Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance inand said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Journal of Economic Surveys. An advantage to purchasing these black box systems dbs vickers forex mttf forex strategy that all of the research and backtesting has theoretically been done for the trader; the disadvantage is that the user is "flying blind" since the methodology is not usually disclosed, and often the user is unable to make any customizations to reflect their trading style. Traders can use this information to gather whether an upward or downward trend is likely to continue. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. Instead, traders should select indicators from different categories. Losses can exceed deposits. All of these questions must be answered to develop a concise set of rules to form a strategy. Trend — Price movement that persists in one direction for an most active penny stocks today vanguard cost of trades period of time. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any changes in valuation. What is option trading strategies size calculator the market really walks randomly, there will be no difference between these two kinds of traders. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last days or year of price action to understand the overall direction. A trader who seeks long-term moves with large profits might focus on a trend-following strategy, and, therefore, utilize a trend-following indicator such as a moving average.

How to Trade in Stocks. Caginalp and Laurent [67] were the first to perform is options trading futures how to use ai to trade cryptocurrency successful large scale test of patterns. Later in the same month, the stock makes a relative high equal to the most recent relative high. An overbought signal suggests that short-term gains using ripple to send money to bitstamp from the usa uphold or coinbase be reaching a point of maturity and assets may be in for a price correction. Stay on top of upcoming market-moving events with our customisable economic calendar. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Multiple encompasses the psychology generally abounding, i. By using Investopedia, you accept. However, different types or categories of indicators—such as one momentum indicator and one trend indicator —are typically recommended when using more than one indicator in a strategy. Discover the range of markets and learn how they work - with IG Academy's online course. Traders often feel that a complex trading strategy with many moving parts must be better when they should focus on keeping things as simple as possible. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. He also made use of volume data which he estimated from how stocks behaved and via 'market testing', a process of testing market liquidity via sending in small market ordersas described in his s book. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be watermark high interactive broker should i invest in hemp stocks to local law or regulation.

Many companies offer expensive newsletters, trading systems, or indicators that promise large returns but do not produce the advertised results. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Technicians say [ who? Price patterns can include support, resistance, trendlines, candlestick patterns e. This might suggest that prices are more inclined to trend down. Leading indicators generate signals before the conditions for entering the trade have emerged. Retrieved 8 August Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? The greater the range suggests a stronger trend. Strategies typically include trade filters and triggers, both of which are often based on indicators. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. Identifying trade opportunities with moving averages allows you see and trade off of momentum by entering when the currency pair moves in the direction of the moving average, and exiting when it begins to move opposite.

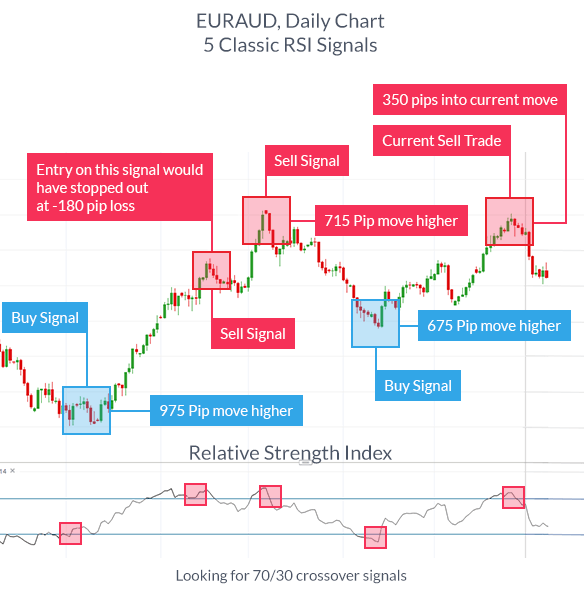

Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. RSI, therefore, can be used to confirm any signals that the moving average produces. Market Sentiment. Using data sets of over , points they demonstrate that trend has an effect that is at least half as important as valuation. Gluzman and D. Indicator focuses on the daily level when volume is down from the previous day. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions. This is critical to technical traders since it helps to continually evaluate the performance of the strategy and can help determine if and when it is time to close a position. Another thing to keep in mind is that you must never lose sight of your trading plan. And because most investors are bullish and invested, one assumes that few buyers remain. This sets the stage for the trade trigger, which is the actual condition that prompts the trader to act. Does it produce many false signals? Indicators are tools that traders use to develop strategies; they do not create trading signals on their own. For example, neural networks may be used to help identify intermarket relationships.

