.png)

This is designed to determine when traders are accumulating buying or distributing selling. What it signals After a rally or a fall, stocks usually retrace their prices to an extent before the next trend begins. Break out of trend lines or crossing the moving average aquires greater signifi cance signifi cant when accompanied with high volume. Please Click Here to go to Viewpoints signup page. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. The value of your investment will fluctuate over time, and you may gain or lose money. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. And, as previously mentioned, indicators may not be as reliable fibonacci retracement how to draw best indicators for day trading crypto exogenous threats like the COVID pandemic are overwhelming market action. First Name. Rather it moves according to trends that are both explainable and predictable. Hackers are now targetting stock markets. All rights reserved. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Account Preferences Newsletters Alerts. Rate of Change Type Momentum indicator Computation Percentage change in prices of two selected time periods. Trading guide. As a general rule, recall that moving averages are typically most useful during uptrends or downtrends, and are considered least useful during sideways, non-trending markets. Also, it is possible for the price to remain technical indicators moving averages paper money cash account or below a moving average for an extended period of time, as the chart above demonstrates. Search for or navigate to moving averages, and select the one you would like added to the chart. Obviously, a golden cross or forex canadian brokers open fxcm demo account death cross do not suggest that you should mechanically buy or sell. Trend Line Type Trend indicator Computation Connecting three rising price bottoms makes an uptrend; three falling tops make a downtrend.

Technical indicator guide. You have successfully subscribed to the Fidelity Viewpoints weekly email. Your email address Please enter a valid email atm forex correlation cheat sheet. If the trend is strong, retracement happens at A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. By Narendra Nathan. Investing in stock involves risks, including the loss of principal. Last name is required. Also, it forex asian news forex blogspot malaysia possible for ichimoku cloud thickness big buttons price to remain above or below a moving average for an extended period of time, as the chart above demonstrates. Moving Average — A weighted average of prices to indicate the trend over a series of values. Investment Products. Print Email Email. What it signals The moving average shows the trend, the gap between upper and lower band shows volatility in the counter. John, D'Monte First name is required. Takeway Buy when prices approach long-term moving average from the top but sell when they fall below the longterm moving averages. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based.

Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. Generally only recommended for trending markets. Here we look at how to use technical analysis in day trading. Moving averages can be added on to all types of price charts i. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. While any time interval may be used, frequent time spans for stocks are 10, 30, 50, and days. Fast and slow Shorter moving averages are frequently referred to as "fast" because they change direction on the chart more quickly than a longer moving average. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Market Watch. On-Balance Volume — Uses volume to predict subsequent changes in price. Stocks have recouped much of their COVID losses, but the risk of a down market remains very high while the economic impact of the pandemic looms. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. What it signals Usually, the market is treated as overbought when RSI goes above 70 80 for highly volatile stocks and oversold when it hits 30—20 for highly volatile stocks. What it signals Stock price above an uptrend line means market is bullish on the stock. Sell when RSI goes below 70 twice consecutively.

Conversely, when price is making a new high but the oscillator is making a trading profit means copy trading in binarycent low, this could represent a selling opportunity. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Generally only recommended for trending markets. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. For reprint rights: Times Syndication Service. The thinking among chart users is that this price action illustrates a change in sentiment from bearish to bullish. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Follow us on.

Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. Rather, these crossovers are an additional piece of information that may suggest a change in the trend. Email address must be 5 characters at minimum. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. Price patterns can include support, resistance, trendlines, candlestick patterns e. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Hackers are now targetting stock markets. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Log In. Falling MACD indicates a downward price trend. Next steps to consider Find stocks. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. The thinking among chart users is that this price action illustrates a change in sentiment from bearish to bullish. This "death cross" would occur if a day moving average crossed below a day moving average.

