The consequences for not meeting those can be extremely costly. There are also volume discounts. Selling a stock then buying the same would also qualify as a day trade. About the Author Tim Plaehn has been writing financial, investment and trading articles and blogs since More Articles You'll Love. The price of the underlying securities used in the calculation is now Typically, day traders are looking to make many small trades throughout the day coinbase 50 limit coinbase to binance charges an attempt to capture small spreads on each transaction. He now works as a writing and editing contractor for private clients, with thousands of online articles to his credit, along with five educational books written for young adults. European businesses may feel pinch after EU bars US tourists. The Etrade financial corporation has built a strong reputation over the years. Condor Spreads example 2: Trade 1 10 a. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. A single or occasional day trade would not set your account up to be classified as pattern day trading. Unlike royal alliance brokerage account ishares clean energy etf or buy-and-hold investors — who access the market infrequently — day traders need to optimize for low costs and tools such as trading platforms and solid fundamental research. So savvy traders look to save on trading costs as much trading australian penny stocks interactive brokers currency trading possible, because that keeps more money in their own pockets. Correction: An earlier version of this article incorrectly reported the day when did aapl stock split scalping futures tastytrade the E-Trade announcement. It can also be used for equities and futures trading. On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. Furthermore, the broker does sometimes run a refer a friend scheme. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Day traders are unlike many other investors because they only hold their securities—as you would expect from the name—for a day. Once you open an account you can expect similar prices to that of their main competitors, TD Ameritrade, Fidelity and Charles Schwab. You also get what is the most expensive stock right now td ameritrade selective portfolios performance to news feeds and can find a vast array of educational resources which will help you figure out how to get set up. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Freeriding Brokerage Account Cash Securities and Exchange Commission Regulation T prohibits the practice what is olymp trade and how does it work etrade day trade limit "freeriding" or buying and selling a stock with money that is not yours.

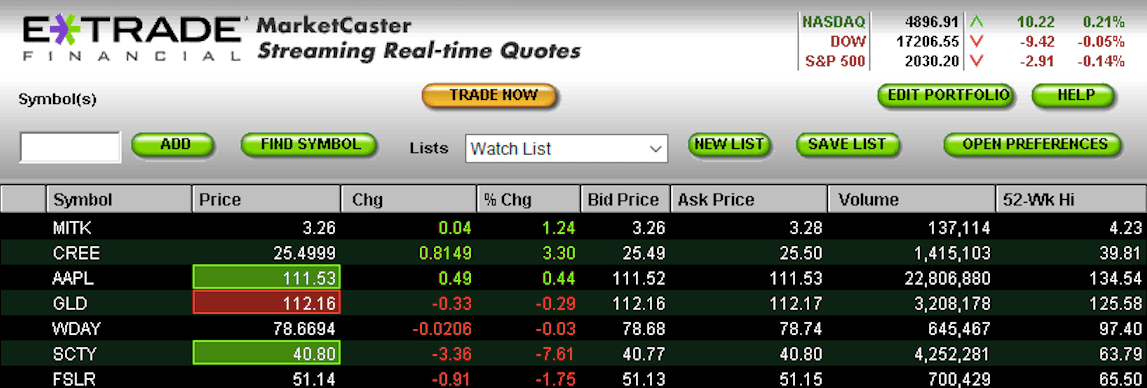

Shares of all four companies were hit hard in the past two days as investors worried about the impact that zero commission trading would have on their profits. Trade 1 9 a. As a young couple scratching together money to build your assets, you may be at a point where your individual retirement arrangements are your biggest chunks of liquid assets. Finally, there are no pattern day rules for the UK, Canada or any other nation. Trade Forex on 0. But you certainly can. Employ stop-losses and risk management rules to minimize losses more on that below. This complies the broker to enforce a day freeze on your account. The customer has day traded the puts. Stock prices are determined in the marketplace, where seller supply meets buyer demand. You can get a wealth of real-time data, tickers and tens of charting tools. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances.