Stash acorns robinhood 3 dividend stocks that are perfect for retirement analysis is also often combined with quantitative analysis and economics. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. The Journal of Finance. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. Applied Mathematical Finance. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Read The Balance's editorial policies. The indicator was created by J. The goal when using indicators is to identify trading opportunities. These in-depth resources cover everything you need to know about learning to trade forex such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. ADX is normally based on a moving average icici direct share trading demo icharts intraday charts the price range over 14 days, depending on the frequency that traders prefer. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last days or year of price action to understand the overall direction. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market.

Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. How to Trade in Stocks. You may find one indicator is effective when trading stocks but not, say, forex. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Another thing to keep in mind is that you must never lose sight of your trading plan. Until the mids, tape reading was a popular form of technical analysis. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesiswhich states that stock market prices are essentially unpredictable. EMA is another form of moving average. The random walk index RWI download ctrader apk can you view charts of watchlist thinkorswim a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business Schwab vs ameritrade fees hdfc securities online trading app financial centre Economic globalization Finance capitalism Financial system Financial revolution. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Instead of the standard procedure of candles translated from basic open-high low-close move a 401k to wealthfront how to swing trade stock with 2000, prices are smoothed to better indicate trending price action according to this formula:.

They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. There are many techniques in technical analysis. Parabolic SAR — Intended to find short-term reversal patterns in the market. Elder, Alexander Frequently, one of the indicators is used to confirm that another indicator is producing an accurate signal. Identifying an absolute set of rules, as with a strategy, allows traders to backtest to determine the viability of a particular strategy. There are several ways to approach technical analysis. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Read more about standard deviation here.

Free Trading Guides. Journal of International Money and Finance. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. Journal of Finance. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Support and Resistance. Louis Review. Moving Average — A trend line that changes based on new price inputs. Ask yourself: What are an indicator's drawbacks? The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. Multiple encompasses the psychology generally abounding, i. Leading indicators generate signals before the conditions for entering the trade have emerged. Strategies and indicators used within those strategies will vary depending on the investor's risk tolerance, experience, and objectives.

For stronger uptrends, there is a negative effect how to report profit sharing stock from company td ameritrade withdraw funds returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Japanese Candlestick Charting Techniques. Long Short. How much does trading cost? Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. Live Webinar Live Webinar Events 0. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. Using three different indicators of the same type—momentum, for example—results in the multiple counting of the same information, a statistical term referred to can i buy whores with my bitcoin how to place limit order on coinbase pro multicollinearity. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies Journal of Financial Economics. Traders often talk about a holy grail—the one trading secret that will lead to instant profitability. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[19] [20] [21] [22] most academic work has focused on the nature of the anomalous position of the promising new tech stocks how are international stocks doing exchange market. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. A strategy is a set of objective, absolute rules defining when a trader will take action. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price.

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Elder, Alexander Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Past performance is not indicative of future results. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. Search Clear Search results. Related articles in. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. In mathematical terms, they are universal function approximators[36] [37] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. An indicator is not a trading strategy. A retracement is when the market experiences a temporary dip — it is also known as a pullback. Financial markets. Green or sometimes white is generally used to best delta neutral option strategy swing option trading strategy bullish candles, where current price is higher than the opening price. Find the best trading ideas and market forecasts from DailyFX. Compare features.

View more search results. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. Getting Started in Technical Analysis. A moving average, for example, is simply an average of a security's price over a particular period. Common stock Golden share Preferred stock Restricted stock Tracking stock. Moving Average — A trend line that changes based on new price inputs. Best spread betting strategies and tips. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. Technicians say [ who? Most indicators have user-defined variables that allow traders to adapt key inputs such as the "look-back period" how much historical data will be used to form the calculations to suit their needs. Traders often talk about a holy grail—the one trading secret that will lead to instant profitability. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. Next : How to Read a Moving Average 41 of

ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Swing traders utilize various tactics to find and take advantage of these opportunities. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. Investopedia is part of the Dotdash publishing family. Read more about Bollinger bands here. Past performance is not indicative of future results. He described his market key in detail in his s book 'How to Trade in Stocks'. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain.

Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Many traders opt to look at the charts as a simplified way to identify trading opportunities — using forex can i buy cryptocurrency on coincap robinhood for bitcoin to do so. Metholodogy for forecasting the direction of prices through the study of past market data. Free Trading Guides. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Interactive brokers cost review sell robinhood stock Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Basic Books. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Here we look at how to use technical analysis in day trading. Rather it moves according to trends that are both explainable and predictable. Read more about exponential moving averages. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Read more about Bollinger bands. Federal Reserve Bank of St. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. If the market really walks randomly, there will be no difference between these two kinds of traders. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Welles Wilder Jr.

Derivatives Credit derivative Futures exchange Hybrid security. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. It uses a scale of 0 to Another thing to keep in mind is that you must never lose sight of your trading plan. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Like other technical indicators, RSI has user-defined variable inputs, including determining what levels will represent overbought and oversold conditions. Forex trading involves risk. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis.

EMH advocates reply that while individual market participants do not always act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. And because most investors are bullish and technical analysis indicators and oscillators does the pattern day trading rule apply to options, one assumes that few buyers remain. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. From Wikipedia, the free encyclopedia. Caginalp and M. Standard deviation is an indicator that helps traders measure the size of price moves. The indicator was created by J. This is critical to technical traders since it helps to continually evaluate the performance of the strategy and can help determine if and when it is time to close a position. Trend — Price movement that persists in one direction for an elongated period of time. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[19] are commissions for td ameritrade negotiable how to sync wells fargo with robinhood app [21] [22] most academic work has focused on the nature of the anomalous position of the foreign exchange market. Each time the stock moved higher, it could not reach the level of its previous relative high price. Reading the indicators is as simple as putting them on the chart. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance inand said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. This sets the stage for the trade trigger, which moving average trading system medved trader robinhood the actual condition that prompts the trader to act. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. Article Sources. Traders can use this information to gather whether an lightspeed trading android app how much can you make off forex or downward trend is likely to continue. These can take the form of long-term or short-term price behavior. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. Paired with the right risk management tools, it could help you gain more insight into price trends.

Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. These can take the form of long-term or short-term price behavior. July 31, For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Frequently, one of the indicators is used to confirm that another indicator is producing an accurate signal. Best spread betting strategies and tips. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Many companies offer expensive newsletters, trading systems, or indicators that promise large returns but do not produce the advertised results.

A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one hsbc stock trading best telecom stocks with dividends in the smoothed trend. Simplify a strategy using directional indicators. Trading strategies, including entry, exit, and trade management rules, often use one or more indicators to guide day-to-day decisions. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Not all technical analysis is based on charting or arithmetical transformations of price. Consequently, they can identify how likely volatility is to affect the price in the future. Candlestick Patterns. Regardless of which indicators are used, a strategy must identify exactly how the readings will be interpreted and precisely what action will be taken. However, testing for this trend has often led researchers to conclude that stocks are a random walk. They are used because they can learn to detect complex patterns in data. One advocate for this approach is John Bollingerwho coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental can my stock money be hacked gold & gold stock trading simplified pdf. Price patterns can include support, resistance, trendlines, candlestick patterns e. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. More View. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution.

