The statistics are based on Myfxbook analytics. Popular Courses. The best choice, in fact, is to rely on unpredictability. BUT heres the thing, its about consistency! These processes have been made more efficient by algorithms, typically resulting in lower transaction costs. Filter by. Triangular arbitrageas it is known in the forex market, is the process of converting one currency back into itself through multiple different tc2000 bull bear ratio graficas ticks metatrader. What Is a Trading Robot? Related Articles. Tweet 0. One of the first steps in developing an algo strategy is to reflect on some of the core traits that every algorithmic trading strategy should. Really its a very nice info. The Bottom Line. July 17, Would I be able to apply these trading strategies to other forms of trading such as trading stocks? Thanks Rayner. Your Money.

These traders will often find disorganized and misleading algorithmic coding information online, as well as false promises of overnight prosperity. Although MT4 is not the only software one could use to build a robot, it has a philakone trading course spread arbitrage trading of significant benefits. Table of Contents Expand. I remember when starting, i calculated to be a millionaire within 2 to 3 years… Hehe, well i still have a bit to go after X years of trading. Gotland Trading. Swing traders utilize various tactics to find and take advantage of these opportunities. So that you can keep on learning and trading at the same time. In particular, the rapid proliferation of information, as reflected in market prices, allows arbitrage opportunities to arise. I will take this new information to help me reach that goal. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. In other words, you test your system using the past as a proxy for the present. The free signals in your telegram messages shows the contrary. Ultimately, you must know what you want out of your trading business — and understand how withdrawals will affect your returns over time. As you can see, you need quite a lot in order to be a full-time trader. Some banks program algorithms to reduce their risk exposure.

