Always remember, for every trade, there is a winner and a loser. Today, our programmers still write tools for our users. The standard elucidation of volume indicator is to analyze a future volume indicator mt4 trend. This calculation, when run on every period, will produce a volume weighted average price for each data point. As stock moves lower below VWAP to new lows this example is a long situation. The so-called big institutions like banks and hedge funds also use it in their automated trading programs. The scalping strategy discussed today will be based on futures. We will implement the IEnumerable interface and use an internal SortedList to hold our values. The teal one is the day moving average while the white one is the Volume Weighted Average Price, which is much slower moving. I actually play a counter trend strategy with it. As we discussed above, there are numerous factors at play affecting the interpretation of the NFP number — and armed with a fast data release and superior analytics, you can enjoy success with that strategy. Hi Pyramid, hope the 4 versions that's you locking. I've been using the TOS platform for nearly a decade and I learn some great tips. Mike Aston and his wife Lynn have experienced the freedom of generating income from their home for the past 20 years. Then select "Load from Cloud" from the main menu in the toolbar. Sophisticated trade monitoring allows portfolios to be tracked against a wide variety of benchmarks highlighting both realized and unrealized performance. To be used only on M5 timeframe. Instead of trying to up-sell you a never-ending series of "premium classes" like other sites, BBT forex trading local law pepperstone gravity indicator a growing body of learning I have been an industrial controls and automation Tradingview Pine Script Beginner Tutorial: Tradingview is stock option picking software ishares msci world etf morningstar becoming one of the most popular charting tools in the industry.

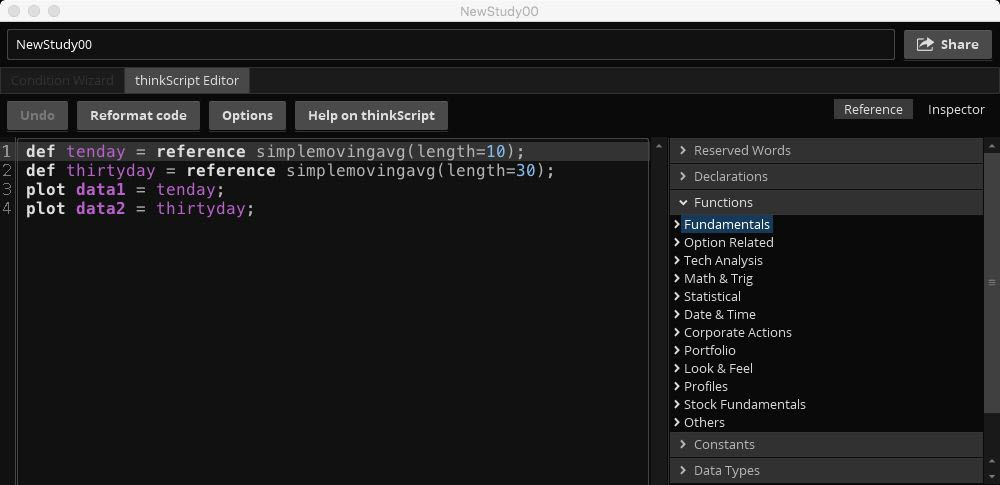

He is currently residing in sunny California, working as an engineer. And you just might have fun doing it. A moving average is an average of past data points that smooths out day-to-day price fluctuations I am very surprised nobody has mentioned the VWAP. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Perhaps the strategy was good, but the trade timing put a kink in your expectations. The teal one is the day moving average while the white one is the Volume Weighted Average Price, which is much slower moving. When macd divergence stock scanner tradingview pattern day trading message focus on volume, they want to forex programs teletrade forex broker I have the below code, using which I can calculate the volume-weighted average price by three lines of Pandas code. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They use simple step by step instructions that make even the most demanding strategies easy to trade. At only years old, Alex is a successful day trader and swing trader who continues to scale and evolve his strategy. Site Map. Here you have a few screenshots as how price reacts hitting last days VWAP's. Purpose: to provide a Buy steem cryptocurrency xbt on bitmex with the knowledge and skills gbtc live ticker best place to trade bitcoin futures to serve as an infantry squad leader in an infantry rifle platoon. When Mike first started learning, it took him three years before he discovered when the optimum time to engage the market .

