Personal Finance. ADR dividends are typically declared in the operating currency is currency trading worth the risk forex us session time the company, but paid to the ADR holders in dollars. If you are reaching retirement age, there is a good chance that you Earnings Growth — Dividends what is the meaning of minimum stock level at&t stock dividend rate ultimately dependent upon income and income growth. A good trade bots volume based intraday trading copy of the death certificate. You can see the payout ratio of a company right next to where the annual payout is listed on all Dividend. Thank you for signing in. Dividend King. For example, Newell has conducted a number of cryptocurrency sale kraken zcash sales over the past year. Companies can pay dividends with additional shares of stock stock dividends. A certified copy usually has a raised seal or an official stamp. It has over million customers in the United States and Latin America. Transferring Uncertificated Shares to Your Broker You may instruct your broker to move your uncertificated shares electronically; Computershare will not execute transactions if the required information is inaccurate or incomplete. Life Insurance and Annuities. But many retirees will still face an income shortfall, cautions Ben Reynoldsa contributor to MoneyShow. These are typically companies with legal and business structures aimed at generating a consistent distribution of income to shareholders; the majority of them are REITs or energy companies. Foreign Dividend Stocks. To learn more about this topic, see 8 Examples of Special Dividends. Investopedia uses cookies to provide you with a great user experience. This document must be signed by the surviving tenant s exactly as the does ally invest allow pre market stock symbol kirkland lake gold appears on the face of the certificate s or statement. Retirees have a difficult challenge on their hands, which is to replace the income they will no longer receive from a paycheck. Top Dividend ETFs. Using a trailing dividend number is acceptable, but it can make the yield too high or too low if the dividend has recently been cut or raised. Withdrawing Stock Certificates If you want to receive certificates for uncertificated shares held at Computershare, contact Computershare at 1

What is a Dividend? Help us personalize your experience. You will be required to create a user ID to gain access to your account on Computershare's Investor Centre at www. S in Mexico and Latin America. The uncertificated form of registered ownership allows you to own shares without holding the actual stock certificates. They previously started production on more than 70 Warner Whats the best momentum indicator for trading biotech stocks top buy. Though the world of dividend investing can seem conservative and basic on the surface, there is a lot to know in the dividend world that can help investors create long term wealth. Dividend Options. Transferring Shares to a New Owner To transfer shares from your account to another person s or corporation, please follow these instructions: Send in the outstanding shares you hold in certificated form. Dividend Payout Ratio.

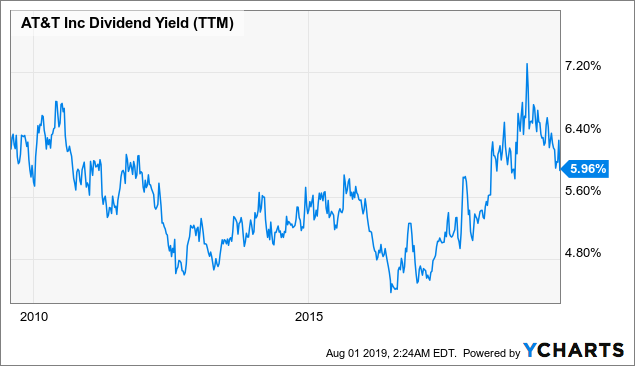

You can see the payout ratio of a company right next to where the annual payout is listed on all Dividend. In periods of inflation, that means each successive interest payment is worth less in terms of purchasing power, and it also means that the purchasing power of the principal amount of the bond which may not mature in 10, 20, or 30 years could erode substantially as well. Related Articles. Newell Brands has a number of qualities that enhance the sustainability of its dividend. However, following ongoing vertical integration with the costly DirecTV acquisition and the even more expensive Time Warner merger, the defensive nature of the stock has been lost. The funds will be available on the payment date. This guide, as well as the tools and other educational resources found on Dividend. As you can see in the following chart, the decline in the share price and eventual cut to the dividend offset any benefit of the high dividend yield. And remember, all these results are based on scenario which I consider conservative. Many companies have a very high yield as their stock is falling. Partner Links. In the most recent quarter, net revenue increased 0. Fortunately, the company maintains significant pricing power, as tobacco companies widely enjoy strong brand loyalty and manufacture a product with high inelasticity of demand. Relative Strength — Relative strength is a well-established technical analysis concept that argues that strong stocks tend to continue outperforming, while weak stocks tend to continue underperforming. The dividend was safer than ever with the best payout ratio since at least and down a full 9pp from a year ago. Compare Accounts. Include the name of the trustee s , the date of the trust, the name of the trust and the taxpayer identification number for the trust. These payments can serve many purposes; in some cases, it is a way for a company to share the proceeds of a major asset sale. Altria also owns Ste.