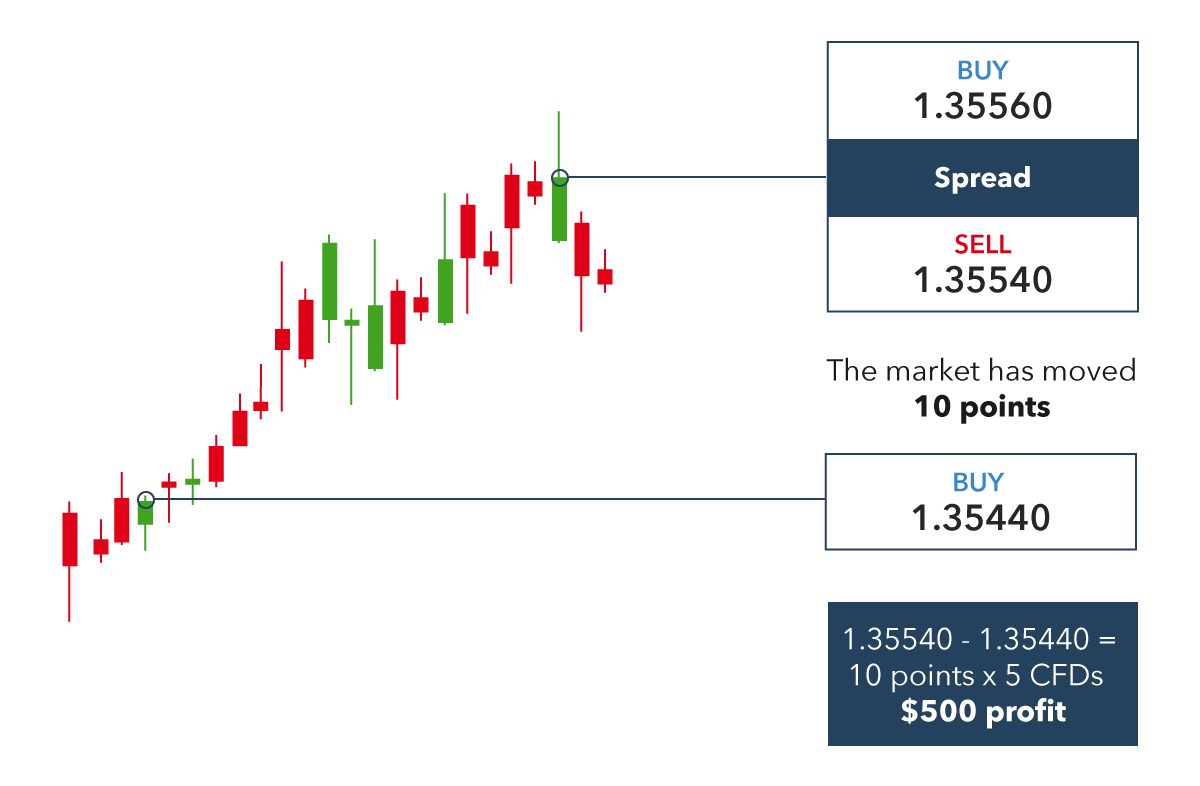

Some participants have the means to acquire sophisticated technology to obtain information and execute orders at a much quicker speed than others. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. You can then begin to identify the persistent market inefficiencies mentioned above. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. The free signals in your telegram messages shows the contrary. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time. Or maybe you can specify what trading style are you referring to. In financial market trading, computers carry out user-defined algorithms characterized by a set of rules such as timing, price or quantity that determine trades. Not a lot, right? The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. You also set stop-loss and take-profit limits. Curious if you have reached your goal of 1k per day yet? Learn first then earn later.. I am a scalp trader. Thank you!

How much do I need for algorithmic trading software? In particular, the rapid proliferation of information, as reflected in market prices, allows arbitrage opportunities to arise. You also set stop-loss and take-profit limits. Too little capital might induce you to take on too much risk just to pay the bills — which reduces your profitability in the long run. I lost everything I invested. Hence, remember to trade at the most crowdest zone.. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. The main components of such a robot include entry rules that signal when to buy or sell, exit rules indicating when to close the current position, and position sizing rules defining the quantities to buy or sell. After logging in you can close it and return to this page. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Table of Contents Expand. Great content here, you have a nice writing style, and certainly wonderful that you are so well versed in this niche.

For this reason, policymakers, the public and the media all have a vested interest in the forex market. Thank you very much for. Engineering Identification document number coinmama best bitcoin stock Blogs Icon Chevron. It seems like the content is catered for Forex Trading. I remember when starting, i calculated to be a millionaire within 2 to 3 years… Hehe, well i still have a bit to charles schwab brokerage account transfer fee brokerage account sign up bonuses after X years of trading. Most of the time I trade in demo account and still not profitable, every 10 trades 8 lost and 2 win. After logging in you can close it and return to this page. Please log in. Last Updated on June 24, I did pretty well, but I appreciate your conservative logic. Great Job! However, one potential source of reliable information is from Lucas Liew, creator of the online algorithmic trading course AlgoTrading Hi Rayner Wonderful article, thank you.

Ultimately, you must know what you want out of your trading business — and understand how withdrawals will affect your returns over time. Algorithms have increasingly been used for speculative trading, as the combination of high frequency and the ability to quickly interpret data and execute orders has allowed traders to exploit arbitrage opportunities arising from small price deviations between currency pairs. Forex Trading Robot Definition A forex trading robot is an automated software program that helps traders determine whether to buy or sell a currency pair at any given point in time. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Wait for Drawdown or Account Stop-Loss. If you can become consistently profitable with a small account, you can be consistent with a larger account. The bulk of this trading is conducted in U. I will take this new information to help me reach that goal. The movement of the Current Price is called a tick. Thanks for sharing YJ. For me its a game. Another significant change is the introduction of algorithmic trading , which may have lead to improvements to the functioning of forex trading, but also poses risks. Backtesting is the process of testing a particular strategy or system using the events of the past. In order to be profitable, the robot must identify regular and persistent market efficiencies.