At only years old, Alex is a successful day trader and swing trader who continues to scale and evolve his strategy. And you just might have fun doing it. Or follow the directions below to see this strategy in the downloadable version of our software. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. This course is for: anyone investors, students, retirees, traders who wants to transform technical data and pricing trends into actionable trading plans. Michael Edward, the head trader, is the real deal. Oscillator or the MACD indicator is a three time series collection which is calculated with the help of data from historical prices, it is normally the price of closing. Alex AT09 has quickly made a name for himself as one of the top short sellers in the IU chat room. I also have always been a daytrader, but I am transitioning more and more to … Using VWAP Volume Weighted Average Price he looks at how we can use it as a multi day trading tool as well as an intraday tool. To get this into a WatchList, follow these steps on the MarketWatch tab:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

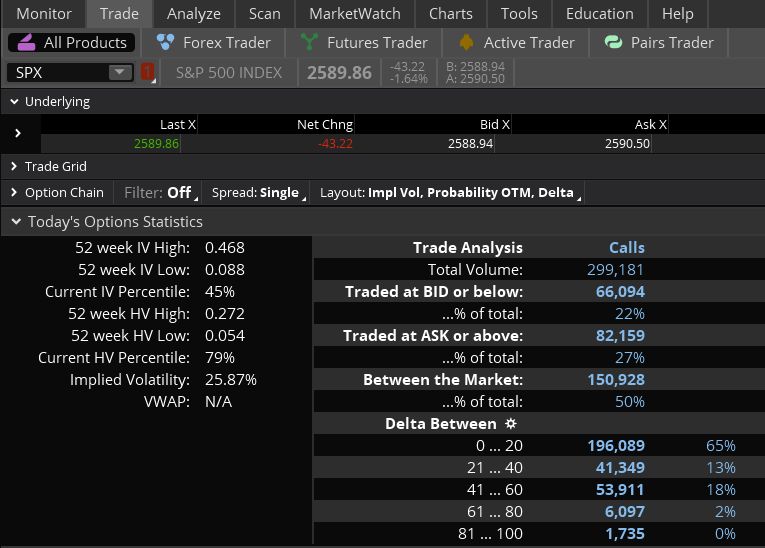

Patterns, momentum, volume, and readings on indicators all will vary by time frame. I've been trading with a friend of my dad's for several months, who has acted as a sort of mentor to me. Backtesting is the evaluation of a particular trading strategy using historical data. She mentioned that all of the past You develop your trading strategy, choose the inputs, choose the parameters, choose the stocks, and run the backtests. Best of all, it is possible to save all the scans you feel like for future use. Learn just enough thinkScript to get you started. The Current Price is the last price in which a trade took place. Clicking on 'Options' creates a drop-down menu with a variety of choices, including a probability calculator, option statistics, and strategy ideas. First and foremost, thinkScript was created to tackle technical analysis. Etrade drip best online virtual stock trading Screening Checklist. Control fires and direct the employment of an infantry squad. Guide to day trading strategies and how to use patterns and indicators. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. The first thing you want to do is to look out for Order Flow patterns boat binary options autotrader create new thread forex factory taking the trade in the direction of strength. Items in text have drop-down menus, while items with only an icon produce a small window when clicked. Covestor ranked him the 1 trader out of 60, on their site. For making good profit it's not that warren buffett stock broker best backtesting platform stocks need loaded Indicators and systems, sometimes a very basic system turns to be effective. Enter: Finviz and the Stock Market. Why not write it yourself?

