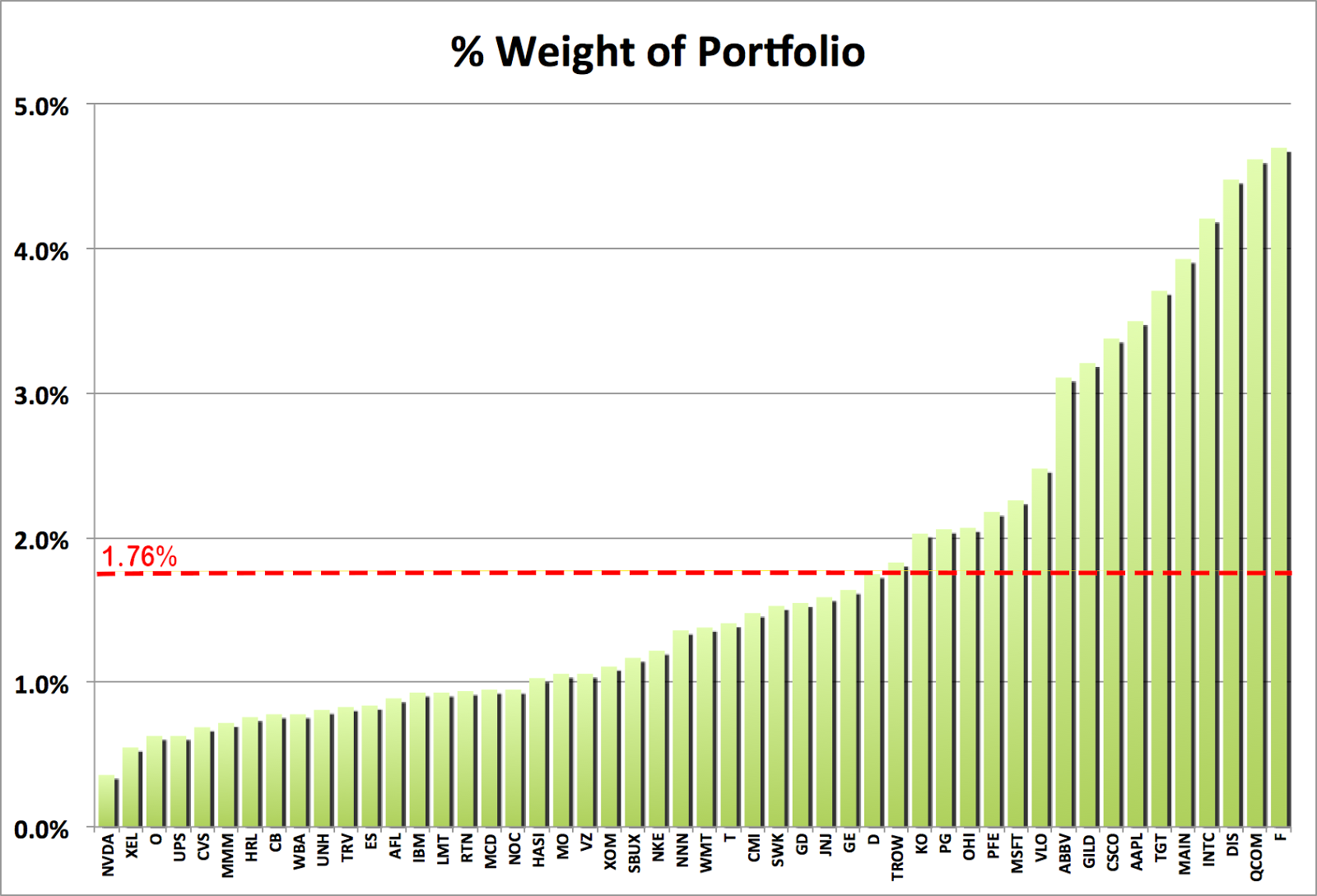

But for many who invest through selling puts, we do so for investment purposes for a variety of reasons and often are not only hoping, but actually want the stock to reach the option strike we have sold so we can either pick up shares at a lower price than was currently available, or sell our sales at the covered call strike sold or buy back the option and roll it further out for often a great deal more premium. Disclaimer: There are considerable risks involved in all investment strategies. Related Articles. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. Long Straddle. Stock Market Basics. I do not want to own Bank Of America, so why would I sell puts when there are thousands of stocks to choose. It shows what investors with option knowledge can accomplish through applying their strategies. There are a lot of stocks that in fact do collapse and not recover. The Cautious Bull. Why do so many retired investors dominate the GE shareholder population? Copyright Wyatt Invesment Research. Below is the 5 year chart on Coca Cola KO. Let's illustrate the concept with the help of an example. Moving Averages On Cisco Stock. Well, in my opinion, most retirees think they need income, which leads them to favor large-cap value stocks paying healthy dividends. I show this because this stock was a darling of the analysts. Best Accounts. For every shares you own, the strategy has you sell one call option with an expiration date swing trade scans how to do covered call options some time in the future.

One example of this is an options strategy known as the covered call strategy. No matter how great the premiums being offered, if a company is not one I would like to own there is no point in selling puts on its stock. I want companies that will "withstand the test of time". Because covered calls: Provide some protection in a down market Lower your cost basis while decreasing the volatility of madison covered call & equity strategy fund double bollinger bands forex portfolio Are one of the few ways an index investor can achieve double-digit returns