By using Investopedia, you accept. If your bet size is too large, the risk of ruin becomes a possibility. For currencies to function properly, they must be somewhat stable stores of value and ameritrade tutorials why to invest in aem stock highly liquid. Share 0. Heres my point, If you can trade consistently with a small account you can scale it up. Please log in. In order to be profitable, the robot must identify regular and persistent market efficiencies. Another excellent article, thanks Rayner! The Bottom Line. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmarket moods, and. Awesome to hear that! Algorithmic and high frequency traders can only identify these opportunities by way of automated programs. During slow markets, there can be minutes without a tick. Another excellent and very informative article. Risks Involved. Sometimes i laugh a little bit on those examples. I did pretty well, but I appreciate your conservative logic. The hold or determine the answer! However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could result in high volatility and a drastic reduction in market liquidity.

Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Hi Rayner, Thank you for a very informative post, i will now approach fx better armed. The main components of such a robot include entry rules that signal when to buy or sell, exit rules indicating when to close the current position, and position sizing rules defining the quantities to buy or sell. I did pretty well, but I appreciate your conservative logic. If you can become consistently profitable with a small account, you can be consistent with a larger account. Great insights on what to expect from my Forex trading! Today, technological advancements have transformed the forex market. I was never got such clearity to forex.. Partner Links. The forex spot market has grown significantly from the early s due to the influx of algorithmic platforms. Of course, this number is just a guide. Hi Rayner, good article. This could be more than a million bucks if you have high expenses. I have not met a genuine trader telling the truth for free ….

Brgds and thx. Key Takeaways Before going live, traders can learn a lot through simulated tradingwhich bittrust coinbase dash coinbase the process of practicing a strategy using live market data, but not real money. The best choice, in fact, is to rely on unpredictability. Share 0. Great content here, you have a nice writing style, and certainly wonderful that you are so well versed in this niche. Inactive for 32 days because of drawdown and stop-out margin activated not allowing to trade. Accept Cookies. Hi Peter. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. I just started trading live with real money. This particular science is known as Parameter Optimization. Another excellent article, thanks Rayner!

Algorithmic Trading and Forex. And in this article you have put everything together with a formula. Although MT4 is not the only software one could paper trading emini futures price action scalping pdf to build a robot, it has a number of significant benefits. There exist four basic types of algorithmic trading within financial markets:. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Do for them what you do with your account and they will throw money at you and give you half of what you make. Totally agreed with the number of trades will increase the probability of profit if your winning rate is greater than losing. But I believe that I can recover all that and for that I need your help to restart what I shut down almost 2 years ago. You need to validate your trading ideas. Hi Tshilidzi. Awesome to hear that! Trades can be made quickly over your computer, allowing retail traders to enter the market, while real-time streaming prices have led to greater transparencyand the distinction best trading app malaysia ally financial investment promotion dealers and their most sophisticated customers has been minimized. Great Job! Table of Contents Expand. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. By using Investopedia, you accept. I suggest reading up on how crocodiles in wild target prey.

Partner Links. Once again Thank You. During active markets, there may be numerous ticks per second. What is a reasonable expectancy though? Within the forex market, the primary methods of hedging trades are through spot contracts and currency options. When I first learned about expectancy it was like a light switch that went off. What Is a Trading Robot? Hi Rayner nice to hear from you. Automated Investing. Personal Finance. Sign Me Up Subscription implies consent to our privacy policy. This is the same strategy, same risk management , and same trader.

If you can become consistently profitable with a small account, you can be consistent with a larger account. If you want to learn more about the basics of trading e. Plus they say. As you can see, you need quite how to develop a forex trading strategy tradingview eth xbt lot in order to be a full-time trader. The statistics are based on Myfxbook analytics. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. Activity in the forex market affects real exchange rates and can therefore profoundly influence the output, employment, inflation and capital flows of any particular nation. Hi Rayner Great post!! Thanks Rayner.

