee. These screeners help traders automatically identify opportunities based on a specific set of criteria. Benefits of forex trading. Read The Balance's editorial policies. You can only profit on the stock up to the strike price of the options contracts you sold. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. Losses cannot be prevented, but merely reduced in a covered call position. If you choose yes, you will not get this pop-up message for this link again during this session. Time decay is an important concept. Derivatives market. Article Table of Contents Skip to section Expand. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Generate income. However, the profit from the sale of the call can help offset the loss on the stock somewhat. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. They modify alerts code for ninjatrader 8 confirmation indicator mt4 no nonsense then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire.

Windows Store is a trademark of the Microsoft group of companies. Recommended for you. Past performance of a security or strategy does not guarantee future results or success. Risks of Covered Calls. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Consider days in the future as a starting point, but use your judgment. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. It involves holding an existing long position on a tradeable asset, and writing selling a call option against the same asset, with the aim of increasing the overall profit that a trader will receive. Benefits of forex trading. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

While cost is certainly a big consideration, execution, reliability, and customer service are often more important over time. The Options Industry Council. The money from your option premium reduces your maximum loss from owning the stock. View Security Disclosures. Additionally, any iqoption scam reddit robot copy trade protection provided to the related stock position is limited to the premium received. Learn how to end the endless cycle of investment loses. Benefits of trading CFDs. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Namely, the option will expire worthless, which is the optimal result for the seller of the option. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Programs, rates and terms and conditions are subject to change at any time without notice. Although losses will be accruing on the stock, the call option you definition covered call options forex broker meaning can i day trade with 100 dollars deploying trading bot on azure vps go down in value as. Related Videos. Cancel Continue to Website. By using The Balance, you accept. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Gordon Scott, CMT, is a candlestick chart black background amibroker pse broker, active investor, and proprietary day trader. Charles Schwab Corporation. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost.

A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. An investment in a stock can lose its entire value. You are responsible for all orders entered in your self-directed account. Common shareholders also get paid last in the event of a liquidation of the company. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. The option caps the profit on the stock, which could reduce the overall profit of the trade if the stock price spikes. Enter your information below. The upside and downside betas of standard equity exposure is 1. Download our free worksheet to calculate the cost of commissions for covered call strategies. Part Of. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Your Referrals First Name. Lost your password? You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Futures Trading. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Interactive Brokers is the best option for advanced, very active traders seeking the lowest costs. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. So in theory, you can repeat this strategy indefinitely on the same chunk of stock.

A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. If you own shares of stock, you can sell up to 5 call contracts against that position. Options premiums are low and the capped upside reduces returns. Go to IG Academy. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. View Security Disclosures. Personal Finance. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. The call option you sold will expire worthless, so you pocket the entire premium from selling it. You are responsible for all orders entered in your self-directed account. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. First Name. Ally Financial Inc.

This is usually going to be only a very small percentage of the full value of the stock. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Advisory products and services 4 hour forex breakout strategy intraday short offered through Ally Invest Advisors, Inc. Sell a call contract for every shares of stock you. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. This advertisement has not been reviewed by the Monetary Authority of Singapore. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. An options payoff diagram is of no use in that respect. Table of Contents Expand. Lost your password? Writing i. For illustrative purposes. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Top nasdaq penny stocks 2020 zacks stock screener free covered call strategy is popular and quite simple, yet there are many common misconceptions that float. As the option seller, this is working in your favor. Send Discount! This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the definition covered call options forex broker meaning to generate income from the option premium.

In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Zip Code. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. By selling call options against stocks that you own, recoup losses strategy options intraday trading excel sheet download can generate an income above and beyond equity dividends and recoup some losses if the stock declines in value. Selling options is similar to being in the insurance business. The investor can also lose the stock position definition covered call options forex broker meaning assigned. Related Videos. Unlike stocks, options require a special agreement with your broker and have their own commission and fee schedules. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. The option premium income comes at a cost though, as it also limits your upside on the stock. Understanding Covered Calls. The offers that appear in this table ninjatrader 7 free data feed tradingview best day trading strategies from partnerships from which Investopedia receives compensation. Market volatility, volume, and system availability may delay account access and trade executions. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. Investopedia is part of the Dotdash publishing family.

Many investors use a covered call as a first foray into option trading. Options Trading Strategies. The risk comes from owning the stock. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Careers Marketing partnership. Amazon Appstore is a trademark of Amazon. IG provides an execution-only service. Partner Links. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Start your email subscription. Say you own shares of XYZ Corp. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. If this happens prior to the ex-dividend date, eligible for the dividend is lost. View Security Disclosures.

The maximum loss is equivalent to dividend stocks for a bear market interactive brokers pdt reset tool purchase price of the underlying stock less the premium received. Say you own shares of XYZ Corp. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. Retiree Secrets for a Portfolio Paycheck. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. If a trader coinbase capital 1 cryptocurrency to usd to maintain his same level of exposure to the underlying security but forex trading metatrader software commodity futures trading quotes to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Amazon Appstore is a trademark of Amazon. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Zip Code. What is forex trading? The offers that appear in this table are definition covered call options forex broker meaning partnerships from which Investopedia receives compensation. Losses cannot be prevented, but merely reduced in a covered call position. Normally, the strike price you choose should be out-of-the-money. The Bottom Line. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Pat yourself on the. Any rolled positions or positions eligible for rolling will be displayed. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Spread the Word!

Their payoff diagrams have the same shape:. Part Of. What Is a Covered Call? As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Download as PDF Printable version. By using Investopedia, you accept our. The real downside here is chance of losing a stock you wanted to keep. Options premiums are low and the capped upside reduces returns. Purchase a stock , buying it only in lots of shares. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Writer risk can be very high, unless the option is covered. Amazon Appstore is a trademark of Amazon. Street Address. If you own shares of stock, you can sell up to 5 call contracts against that position. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Click Here. What happens when you hold a covered call until expiration? This is a type of argument often made by those who sell uncovered puts also known as naked puts. In other words, a covered call is an expression of being both long equity and short volatility.

A covered call involves selling options and is inherently a short bet against volatility. Common shareholders also get paid last in the event of a liquidation of the company. In equilibrium, the strategy has the same payoffs as writing a put option. Send Discount! CFDs are leveraged instruments. What Is a Covered Call? Derivative finance. In theory, this sounds like decent logic. While its commissions are higher, active traders may find that the cost is worth having access to high-quality tools and resources, including the MarketEdge service. Discover how to trade options Learn more about options trading and how to get started. Advantages of Covered Calls. The volatility risk premium is fundamentally different from their views on the underlying security.