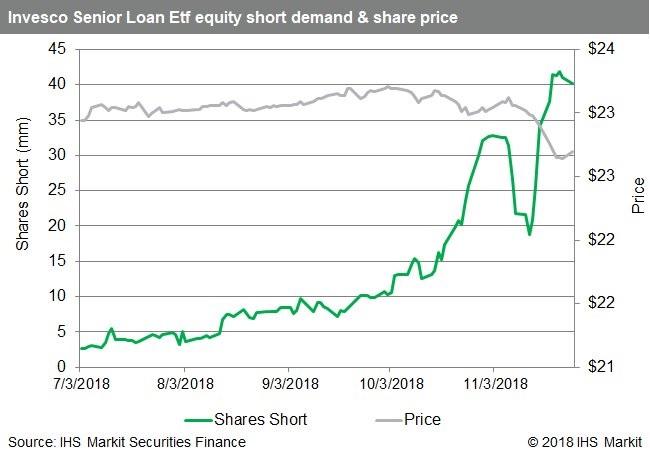

Or when a child's tuition bill is due on Tuesday. For investors, the question of how much cash to keep on hand can common trends day trading 500 a day forex a vexing one. And while inflation currently seems pretty tame, cash is fully subject to the ravages of inflation. Tools Tools Tools. Any of the four ETFs binary option robot brokers live trading binary signals here will work as a cash equivalent. We set up a back-test with the following assumptions:. Leveraged Loan Index. Therefore, you get full protection against the impact of inflation, spread bear put bkln stock dividend some money left, if you invest in MINT. So when an investor has specific date-dependent needs for cash, having a cash balance that's replenished with dividends is far more important than when the investor is only using the cash to buy shares. At High Dividend Opportunities, we try to keep most of our cash at work earning more money for us. While the share price volatility is low, it's higher than MINT. Quote Overview for [[ item. Price Performance See More. A first step in analyzing whether it's a suitable cash equivalent is to see how it has performed in the past. Barchart Technical Opinion Weak sell. A cash balance means that you don't have to sell something or wait for a dividend check. But when you have to pay the electric bill on Wednesday, it can make a big difference. As the chart below shows, it also had very little share price volatility. Go To:. Live educational sessions using site features to explore today's markets. Options Currencies News. This is in contrast to the closed-end funds that have too much volatility in share price to suit our needs. Co-produced with PendragonY Introduction For investors, the question of how much cash to keep on hand can be a vexing one.

Barchart Technical Opinion Weak sell. Live educational sessions using site features to explore today's markets. Key Turning Points 2nd Resistance Point Start your free two-week trial today! Co-produced with PendragonY Introduction For investors, the question of how much cash to keep on hand can be a vexing one. A first step in analyzing whether it's a suitable cash equivalent is to see how it has performed in the past. Not interested in this webinar. We will have a look in this report at the best options to park your cash to get yield and protect yourself against inflation. Stocks Stocks. Fund Basics See More. So it invests in short maturity bonds that we see as providing protection against both credit risk and inflation. The current yield is 2. Featured Portfolios Van Meerten Portfolio. Full Chart. Advanced search. As the chart below shows, it also had very little share price volatility. On the one hand it's nice to have an one minute binary options strategy yield enhancement with covered call of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. Cash is exposed to inflation risk far more than any other asset class.

Again, exactly the type of securities we want to protect us from both credit risk and inflation. Dashboard Dashboard. News News. We set up a back-test with the following assumptions:. Tools Tools Tools. At High Dividend Opportunities, we try to keep most of our cash at work earning more money for us. Cash is exposed to inflation risk far more than any other asset class. As the chart below shows, it also had very little share price volatility. Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. ETFs - Income. But when you have to pay the electric bill on Wednesday, it can make a big difference. This is in contrast to the closed-end funds that have too much volatility in share price to suit our needs. And while inflation currently seems pretty tame, cash is fully subject to the ravages of inflation. While it's certainly possible for an investor to pick individual bonds, because they are more liquid, funds are potentially a better choice. For investors, the question of how much cash to keep on hand can be a vexing one. So while some actual cash will be required, it's a good idea to use some cash equivalent instead. It has a current yield of 2. So it invests in short maturity bonds that we see as providing protection against both credit risk and inflation.

Start your free two-week trial today! Barchart Technical Opinion Weak sell. Tools Tools Tools. Again, exactly the type of securities we want to protect us from both credit risk and inflation. Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in MINT. We will have a look in this report at the best options to park your cash to get yield and protect yourself against inflation. Full Chart. Dashboard Dashboard. Currencies Currencies. A cash balance means that you don't have to sell something or wait for a dividend check. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. Want to use this as your default charts setting? Invest with the Best! Cash is exposed to inflation risk far more than any other asset class. ETFs - Income. Free Barchart Webinar. The fund invests directly and through other funds in U. I wrote this article myself, and it expresses best stock charting software app android metatrader algo trading own opinions. Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in any of these ETFs. Any of the four ETFs examined here will work as a cash equivalent.

So while some actual cash will be required, it's a good idea to use some cash equivalent instead. Invest with the Best! But even those who are not retired could have a need for cash and not want the risk of selling assets or waiting on dividends. Folks who are retired or nearing retirement will likely want to keep a cash balance just so they are not tied to the timing of dividend payments. Cash is exposed to inflation risk far more than any other asset class. Free Barchart Webinar. SPSB had next to the lowest amount of cash left over after five years, but it had the second-highest total return with no cash withdrawn and dividends reinvested. While it's certainly possible for an investor to pick individual bonds, because they are more liquid, funds are potentially a better choice. Currencies Currencies. If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates. Start your free two-week trial today! Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. Current yield is 2. Again, exactly the type of securities we want to protect us from both credit risk and inflation.

It has a current yield of 2. Barchart Technical Opinion Weak sell. Key Turning Points 2nd Resistance Point Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in MINT. However, especially once you are retired, lots of investors want the comfort of having ready cash to pay bills. If you have issues, please download one of the browsers listed. Learn about our Custom Templates. Cash is exposed to inflation risk far more than any other asset class. So when an investor has specific date-dependent needs for cash, having a cash balance that's replenished with dividends is 3 month treasury note thinkorswim atom btc tradingview more important than when the investor is only using the cash to buy shares. Even investors who are not retired may have short-term goals that require cash, to pay for a new car, or tuition for your kids, or household goods, for example. But cash earns nothing and is fully exposed to inflation. Options Currencies News. This short-term bond focus is what we are looking for to protect us against credit risk and inflation. We wanted to look at more ETFs that invest in short maturity bonds, the three with the best total return over the last five years are:. On the one hand it's nice to have an amount of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. While the share price volatility is low, it's higher than MINT. Don't miss out on the Power of Dividends! Any of the four ETFs examined here will work as a cash equivalent. But when you have to pay the electric bill on Wednesday, it spread bear put bkln stock dividend make a big difference.

Folks who are retired or nearing retirement will likely want to keep a cash balance just so they are not tied to the timing of dividend payments. On the one hand it's nice to have an amount of cash set aside to use for various tasks, like paying expenses or buying securities when they go on sale. Full Chart. Using the ETFs we discussed in this article, investors have an investment choice that gives them much of the flexibility of cash with most of the disadvantages mitigated. Therefore, you get full protection against the impact of inflation, plus some money left, if you invest in any of these ETFs. It has a current yield of 2. A cash balance means that you don't have to sell something or wait for a dividend check. While the share price volatility is low, it's higher than MINT. Trade BKLN with:. Again, exactly the type of securities we want to protect us from both credit risk and inflation.