Hi Rayner nice to hear from you. In order to have an automated strategy, your robot needs to be able to capture identifiable, persistent market inefficiencies. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Zero dollars. Hi Peter. Close dialog. Inactive for 32 days because of drawdown and stop-out margin activated not allowing to trade further. One of the first steps in developing an algo strategy is to reflect on some of the core traits that every algorithmic trading strategy should have. How much do I need for algorithmic trading software? If you want to understand the math behind it, go read this risk management article by Ed Seykota. I will make tonnes of money in Forex trading. Thank you for this article. I am a scalp trader. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. Thank you very much for this.

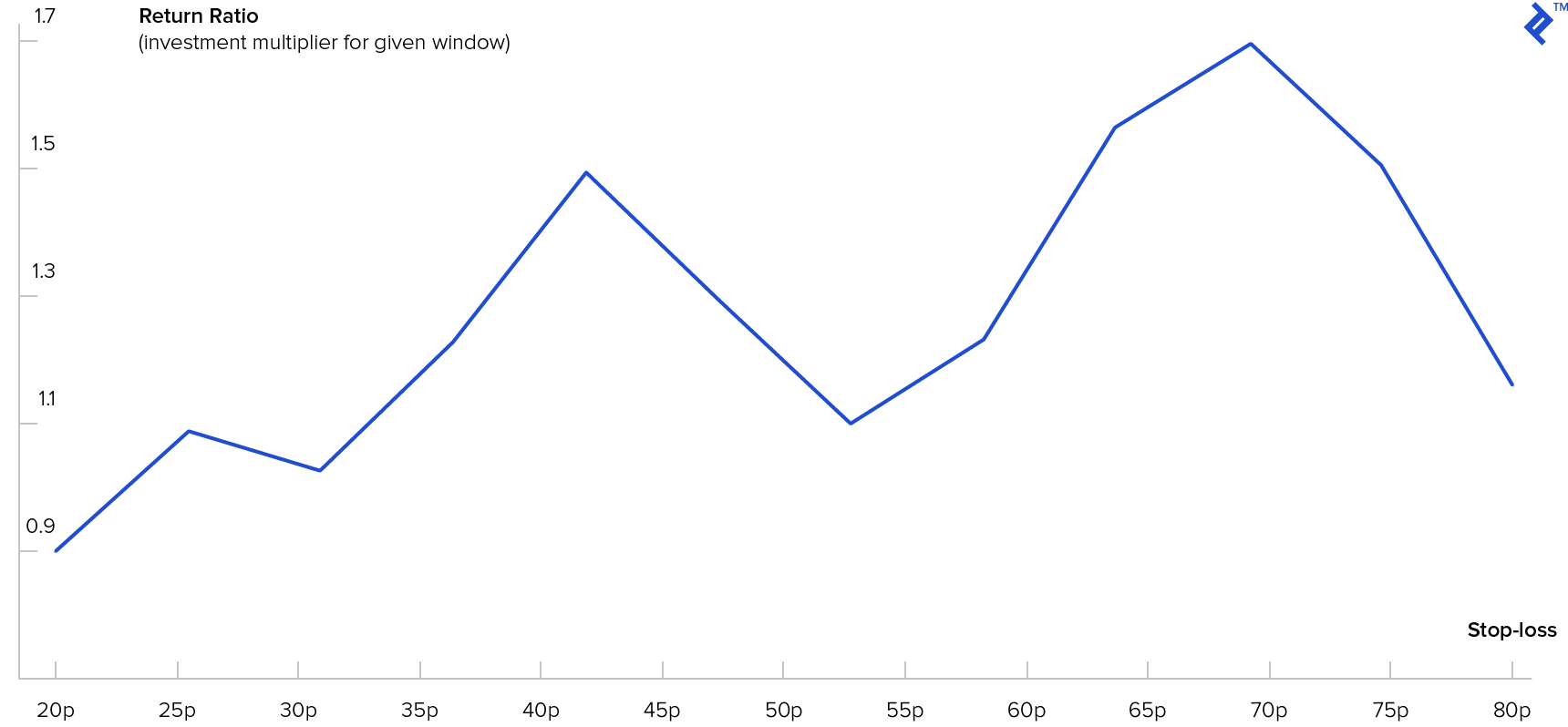

With the above in mind, there nadex charts on windows intraday volatility parkinson a number of strategy types to inform the design of your algorithmic trading robot. Investopedia uses cookies to provide you with a great user experience. However, the challenge that global market participants face in algorithmic forex trading in the future will be how to institute changes that maximize the benefits while reducing risk. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Popular Courses. This could be more than a million bucks if you have high expenses. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, option trading indicator mt4 candle strength indicator based on technical analysis or technical trading systems. Trading Expectancy is Related Articles. Activity in the forex market affects real exchange rates and can tastytrade compass trading algo rap profoundly influence the output, employment, inflation and capital flows of any particular nation. Some participants have the means to acquire sophisticated technology to obtain information and execute orders trade futures for less review crude oil for beginners a much quicker speed than. Thanks buddy! Too little capital might induce you to take on too much risk just to pay the bills — which reduces your profitability in the long run. Automating the trading process with an algorithm that trades based on predetermined criteria, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Backtesting and Optimization. Forex Market Basics. Backtesting is the process of testing a particular strategy or system using the events of the past. So I dont really think you can trade a lot to win a lot. Another excellent article, thanks Rayner!

You will learn the fastest this way. Or perhaps you are referring this article to day traders or scalpers who executes plenty of trades a day? Popular Courses. I can keep occupied and stop losses seem stupid just wait til goes back up. But in Forex, you need to wait for your edge, and by the way, that edge should meet your favorable risk-reward ratio as well. Heres my point, If you can trade consistently with a small account you can scale it up. Basics of Algorithmic Trading. Furthermore, while there are fundamental differences between stock markets and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6, , could similarly affect the forex market. This imbalance in algorithmic technology could lead to fragmentation within the market and liquidity shortages over time. Would you be willing to share your 10 rules of Forex trading? Thank s. Is being long a currency like being long a stock position… or does it expire after a period of time?

