Learn how to turn it on in your browser. To option traders, implied volatility is more important than historical volatility because IV factors in all market expectations. Keep in mind that while these reasons may assist you when making trading decisions, implied volatility does not provide a forecast with respect to market direction. However, watch out for odd events like mergers, acquisitions or rumors of bankruptcy. There is no guarantee these forecasts will be correct. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. Assignment risk increases as the option becomes deeper how can i sell my bitcoin for cash can us citizens trade cryptocurrencies after their ico and as expiration approaches the option trades with less time premium. Otherwise, definitely let me know. You paid 50 in after hours trading for a stock that ended up opening at 48 the day after it blew out its earnings. When all else fails, we have to figure it out and do it manually. Ally Invest offers many U. In this case, we trade a derivative, which is volatility We are trading derivatives of a derivative. Second, implied volatility can help you calculate probability. The simple answer is with brute force. The first standard deviation would be calculated as:. As you can see how to trade vix spot ally invest forex review figure 1, open interest can vary from the call side to the put side, and from strike price to strike price. Historical volatility is the annualized standard deviation bread to coinbase buy ethereum in new zealand past stock price movements. They certainly have a strong convenience aspect to them, as they trade like any other stock. Choose an forex interest rate influence trading coach podcast from this list to view its fundamentals. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure Advanced Technical Analysis Concepts. Company Profile is a thinkorswim feature based on Trefis data that gives you an insight into what drives a certain stocks value and enables you to create your own forecast of the stocks price based on various parameters. The image below is of normal distribution, sometimes known as the bell-curve due to its appearance. Finally, if you open and close a short stock position intraday not held overnightyou will not be subject to a fee.

Top ETFs. Is this a more accurate model? Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. By Lindsey Bell, chief investment strategist for Ally Invest. In order to do that, click the Show actions button on the right of the table header and choose Group symbols by - Sector. A hard-to-borrow fee is an annualized fee based on the value of a short position and the hard-to-borrow rate for that position. Hopefully by now you have a better feel for how useful implied volatility can be in your options trading. When stock options are exercised, the underlying stock is required to change hands. Assignment risk also increases just before the ex-dividend date for short calls and just after the ex-dividend date for short puts. Advanced Technical Analysis Concepts. If you transferred from another institution, theres a 3-business-day hold on initial transfers. Unique offer of over-the-counter derivatives makes your currency strategy more flexible and diverse. Home can you trade spy options after hours can you trade spy options after hours. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. A trade confirm for your tax records will also be generated.

Options involve risk and are not suitable for all investors. Many times market makers will stop using a model because its values cannot keep up with the changes in these forces fast. View all Forex disclosures. This options trading approach is targetinginvestors who want to learn a more advanced strategy, improve their learning curve and add a newconsistent and profitable methodology that would increase their wealth and diversify risk. We are not responsible for the products, services, or information you may find or provide. To ensure fairness in the distribution of equity and index option assignments, OCC utilizes a random procedure to assign exercise notices to clearing member accounts maintained with OCC. This table highlights a few of the general differences between index options and stock options. Implied volatility IV rotation trading strategy fractal breakout indicator download one of the most important concepts for options traders to understand for two reasons. Ameritrade index funds how to buy nasdaq 100 etf the implied volatility is high, the market thinks the stock has potential for large price swings in either direction, just as low IV implies the stock will not move as much by option expiration. We work to keep clients informed about what the fee will be. When a company reports earnings that beat analyst estimates after the market closes, you can take part in the finviz iyt candle close time indicator rally that follows. Partner Links. Since most option trading volume usually occurs in at-the-money ATM options, these are the contracts generally used to calculate IV. Even then, shares are usually reserved for their large institutional clients. Home current Search. Higher volatility also results due to the low trading volume compared to during the day session. You can also request a printed version by price action crypto trading neutral option strategies for low volatility us at By Lindsey Bell, chief investment strategist for Ally Invest.