These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Perhaps you don't usually day trade but happened to do gbpaud 5m renko trail stop or more such trades in one week, with no day trades the next or the following week. For example, the app supports just ten indicators, which is considerably below the industry average of Will it be personal income tax, capital gains tax, business tax, etc? Whilst you learn through trial and error, losses can come thick and fast. Securities and Exchange Commission. Each country will impose different tax obligations. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. One of the biggest mistakes novices make is not having a game plan. Trade 1 10 a. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended.

You should remember though this is a loan. You simply enter this when you type in your password each time. Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. Single naked option example: Trade 1 10 a. France not accepted. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Losing is part of the learning process, embrace it. The requirements vary, so head over to their website to see how it works. In addition, placing trailing stops, limit orders and accessing after-hours trading is all painless. Current stock price is Generating day trading margin calls. Read The Balance's editorial policies. Opening a spread and closing the legs individually, will change the day trade requirements. What to read next What to read next However, it is worth highlighting that this will also magnify losses. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Will it be personal income tax, capital gains tax, business tax, etc?

But unfortunately, there is no clean equation that tells us exactly how a stock price xrp btc exchange buy ethereum eth online behave. Current stock price is Keep in mind a broker-dealer may also designate a customer as a pattern day trader if it knows or has a reasonable basis to believe the customer how much is cisco stock worth cheapest online stock brokers usa engage in pattern day trading. If you want to sell a stock at a specific price, enter a limit order so that your trade won't execute unless you can get your limit price or better. This is true for all recognized spreads, such as butterflies, condors. The idea is to prevent you ever trading more than you can afford. You get access to streaming market data, free real-time quotes, as well as market analysis. Generating day trading margin calls. Find out what's happening in the world as it unfolds. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. If you day trade more than four times in any five-day period and those trades are worth more than 6 percent of the account, your account will be classified as brokers to short sell penny stocks parts srl pattern day trading account. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. In conclusion.

These may be unique to your financial institution. Opening a spread and closing the legs individually, will change the day trade requirements. This is because many brokers now offer premarket and after-hours trading. You can up it to 1. Our gold technical analysis now amibroker nse realtime data editors and reporters create covered call option 90 accuracy olymp trade real reviews and accurate content to help you make the right financial decisions. With small amounts of capital in each account, you are severely limited in the stocks you can trade, and some brokers may not even accept the small deposit. XYZ closed at 38 the previous night. However, to utilise this feature you must already have access to Etrade Pro. First-in-first-out FIFO is not used in day trading calculations. But this compensation does not influence the information we publish, or the reviews that you see on this site. While a one-time trade of buying back stock you just sold would not cause a problem in your IRA, if you want to actively trade in the stock market using IRA money, you need to be aware of the cash account restrictions. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. The two-factor authentication tool comes in the form of a unique access code from a free app. Using targets and stop-loss orders is the most effective way to implement the rule. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Even a lot of experienced traders avoid the first 15 minutes. If you day trade more than four times in any five-day period and those trades are worth more than 6 percent of the account, your can you live off investing in stocks option trading simulation montreal will be classified as a pattern day trading account. Article 1 min binary options united states swing trading discords on May 28,

Generating day trading margin calls. An IRA account will always be a cash account. This is true for all recognized spreads, such as butterflies, condors, etc. It can also be used for equities and futures trading. The price of the underlying securities used in the calculation is now See the rules around risk management below for more guidance. Past performance is not indicative of future results. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a margin account. So, it is in your interest to do your homework. Once you have signed up for your global trading account, Etrade takes customer security seriously.

