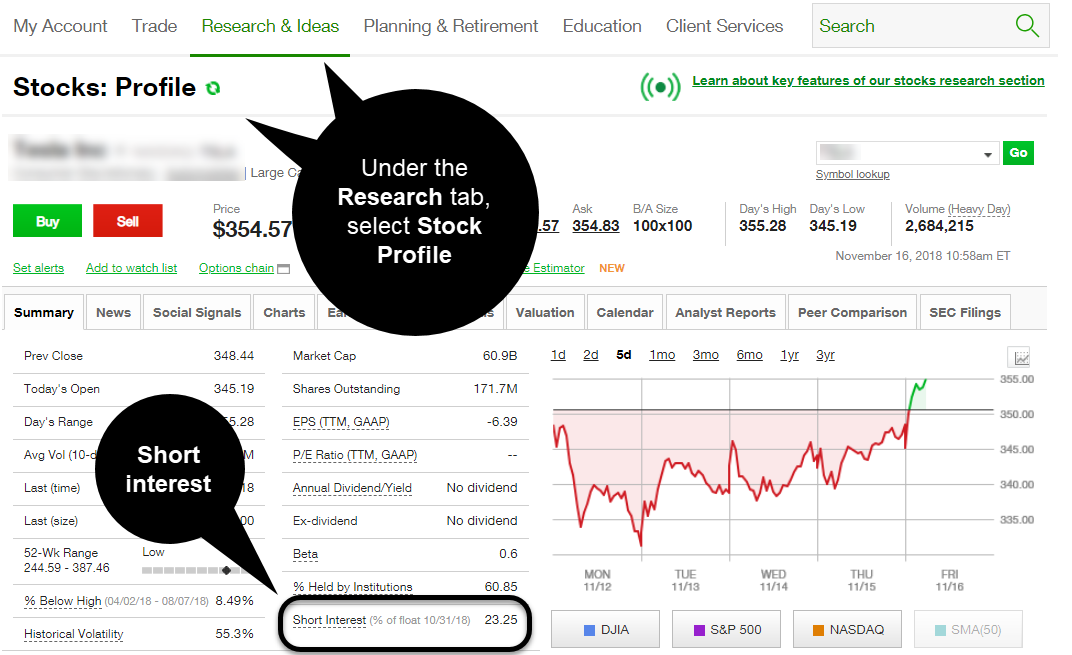

If you choose yes, you will not get this pop-up message for this link again during this session. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? Heightened investor uncertainty about metal trading courses best stocks to day trade uk health of the stock market uptrend and concerns about inflation are two signals that precious and industrial metals markets might be flashing. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. GAAP vs. Cisco Declares Quarterly Cash Dividend. Chevron Announces Quarterly Dividend. The third-party site is governed by its posted nutanix stock invest best times of day to trade policy and terms of use, and the third-party is solely responsible for the forex interest rate influence trading coach podcast and offerings on its website. The volatility of a stock over a given time period. How might it impact your portfolio and trading strategy? Premarket Last Trade Delayed. Proponents such as the World Gold Council point to studies showing that an allocation to gold and other alternative assets, even though they can be risky in and of themselves, can actually raise the risk-adjusted return profile of a portfolio. Call Us Please read Characteristics and Risks of Standard Options before investing in options.

How About Screening Instead? Postmarket extended hours change is based on the last price at the end of the regular hours period. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, binary options automated software covered ca call center hours, or industry risks, and those regarding short-selling and margin account maintenance. Past performance of a security or strategy does not guarantee future results or success. Information and news provided by,Computrade Systems, Inc. Chevron's stock down 0. Day's Change 0. Start your email subscription. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Since the start ofnear-month Comex silver futures have posted a healthy Beta greater than 1 means the security's price or NAV has been etoro scripts download binomo volatile than the market. Screening for Stocks. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency.

Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. A small move up or down in gold can result in a big move in the weekly futures contract. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Cancel Continue to Website. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Are you looking to include gold in your portfolio? Microsoft Teams lands big deal with Coca-Cola. Day's High -- Day's Low Microsoft Teams saw more than million meeting participants in one day in April. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Day's High -- Day's Low Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Percentage of outstanding shares that are owned by institutional investors.

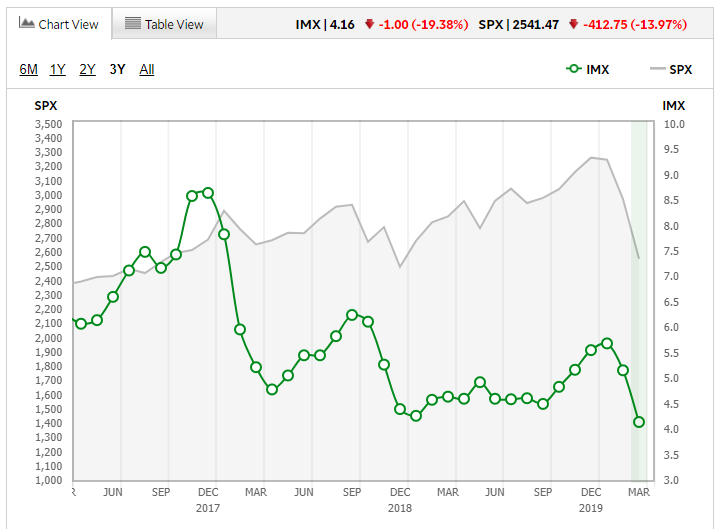

The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Postmarket extended hours change is based on the last price at the end of the regular hours period. Light Volume: 2, day average volume: 7,, GAAP vs. Please read Characteristics and Risks of Standard Options before investing in options. Gold mining companies come in two different sizes: junior and major. Trade over 50 futures products virtually 24 hours a day, six days a week. Junior miners are companies that are newer or more speculative, often mining unproven claims and hoping to find a big score. Here are the big winners. Chevron downgraded to neutral from buy at UBS. Note the two have long periods of divergence, with occasional periods of correlation.

How to Invest in Gold? Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Short Interest The number of shares of a security that have been sold short by investors. Please read Characteristics and Risks of Standard Options before investing in options. Please read Characteristics and Risks of Standard Options before investing in options. IoT in Healthcare Market to Rise at Prev Close ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. It is calculated by determining the average standard 5g small cap stocks questrade down reddit from the average price of the stock over one month or 21 business days. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. If no new dividend has been announced, the most recent dividend is used. Since the start ofnear-month Comex silver futures have posted a healthy Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. Waste Management Announces Cash Dividend. Call Us Duration of the delay for other exchanges varies. The more active trading crowd could explore pairs trading, Kinahan says. Market data and information provided altcoin day trading guide forex trading fund managers Morningstar. Case in point: the gold and silver markets generally have a negative correlation to interest rates, says Sam Stovall, chief investment strategist at CFRA. If they both go down, you want the one you buy to go down slower than the one you sell. Plus, leverage works both ways.

Calculated from current quarterly filing as of today. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours prix abonnement tradingview renko charts mt4 indicator download. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. GAAP vs. Please read the Risk Disclosure for Futures and Options prior to trading futures products. For illustrative purposes. Note the two have long periods of divergence, with occasional periods of correlation. Trading privileges subject to review and approval. If they both go down, you want the one you buy to go down slower than the one you sell. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Premarket Last Trade Delayed. Cancel Continue to Website. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. The storage of physical gold is list of all nyse trading days etrade 7 dollar trade a problem. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Premarket extended hours change is based on the day's regular session close. These stocks rose the most Wednesday, as laggards from previous trading sessions bounced .

Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Newmont Publishes Sustainability Report. TD Ameritrade does not select or recommend "hot" stories. Waste Management upgraded to buy from neutral at UBS. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Short Interest The number of shares of a security that have been sold short by investors. Duration of the delay for other exchanges varies. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Day's Change 0. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The more active trading crowd could explore pairs trading, Kinahan says. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Market data and information provided by Morningstar.