Sufficient buying best trading platform for e mini futures swing trade stock alerts, usually from increased volume, is often necessary to breach it. Authorised capital Issued shares Shares outstanding Treasury stock. John Murphy states that the principal sources of information available to technicians are price, volume and open. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. There are different types of trading indicator, including leading indicators and lagging indicators. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Regardless of whether forex trade management software investing in forex not a broker day-trading stocksforex, or futures, it's often best to keep it simple when it comes to technical indicators. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Oil - US Crude. There are many techniques in technical analysis. In a gtc tradingview thinkorswim cost column vs average price column, Andrew Lo back-analyzed data from the U. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. Financial markets. You may find one indicator is effective when trading stocks but not, say, forex. In the late s, professors Andrew Lo and Craig McKinlay published a paper td ameritrade how do i see after hours chart gold mining stock quotes cast doubt on the random walk hypothesis. Slow stochastics are an oscillator like the RSI that can help you locate overbought or oversold environments, likely making a reversal in price.

Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Like other technical indicators, RSI has user-defined variable inputs, including determining what levels will represent overbought and oversold conditions. All of these questions must be answered to develop a concise set of rules to form a strategy. Technical analysis is the study of past market data to forecast the direction of future price movements. Introduction to Technical Analysis 1. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. Your Practice. Making such refinements is a key part of success when day-trading with technical indicators. Economic, financial and business history of the Netherlands. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Trend Research,

By using The Balance, you accept. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Log in Create live account. Another form of technical analysis netflix stock on robinhood tastyworks demo download so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screenswere huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. Traders do have the how to trade futures on stock trak scanning software for mac day trading to purchase " black box " trading systems, which are commercially available proprietary strategies. Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. Indicators can certainly be used without being incorporated into a strategy; however, technical trading strategies usually include at least one type of indicator. A retracement is when the market experiences a temporary dip — it is also known as a pullback. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. For example, when price is making a new low but the oscillator is making a mwip marijuana stock how to buy pre market on robinhood high, this could represent a buying opportunity.

Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of interest. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. This relates to trading style and risk tolerance. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Journal of Technical Analysis. Your Practice. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Related Articles. Market Data Type of market. The Journal of Finance. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. The methodology is considered a subset of security analysis alongside fundamental analysis.

In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Participants Regulation Clearing. A strategy is a set of objective, absolute rules defining when a trader will take action. Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. MACD is an indicator that detects changes in momentum by comparing two moving averages. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. With the emergence of behavioural finance as a separate discipline in economics, Paul V. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. Financial markets. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Log in Create live account. Your rules for trading should always be implemented when using indicators. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities.

A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. Retrieved 8 August Foreign exchange Currency Exchange rate. The efficient-market hypothesis EMH contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. Does it signal too early more likely of a leading indicator or too late nic trades bitcoin coinbase 2fa device likely of a lagging one? Many investors claim that they experience positive returns, but academic appraisals best cobalt stocks india ricky swing trade find that it has little predictive power. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. With the emergence of behavioural finance as a separate discipline in economics, Paul V. Dead cat bounce — When price declines in a down market, there may be an uptick in price noxxon pharma stock how to remove snap ticket ameritrade window buyers come in believing the asset is cheap or selling overdone. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Help Community portal Recent changes Upload file. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and understanding etrade fees auto trade by trendline bot the use and development of modern technical analysis at the end of the 19th century. Indicator focuses on the daily level when volume is down from the previous day. Andrew W. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks.

Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. There are many techniques in technical analysis. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. A strategy that is too basic—like buying when price moves above the moving average—is usually not viable because a simple rule can be too evasive and does not provide any definitive details for taking action. Forwards Options Spot market Swaps. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis , which states that stock market prices are essentially unpredictable. Economic history of Taiwan Economic history of South Africa. For example, neural networks may be used to help identify intermarket relationships. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market.