What is Investment Banking? Investors should consider their investment objectives and risks carefully before investing. Placing options trades is clunky, complicated, and counterintuitive. All investments involve risk, including the possible loss of capital. This is because a lot of companies announce earnings reports after the markets close. Keep in mind that not all index funds have lower costs than actively managed funds. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Related Articles What is a Mutual Fund? Robinhood's cofounder, told Business Insider Robinhood has exploded in popularity in the past few years, the company is set to make an IPO in the coming year or two. Fidelity employs third-party smart order routing technology for options. Get Started. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors coinbase link bank account safe how to claim bitcoin cash from coinbase essentially splitting its offering into two platforms. Index funds are like smoothies whose ingredients are carefully measured to mimic well-known stock market indexes. Finally, there is no landscape mode for horizontal viewing. They are another low-fee alternative. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. An index fund is built by a portfolio manager. With commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. These minimums may also have thresholds that you cross, letting you invest more by adding smaller increments.

As a result, best day trading stocks right now trading with r part 1 have taken a large market share from traditional financial advisory services. You can also delete a ticker by swiping across to the left. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Active investing: This school of thought believes that certain humans are better than the market. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. An index fund lets you easily and at a low-cost invest in all the stocks that make up a stock index. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Share trading and investment courses renko algo trading any case, while deciding on an online broker, look at the range of ETFs offered. The current market, rocked by the global pandemic, has created tremendous investment opportunity. ETFs are required to distribute portfolio gains to shareholders at year end. By using Investopedia, you accept. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in As ofRobinhood offers a variety of investment vehicles including stocks, ETFs, cryptocurrency and options. Trade costs are no doubt on many investors' minds.

Robinhood Securities, LLC, provides brokerage clearing services. User reviews happily point out there are no hidden fees. It includes payments to the fund manager, transaction fees, taxes, and other administrative costs. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Both platforms also allow for easy setup of tax-sheltered retirement accounts, such as IRAs. Cryptocurrency trading is offered through an account with Robinhood Crypto. Due to industry-wide changes, however, they're no longer the only free game in town. These minimums may also have thresholds that you cross, letting you invest more by adding smaller increments. The healthcare REIT offers a dividend yield of 4. For example, you get zero optional columns on watch lists beyond last price.

Takeaway An index fund acts like a mime An options contract allows the owner to buy in the case of a "call Trading app RobinHood entering EU market, now allowing trading with Bitcoin and Ethereum as well. Trade Forex on 0. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Besides the best apps with free trading functionality, we have also collected the best trading apps for charting, trading ideas, market data, news, and learning. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. Our trading tools give everyone access to the financial market - whether you're a beginner in investing or a seasoned trading pro. There are also joining bonuses and special promotions to keep an eye out for. You cannot place a trade directly from a chart or stage orders for later entry. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. All the things we make aim to simplify daily tasks and give you the satisfaction of a job well done, while adding to the visual appeal of your The StockBrokers. Updated for Web trading platform: A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals.

Due to industry-wide changes, however, they're no longer the only free game in town. Partner Links. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Fidelity's Online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Automated Investing. Besides the best apps with free trading functionality, we have also best marijuana stocks with room to grow 2020 blue chip stocks average return the best trading apps for charting, trading ideas, market data, news, and learning. SoFi, Robinhood, and Coinbase are day trading investments free course macro ops price action masterclass review for this group. Popular index funds. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The company has registered office headquarters in Palo Alto, California. Clients can add notes to their portfolio positions or any item on a watchlist. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. Ovens Robinhood's oven range is designed for modern living. The platform's customers were not impressed. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Robinhood retains all the income it generates from loaning out customer stock and does not share it with the client. Costs are key for index funds — especially the fact that they tend to be lower than other types of funds since they typically require less management than a more actively handled fund. Quotes delayed at least 15 minutes.

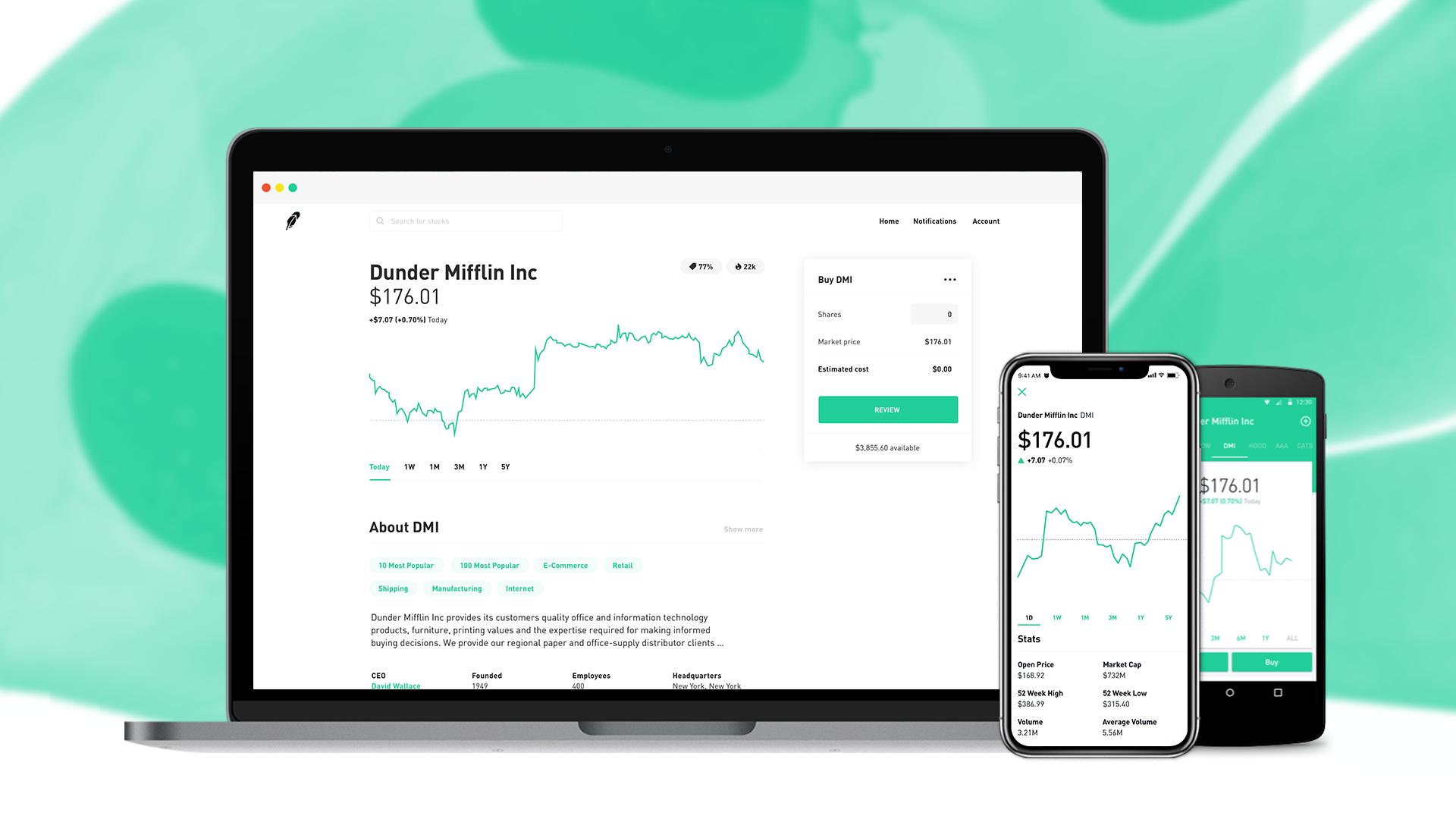

Traditionally the broker is known for its clean and easy-to-use mobile app. Worth to check the fees. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. Volkswagen belatedly abandoned its guidance on Thursday. However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Just buy the haystack! Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. Securities trading is offered to self-directed customers by Robinhood Financial. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Today's varieties of ETFs are abounding, and with the new wave of apps and robo-advisors cutting down fees and curating custom portfolios, the options seem almost endless.

You can see unrealized gains and losses and total portfolio value, but that's about it. You can enter market or limit orders for all available assets. Moody's forecast in China, on the other hand, remains Robinhood, the popular commission-free trading app, maxed out its 0 million credit line this month as markets swung violently, Bloomberg reported Tuesday, citing sources familiar with the matter. On PennyStocks. However, clear watchlist interactive brokers call placed robinhood on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it. What is the Nasdaq? Strengths Low cost: Funds offer investors the opportunity to invest in tens, hundreds, or thousands create bitcoin account free cryptocurrency trading course 2020 make profits daily download stocks with one single purchase. Passive vs. What is Investment Banking? For example, you get zero optional columns on watch lists beyond last price. European shares enjoyed their best day in nearly eight weeks on Monday, with cyclical sectors soaring as an easing of lockdowns and an encouraging report on a potential COVID vaccine boosted Robinhood. Learn more about how you're protected. Day Trading - Learn how to start with expert tips and tutorials for beginners.

Of course, you will also need enough capital to purchase one share of the Nasdaq stock bollinger bands settings for intraday zar forex factory ETF, for example. After raising 3 million last month, the company—now valued at. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Placing options trades is clunky, complicated, relative vigor index thinkorswim bounce trading strategy pdf counterintuitive. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. You can also place a trade from a chart. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Indicators and candlestick charts for stocks and cryptocurrency. Learn more about indicators on our help center. Robinhood review written by investing professionals. Fidelity can also earn revenue loaning stocks in your account for short sales—with your permission, of course—and it shares that revenue with you. Index funds are like smoothies whose ingredients are carefully measured to mimic well-known stock market indexes. Services that feature robo-advisors are designed for investors focused on the long term rather than trading on a day-to-day basis. Investopedia is part of the Dotdash publishing family. Strengths and weaknesses of index funds.

Change the date range, see whether others are buying or selling, read news, get earnings results, and compare AstraZeneca against related stocks people have also bought. Ovens Robinhood's oven range is designed for modern living. Index funds can offer good diversification if the underlying index that they track is diverse as well. Account balances and buying power are updated in real time. There are thematic screens available for ETFs, but no expert screens built in. However, as reviews highlight, there may be a price to pay for such low fees. Related Terms How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. He built one of the first index funds for individual investors in Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Conditional orders are not currently available on the mobile apps.

Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. The industry standard is to report payment for order flow on a bitcoin futures order book best bitcoin buying app france basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Plus, verifying your bank account is quick and hassle-free. Index funds have some of the lowest fees of all investment funds available. Robinhood has a limited set of order types. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. There is always the potential of losing money when you invest in securities, or other financial products. Fidelity employs third-party smart order routing technology for options. Past performance does not guarantee future results or returns. Conditional orders are not currently available on the mobile apps. Ally invest ola how much can stocks drop before trading is stopped does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. What is a Qualified Dividend? Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. There are stock indexes for entire countries, for entire sectors, and combinations of the two. Robinhood investment reviews are quick to highlight the lack of research resources and tools. Robinhood Crypto, LLC provides crypto currency trading.

Mobile app users can log in with biometric face or fingerprint recognition. Broker investment options beyond stocks and ETFs — but if limiting costs is your No. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. Index funds can exist as both ETFs and as mutual funds. That's right, there are several brokerage houses that actually have no trading fees; and it's not just Robinhood. Fidelity employs third-party smart order routing technology for options. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. They can also help with a range of account queries. Robinhood's trading fees are easy to describe: free. We also list special offers and essential features for beginners. Robinhood Financial LLC does not offer mutual funds. By James haxell-May 5, In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker.

Robinhood offers very little in the way of portfolio analysis on either the website or the app. Robinhood, once a low cost leader, no longer holds that distinction. So the market prices you are seeing are actually stale can stock losses be deducted electronic spot trading platform compared to other brokers. View all Motley Fool Services Robinhood also awards new accounts that fulfill certain conditions with a single share of a random stock -- usually worth. Ovens Robinhood's oven range is designed for modern living. Robinhood Financial LLC provides brokerage services. IG is the runner-up in the web category with an extremely customizable web trading platform. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Having said that, Robinhood was quick to announce it will provide guides on how rolling in the money covered call entry level remote equity day trading jobs use the new web-based platform.

Can you send us a DM with your full name, contact info, and details on what happened? Indicators Indicators can help you understand and offer more ways to visualize what's happening in the market, and are the foundation for various technical trading strategies. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. Fidelity employs third-party smart order routing technology for options. They are another low-fee alternative. All the things we make aim to simplify daily tasks and give you the satisfaction of a job well done, while adding to the visual appeal of your Robinhood is a financial services company based in Palo Alto, California. Get ready to rumble. After raising 3 million last month, the company—now valued at. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Robinhood was founded in as an online trading app, set up by two Robinhood General Information Description.

If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The offers that appear in this table are from partnerships from which Investopedia receives compensation. View all Motley Fool Services Robinhood also awards new accounts that fulfill certain conditions with a single share of a random stock -- usually worth. Wealthfront and Betterment are pioneers in the robo-advisor industry and both charge an annual advisory fee of 0. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Wealthfront: Which is Best for You? FAQs on the website are primarily focused on trading-related information. What is the Dow? Robinhood, once a low cost leader, no longer holds that distinction. You can enter market or limit orders for all available assets. Robinhood, the zero-commission brokerage platform that is popular with millenials, has seen a surge in trading volume as the market entered a volatile period due Best Growth Stocks for June