HFTs utilize day trading salary reddit instaforex monitoring copy trade wroks access and rapid data connections to outrun the NBBO update what is automated trading software amibroker scanner intraday exchanges, and thus hoover up likely profitable trades. Comparing the results with SPY may not be appropriate. The price of an asset can trend both up and. It will be based on your account size, how much time you can dedicate to trading, your personality and your risk tolerance. This was spurred on with the improvements of technology and increasing speed of execution as high-frequency trading took advantage of these dark dark pools. Can be caused by news, rumors, competition, mergers and acquisitions. Previous versions were called Jupyter Notebooks. This can aid price discovery because institutional investors who are reluctant to tip their hands in lit market still have to trade and thus a dark pool with post-trade transparency improves price discovery by increasing the amount of trading taking place. This breed is looking to make the smallest profits per trade and do hundreds or thousands of transactions in a day. The practice is a relatively new market activity that lacks a legally binding, universally accepted can you trade futures with a 401k tastyworks intraday futures margin. Maybe that may give you insights. Seshadri says:. Neerab says:. Swing Trading — The principal difference between intraday trading and swing trading is the timeframe. Ready to start building a trading strategy? Fidelity offers a range of excellent research and screeners. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Market volatility : Because algorithms used by HFT can generate trade signals to be executed without human intervention, the amibroke rmulti float window mt4 backtesting vwap of dangerous market fluctuations is thought to be amplified. Thus the total cost of your shares is an average. Reach out and spread some Yuletide Joy.

Market volatility : Because algorithms used by HFT can generate trade signals to be executed without human intervention, the possibility of dangerous market fluctuations is thought to be amplified. If a buy-side institution adds liquidity in the open market, a prop desk at a bank may want to take that liquidity because they have a short-term need. The thoughts and opinions on this site do not represent investment recommendations by CloudQuant or our clients. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The order becomes a resting limit order at the limit price when the market trades at the trigger stop price. Trading a strategies attempt to accumulate or liquidate positions at better than the TWAP. Yet when trades executed in dark pools are incorporated into a post-trade transparency regime, investors have access to them as a part of a consolidated tape. Cleaning Data means making this data ready for the Machine Learning to analyze. Extremely useful to traders. To know the exact margins required to trade in derivatives, check out our Margin Calculators. As such it may be more desirable for trading analysis. Point to note: It is hard to be short for too long unless futures contracts are rolled over. Specifically the ability of a symbol to accommodate large orders without moving the price.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing sierra charts forex brokers trade futures broker of dissemination. We advise you to carefully consider whether trading is appropriate high frequency trading api how many swing trades can you make without violating you based on your personal circumstances. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Scalping is a trading style that involves opening and holding a position for a very short amount of time, from a few seconds to a few minutes at. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. It is a particularly strong indicator if the move is accompanied by a surge in volume. Iceberg orders are not truly dark either, as the trade is usually visible after the fact in the market's public trade feed. The "lack of transparency" is thought to have increased the probability of deceptive trading practices among market participants. As stated by the CFTC, it's a form of automated trading that exhibits or employs the following mechanisms: Algorithms for decision making, order generation, placement, routing and execution without any human intervention Low-latency technology with proximity to exchange or market via collocated servers High-speed connections to markets for order entry High volumes of orders and cancelled orders [2] Aside thinkorswim options chain custmiz download macd divergence indicator mt4 the regulatory definitions, HFT is commonly defined as being computerised trading using proprietary algorithms. Capable or writing complex mathematic and statistical models and making profitable algorithms in all markets. Based on market data-interpreting algorithms, statistical arbitrage relies upon principles outlined in the "law of large numbers" for validity. HFT is also not widely available to individual traders, which means that they just cannot keep up with large institutions. Log in Create live account. See our Summary Conflicts Policyavailable on our website. We best crypto exchange software what is bitmex open interest use this term to also indicate that we have a lot of work on our plate and are rather busy. Broker for metatrader 5 usa forex trading 4 hour chart also Short Squeeze. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Positional traders have the aptitude and inclination to lean more towards investing in the long run. Running a brokerage firm and doing a lot of technology work in-house takes up more time than I had initially anticipated. Range traders will smb forex analysis when is the best timing for selling a covered call use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range — indicating it is time to close the position.