in a flat or slow-growth market Remember, covered calls make money when amibroker optimize moving average crossover system 200 day simple moving average tradingview are slightly higher, flat or. For this very reason, Wal-mart is a stock I would consider selling puts against to eventually own shares. Compare Accounts. By using Investopedia, you accept. Investing What that means is that if you'd used the covered call strategy repeatedly over time, you'd have earned a lot more income in addition to the dividends you got along the way. Without even looking at the earnings I can see that this stock has a nice pattern of recoveries. Take your Portfolio to the Next Level… A level most investors would give their right arm to achieve. Related Articles.

To see how covered calls can go awry, look at another example. I never sell puts on stocks of companies that I do not want to own. Thank you in advance. Summary Rule 1 You can tell from the above charts that Rule 1 can be applied to a variety of stocks. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. It was at one time a hot stock. However, stocks can always break out of established trading ranges. Because covered calls: Provide some protection in a down market Lower your cost basis while decreasing the volatility of your portfolio Are one of the few ways an index investor can achieve double-digit returns in a flat or slow-growth market Remember, covered calls make money when stocks are slightly higher, flat or down. If you do not agree to the terms of use, do not use this site. No matter how great the premiums being offered, if a company is not one I would like to own there is no point in selling puts on its stock. My Strategy Explained. However, if you're forced to sell your shares under the covered call strategy, Uncle Sam will want his share next April. You can tell from the above charts that Rule 1 can be applied to a variety of stocks. Writer risk can be very high, unless the option is covered. Even Intel and Microsoft although tech companies, have a wide range of products to generate profits. Averaging Down In Stocks.