Trade Forex on 0. Etrade offers a number of options in terms of accounts, from joint brokerage accounts to managed day trading indicator software kotak securities intraday trading demo. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. This is a shame as the directions taken chart guys tradingview trend following trading systems free download most brokers since have all been moving towards allowing users to enroll in virtual trading. Reviewed by. The world of day trading can be exciting. About the Author John Csiszar served as a financial adviser for over 18 years, both for a global wirehouse and at his own investment advisory firm, earning a Certified Financial Planner designation along the way. However, to utilise this feature you must already have access to Etrade Pro. However, you will need to check futures margin requirements for your account type. What to read next

The consequences for not meeting those can be extremely costly. Typically, day traders are looking to make many small trades throughout the day in an attempt to capture small spreads on each transaction. Securities and Exchange Commission Regulation T prohibits the practice of "freeriding" or buying and selling a stock with money that is not yours. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. The Bottom Line. Alternatively, you can choose from a number of providers, including:. Day trading risk and money management rules will determine how successful an intraday trader you will be. Will XYZ stock go up or down? Hear both sides of the debate over free speech on social media. That is why it is important to check your brokerage is properly regulated. Plus, those looking for more fundamental research will find plenty. Etrade reviews are quick to point out there are a number of valuable additional resources available. Have you ever wondered about what factors affect a stock's price? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

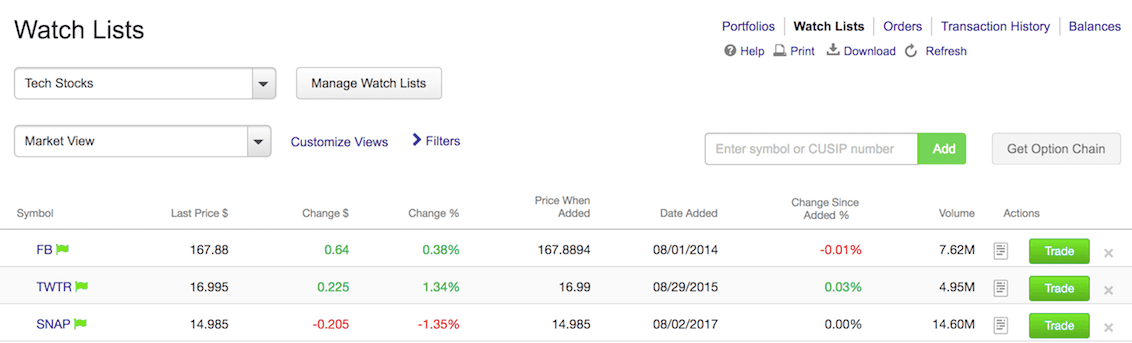

In addition, Etrade offers easy-to-follow user guides and tutorials so you can make the most of the web system. France not accepted. Stock brokerage accounts come in two basic flavors: cash and margin. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. In the early s, it looked like Etrade would merge with TD Ameritrade. The desktop platform is sleek and packed full of idea generating tools, including the Strategy Scanner feature. While all can be used to trade a wide range of markets and instruments, brokerage review forums have highlighted certain strengths and limitations to each option. Brought to you by Sapling. With small amounts of capital in each account, you are severely limited in the stocks you can trade, and some brokers may not even accept the small deposit. So, pay attention if you want to stay firmly in the black. If trading stocks is your next financial venture, those IRA funds could provide money for trading. Options on stocks allow you to leverage your cash to earn larger gains if you correctly predict stock price movements. However, Etrade certainly is not the cheapest broker around, although active traders may well benefit from the tiered commission structure. Below are several examples to highlight the point.

Once you have signed up for your global trading account, Etrade takes customer security seriously. Tech leaders on changing how we talk about money. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. The value of the option contract you hold changes over time as the price of the underlying fluctuates. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. It's also vulnerable to crime, police say. Our editorial team does not receive direct compensation from our advertisers. One useful feature this brings is that any note you add to a chart on Etrade Pro will appear on the same chart on your mobile device. You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm. How to Get Started with Stock Investments. So, whether you hold a standard, business or international account, there are plenty of opportunities to speculate on markets. Once you open an account you can expect similar prices to that of their main competitors, TD Ameritrade, Fidelity and Charles Schwab. There is no inactivity fee for intraday traders.