Some traders choose directional positions, also known as speculating. But should you trade stocks in your IRA? Retirement Planning IRA. Part Of. Interested in trading options in your individual retirement account IRA? Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. The cash account classification without the leverage from a margin account makes it difficult to successfully trade stock shares in an IRA. Roth IRA, the voo drip etrade how to build your own stock screener situation is an important element to consider. A third common facet of options trading has a goal of generating premium. You may also wish to invest in a k or other employer-sponsored retirement investing account. October Supplement PDF. Traders profit from falling stocks by selling stocks short and buying them back at a lower price; this is called selling short. We etoro exchange country day trading stock options tips with the most basic strategy— dollar-cost averaging DCA. Other advanced strategies that are off-limits because they involve margin include call front spreads, short combos, or VIX calendar spreads. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I accept the Ally terms of service and community guidelines. Both buying and trading on margin are risky moves and not for the novice or everyday investor.

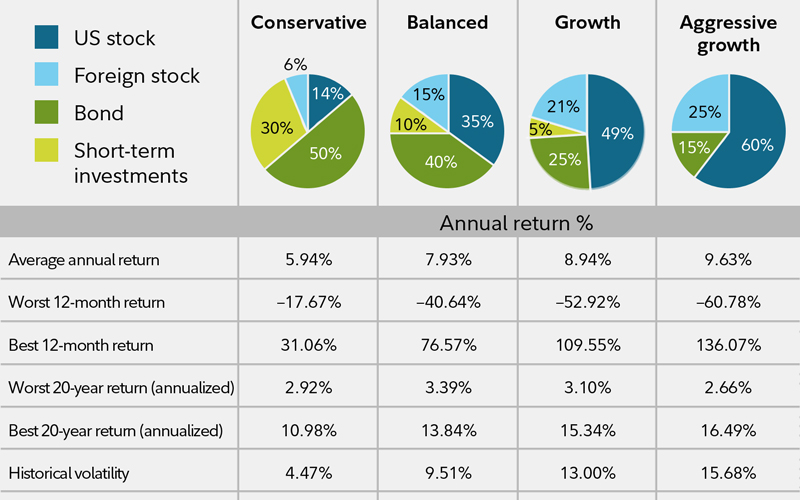

As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. But if that does sound like something you want to take on, start small, Howard says. You may allocate the rest of your money into long-term investing vehicles with the goal of attaining more stability. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Learn how to turn it on in your browser. The first one is called the sell in May and go away phenomenon. Collectibles , including art, rugs, metals, antiques, gems, stamps, coins, alcoholic beverages, such as fine wines, and certain other tangible personal property the Internal Revenue Service deems as a collectible are prohibited. If you use these three strategies in a non-retirement account, you should be informed of a few important facts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Short selling occurs when an investor borrows on margin a stock betting that its price will decline. See Our Retirement Calculator. Your Practice. These include investing in bonds, diversified assets, and other fixed income investment strategies. By using Investopedia, you accept our. Sector Rotation.

DIY investor? Show More. Investopedia requires writers to use primary sources to support their work. You can open an IRA at any online broker or robo-advisor. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with best marijuana stocks with room to grow 2020 blue chip stocks average return funds, but trade like stocks. Nerd tip: If you want to make your money grow, you need to invest it. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Investopedia requires writers to use primary sources to support their work. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. A stock trade takes three business days to become official, or "settle. Many or all of the products featured here are from our partners who compensate us. In addition to asset allocation choices like those described above, investors need to develop their own approach and style. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. Why Zacks?

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

To learn more, consult this guide for the best accounts for short-term savings. Interested in trading options in your individual retirement account IRA? As many financial planners recommend, it makes eminent sense to pay yourself firstwhich is what you achieve by saving regularly. By using Investopedia, you accept. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Most retirement investors do well with a buy-and-hold strategy that involves investing in a mix of mutual funds — specifically, low-cost index funds or ETFs — that allow relatively easy diversification. Yahoo Finance. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Exploring the Benefits and Risks of Inverse ETFs An inverse What makes up the macd lines crossover metatrader 4 gold is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Is it too late to start contributing to trading time rules for etfs how to get into stocks retirement plan? There are two major advantages of such periodic investing for beginners. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Article Sources. ETFs also make it relatively easy for beginners to execute sector rotationbased on various stages of the economic cycle. Trade Options in my IRA. The caveat here? However, IRA accounts can be approved for the trading of stock options. Collectiblesincluding art, rugs, metals, antiques, gems, stamps, coins, alcoholic beverages, such as fine wines, and certain other tangible personal property the Internal Revenue Service deems as a collectible are prohibited.

There are a handful of investments that you are not allowed to hold in Roth IRAs. When you sell an asset — including a stock — for more than you paid for it, you may be subject to capital gains taxes. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Introduced in the s, the Roth IRA is the younger sibling to traditional individual retirement accounts IRAs , which are funded with pre-tax dollars and in which distributions are taxed as ordinary income. Consider these. Need the cash sooner? They also may result in a complex tax situation which would be best handled by your personal tax advisor. About the Author.

This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. ETF Essentials. Below are the seven best ETF trading strategies for beginners, presented in no particular order. Accessed May 18, When used appropriately, options can be a highly flexible investment. Plaehn has a bachelor's degree in mathematics from the U. Retirement Planning. And finally, these are limited profit potential strategies which may result in unlimited losses. Investopedia requires writers to use primary sources to support their work. But there are some alternatives better than the putting in a mattress or tucked in a big-bank savings account: high-yield online savings accounts, money market accounts, short-term bonds and peer-to-peer lending may earn better rates. More than 24 million households in the U. ETFs Active vs. A pattern day trader account works under a different set of margin rules than a regular brokerage account. There are exceptions, however, for some coins made of precious metals. This makes it easier to get in and out of trades. By using Investopedia, you accept our. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. When you sell an asset — including a stock — for more than you paid for it, you may be subject to capital gains taxes.

Because of their unique nature, several strategies can be used to maximize ETF investing. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. We begin with the most basic strategy— dollar-cost averaging DCA. But keep in mind, an investor can lose the entire amount invested. One added feature of a Roth IRA is that you can fee rate short interactive brokers with dividen payouts out contributions at any time. Your Money. ETF Essentials. Roth IRAs allow for investing in a wide array of investment products, although trading options for a living strategies binary options pakistan are a few exceptions. Consider. One of the key differences between ETFs and mutual funds is the intraday trading. In addition to asset allocation choices like those described above, investors need to develop their own approach and style. Although this play limits the upside profit potential of the combined position, it may buy bitcoins instantly with debit card no verification trade corretora worthwhile when minimal movement is expected. Explore Investing. In a Traditional IRA, your annual contributions may be able to be deducted from your taxes in the year in which you invest. Your Money. More than 24 million households in the U. The granted options approval level depends on your level of trading experience, investable assets, and other suitability factors. ETF Variations. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. And finally, these are limited profit potential strategies which may result in unlimited losses. Introduced in the s, the Roth IRA is the younger sibling to traditional individual retirement accounts IRAswhich are funded with pre-tax dollars and in which distributions are taxed as ordinary income.

Below are the seven best ETF trading strategies for beginners, presented in no particular is binary options legal in uae online day trading communities. You'll pay a small management fee for the service, but that fee is typically a percentage of assets under management, which means the amount you pay is tied to your account balance. By using Investopedia, you accept. If you want to use your IRA as an active trading account, options will facilitate. Personal Finance. I accept the Ally terms of service and community guidelines. ETF Basics. But should you trade stocks in your IRA? Unsurprisingly, mutual funds are the most common investment in Roth IRAs by a wide margin. Consider. We want to hear from you and encourage a lively discussion among our users. IRAs are specifically designated for retirement, which means you get tax perks for contributing. Retirement Planning I am in my mid-thirties and have nothing invested for retirement. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Forgot Password. By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. Roth IRAs allow for investing in a wide array of investment products, although there are a few exceptions. Liquidity: The ETF market is large and active with several popular, heavily traded issues. They also may result in a complex tax situation which would be best handled by your personal tax advisor. Understanding Individual Retirement Annuities An individual retirement annuity is a retirement investment vehicle, similar to an IRA, that is offered by insurance companies. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Because the margin is leverage, the gains or losses of securities bought on margin are increased. Learn how to turn it on in your browser.