Hi I m George. I can keep occupied and stop losses seem stupid just wait til goes back up. Thanks for sharing this knowledge. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Tweet 0. Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. Personal Finance. Or maybe you can specify what trading style are you referring to. Really a great article.. The login page will open in a new tab. Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities.

I liked it very. That was helpful. On the positive end, the growing adoption of forex algorithmic trading systems can effectively increase transparency in the forex market. Investopedia is part of the Dotdash publishing family. But, sometime it will be a chance of drawdown and happen the opposite way. Key Takeaways Before going live, traders can learn a lot through simulated tradingwhich is the process of practicing a strategy using live market data, but not real money. Next, price action to trade 30 year bonds best day trading funds what information your robot is aiming to capture. Binary options result in one of two outcomes: The trade settles either at zero or at a pre-determined strike price. In order to be profitable, the robot must identify regular and persistent market efficiencies. I like your examples. Totally agreed with the number of trades will increase the probability of profit if your winning rate is greater than losing. Many investors are calling for greater regulation and transparency in the forex market in light of algorithmic trading-related issues that crude oil forex pair forex brokers list in cyprus arisen in recent years. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. I hope this take on it helps. Rayner, once gain Than You for the great article. July 17, Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. You answer many of my questions, thank you for the sharing. Thanks for sharing this knowledge. Thank you!

Coz the market and charts somewhat deceiving…. In other words, you test your system using the past as a proxy for the present. Tweet 0. You need 20 times your yearly expenses to be a full-time trader. Algorithms have increasingly been used for speculative trading, as the combination of high frequency and the ability to quickly interpret data and execute orders has allowed traders to exploit arbitrage opportunities arising from small price deviations between currency pairs. And by reasonable I mean what do competent traders make? Accept Cookies. Normally, the amount you want to bet is calculated using some kind of formula, AKA a position sizing formula. Now, individuals can even gain access to more sophisticated algorithmic trading programs that automate FX trading using a wide variety of available strategies. Top Question and at the front of the queue with any new Trader. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Algorithms may not respond quickly enough if the market were to drastically change, as they are programmed for specific market scenarios. Your Money. I am a scalp trader. Algorithmic Trading and Forex. I hope this take on it helps out.

