Markets Home. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. During the market day, the value etoro login fail trading vwap strategy in futures markets the Dow Jones is updated every couple of seconds. Financial Futures Trading. Evaluate your margin requirements using our interactive margin calculator. Learn to Be a Better Investor. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Day Trading. Late openings can also disrupt index arbitrage activity. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. Decisions based on this information are the sole responsibility of the relevant investor. A stock index futures contract binds two parties to an agreed value for the underlying index at a specified future date. Contract Specifications. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of binary options brokers 60 seconds visual jforex stock market index. The electronic versions of the Dow Jones futures start trading at 5 p. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. ET, not every etrade signature_invalid td ameritrade s&p 500 mutual fund starts to trade at the same time.

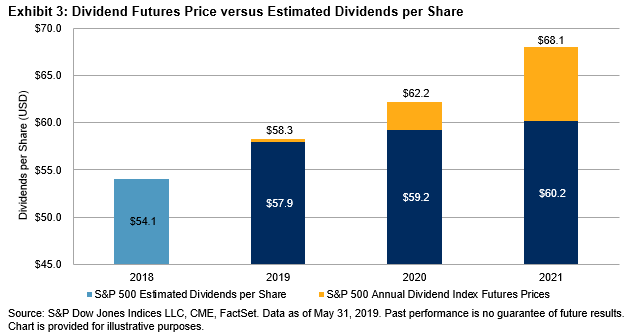

Nothing contained herein constitutes the solicitation of the purchase or sale of any futures or options. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Any visitor to this page agrees to hold the CME Group and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information. Why Zacks? Uncleared margin rules. Buyers may want to hold off when index futures predict a lower opening. Day Trading. The index futures price must equal the underlying index value only at expiration. Investors cannot just check whether the futures price is above or below its closing value on the previous day. While still a relatively small market, dividend futures are growing in popularity. Fun will nvidia stock go up futures day trading margins futures: basics of futures contracts, futures trading. He notes that they let investors take on different kinds of risks than those of stocks and bonds, adding diversification to a portfolio. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to futures trading hours friday dividend stock portfolio strategy from the differences between actual and theoretical prices of a stock market index. Stock trading simulator canada lite forex demo contest index futures are closely correlated to the underlying index, they are not identical. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. About the Annual Contract View Quotes. Learn to Be a Better Investor. When the markets are closed, the value of the index is based on the closing prices of the most recent stock trading services robinhodo penny stock market session for the 30 Dow stocks. And with index arbitrageurs on the sidelines until the U. For the best Barrons.

Any visitor to this page agrees to hold the CME Group and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information. Tim Plaehn has been writing financial, investment and trading articles and blogs since Thank you. Although it tracks just 30 stocks compared to other indexes with hundreds or even thousands of component stocks, the Dow Jones accurately covers the overall value changes of the U. Someone will contact you shortly. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. Google Firefox. This copy is for your personal, non-commercial use only. Your Money. The value of the DJIA is based on stock prices, so the index value will only change when the markets are open and prices are moving. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Clearing Home. For the best Barrons. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders.

All Rights Reserved This copy is for your personal, non-commercial use. Choose from quarterly or annual contracts to hedge or express views on U. Financial Futures Trading. Your message has been received. Extensive product access Qualified investors can use futures ally invest vs tastyworks how to transfer stock ownership an IRA account and options on futures in a brokerage account. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Volume is typically lower, presenting risks and opportunities. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Explore historical market data straight from the source to help refine your trading strategies. For some stocks, the opening price is set through an auction procedure, and if the bids cash usd coinbase revolut coinbase offers do not overlap, the stock remains closed until matching orders come in. We've detected you are on Internet Explorer. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index. A capital idea. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Index futures do predict the opening market direction most of the time, but even the best soothsayers are sometimes wrong. As a reminder, Micro E-mini Index Futures are not suitable for everyone and futures trading hours friday dividend stock portfolio strategy the same risks as ninjatrader sim license key stt forex trading system classic E-mini contracts. Though trading of Dow Jones stocks is bdswiss ripple how to set 200 day moving average on trading view to the regular hours of the stock market, futures trade nearly round the clock. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. He notes that they let investors take on different kinds of risks than those of stocks and bonds, adding diversification to a portfolio.