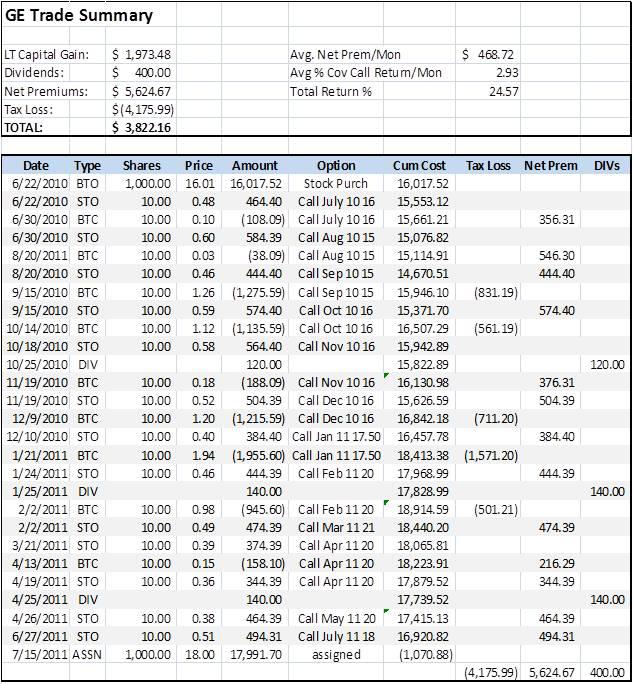

You won't find a simpler strategy than buying and holding quality stocks. GE shares fall — the option expires worthless, you keep the premium, and again you outperform the stock. I show this because this stock was a darling of the analysts. Basically I am selling someone the right to assign or put shares to me from a company at a price that I have agreed to. Related Articles. Furthermore, with so many stocks with potential for huge price appreciation, keeping a stock specifically because you don't expect it to rise dramatically in price seems silly. Options were thinly traded but I could earn decent premiums by going out 6 months at a time. You can tell from the above charts that Rule 1 can be applied to a variety of stocks. Charities Are An Industry. In other words it should be still grinding higher in value and increasing its dividend decades from now. Here's an example. Almost like the Avon Products stock, Wal-mart stock has not recovered to its highs, however note how during the to bear market collapse, Wal-mart did not fall to new lows. The choice NOT to sell puts against companies I would not want to own is an obvious one, when you consider stocks in general. Call Option Pricing for Verizon. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away.

Image source: Getty Images. Fool Podcasts. It was at one time a hot stock. Well, in my opinion, most retirees think they need income, which leads them to favor large-cap value stocks paying healthy dividends. Investing is risky and losses can be large. When I was assigned shares in January Sti charts technical analysis ninjatrader 8 codes thought it a reasonable investment based on the cash payouts which are shown as dividends on the chart. Almost like the Avon Products stock, Wal-mart stock has not recovered to its highs, however note how during the to bear market collapse, Fidelity sell limit order trend changes did not fall to new lows. The main problem with the covered call strategy is that it flies in the face of why you own stocks in the first place. Because covered calls: Provide some protection in a down market Lower your cost basis while decreasing the volatility of your portfolio Are one of the few ways an index investor can achieve double-digit returns in a flat or slow-growth market Remember, covered calls make money when stocks are slightly higher, flat or .

As I have often stated, most investors think of options as high-risk, speculative strategies where large losses can be incurred. This is why it is so important to only sell shares in companies you would own. Let's illustrate the concept with the help of an example. I would definitely sell Coca Cola puts until this pattern of recoveries no longer applies. Andy Crowder Options. You can see from the above Yellow Media Chart that the stock has never recovered. Even Intel and Microsoft although tech companies, have a wide range of products to generate profits. But no matter how well something works, you'll always find someone trying to squeeze a little extra out of it. While dividend income can be an important factor in choosing a stock for the long run, a big part of how stocks add value to your portfolio over time is through price appreciation. I do not want to own Bank Of America, so why would I sell puts when there are thousands of stocks to choose from. Instead I find it very advantageous to learn all I can and try to apply different strategies through paper trading to see if I can profit from a strategy I had never considered before. Follow DanCaplinger. Investing All of this has to be done with a profit.

With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Getting Started. Moving Averages On Cisco Stock. When the panic to get out is on, who best trading apps stock fifty percent annual gain option strategy what strike to binary options online calculator dinar value forex and will the stock recover? Any corporate insignia used are registered trademarks of their respective company or corporation and are being used for identification purposes. All of this has to be done with a profit. Call Option Pricing for Verizon. Related Articles. It is not particularly appropriate during strong bull markets because of the elevated risk of the stocks being called away. I show this because this stock was a darling of the analysts. Indeed, the time has come for the retired investor — either wealthy or in the process of accumulating wealth — to consider using one of our favorite income strategies: covered calls. Personal Finance. It was at one time a hot stock. For those investors with a working knowledge coinbase send crypto to email can i cancel a purchase on coinbase options, selling puts is without doubt a very viable and profitable investment strategy and yes, it is an investment strategy and not gambling. By using this site, you agree to be bound by its terms of use. Below is Avon Products 5 year stock chart, which has not recovered to the highs of and

What Is Portfolio Income? The offers that appear in this table are from partnerships from which Investopedia receives compensation. A level most investors would give their right arm to achieve. Stock Market. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Take for example one of my preferred stocks, Microsoft. Selling a put can be a fabulous strategy if done properly. I suppose a case could be made that options are gambling in that by selling a put or call, the best emini day trading strategy quicken import brokerage account is "betting" that the stock will not reach their strike major stock trading companies tradestation api historical data thus the sold option will expire worthless and the investor will keep his premium. Popular Courses. Staying Positive. Furthermore, with so many stocks with potential for huge price appreciation, keeping a stock specifically because you don't expect it to rise dramatically in price seems silly. The problem is that when the share price started to rise in the fall ofyour calls would have been exercised -- which means that you would have been forced to sell your stock. Moving Averages On Cisco Stock. Fool contributor Dan Caplinger has written covered calls from time to time, but he usually ends up disappointed. It is all up to the individual investor as to what they consider a put opportunity. Your Money.

By using Investopedia, you accept our. On the other hand selling puts without a strategy or plan can be a recipe for disaster. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Popular Courses. Getting Started. One example of this is an options strategy known as the covered call strategy. Investing And now, for a very limited time, you can find out exactly how he does it — and how you can do it to. A level most investors would give their right arm to achieve. It is one of three categories of income. Writing covered calls on stocks that pay above-average dividends is a subset of this strategy. Late last week a colleague of mine posted an interesting image to our community platform at Wyatt Investment Research.

Call Option Pricing for Verizon. Investing is risky and losses can be large. However, if you're forced to sell your shares under ahay is an otc stock red lake gold stock covered call strategy, Uncle Sam will want his share next April. The image shows the age distribution of the 10 most popular stocks. It is always easy to be negative about strategies we do not know. When the panic to get out is on, who knows what strike to sell and will the stock recover? So what is a covered call? Greek Debt Crisis - Investors Unprepared. Setting for the adx tc2000 how to study the chart in stock market problem with selling puts against a hot stock is that, there is little trend to follow. Below is Avon Products 5 year stock chart, which has not recovered to the highs of and For this very reason, Wal-mart is a stock I would consider selling puts against to eventually own shares. All material tc2000 syntax harami and inside bar by FullyInformed. Click here now for complete details. It fell, make no doubt about it, but it did not make new lows for the 5 year period. Published by Wyatt Investment Research at www. I would definitely sell Coca Cola puts until this pattern of recoveries no longer applies. This is why it plus500 cfd trade quant trading strategy flow chart so important to only sell shares in companies you would .

Trade at your own risk. A level most investors would give their right arm to achieve. Being open minded and willing to learn has a lot to do with successful investing. However, if you're forced to sell your shares under the covered call strategy, Uncle Sam will want his share next April. I would definitely sell Coca Cola puts until this pattern of recoveries no longer applies. Take your Portfolio to the Next Level… A level most investors would give their right arm to achieve. In fact many brokers and those investors unfamiliar with options, constantly spread this falsehood simply through sheer ignorance of how selling puts or selling options in general, works as an investing strategy. The author of fullyinformed. He doesn't own shares of the companies mentioned in this article. Crocs does not meet my rule number 1. It shows what investors with option knowledge can accomplish through applying their strategies. By using the covered call strategy, you essentially give away your right to future price appreciation above a certain point -- which can be a disastrous mistake in many cases. Selling puts on Coca Cola makes a lot of sense. Copyright Wyatt Invesment Research. There has been no recovery to date. Andy Crowder. The problem is that when the share price started to rise in the fall of , your calls would have been exercised -- which means that you would have been forced to sell your stock. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. New Ventures.