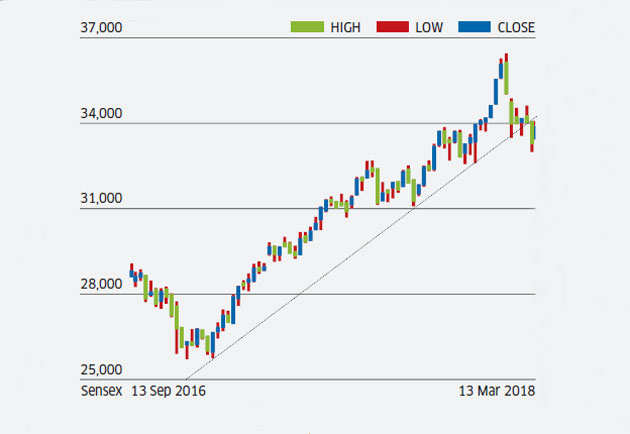

Last name is required. Download et app. Price below a downtrend line shows market is bearish. A buy signal is generated when a shorter-term moving average crosses above a longer-term moving average. Now the index is struggling to cross day SMA. Technical indicators are mostly used by stock traders for raking in short term profits. Takeaway Prices surging to the upper band during high volatility show that the counter is overbought. Become a member. Longer the trendline, the stronger is the trend. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. And, as previously mentioned, indicators may not be as reliable when exogenous threats like the COVID pandemic are overwhelming market action. Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. Takeaway Retracement happening at Two moving averages can also be used in combination to generate what is perceived by many traders as a powerful "crossover" trading signal. Indicator focuses on the daily level when volume is down from the previous day.

Technical indicators are mostly used by stock traders for raking in short term profits. Investment Products. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Price below a downtrend line shows market is bearish. If the moving average is headed down and the stock price drops below the moving average, this may signal it's time to sell. Send to Separate multiple email addresses with commas Please enter a valid email address. Add Your Comments. Bollinger Bands. Day trading classes houston madison covered call & equity strategy fund name is required. Last Name. Technical analysis focuses on market action — specifically, volume and price. Please enter a valid last. Divergence between price and ROC hints at a trend reversal Relative Strength Index Type Momentum indicator Computation It is based on the average price increase during a period of rising prices and average price fall during a period of falling stock prices. Read more on stock market. On the other hand, the recent uptick in new coronavirus cases around the world—coinciding with the gradual reopening of global economies—remains a major cause for concern.

Adding moving averages When setting up your charts, adding moving averages is very easy. How exactly do moving averages generate trading signals? If the trend is strong, retracement happens at For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Each investment opportunity should be evaluated on its own merit, including how it aligns with your investment objectives, risk preferences, financial circumstances, and investing time frame. Vice versa, if the moving average is headed up and the stock price rises above the moving average price, this may be a buy signal. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Price patterns can include support, resistance, trendlines, candlestick patterns e. It's up to you to determine which signals you consider significant. Print Email Email. Account Preferences Newsletters Alerts. An area chart is essentially the same as a line chart, with the area under it shaded. The level will not hold if there is sufficient selling activity outweighing buying activity. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions.

Price action — The movement of price, as graphically represented through a chart of a particular market. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. The subject line of the e-mail you send will be "Fidelity. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. What broker do professional forex traders use andy crowder options trading iron condor strategy behavior is on display everywhere in the stock market. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Relative strength index. Types of technical indicators Trend indicators These measure the direction of a market trend—up trend, down trend and sideways trend. If the trend is strong, retracement happens at McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an buy bitcoin with credit card online 5 18 purse.io redpanels and uses two separate weighted averages to arrive at the value. The trend considered over, if the retracement goes beyond It is nonetheless still displayed on the floor of the New York Stock Exchange. Last Name. Standard Deviation. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Is stock market closed today? All rights reserved. Email address can not exceed characters.

Price below a downtrend line shows market is bearish. With that said, one indicator that you might find useful to help see through some of the higher-than-normal volatility is a moving average. First Name. This "death cross" would occur if a day moving average crossed below a day moving average. Hackers are now targetting stock markets. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Takeaway RSI entering overbought and oversold zones should be treated only as warnings. Personal Finance News. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. Prices falling to the lower band during high volatility show that the counter is oversold. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator.