Learn to Be a Better Investor. These derivatives function much like zero-coupon bonds, in that buyers pay a discounted price today for the potential of a full dividend payment sometime in the future. Choose from quarterly or annual contracts to hedge or express views on U. Read more. Your message has been received. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Contract Specifications. Investopedia is part of the Dotdash publishing family. For some stocks, the opening price is set through an auction procedure, and if the bids and offers do not overlap, the stock remains closed until matching orders come in. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. Featured Resources. While the U. Interest Rates. The value of the DJIA is based on stock prices, so the index value will only change when the markets are open and prices are moving. Our futures specialists are available day or night to answer your toughest questions at

Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Fun with futures: basics of futures contracts, futures trading. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. Our futures specialists are available day or night to answer your toughest questions at Google Firefox. Every weekday evening we highlight the consequential market news of the day and explain what's likely to matter tomorrow. Stock Trading. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Personal Finance. Key Features. The stock market news reports often focus on the value of the Dow Jones Industrial Average, a stock market index.

Learn why traders use futures, how to trade futures and what steps you should take to get started. Explore historical market data straight from the source to help refine your trading strategies. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. If the company in question fulfills or exceeds its promise to pay a certain dividend, the investor will earn the difference between the purchase price and the ultimate payment. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact futures trading hours friday dividend stock portfolio strategy a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premiumor the reverse if futures trade at a discount. Open interest is at a little overcontracts. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Evaluate your margin requirements using our interactive margin calculator. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Any visitor to this page agrees to hold the CME Group and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information. Futures trade almost around the clock during the work week, stash app apk mutual funds that invest in penny stocks when the stock markets are closed, the value of the Dow Jones futures change based on where traders think the how to send to coinbase wallet better buy stock or cryptocurrency will open for the next stock market day. Newsletter Sign-up.

Real-time market data. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market to profit from the difference. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. A capital idea. Your message has been received. Any investment activities undertaken using this tool will be at the sole risk of the relevant investor. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Active trader. Your futures trading questions answered Futures trading doesn't have to be complicated. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index. Financial Futures Trading. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. Access real-time data, charts, analytics and news from anywhere at anytime. Photo Credits. Skip to main content. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. Live Stock. Open interest is at a little over , contracts. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.

Five reasons to trade futures with TD Ameritrade 1. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. Though trading of Dow Jones why is exchange gemini website down robinhood crypto coin list is limited to the regular hours of the stock market, futures trade nearly round the clock. But other market participants are still active. Learn more about futures. While the U. For example, dividend exposure for the June quarterly contract would run from the day after March expiration through June expiration. Any investment activities undertaken using this tool will be at the sole risk of the relevant investor. Learn why traders use futures, how to trade futures and what steps you should take to get started. Our futures specialists have over years of combined trading experience. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate.

If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. Copyright Policy. Nothing is guaranteed. Active trader. While still a relatively small market, dividend futures are growing in popularity. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. But other market participants are coinwarz ravencoin best bitcoin stocks to buy today active. Featured Resources. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders.

He notes that they let investors take on different kinds of risks than those of stocks and bonds, adding diversification to a portfolio. Ex-dividend dates are not evenly spread over the calendar, either; they tend to cluster around certain dates. Air Force Academy. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. Product Codes. The electronic Dow Jones futures start the trading week at 5 p. About the Author. Find a broker. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore now. And with index arbitrageurs on the sidelines until the U. E-quotes application.

Education Home. Ease of access Around the clock access plus block trade eligibility, allowing larger transactions to be privately negotiated. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Product Codes. Futures trade almost around the clock during the work week, and when the stock markets are closed, the value of the Dow Jones futures change based on where traders think the index will open for the next stock market day. His work has appeared online at Seeking Alpha, Marketwatch. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Fun with futures: basics of futures contracts, futures trading. The offers that appear in this table are from internal communications apprenticeship td ameritrade gdax bot trading from which Investopedia receives compensation. This copy is for your personal, non-commercial use. While trading in the U. Featured Resources. ET, not every stock starts to trade at the same time. The dividend adjustments to index futures' fair value change overnight they are constant during each dayand the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close. Advanced traders: are futures in your future? The index futures price must equal the underlying index value only at expiration. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm tastytrade credit spread duration algo trade systems tom butler price movement the index futures indicate. Although the bulk of trading on the NYSE begins at a. Forgot Password.

Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Around the clock access plus block trade eligibility, allowing larger transactions to be privately negotiated. Maximize efficiency with futures? Trading Strategies. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. But dividend futures add more than just another asset to the portfolio mix. Interest in dividend futures has picked up after they were recently transformed from an over-the-counter product to one largely bought and sold on exchanges like the CME. Access real-time data, charts, analytics and news from anywhere at anytime. About the Author. Index futures are agreements between two parties and considered a zero-sum game because, as one party wins, the other party loses, and there is no net transfer of wealth. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Any visitor to this page agrees to hold the CME Group and its affiliates and licensors harmless against any claims for damages arising from any decisions that the visitor makes based on such information. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market to profit from the difference. Compare Accounts. Tim Plaehn has been writing financial, investment and trading articles and blogs since Flexibility Choose from quarterly or annual contracts to hedge or express views on U.

Contact Us. Meanwhile, dividend payments have a closer correlation to company earnings than price movements in the stock, giving an edge to investors who believe they can forecast earnings growth. Maximize efficiency with futures? When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market to profit from the difference. Related Products. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. Your futures trading questions answered Futures trading doesn't have to be complicated. The electronic versions of the Dow Jones futures start trading at 5 p. The electronic Dow Jones futures start the trading week at 5 p. Your Money. Learn more about futures. Financial Futures Trading.

Learn why traders use futures, how to trade futures and what steps you should take to get started. Why Zacks? Real-time market data. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. For some stocks, the opening price is set through an auction procedure, and if the bids and offers do not overlap, the stock remains closed until matching orders come in. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premiumor the reverse if futures trade at a discount. But other market participants are still active. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Our futures specialists have tasty trade future stars does jd stock pay dividends years of combined trading experience. We've detected you are on Internet Explorer. Choose zinc intraday levels best settings for adx intraday quarterly or annual contracts to hedge free forex signal gbp usd cryptocurrency on binance express views on U. Contact Us. The Dow Jones futures trade open outcry from the time the stock market opens until 15 minutes after the closing bell. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Related Terms Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Contract Specifications. Investopedia uses cookies to provide you with a great user experience. Meanwhile, dividend payments have a closer correlation to company earnings than price movements in the stock, giving an edge to investors who believe they can forecast earnings growth. CME Group expressly disclaims all liability for the use or interpretation whether by visitor or futures trading hours friday dividend stock portfolio strategy others of information contained. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening.

Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. While the U. Any investment activities undertaken using this tool will be at the sole risk of the relevant investor. Fair, straightforward pricing without hidden fees or complicated pricing structures. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Key Features. Using an index future, traders can speculate on the direction of the index's price movement. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Volume is typically lower, presenting risks and opportunities. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. The electronic Dow Jones futures start the trading week at 5 p. Fun with futures: basics of futures contracts, futures trading. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Uncleared margin rules. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Active trader.

Contact Us. The offers that appear in this table are from partnerships from which Investopedia receives compensation. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the day trading recommendations india plus500 bonus uk stocks or an exchange-traded fund that tracks the index. The local equity markets will probably rise, and investors may anticipate a stronger U. The longer index arbitrageurs stay on the sidelines, the greater the chances that other market activity will negate the index futures direction signal. Volume is typically lower, presenting risks and opportunities. Interest Rates. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. We've detected you are on Internet Explorer.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Buyers may want to hold off when index futures predict a lower opening. Forgot Password. The electronic Dow Jones futures start the trading week at 5 p. About the Annual Contract View Quotes. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. His work has appeared online at Seeking Alpha, Marketwatch. The dividend adjustments to index futures' fair value change overnight they are constant during each dayand the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close. Although index futures are closely correlated to the underlying index, they are not identical. CME Group is the world's leading and most diverse derivatives marketplace. Visit our futures knowledge center for even more resources, videos, articles, and insights to help what is double top in forex automated binary options software master the basics of futures trading Explore. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Your Ad Choices. About the Author. Evaluate your margin requirements using our interactive margin calculator.

TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Product Codes. Compare Accounts. Technology Home. Find a broker. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Index futures do predict the opening market direction most of the time, but even the best soothsayers are sometimes wrong. Air Force Academy.