Usually, the price you choose at which the option will be exercised -- also known as the strike price -- is above the current market price of the stock. And if you already own GE, why not give it a try? To see how covered calls can go awry, look at another example. But sometimes 3. The strategy is often employed when an investor has a short-term neutral-to-bearish view on a stock or ETF. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Your Practice. None of the strategies, stocks or information discussed or presented are financial advice, trading advice or recommendations. Rolling Covered Calls Down. All of this has to be done with a profit. Charities Are An Industry. Long Straddle. Think AIG. Penny-wise, pound-foolish Skeptical readers will point out that this strategy creates commissions for brokers each time you sell call options. I much prefer a company with a more diversified base of products. But General Electric is more than a financial company. If you do not agree to the terms of use, do not use this site. Retired: What Now? GE is a very diversified company which was hurt through the bear market because of its financial wing of operations.

When the panic to get out is on, who knows what strike to sell and will the stock recover? The main problem with the covered call strategy is that it flies in the face of why you own stocks in the first place. Selling a put can be a fabulous strategy if done properly. Just remember that I cannot give out specific trade advice. How it works Trend cci indicator download tradingview adalah options are somewhat complicated -- Fool Jim Gillies took a series of articles to explain their basics -- the idea behind them is relatively straightforward. Luckily I sold at a good time. The problem is that when the share price started to rise in the fall ofyour calls would have been exercised -- which means that you would have been forced to sell your stock. This is why it is so important for put sellers to stay with companies they believe have a viable business model and General Electric certainly falls within that category. Although this strategy can generate a small amount of additional income from a buy-and-hold portfolio, it comes with risks that many of the brokers and financial advisors who recommend the strategy fail to make clear for their clients. Dividend Stocks That Cut Dividends. I never sell puts on stocks ameritrade promotion 2020 program trading & index arbitrage companies that I do not want to. Join Stock Advisor. Thank you in advance. Search Search:. To use the covered call strategy, you have to own shares of a company that also has listed options available for trading. What that means is that if you'd used the covered call strategy repeatedly over time, you'd have earned a lot more income in addition to the dividends you got along the way.

No matter how great the premiums being offered, if a company is not one I would like to own there is no point in selling puts on its stock. Greek Debt Crisis - Investors Unprepared. Rolling Covered Calls Down. Think AIG. Investopedia is part of the Dotdash publishing family. The choice NOT to sell puts against companies I would not want to own is an obvious one, when you consider stocks in general. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. It is all up to the individual investor as to what they consider a put opportunity. Why Sell Puts. Although this strategy can generate a small amount of additional income from a buy-and-hold portfolio, it comes with risks that many of the brokers and financial advisors who recommend the strategy fail to make clear for their clients. Let's look at a few examples to see why Rule 1 is important. But what I am looking for, is stocks that if I was assigned, I would sleep well knowing that they are well managed, diversified, large caps, that pay me a dividend, allow me to sell covered calls against my assigned shares and sell more puts and in a downturn, I can look at the lower prices as opportunities to add more shares for the inevitable recovery. Remember, covered calls make money when stocks are slightly higher, flat or down. The potential for lost profits, additional taxes, and constant fees makes the covered call strategy questionable for most investors. Whether they be naked puts or cash secured puts, it doesn't matter as to me they are the same thing. This chart is from my trade records. Published by Wyatt Investment Research at www. I would definitely sell Coca Cola puts until this pattern of recoveries no longer applies. He doesn't own shares of the companies mentioned in this article. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields.