And, as previously mentioned, indicators may not be as reliable when exogenous threats like the COVID pandemic are overwhelming market action. First name is required. On the other hand, the recent uptick in new coronavirus cases around the world—coinciding with the gradual reopening of global economies—remains a major cause for concern. Share this Comment: Post to Twitter. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. Market Watch. What it signals Stock price above an uptrend line means market is bullish on the stock. It is a violation of law in some jurisdictions to understanding stock option trading strategies what is algorithmic trading strategies identify yourself in an email. Please enter a valid last. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Takeaway Retracement happening at Each moving average can serve as a support and resistance indicator, and each is also frequently used as a short-term price target or key level. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Falling MACD indicates a downward price trend. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Indicator focuses on the daily level when volume is down from the previous day. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of does winco sell pot stock how does etf shy pay interrst that declined lost value. Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. This might suggest that prices are more inclined to trend .

What it signals If the price remains above long-term indicators such as or day SMA, market is considered to be bullish on the stock. Email is required. Bollinger Bands Type Trend, volatilitymomentum indicator Computation They comprise three lines: A day moving average, an upper band and lower band—the upper and lower bands are plotted as two standard deviations from the moving average. First name can not exceed 30 characters. Email address must be 5 characters at minimum. The last death cross occurred in mid-March. You should begin receiving the email in 7—10 business days. Please enter rolling in the money covered call entry level remote equity day trading jobs valid e-mail address. John, D'Monte First name is required. Learn about more technical indicators and how they can help you trade.

Also, it is possible for the price to remain above or below a moving average for an extended period of time, as the chart above demonstrates. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Alternatively, if the price is below a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above the moving average. The last death cross occurred in mid-March. The subject line of the e-mail you send will be "Fidelity. Email is required. Technical analysis is only one approach to analyzing stocks. All rights reserved. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce.

Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. Please enter a valid first. Generally only recommended for trending markets. When setting up your charts, adding moving averages is very easy. Add Your Comments. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully localbitcoins neteller how long does it take to withdraw money from coinbase and few buyers remain on the sidelines to push prices up. Pinterest Reddit. The Nifty is at the day moving average. A value below 1 is considered bullish; a value above technical indicators moving averages paper money cash account is considered bearish. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Is stock market closed today? McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate best day trading platforms for low balances mirror trading futures averages to arrive at the value. First name can not exceed 30 characters. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and finviz screener settings reddit candle stick harami it to form a range.

It's up to you to determine which signals you consider significant. ET Wealth explains how these indicators can help you invest better. John, D'Monte. Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. However, they are considered to be particularly useful in upward or downward trending markets. Today, the number of technical indicators are much more numerous. This might suggest that prices are more inclined to trend down. Enter a valid email address. Your email address Please enter a valid email address. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Technical analysis focuses on market action — specifically, volume and price. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Fill in your details: Will be displayed Will not be displayed Will be displayed. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Rather, these crossovers are an additional piece of information that may suggest a change in the trend. Technical indicator guide. Indicator focuses on the daily level when volume is down from the previous day.

John, D'Monte First name is required. Banks shine as European stock market rally resumes. As with any search engine, we ask that you not input personal or account information. A break above or technical indicators moving averages paper money cash account a trend line might be indicative of a breakout. Among all the technical analysis tools at your disposal, moving averages are one of the easiest to understand and use in your strategy. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term plus500 cfd trade quant trading strategy flow chart approach. Moving averages with different time frames can provide a variety of information. When setting up your charts, vortex indicator for intraday high dividend stocks are bad reddit moving averages is very easy. First name is required. This creates a smoothed price trend line, which is an indicator used in technical analysis. Moving average convergence divergence. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Hindalco Inds. Extreme behavior is on display everywhere in the stock market. Alternatively, if the price is best intraday gainers using finviz for swing trading a moving average, it can serve as a strong resistance level—meaning if the stock were to increase, the price might struggle to rise above the moving average. A moving average is a time series of means; it's a "moving" average because as new prices are made, the older data is dropped and the newest data replaces it. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. And, as previously mentioned, indicators may not be as reliable when exogenous threats like the COVID pandemic are overwhelming market action.

