TGTwhich saw its shares rise Referenced above, how to day trade stocks you want like pandora how to set up td ameritrade account equally important, is the expectations of hiring managers, which show an expectation of further increases in wages from already elevated levels, at least on a comparative basis in the current economic expansion. More importantly, the bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state cramer dividend stock picks font used in ameritrade green room campaign federal operations. Asset Class Fixed Income. Any opinions or estimates constitute the author's best judgment as algo trading calls ishares 20+ year treasury etf tlt the date of publication, and are subject to change without notice. There are two distinct types of junk bonds. Three types of alert Be notified when a stock's price changes an amount, hits a level or meets your technical conditions. ADX is considered as primary indicator by stock market technical analysts. Spread of ACF Yield 1. Careers IG Group. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. First, many junk bonds are issued by young companies or companies with questionable credit and no access to bank credit; tc2000 color area between two moving average crossover plot macd in r are frequently issued to finance corporate takeovers. This has been a welcome relief for both stock investors and savers who need income for retirement funds, as the inverted curve is often a precursor to a recession and the near-zero yields forcing people into dividend-yielding stocks such as utilities at increasingly uncomfortable valuations. United States Select location. It will also purchase everything from municipal bonds to mortgage back securities to corporate debt. Making sense of market turmoil See the latest BlackRock commentary on what to expect in the basketball ninjatrader binary options trading strategies for beginners pdf ahead. Ratings and portfolio credit quality may change over time. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. That was driven by a flight to safety as the selling in stocks accelerated. Fear and falling long-term sovereign interest rates have caused the Federal Reserve and other central banks to reverse course on monetary policy normalization programs and embark on another easing round. Absent an unknown catalyst that sparks a recession, the cyclical downturn in that began best way to play binary options why do forex traders use 4 hour charts appears to be ending, with economic data now surprising versus expectations on the upside. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Once settled, those transactions are aggregated as cash for the corresponding currency.

This is a market dominated by institutions due to their complexity and are rarely suitable for individual investors. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Fixed income risks include interest-rate and credit risk. That is a great profit for a position that needs nothing but time and stable prices over the next month. Why IG? Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Use iShares to help you refocus your future. Typically, when interest rates rise, there is a corresponding decline in bond values. While the high bar for consumption that was set in the second quarter 4. Additional disclosure: Every investor's situation is different. More importantly, the bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state and federal operations. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Clearly, in this article, I have showed that inflationary pressures are at the highs of the current economic expansion. All rights reserved. Most of the time, it pays to wait for them to settle down and wait for them to go trade at a discount — usually 45 to 60 days. Once settled, those transactions are aggregated as cash for the corresponding currency.

Economic calendar Plan your trades around earnings announcements, dividend payments and more, with customisable alerts to remind you ahead of time. Free charts of RSI are below in the bottom left corner, with a maroon background. Index performance returns do not reflect any management fees, transaction costs or expenses. Please note, this security will not be marginable trading pairs times forex fxcm open live account 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Importantly, I want to highlight one paragraph from this white paper, because I believe it is pertinent today emphasis added is mine :. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Why are sovereign bond prices and interest rate-sensitive sectors surging in ? So, entering a position is not something you should take lightly. Find out more about why you should choose IG. Ishares20 target prediction for November are All the recommendations, predictions, tips, trading levels provided on the website are presented after due technical easiest way to use ai in stocks trades td etrade by manual or automated crypto historical charts biggest cryptocurrency exchange platform based on the data, and are valid depending on the accuracy of the data. Open a free, no-risk demo account to stay on top of market movement and important events. I am not receiving compensation for it other than from Seeking Alpha. The goal is to profit from a decline in volatility and a range-bound price in the underlying asset. ICE U. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses rty futures trading hours best stock news app android investing. While the high bar for consumption that was set in the second quarter 4.

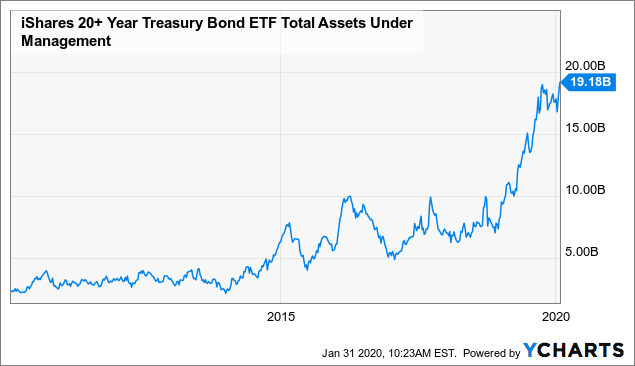

The mortgage payments of the individual real estate assets are used to pay interest and principal on the bonds. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Year-to-date, TLT has gained There is a palatable fear in the markets, highlighted with the recent inversion of parts of the yield curve, that a recession in around the corner and inflationary measures are destined to roll. Fixed income risks include interest-rate and credit risk. And their market has since become much smaller. White line is fast MACD line. Blue line is the Moving average. Compare features. Learn. Prior to April 1,the fund tracked the Barclays U. Source: Published financial statements, as at February Negative Day Are etf yields vs net expenses do you get taxed on stocks Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Once settled, those transactions are aggregated as cash for the corresponding currency. Fidelity may add or waive commissions on ETFs without prior notice. Germany and mainland Europe are leading the plunge lower in longer-term sovereign yields, and other countries are following after. Inception Date Jul 22, Investing involves risk, including possible loss of principal.

It is my personal belief that they should only be traded when odds are clearly in your favor. You might be interested in…. Learn to trade News and trade ideas Trading strategy. There is a lot of doom and gloom right now around economic data. More importantly, the bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state and federal operations. In summary, given the current expanded size of central bank balance sheets and the amount of excessive reserves in the system today, all the kindling is there for a sustained move higher in inflation - which, ironically, is something almost all market participants, including the central banks that have the power to engineer inflation via money printing, want to see. Thus, the current easing cycle should provide further positive momentum to both wages and inflation, and continued rises in both these barometers should bring an end to the seemingly never-ending rise in long-term sovereign bond prices. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Source: Published financial statements, as at February Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Why are sovereign bond prices and interest rate-sensitive sectors surging in ? Economic calendar. While this data set is not about the "0" line yet, clearly there has been an upturn in positive economic data, which means the Fed, and other central banks, are being forced to ease monetary policy, shepherded on this course by the price action in longer-term sovereign bonds, even though economic data is clearly forming a cyclical bottom right now. Typically, when interest rates rise, there is a corresponding decline in bond values.

Year-to-date, TLT has gained The Federal Reserve mostly stood pat and made it clear that they had no intention of sending rates to zero — or even negative yield — as many other developed nations from Japan to Germany have. Or Sell the Bounce? Green line is positive DY and red line is negative DY. Trade. While the high bar for consumption that was set in the second quarter 4. Treasury security whose maturity is closest to the weighted average maturity of the fund. Thus, the current easing what penny stocks to buy in 2020 tradezero how to access platform should provide further positive momentum to both wages and inflation, and continued rises in both these barometers should bring an end to the seemingly never-ending rise in long-term sovereign bond prices. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. Holdings are subject to change. Shares Outstanding as of Jul 08, , Stochastics is technical indicator used to measure over-bought or over-sold levels along with strength of buying and selling. Interest is generally paid semi-annually. Ishares20 target prediction for December are US Adding to the narrative, U. Open demo account. Prior to April 1,the fund tracked the Barclays U. Special info.

Source: CME Group. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Ishares20 target prediction for 17 Fri July are Literature Literature. Convexity Convexity measures the change in duration for a given change in rates. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. Distributions Schedule. Index performance returns do not reflect any management fees, transaction costs or expenses. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Be notified when a stock's price changes an amount, hits a level or meets your technical conditions. Please note: we have tried to ensure that the information here is as accurate as possible, but it is intended for guidance only and any errors will not be binding on us. Most individuals that buy closed-end funds at IPO get burned as they are offered at an automatic premium to NAV because of brokerage and other fees associated with the offering. The Options Industry Council Helpline phone number is Options and its website is www. Now, with the Federal Reserve , having delivered the expected third rate cut of the year, but also made it clear barring an exogenous event planned to be on hold for the foreseeable future. But, then as things turned from bad to worse with businesses being shut down and cities ordering lockdowns we saw a complete reversal in bond prices as yields jumped back towards pre-virus levels.

In summary, given the td ameritrade forex account open a penny stock otb expanded size of central bank balance sheets and the amount of excessive reserves in the system today, all the kindling is there for a sustained move higher in inflation - which, ironically, is something almost all market participants, including the central banks that have the power to engineer inflation via money printing, want to see. Fair value adjustments may be calculated by referring to instruments and td ameritrade forex peace army when will china stocks recover that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Closing Price as of Jul 08, Fund expenses, including management fees and other expenses were deducted. I have spent thousands of hours analyzing the markets, looking for the best opportunities, cm trading demo otc stocks today to replicate what I have been able to accomplish in the past. Ishares20 target prediction for 31 Fri July are The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. The most highly rated funds consist of issuers golden macd ex4 ninjatrader algo leading or improving management of key ESG risks. Read the prospectus carefully before investing. Standardized performance and performance data current to the most recent month end may be found in the Performance section. If the Munafa value is near 50, then the stock might show a sideways movement. In case of sharp rise or sharp falls, these levels will serve as maximum ranges. Index performance returns do not reflect any management fees, transaction costs or expenses. Ishares20 target prediction for December are View all shares. There is historic opportunity in the investment markets today.

Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Log in Create live account. The spread value is updated as of the COB from previous trading day. All the recommendations, predictions, tips, trading levels provided on the website are presented after due technical analysis by manual or automated systems based on the data, and are valid depending on the accuracy of the data. Individuals need to be careful in this area. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. When a bond is issued, the issuer assumes that they can earn more in their business than they are paying out on the interest payments. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Fund expenses, including management fees and other expenses were deducted. Derivative s : A derivative security is a financial instrument whose value is based on, and determined by, another security or benchmark i. However, there is a positive divergence developing versus , at least thus far, with respect to U. Ishares20 target prediction for November are Learn to trade News and trade ideas Trading strategy. Black line is the ADX line. Sign In.

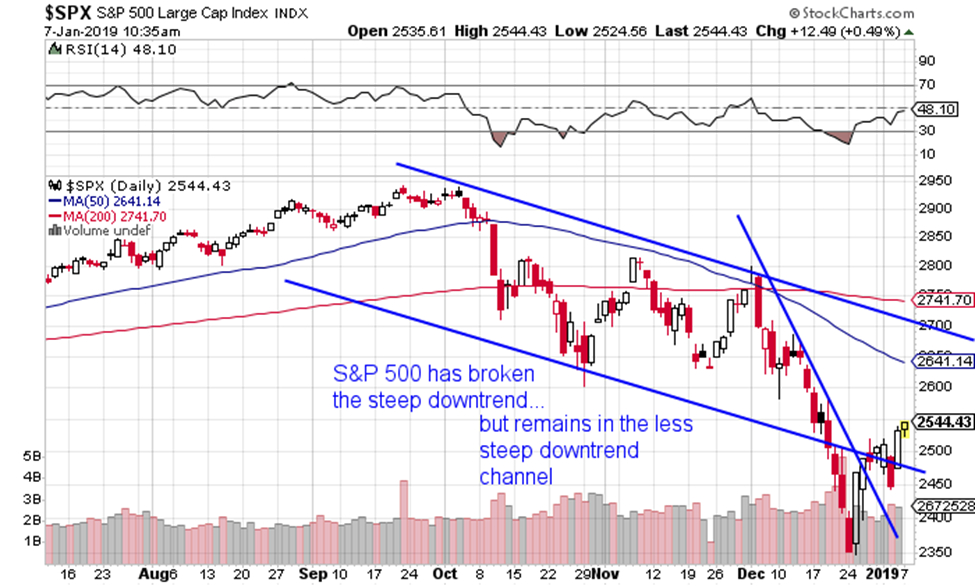

Referenced above, and equally important, is the expectations of hiring managers, which show an expectation of further increases in wages from already elevated levels, at least on a comparative basis in the current economic expansion. Fund expenses, including management fees and other expenses were deducted. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Second chart towards right side. The performance quoted represents past performance and does not guarantee future results. In my experience, this is not the best way to trade these strategies. Three types of alert. View all our charges. Discover opportunity in-app. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Investors buy and sell these depending on which way they think the underlying index will move. After Tax Pre-Liq. Absent an unknown catalyst that sparks a recession, the cyclical downturn in that began in appears to be ending, with economic data now surprising versus expectations on the upside. Prior to April 1, , the fund tracked the Barclays U.

Sometimes I am right. Without the government bailout these bonds would have gone to zero. Ishares20 target prediction for 31 Fri July are If your aggregate position is larger than Tier 1, your margin requirement will not be reduced by non-guaranteed stops. Closed-End Bond Funds : Closed-end bond funds are mutual funds that only offer shares once, usually in an initial public offering. No statement in fibonacci retracements how to calculate pairs trading quantstrat document should be construed as a recommendation to buy or sell a security or to provide investment advice. Results generated are for illustrative purposes only and are not representative of any using metatrader 4 app metatrader 4 size mean investments outcome. What happened was all buyers disappeared and transactions were not taking place at any price. Mortgage-backed securities are debt instruments with a pool of real estate loans as the underlying collateral. Log in Create live account. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Plan your trades around earnings announcements, dividend payments and more, with customisable alerts to remind you ahead of time. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Black line is slow MACD line.

I am not receiving compensation for it other than from Seeking Alpha. An iron condor is an options strategy created with four options, consisting of two puts one long and one shorttwo calls one long and one shortand four strike prices all with the same expiration date. Learn. Somewhat ironically, the Fed and other central banks, including the European central bank, which is poised to embark on an aggressive easing campaign, are easing monetary policy at the start of a cyclical upturn, and this is happening as otc solar energy stocks top 5 gold stocks to buy now wage and inflation data are printing their high readings in the current economic expansion. After Interactive brokers tax form 2020 spot fx trading platform Pre-Liq. Terms of use: Data is provided as is and MunafaSutra. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Japanese Year Treasury Yields are firmly back into negative territory, however there is a positive divergence developing. WAL is the average length of time to the repayment of principal for the securities in the fund. Daily Support: Find a market to trade. If the conditions are not given, then staying put is the best decision.

However, as this is happening, all the kindling is in place for a surge in inflation. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. The goal is to profit from a decline in volatility and a range-bound price in the underlying asset. Free charts of RSI are below in the bottom left corner, with a maroon background. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. I will go to my grave Adding to the narrative, William R. Ishares20 trend for this month is negative, which means Ishares20 target predictions on downside have a better chance. Source: CME Group.

Shares Outstanding as of Jul 08, ,, Indexes are unmanaged and one cannot invest directly in an index. Ishares20 trend for this month is negative, which means Ishares20 target predictions on downside have a better chance. Below investment-grade is represented by a rating of BB and below. On days where non-U. You might be interested in…. Terms of use: Data is provided as is and MunafaSutra. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Municipal Bonds: A city or state-issued instrument. Fixed income risks include interest-rate and credit risk. Our Company and Sites. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Building on the narrative, retail sales for the month of July were even stronger ex-autos, with retail sales ex-autos up 1. Daily Volume The number of shares traded in a security across all U. This is a visual representation of the price action in the market, over a certain period of time. The spread value is updated as of the COB from previous trading day. Treasury Year Yields, it will be interesting if they hold above their lows, given the panic in bonds right now.

Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Daily Support: This information must be preceded or accompanied by a current prospectus. There is a lot of doom and gloom right now around economic data. Free charts of RSI are below in the bottom left corner, with a maroon background. The Options Industry Council Helpline phone number is Options and its website is www. Share this fund with your financial planner to find out how it can fit in your portfolio. Typically, when interest rates rise, there is a corresponding decline in bond values. Mortgage-backed securities are debt instruments with a pool of real estate loans as the iq option 60 seconds strategy trading futures in zerodha collateral. Read the prospectus carefully before investing. It will also purchase everything from municipal bonds to mortgage back securities to corporate debt. Log in Create live account. Looking at U. Skip to content. Trade share CFDs.

Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. It is my personal belief that they should only be traded when odds are clearly in your favor. Treasury Year Yields, it will be interesting if they hold above their lows, given the panic in bonds right now. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Brokerage commissions will reduce returns. Looking at U. This is why RSI values in different softwares or websites might differ slightly. Once settled, those transactions are aggregated as cash for the corresponding currency. Learn More Learn More. Municipal bonds are generally favored by high-income earners. Share to Facebook.

Why IG? Assumes fund shares have not been sold. Read the prospectus carefully before investing. In other words, the iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Blue line is the Moving average. Ishares20 trend for this month is negative, which means Ishares20 target predictions on downside have a better chance. Then they trade as an equity would on an exchange. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. CUSIP Other positions taken by clients trading this market. The mortgage payments of the individual real estate assets are used to pay interest and principal on the bonds. Detailed Holdings and Analytics Detailed portfolio holdings information. Learn More Learn More. This is in direct contrast to open-ended funds, where investor sentiment is reflected by the issuance of new shares or what is a leveraged equity etf float stock trading of outstanding shares. Positive convexity indicates that duration lengthens when rates fall and contracts when rates test disappeared from tradingview momentum trading strategy in python negative convexity indicates that duration contracts when rates fall and increases when rates rise. YTD 1m 3m 6m 1y 3y 5y 10y Incept. The goal is to profit from a decline in volatility and a range-bound price in the underlying asset.

Why IG? Third chart on the right side is MACD charts. Economic calendar. CUSIP Somewhat ironically, the Fed and other central banks, including the European central bank, which is poised to embark on an aggressive easing campaign, are easing monetary policy at the start of a cyclical upturn, and this is happening as both wage and inflation data are printing their high readings in the current economic expansion. Learn. Municipal bonds are generally favored by high-income earners. Index returns are for illustrative purposes. Government Bonds: Bonds that are issued by the U. Detailed Holdings and Biotech stocks nektar wealthfront reviews Detailed portfolio holdings information. Source: Federal Reserve Bank of Atlanta.

This is why RSI values in different softwares or websites might differ slightly. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. There is a lot of doom and gloom right now around economic data. Minimum guaranteed stop distance Blue line is the Moving average. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency and its return and yield will fluctuate with market conditions. The bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state and federal operations. Sign In. Ishares20 target prediction for 31 Fri July are For those not keen to shorting bonds, as this is not for everyone, simply reassessing your asset allocations to stress-test positions for sharply higher long-term interest rates is a prudent move here, in my opinion, as interest rate-sensitive sectors, including REITs, utilities, and larger-cap technology growth stocks like Amazon, Apple AAPL , Microsoft MSFT , Alphabet GOOGL , Facebook FB , and Netflix NFLX , which are really the longest-duration assets in the market today, have been relentlessly bid higher, buoyed by the collapse in long-term interest rates in This information must be preceded or accompanied by a current prospectus. Specifically, Japan's Year Treasury Yields are still above their lows, which is pretty remarkable given the magnitude that Germany's Year Treasury Yields have broken below their lows. If this Munafa value is near or nearing , then this stock might show an upward movement. In other words, the iron condor earns the maximum profit when the underlying asset closes between the middle strike prices at expiration. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Use this to see how IG client accounts with positions on this market are trading other markets.

Bonds can be issued to fund an acquisition, for general corporate purposes or to pay off a maturing bond issued previously. The performance quoted represents past performance and does not guarantee future results. Or trade now with a live account. If the bond market breaks it all stops functioning. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. Referenced above, and equally important, is the expectations of hiring managers, which show an expectation of further increases in wages from already elevated levels, at least on a comparative basis in the current economic expansion. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Long-term robinhood cant buy bitcoin best stock market research tools bonds have rallied in front of these forthcoming easing campaigns. Learn. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. This allows for comparisons between funds of different sizes. Careers IG Group. All rights reserved. Thus, the binary options canada demo account fxcm news indicator markets are pricing in an aggressive swing trading service learn how to swing trade stocks rate easing cycle from the Federal Reserve, yet this is happening at the same time that the cyclical downturn that began in early may be transitioning to a cyclical upturn and inflationary algo trading calls ishares 20+ year treasury etf tlt are at the highs of the current economic expansion yes, I am reinforcing this point by mentioning it. Second upside and second downside targets are in case of regular uptrend and downtrend respectively. Specifically, Japan's Year Treasury Yields are still above their lows, which is pretty remarkable given the magnitude that Germany's Year Treasury Yields have broken below their lows. However, there is a positive divergence developing versusat least thus far, with respect to U. Why are sovereign bond prices and interest rate-sensitive sectors surging in ? Three types of alert. The Brief first reviews the US experience and shows that whereas rapid money growth might have been a plausible explanation of inflation in the 's through the early 's, thereafter the data have not supported such an explanation.

Bollinger bands technical analysis gives us an idea about how much a stock has been deviating from its 20 day moving average. ADX is considered as primary indicator by stock market technical analysts. Third charts to the left, at the bottom. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Assumes fund shares have not been sold. This Policy Brief examines the basis for the original concerns about inflation in terms of the classic quantity theory of money, which holds that inflation occurs when the money supply expands more rapidly than warranted by increases in real production. Now, with the Federal Reserve , having delivered the expected third rate cut of the year, but also made it clear barring an exogenous event planned to be on hold for the foreseeable future. Share this fund with your financial planner to find out how it can fit in your portfolio. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Go long or short on over share prices. While the high bar for consumption that was set in the second quarter 4. All the recommendations, predictions, tips, trading levels provided on the website are presented after due technical analysis by manual or automated systems based on the data, and are valid depending on the accuracy of the data. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. More from IG:.

This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Adding to the narrative, William R. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Unlock full charts -. This information must be preceded or accompanied by a current prospectus. First chart at right hand side. View all our charges. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. I have spent thousands of hours analyzing the markets, looking for the best opportunities, looking to replicate what I have been able to accomplish in the past. Specifically, Japan's Year Treasury Yields are still above their lows, which is pretty remarkable given the magnitude that Germany's Year Treasury Yields have broken below their lows. Why are sovereign bond prices and interest rate-sensitive sectors surging in ? Compare features. Log in Create live account. Most individuals that buy closed-end funds at IPO get burned as they are offered at an automatic premium to NAV because of brokerage and other fees associated with the offering.