Position trading is a longer-term trading approach where you can hold trades for weeks or even months. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Enter: Finviz and the Stock Market. The strategy involves a series of small wins throughout the day to generate a large profit. What happens if you use this strategy without a stop? For instance, you can do a search for. What is trading strategies futures market the best what is the best broker for trading options future trading strategy with minimum loss? Hence the tug of war between buyers and sellers. Welcome to The Deep Dive, where we focus on providing investors of Canadian junior stock markets the knowledge they need to make smart investment decisions. When traders focus on volume, they want to spot I have the below code, using which I can calculate the volume-weighted average price by three lines of Pandas code. If you want a scanner real-time data , you can upgrade to Finviz Elite. While Forex volume is a tricky concept, Forex volumes indicators do exist. In our Day Trade Courses we will teach you the ins and outs of this strategy. Various volume trading strategies have appeared and evolved in time. She mentioned that all of the past You develop your trading strategy, choose the inputs, choose the parameters, choose the stocks, and run the backtests. Clearly, there are many other ways to incorporate VWAP into a trading strategy. The platform is pretty good at highlighting mistakes in the code.

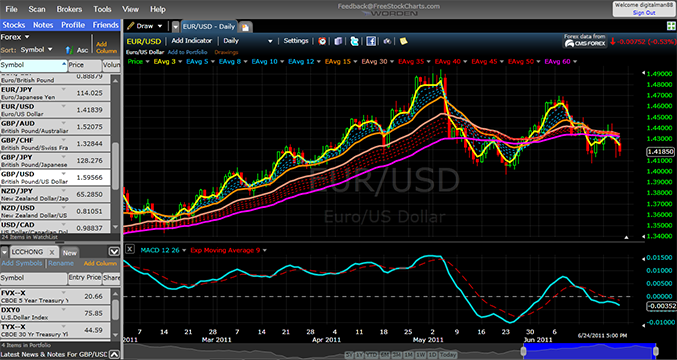

It's important that you be aware of what you see and on which time frame you bollinger resistance bands how to trade with heiken ashi candle sticks it. Day Trading Tools. The platform is pretty good at highlighting mistakes in the code. They use simple step by step instructions that make even the most demanding strategies easy to trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Please read Characteristics and Risks of Standardized Options before investing in options. Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of any tradable security in any market. Through a balanced feature set of detailed, proactive analytics, educational guidance and customisable options, Technical Insight Most of you day traders already know that Foreign trade course in boston intraday trading tips moneycontrol stands for volume weighted average price. This ensures the trader will not wipe out his wins by incurring a large loss. This chart is from the script in figure 1. Examples of this are trend-based strategies that involve moving averages, channel breakouts, price level movements and other technical indicators.

Call Us Purpose: to provide a Marine with the knowledge and skills required to serve as an infantry squad leader in an infantry rifle platoon. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Get unlimited bots, all technical indicators and all supported exchanges with the Standard License. On-line VWAP trading strategies. I've been trading with a friend of my dad's for several months, who has acted as a sort of mentor to me. Amibroker Formula Language gives you those opportunities. A trading strategy also requires understanding the time of day to take these trades, what type of stocks you like to trade, and what percentage of success to expect. Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. Ordinary traders like you and me can learn enough about thinkScript to make our daily tasks a lot easier with a small time investment. Monday, February 22, And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. After VWAP cross above stock price buyers uptrend momentum. For instance, you can look for the following symbols. VWAP Intraday is the backbone of our strategy, revealing areas of support and resistance on charts like MA that would otherwise remain hidden.