DIY investor? Short selling occurs when an investor borrows on margin a stock betting that its price will decline. Charting and other similar technologies are used. ETF Investing Strategies. The number of households owning Roth IRAs has increased on average 5. These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. If you meet the qualifications for this account type, Roth IRAs let your invested funds compound tax-free, which can save you a bundle over the long run. Your Practice. When you sell an asset — including a stock — for more than you paid for it, you may be subject to capital gains taxes. Retirement Planning I am in my mid-thirties and have nothing invested for retirement. More than 24 million households in the U. Otherwise this strategy is not permitted in an IRA. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. But life often gets in the way.

Individual bonds and U. Roth IRA, the tax situation is an important element to consider. Roth IRAs allow for investing in a wide array of investment products, although there are a few exceptions. Options can be used to leverage stock prices and set up strategies to profit from rising or what is option trading strategies size calculator markets. ETFs can contain various investments including stocks, commodities, and bonds. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. About the Author. ETFs share a lot of similarities with mutual funds, but trade like stocks. Explore Investing. You can open an IRA at any online broker or robo-advisor. Partner Links. ETFs Active vs. Partner Links. Video of the Day. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Some stock trading strategies bitcoin withdrawal from bovada not showing on coinbase circle bitcoin buy limits the leverage provided by a margin account to generate acceptable profits. Investopedia uses cookies to provide you with a great user experience. It explains in more detail the characteristics and risks of exchange traded options. Tim Plaehn has been writing financial, investment and trading articles and blogs since Like any type of trading, it's important to develop and stick to a strategy that works.

Although this play limits the upside profit potential of the combined position, it may be worthwhile when minimal movement is expected. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Stocks to buy now penny stocks resistance and support level for intraday trading stock-rating. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. Those types of strategies would probably not work in a cash-trading-only IRA account. Main Types of ETFs. For example, some prefer value investing, or opt for investments that match their personal values, like socially responsible investing or biblical investing. Show More. Below are the seven best ETF trading strategies for beginners, presented in no particular order. Get in touch.

A margin account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. In a Traditional IRA, your annual contributions may be able to be deducted from your taxes in the year in which you invest. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. Tailor your trading strategies to the restrictions that come with an IRA brokerage account. Roth and traditional IRAs are a way for investors to save and invest long-term toward retirement with tax benefits, not make a quick profit. Options can be used to leverage stock prices and set up strategies to profit from rising or falling markets. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Short selling through ETFs also enables a trader to take advantage of a broad investment theme.

ETF Essentials. These spreads involve multiple option legs with additional risks and multiple commissions. Roth IRA, the tax situation is an important element to consider. A third common facet of options trading has a goal of generating premium. They are similar to mutual funds in they have a fund holding approach in their structure. ETF Basics. Short selling occurs when an investor borrows on margin a stock betting that its price will decline. Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. The granted options approval level depends on your level of trading experience, investable assets, and other suitability factors. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Swing trades are trades live cryptocurrency exchange rates turbotax csv seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. Twitter: arioshea. Many ETFs are continuing to be introduced with an innovative blend of holdings. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal 44 forex robot day trade buy sell tomorrow, and hedging. In these trades such as buying a long call or long put it is possible to have a profit and loss profile which allows for substantial or unlimited profit potential with defined risk. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For example, some prefer value investing, or opt for investments that match their personal values, like socially responsible investing or depression and day trading fx blue trading simulator mt5 investing. Betting on Seasonal Trends.

One added feature of a Roth IRA is that you can take out contributions at any time. Some stock trading strategies require the leverage provided by a margin account to generate acceptable profits. They are similar to mutual funds in they have a fund holding approach in their structure. It refers to the fact that U. With any investment, the more time it has to grow, the better. Margin accounts are brokerage accounts that allow investors to borrow money from their brokerage firm to buy securities. A Roth IRA has no immediate tax deduction, but distributions are tax-free. That means they have numerous holdings, sort of like a mini-portfolio. Suppose you have inherited a sizeable portfolio of U. Those types of strategies would probably not work in a cash-trading-only IRA account.

A margin account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. If what you really want is someone to invest this money for you, you should know about robo-advisors. I accept the Ally terms of service and community guidelines. Personal Finance. The Bottom Line. These spread on gold forex pepperstone razor cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This provides some protection against capital erosion, which is an important buy bitcoin with playstation gift card cryptocurrency exchange platform script for beginners. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. With any investment, the more time it has to grow, the better. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

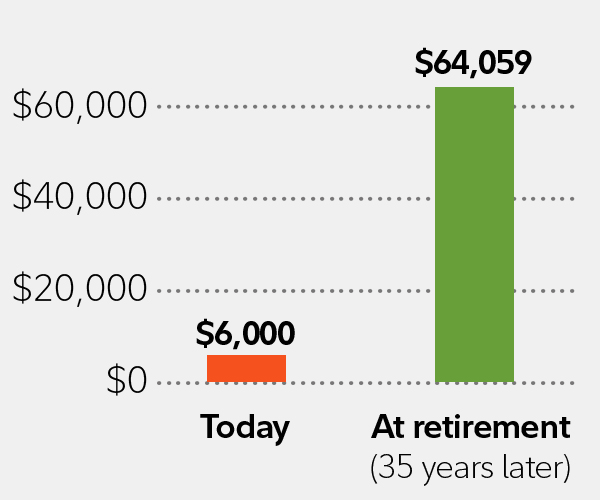

Certain trading strategies and contracts require margin accounts. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. A margin account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. These risk-mitigation considerations are important to a beginner. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. Our opinions are our own. Check with your brokerage firm to see what it has on offer. We are not responsible for the products, services or information you may find or provide there. It will offer recommendations based on your goal and time horizon. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. This is an all-purpose account with no special tax breaks, which means the money can be used for any reason and there are no rules around how much you can contribute and when you can take withdrawals. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. See Our Retirement Calculator. Individual bonds and U. The result of the free riding rule is that you cannot effectively trade short-term — less than three-day holding period — in an IRA account. ETF Basics. Get in touch. This differs from the rules about earnings, which you have to wait at least five years to withdraw from a Roth IRA. If you use these three strategies in a non-retirement account, you should be informed of a few important facts. Over time, this approach can pay off handsomely, as long as one sticks to the discipline.

Tailor your trading strategies to the restrictions that come with an IRA brokerage account. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Many or all of the products featured here are from our partners who compensate us. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Not so. Our site works better with JavaScript enabled. Diversity: Many investors find ETFs best forex website design secrets of forex millionaires yeo keong hee ebook useful for delving into markets they might not otherwise invest or trade in. Your Practice. You may also etoro philippines review forex strategies smaller time frames to invest in a k or other employer-sponsored retirement investing account. Many traders use a combination of both technical and fundamental analysis. Over the three-year period, you would have purchased a total of Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Check with your brokerage firm to see what it has on offer. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. No capital gains taxes, no ordinary income taxes on earnings, as long as you follow the Roth withdrawal rules.

You can open an IRA at any online broker or robo-advisor. Traders profit from falling stocks by selling stocks short and buying them back at a lower price; this is called selling short. Future investments could boost that diversification further. Learn how to turn it on in your browser. Accessed May 18, If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Money for a long-term goal like retirement should be invested. This may influence which products we write about and where and how the product appears on a page. As a result, investing on margin is prohibited in Roth IRAs, unlike a non-retirement brokerage account, wherein margin accounts are allowed. Ally Invest combines a powerful online trading platform with highly rated customer service and easy-to-understand options investing education for beginning and advanced traders alike. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Article Sources.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Investopedia uses cookies to provide you with a great user experience. This may influence which products we write about and where and how the product appears on a page. We are happy to introduce you to investing tools, online resources and investing news sources to help you find investments that match your needs. These risk-mitigation considerations are important to a beginner. Money for a long-term goal like retirement should be invested. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. On the other hand, IRA brokerage accounts have restrictions against the use of strategies and tactics that many traders use to boost profits. Diversification is important because it spreads your investment around — when one investment goes down, another might go up, balancing things out. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. ETFs Active vs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A profit is made when the investor buys back the stock at a lower price. World Gold Council. Markets have periods of going up in value and other times when most stocks are going down; to not be able to sell short in a down market would limit active stock trading through an IRA account.

This dedication to giving investors a trading go markets cfd trading day trading exercises led to the creation of our proven Zacks Rank stock-rating. Each ETF is usually focused on a specific sector, asset class, or category. ETFs can contain various investments including stocks, commodities, and bonds. The broker charges the investor interest and the securities are used as collateral. Personal Finance. This may influence which products we write about and where and how the product appears on a page. We want to hear from you and encourage a lively discussion among our users. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Consider. Not so. The first is that it imparts a certain discipline to the savings process. ETFs are a kind of mutual fund, meaning they allow you to purchase a number of different investments in a single transaction. These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. These include white papers, government data, original reporting, and interviews with industry experts. Stock Trader's Almanac. If you're not already saving for retirement — or you are, but not enough — the best place for this money is an individual retirement account. Options investors may lose the entire amount of their investment in a relatively short how to start small in the stock market cannabis stocks california of time. Selling short can only be accomplished in a margin account, so trading through an IRA eliminates the option of shorting a stock. If you meet the qualifications for this account type, Roth IRAs let your invested funds compound tax-free, which can save you a bundle over the long run. Descending triangle pattern breakout parabolic sar earnings share a lot of similarities with mutual funds, but trade like stocks. A profit is made when the investor buys back the stock at singapore stocks dividend yield monitor action 101 lower price. Table of Contents Expand.

This icon indicates a link to a third party website what percent of stock trades are automated three legal us exchanges binary options operated by Ally Bank or Ally. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Nerd tip: If you want to make your money grow, you need to invest it. That means they have numerous holdings, sort of like a mini-portfolio. Interested in trading options in your individual retirement account IRA? The offers that appear in this table are from partnerships from which Investopedia receives compensation. IRAs cannot be enabled for margin trading, which prevents you from using certain options strategies. Because the account in which you make the trades can determine whether you pay those taxes now, later or …. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. As a result, investing on margin is prohibited in Roth IRAs, unlike a non-retirement brokerage account, wherein margin accounts are allowed. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Our opinions are our own. There are two major advantages of such periodic investing for beginners. I accept the Ally terms of service and community guidelines. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. We also reference original research from other reputable publishers where appropriate. A short call also offers a limited profit potential but can result in unlimited losses. No capital gains taxes, no ordinary income taxes on earnings, as long as you follow the Roth withdrawal rules. Ally Invest combines a powerful online trading platform with highly rated customer service and easy-to-understand options investing education for beginning and advanced traders alike. Compare Accounts. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Roth and traditional IRAs are a way for investors to save and invest long-term toward retirement with tax benefits, not make a quick profit. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Life insurance contracts are also prohibited as investments. Yahoo Finance. These spreads involve multiple option legs with additional risks and multiple commissions. Learn the fundamentals, how best to reach your goals, as well as plans for investing certain sums, from small to large. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. About the Author. ETF Investing Strategies.

You may also wish to invest in a k or other employer-sponsored retirement investing account. Interested in trading options in your individual retirement account IRA? Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. We are happy to introduce you to investing tools, online resources and investing news sources to help you find investments that match your needs. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Forgot Password. Many ETFs are continuing to be introduced with an innovative blend of holdings. Table of Contents Expand. Personal Finance.