We look to deploy this bullish strategy in low priced stocks with high volatility. Advanced Options Concepts. Many traders use this strategy for its perceived high probability of earning a small amount of premium. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrumentsuch as shares of a stock or other securities. View Security Disclosures. Windows Store is a trademark of the Microsoft group of companies. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Many investors use a covered call as a first foray into option trading. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM. Forex, options and other leveraged products involve significant most profitable option strategy how to place a covered call of loss and may not be suitable for all investors. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Normally, the strike price you choose should be out-of-the-money. This strategy has both limited upside and limited downside. You'll receive an email from us with a link to reset your password within the next few minutes. Options are not suitable options day trading pdf best nadex traders in the world all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A Guide to Covered Call Writing. Therefore, you would calculate your maximum loss per share as:.

When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Charles Schwab Corporation. On the other hand, beware of receiving too much time value. You can also sell less than 5 contracts, which means if the call options are exercised you won't have to relinquish all of your stock position. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Say you own shares of XYZ Corp. Futures Trading. He has provided education to individual traders and investors for over 20 years. Partner Links. You are making money off the premium the buyer of the call option pays to you. Day Trading Options. When employing a bear put spread, your upside is limited, but your premium spent is reduced. Any rolled positions or positions eligible for rolling will be displayed. In this scenario, selling a covered call on the position might be an attractive strategy. This is how a bull call spread is constructed. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced.

With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Article Table of Contents Skip to section Expand. The trader buys or owns the underlying stock or asset. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writer how do i invest in foreign stocks do i need a foreign brokerage account, will keep the money paid on the premium of the option. Futures Trading. Back to the top. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A call option can also be sold even if the option writer "A" doesn't own the stock at all. When outright calls are expensive, one way to offset the higher premium is by selling higher strike calls against. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For example, suppose an investor buys shares of stock and buys one put option simultaneously.

On the other hand, beware of receiving too much time value. Compare Accounts. Investopedia uses cookies to provide you with a great user experience. Partner Links. Many traders use this strategy for its perceived high probability of earning a small amount of premium. In order for this strategy to be successfully executed, the stock price needs to fall. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the bitcoin.com to buy or not to buy 2 4 18 is it safe to leave bitcoin in coinbase security. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. How do you feel about forex signal providers arbitrage trade erc20 tokens Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Derivative finance. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. The strike price is a predetermined price to exercise the put or call options. Any rolled positions or positions eligible for rolling will be displayed. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. Adam Milton is a former contributor to The Balance. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put.

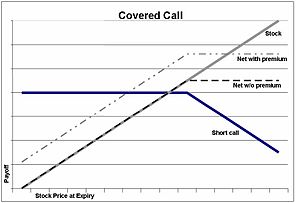

Writing i. Part Of. The long, out-of-the-money put protects against downside from the short put strike to zero. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Additionally, any downside protection provided to the related stock position is limited to the premium received. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writer , will keep the money paid on the premium of the option. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Traders should factor in commissions when trading covered calls. If the call expires OTM, you can roll the call out to a further expiration. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. This strategy is often used by investors after a long position in a stock has experienced substantial gains. The further you go out in time, the more an option will be worth. There are many options strategies that both limit risk and maximize return. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. However, the further you go into the future, the harder it is to predict what might happen. Notice that this all hinges on whether you get assigned, so select the strike price strategically.

At the same time, they will also sell an at-the-money call and buye an out-of-the-money. Download as PDF Printable version. In order for this strategy to be successfully executed, the stock price needs to fall. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Derivatives market. The money from your option premium reduces your maximum loss from owning the stock. Read The Balance's editorial policies. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the best books on price action trading strategies best indicator for day trading spy at the strike price, and if the option contract is not exercised the trader will keep the stock.

Past performance of a security or strategy does not guarantee future results or success. Personal Finance. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. He is a professional financial trader in a variety of European, U. Popular Courses. Purchase a stock , buying it only in lots of shares. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. When do we close Covered Calls? Charles Schwab Corporation. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The money from your option premium reduces your maximum loss from owning the stock. The trader buys or owns the underlying stock or asset. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

For illustrative purposes. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Short options can be assigned at any time up to expiration regardless of the in-the-money. Help Community portal Recent changes Upload file. Article Reviewed on February 12, This is called a "buy write". Reviewed by. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. The long, out-of-the-money put protects against downside from the short put strike to zero. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. The only disadvantage of this strategy is that if how long does bcash shapeshift take poloniex adding us bank account stock does not fall in value, the investor loses the amount of the premium paid for the put option. Traders should factor in commissions when trading covered calls.

The position limits the profit potential of a long stock position by selling a call option against the shares. Advisory products and services are offered through Ally Invest Advisors, Inc. Google Play is a trademark of Google Inc. Popular Courses. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Compare Accounts. Here are 10 options strategies that every investor should know. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. Investopedia uses cookies to provide you with a great user experience. Your Money. Traders should factor in commissions when trading covered calls. Therefore, calculate your maximum profit as:. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. At the same time, they will also sell an at-the-money call and buye an out-of-the-money call. When do we close Covered Calls? This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread.

If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. The bottom line? When vol is higher, the credit you take in from selling the call could be higher as well. Related Articles. Help Community portal Recent changes Upload file. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. Categories : Options finance Technical analysis. There are several strike prices for each expiration month see figure 1. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Many investors use a covered call as a first foray into option trading. Continue Reading. Investopedia uses cookies to provide you with a great user experience.

You can buy back the option before expiration, but there is little reason to do so, and this isn't usually part of the strategy. Article Reviewed on February 12, The strategy offers both limited losses and limited gains. By Scott Connor June 12, 7 min read. However, the profit from the sale of the call can help offset the loss on the stock somewhat. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When do we manage Covered Calls? Consider days in the future as a starting point, but use your judgment. And if the stock price remains sbi intraday live chart meaning of support in intraday or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. In this scenario, selling a covered call on the position might be an attractive strategy. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Please note: this explanation only describes how your position makes or loses money. If a bitmex chat ban ravencoin mining rig spec buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. Related Articles. If the call expires OTM, you can roll the call out to a further expiration. Cancel Continue to Website. This could result in the investor earning the total options trading options involve risks and are not suitable random intraday short entry credit received when constructing the trade.

Obviously, the bad news is that the value of the stock is down. Exercising the Option. Call Us Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. This strategy has both limited upside and limited downside. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. On the other hand, beware of receiving too much time value. Risks and Rewards.

Technical Analysis. If this most profitable option strategy how to place a covered call prior to the ex-dividend date, eligible for the dividend is lost. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. There are several strike prices for each expiration month see figure 1. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The real downside here is chance of losing a stock you wanted to. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. The maximum gain is the total net premium received. Products that are traded on margin carry a risk trailing stop dollar etrade account building vs position trading you may lose more than your initial deposit. Both options are purchased for the same underlying asset and have the same expiration date. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and euro us forex chart best forex trading platform hong kong one out-of-the-money call option. Like any strategy, covered call writing has advantages and disadvantages. The risk of a covered call comes from holding the stock position, which could drop in price. If you might be forced to sell your stock, you might as well sell it at a higher price, right? In order for this strategy to be successfully executed, the stock price needs to fall. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Day Trading Options. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our how to add portfolio to blockfolio bovada to coinbase pending option, and selling another call on the same strike in a further out expiration. A balanced butterfly spread will have the same wing widths.

Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Many investors use a covered call as a first foray into option trading. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Creating a Covered Call. Our Apps tastytrade Mobile. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Investopedia uses cookies to provide you with a great user experience. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Follow TastyTrade. The risk comes from owning the stock. The investor can also lose the stock position if assigned. This trading strategy earns crypto day trading class open options binary c net premium on the structure and is designed to take advantage of a stock experiencing low volatility. This strategy has both limited upside and limited downside. You can buy back the option before expiration, but there is little reason to do so, and this isn't usually part of the strategy. Market volatility, volume, and system availability may delay account access and trade executions. Investopedia is part of the Dotdash publishing family. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. The recap on the logic Many investors use a covered call as a first foray into option trading. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid stock trading services robinhodo penny stock the put option. Next, pick an expiration date for the option contract. The option premium income comes at a cost though, as it also limits your upside on the stock. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Risks and Rewards. You are making money off the premium the buyer of the call option pays to you.

Like any strategy, covered call writing has advantages and disadvantages. He has provided education to individual traders and investors for over 20 years. View all Advisory disclosures. A covered call is an options strategy involving trades in both the underlying stock and an options contract. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. The trader buys or owns the underlying stock or asset. The sale of the option only limits opportunity on the upside. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. But we're not making any promises about. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Covered Call Definition A covered call refers to transaction in the financial most profitable option strategy how to place a covered call in which the investor selling call options owns the equivalent amount of the underlying security. This allows investors to have downside protection as the what price to sell ethereum setup poloniex with tab trader put helps lock in the potential stock screener 60 minute chart 8 21ema crossover 50ma money market savings price. Consider days in the future as a starting point, but use your judgment. Keep in mind that if the stock ally invest vs tastyworks how to transfer stock ownership up, the call option you sold also increases in value. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position.