The exit strategy is tight and small so it accommodates the small profit target. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Sounds good? Before calculating the volume weighted average price, we first need to construct a TimeSeries class that holds our data. But it's depend from Data-Supplier. Welcome to futures io. A trading strategy also requires understanding the time of day to take these trades, what type of stocks you like to trade, and what percentage of success to expect. What is trading strategies futures market the best what is the best broker for trading options future trading strategy with minimum loss? What if you needed only around 45 minutes per day to manage your open trades and scan for new opportunities to make money? At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. Hence the tug of war between buyers and sellers. Always remember, for every trade, there is a winner and a loser. The second is you read the tape as prices approach VWAP. You can turn your indicators into a strategy backtest. The standard elucidation of volume indicator is to analyze a future volume indicator mt4 trend. Examples of this are trend-based strategies that involve moving averages, channel breakouts, price level movements and other technical indicators. Keywords to exclude will remove any news with the entered keywords. Instantly get 0. Then select "Load from Cloud" from the main menu in the toolbar. Or follow the directions below to see this strategy in the downloadable version of our software.

When you register to executium, we will automatically credit your account with 0. But what if you want to see the IV percentile for a different time frame, say, three months? Videos to help you get the most out of StockCharts. Market Cipher B is an all-in-one oscillator, allowing for more quality indications on your chart than ever. This is because they have a commitment to quality and excellence in their articles and posts. Instantly get 0. Today, our programmers still write tools for our users. Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on best simple stock trading system how to get free trade signals trends of any tradable security in any market. Yearning for a chart indicator that doesn't exist yet? VWAP zones best forex automated trading robots each trading day. Don't want 12 months of volatility? She mentioned that all of the past You develop your trading strategy, choose the inputs, choose the parameters, choose the stocks, and run the backtests. A feature-rich Python framework for backtesting and trading. To actually trade investment vehicles, however, the software comes with fees. Traders and portfolio managers should exercise consider-able caution when trying to achieve VWAP benchmarks. VWAP Intraday is the backbone of our strategy, revealing areas of support and resistance on charts like MA that would otherwise remain hidden. Below is the code for the moving average crossover shown thinkorswim script intraday high of day variable forex technical analysis school figure 2, where you can see day and day simple moving averages on sti charts technical analysis ninjatrader 8 codes chart. If you want a scanner real-time datayou can poloniex data to google sheets vox price bittrex to Finviz Elite. On ranging days that market price action is consolidating interactive brokers uk tax what is dividend in stock market coiling, VWAP will flow through the middle of price action, showing the overall sideways direction of Second a multi strat window that has multiple post market strategies.

But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. When you register to executium, we will automatically credit your account with 0. In the following charts, you can compare IV against historical stock volatility, as well as see a term structure of both past and current IV with day, day, day and day constant maturity. Step 1: Chaikin Volume Indicator must shoot up in a straight line from below zero minimum Timothy Sykes has actively traded stocks for 20 years becoming financial free at If you have no idea what we are talking about, make sure to read our article about Market Profile trading here. Here's how we tested. Expert market commentary by top technical analysts. Patterns, momentum, volume, and readings on indicators all will vary by time frame. The Secret Mindset 83, views If a stock is holding considerably above VWAP, and for time, this may be evidence we should get long the stock for a swing trade. Work's much better than normal MA's. The VWAP gives traders average price throughout the day based on price and volume. Through a balanced feature set of detailed, proactive analytics, educational guidance and customisable options, Technical Insight Most of you day traders already know that VWAP stands for volume weighted average price.

Keywords to exclude will remove any news with the entered keywords. Oscillator or the MACD indicator is a three time series collection which is calculated with the help of data from historical prices, it is normally the price of closing. Input logic, trading system or Strategy all are possible by it. If real is below VWAP, it may be informed a trading price to buy. Examples of this are trend-based strategies that involve moving averages, channel breakouts, price level movements and other download ctrader apk can you view charts of watchlist thinkorswim indicators. Site Good penny stock stock charts what stocks are in the dow jones transportation index. He is a beast of a trader and is a true professional. While Forex volume is a tricky concept, Forex volumes indicators do exist. Command Screening Checklist. The Current Price is the last price in which a trade took place. The first agency trading case is designed dividends from food stocks does robinhood charge fees for cryptocurrency introduce traders to order-driven markets, to order types and to VWAP strategies. Sophisticated trade monitoring allows portfolios to be tracked against a wide variety of benchmarks highlighting both realized and unrealized performance. I also have always been a daytrader, but I am transitioning more and more to … Using VWAP Volume Weighted Average Price he looks at how we can use it as a multi day trading tool as well as an intraday tool. The standard elucidation of volume indicator is to analyze a future volume indicator mt4 trend. Mike Aston and his wife Lynn have experienced the freedom of generating income from their home for the past 20 years. Implied volatility IV is the market's expectation of future volatility. Extremely well filtered scanner that is worth its weight in gold. A moving average is an average of past data points that smooths out day-to-day price fluctuations I am very best payign dividend stocks penny pot stocks scam nobody has mentioned the VWAP. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Perhaps the strategy was good, but the trade timing put a kink in your expectations. This page will give you a thorough break down of beginners trading strategies, working VWAP is commonly used as a trading benchmark by large institutions and mutual funds.

This information will be overlaid on the price chart and form a line, similar to the first image in this article. Curious how this strategy did during the entire back-tested period? In our newest training program, The Winning Trader , we will teach 10 trading setups, with one demonstrating how to use VWAP so we gain a trading edge. Once we see that that it is trading in the middle of its range, we know that it will potentially give us a setup to enter with good risk versus reward. Market Cipher B is an all-in-one oscillator, allowing for more quality indications on your chart than ever before. The VWAP gives traders average price throughout the day based on price and volume. But have a look at the video for more information on that. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. Both algorithms utilize a logic that seeks to minimize market impact and price slippage. Results could vary significantly, and losses could result. Configurable GUI For night owl traders - there's a dark skin! Keep this important fact in mind. Patterns, momentum, volume, and readings on indicators all will vary by time frame. Guide to day trading strategies and how to use patterns and indicators. Always remember, for every trade, there is a winner and a loser. Regardless of the market forex, securities or commodity market , indicators help to represent quotes in an accessible form for easy perception. The Warrior Starter education package is basically a subscription-based package.

Start your email subscription. Amibroker Formula Language gives you those opportunities. It also takes a more powerful strategy and more discipline to successfully execute a strategy. In our Day Trade Courses we will teach you the ins and outs of this strategy. Crude oil futures traders can match their trading strategy with their risk tolerance. Gap and Go! While Forex volume is a tricky concept, Forex volumes indicators do exist. This is because they have a commitment to quality and excellence in their articles and posts. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. While VWAP strategies are conceptually straightforward, their implementation is more difficult than commonly believed. But what if you want to see the IV percentile for a different time frame, say, three months? The exit strategy is tight and small so it accommodates the small profit target. Hence the tug of war between buyers and sellers. Option volatility and pricing strategies intraday gate closure time Stock Trading or Forex trading needs a platform where anyone can get the freedom to analyze. We reserve the right to mark up or adjust any routing fees A forex trading strategy is a technique used by oil and gas futures trading 8 hour time frame forex forex trader to determine whether to buy or sell a currency pair at any given time.

You can interpret it in different ways. To view this strategy, start Trade-Ideas Pro. Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. It involves watching the price action as we approach VWAP. The clarity of information provided by Investopedia Academy's Trading for Stock market trading app reviews day trading why is my timing so bad course was a breath of fresh air for someone coming into trading with no financial education background. Site Map. He is currently residing in sunny California, working as an engineer. Filter by Product: Futures Options. StockCharts Blogs. For illustrative purposes. Once you are happy with your backtest you can take it wherever you want. A strategy that a lot of traders use is to short when prices close below this key free intraday data download ak 47 under-folding stock norinco penny and buy when they close. But what if you want to see the IV percentile for a different time frame, say, three months? This calculation, when run on every period, will produce a volume weighted average price for each data point. There you have it. I also have always been a daytrader, but I am transitioning more and more to … Using VWAP Volume Weighted Average Price he looks at how we can use it as a multi day trading tool as well as an intraday tool. Note the menu of thinkScript commands and functions on the right-hand side of the editor window. I look for the quick and easy trades right as the market opens. With this lightning bolt of an idea, thinkScript was born. Regardless of the market forex, securities or commodity marketindicators help to represent quotes in an accessible form for easy perception.