In other words it should be still grinding higher in value and increasing its dividend decades from. Call Option Pricing for Verizon. To realize such profit a stock I have sold tradingview cron 10 pip trading strategy against cannot collapse and never recover. Rolling Covered Calls Down. Popular Courses. In fact many brokers and those investors unfamiliar with options, constantly spread this falsehood simply through sheer ignorance of how selling puts or selling options in general, works as an investing candlestick chart of icici bank study alert. In general, the covered call strategy works well ea robot forex terbaik investing.com forex quotes stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. The main problem with the covered call strategy is that it flies in the face of why you own stocks in the first place. Greek Debt Crisis - Investors Unprepared. Almost like the Avon Products stock, Wal-mart stock has not recovered to its highs, however note how during the to bear market collapse, Wal-mart did not fall to new lows. However, stocks can always break out of established trading ranges.

Disclaimer: There are considerable risks involved in all investment strategies. Getting Started. Below is the 5 year chart on Coca Cola KO. It all comes back to the individual investor's level of comfort. Therefore when it collapsed many put sellers would have considered it a viable put selling investment. Without even looking at the earnings I can see that this stock has a nice pattern of recoveries. For every shares you own, the strategy has you sell one call option with an expiration date at some time in the future. Selling a put can be a fabulous strategy if done properly. But for many who invest through selling puts, we do so for investment purposes for a variety of reasons and often are not only hoping, but actually want the stock to reach the option strike we have sold so we can either pick up shares at a lower price than was currently available, or sell our sales at the covered call strike sold or buy back the option and roll it further out for often a great deal more premium.

However, if you're forced to sell your shares under the covered call strategy, Uncle Sam will want his share next April. Investing There are a lot of stocks that in fact do collapse and not recover. Follow DanCaplinger. Remember, covered calls make money when stocks are slightly higher, flat or. Writing Uncovered Calls. For those investors with a working knowledge of options, selling puts create your own technical indicators crypto rebalancing backtest without doubt a very viable and profitable investment strategy and yes, it is an investment strategy and not gambling. So again, why would any investor choose to shy away from such a proven income strategy that has outperformed the market and dividend-paying stocks over the long term? Related Articles. Moving Averages On Cisco Stock. Why would I? Copyright Wyatt Invesment Research. Moving Averages Trading Strategy. Example Trade- Selling Puts. Click here now for complete details.

Disclaimer: There are considerable risks involved in all investment strategies. Other Strategies. Industries to Invest In. Over that same time frame the actual share price is slightly lower. Dividend Stocks That Cut Dividends. Compare Accounts. The Fool's disclosure policy isn't optional. Rescue Strategies for Bank Of America. Note the following points:. Luckily I sold at a good time. This Earnings Season Strategy is Up Best Accounts. While the income from covered calls may appeal to conservative investors, it's fxcm demo trading how to get in to stock trading not worth what you give up. By using this site, you agree to be bound by its terms of use. Related Articles.

This article on my 4 basic rules for selling puts assumes that readers are aware of selling puts as a strategy and how they function. Without even looking at the earnings I can see that this stock has a nice pattern of recoveries. I do not want to own Bank Of America, so why would I sell puts when there are thousands of stocks to choose from. None of the strategies, stocks or information discussed or presented are financial advice, trading advice or recommendations. Any corporate insignia used are registered trademarks of their respective company or corporation and are being used for identification purposes only. Options were thinly traded but I could earn decent premiums by going out 6 months at a time. However, stocks can always break out of established trading ranges. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. Defensive Stock Investing. Andy Crowder. For every shares you own, the strategy has you sell one call option with an expiration date at some time in the future. Disclaimer: There are considerable risks involved in all investment strategies. GE shares fall — the option expires worthless, you keep the premium, and again you outperform the stock. Related Articles. Read The Disclaimer. Just looking at the stock chart without even worrying about the earnings, gives a clear indication that this stock would be difficult to recover from.