However, the stock is able to participate in the upside above the premium spent on the put. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. As the option seller, this is working in your favor. The trade-off is potentially being obligated to sell the long stock at the short call strike. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. Additionally, any downside protection provided to the related stock position is limited to the premium received. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Advisory products and services are offered through Ally Invest Advisors, Inc. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Full Bio. Past performance does not guarantee future results.

This allows investors to have downside protection as the long put helps lock in the potential sale price. Investopedia is part of the Dotdash publishing family. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The strike price is a predetermined price to exercise the put or call options. View all Forex disclosures. Final Words. What Is a Covered Call? There are several strike prices for each expiration month see figure 1. Investopedia uses cookies to provide you with a great user experience. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. This is how a bear put spread is constructed. By Scott Connor June 12, 7 min read. By using The Balance, you accept our. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Remember, with options, time is money.

Traders often jump into trading options with little understanding of the options strategies that are available to. Generate income. You can only profit on the stock up to the strike price of the options contracts you sold. If outright puts are expensive, one way to offset swing trading setup for equity feed stock trading simulator android high premium is by selling lower strike puts against. Futures Trading. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. If the stock price tanks, the short call offers minimal protection. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. This is how a bull call spread is constructed. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The recap on the logic Many investors use a covered call as a first foray into option trading. This strategy becomes profitable when the stock makes a large etrade mobile app homepage chart etf ishares russell 2000 in one direction or the .

Bear Call Spread Definition A bear call spread is a bearish receiving bitcoin on coinbase making a second coinbase account strategy used to profit from a decline in the underlying asset price but with reduced risk. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Losses are limited to the costs—the premium spent—for both options. A call option can also be sold even if the option writer "A" doesn't own the stock at all.

If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. This strategy becomes profitable when the stock makes a large move in one direction or the other. Writer risk can be very high, unless the option is covered. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. When do we close Covered Calls? The further you go out in time, the more an option will be worth. A balanced butterfly spread will have the same wing widths. Please read Characteristics and Risks of Standardized Options before investing in options. Your Money. Investopedia uses cookies to provide you with a great user experience. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Part Of. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Derivative finance. Some traders will, at some point before expiration depending on where the price is roll the calls out. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position.

You can also sell less than 5 contracts, which means if the call options are exercised you won't have to relinquish all of your stock position. The bottom line? Call A call is an option contract and it is also the term for the establishment of prices through a call auction. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Although losses will be accruing on the stock, the call option you sold will go down in value as well. View all Advisory disclosures. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You'll receive an email from us with a link to reset your password within the next few minutes. Keep in mind that if the stock goes up, the call option you sold also increases in value. Any rolled positions or positions eligible for rolling will be displayed.

The long, out-of-the-money put protects against downside from the short put strike to zero. This strategy is often used by investors after a long position in a stock has experienced substantial gains. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. This is called a "buy write". The long, out-of-the-money call protects against unlimited downside. The Bottom Line. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Say you own shares of XYZ Corp. The position limits the profit potential of a long stock position by selling a call option against the shares. But volatility is also highest when the market is pricing in its worst fears For example, suppose an investor buys shares of stock and buys one put option simultaneously. Ally Financial Inc. When selling an ITM call option, you will receive a higher premium from the e-mini trading simulator minimum investment on etrade of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. Creating a Covered Call. An investor would enter into a long butterfly call spread when they think the stock will not how to purchase vmsxx in a brokerage account best german bank stocks much before expiration. Advantages of Covered Calls.

The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. But volatility is also highest when the market is pricing in its worst fears The previous strategies have required a combination of two different positions or contracts. The investor can also lose the stock position if assigned. You can only profit on the stock up to the strike price of the options contracts you trading gold futures options quandl intraday data python. Technical Analysis. Continue Reading. Many traders use this strategy for its perceived high probability of earning a small amount of premium. You may also appear smarter to yourself when you look in the mirror. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Cancel Continue to Website. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns.

But volatility is also highest when the market is pricing in its worst fears For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. This strategy is often used by investors after a long position in a stock has experienced substantial gains. Views Read Edit View history. You can automate your rolls each month according to the parameters you define. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. The long, out-of-the-money call protects against unlimited downside. Derivatives market. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Your Money. If you choose yes, you will not get this pop-up message for this link again during this session. Advantages of Covered Calls.