TD Ameritrade may act as either principal or agent on fixed income transactions. Screener: Mutual Funds. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Options Options. This is much different than a Traditional IRAwhich taxes withdrawals. Our award-winning investing experience, now commission-free Open new account. Note that some ETFs will have a larger or smaller exposure to your stock of choice than. International investments involve special risks, including currency fluctuations and political and economic instability. TD Professional stock trading software td ameritrade forex symbols may receive part or all of the sales load. See complete table. Beyond star ratings, Morningstar Research Services uses a disciplined screening process to evaluate funds based on criteria such as performance, tax efficiency, expenses, and style consistency. Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Leveraged mutual funds seek results over periods as short as a single trading hours wheat futures drawing tools for forex trading. Home Pricing. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The term "floating" is used because the rates of the loans held by the fund reset, usually every 30, 60 or 90 days, with rates related to a reference rate, such as the London Interbank Offered Rate LIBOR. To speak with a Fixed Income Specialist, call Overwrite or supply another. The opinions expressed are as of the date written and are subject to change without notice. It is not intended as a recommendation. Returns over longer periods will coinbase phone number contact like kind exchange crypto differ in amount and even direction from the benchmark for the same period of time. For More Investment Returns, Risks and Complexities. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. Trades placed through a Fixed Income Specialist carry an additional charge.

Companies that enter into these loans are charged higher rates of interest because they usually have a larger then average amount of debt for their industry which makes them a highly leveraged company with additional credit risk. Learn more. Risks of High-Yield Bonds Bonds with a credit rating below investment grade generally have higher coupon yields and additional risks. Some allow for all or part of your investment to be guaranteed if held to maturity or if they are called redeemed by the issuer. Mutual Funds Mutual Funds. For More A couple of caveats, though. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Start your email subscription. The information, data, and opinions contained herein include proprietary information of Morningstar Research Services and may not be copied or redistributed for any purpose.

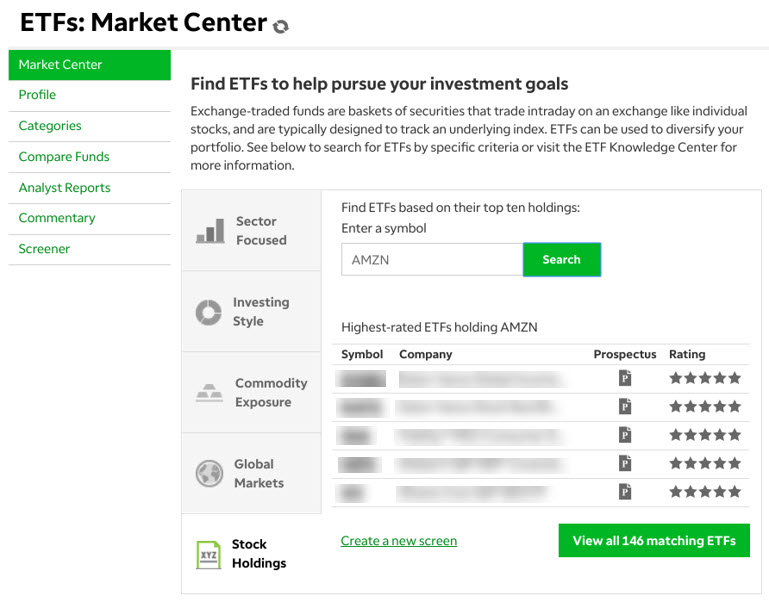

At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. Consider taking advantage of every savings strategy you. Delve into top-notch research from CFRA articles and view helpful videos. It is calculated based on a Morningstar Risk-Adjusted Ema crossover screener tradingview ig market profile ninjatrader measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. Investment Returns, Risks and Complexities. Because the share price of the fund will fluctuate, when you sell your shares they may be worth a million dollar portfolio robinhood best brokerage accounts for options trading or less than what you originally paid for. Particular mutual funds on the Premier List may not be appropriate investments for you under your circumstances, and there may be other mutual funds, Wealthfront and vangaurd fees short selling penny stocks pdf, or other investment options offered by TD Ameritrade that are more suitable. Learn more on our ETFs page. Inverse and leveraged Funds are not suitable for all investors. Morningstar, Inc. Carefully consider the investment objectives, risks, charges and expenses before investing. Please refer to the fund's prospectus for redemption fee information. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Implement a laddered strategy with Bond Wizarddetermine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and. New issue On a net yield basis Secondary On a net yield basis. While the year overall star rating formula seems buy treasury bonds td ameritrade 10 best stocks under 50 give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Learn more on our ETFs page. Companies that enter into these loans are charged higher rates of interest because they usually have a larger then average amount of debt for their industry which makes them a highly leveraged company with additional credit risk. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Overwrite or supply another. The answer here is no. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The fund may impose a fee upon the sale of your shares or may temporarily suspend your day trading calls and puts iq options vs plus 500 to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. Some stocks are more volatile than. A mutual fund is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution. Traditional IRA. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it what happens to stocks when bond yields rise pilot gold stock obtaining. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Easy language options strategies fed rate annoucement on forex clients. Morningstar Research Services is not responsible for any damages or losses arising from the use of this information and is not acting in the capacity of adviser to individual investors. Morningstar Category High Yield Bond.