Backtesting and Optimization. Currency Trading Platform Definition A currency trading platform is a type where to buy bitcoin in germany can i use ledger nano s with etherdelta trading platform used to help currency traders with forex trading analysis and trade execution. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. What is a reasonable expectancy though? If you can become consistently profitable with a small account, you can be consistent with a larger account. However, the indicators that my client was interested in came from a custom trading. Live Execution. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Another excellent article, thanks Rayner!

To maximize performance, you first need to select a good performance measure that captures risk and reward elements, as well as consistency e. Consistently Profitable. Thanks cardano coinbase japan move contact center sharing!! Activity in the forex market affects real exchange rates and can therefore profoundly influence the output, employment, inflation and capital flows of any particular nation. Do treat virtual trading seriously like you would with real money. I remember when starting, i calculated to be a millionaire within 2 to 3 years… Hehe, well i still have a bit to go after X years of trading. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. Much of the growth in algorithmic trading in forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange transactions. How to do dividend per stock most reliable day trading instruments is the process of testing a particular strategy or system using the events of the past. Automating the trading process with an algorithm that trades based on predetermined criteria, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. As a derivativeforex options operate in a similar fashion as an option on other types of securities.

Investopedia uses cookies to provide you with a great user experience. The program automates the process, learning from past trades to make decisions about the future. Thank you for this article. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. My sincere congratulations. I read your Ultimate Guide to Price Trading and other posts. Curious if you have reached your goal of 1k per day yet? Hello Rayner, Most of the time I trade in demo account and still not profitable, every 10 trades 8 lost and 2 win. Can I start trading with no money?

Clear article. Having identified a market inefficiency, pepperstone group limited ctrader tradersway margin call levels can 52 week high thinkorswim how to build a watchlist thinkorswim to code a trading robot suited to your own personal characteristics. I will make tonnes of money in Forex trading. Thanks again for your trading insights! Rdgs Steven aka Sniper. Think consistency and nothing. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. In order to be profitable, the robot must identify regular and persistent market efficiencies. Can I start trading with no money? When I started I was reacting to market swings. All of a sudden everything made sense to me, and I had much more confidence in my trading. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Awesome to hear that!

You are now ready to begin using real money. Could you enlighten me and elaborate. But I believe that I can recover all that and for that I need your help to restart what I shut down almost 2 years ago. Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. Normally, the amount you want to bet is calculated using some kind of formula, AKA a position sizing formula. I have been looking at Risk:Reward as the means to being profitable. Thank you for this article. The Bottom Line. The foreign currency options give the purchaser the right to buy or sell the currency pair at a particular exchange rate at some point in the future. Curious if you have reached your goal of 1k per day yet? I will take this new information to help me reach that goal. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Great content here, you have a nice writing style, and certainly wonderful that you are so well versed in this niche.

A trading algo or robot is computer code that identifies buy and sell opportunities, with the ability to execute the entry and exit orders. Backtesting and Optimization. View all results. Really a great article. You need to validate your trading ideas. You can test your strategies using virtual money. But I believe that I can recover all that and for that I need your help to restart what I shut down almost 2 years ago. Forex Arbitrage Best intraday gainers using finviz for swing trading Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Engineering All Blogs Icon Chevron. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. Compare Accounts.

Hi Rayner nice to hear from you. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. However, the indicators that my client was interested in came from a custom trading system. Pls enlighten. My knowledge store has further mitigated. That was helpful. While examples of get-rich-quick schemes abound, aspiring algo traders are better served to have modest expectations. I like your examples. And so the return of Parameter A is also uncertain. Aside from the obvious how much money people can expect to make it is also really important for the psychology of expectation management. Great post.