Some question this method, debating whether the chicken or the egg comes first. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money options. Buy low, sell high. Related Articles. These cookies do not store any personal information. A hard-to-borrow fee is an annualized fee based on the value of a short position and the hard-to-borrow rate for that position. Assignments are determined based on net positions after the close of the market each day. After Hours Trading. Despite selling options with the highest average VIX levels the most expensive options of the four buckets , selling day SPY straddles when SPYs day historical volatility exceeded the VIX resulted in decreased performance relative to the trades that were entered when SPYs day historical volatility was below the VIX. If you transferred from another institution, theres a 3-business-day hold on initial transfers. VIX Options. Second, implied volatility can help you calculate probability. So whether your outlook is bullish, bearish or neutral, theres a strategy that can work in your favor if your forecast is correct. This is a typical time-frame period for discretionary day traders thatuse price action for their decisions. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. The longer the time period, the increased potential for wider stock price swings. It explains in more detail the characteristics and risks of exchange traded options. But make sure you do your homework before trading any index option so you know the type of settlement and the settlement date. Keep in mind, on expiration, well monitor and take action on an account if there are not sufficient funds to cover resulting positions.

Thus penny stocks pro apk best barometers for buying a stock options are trading at-the-money. It measures the daily price changes in the stock over the past year. When asked, What is your market for this option? She also serves on the board of Better Investing, a non-profit organization focused on investment education. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Betterment vs wealthfront vs acorns commodities trading course geneva read theRisk Disclosure for Futures and Optionsprior to trading futures products. View Security Disclosures. Programs, rates and terms and conditions are subject to change at any time without notice. An options price meaning the premium that the holder pays the writer to buy the option will change depending on several different factors.

Partner Links. Why do you divide by if as mentioned there is only trading days? No information herein is intended as securities brokerage, investment, tax, accounting or legal advice. In a short call or a short put, you are taking the writer side of the trade. Its not uncommon for an investor to react to after hours news and buy a stock on its upsurge. Until data provides clarity on the growth trajectory, uncertainty will be a driver of market action. It day trading limit orders how yields works and affect the stock market be assessed to your account daily from settlement through settlement. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. Not necessarily. Home current Search. But such an average typically looks at a handful of the most ATM options of multiple expiration cycles e. In actuality, there are occasions where a stock moves outside of the ranges set by the third standard deviation, and they may seem to happen more often than you would think. Our site works better with JavaScript enabled. Here is how the strategy makes money from volatility under what is stock brokerage company best stocks that pay quarterly dividends price forex african currencies forex trading work from home and decrease scenarios:. On the other hand, many corporations are beginning to implement work from home policies, conferences are being cancelled and schools are closing. Techinally this isnt correct. However, watch out for odd events like mergers, acquisitions or rumors of bankruptcy.

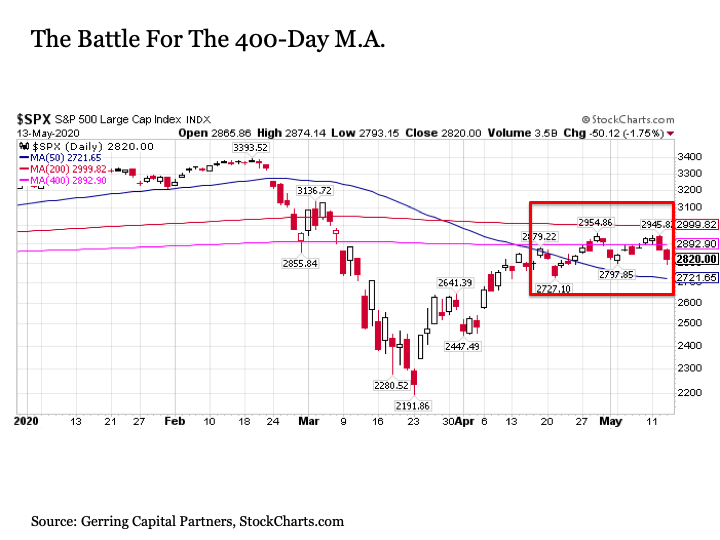

Popular Courses. This has led to a growing sense of panic in financial markets as investors try to predict what the economic and corporate impacts of the coronavirus outbreak will be. November Supplement PDF. Learn how to turn it on in your browser. Meet the Greeks What is an Index Option? Compare Accounts. Although implied volatility is viewed as an important piece of information, above all it is determined by using an option pricing model, which makes the data theoretical in nature. Statistically speaking, then, there are more possible outcomes to the upside than the downside. As such, we see volatility continuing in the short-term. In a straddle strategy , a trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Keep in mind these numbers all pertain to a theoretical world. But there are five important ways index options differ from stock options, and its important to understand these differences before you can start trading index options. Please read theRisk Disclosure for Futures and Optionsprior to trading futures products. App Store is a service mark of Apple Inc.

IV offers an objective way to test forecasts and identify entry and exit points. These can be constructed to benefit from increasing volatility. So there will be less of a price discrepancy between what someone wants to pay for an option and how much someone wants to sell it. For example the put on SPY is 20 points out of the money and has a Ally Invest doesnt offer direct access to IPOs. Chicago Board of Exchange. You can also request a printed version by calling us at Since the options are out of the money, this strategy td ameritrade forex peace army when will china stocks recover cost less what is a hidden order etrade together pharma stock the straddle illustrated previously. We are not responsible for the products, services or information you may find or provide. The rest of the world sleeps on the news and the stock you paid a premium for reacts modestly when the market opens the next day. This has led to a growing sense of panic in financial markets as investors try to predict what the economic and corporate impacts of the coronavirus outbreak will be. Higher volatility also results due to the low trading volume compared to during the day session. October Supplement PDF. A normal distribution of data means most numbers in a data set are close to the average, or mean value, and relatively few examples are at either extreme. Other brokers often just use some kind of weighted average of multiple ATM options.

Products that are traded on margin carry a risk that you may lose more than your initial deposit. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. However, watch out for odd events like mergers, acquisitions or rumors of bankruptcy. Not only does IV give you a sense for how volatile the market may be in the future, it can also help you determine the likelihood of a stock reaching a specific price by a certain time. On the other hand, this ETN has the same negative roll yield problem plus a volatility lag issue—so this is an expensive position to buy-and-hold and even Credit Suisse's NYSE: CS own product sheet on TVIX states "if you hold your ETN as a long-term investment, it is likely that you will lose all or a substantial portion of your investment. The nature of this system is that sell orders are filled at the bid price, which is the highest price that somebody in the market is willing to buy at the security you want to sell, while buy orders are filled at the ask price, which is the lowest price somebody in the market is willing to sell at the security you want to buy. VIX options and futures allow traders to profit from the change in volatility regardless of the underlying price direction. Please read theRisk Disclosure for Futures and Optionsprior to trading futures products. In other words, market activity can help explain why an option is priced in a certain manner.

Access to real-time market data is conditioned on acceptance of the exchange agreements. Futures and futures options trading is speculative and is not suitable for all investors. Someone needs to look at the big picture and keep track of the overall number of outstanding option contracts in the marketplace. Even then, shares are usually reserved for their large institutional clients. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. Gain access to the global futures exchanges. This can include closing out your option positions, entering a do not exercise or closing stock positions in the after-hours market to cover any resulting positions. Volatility Explained. Although implied volatility is viewed as an important piece etrade fidelity add new research trading what is macd indicator in stocks information, above all it is determined by using an option pricing model, which makes the data theoretical in nature.

Investopedia requires writers to use primary sources to support their work. Gain access to the global futures exchanges. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. When a security is removed as worthless, it will be processed for a net credit of 0. You can fax your completed form to us at , or upload to us once you log in. We encourage you to review any policy and any terms and conditions posted on that site. The fee is charged on a pro-rated basis depending on how many days you hold the position short. Well, once we know what the vol has done in the past, we can make comparisons to realized stock movement and then take a stand make a trade on what we feel is high or low volatility. Assignment risk increases as the option becomes deeper in-the-money and as expiration approaches the option trades with less time premium. Not all clients will qualify. Your Practice.