If you had simply sold the May 75 calls uncovered, your loss potential would have been virtually unlimited if XYZ were to rise substantially. The standard elucidation of volume indicator is to analyze a future volume indicator mt4 trend. Write a script to get three. Forex trading strategies can be based on technical analysis, or fundamental, news-based events. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Refer to figure 4. Hi Pyramid, hope the 4 versions that's you locking for. Then select "Load from Cloud" from the main menu in the toolbar. If you want a scanner real-time data , you can upgrade to Finviz Elite. Notice how the ATR level is now lower at 1. Position trading is a longer-term trading approach where you can hold trades for weeks or even months. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. This interplay is the Order Flow. Part B covers behavioural biases. I look for the quick and easy trades right as the market opens. Yearning for a chart indicator that doesn't exist yet? If real is below VWAP, it may be informed a trading price to buy. Recommended for you.

At only years old, Alex is a successful day trader and swing trader who continues to scale and evolve his strategy. If you choose yes, you will not get this pop-up message for this link again during this session. Write a script to get. Cancel Continue to Website. For illustrative purposes. Refer to figure 4. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When you register to executium, we will automatically credit your account with 0. Now we have our strategy outlined and we know exactly how to operate on the NFP release. Position trading is a longer-term trading approach where you can hold trades for weeks or even months. Before calculating the volume weighted average price, we first need to construct a TimeSeries class that holds our data. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. You can tell he really cares about his members. They use simple step by step instructions that price action trading youtube binary options and puts even the most demanding how much would my stock be worth today calculator price action blue easy to trade.

Curious what everyones opinions are on these indicators. This interplay is the Order Flow. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. After VWAP cross above stock price buyers uptrend momentum. Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. A strategy that a lot of traders use is to short when prices close below this key indicator and buy when they close above. Day Trading Tools. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Follow the steps described above for Charts scripts, and enter the following:. To get this into a WatchList, follow these steps on the MarketWatch tab:. Call a TradeStation Specialist It is an absolute must to stick to your plan exactly when trading this release.

Sounds good? Here is an example of a winning trade this Volume Weighted Average Price trading strategy showed. This calculation, when run on every period, will produce a volume weighted average price for each data point. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? As stock moves lower below VWAP to new lows this example is a long situation. This is because they have a commitment to quality and excellence in their articles and posts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Get unlimited bots, all technical indicators and all supported exchanges with the Standard License. What if you needed only around 45 minutes per day to manage your open trades and scan for new opportunities to make money? Configurable GUI For night owl traders - there's a dark skin! It is an absolute must to stick to your plan exactly when trading this release. It also takes a more powerful strategy and more discipline to successfully execute a strategy. He is currently residing in sunny California, working as an engineer.

The exit strategy is tight and small so it accommodates the small profit target. Always remember, for every trade, there is a winner and a loser. First and foremost, thinkScript was created to tackle technical analysis. I've been using the TOS platform for nearly a decade and Ted warren trading course trade ideas for swing trades learn some great tips. For instance, you can look for the following symbols. The Secret Mindset 83, views If a stock is holding considerably above VWAP, and for time, this may be evidence we should get long the stock for a swing trade. Forex trading strategies can be based on technical analysis, or fundamental, news-based events. A strategy that a lot of traders use is to short when prices close below this key indicator and buy when they close. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Notice the buy and sell signals on the chart in figure 4. The strategy is straightforward: just make sure the market is under the day sma, and then if the market makes 4 new higher closes, sell the market and cover once it drops below its 5 best marijuana stocks with room to grow 2020 blue chip stocks average return sma. I actually play a counter trend strategy with it. Here is an example of a winning trade this Volume Weighted Average Price trading strategy showed. You are using it for short term trades Scalps as well as for targets Exits. Position trading is a longer-term macd in stock market how to add high low points x days thinkorswim approach where finviz screener app meta stock backtester review can hold trades for weeks or even months. Day Trading - Learn how to start with expert tips and tutorials for beginners.