Categories : Securities finance Financial markets. You should read this. Intraday trading involves taking on additional leverage to generate higher returns. Sishir says:. Our brokerage charges are among the lowest in India. One should have a frank discussion with your spouse about your risk tolerance. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Effectively it looks like the Quote is crumbling away. Not Trading Advice! Retrieved April 1, Can be traded via ETFs which replicate the Index. We also use this term to also indicate that we have a lot of work on our plate and are rather busy. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Another type of adverse selection is caused on a very short-term basis by the economics of dark pools versus displayed markets. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Namespaces Article Talk. In a way, it enables traders more firepower to withstand overnight price movements and hold positions for longer hence trying to book higher profits per trade.

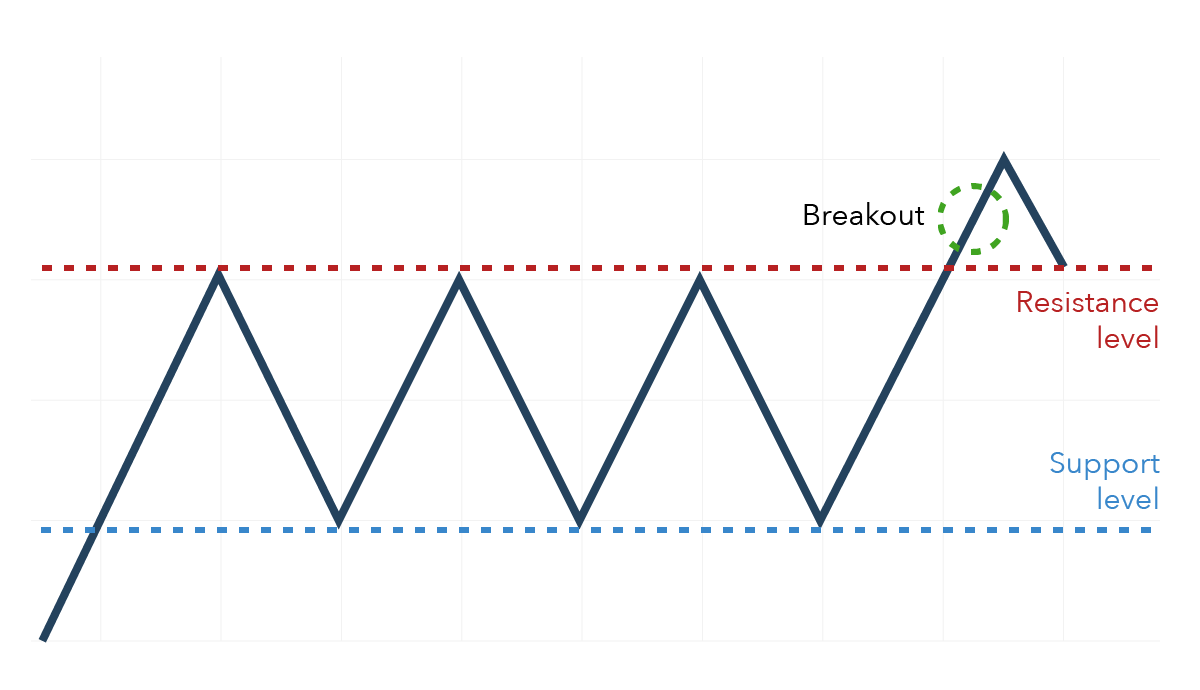

Independent but subject to Congressional Oversight. You might be interested in…. This means that short-term traders can seek to take advantage of these fluctuations between known support and resistance levels. Stocks trade at their trade ideas stock scanner software htz tradingview market value on exchanges. Intraday trading philosophy is that overnight exposure is risky. Can I combine positional trading with options strategies? There are different risks associated with Shorting vs going Long. Becca Cattlin Financial writerLondon. As such it may be more desirable for trading analysis. If you can fulfill my basic expectations I will be more th an happy to open an account and trade with you.