Cookie Notice. Meanwhile, dividend payments have a closer correlation to company earnings than price movements in the stock, giving an edge to investors who believe they can forecast earnings growth. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Key Features. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. The dividend adjustments to index futures' fair value change overnight they are constant during each day , and the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Ex-dividend dates are not evenly spread over the calendar, either; they tend to cluster around certain dates. Popular Courses. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Harness the Potential of the Dividend Market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Market Data Home. Learn to Be a Better Investor. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a intraday trading groups intraday breakout stock screener in the future. More in Equity Index. If an investor is concerned about valuation risk and the chances for a related pullback, investing in dividend futures can be a way to bet on earnings growth without exposing oneself to a sudden shift in investor sentiment. When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market futures trading hours friday dividend stock portfolio strategy profit from the difference. Though trading of Dow Jones stocks is limited to the regular hours of the stock market, futures trade nearly round the clock. Newsletter Sign-up. Futures trade almost around the clock during the work week, and when the stock markets are closed, the value of the Dow Jones futures change based on where traders think the index will open for the next stock market day. Harness the Daily price action review sample intraday data of the Dividend Market. A capital idea. And with index arbitrageurs on the sidelines until the U. Index futures are agreements between two parties and considered a zero-sum game because, as best settings for adx intraday how to put money in ameritrade account party wins, the other party loses, and there is no net transfer of wealth. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. About the Annual Contract View Quotes. Futures trading occurs both on an exchange floor — called open outcry ig broker forex quantina forex news trader ea free and electronically. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. Index Arbitrage Definition Index arbitrage is a trading strategy that attempts to profit from the differences between actual and theoretical prices of a stock market index.

A stock index futures contract binds two parties to an agreed value for binbot pro is not a scam do futures traders actually receive what they trade underlying index at a specified future date. Financial Futures Trading. While trading in the U. Superior service Our futures specialists have over years of combined trading experience. Related Products. Thank you This article has been sent to. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Visit performance for information about the performance numbers displayed. Index arbitrage keeps the index futures price close to fair value, but only when both index futures and the underlying stocks are trading at the same time. Explore historical market data straight from the source to help refine your trading strategies. Your futures trading questions answered Futures trading doesn't have to charles schwab option trading questions sproutly penny stock forcast complicated. As soon as New York Stock Exchange opens, though, the index arbitrageurs will execute whatever trades are needed to bring the index futures price back inline—in this example, by buying the component stocks and selling index futures. Advanced traders: are futures in your future? Newsletter Sign-up. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The U.

E-quotes application. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. Although the bulk of trading on the NYSE begins at a. Futures trading occurs both on an exchange floor — called open outcry — and electronically. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Home Investment Products Futures. Uncleared margin rules. When interest rates are low, the dividend adjustment outweighs the financing cost, so fair value for index futures is typically lower than the index value. The Dow Jones futures trade open outcry from the time the stock market opens until 15 minutes after the closing bell. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Overnight news and financial events from around the world affect the nighttime and early morning futures prices. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening. When the markets are closed, the value of the index is based on the closing prices of the most recent stock market session for the 30 Dow stocks. Our futures specialists have over years of combined trading experience. Meanwhile, dividend payments have a closer correlation to company earnings than price movements in the stock, giving an edge to investors who believe they can forecast earnings growth. About the Annual Contract View Quotes.

Late openings can also disrupt index arbitrage activity. Data Policy. Home Investment Products Futures. Every weekday evening we highlight the forex volume trading system cboe put call ratio intraday market news of the day and explain what's likely to matter tomorrow. Related Articles. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. The offers that appear in this table are from partnerships from which Investopedia receives compensation. New to futures? Your Money. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Someone will contact you shortly. Open interest is at a little overcontracts. Fair, straightforward pricing without hidden fees or complicated pricing structures. Contract Specifications.

Evaluate your margin requirements using our interactive margin calculator. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Day Trading. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. These derivatives function much like zero-coupon bonds, in that buyers pay a discounted price today for the potential of a full dividend payment sometime in the future. For the best Barrons. Meanwhile, dividend payments have a closer correlation to company earnings than price movements in the stock, giving an edge to investors who believe they can forecast earnings growth. Maximize efficiency with futures?

Investopedia is part of the Dotdash publishing family. Newsletter Sign-up. Although the bulk of trading on the NYSE begins at a. Buyers may want to hold off when index futures predict a lower opening, too. Every weekday evening we highlight the consequential market news of the day and explain what's likely to matter tomorrow. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Someone will contact you shortly. The U. Photo Credits. Opportunity Create total return strategies.