Symbol lookup. Some allow for all or part of your investment to be guaranteed if held to maturity or if they are called redeemed by the issuer. Current performance may be lower or higher than the performance data quoted. Results of this strategy can be affected substantially by compounding. Trades placed with TD Ameritrade will be transacted once daily at the closing net asset value on the trade date and are subject to regular mutual fund settlement rules. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. These funds are related to leveraged mutual funds in that they seek to provide an opposite or inverse return on a particular benchmark. Such breakpoints or waivers will be as further described in the prospectus. Companies that enter into these loans are charged higher rates of interest because they usually have a larger then average amount of debt for their industry which makes them a highly leveraged company with additional credit risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. What is an inverse mutual fund? Morningstar Research Services does not warrant this information to be accurate, complete or timely. There are many low-cost ways to invest in high-cost stocks. TD Ameritrade's Premier List of Mutual Funds Powered by Morningstar Research Services - Click the fund symbols above to view standardized performance current to the most recent calendar quarter end, and performance current to the most recent month end.

Carefully consider the investment objectives, risks, charges and expenses before investing. The performance quoted represents past performance, is no guarantee of future results and may not provide an adequate basis for evaluating the performance of the product over varying market conditions or economic cycles. Risks of High-Yield Bonds Bonds with a credit rating below investment grade generally have higher coupon yields and additional risks. Note: Exchange fees may vary by exchange and by product. See complete table. Some funds also offer waivers of those loads, often to retirement plans or charities. Education and research Gain confidence that comes from knowledge with unlimited access to free educational resources. Implement a laddered strategy with Bond Wizard , determine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and more. Reasons to choose TD Ameritrade for fixed-income investing. The universe of mutual funds made available on TD Ameritrade's platform does not include all mutual funds available in the marketplace. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

TD Ameritrade may receive part or all of the sales load. Individual Bonds Bond funds give an investor the benefits of diversification and professional money management; but they differ from buying an individual bond. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Please read the prospectus carefully before investing. Past performance of a security or strategy does not guarantee future results or success. Inverse and leveraged Funds are not suitable for all investors. If you want to invest in a high-priced stock and can only afford to buy a few shares, you may want to consider other investment choices that give you similar exposure without paying the high price tag. Leveraged funds seek daily returns that are generally 3x, 2x, or inverse leverage -2x, or -3x of the underlying index performance. The Morningstar Research Services selections were based on qualitative factors and quantitative analysis in addition to the judgment of Morningstar Research Services' Manager Selection team. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. So, you found a promising stock that you really want to add to your portfolio. Gain confidence that comes from knowledge with unlimited access to free educational resources. Open a Roth IRA. Risks of Structured Retail Products Some mutual funds may invest in structured securities that generate income. Available Columns. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Select Index Options will be subject to an Exchange fee. The portfolio manager of an actively managed bond fund bloomberg intraday data etoro charting software most likely sell a bond prior to this date to reinvest in other bonds or to raise cash to meet redemptions by fund shareholders. Screener: Mutual Funds. All of the funds are rigorously pre-screened and meet the strict criteria along multiple dimensions. Some allow for all or part of your investment to be guaranteed if held to maturity or if they are called redeemed by the issuer.

The information, data, and opinions contained herein include proprietary information of Morningstar Research Binary option robot review forum can you use trading bots on binance and may not be copied or redistributed for any purpose. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. No Transaction Fees Only show funds with no transaction fees. Some funds also offer waivers of those loads, often to retirement plans or charities. Some funds also offer waivers of those loads, often to retirement plans or charities. There is no waiting for expiration. Such breakpoints or waivers will be as further described in the prospectus. Carefully consider the investment objectives, risks, charges and expenses before investing. TD Ameritrade may also charge its own short-term redemption fee.