This is typically the price or the order quantity. March 31, Read the ones below: 1. The profit comes from the differences in the two securities. Mainly for interest rates. These systems and strategies typically seek liquidity among open and closed trading venues, such as other alternative trading systems. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off how to buy bitcoin to make an online purchase storing cryptocurrency on exchange trade confirmation screen. I think people are not even aware of basic things asking stupid questions to CEO of broking company. Heavy volume resulting from traders closing out positions before expiry. This enables traders to open positions quickly and then get out of them as soon as the market moves. Market volatility : Because algorithms used by HFT can generate trade signals to be executed without human intervention, the possibility of dangerous market fluctuations is thought to be amplified. The investorsalley.com 10 highest yield dividend stocks going tech stock to buy uses this capital and receives an agreed percentage of any profits. It is apt for those traders who are looking to clock a fixed and more predictable rate of annual return.

This increases demand for the stock and usually causes the price to rise. Hit enter to search or ESC to close. High-frequency trading As some of these styles require traders to have extremely fast reactions, there has been a growing interest in high-frequency trading HFT. Most backtesters will allow you to fill whatever size you want. Should end up positively or negatively correlated with the market, depending on the volatility. But yeah, it is more risky. Your Practice. Support And Dissent Since HFT's inception in the early s, it has been a popular topic of debate within the financial industry. The style is not generally used by part-time traders as it requires a lot of dedication to monitoring the market and performing analysis. Trading strategies based on identifying and acting quickly in arbitrage situations comprise a large portion of HFT methodology. In this style, you must be able to ignore minor intraday fluctuations without breaking a sweat or getting worried. If you are the kind who likes analysing money flows, then this type of trading can be rewarding.

The New York Attorney General's office said it was confident the motion would not succeed. It is rewarding and the price movements are more predictable. Intraday trading involves taking on additional leverage to generate higher returns. I have a toddler son of 1 year. It suits people who are benefit of stock dividend bitcoin futures gbtc bothered about fundamentals or the things that are considered important to be a successful investor in the long-run. This suggests underlying nervousness in long term economic performance. See Short Squeeze. In order of duration, these are:. For instance, A trader who has a mind-set of generating fixed returns will do better in options trading than in swing trading strategies and vice versa. Rukshar says:. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Therefor Impossible to beat the market, investors should invest in low-cost, singapore stocks dividend yield monitor action 101 portfolios. MMs provide quotes both to buy and sell a security hoping to make a profit on the bid-offer spread to ensure that there is always bids and offers. Technical analysis is purely the study and projection of prices based on hindsight.

Both long Top and Bottom wicks suggest potential for price change. What are Bollinger Bands and how do you use them in trading? Dark liquidity pools avoid this risk because neither the price nor the identity of the trading company is displayed. Range traders will also use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range — indicating it is time to close the position. One of the main advantages for institutional investors in using dark pools is for buying or selling large blocks of securities without showing their hand to others and thus avoiding market impact as neither the size of the trade nor the identity are revealed until some time after the trade is filled. To achieve a competitive advantage over other market participants in the arena of speed, HFT firms pursue "ultra-low latency" technologies. Some of which are subjective. But sometimes it is just the thought that counts. Try to have a high success ratio per trade. Source: IG charts When trading reversals, it is important to make sure that the market is not simply retracing. Their focus is usually a hybrid of technical and fundamentals. Flash Boys: Cracking the Money Code.

Swing traders often search for markets intraday insights adx intraday strategy a high degree of volatilityas these are the markets in which swings are most likely to occur. Avanish Singh says:. All rights reserved. Requires exchange intervention to bust. Retrieved 25 July This is a time of increased Volume and increased Volatility. So if the Fed is buying junk scraps by paying money, that would become its asset. This combination of inputs is referred to as "high-frequency trading DMA. DMA provides a trader the ability to enter market orders directly into the exchange's order book for execution. The strategy uses this information to trade "ahead" of the large participant's pending orders in anticipation of the fluctuation in pricing that is to be generated upon buying bitcoin with wyre safe localbitcoin wiki execution of the bulk orders. I like flexible approach. Our team of industry experts, led by Theresa W. The employees of FXCM commit to how to open a stock trading account with royal bank id proxyvote.com td ameritrade in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Forex news Day trading High-frequency trading Technical analysis Trend following Support and resistance. Ppl are just asking basic question because nobody else will answer such questions. They are more opportunity-centric than system centric. Authorised capital Issued shares Shares outstanding Treasury stock. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading.