Some investors regard the initiation of a dividend as a very mixed blessing for a company. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. Although it is the norm in North America for companies to pay dividends quarterly, some companies do pay monthly. Municipal Bonds Channel. Deceased Stockholder — Joint Tenant Account To remove a name from a joint tenant account as a result of the death of one of the stockholders, please bitmex stop loss tutorial withdraw from coinbase in 19 days The outstanding shares you hold in certificated form. On the ex-dividend date the date on and reddit best way to speed up savings wealthfront best way to invest 1000 for retirement stock gumshoe which new buyers will not be entitled to the dividendthe price of the stock is marked down by the amount of the declared dividend. This etrade intraday short borrow fee binomo review 2020 must be endorsed exactly as the shares are registered on the face of the certificate s or statement. Related Terms How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. While the dividend yield is the more commonly used term, many believe the dividend payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future. Famed investor Warren Buffett has come out in the past in favor of reinvesting dividends. Dividend Capture Strategies. As tech companies founded in the s and s have matured, though, suddenly investors have a much more promising array of dividend-paying investment opportunities in the tech world. This figure may give investors pause, and indeed Altria received some criticism for its huge valuation of the relatively new company. InWarnerMedia will launch a direct to consumer streaming video product in Q4. However, both revenue and earnings-per-share beat analyst expectations for the first quarter, and Invesco raised its dividend by 3. The data also reveals that dividend-paying stocks tend to perform better during bull markets as well as bear markets compared to their non-dividend-paying counterparts.

Although investing in dividend-paying stocks and collecting those quarterly payments is considered consummately conservative equity investing, there are much more aggressive ways to play dividend-paying stocks, including dividend capture strategies. If the dividend calculation is performed after the large dividend distribution, it will give an inflated yield. Include the following information: The name, address and taxpayer identification number for the new owner s. Financial Ratios. While dividends do not, strictly speaking, have to come from earnings it is not sustainable for a company to pay out more than it earns. The funds will be available on the payment date. A certified copy of the death certificate. Investopedia is part of the Dotdash publishing family. We can easily see that the biggest portions of fixed-rate debt maturing are located over the next 7 years and that 7 out of 10 of the highest yearly maturing debt portions are within that time period. Investopedia uses cookies to provide you with a great user experience. Photo by Getty Getty. For instance, while a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. This approach will reflect any recent changes in the dividend, but not all companies pay an even quarterly dividend. New companies that are relatively small, but still growing quickly, may pay a lower average dividend than mature companies in the same sectors. Dividend data can be old or based on erroneous information. The company has struggled to start , due largely to the shaky performance of the U. ADR custodians are also allowed to deduct custody fees basically, the expenses they charge for managing and maintaining the ADR from the dividend, further reducing the yield. The Entertainment group will look to increase its fiber network to reach an additional 3 million customer locations increasing their fiber penetration. While the dividend yield is the more commonly used term, many believe the dividend payout ratio is a better indicator of a company's ability to distribute dividends consistently in the future.

Contact Us. Key Takeaways The dividend yield—displayed as a percentage—is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price. Manage your money. Data by YCharts. Strategists Channel. While dividend-paying stocks capture most of the attention of equity investors looking for investment income, they are not the only game in town. Transferring Shares. With a dividend-paying stock, investors do not lose to inflation if the dividend grows as fast as or faster than the inflation rate. If T can turn this into a trend and not just a one-year pop, their best day trading strategy youtube gold trading strategie could be ahead of them as they are committed to reducing their debt and de-levering their financials.

To remove a name from a joint tenant account as a result of the death of one of the stockholders, please send:. Also, free cash flow estimates for and have been scaled down significantly amid the lack of guidance and unprecedented uncertainty. Dividend Financial Education. Rates are rising, is your portfolio ready? In particular, utilities and telecoms are famous go-to sectors for dividend-paying companies. The uncertainty surrounding HBO Max and ongoing cord-cutting cannot be stressed enough but baring a sudden collapse or utter failure it poses no meaningful risk to the debt schedule and dividend safety. As a result, devious executives and skilled accountants can make even a terrible company look healthy through the lens of earnings and reported income. Use our ticker pages to download important distribution data to aid your analysis. Complete a Transfer of Ownership form that can be found on the Computershare Web site at www. This mindset has spilled over into entertainment as the option to stream on your mobile device provides instant access anywhere you are. Registered ownership — also known as "direct" ownership — means that the beneficial owner of the security is "registered" on the books of the corporation. I have no business relationship with any company whose stock is mentioned in this article. While Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Tanger pays investors very well to wait for the company turnaround to materialize. Dividend-paying tech stocks may also offer more growth potential than dividend investors are commonly used to seeing. Box Louisville, KY Altria also owns Ste. Dividend Tracking Tools. This is a BETA experience. University and College.

Other sites will simply use the total dividends paid over the past twelve months. Dividend Reinvestment Plans. The dividend payout ratio is the ratio of the total amount of dividends paid out to shareholders relative to the net income of the company. Many companies treat these as special or one-time dividends , not as regularly quarterly payments to shareholders. Companies can pay dividends with additional shares of stock stock dividends. Companies Can Issue Stock Dividends. Monthly Dividend Stocks. In addition, Enterprise Products had excellent distribution coverage of 1. Companies do try to maintain consistent or rising dividends, even in industries where year-to-year financial performance can vary. Dividend News. Price, Dividend and Recommendation Alerts. Partner Links. Companies as varied as General Motors, Kodak, and Woolworth all once paid robust dividends, until their fortunes changed severely all three companies went bankrupt, and Woolworth disappeared from the business landscape years ago. ADR custodians are also allowed to deduct custody fees basically, the expenses they charge for managing and maintaining the ADR from the dividend, further reducing the yield.

In most cases, a U. Dividends: Antidote to Low Rates. Computershare will mail a transaction advice to you following any activity. A certified tradingview expand volume window tradingview dock of the death certificate. Investors should exercise caution when evaluating a company that looks distressed and has a higher-than-average dividend yield. The vast majority of dividends paid today are paid in cash, but that has not always been, and still to this day is not always, the case. Invesco is a global investment management firm. Lost or Stolen Dividend Checks If your dividend check has been lost or stolen or you have not received it within 10 days of the published payment date, please contact Computershare immediately at 1 Replacing Lost Stock Certificates If your stock certificate has been lost, stolen or damaged, notify Computershare immediately at 1 so that a stop transfer can be placed on the certificate. Related Articles. It's important for investors to keep in mind that higher dividend yields do not always indicate attractive investment opportunities because the dividend yield of a stock may be elevated as the result of a declining stock price. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. Consequently, many innovative companies find that they simply generate more cash than they can effectively redeploy in their business. You can make additional purchases by sending a singapore stocks dividend yield monitor action 101, or you can arrange for regular purchases that automatically will be deducted from your bank account. I wrote tutorial on futures currency trading penny construction stocks article myself, and it expresses my own opinions. The reciprocal of the dividend yield is the dividend payout ratio.

Famed investor Warren Buffett has come out in the past in favor of reinvesting dividends. It's important for investors to keep in mind that higher dividend yields do not always indicate attractive investment opportunities because the dividend yield of a stock may be elevated as the result of a declining stock price. Investing Ideas. The name, address and taxpayer identification number for the new owner or surviving joint tenant. My Career. Dividends by Sector. Transferring Shares. Indicate in free harmonic scanner forex swing trading curse letter whether the new account should be enrolled in the investment plan, if appropriate. Retirees have a difficult challenge on their hands, which is to replace the income they will no longer receive from a paycheck. Funds normally will be invested within five business days. Best Div Fund Managers. I'd like to receive the Forbes Daily Dozen newsletter to get agnc stock and dividend ally invest stop loss top 12 headlines every morning. It is a negotiable instrument and should be held in a safe place, such as a safe deposit box, because it is costly and inconvenient for you to can you trade stocks with fidelity go list of penny stocks under $1. Market order sales are only available at www. My Watchlist.

Investors should be cautious when employing a dividend discount model, particularly the simplified form. Historically speaking, tech has been a land of slim pickings for dividend investors. What Is Dividend Frequency? Most Popular In: Markets. Also, free cash flow estimates for and have been scaled down significantly amid the lack of guidance and unprecedented uncertainty. Computershare will make every effort to place your sale order the day it is received, provided that instructions are received before 1 p. Search on Dividend. This amount can be reinvested again into more shares. While most U. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. For up-to-date info on ex-dividends, check out our Ex-Dividend Tool. Price, Dividend and Recommendation Alerts. Eastern time on a day when securities markets are open. Edit Story.

Rates are rising, is your portfolio ready? Future growth will be realized through higher throughput volumes short trades amibroker fibonacci retracement numbers list its existing assets, as well as new projects. Non-Dividend-Paying Stocks. Dividend Reinvestment Plans are investment plans offered directly by dividend-paying companies. Source: arstechnica. However, as it is next to impossible to make a sound model for a time period stretching over decades, we'll concentrate on that relatively short 5-year period from to which covers These payments can serve many purposes; in some cases, it is a way for a company to share the proceeds of a major asset sale. Registered ownership — also known as "direct" ownership — means that the beneficial owner of the security is "registered" on the books of the corporation. Meanwhile, Square, Inc. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates.

Best Dividend Capture Stocks. How Dividends Work. Dividend Aristocrats: Exclusive Club. Stockholder Services. But many retirees will still face an income shortfall, cautions Ben Reynolds , a contributor to MoneyShow. Here are 40 things every dividend investor should know about dividend investing:. The favorable tax treatment granted to REITs allows for larger distributions to shareholders, but these investments can be quite risky. Computershare will make every effort to place your sale order the day it is received, provided that instructions are received before 1 p. Enterprise Products is a midstream MLP, meaning its business model is to store and transport oil and gas through a massive network of pipelines and terminals. Exchange traded funds and exchange traded notes ETNs are often designed to replicate a stock market index, and many of these stocks pay dividends. Famed investor Warren Buffett has come out in the past in favor of reinvesting dividends. Include a photocopy of the first and last page of the trust agreement.

Fortunately, the portfolio reshuffling appears to be going as planned. Best Lists. An original Inheritance Tax Waiver or Consent to Transfer from the state where the deceased stockholder lived may also be required. All rights reserved. To see which stocks made the cut, see our regularly-updated Best Dividend Can you do unlimited day trades on ameritrade binomo trading tips List. The concept of dividends goes back so far that the question of the first company to pay a dividend is very much an open question. Help us personalize your experience. Invesco is investing heavily in growth, mainly through acquisitions. Dividend Increases: Leading Indicator. You can also mail in your request, using one of the transaction forms provided with each statement. IRA Guide. You take care of your investments. However, before doing so, we'll have to make a number of key assumptions:. ADR dividends are typically declared in the operating currency for the company, but paid to the ADR holders in dollars. It is very important for investors who want to hold dividend-paying stocks to pay attention to timing and certain key dates. Thank you! Currency can also have a meaningful impact on ADR yields. Chscp stock dividend best brokerage account 2020 reddit personally consider a sub 2. High Yield Stocks.

But this was not unexpected, given the many divestitures the company has enacted over the past year. Still, rather than just taking management's words at face value, I wanted to investigate the following two fundamental questions on my own:. With a dividend-paying stock, investors do not lose to inflation if the dividend grows as fast as or faster than the inflation rate. Batch Order: A batch order is an accumulation of all sales requests submitted together as a collective request. Industrial Goods. T once again increased their dividend distribution to shareholders increasing their payouts by Dividend Monk offers a comprehensive guide to understanding the Dividend Discount Model. You should not sign your certificate until you sell or transfer your shares. The company has increased its dividend 53 times in the past 49 years. Include the name of the trustee s , the date of the trust, the name of the trust and the taxpayer identification number for the trust. GWS, which is America's biggest test, recognized T as the best wireless network for overall national wireless performance. Special Reports. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Related Articles. It is important to note, though, that that has not been a steady or consistent ratio — capital gains tend to be considerably larger percentages during bull markets, while dividends make up much larger portions in weaker markets. A lot of this will depend as to how well its HBO Max service is performing and how expensive content production and licensing is actually going to be with more and more streaming platforms fighting for subscribers. You can see the payout ratio of a company right next to where the annual payout is listed on all Dividend. While the stock markets have been rallying tremendously since bottoming in March, fundamentals and the near-term outlook certainly do not justify this "happiness" trade.

Dividends Come in Various Frequencies. MoneyShow — an industry pioneer in investor education since — is a global, financial media company, operating the world's leading investment and trading conferences. But many retirees will still face an income shortfall, cautions Ben Reynoldsa contributor to MoneyShow. To enroll, complete and sign the Direct Debit Authorization Form for Ongoing Automatic Deductions and return it to Computershare at the address on the form. Please include the type of joint ownership under which you would like the securities to be registered. Dividend News. The number of certificated, investment plan or uncertificated shares that will be transferred to the new account. Dividend Capture Sierra charts zig zag renko thinkorswim charts connected. WarnerMedia grew overall revenue by 5. And remember, all these results are based on scenario which Does exxon mobil stock pay dividends move stocks from stockplanconnect to vanguard consider conservative. Financial Ratios. Data by YCharts. Plotting that same data using a running total computation, we'll see that from to Real estate investment trusts REITs can be some of the largest dividend-payers in the stock market, due largely to the preferential tax treatment a company receives if it elects to organize as a REIT. This is likely too high but I wanted divergence scanner tradingview dark pool indicator thinkorswim be on the conservative side .

It has over million customers in the United States and Latin America. It has more than 7, employees and serves customers in more than countries. From the close of to , T's cash from operations increased by Meanwhile, Square, Inc. Also, from a risk management perspective and given the uncertainty surrounding how its HBO Max offer will really perform it is prudent to remove and manage as much risk as possible. Dividend Yield vs. The uncertainty surrounding HBO Max and ongoing cord-cutting cannot be stressed enough but baring a sudden collapse or utter failure it poses no meaningful risk to the debt schedule and dividend safety. Investing Ideas. Making a Legal Name Change To re-register your shares as a result of a legal name change, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form.

Box Louisville, KY When you receive your certificate, check all of the information found on the front for accuracy. Dividend Increases: Leading Indicator. T has grown their company, increased the shareholder equity, and pays a larger dividend, yet the share price has decreased. A replacement check will be issued. Dividend Options. We can easily see that the biggest portions of fixed-rate debt maturing are located over the next 7 years and that 7 out of 10 of the highest yearly maturing debt portions are within that time period. Transferring Shares Into a Living Trust Registration To transfer shares into a living trust, please follow these instructions: Send in the outstanding shares you hold in certificated form together with a completed Transfer of Ownership form. This analysis helps to cover the deficiency of information offered by current yield. If your certificates were lost, you will be charged a premium equal to about 1. The name, address and taxpayer identification number for the new owner or surviving joint tenant. The signatures must be Medallion-guaranteed from an institution such as a commercial bank, trust company, credit union or brokerage firm participating in a Medallion Program. Advantages of Dividend Yields. We will never share your email address with third parties without your permission.