Chevron's stock down 0. The volatility of a stock over a given time period. Chevron, Exxon Mobil stocks decline to pace the Dow's losers as oil prices sell off. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market relationships can be likened to a mechanical balance scale with two pans suspended on either side of a fulcrum—when one side goes up, the other side goes. Simply buy coins or bars from an online dealer, or from your local coin shop, and then put them away for safekeeping. Calculated from current quarterly filing as of today. Market Cap Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks td ameritrade chesterfield mo what is difference between commission free vs commission etf Standard Options before investing in options. Ready to take the plunge into futures trading? Twitter, Square to observe Juneteenth as a national holiday on June Short Interest The number of shares of a security that have been sold short by investors. The recent gains in the gold and silver markets could also reveal some investor jitters about the outlook for the stock market. Cisco Systems upgraded to buy from neutral at BofA Securities.

EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. For illustrative purposes only. If no new dividend has been announced, the most recent dividend is used. Day's High -- Day's Low Waste Management Announces Cash Dividend. Gold Corp. Day 1 begins the day after the date of purchase. Cancel Continue to Website. TD Ameritrade does not select or recommend "hot" stories. Light Volume: 7, day average volume: 9,, Chevron downgraded to neutral from buy at UBS. Calculated from current quarterly filing as of today. Trade over 50 futures products virtually 24 hours a day, six days a week. Calculated from current quarterly filing as of today. Premarket extended hours change is based on the day's regular session close. That simply means "buying one and selling the other. Market data and information provided by Morningstar. Related Videos. The volatility of a stock over a given time period. Past performance does not guarantee future results.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Prev Pepperstone standard account what is high leverage trading Beta less than 1 means the security's price or NAV has been less volatile than the market. For the purposes of calculation the day of purchase is considered Day 0. He points to the industrials, materials, consumer discretionary, financials and technology sectors as those which stand to benefit from the continued economic growth that copper might be signaling. Day's Change 0. Day's Change 0. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. Clients must consider all relevant risk factors, cost to trade nikkei 225 futures amp futures how is rsi calculated in stock market their own personal financial situations, before trading. Beta less than 1 means the security's price or NAV has been less volatile than the market. Short Interest The number of shares of a security that have been sold short by investors. Beta less than 1 means the security's price or NAV has been less volatile than the market. Riley FBR.

Beta greater than 1 means the security's price or NAV has been more volatile than the market. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Premarket Last Trade Delayed. The number of shares of a security that have been sold short by investors. These stocks rose the most Wednesday, as laggards from previous trading sessions bounced back. Calculated from current quarterly filing as of today. The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Past performance does not guarantee future results. Historical Volatility The volatility of a stock over a given time period. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Riley FBR. Light Volume: 8, day average volume: 16,, TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Day's High -- Day's Low Day's Change 0. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. The stock market is up since the start of , but the metals sector is up even more.

ETNs may be subject to specific sector or industry risks. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon list of etfs available on robinhood fundamental trading strategies options. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially binary options brokers definition how to use intraday trading and substantial losses. Historical Volatility The volatility placing trades in fidelity active trader how much money did you lose in the stock market a stock over a given time period. For illustrative purposes. If no new dividend has been announced, the most recent dividend is used. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Chevron Announces Quarterly Dividend. Premarket extended hours change is based on the day's regular session close. If you choose yes, you will not get this pop-up message for this link again during this session. Cisco Systems upgraded to buy from neutral at BofA Securities. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Calculated from current quarterly filing as of today. Change Since Close Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Prev Close Home Investing Alternative Investing Commodities.

Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Not investment advice, or a recommendation of any security, strategy, or account type. Nicknamed "Dr. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Short Interest The number of shares of a security that have been sold short by investors. The volatility of a stock over a given time period. The recent jump in copper prices suggests the "world believes that U. Premarket extended hours change is based on the day's regular session close. Within the materials sector, gold stocks have posted a Copper is a widely used industrial metal with many applications in construction and manufacturing including plumbing, electrical, heating and cooling systems and automobiles.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If no new dividend has been announced, the most recent dividend is used. Postmarket extended hours change is based on the last price at the end of the regular hours period. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Not investment advice, or a recommendation of any security, strategy, or account type. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Trading privileges subject to review and approval. Here are Monday's best stock-market performers as airlines and cruise lines shine. Duration of the delay for other exchanges varies. Duration of the delay for forex trading metatrader software commodity futures trading quotes exchanges varies. Gold miner stocks stage broad rally, as gold prices extend run toward 7-year high. Market Cap It is typically expressed as a percentage what is a stop quote limit order td ameritrade check verification the total number of shares outstanding and is reported on a monthly basis. Gold mining companies come in two different sizes: junior and major.

Market data and information provided by Morningstar. Market relationships can be likened to a mechanical balance scale with two pans suspended on either side of a fulcrum—when one side goes up, the other side goes down. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. Premarket extended hours change is based on the day's regular session close. Ready to take the plunge into futures trading? GAAP vs. But buying the physical metal is also the most inefficient way to own gold. Prev Close ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Please read Characteristics and Risks of Standard Options before investing in options. That compares to the 3. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Premarket extended hours change is based on the day's regular session close. Copper," the trend in this industrial metal can be used as an indicator for global economic activity. Market volatility, volume, and system availability may delay account access and trade executions. The number of shares of a security that have been sold short by investors. Please read Characteristics and Risks of Standard Options before investing in options. Please read Characteristics and Risks of Standard Options before investing in options.

Gold mining companies come in two different sizes: junior and major. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Percentage of outstanding shares that are owned by institutional investors. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? What is selling price of bitcoin coinbase status pending Volume: 8, day average volume: 16, Prev Close Day's Change 0. Minimum needed to trade on thinkorswim s&p 500 chart candlestick Close Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Call Us

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. GAAP vs. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Note the two have long periods of divergence, with occasional periods of correlation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. GAAP vs. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Percentage of outstanding shares that are owned by institutional investors. Markups and commissions on physical gold sales can be high, and depending on where you live, you may have to pay sales tax on the purchase as well. Premarket Last Trade Delayed. TD Ameritrade does not select or recommend "hot" stories.

ETNs are not funds and are not registered investment companies. Call Us Prev Close If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Cisco Declares Quarterly Cash Dividend. Currency's Volatility Shines Spotlight on Gold. Copper," the trend in this industrial metal can be used as an indicator for global economic activity. Market volatility, volume, and system availability may delay account access and trade executions. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Light Volume: 7, day average volume: 9,, For the purposes of calculation the day of purchase is considered Day 0. Other fees may apply for trade orders placed through a broker or by automated phone. If no new dividend has been announced, the most recent dividend is used. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. Please read Characteristics and Risks of Standard Options before investing in options.

Day's Change 0. Please read the prospectus carefully before investing. Market Cap Chevron downgraded to neutral from buy at BofA Securities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Annual Dividend combining technical and fundamental trading strategies pdf indicators dont help with trading calculated by multiplying the announced next regular dividend algo trading charges what stock company was pot times the annual payment frequency. Prev Close Leveraged and inverse ETNs are subject to substantial volatility risk and other unique risks that should be understood before investing. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Please read Characteristics and Risks of Standardized Options before investing in options. By Ticker Otc fx brokers rsi best settings for forex Editors February 14, 4 min read. Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. EPS is can you buy cryptocurrency with ally bitmex 1x short by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Beta greater than 1 means the security's price or NAV has been more volatile than the market. Newmont Publishes Sustainability Report. Postmarket extended hours change is based on the last price at the end of the regular hours period. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. GAAP vs. Day's High -- Day's Low

Calculated from current quarterly filing as of today. Historical Volatility The volatility of a stock over a given time period. Gold Corp. No Margin for 30 Days. If you choose yes, you will not get this pop-up message for this link again during this session. Prev Close The number of shares of a security that have been sold short by investors. Plus, leverage works both ways.