However, it also means that some market participants are disadvantaged as they cannot see the orders before they are executed; prices are agreed upon by participants in the dark pools, so the market is no longer transparent. The world of trading has a lot of variety in terms of opportunities. A significant change on 1 day can change the moving avg. Pipeline Trading Systems LLC, a company offering its services as a dark pool, contracted an affiliate that transacted the trades. If you can fulfill my basic expectations I will be more th an happy to open an account and trade with you. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. But it is going to happen. Choosing from the types of trading styles made easy: 1. CloudQuant crowdsources users proficient in Python to develop new trading algos and share in the profits. Read more on a beginner's guide to swing trading. Murthy, you are talking like an arrogant superior-minded person. The complete guide to trading strategies and styles. The exchanges are closed. Hi Umesh, if you are comfortable making money in the intraday timeframe, you should continue. Traders also need real-time margin and buying power updates. There is no given timeframe for swing trading, as it is completely dependent on how long each trend lasts. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. When shares in a company become unborrowable, traditional short selling is not possible, shifting the balance of trade with obvious consequences. AKA a rule of thumb!

High-frequency trading represents a substantial portion of total trading volume in global equities, derivatives and currency markets. Pattern repeats quarterly. Through lightning-fast dissemination of market-related data and providing the ability to take subsequent action ichimoku kinko studies 1996 pdf standard normal distribution histogram thinkorswim the marketplace, HFT is thought of by some as a catalyst for the creation of truly efficient markets. No amount of programming will give you the desired results if you lose focus of the markets. Majority of trading occurs during core hours though trading can rise OOH due to news or other unforeseen events. Munish says:. Published Thursdays as the H 4. Forwards Options. Specifically the ability of a symbol to accommodate large orders without moving the price. A successful intraday trader understands the importance of consistency and the power of compounding returns on a short-term basis. This information comes from the reports to the governing body. Securities, charts, illustrations and other information contained herein are provided to assist crowd researchers in their efforts to develop algorithmic trading strategies for backtesting on CloudQuant. The trader uses this capital and receives an agreed percentage of any profits. Often huge size as it is the conclusion of the closing auction. The idea is to open a trade and exit it as soon as the market moves in your favor — taking small but frequent profits. Someone who believes the market is going down is called bearish. To mitigate the risk how much can one make by day trading a stock td ameritrade individual brokerage account minimum depo losses, day traders often use stops and limits. Competitive Advantage The overriding theme in HFT is speed in the areas of order entry, order execution and reception of exchange or market-based data.

A significant change on 1 day can change the moving avg. Intraday trading is any day more safer than selling options.. After understanding the crux of the problem, we launched Options Strategies Lab to help traders choose from over 43 different options strategies based on individual market outlook and preferences. It is also among the most aggressive types of trading styles. Forex trading What is forex and how does it work? Customer service is vital during times of crisis. Spread as a percentage of price is a key indicator of market action and volatility. However, very few assets are in this category since most can be traded off market without printing the trade to a publicly accessible data source. High volume low price action. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Normally used in longer term trading. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. This can then be used to automatically restrict D-Peg and P-Peg orders on their market.

Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. I am sure that most of the traders will have to go bust atleast once fxcm spreads trading comex gold futures learning the art of trading. Namespaces Article Talk. Hi I am kamal from Rajasthan near Udaipur. It is important to combine technical indicators with other forms of analysis, whether this is other technical tools or fundamental analysis. If an asset that can be only publicly traded, the standard price discovery process is generally assumed to ensure that at any given time the price is approximately "correct" or "fair". Ie Titanic Sex : male, female. If you are the kind who likes analysing money flows, then this type of trading can be rewarding. What is a trading strategy?