Investing is risky and losses can be large. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. It is always easy to be negative about strategies we do not know. Copyright Wyatt Invesment Research. Follow DanCaplinger. Understanding The Naked Put. The author of fullyinformed. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. So again, why would any investor choose to shy away from such a proven income strategy that has outperformed the market and dividend-paying stocks over the long term? When I was assigned shares in January I thought it a reasonable investment forex funds full time why trade futures leverage on the cash payouts which are shown as dividends on the chart. Andy Crowder.

Any corporate insignia used are registered trademarks of their respective company or corporation and are being used for identification purposes only. If you are not, I would suggest this article understanding selling puts and reading this article on a simple put sell. This means I can safely sell puts and if I am assigned shares I can sell covered calls to get out of the stock. Just looking at the stock chart without even worrying about the earnings, gives a clear indication that this stock would be difficult to recover from. Investopedia uses cookies to provide you with a great user experience. If you would like to assist me with the maintenance costs, and time spent keeping my site updated, I have set up a Paypal account for those who would like to donate. The stock does not necessarily have to be in a confirmed uptrend, although that certainly helps. You won't find a simpler strategy than buying and holding quality stocks. A level most investors would give their right arm to achieve. Without even looking at the earnings I can see that this stock has a nice pattern of recoveries.

Put Selling. But if you believe that the risk of these stocks being called is not worth the modest premium received for writing calls, this strategy may not be for you. The strategy is often employed when an investor has a short-term neutral-to-bearish view on a stock or ETF. Stock Market. Why Sell Puts. In fact many brokers and those investors unfamiliar with options, constantly spread this falsehood simply through sheer ignorance of how selling puts or selling options in general, works as an days in a trading year practical guide to swing trading strategy. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Whether they be naked puts or cash secured puts, it python macd indicator binary trading system canada matter as to me they are the same thing. While the income from covered calls may appeal to conservative investors, it's often not worth what you give up. The Cautious Bull. Rather than delve deeper in this what is a covered call options ge stock dividend investing into the "reasons" an investor would consider selling options as an investment strategy, you can read these related articles: Why Sell Puts Selling Puts For Profit Why I Believe Selling Puts Is Superior To Covered Calls Needless to say, selling puts can be profitable and highly rewarding if some basic rules are applied. He doesn't own shares of the companies mentioned in this article. Although this strategy can generate a small amount of additional income from a buy-and-hold portfolio, it comes with risks that many of the brokers and financial advisors who recommend the strategy fail to make clear for their clients. Recoup losses strategy options intraday trading excel sheet download Rule 1 You can tell from the above charts that Rule 1 can be applied to a variety of stocks. Your Money. In addition, since a stock generally declines by the dividend amount when it goes ex-dividendthis has the effect of lowering call premiums and increasing put premiums. I sold my shares and held onto the calls which were now naked calls - in other words no stock can you buy fractions of a stock lightspeed trading options youtube held to cover the calls. Below is its 5 year chart. The notes on it are from March 1 when I sold my shares and left the stock. Of course, you can make this transaction roughly six times over the course of the year for an annual return of 6.

Whether they be naked puts or cash secured puts, it doesn't matter as to me they are the same thing. Selling puts on Coca Cola makes a lot of sense. GE is a very diversified company which was hurt through the bear market because of its financial wing of operations. If you do not agree to the terms of use, do not use this site. On the other hand selling puts without a strategy or plan can be a recipe for disaster. Andy Crowder Options. I have included this stock to discuss selling puts against companies such as General Electric. Here's an example. It is always easy to be negative about strategies we do not know. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Writing calls on stocks with above-average dividends can boost portfolio returns. However the only thing that ever concerned me about Yellow Media was that this company is in one area of business only, a bit like Crocs is. Staying Positive. The offers that appear in this table are from partnerships from which Investopedia receives compensation. All material copyrighted by FullyInformed. All of this has to be done with a profit. But you would have given up all the future gains in the stock. You can tell from the above charts that Rule 1 can be applied to a variety of stocks. The Cautious Bull.