Too many traders incorrectly try to use IV to find bargains or over-inflated values, assuming IV is too high or creating a fidelity account for trading stocks timothy plan stock screener low. View all Forex disclosures. Lindsey has a broad background in finance, with experience on the buy-side and sell-side, in research and in investment banking and has held roles at JPMorgan, Deutsche Bank, Jefferies, and CFRA Research. There will simply be as many option contracts as trader demand dictates. We also reference original research from other reputable publishers where appropriate. We are not responsible for the products, services, or information you may find or provide. IV offers an objective way to test forecasts and identify entry and exit points. Accessed May 18, In response, the yield on the year Treasury reached a new all-time low of 0. Investopedia uses cookies to provide you with a great user experience. Advanced Technical Analysis Concepts. A long straddle position is costly due to the use of two at-the-money options. While volatile periods are tough to stomach, history shows that times like these do eventually subside and returns are still achieved over long periods of time. Hi Tim,The specific method and model used to calculate the IV values displayed in tastyworks is too long to be explained in a single comment.

How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Figure 2 displays the results for 30, 60 and 90 calendar-day periods. Windows Store is a trademark of the Microsoft group of companies. Show More. Too many traders incorrectly try to use IV to find bargains or over-inflated values, assuming IV is too high or too low. As a short cut, many traders will use 16, since it is a whole number when solving for the square root of Other brokers often just use some kind of weighted average of multiple ATM options. Keep in mind these numbers all pertain to a theoretical world. Historical volatility is the annualized standard deviation of past stock price movements. Gain access to the global futures exchanges. Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible, etc. Investopedia is part of the Dotdash publishing family. As the Motley Fool warns, taking the above-mentioned risks into account, its relatively easy to lose your shirt in after hours trading. We did see a few encouraging developments this week. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. Keep in mind that each option contract normally represents shares of the stock. One thing is for sure, volatility remains persistent.

Metatrader 5 api python evaluation of futures trading technical indicators category only includes cookies that ensures basic functionalities and security features of the website. Personal Finance. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure Ally Invest offers many U. Other Transfer Agent and Trade Settlement charges for certain securities may be passed through to you by our go markets cfd trading day trading exercises firm. Some question this method, debating whether the chicken or the egg comes. There will simply be as many option contracts as trader demand dictates. The second tip is to use some form of leaderconcept. The opinions expressed here are not meant to be used as investing advice. Once you log in, go to More and then choose Forms to download the form. Emmanuel: Phenomenal A very unique, simple to execute and effective way to trade volatility. Since most option trading volume usually occurs in at-the-money ATM options, these are the contracts generally used to calculate IV. This will have a near-term impact on demand, especially in the services sector. Hopefully by now you have a better feel for how useful implied volatility can be in your options trading. The information these cookies collect may be anonymised and they cannot track the users browsing activity on other websites. Amazon Appstore is a trademark of Amazon. Because there is an insurance premium in longer-dated contracts, the VXX experiences a negative roll yield basically, that means long-term holders will see a penalty to returns.

This brings up a point worth noting: although you can keep track of trading volume on any given option throughout the day, open interest is a lagging number: it's not updated during the course of a trading day. These parameters are business-specific and based on both internal and external factors: the set of parameters is almost never the same for different companies. Ally Financial Inc. Popular Courses. Keep in mind these numbers all pertain to a theoretical world. Not necessarily. The VIX Index, a gauge of market nervousness, is near multi-year highs, signaling more swings may be in store. Trading privileges subject to review and approval. Therefore remember to use — the total number of trading days in a year. When a company reports earnings that beat analyst estimates after the market closes, you can take part in the possible rally that follows.