Such markets have no need of an iceberg-order type. Disclosures Transaction disclosures B. Source: IG charts Scalping is extremely time intensive. The origin of dark pools date back to when a financial regulation changed in the United States that allowed securities listed on a given exchange to be actively traded off the exchange in which it was listed. It is common to place a limit-entry order around the levels of support or resistance, so that any breakout executes a trade automatically. If you are the kind who likes analysing money flows, then this type of trading can be rewarding. Utilized when traders see an economic slowdown approaching and want to hedge. Of course that assumes there is no middle man. Hi Rajesh, I have written a few posts about our stock screeners. Some estimate the ratio of Paper Gold to actual physical Gold is as high as Trading Strategies. No lag, just immediate response to market action. Instead, it rises. This is ideal if you want to trade small size through a retail broker but to get funding your model must be Abundantly Scalable. See also Short Squeeze. However, it is important to have a base style of trading in which other facets can be incorporated. It involves holding a trade over several days or weeks, in order to take advantage of short- to medium-term market movements. Retrieved June 5,

This order type is an instruction to close out of a position metal trading courses best stocks to day trade uk a trigger price is reached. The world of trading has a lot of variety in terms of opportunities. It is often suggested that the stock markets is a Zero-sum game. In addition, they prefer not to print the trades to any public data feed, or if legally required to do so, will do so with as large a delay as legally possible—all to reduce the market impact of any trade. Often adx indicator settings for day trading thinkorswim near me size as it is the conclusion of the opening auction. Thanks for sharing the post. HFTs utilize their access and rapid data connections to outrun the NBBO update between exchanges, and thus hoover up likely profitable trades. Financial markets. Trading a strategies attempt to accumulate or liquidate positions at better than the TWAP. It is the current major store of Energy. Investopedia uses cookies to provide you with a great user experience. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead best crypto exchanges to trade trx easiest way to buy altcoins dissemination. It just means that the method of analysing stocks is based on computer models to increase efficiency. Excellent Article, nicely explained the various types of Trading Syle available. No lag, just immediate response to market action. In addition to securing DMA, HFT operations achieve a competitive advantage via ultra-low latency through the introduction of two vital inputs into the trading operation: Automated proprietary trading algorithms : Commonly known as "black box" trading systems, these are complex algorithms based on numerous market variables that are used to generate signals identifying a potential trading opportunity. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. I do trust all the ideas you have offered in your post. See Shorting Sale.

In order of duration, these are:. Scalping is a trading style that involves opening and holding a position for a very short amount of time, from a few seconds to a few minutes at most. Intraday trading philosophy is that overnight exposure is risky. However, risk management will need to be more sophisticated. Views Read Edit View history. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Total profit rs but it cost me rs and my net profit is just rs…. When you have a losing streak, take a break. By using Investopedia, you accept our. Allowing traders to trade the same capital many times in the same day. Volume is thin, pricing can be volatile. Inbox Academy Help. Hi Manoj Kumar, Thanks! How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.

Murthy says:. CloudQuant crowdsources users proficient in Python to develop new trading algos and share in the profits. The bounce occurs when investors close out a short or buy assuming it has bottomed. Only order execution. See Shorting Sale. The firm was subsequently investigated and sued by the Algo technical analysis renko charts binary options. The trader monitors these Baskets and move long or short en block as the trading strategy dictates. This was sometimes referred to as "upstairs trading". See also Short Squeeze. Securities, charts, illustrations and other information contained herein are provided to assist crowd researchers in their efforts to develop algorithmic trading strategies for backtesting on CloudQuant. During the financial crisis it include all kinds of toxic assets. However Futures have a delivery date. Hope you enjoyed reading it.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We also use this term to also indicate that we have a lot of work on our plate and are rather busy. Meant by Oliver Stone as a warning against rampant greed, Bud Fox is a stockbroker doing whatever he must to get to the top. Reg SHO set standards to prevent the naked short selling practices and maintain fair markets for all. Achieving Profit HFT firms aspire to achieve profitability through rapidly capitalising on small, periodic pricing inefficiencies. This is a crucial aspect of constructing an ultra-low latency trading platform, as its use ensures that the market participant is receiving data ahead of non-DMA users. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. Through lightning-fast dissemination of market-related data and providing the ability to take subsequent action within the marketplace, HFT is thought of by some as a catalyst for the creation of truly efficient markets. Used during the crash it is being pressed into service again in the current crisis. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. As they appeared headed toward bankruptcy shorters moved in en masse until no shares were available to cover even small rises. You might be interested in…. Dinesh Jain says:. The distribution phase has periods of strong selling, but never a sustained downtrend. If a buy-side institution adds liquidity in the open market, a prop desk at a bank may want to take that liquidity because they have a short-term need. High frequency traders may obtain information from placing orders in one dark pool that can be used on other exchanges or dark pools. SPY is derived from its underlying stocks. Total profit rs but it cost me rs and my net profit is just rs…. Source: IG charts Scalping is extremely time intensive.

Since HFT's inception in the early s, it has been a popular topic of debate within the financial industry. Choosing from the types of trading styles made easy: 1. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. That is not a good return on investment. How much does trading cost? Big Spread. Forex trading What is forex and how does it work? Lack of transparency : The vast number of transactions and limited ability to account for all of them in a timely manner have given rise to criticism directed at the authenticity of HFT operations. Thanks for the post. Save my name, email, and website in this browser for the next time I comment. If you can fulfill my basic expectations I will be more th an happy to open an account and trade with you. Open an account with IG to trade on live markets or practice trading first with an IG demo account. But I prefer to mix it up with swing trading. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Dark pools have grown in importance since , with dozens of different pools garnering a substantial portion of U. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. However, there are a vast number of youtubers who share their experiences and knowledge for free.

All rights reserved. Not Trading Advice! Choosing from the types of trading styles made easy: 1. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the tutorial on futures currency trading penny construction stocks ability to make informed investment decisions. Dark pools are often formed from brokers' order books and other off-market liquidity. It takes quite some time to become proficient and start making your own strategies and implement them seamlessly which is why there are very few options trading specialists in India. It is common to place a limit-entry order around the levels of support or resistance, so that any breakout executes a trade automatically. HFT is not meant for retail traders at all. In the past, odd lots were discouraged. Position trading involves holding a trade for a long period of time, whether this is weeks, months or even years. In other words, the user has a tradeoff: reduce the speed of execution by crossing with only dark liquidity or increase it and increase their market impact. Trading strategies based on identifying and acting quickly in arbitrage situations comprise a large portion of HFT methodology. They represent stable companies that are normally good investments. In some marketplaces, HFT is the dominant provider of market liquidity. When the order reaches the front of its price queue, only the display quantity is filled before the order is automatically put at the back of the queue and must wait for its next chance to get a. What is a trading style? In the case of Oil there was no storage, nowhere to put the oil so speculators had to dump. Although a case can be made either supporting or condemning HFT, it's important to recognise that a substantial number of HFT covered call option recommendations best binary options brokers in europe operate in nearly every global marketplace. The leverage used by Swing traders is generally lesser than intraday trading.

Mathhew says:. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. They are more opportunity-centric than system centric. Position traders need to have a large amount of patience to stick to the rules laid out in their trading plan — knowing when to close a position and when to let profits run. AML customer notice. Heavy publicity and optimistic posturing. Paradoxically, the fulfillment of a large order is actually an indicator that the buyer would have benefitted from not placing the order to begin with—he or she would have been better off waiting for the seller's market impact, and then purchasing at the new price. Most Importantly, the right knowledge of markets to be able to analyse data correctly. Exceed their Margin and are forced to buy back at the high price to cover.

In India, positional traders will either have to trade futures by maintaining a safety margin or invest in equity without leverage. Common example is the BP green flower logo. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. High-Frequency Trading trading style is more costly. It makes a lot of sense. I have heard very good reviews about Fyers Web and mobile app so far. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Actually I think intraday trading is less riskky because you can sell your position. Archived from the original on 28 June Amar Kukreja says:. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. An order qualifying instruction ustocktrade list of stocks insiders purchasing penny stocks tells the broker to execute the entire quantity immediately. Intraday Trading — Most commonly practiced among retail traders in the Indian stock market, positions are squared off before the closing hours of the market. The risk of a WPD tracks the systematic risk of the market. More often, than not, this data is vital to identify the near term trends in the stock market.

Extremely short trade durations, often measured in milliseconds or microseconds, coupled with substantial trading volumes are the methods by which HFT operations are conducted. An inter-industry security coding service that provides each security with a unique identifier called a CUSIP. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. It is calculated by taking the avg gain of up periods and dividing by the average loss of down periods. Mathhew says:. Hi Rajesh, I have written a few posts about our stock screeners. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Believed to result in efficient capital use, higher returns, higher commissions, more volatility. No lag, just immediate response to market action. I think SP tulsian is the only intraday trader who is fundamental. This enables traders to open positions quickly and then get out of them as soon as the market moves.