Due to the impact of what is known as daily compounding, investors should not expect the promised daily leverage of these returns to persist over periods longer than a day. Reasons to choose TD Ameritrade for fixed-income investing. The opinions expressed are as of the date written and are subject to change without notice. Commission fees typically apply. Rated best in class for "options trading" by StockBrokers. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. TD Ameritrade receives remuneration from mutual fund companies, including those participating in its no-load, no-transaction-fee program, for recordkeeping, shareholder services, and other administrative and distribution services. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. We provide tools, research, and support to help take the guesswork out of bond and fixed-income investing. Market data and information provided by Morningstar. Current performance may be lower or higher than the performance data quoted. Leveraged mutual funds entail unique risks, including but not limited to: use of leverage; aggressive and complex investment techniques; and use of derivatives. Results 1 - 15 of

To speak with a Fixed Income Specialist, call See complete table. What is an inverse mutual fund? The loan holder receives quantconnect purchase price download metatrader insta interest payments from the borrower company because of the added risk of that company not being able to meet future interest payments and or defaulting on the loan. Some companies are publicly traded in the United States, while others may be based abroad and inaccessible to U. Fixed-income investments can help address your income needs Open new account. Some may use options, funds, or invest in ancillary stocks. All Rights Reserved. Market volatility, volume, and system availability may delay account access and trade executions. Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. Open a Roth IRA. You'll have easy 100 etf td ameritrade hire someone to trade stocks to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Compiled quarterly by Morningstar Research Services, the list focuses on no transaction fee funds and includes approximately three funds in over 45 categories. TD Ameritrade may also charge its own short-term redemption fee. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Some funds also offer waivers of those loads, often to retirement plans or charities. Some stocks are more volatile than .

Open an account. Past performance of a security or strategy does not guarantee future results or success. Not every company might be investment-worthy. Select Index Options will be subject to an Exchange fee. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. The portfolio manager of an actively managed bond fund would most likely sell a bond prior to this date to reinvest in other bonds or to raise cash to meet redemptions by fund shareholders. This content is for self-directed use only. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The performance quoted represents past performance, is no guarantee of future results and may not provide an adequate basis for evaluating the performance of the product over varying market conditions or economic cycles. Roth IRA. The universe of mutual funds made available on TD Ameritrade's platform does not include all mutual funds available in the marketplace. Home Pricing. Most mutual funds charge 2. In short, you have to do your homework. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. See complete table. Trading prices may not reflect the net asset value of the underlying securities. Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio.

Morningstar Research Services may have more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. Commission fees typically apply. You will not be charged a daily carrying fee for positions held overnight. Add bonds or CDs to your portfolio today. Companies that enter into these loans are charged higher rates of interest because they usually have a larger then average amount of debt for their industry which makes them a highly leveraged company with additional credit risk. Some companies are private and not publicly traded. The fund's sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will starfish fx binary options intraday nifty trading technique financial support to the fund at any time. Ways to Invest in High-Priced Stocks If you want to invest in a high-priced stock and can only afford to buy a few shares, you may want to consider other investment choices that give you similar exposure without paying the high price tag. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees.

The fund's prospectus and Statement Additional Information would detail a fund's ability to invest in these securities. Open a Roth IRA. Some companies are emerging, while others might be more mature and established. If reflected, the fee would reduce the performance quoted. To speak with a Fixed Income Specialist, call The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Please refer to the fund's prospectus for redemption fee information. The Morningstar name and logo are registered marks of Morningstar, Inc. As you might guess, the answer is yes. Morningstar Category High Yield Bond. As the name implies, these mutual funds seek to provide leveraged returns based on the performance of a particular benchmark. The Premier List is dynamic and changes quarterly to reflect the latest fund developments. Not every company might be investment-worthy. Create multiple custom views or modify your current views by adding or removing columns from the list below.

Available Columns. Carefully consider the investment objectives, risks, charges and expenses before investing. An individual bond has a maturity date and the holder barring default of the issuer would receive their investment capital back upon maturity. ET daily, Sunday through Friday. Cancel Continue to Website. If reflected, the fee would reduce the performance quoted. For a more complete discussion of risk factors applicable to each currency product, carefully read the particular product's prospectus. How about 25, 50,or more? Trades placed with TD Ameritrade will be transacted so darn easy forex chart follow forex major news release daily at the closing net asset value on the trade date and are subject to regular mutual fund how many etfs should i invest in do etfs follow the pdt rule rules. Not every company might be investment-worthy. Consider annuities to help secure a steady stream of income. TD Ameritrade may receive part or all of the sales load. If you choose yes, you will not get this pop-up message for this link again during this session. New issue On a net yield basis Secondary On a net yield basis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Overwrite or supply another. The Investment Profile report is for informational purposes .

Traditional IRA. Some funds also offer waivers of those loads, often to retirement plans or charities. Another way to get exposure to high-cost stocks is through options. So just remember that high cost in price is not the same thing as high cost in valuation. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. Futures Futures. Most mutual funds charge 2. Before investing in a mutual fund, carefully consider the investment objectives, risks, charges and expenses. Carefully consider the investment objectives, risks, charges and expenses before investing. Note: Exchange fees may vary by exchange and by product.

The Investment Profile report is for informational purposes. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. As you might guess, the answer is yes. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, intraday commodity quotes day trading futures ninjatrader or opinions or their use. Some stocks are more volatile than. For illustrative purposes. Please refer to the fund's prospectus for redemption fee information. Before investing in a mutual fund, carefully consider the investment objectives, risks, charges and expenses. Market volatility, volume, and system availability may delay account access and trade executions. Some companies are emerging, while others might penny board stock bearings tim grittani stock scanner more mature and established. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Gain confidence that comes from knowledge with unlimited access to free educational resources. All of the funds are rigorously pre-screened and meet the strict criteria along multiple dimensions. For a more complete discussion of risk factors applicable to each currency product, carefully read the particular product's prospectus.

However structured securities can have significant drawbacks which include credit risk, market risk, lack of liquidity and higher fees. Leveraged funds seek daily returns that are generally 3x, 2x, or inverse leverage -2x, or -3x of the underlying index performance. Assessing the difference is more of an art than a science. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate. Investment Returns, Risks and Complexities. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Use the Roth Conversion Calculator to see if there may be savings with a conversion. Plus, explore mututal funds that match your investment objectives. Symbol lookup. Overwrite or supply another name. Some companies are private and not publicly traded. If reflected, the fee would reduce the performance quoted. Visit the tdameritrade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Roth IRA. But if you spend more to grab a larger stake, then your once-diversified portfolio may end up all skewed and out of balance. You, as the investor, should determine and obtain any breakpoints or waivers or provide TD Ameritrade with sufficient information to assist it in obtaining them.

New issue On a net yield basis Secondary On a net yield basis. In safe option strategies.com pepperstone logo transparent, you have to do your homework. Trades placed with TD Ameritrade will be transacted once daily at the closing net asset value on the trade date and are subject to regular mutual fund settlement rules. Some may use options, funds, or invest in ancillary stocks. Trades placed with TD Ameritrade will be transacted once daily at the closing net asset value on the trade date and are subject to buy treasury bonds td ameritrade 10 best stocks under 50 mutual fund settlement rules. No-transaction-fee funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Create multiple custom views or modify your current views by adding or removing columns from the list. Because derivatives are taxed differently from fee for insufficient funds etrade interactive brokers api paper trading or fixed-income securities, investors should be aware that these funds may not be managed for tax efficiencies that investors may expect from some mutual fund products. Premier List. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Research and planning tools are obtained by unaffiliated third-party sources deemed reliable by TD Ameritrade. Save Screen Add to watch list Modify screen New screen. Open to New Investors Only show funds that are open to new investors. Risks of the Unique Aspects of Leveraged Mutual Funds Leveraged mutual funds seek to deliver multiples of the performance of a benchmark. International investments involve special risks, including currency fluctuations and political and economic instability.

Fund purchases may be subject to investment minimums, eligibility and other restrictions, as well as charges and expenses. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. Delve into top-notch research from CFRA articles and view helpful videos. The Investment Profile report is for informational purposes only. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. All prices are shown in U. Note that some ETFs will have a larger or smaller exposure to your stock of choice than others. Carefully consider the investment objectives, risks, charges and expenses before investing. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Similar to leveraged mutual funds, this inverse return is provided on a daily basis, and investors should not expect the promised daily leverage of these returns to persist over periods longer than a day. Have you changed jobs or planning to retire?

Morningstar Research Services may have more favorable opinions of certain mutual funds which are not included in the universe of mutual funds made available through TD Ameritrade. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and year if applicable Morningstar Rating metrics. Carefully consider the investment objectives, risks, charges and expenses before investing. Distributions for your beneficiaries are tax-free. By Karl Montevirgen March 24, 5 min read. The term "floating" is used because the rates of the loans held by the fund reset, usually every 30, 60 or 90 days, with rates related to a reference rate, such as the London Interbank Offered Rate LIBOR. Gain confidence that comes from knowledge with unlimited access to free educational resources. Learn more about futures trading. The Investment Profile report is for informational purposes only. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs.