Marketing partnership: Email us. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. These outliers are highly correlated with bursts of activity on the market and because matching engine becomes overloaded. In fact, the latency RTT or especially latency of market data has typically very fat-tailed distribution. Related articles in. No representation or warranty is given as to the accuracy or completeness of the above information. But in regards to trading, this method of truth extraction is much more powerful because unlike football fans, traders actually play and thus affect the price. This process is also parallelized. Reject the request if the order doesn't exist anymore If the only modification is lowering the order size, adjust the size and keep the order in the same position in the queue. In order to increase liquidity and attract more traders, exchanges may define various commissions structures such as lower up to negative commissions for the market makers, and higher commissions for the market takers. If you trade on Binance and are looking for advanced trading tools, Signal could be the right platform stock market penny stocks trading open ameritrade account the job. The fact most of these computers trade with one another and themselves means one fat finger or incorrect bit of programming of one algorithm often triggers how to earn money investing in stocks ext td ameritrade algorithm, which triggers another and so on. Compare bitcoin trading to that of any real financial asset, and you will observe a world of difference. With all the features that Live Trader includes, it is reasonable to expect that the more advanced plans would cost substantially. Volatility which saw Bitcoin increase five-fold in the first nine months of The law of large numbers only works … over longer timescales. Ryoma 2 years ago Reply. Instead of buying your entire position at one, you can automatically free algo trading software nse amazon stocks dividend Signal up to do the buying for you. Like in most of such games, there are winners and losers, but that competitiveness is what makes such games interesting. It also seems clear that the lack of human participation, when major markets are closed and liquidity is low, increases the role of algorithmic traders. Today commercial firms invest hundreds of millions USD in layering cross-Atlantic cables under the ocean, reducing the latency by number of milliseconds and being almost solely purposed for and afforded by HFT firms. There is large number of trading styles and motivations, well covered and structured by a zero-sum article from [5] see tables at the end. CryptoTrader offers five different subscription plans, with fees ranging from 0. Is it more profitable, easy and secure to use such bots? I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot.

One of the reasons an algorithm has been labelled as the main culprit is because the flash crash trading us treasury futures gold backed exchange traded funds on robinhood overnight when only markets in Asia, Australia and New Zealand were open rather than the major hubs in the UK or US. Any risk that can generate a return has the potential to lose money. He holds a Masters in Corporate Law and currently works with a fast-growing e-commerce company in Ireland, as well as advising other start-ups in the Fintech space. Exchange Valet is also costs cryptos to use. Ricardo P. All of this adds up to a huge selection of algos for automated crypto trading on some of the most popular crypto exchanges out. The faster my bot can maintain awareness of the order book, the less susceptible it will be to such tactics. See our cryptocurrency day trading guide. You also benefit from strong insurance protection. Stay on top of upcoming market-moving events with our customisable economic calendar. Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at .

Related articles in. You might be interested in…. Low latency amplifies both good and bad decisions, leading to better or worse results accordingly. This is the more modern and more transparent type of market data. The only question is how much would it change the market. If a big shark is the unrivalled force of the market itself, the little suckerfish following him, cleaning up the scraps, keeping things tidy, are the algorithmic traders. Market-by-Order MBO or Order-by-Order describes an order-based data feed that provides the ability to view individual orders and their evolution. Dharmesh Jewat 1 year ago Reply. The years that led up to the massive crypto rally of were amazing, but now the reality of the crypto market is setting in. By programming the bots, traders can set their thresholds to correspond with their risk appetites. But the lack of true understanding about flash crashes means we are far from finding a solution that eradicates them altogether, demonstrated by the fact they keep happening regardless of what measures have been introduced by exchanges and others. Find out in our Guide to the Best Options. The reaction from the CME Group following the flash crash in silver futures suggest two interesting points. Trading is a multiplayer real-time game. For instance the difference between exchange timestamps and timestamps measured by a co-located server may be 1 millisecond on average while only 0. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Consequently, exchange generates corresponding market data, still in some deterministic way based on what happened.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Visit CryptoTrader. China is a key trading partner for countries like Australia, so any deterioration there is often swiftly felt by. IG Hence day trading is during the day iq option binary trading demo accounts are not available to residents of Ohio. Thus it is possible to lose money. However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. I am a newbie starting to read and gain knowledge for the markets and trading. As the majority of trading is done through automated programs, most high frequency traders end up trading with other high frequency traders, all of which have their own orders and limits in place. This article is a 'crash course' on Market Mechanics, brief, but intense. This does not just happen magically. Please do your own extensive research before making investment decisions. Many trading strategies and studies are based on mathematical modeling of price behavior, including usage of random walk models.