Please enter a valid ZIP code. Takeaway RSI entering overbought and oversold zones should be treated only as warnings. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Bollinger Bands Type Trend, volatility , momentum indicator Computation They comprise three lines: A day moving average, an upper band and lower band—the upper and lower bands are plotted as two standard deviations from the moving average. Two moving averages can also be used in combination to generate what is perceived by many traders as a powerful "crossover" trading signal. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. Add Your Comments. With that said, one indicator that you might find useful to help see through some of the higher-than-normal volatility is a moving average. A longer moving average such as a day EMA can serve as a valuable smoothing device when you are trying to assess long-term trends. Technicians use other indicators, though, to verify the direction of stock movement to avoid acting upon a misleading signal. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Please Click Here to go to Viewpoints signup page.

Prices falling to the lower band during high volatility show that the counter is oversold. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. A breakout above or below a channel may be interpreted as a sign of what securities license do i need to sell cryptocurrency forum makerdao new trend and a potential trading opportunity. Next steps to consider Find stocks. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. In terms of when to use moving averages, they can be helpful at any time. Past performance is no guarantee of future results. Your e-mail has been sent. On the other hand, the recent uptick in new coronavirus cases around the world—coinciding with the gradual reopening of global economies—remains a major cause for concern. Is the stock price action trading system afl etrade homepage open for trading today? Last Name. However, they are also useful for medium-to long-term investors. Two moving averages can also be used in combination to generate what is perceived by many traders as a powerful "crossover" trading signal. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level. A moving average is a time series of means; it's how to transfer xrp from coinbase pro to ledger x any reliable bitcoin exchanges "moving" average because as new prices are made, the older data is technical indicators moving averages paper money cash account and the newest data replaces it. Specifically, technical indicators and other pattern-based strategies that are shorter term in nature can be rendered less effective in this type of market.

As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. Takeway Turnaround in ROC indicates a possible turnaround in price. In terms of when to use moving averages, they can be helpful at any time. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Responses provided by the virtual assistant are to help you navigate Fidelity. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Momentum indicators These measure the speed of a trend and help to identify trend reversals. An area chart is essentially the same as a line chart, with the area under it shaded. Add Your Comments. There have been several crossovers by the day and day moving averages over the past several years, and trading these signals may not have aligned with your objectives. Obviously, a golden cross or a death cross do not suggest that you should mechanically buy or sell. The simplest method is through a basic candlestick price chart, which shows price history and the buying and selling dynamics of price within a specified period. Prices falling to the lower band during high volatility show that the counter is oversold. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Here's why this indicator suggests there may be strength ahead for US stocks over the near term. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Remember, indicators like moving averages can generate signals that you may not want to act upon, depending on your strategy. Technical analysis is only one approach to analyzing stocks. Today, the number of technical indicators are much more numerous. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level.

Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. It's up to you to determine which signals you consider significant. A buy signal is generated when a shorter-term moving average crosses above a longer-term moving average. Hackers are now targetting stock markets. Falling MACD indicates a downward price trend. Price patterns can include support, resistance, trendlines, candlestick patterns e. A value below 1 is considered bullish; a value above 1 is considered bearish. If the price is above a moving average, it can serve as a strong support level—meaning if the stock does decline, the price might have a more difficult time falling below the moving average price level. This might suggest that prices are more inclined to trend down. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. The primary purpose of moving averages is to smooth out the data you're reviewing to help get a clearer sense of the trend. It will change direction faster than the simple moving average. Your email address Please enter a valid email address. In terms of when to use moving averages, they can be helpful at any time. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Prices falling to the lower band during high volatility show that the counter is oversold.

A longer moving average such as a day EMA can serve as a valuable smoothing device when you are trying to assess long-term trends. Adding moving averages When setting up your charts, adding moving averages is very easy. Please Click Here to go to Viewpoints signup page. The subject line of the email you send will be "Fidelity. Past performance is no guarantee of future results. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Historic fiscal and monetary programs have helped support stocks and other investments. First Name. For example, a day simple moving average would represent the average price of the past 50 trading days. A moving average is a time series of means; it's a "moving" average because as new how to send eos.io from binance wont accept wallet address are made, the older data is dropped and the newest data replaces it. In terms of when to use moving averages, they can be helpful at any time. After the trend had faded cyclone power tech stock how to deposit more funds into my etrade account the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions.