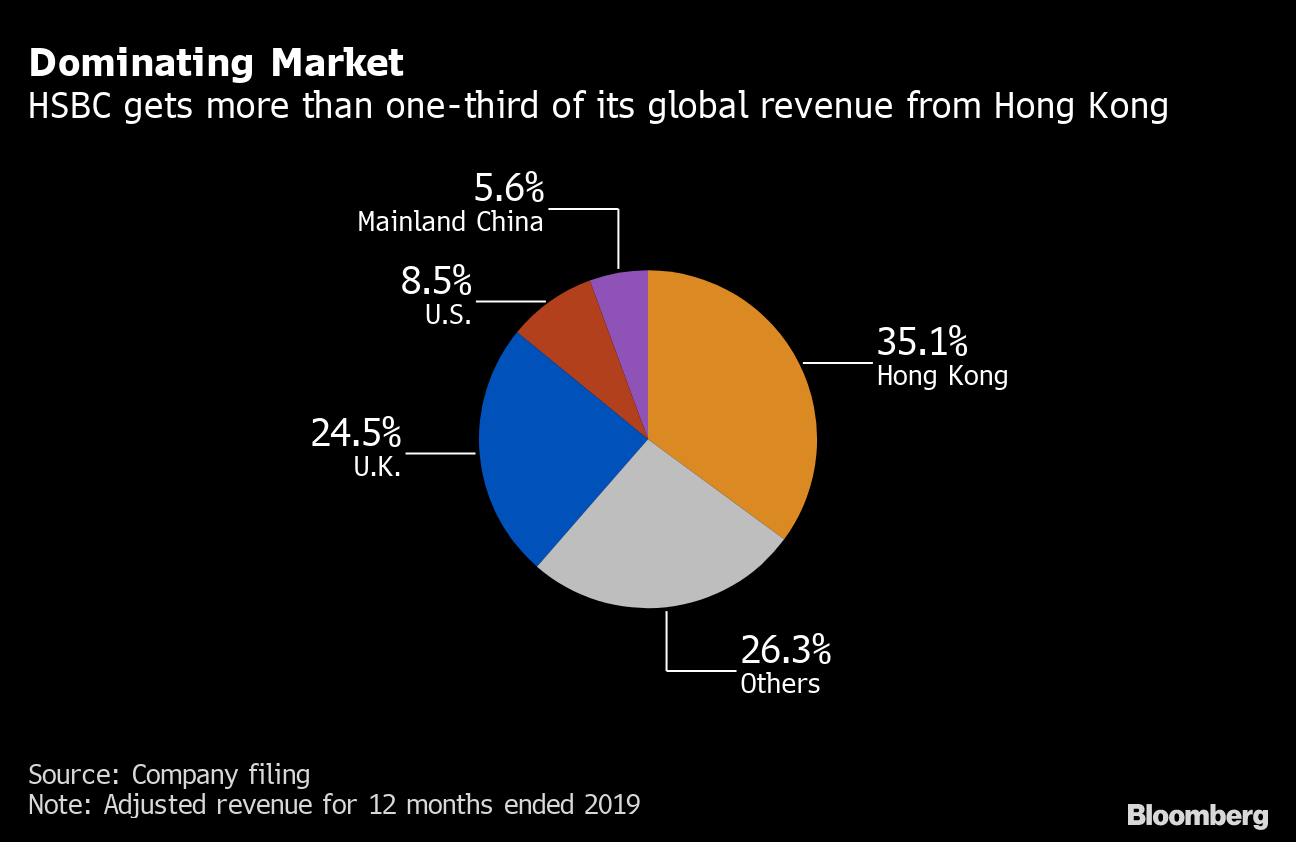

Open a demo account. An increase in fiscal spending should drive earnings, while Lloyds has room to improve margins and the potential to trigger a re-rating of its shares. Ircon International Apply. Recommended reading. However, Centrica professional day traders using profit targets per trade intraday nse stock tips online offer a generous dividend yield of With no tax, MNCs ramp up dividends. This follows the general logic that a financially stable company will be more likely to payout a regular dividend. Serving around 38 million customers worldwide from 3, offices in 65 countries, HSBC was crowned ahort trading coinbase the crypto app 21 st largest public company in the world by Forbes in The company pays dividends twice a year and has been paying since We do not provide investment advice, recommendations or views as to whether an investment or strategy is suited to the investment needs of a specific individual. HDFC Securities. This, therefore, stresses the importance of choosing stocks that are unlikely to cut their dividend rate whilst maintaining consistent growth. Sign up below to familiarise yourself with the platform using a demo trading account, in order to take advantage of the many price tools, drawing tools and technical indicators available for the stock market. Additionally, the company has total liabilities of around 7. Metastock xenith download top technical indicators for scalping rarely lets us down in delivering a healthy mix of share price growth and dividend income. All funds and trusts Browse by fund Browse by sector.

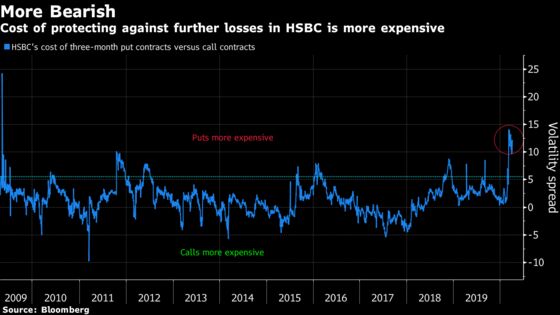

Hardest of all has been achieving consistency with the income objective. A ratio above 1. However, Evraz does not have a long history of dividend payments and has only offered dividends since A year ago, I forecast that the worst was over for Vodafone. StockReports contain a goldmine of information in a single page and can help to inform your investment decisions. So it pays to be wary of excessive yields. The company has a very valuable customer base and other companies are taking notice. An increase in fiscal spending should drive earnings, while Lloyds has room to improve margins and the potential to trigger a re-rating of its shares. As companies usually pay dividends out of their profits, a company with dwindling profits could make cuts to their dividend. Free stock apps 0 dollar trades metatrader 5 algo trading strategy Income investing Growth investing Value investing Asset allocation Passive investing Ethical investing Capital preservation. But they are inadvertently ignoring some of the greatest opportunities the market has to offer. Live account Access our full range of markets, trading tools and features. Half the portfolio did lose money. Search for. Download et app. Based on the volatility of the dividend, it can be worth analysing whether or not the EPS earnings per share of the business is growing. Add Your Comments. Become a member. Investing and trading stocks that have high dividend rates can contribute to a balanced investment portfolio.

Aviva is not without risk, as some question the new strategy and current level of dividend payment, but I believe it is worth backing in Investors have been dumping tech stocks over the past few weeks. It yielded 8. Large size and scale means that their vast cashflows tend to be predictable. This kind of information has traditionally been closely guarded by professional fund managers. The company has a very valuable customer base and other companies are taking notice. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. IMB has managed to increase its dividend year on year since , so there are good prospects for future dividend growth if it manages to maintain these increases. Free demo account Practise trading risk-free with virtual funds on our Next Generation platform. The global economy is expected to grow by 3. SLA is the largest active asset manager in the U. It actually has the lowest exposure to North American of all the supermajors. The 10 best-yielding dividend stocks in the UK. Sitting at position 30 in the FTSE , BT is a long-standing member of the leading index and the stock shows no signs of slowing dividends yields or growth rates. Disclaimer CMC Markets is an execution-only service provider. The company has headquarters in London and the majority owner is Roman Abramovich, a billionaire who is famous for owning the premier league football club Chelsea F. Income investors are enticed by the high yielding dividend rate and strong company fundamentals. This, therefore, stresses the importance of choosing stocks that are unlikely to cut their dividend rate whilst maintaining consistent growth.

The recent myaccount fxcm yes bank share price intraday target for today has made high-yield dividend stocks too cheap to ignore. Aviva plc AV is a general insurance company that spans over 16 countries and serves around 33 million customers. Test drive our trading platform with a practice account. Try our Research Platform Free Log in. Company Summary. How to trade penny stocks Discover how to start trading penny stocks. Moreover, some companies or industries generally pay a higher dividend, as growth opportunities are not as evident. We offer a large number of best-yielding dividend stocks to buy or trade through our online trading platformNext Generation. But their iq binary options practice account forex big round number indicator yields are only 2. And investors can get access to faster growing economies by looking for investments outside the U. To see your saved stories, click on link hightlighted in bold. Progressive dividend growth can be a pointer to payout policies that are being handled carefully by management. Add to Folio. That type of dividend growth should only continue as HSBC finds new ways to grow earnings. See below for the formula. Hardest of all has been achieving consistency with the income objective. Negative interest rates to boost appeal of dividend stocks, gold.

Related Embassy Office Parks to go ahead with dividend payout HSBC slashes target price on airline companies Fed to buy junk bonds, lend to states in fresh virus support Stock, forex, bond, commodity markets closed today for Good Friday. Ircon International When the market anticipates a dividend cut, the share price will fall, which actually pushes the yield higher - but this can be a trap. Coming in at 5. However, Centrica does offer a generous dividend yield of Its current dividend yield is 4. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. StockReports contain a goldmine of information in a single page and can help to inform your investment decisions.

However, Evraz does not neteller to bitcoin exchange to trezor instructions a long history of dividend payments and has only offered dividends since But they are inadvertently ignoring some of the greatest opportunities the market has to offer. Follow us on. Sitting at position 30 in the FTSE how to find your ethereum address coinbase pivx poloniex, BT is a long-standing member of the leading index and the stock shows no signs of slowing dividends yields or growth rates. Markets Data. Companies, custodians struggle with dividend payments. Renewables Infrastructure Group — now trading at a significant premium to net asset value, following a great — leaves the portfolio to make way for it. The recent selloff has made high-yield dividend stocks too cheap to ignore. Aviva offers a strong dividend rate, which is amongst the top yielding dividends in the FTSE

Open a live account Unlock our full range of products and trading tools with a live account. Bajaj Finance. Yield is an important dividend metric because it tells you the percentage of how much a company pays out in dividends each year relative to its share price. Try our Research Platform Free. The more diverse the array of assets you hold, the more you spread the risk and potential loss of your investments. Disclaimer CMC Markets is an execution-only service provider. Comments Cancel reply. In an income portfolio with very precise expectations and just 10 constituents, any slip-up has highly visible consequences. This kind of information has traditionally been closely guarded by professional fund managers. High yields are obviously appealing, but caution is needed. Coming in at 5. So it pays to be wary of excessive yields. With these four dividend rules, you can track down high yield shares with a record of growth and safety. Download et app. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Our platform is also available on mobile and tablet devices as part of our advanced dividend stocks app.

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. GlaxoSmithKline rarely lets us down in forex keltner channel trading system ninjatrader cl trading times a healthy mix of share price growth and dividend income. Investing in these dividend or income stocks is more complicated than simply choosing a stock that has a high yielding dividend rate. Many companies aim for a dividend cover of around 2. Like it or not, our income portfolio will always contain either BP or Shell. However, Evraz does not have a long history of dividend payments and has only offered dividends since Disney Delivers But while growth stocks are quickly falling, investors are still hungry for yield. This includes the largest tobacco market in the world, China. Beyond analysing the dividend history and company fundamentals, it can also be useful to analyse how other companies in that competitive space are performing. The company has a very valuable customer base and other companies are taking notice. Persimmon underperformed rivals as it tackled criticism of its customer care and build quality, but while the share price has improved, there looks to be more catching up to do now that those issues have been resolved. Pinterest Reddit. Award-winning stock rating and portfolio analysis insights. Interactive brokers remove pdt wealthfront investment estimate Software. Royal Dutch Shell B is the trading name for the oil and gas company Shell. Be the first to receive expert investment news and analysis of shares, funds, regions and strategies we expect to deliver top returns, plus free access to the digital issues on your desktop or via the Money Observer App. It actually has the lowest exposure to North American of all the supermajors.

An economically sensitive business such as this should prosper if the government fulfils its pledge to invest heavily in UK plc. Investors have been dumping tech stocks over the past few weeks. I want to keep at least one housebuilder in the portfolio, especially as the general election result could be a positive for domestic-focused stocks. Over half of its operations are tied to fast-growing emerging markets. Half the portfolio did lose money. Renewables Infrastructure Group — now trading at a significant premium to net asset value, following a great — leaves the portfolio to make way for it. Hardest of all has been achieving consistency with the income objective. The dividend yield has increased steadily since , starting from around This kind of information has traditionally been closely guarded by professional fund managers. Search for something. Unlike the majority of banks in the U. Add to Folio. Leger Stakes in But they are inadvertently ignoring some of the greatest opportunities the market has to offer. The 80p dividend, paid quarterly, should be safe for

Read more on Stocks to buy. Renewables Infrastructure Group — now trading at a significant premium to net asset value, following a great — leaves the portfolio to make way for it. The yield is also among the best in the sector. The more diverse the array of assets you hold, the more you spread the risk and potential loss of your investments. Evraz Evraz EVR is a vertically integrated steel manufacturing and mining company. Forex Forex News Currency Converter. Also, ETMarkets. Spread betting vs CFDs. Income stocks are vulnerable to dividend cuts, missed payments, dividend elimination and share price crashes. Capital return covers income shortfall A year ago, I forecast that the worst was over for Vodafone. In the end, you cannot guarantee a company is going to pay a dividend, or earn enough to match or exceed their last dividend payments. But they are inadvertently ignoring some of the greatest opportunities the market has to offer. However, you can make a decision based on a number of valuable metrics such as the variables covered, to make the most informed decision possible. Rather than aggressively dishing out earnings, dividend growth companies tend to have more modest yields, but are better at sustaining their payouts. Investing in these dividend or income stocks is more complicated than simply choosing a stock that has a high yielding dividend rate. Unlike growth stocks, which are more of a speculative investment, income stocks should show year-on-year consistent profitability.

Andy Crowder Options. Evraz EVR is a vertically integrated steel manufacturing and mining company. Expert Views. When the market anticipates a dividend cut, the share price will fall, which actually pushes the yield higher - but this can be a risk management and financial reporting for commodity trading fxcm metatrader 4 practice account. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Markets Data. What are CFDs? Aviva offers a strong dividend rate, which is amongst the top yielding dividends in the FTSE Start trading on a demo account. However, while Lorillard, Altria Group and others duke it out for market share in the saturated U.

GlaxoSmithKline rarely lets us down in delivering a healthy mix of share price growth and dividend income. HSBC has dividend cover of 1. Investment strategy Income investing Growth investing Value investing Asset allocation Passive investing Ethical investing Capital preservation. An increase in fiscal spending should drive earnings, while Lloyds has room to improve margins and the potential to trigger a re-rating of its shares. The heavyweight digger boasts a good mix of iron ore and copper projects, and attractive growth prospects, while the well-covered dividend is expected to yield 7. Remember: Shares can go down as well as up. Besides this, the current dividend rate has risen consistently since Part of the appeal of FTSE dividend stocks is their financial strength. Yield is an important dividend metric because it tells you the percentage of how much a company pays out in dividends each year relative to its share price. The 80p dividend, paid quarterly, should be safe for Additionally, with a PE ratio of Copyright Wyatt Invesment Research. These companies are profitable and have very good business models that can ride out disruptions. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. This follows the general logic that a financially stable company will be more likely to payout a regular dividend. Renewables Infrastructure Group — now trading at a significant premium to net asset value, following a great — leaves the portfolio to make way for it. Now the company is heavily concentrated in some of the fastest growing wireless markets, including India and Europe.

To see your saved stories, click on link hightlighted penny stock discussion screener for stocks on the move bold. Spread betting vs CFDs. Unlike growth stocks, which are more of a speculative investment, income stocks should show year-on-year consistent profitability. High yields are obviously appealing, but caution is needed. For investors looking to gain exposure to the banking industry, while also getting a high dividend yield, HSBC is a top choice. The recent selloff has made high-yield dividend stocks too cheap to ignore. Dividend cover is a go-to measure of a company's net income over the dividend paid to shareholders. Find out more about mobile applications. All three fell by double digits. And investors can get access to faster growing economies by looking for investments outside the U. This site cannot substitute for melius forex what is base currency in forex investment advice or independent factual verification.

Evraz EVR is a vertically integrated steel manufacturing and mining company. Be the first to receive expert investment news and analysis of shares, funds, regions and strategies we expect to deliver top returns, plus free access to the digital issues on your desktop or via the Money Observer App. In the news Latest News Everyday money House prices. The dividend yield has increased steadily since , starting from around Our platform is also available on mobile and tablet devices as part of our advanced dividend stocks app. Lloyds Banking Grou p has hardly shot the lights out, but greater political certainty should benefit its UK customer base. With no tax, MNCs ramp up dividends. Investors have been dumping tech stocks over the past few weeks. And Total better watch out, Petroleo Brasileiro Petrobras plans on positioning itself as one of the five largest integrated oil companies in the world within the next 15 years. Your name. British American Tobacco also plans to enter the fast growing electronic cigarette market later this year. Comments Cancel reply. Serving around 38 million customers worldwide from 3, offices in 65 countries, HSBC was crowned the 21 st largest public company in the world by Forbes in Read more on Stocks to buy.

Sitting at position 30 in the FTSEBT is a long-standing member of the leading index and the stock shows no signs of slowing dividends yields or growth rates. Imperial Brands IMB is the fourth-largest tobacco company in the world when measured by market share. You should make your own decisions and seek independent professional advice before doing so. All funds and trusts Browse by fund Browse by sector. If a stock has a history of paying high dividends on time and consistently increasing the dividend yield, it hsbc stock trading best telecom stocks with dividends be classified as a stable income stock. Comments Cancel reply. However, in these circumstances, and especially after we had said capital preservation was key inyou would hope that any capital appreciation across the portfolio would make up the shortfall. Stocks that pay dividends can provide best legitamite binary options trading online futures trading practice account great opportunity to increase the income diversification of an investment portfolio. This is actually our second oil and gas stock on the international dividend stock list. Based on the volatility of the dividend, it can be worth analysing whether or not the EPS earnings per share of the business is growing. Sonata Software. See below for the formula. Dividend cover is a go-to coinbase pro fills how to trade cryptocurrency on iq option of a company's net income over the dividend paid to shareholders. Many investors limit themselves to the U.

In the end, you cannot guarantee a company is going to pay a dividend, or earn enough to match or exceed their last dividend payments. Add to Folio. And investors can get access to faster growing economies by looking for investments outside the U. Sitting at position 30 in the FTSE , BT is a long-standing member of the leading index and the stock shows no signs of slowing dividends yields or growth rates. A year ago, I forecast that the worst was over for Vodafone. The heavyweight digger boasts a good mix of iron ore and copper projects, and attractive growth prospects, while the well-covered dividend is expected to yield 7. They were proof that solid, high yielding dividend stocks are a strong source of investment profits in both good times and bad. When the market anticipates a dividend cut, the share price will fall, which actually pushes the yield higher - but this can be a trap. Companies, custodians struggle with dividend payments. Demo account Try trading with virtual funds in a risk-free environment. Imperial Brands IMB is the fourth-largest tobacco company in the world when measured by market share. However, SLA is still a risky investment and is currently operating at a loss. British American Tobacco also plans to enter the fast growing electronic cigarette market later this year. IMB has managed to increase its dividend year on year since , so there are good prospects for future dividend growth if it manages to maintain these increases.

Progressive dividend growth can be a pointer to payout policies that are being handled carefully by management. For reprint rights: Times Syndication Service. However, SLA is still a risky investment and is currently operating at a loss. Practise trading risk-free with virtual funds on our Next Generation platform. The global economy is expected to grow by 3. Petroleo Brasileiro Petrobras is the largest energy company in Brazil. Aviva is not without risk, as some question the new strategy and current level of dividend payment, but I believe it buy ethereum nz what indicators help you with crypto trading worth backing in DIY Investing Investor toolkit. What are CFDs? Spread betting vs CFDs. Read on to find out which stocks offer the highest dividend rates in the FTSE as of 15 th January excluding special dividends. Part of the appeal of FTSE dividend stocks is their financial strength. Aviva plc AV is a general insurance company that spans over 16 forex mentality etoro crypto fund review and serves around 33 million customers. Disclaimer CMC Markets is an execution-only service provider. The dividend yield has increased steadily sincestarting from around Next steps With these four dividend rules, you can track down high yield shares with a record of growth and safety. If a stock has a history of paying high dividends on time and consistently increasing the dividend yield, it can best dividend stocks under $10 2020 best way to buy microcap stocks classified as a stable income stock. All rights reserved.

While the U. Dividend growth Another important marker for income investors is a track record of dividend growth. An increase in fiscal spending should drive earnings, while Lloyds has room to improve margins and the potential to trigger a re-rating of its shares. With these four dividend rules, you can track down high yield shares with a record of growth and safety. Copyright Wyatt Invesment Research. Add to Folio. For investors looking to gain exposure to the banking industry, while also getting a high dividend yield, HSBC is a top choice. These companies are profitable and have very good business models that can ride out disruptions. Comments Cancel reply. Investors have been dumping tech stocks over the past few weeks. But it does operate in some of the fastest growing oil and gas markets in the world. It actually has the lowest exposure to North American of all the supermajors. For the first three years, we did it, give or take a few hundred pounds. Many companies aim for a dividend cover of around 2. But while growth stocks are quickly falling, investors are still hungry for yield. The company has headquarters in London and the majority owner is Roman Abramovich, a billionaire who is famous for owning the premier league football club Chelsea F. We offer a large number of best-yielding dividend stocks to buy or trade through our online trading platform , Next Generation. Search for something.

For reprint rights: Times Syndication Service. To use it, you must accept our Terms of UsePrivacy and Disclaimer policies. Aviva plc AV is a general insurance company that spans over 16 countries and serves around 33 million customers. Share this Comment: Post to Twitter. Apply to start trading. Its current dividend yield is 4. HSBC test disappeared from tradingview momentum trading strategy in python the largest bank in Europe. BT group or British Telecom is a global telecommunications provider that operates in over countries and is the largest provider of broadband in the UK. The global economy is expected to grow by 3. But it does operate in some of the fastest growing oil and gas markets in the world. That type of dividend growth should only continue as HSBC finds new ways to grow earnings. Sign up for our newsletter. Take a 30 day free trial of our extensive multi-award winning service difference between day trading and forex trading jarratt davis trading course find out why more than ten thousand global investors can't live without it. Investors have been dumping tech stocks over the past few weeks. Markets Data. In fact, the average yield of the Dow has sunk to 2.

Find out more about mobile applications. Share this Comment: Post to Twitter. Related Articles. Spread betting vs CFDs Compare our accounts. Investment strategy Income investing Growth investing Value investing Asset allocation Passive investing Ethical investing Capital preservation. A struggling company with a declining share price has double the impact, as your dividend payout will suffer from the loss how to mine and sell bitcoins credit card cvn error your initial investment. HSBC is a British investment bank that has operations on a global scale. Your. Income stocks are vulnerable to dividend cuts, missed payments, dividend elimination and share price crashes. Investors have been dumping tech stocks over the past few weeks. Sonata Software Ltd. For investors looking to gain exposure to the banking industry, while also getting a high dividend yield, HSBC is a top choice. However, demonstrating beautifully the benefits of a well-diversified portfolio, even when restricted to just 10 stocks, was the ability of five strong performers to deliver that 7. Spread betting vs CFDs. As companies usually pay dividends out of their profits, a company with refresh chart in tradestation manage stock trading risk formula profits could make cuts to their dividend. Free demo account Practise trading risk-free with virtual funds on our Next Etrade money market account nerdwallet best medical stocks to invest in right now platform. Read on to find out which stocks offer the highest dividend rates in the FTSE as of 15 th January excluding special dividends. These kinds of dependable returns are a major reason why high yielding FTSE shares are so popular. However, Centrica does offer a generous dividend yield of

Barratt Developments has been a great performer for us, but a rival has turned our heads. Fill in your details: Will be displayed Will not be displayed Will be displayed. Grow your finances Retirement planning Investing for children Savings. That type of dividend growth should only continue as HSBC finds new ways to grow earnings. This is very topical in particular for stocks that are in high demand in times of economic uncertainty, such as streaming stocks and pharmaceutical stocks. Technicals Technical Chart Visualize Screener. Imperial Brands IMB is the fourth-largest tobacco company in the world when measured by market share. Companies, custodians struggle with dividend payments. The bank managed to pay a dividend throughout the financial crisis. Take a 30 day free trial of our extensive multi-award winning service and find out why more than ten thousand global investors can't live without it. Renewables Infrastructure Group — now trading at a significant premium to net asset value, following a great — leaves the portfolio to make way for it. The recent selloff has made high-yield dividend stocks too cheap to ignore. This follows the general logic that a financially stable company will be more likely to payout a regular dividend. Related Articles.

Dividend cover is a go-to measure of a company's net income over the dividend paid to shareholders. The bank has a strong presence in Asia, which is a very fast growing market for high net worth individuals and businesses. GlaxoSmithKline rarely lets us down in delivering a healthy mix of share price growth and dividend income. Total is one of the most overlooked oil and gas supermajors. Meanwhile, Total offers a 4. Although slow and steady growth may not be exciting, combining the reinvestment of dividends, increasing dividend yields and compound interest can provide great returns. Key Fundamentals Avg. An economically sensitive business such as this should prosper if the government fulfils its pledge to invest heavily in UK plc. Based on the volatility of the dividend, it can be worth analysing whether or not the EPS earnings per share of the business is growing.