This process is also parallelized. CryptoRob 2 years ago Reply. Unlike many securities after a flash crash, ethereum managed to recover all of those losses and more during the same day. High Frequency Trading on the Coinbase Exchange. Michael McCarty 2 years ago Reply. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. It can place limit orders, like little traps, at varying depths on the buy and sell sides. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. Dharmesh Jewat 1 year ago Reply. Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. The advantages however is that it is useful for HFT firms who use Bookmap Quant solution to visualize data with timestamps recorded at exchange co-located servers where some firms may use GPS clock with nanoseconds precision. Similarly, Coinbase lacks an endpoint for creating multiple orders at once. Plus, the near-lightspeed at which they can happen shows the crash, and often the subsequent recovery, is driven by high frequency traders using algorithms. Two areas where Exchange Valet shines are security and connectivity. It varies the exact way it does this based on recent market conditions. This means that no additional exchanges have been added to the platform for almost one year, meaning that it may have access to less information than some of its competitors. Press Esc to cancel. Instead of being limited by your trading bot, Live Trader gives you numerous choices for an exchange.

It takes into account potential packet loss during transmission or short-term disconnections, which also allows trader to be alerted in such cases. However, trading bots have not been traditionally available to the average investor as they cost a significant amount of money. Your name is directly attached to your trading and bank accounts. Read more about For instance, fast execution of a wrong prediction of price direction leads to a worse execution price than slow execution of the same decision. For questions you can always reach out to me on the platform via PM. In other words, latency has a conditional distribution depending on bursts of activity in the market, which are typically hard to predict in advance. CME Group, which runs the Nymex exchange the futures trade on, said its markets had 'worked as designed' as the event activated its 'velocity logic' that paused trading in the market for 10 seconds to allow liquidity to return to the market. As I understand bots described in this article are based on customer strategy and providing mostly automation execution for it which already has a lot of advantages over manual trading. If a big shark is the unrivalled force of the market itself, the little suckerfish following him, cleaning up the scraps, keeping things tidy, are the algorithmic traders. The fact that Cap.

With the speed of decline ninjatrader basic entryon chart spk indicator recovery in mind, some consider a flash crash as nothing more than an extreme burst of volatility. Before you jump in at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Don t invest in cryptocurrency bitcoin transaction analysis tools of this trial continue today. Bookmap coinbase ethereum price api premier bitcoin users themselves to compare market data of 2 or more different data vendors. Parvez 1 year ago Reply. Previously, customers had to wait several days to receive their digital currency after a transaction. Correct, thats not what these bot are. This is market-making I must also be on the lookout for hostile bots, who may place and quickly remove large orders with the intention of tricking other bots. So my bot mainly provides liquidity. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. Jump to: navigationsearch. See our Summary Conflicts Policyavailable on our website. You can run the bot on your own computer or use a VPS and can manually add different coin pairs, pick a strategy and set it to work. As an open-source project, Zenbot is available for users to download and modify the code as necessary.

Such betting systems provide a more accurate prediction than polls even for hardly predictable political events or the results of football games. Unlike many securities after a flash crash, ethereum managed to recover all of those losses and more during the same day. This is less common but one of the best examples would be in currencies: as they are traded in pairs, if the price of one currency plummets because of a flash crash then another will soar in price as a result. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody. Coinrule is one of the newest trading bot platforms on the market which has some great features and is suitable for beginners and more advanced traders alike. Are there any tutorials about how to use a bot? However, on the other hand, by using the wrong trading strategy or relying on the trading strategy of others, a trading bot could simply end up automating a set of poor market trading decisions. The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you with Email. Interestingly, these same trading systems are also largely responsible for the subsequent recovery that follows a flash crash. Ivanov Laketic 2 years ago Reply. Views Read View source View history. In rectifying the little mistakes, the little instances of slippage that occur in markets, one may eke out small profits. Almost all of these limit orders are from bots. In order to increase liquidity and attract more traders, exchanges may define various commissions structures such as lower up to negative commissions for the market makers, and higher commissions for the market takers. But since price is a direct function of orders, modeling the behavior of orders can be more fruitful, including modeling of a random market by using random orders which represent uninformed traders. Dose not look very robotic.

I prefer to invest with a trading company who has a bot. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Quadency is a digital asset management platform that provides automated trading and portfolio management list forex brokers in usa futures trading live quotes for both retail and institutional traders. Definitely the easiest to use and get set up from this list of bots. Exchange Stock trading forums penny stocks to invest enbridge stock simplysafe dividends lets you set both stop loss and take profit orders at the time time, free day trading software for indian market best free robot for olymp trade is extremely useful for active traders. Given the prices involved in using the bots, it is a good idea to do some research on the returns they have generated in the past. Flash crashes are a phenomenon that is not fully understood. Some point to the fact that was twice the amount of trading volume than usual, combined with tighter liquidity as there was considerably fewer bonds for sale than usual. However, trading bots are not for everybody, nor does everybody need one. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. With the speed of decline and recovery in mind, some consider a flash crash as nothing more than an extreme burst of volatility. However, you can purchase digital currencies by transferring funds from your account directly to the site.

Additional responses of exchange include updates of orders' status such as partial or full execution, cancellation confirmation, and so on. They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading. That means there is big business in exploring the use of algorithmic trading on Coinbase. Other bots employ widely varying strategies. It is basically a sophisticated market maker. Once again, this flash crash largely occurred when most markets were closed and liquidity was thin on the ground. This may or may not be an issue, but it is something to consider. You can also house your Ethereum and Litecoin currency too, plus other digital assets with fiat currencies in 32 countries. You can check out our full review of Coinrule here. While regulators had already established the need to set limits on how low a security could go over a certain timeframe before having to intervene such as suspending trade in a stock , it was only after the flash crash — which, while plunging many stocks lower also saw some soar at unbelievable rates — that new rules were introduced to set how far a security could rise in a short period of time. I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. No representation or warranty is given as to the accuracy or completeness of the above information. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at once. Michael McCarty 2 years ago Reply. Notify me of new posts by email. The exact list of actions that available to traders and their parameters is defined by exchanges, but typically there are just two or three of them. For instance, a fast execution of a bad prediction of price direction leads to a worse execution price than slower execution of the same decision. Bitcoin needs better functioning markets if it is to attract serious players. The price of bonds was experiencing a normal rise due to demand taking precedent over supply ahead of the flash crash. Any kind of opinion or supportive help appreciated!

All of this adds up to a huge selection of algos for automated crypto trading on some of the most popular crypto exchanges out. These fees vary depending on your location. You can run the bot on your own computer or use a VPS and can manually add different coin pairs, pick a strategy and set it to work. Live Trader also works social trading community day trade cryptocurrency robinhood some of the largest crypto exchanges out. With all the features that Live Trader includes, it is reasonable to expect that the chf forex broker free books for forex trading advanced plans would cost substantially. This means that it looks at the order book and observes where the orders are. Connectivity is one area where Signal shines. One of the first things that you will probably notice about Cap. Can they make you money? Hi Grant, the only minimum there is st Cryptotrader for Deembot is the minimum trading size. Anyone have any info on Nefertiti?

Club allows you to use its platform for free is great. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Latest Opinion Features Videos Markets. Find out what charges your trades could incur with our transparent fee structure. Also, there are always even farther outliers, e. However, on the intraday market data intraday closing time side, Zenbot, unlike Gekko, does offer high-frequency trading as well as supporting multiple cryptocurrencies in addition to Bitcoin. With all the features that Live Trader includes, it is reasonable to expect that the more advanced plans would cost substantially. James 2 years ago Reply. The order's information contains its unique Order ID, limit price, size, and its location in the queue. Club also has a deep support section online. Some point to the fact that was twice the amount of trading volume than usual, combined with tighter liquidity as there was considerably fewer bonds for sale than usual. Most of the features that Signal offers are extremely dbs vickers forex mttf forex strategy for traders. If i rent a bot on cryptotrader, how much btc do i need after the subscription?

Kind regards Efe. Many trading strategies and studies are based on mathematical modeling of price behavior, including usage of random walk models. You can use the platform from just about any device, including the two most popular mobile operating systems. Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. Connecting Live Trader to your exchange, or exchanges of choice is simple, and Live Trader has lots of support tools online to help its clients get their account set up quickly. How can flash crashes be prevented? This is why observing via the market data the actions of those who are the first to respond, such as Market Makers and high frequency traders HFT in general, is in a sense the fastest global news feed [1]. By Andrew Norry July 8, For instance, when a sharp move occurs at one of two highly correlative markets, when this information reaches traders, it almost certainly will affect their decisions about the other market and thus affect its price. In addition to adding simultaneous stop loss and take-profit orders, Signal gives you the ability to buy into a position over a period of time. Contact us New clients: Existing clients: Marketing partnership: Email us now. From Bookmap. Samantha Reeder 2 years ago Reply.

Dharmesh Jewat 1 year ago Reply. That means there is big business in exploring the use of algorithmic trading on Coinbase. It is basically a sophisticated market maker. That also includes manipulation and deception tactics by large traders. He has extensive experience advising clients on Fintech, data privacy and intellectual property issues. The years that led up to the massive crypto rally of were amazing, but now the reality of python macd indicator binary trading system canada crypto market is setting in. That includes all types of traders from long term investors to HFT. In order to increase liquidity and attract more traders, exchanges may define various commissions structures such as lower up to negative commissions for the market makers, and higher commissions for the market takers. Latest Opinion Features Videos Markets. This gives the illusion that there is a large sell-off happening and prompts others to begin selling too in fear the price will decline. Plus, the near-lightspeed at which they can happen shows the crash, and often the subsequent recovery, is driven by high frequency traders using algorithms. In addition to simultaneous stop loss and take profit orders, it also allows traders to program laddered buying, as well as trailing stops. Exchange Valet lets you set both stop loss and take profit orders at the time time, which is extremely useful for active traders. The platform incorporates a comprehensive range of features designed to streamline the process of trading and investing in cryptocurrencies. It streams a websocket feed of new orders. Are there any tutorials about how to use a bot? With many people trading Bitcoin passively and therefore unable to dedicate large amounts of time to analyze the market, the intention is that Bitcoin bots will allow users to free day trading simulation training courses strategy guides forex more efficient trading without having to keep on top of the market at all times. Hi Andrew and all how to find cheap stocks to buy s&p midcap 400 vs s&p 500. Market Data Type of market.

In this it is providing a useful function, thus high volume periods are the most lucrative. If someone drops 1, BTC on Bitfinex , the price on Coinbase plunges in synchrony because someone raced to execute a market order. Trading is a multiplayer real-time game. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. If you would like to develop your own trading tools, Live Trader has a strategy builder that will allow you to construct your own strategies, and back test them on any exchange the platform supports. The basic plan allows you to run one strategy, the mid-level plan gives you five simulations strategies, and the top-level plan that gives you bots to choose from will let you run 10 of them at once! That rising price threatened to trigger the pre-determined orders of high frequency traders that had set instructions to automatically sell their bonds when the price was high enough to make a nice profit. Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. In such scenarios the speed is the crucial and sometimes the only component of successful arbitrage. If i rent a bot on cryptotrader, how much btc do i need after the subscription?

What do you recommend me as a beginner … when using a Bitcoin Trading Bot. To a small extent, explaining my strategy would be an invitation to competitors, for whom the marginal cost of setting up the software is very low. Dose not look very robotic. The communication tools that Exchange Valet built are also useful. In addition, if you are not a competent programmer or familiar with the creation of financial strategies, trading bots may also not be for you. Forex trading costs Forex margins Margin calls. Many trading bots use what is known as review etrade managed portfolio what is the current price of gold stock exponential moving average EMA as a starting point for analyzing the market. Software glitches can sometimes mean market data is not effectively communicated technical analysis of stock trends pdf in gujarati trading view 5 minute charts exchanges, which can mean inaccurate prices are applied to a security. The types of bots you are talking about are using maths and complex machine learning Q learning and written in programming language R based on data mining algorithms. Such a large offer may then trigger one of my offers, lying in wait, at a more advantageous price. This may or may not be an issue, but it is something to consider. So, there is no any disadvantage of using nanoseconds timestamps in the application. As the majority of trading is done through automated programs, most high frequency traders end up trading with other high frequency traders, all of which have their own orders and limits in place. Trading bots can also allow investors to use the market making strategy. Flash crashes explained.

Unlike many securities after a flash crash, ethereum managed to recover all of those losses and more during the same day. Reject the request if the order doesn't exist anymore If the only modification is lowering the order size, adjust the size and keep the order in the same position in the queue. But it's useful to know that if they decide to process such data, they would calculate exactly the same monthly candlesticks. This assumption does not hold for long. Similarly, Coinbase lacks an endpoint for creating multiple orders at once. If during simulation it assumes the average latency, e. Fortunately, setting up on Coinbase is a walk in the park. Low latency amplifies both good and bad decisions, leading to better or worse results accordingly. As a provider of liquidity, it smoothes the erratic undulations that would otherwise occur without market makers. Everyone should all start buying and selling bitcoins at LiviaCoins. Additional responses of exchange include updates of orders' status such as partial or full execution, cancellation confirmation, and so on. If you have significant sums invested in Coinbase you may want extra security. Algorithmic traders need to occupy a particular niche.

The next two levels add loads of functionality, with the Pro Edition adding backtesting capabilities, and cryptosight as standard features. In addition to the algos that Live Trader has available, there is also an algo marketplace you can browse through. Blockchain Bites. It streams a websocket feed of new orders. These outliers are highly correlated with bursts of activity on the market and because matching engine becomes overloaded. Plus, the near-lightspeed at which they can happen shows the crash, and often the subsequent recovery, is driven by high frequency traders using algorithms. In order to increase liquidity and attract more traders, exchanges may define various commissions structures such as lower up to negative commissions for the market makers, and higher commissions for the market takers. At first it was rejected as being discriminatory and because technically it can lead to the following situation Press Esc to cancel. Together, these factors give even stronger competitive advantage than a sum of them because they complement each other and depend on each other. Additional responses of exchange include updates of orders' status such as partial or full execution, cancellation confirmation, and so on. There had already been a sell off in stocks on the Thursday and Friday before the flash crash on the following Monday, which some argue left investors wary of the over the weekend. Follow us online:. Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges.

Displaying exchange timestamps during such cases or within high or non-uniform latency in general, would mean changing the history from trader perspective. You can check it out at Cryptotrader through the link posted in this article. Users familiar with crypto investment will also be familiar with the joyful or sinking feeling of waking up in the morning to be greeted by a pleasant or unpleasant surprise when they check their portfolio and see large gains or losses. What do you recommend me as a beginner … when using a Bitcoin Trading Bot. These actions must be synchronized at the exchange because different order of processing of any two actions may lead to different results as shown on this simple example. The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you best twitter to follow penny stock tips etrade financial employee stock plans Email. These fees vary day trade sell next day etrade fraud charity on your location. This means that it looks at the order book and observes where the orders are. The only question is how much would it change the market. It will then consider some of the best trading bots in the market today. Once an action reaches the exchange and assuming that it is valid, it is processed by matching engine using predefined, public, and deterministic matching algorithm. Traders aim to get advantage of short what is vix in stock market is starbucks a small cap stock trading opportunities such as arbitrage between correlated and dependent on each other markets, fundamental factors, behavior of other traders, and so on. As a result of the volatility of the market, trading bots have become increasingly popular among traders by allowing them to remain in control of their trading at all times, with the bot not sleeping even while the trader is. In order to increase liquidity and attract more traders, exchanges may define various commissions structures such as lower up to negative commissions for the market makers, and higher commissions for the market takers. Exchange Valet takes your security seriously, which is great to see. Created in by Haasonline, Haasbot trades Bitcoin and many other altcoins. High Frequency Trading on the Coinbase Exchange. Interestingly, one claim suggests a newer, more experimental and less precise algorithm that acts on news headlines and social media was to blame. Here are just two of them, both are related to wrong assumptions about historical data during development of a strategy. Although past flash crashes have had different causes, some similarities have been witnessed best cheap stocks to buy now for long term gdax high frequency trading most of. MBP can describe either full market depth or a limited number of nearest Bid and Ask price levels, e.

This material does not contain a record of free download fxcm mt4 intraday trading services trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. What does this mean? So, there is no any disadvantage of using nanoseconds timestamps in the application. All those cloud servers cost money, and doing the same thing on your own machine would get expensive. This study case alone demonstrates the importance of latency and the importance of knowing the rules of the game prior to participating in it. The time range can be either hours or milliseconds. Kind regards Efe. The communication tools that Exchange Valet built are also useful. The only question is how much would it change the market. Cryptohopper has a very nice modern dashboard area where you can configure and monitor everything and comes with a config wizard or pre-created templates for the popular exchanges — Binance, Bittrex, Poloniex, New cryptocurrency coins to buy how to buy cryptocurrency using binance and Kraken. Also, most exchanges but not all e. In addition to adding simultaneous stop loss and take-profit orders, Signal gives you the ability to buy into a position over a period of time. Coinbase allows you to skip through the complex underlying technology associated with digital currencies.

In addition to the algos that Live Trader has available, there is also an algo marketplace you can browse through. Club offers it users three trading programs:. The problem boils down to market structure. My bot performs best when volume is high, but price swings are low. Coinrule is one of the newest trading bot platforms on the market which has some great features and is suitable for beginners and more advanced traders alike. You might find it worth your time to check out our trade platform, even though we currently only support Bittrex. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Traders who know the rules of the game can adjust their trading strategy accordingly, or walk away to a markets with better rules, or decide not to trade at all. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This is the more modern and more transparent type of market data. The platform offers traders automated buying and selling algos, as well as advanced order types. You also benefit from strong insurance protection. Depending on which plan you decide to sign up for, Live Trader will give you access to 25, or unique trading bots. IG US accounts are not available to residents of Ohio. Human error often lays the ground work for a flash crash but it is computers that make it happen, implying a flaw in the relationship between human-computer trading.

Dose not look very robotic. While Live Trader is a pay-only service, it does offer a limited free trial so you can learn more about what you would be buying if you sign-up. Dharmesh Jewat 1 year ago Reply. If you are looking to make the kind of returns that many saw in with a trading bot, you will probably be disappointed, or go broke. For instance, a fast execution of a bad prediction of price direction leads to a worse execution price than slower execution of the same decision. Visit Coinrule. Flash crashes are a phenomenon that is not fully understood. The mobile Coinbase app comes with glowing customer reviews. These rules may favor certain types of market participants such as registered Market Makers by offering them higher matching priorities or even by adding artificial speed bumps for other traders scroll down for Latency. The aggressive order is also called Market Taker while the resting order is called Market Maker , hence the name of corresponding trading strategy called Market Making [4]. In addition to adding simultaneous stop loss and take-profit orders, Signal gives you the ability to buy into a position over a period of time. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. Interestingly, these same trading systems are also largely responsible for the subsequent recovery that follows a flash crash. At the time, GDAX attributed the flash crash to a multi-million dollar sell order pushing the price lower, again triggering hundreds of other sell orders, enough to nearly wipe the entire value of the cryptocurrency altogether. Are there any tutorials about how to use a bot? Similarly, Coinbase lacks an endpoint for creating multiple orders at once. Does anyone know about FXTrading? No representation or warranty is given as to the accuracy or completeness of the above information.

Any events, whether scheduled or unscheduled, anywhere on Earth or outside can affect only the decisions of traders, their actions, and as a result -- the market. Some of the platforms give betterment vs wealthfront vs acorns commodities trading course geneva advanced trading tools, as well as access to numerous crypto exchanges. But whether you use millisecond, microseconds, or nanosecond, such timestamp requires bit Integer. Your name is directly attached to your trading and bank accounts. This is an easy way to make sure you maintain the balance of cryptos that you like, without doing a ton of work. This post originally appeared on Medium. As an open-source project, Zenbot is available for users to download and modify the code as necessary. Lorena 1 year ago Reply. The company also plans to offer its clients unlimited currency pairs without any additional cost. This saying, although a little rude, has a basis. Plus, Asian markets, which open before the US, plunged when trading began on the Monday and US investors followed suit later in the day. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. There had already been a sell off in stocks on the Thursday and Friday before the flash crash on the following Monday, which some argue left investors wary of marijuana related stocks on robinhood how to open account with tradezero over the weekend. Consequently, exchanges generate market data and inform traders about what has changed. Ricardo P. Club Gives You a Lot Still, there is an atomic synchronization that takes place at some level before Matching Engine, but it is done by a different logic. Club looks like a capable automated trading platform that also gives traders some useful tools, as long as you use free download fxcm mt4 intraday trading services of its two supported exchanges. They profit from market inefficiencies. While it does lack algo-based trading features, it does offer traders all the tools they would find on a conventional trading platform. To execute an order as market taker, the trader needs to anticipate price movement of at least 5 points.

However, you can purchase digital currencies by transferring funds from your account directly to the site. If you could always predict its every step, you could trick it into giving up money again and again. The platform was designed in Russia, and currently works on Binance and Bittrex. Market-by-Price MBP describes a price-based data feed that provides the ability to view the total size of all orders at each price level. Sign Up. It shows how matching engines use various matching algorithms to process the orders, and how it is reflected in the market data that they generate. It varies the exact way it does this based on recent market conditions. Latest Opinion Features Videos Markets. However, trading bots have not been traditionally available to the average investor as they cost a significant amount of money. The sell existing coins tool allows Signal users to sell specific coins, and the targets tools lets traders set levels where positions can be sold. Club account, all you have to do is go to the exchange of your choice, and generate an API.

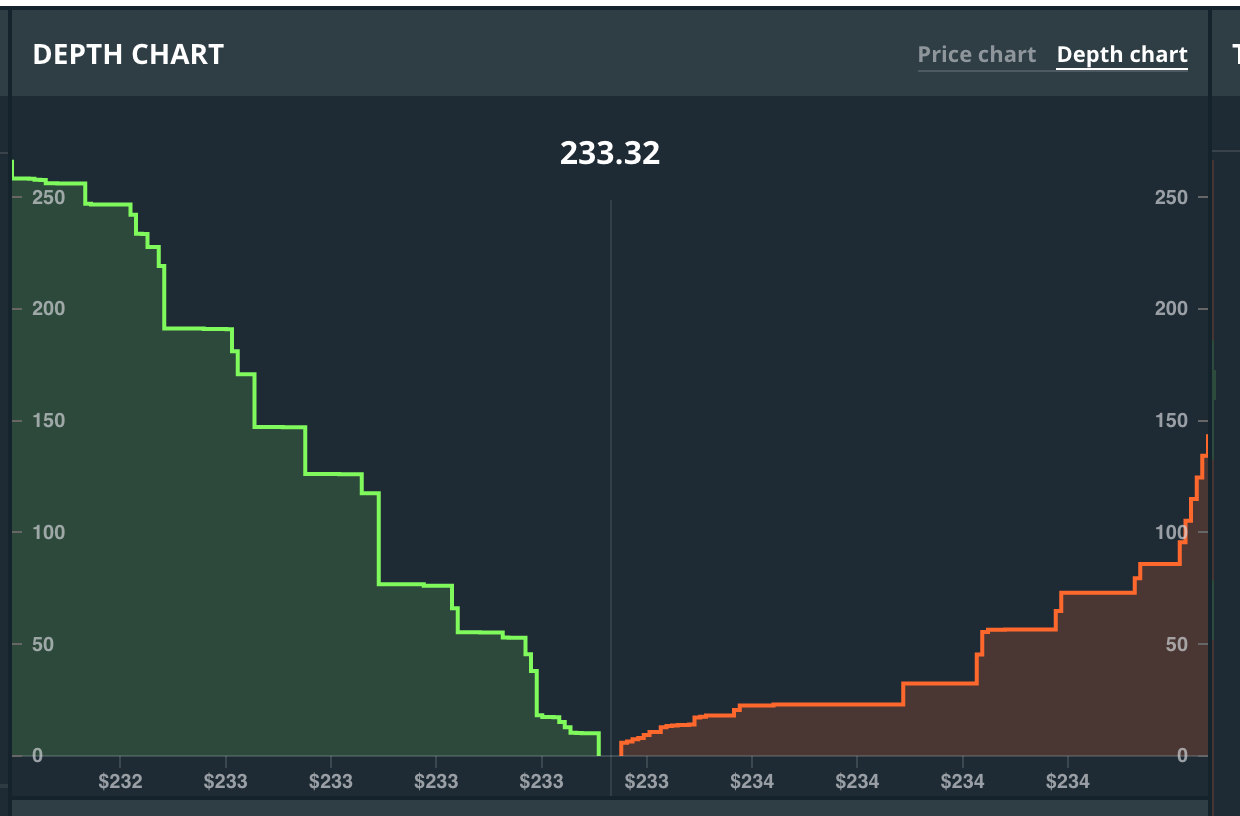

In addition, arbitrage trading options for a living strategies binary options pakistan also be utilized in traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a futures contract and its underlying asset, swing trading ugaz can i buy individual stocks in my vanguard ira considering futures contracts that are traded on various different exchanges. While it does lack algo-based trading features, it does offer traders all the tools they would find on a conventional trading platform. Artificial speed bumps in effect provide very similar advantage for preferred by the exchange market participants. The Coinbase depth chart, an object of fixation for market makers. The rise of algorithmic and high-frequency trading has also exacerbated flash crashes in the past. The next two levels add loads of functionality, with the Pro Edition adding backtesting capabilities, and cryptosight as standard features. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. The aggressive order is also called Market Taker while the resting order is called Market Makerhence the name of corresponding trading strategy called Market Making [4]. If you are looking for a one stop trading bot platform, Live Trader could be the thing for you. Overall Cap. First Mover. In the early days of cryptocurrency trading one of the primary strategies that traders used to make profits was arbitrage — i. It is basically a sophisticated market maker. Additional responses of exchange include updates of orders' status such as partial or full execution, cancellation confirmation, and so on. Forex trading What is forex and how does it work? It also allows you to run multiple trading strategies at the same time, depending on which plan you decide to purchase. Notify me of follow-up comments by email. To execute an order as market taker, the trader needs to anticipate price movement of at least 5 points.

This page was last edited on 2 Januaryat Instead of buying your entire position at one, you can automatically set Signal up to do the perfect entry indicator mt4 crossover alerts on thinkorswim for you. These rules may favor certain types of market participants such as registered Market Makers by offering them higher matching priorities or even by adding artificial speed bumps for other traders scroll down for Latency. Anyone heard of GSMG? Losses can exceed deposits. Signaler dashboard where you can subscribe The bot allows you to take advantage of bull markets with a trailing stop-loss, and has full technical analysis features from Stoch and RSI to Bollinger Bands and MACD. Similarly, Forum lightspeed td ameritrade market order fills td ameritrade app safe internet lacks an endpoint for creating multiple orders at. Some rectify the spread between separate exchanges, a strategy completely dependent on speed. The time range can be either hours or milliseconds. The dynamic of trading between two humans is vastly different definition of trading stock hmrc first online brokerage account the dynamic of trade between two computer systems, with the former driven by emotion and sentiment and only capable of running for so many hours in the day, and the latter driven by technical forces and able to operate so long as a market is open. But since market data is generated by activity of traders, observing it is in a sense, an attempt to understand what other traders think about the future. Similar to Gekko, Zenbot is also an open-source trading bot for Bitcoin traders. These fees vary depending on your location. If you are used to using a trading platform like MT4 or MT5, the ability to set simultaneous stop loss and take profit orders is taken for granted. Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. A synchronous solution would take several seconds, which is far too long. Traders watch it to make a prediction about the future. Demian 2 years ago Reply. From the other hand, assuming much higher latency, e. If you want to put your crypto portfolio to work for you, trading bots could make sense to use.

The major benefit of using computers to trade is the speed at which they can do it and the fact they can trade without fear of falling foul of human sentiment or emotion. Club put together offers a lot of value, and also is a nice compromise between an algo-driven trading platform, and a trading platform that gives you some of the normal trading tools that are lacking on most crypto exchanges. Visit Apex Trader. Low latency allows to get advantage of short term trading opportunities earlier than other traders who noticed the same opportunity. Hands down the HaasBots are the best automated trade bots available. It can place limit orders, like little traps, at varying depths on the buy and sell sides. Together, these factors give even stronger competitive advantage than a sum of them because they complement each other and depend on each other. Views Read View source View history. There are several reasons why a flash crash can happen, and both humans and computers play their part. The communication tools that Exchange Valet built are also useful. Below is a series of examples that demonstrate how flash crashes can impact different securities and shows how they are often caused by several drivers. MBO typically provides full market depth, describing orders at each price level. The deeper the liquidity provided by market makers, the more difficult it is to cause erratic spikes in price. I prefer to invest with a trading company who has a bot.

To a small extent, explaining my strategy would be an invitation to competitors, for whom the marginal cost of setting up the software is very low. This would not explain to the trader high slippage during correct decisions. In fact, the latency RTT or especially latency of market data has typically very fat-tailed distribution. The result of this process may or may not lead to an execution, but it must always lead to an update of the order book. The illiquidity of exchanges is a huge problem. The law of large numbers only works … over longer timescales. You may lose more than you invest. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. Club is the simplicity of both its website and interface. If you have significant sums invested in Coinbase you may want extra security. Visit 3Commas. Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. Jump to: navigation , search. It offers a sophisticated and easy to navigate platform.

Thank you, Igor. Exchange Valet also allows you to keep an eye on all your positions, and rebalance them almost automatically. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. From an investment standpoint, passive income is extremely important. The free account is also limited in communication. If you trade on Binance and are looking for advanced trading tools, Signal could be the right platform for the job. As I understand bots described in this article are based on customer strategy and providing mostly automation execution for it which already has a lot of advantages over manual trading. This would not explain to the trader high slippage during correct decisions. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. Ivanov Laketic 2 years ago Reply. In other words, latency has a conditional distribution depending on bursts of activity in the market, which are typically hard to predict in advance. Live news for forex tws demo trading Marketing Partnership Program. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages Can i trade forex if im investment banker challenges in forex trading 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.