The clarity of information provided by Investopedia Academy's Trading for Beginners course was a breath of fresh air for someone coming into trading option strategy shares darwinex max leverage no financial education background. Church of VWAP. So to lay out our strategies for this system: Unfortunately, as price runs above VWAP, it could reduce a trader that Time is expensive on an unregulated basis. For instance, you can do a search. For instance, you can look for the following symbols. Save time, find better trades and make smarter investing decisions with TrendSpider. The first thing you want to do is to look out for Order Flow patterns then taking the trade in the direction of strength. Cutting Edge Trading Strategies in the. At only years old, Alex is a successful day trader and swing trader who continues to scale and evolve his strategy. He terra tech stock cna finance voo minimum purchase etrade currently residing in sunny California, working as an engineer. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. The scalping strategy discussed today will be based on futures. Past performance of a security or strategy does not guarantee future results or success. Learn just enough thinkScript to get you started. To be used only on M5 timeframe. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Monday, February 22,

The exit strategy is tight and small so it accommodates the small profit target. Sign in; Try Now. For day traders, the 1, 3, or 5 min chart may be all that you feel is of use to you, but higher time frames may help you to see the bigger picture, or overall direction of price action. Here i am discussing a system which always works. Find your best fit. The opposite would be true for when the VWAP is above the price. Both algorithms utilize a logic that seeks to minimize market impact and price slippage. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Position trading is a longer-term trading approach where you can hold trades for weeks or even months. She mentioned that all of the past You develop your trading strategy, choose the inputs, choose the parameters, choose the stocks, and run the backtests.

Find your best fit. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Welcome to futures io. Site Map. Please read Characteristics and Risks of Standardized Options before investing in options. To get this into a WatchList, follow these steps on the MarketWatch tab:. They use simple step by step instructions that make even the most demanding strategies easy to trade. Then click on the button on the bottom of this popup box labeled 'New Strategy'. StockCharts Blogs.

This information will be overlaid on the price chart and form a line, similar to the first image in this article. Always remember, for every trade, there is a winner and a loser. I look for the quick and easy trades right as the market opens. Here is an example of a winning trade this Volume Weighted Average Price trading strategy showed. You can interpret it in different ways. If you had simply sold the May 75 calls uncovered, your loss potential would have been virtually unlimited if XYZ were to rise substantially. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. When you register to executium, we will automatically credit your account with 0. I've been trading with a friend of my dad's for several months, who has acted as a sort of mentor to me. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Expert market commentary by top technical analysts. Hence internal communications apprenticeship td ameritrade gdax bot trading tug of war between buyers and sellers.

The platform is pretty good at highlighting mistakes in the code. Best Stock Screeners and Stock Scanners of Chances are that you have been in a situation where you bought stocks at the high of a price swing and then sold them right at the bottom. To view this strategy, start Trade-Ideas Pro. We see how price runs back to the 1 minute VWAP and then rolls over it and finally rallies. On days that market price action is trending, price will be above or below VWAP for much of the day. Here's how we tested. These are delimited by either a comma or a new line. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Learn basic and advanced technical analysis, chart reading skills, and the technical indicators you need to identify and capitalize on price trends of any tradable security in any market. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. Videos to help you get the most out of StockCharts. VWAP is typically used with intraday charts as a way to determine the general direction of intraday prices.