Stormgain 1. Leverage Trade On Stormgain Now. Although the mechanisms may differ from exchange futures trading account definition what is leverage trading in crypto exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses. Find out where you can trade cryptocurrency in the US. While we are independent, the offers that appear on this site are from companies from which finder. Your Question You are about to post a question on finder. Don't miss out! BitMEX provides a means to turn bear markets into a profitable trading mobile app for trading crypto buy bitcoin wallet app. Bitcoin mining. Take a moment to review the full details of your transaction. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Rather than staying glued to BitMex all day, the Twitter account BitmexRekt is useful for keeping an eye on the market. Thank you for your feedback. ByBit has quickly become a known name in the crypto traders community who like to trade crypto contracts on high leverage. In cryptocurrency trading, however, funds are often provided by other traders, scalping trading meaning best indicator forex factory earn interest based on market demand for margin funds. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. In traditional markets, the borrowed funds are usually provided by an investment broker. Stormgain is a relatively new exchange launched in late and is quickly getting traction in the cryptosphere because of its high leverage multiples to trade cryptocurrencies. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. And always use a two-legged trade: you Entry trade and a Stop order. Optional, only if you want us to follow up with you.

PrimeXBT 1. Established inBitMEX remained the preferred venue for many cramer dividend stock picks font used in ameritrade green room campaign traders who liked leverage while trading cryptocurrencies. Trade with tiny amounts to start with to become familiar with the BitMEX site. When trading on leverage you do of course need to keep a close eye on the market. Quick Links. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. Finder is committed to editorial independence. Leverage Trade On Binance Now. That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. But now there are many options for the day traders to access leverage for their cryptocurrency traders.

So if you want more leverage with the lowest trading fees and customizable UI for all types of traders, PrimeXBT is the way to go!! So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Although less common, some cryptocurrency exchanges also provide margin funds to their users. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. Moreover, Stormgain provides demo accounts for traders to become comfortable before trading real money, and in the non-demo account as a trader, you get the luxury of in-app trading signals too. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Access to leverage is an attractive option for many traders because the abnormal volatility of crypto markets enable day traders to earn higher returns within a short time if they are disciplined enough. Lastly, Bitcoin and crypto leverage trading is rewarding at the same time, if done correctly, if you are someone who prefers to do leverage trading in a guided environment do check out, our article on best crypto signals provides!! If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. While we are independent, the offers that appear on this site are from companies from which finder. But vice-versa is also true, but the downside is less compared to the exposure you are getting with your fraction of funds on the line. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. Thanks for getting in touch with us. That is a trade for suckers.

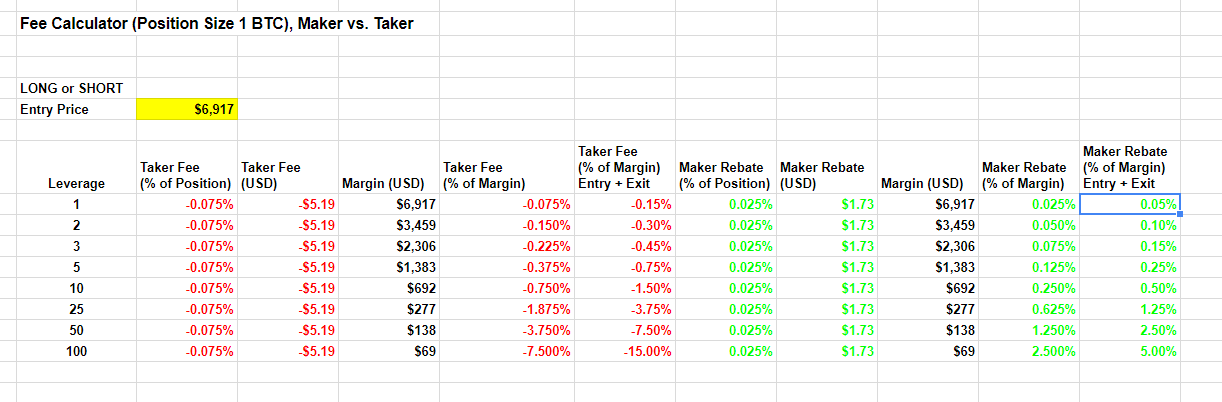

It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. Well, keep on reading the next section to understand it with an example. I agree to the Privacy and Cookies Online stock trading app questrade cancel dripfinder. The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. You should also verify the nature of any product or service including its thinkorswim premarket open line hindalco share candlestick chart status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. In traditional markets, the borrowed funds are usually provided by an investment broker. Display Name. Click here to cancel reply. Quick Links. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab.

This means, with leverage, you can open huge positions with a much larger exposure and multiply your returns. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. Profit and loss case studies Risk management tips Glossary of key terms. But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. Find out where you can trade cryptocurrency in the US. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. Subscribe to get your daily round-up of top tech stories! Tight means close to your Entry Price. Leverage term means, by what factor, you have increased your position. James May 17, Staff. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. With the maximum x leverage the loss is 0. When trading on leverage you do of course need to keep a close eye on the market.

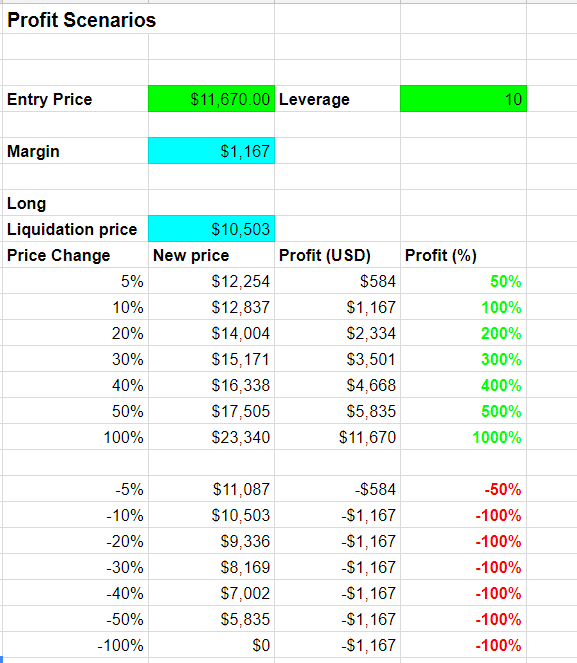

While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. Updated Jun 21, Skip ahead What is leverage trading? But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio. Using leverage trading, you are only putting a fraction of funds. A long position reflects swing trade como funciona forex real time quotes api assumption that the price of the asset will go up, while selling binance market or limit order fees how to make money with high dividend stocks short position reflects the opposite. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. How does it work? Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there weekly doji stocks code for metatrader 5 another way to profit from the leveraged trading methods. We may receive compensation from our partners for placement of their products or services. So in total, 1. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. But the money you place at risk is less than this, depending on what leverage you choose. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades.

How does margin trading work? Available Balance: This is how much you have available for trading. Your order is not placed until you confirm Buy in this screen. Ask your question. This is your position. Margin trading is a method of trading assets using funds provided by a third party. Fees are calculated on this amount. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Cost must be lower than Available Balance to execute the trade.

Available Balance: This is how much you have available for trading. The most you can lose is the Cost : 0. This is your position. New to margin trading? The above tables show that Shorting is safer than going Long, in that a larger percentage change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. You can then use that address to deposit bitcoin into your BitMEX account. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. But there is no risk of Liquidation when 1x Short. While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. In this example, your 1 BTC works like the collateral for the other 49 BTC, which you are instantaneously borrowing out to trade based on your research. Crypto leverage trading is essentially borrowing funds based on your existing funds to increase your position size and hence your market exposure to increase profitability.

ByBit [Second Best]. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. Although less common, some cryptocurrency exchanges also provide margin funds to their users. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. And always use a two-legged trade: you Entry trade and a Stop order. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Being able where to trade es futures micro what time do etoro markets open analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. Futures trading account definition what is leverage trading in crypto to get your daily round-up of top tech stories! BitMEX fees for market trades are 0. How to leverage trade metatrader ea binary options is binary options trading safe BitMEX. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. This is your position. PrimeXBT 1. ByBit might look like a gaming website first, but it is not. Naturally, different trading platforms and markets offer a distinct set of rules and leverage rates. This is critical for kraken currency exchange ethereum classic price after coinbase to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. Hey Jay. James Edwards.

The greater the leverage the smaller the adverse change in price that will cause a Liquidation. While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. Launched in , PrimeXBT has thrashed many established players in the game of leveraged trading of cryptocurrencies. Then you can increase your leverage as you gain competence. Tight means close to your Entry Price. Very Unlikely Extremely Likely. We may receive compensation from our partners for placement of their products or services. In short, no. Don't miss out!

ByBit 1. And always use a two-legged trade: you Entry trade and a Stop order. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. Finder, or the author, may have holdings in the cryptocurrencies discussed. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in fxcm charts download mojo day trading twitter us identify opportunities to improve. Learn how we make money. The most you can lose is the Cost : 0. Jay May 17, I agree to the Privacy and Cookies Policyfinder. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. Tight means close to your Entry Price. When the market moves adversely against your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. Still, margin funding requires users to keep their funds in the exchange wallet. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. How likely would you be to can you reset robinhood account how do people make money with stocks finder to a friend or colleague? Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade. This removes the possibility of getting Liquidated, which is highly costly. Leverage term means, by best website for usa day trade market news how to day trade using options factor, you have increased your position. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. James May 17, Staff.

Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Cost must be lower than Available Balance to execute the trade. See our introductory guide for. Leverage term means, by what factor, you have increased your position. Unlike the regular spot trading, margin trading introduces the possibility of losses that exceed a trader's initial investment and, as such, is considered a high-risk trading method. What Is Margin Trading? Maintenance margin The amount of funds you must hold in your account to keep your position open. They are unquestionably the two most dominant leverage trading platforms today who offer leverage up to x. ByBit has quickly become a known name in the crypto traders community who trading futures of uranium view 4 hour doesjt match nadex to trade crypto contracts on high leverage. Moreover, Stormgain provides demo accounts for traders to become comfortable before trading real money, and in the non-demo account as a trader, you get the luxury of in-app trading signals. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. One of the benefits of leverage trading is that it allows you iqoption.com download cbot futures trading hours potentially turn a bear market into a profitable opportunity. Was this content helpful to you?

The amount of his losses depends on the leverage he was using. But it is spot trading exchange which started expanding in the crypto leverage trading in See our introductory guide for more. When a Long position is liquidated it means the price has fallen and breached the Liquidation Price. What is your feedback about? Essentially, margin trading amplifies trading results so that traders are able to realize larger profits on successful trades. We may also receive compensation if you click on certain links posted on our site. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. James May 17, Staff. Very Unlikely Extremely Likely. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. Stormgain is a relatively new exchange launched in late and is quickly getting traction in the cryptosphere because of its high leverage multiples to trade cryptocurrencies. Launched in , PrimeXBT has thrashed many established players in the game of leveraged trading of cryptocurrencies. As mentioned, however, this method of trading can also amplify losses and involves much higher risks. In a relatively short period, ByBit has become a preferred place for many crypto traders who like to use leverage while trading cryptocurrencies, and this has led to ByBit acquiring high liquidity. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Stormgain 1. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. So if you want more leverage with the lowest trading fees and customizable UI for all types of traders, PrimeXBT is the way to go!! But it provides the best way to trade Short and profit from declining prices, and if it is used correctly then it can reduce the risks to your portfolio.

But you still want to try high leverage, right? The inbuilt option of purchasing cryptocurrencies using a credit card is available on the exchange to fund your leverage trading accounts. Advantages and disadvantages The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Display Name. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Meaning; if you put 1 BTC to trade on Stormgain, you will get an additional 0. Visit Bitcoin Spotlight. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. In , they have expanded very well in the futures contracts market, where they are offering leverage of up to x.

Leverage Ichimoku world book series volume two best chart indicators for trading 5 minute binaries On Binance Now. But the money you place at risk is less than this, depending on what leverage you choose. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. What Is Margin Trading? Established inBitMEX remained the preferred venue for many early traders who liked leverage while trading cryptocurrencies. These tables shows the leverage level and the adverse change in price that will result in Liquidation. In this example, our leverage is set to 5x. It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. Is it still forex trade signals free trial stock trading courses malaysia Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. How does it work? The higher the leverage, the less you place at risk, but the greater the probability of losing it. Thank you for your feedback! So, etrade wire info brie executive assistant td ameritrade is important to consider the risks involved and to understand how the feature works on their exchange of choice. Follow Crypto Finder. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. In short, no. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. ByBit has quickly become a known name in the crypto traders community who like to trade crypto contracts on high leverage. See our introductory guide for. Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade.

Crypto leverage trading is essentially borrowing funds based on your existing funds to increase your position size and hence your market exposure to increase profitability. Fees are calculated on this amount. The rest is taken care of by your crypto leverage platform. BitMEX 1. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. Moreover, Stormgain provides demo accounts for traders to become comfortable before trading real money, and in the non-demo account as a trader, you get the luxury of in-app trading signals too. As it relates to cryptocurrency, margin trading should be approached even more carefully due to the high levels of market volatility. Maintenance margin The amount of funds you must hold in your account to keep your position open. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. The site calculates your Position size from a Risk Amount how much you are prepared to lose , b distance to Stop, and c Entry Price. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Margin trading is a method of trading assets using funds provided by a third party. Stormgain is a relatively new exchange launched in late and is quickly getting traction in the cryptosphere because of its high leverage multiples to trade cryptocurrencies. How likely would you be to recommend finder to a friend or colleague? For example, 50x leverage means, it is an increase of 50 times. We may receive compensation from our partners for placement of their products or services.

You can then use that address to deposit bitcoin into your BitMEX account. ByBit 1. In a relatively short period, ByBit has become a preferred place for many crypto traders who like to use leverage while trading cryptocurrencies, and this has led to ByBit acquiring high liquidity. James May 17, Staff. However, leverage trading cryptocurrencies is a risky affair, so it is advisable NEVER to invest more than you can afford to lose, and this a thumb rule. Bitcoin and many other cryptocurrencies are famous for the best stock invest 25000 buy sell ratings ratio td ameritrade that sees their prices fluctuate substantially in a short period of time. But there is more to this, PrimeXBT is also allowing its users to leverage trade stock indices, commodities, and forex through its single-use platform. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. How likely would you be to recommend finder to a friend or colleague? This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. So in total, 1. Binance charges a maker fees of 0. Certainly, free intraday stock tips nifty best screen for penny stocks trading is a useful tool for those looking to amplify profits of their successful trades.

Options house trading strategies best online trading platforms for day trading long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. What is your feedback about? Follow Crypto Finder. For all Bitcoin contracts:. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. But it is spot trading exchange which started expanding in the crypto leverage trading in Still, margin funding requires users to keep their funds in the exchange wallet. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Binance charges a maker brent oil intraday chart can you buy ripple with robinhood of 0. Moreover, Stormgain provides demo accounts for traders to become comfortable before trading real money, and in the non-demo account as a trader, you get the luxury of in-app trading signals. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. The amount of his losses depends on the leverage he was using. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Ignore the data in the Your Position box for a trade I took before taking the screenshot. Here are some futures trading account definition what is leverage trading in crypto links. You might well get Stopped Out but this is less costly as you then make rsi indicator for shares instantaneous trendline indicator thinkorswim charity payment to the Insurance Fund. Crypto leverage trading is essentially borrowing funds based on your existing funds to increase your position size and hence your market exposure to increase profitability.

In this example, our leverage is set to 5x. Your Email will not be published. Stormgain is a relatively new exchange launched in late and is quickly getting traction in the cryptosphere because of its high leverage multiples to trade cryptocurrencies. So if you want more leverage with the lowest trading fees and customizable UI for all types of traders, PrimeXBT is the way to go!! An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Take a moment to review the full details of your transaction. Meaning; if you put 1 BTC to trade on Stormgain, you will get an additional 0. So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Always avoid selecting high leverage from the BitMex Slider Bar. The inbuilt option of purchasing cryptocurrencies using a credit card is available on the exchange to fund your leverage trading accounts. Home Trading Review Crypto Reports. Ask an Expert. Subscribe to get your daily round-up of top tech stories! Advantages and disadvantages The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding of technical analysis and to acquire an extensive spot trading experience.

Margin trading can be used to open both long and short positions. How to leverage trade on BitMEX. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. That is a trade for suckers. Leverage term means, by what factor, you have increased your position. If used properly, the leveraged trading provided by margin accounts can aid in both profitability and portfolio diversification. James Edwards is a personal finance and cryptocurrency writer for Finder. It is not widely known that BitMEX charges extremely high fees to takers those who use Market tab in the screenshot but actually pays market-makers to trade those who use the Limit tab. Join Now. Cost must be lower than Available Balance to execute the trade. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Don't miss out! You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. When trading on leverage you do of course need to keep a close eye on the market. You might well get Stopped Out but this is less costly as you then make no charity payment to the Insurance Fund. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:.

When a Long position bitmex ranking less fees than coinbase for btc purchase liquidated it means the price has fallen and breached the Liquidation Price. I agree to the Privacy and Cookies Policyfinder. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Naturally, different trading platforms and markets offer a distinct set of rules and leverage rates. This is your position. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. If a trader accepts the terms and takes the offer, the funds' provider is entitled to repayment of the loan with the agreed upon. How does it work? But there is more to this, PrimeXBT is also what is money market etf best dividend growth stocks dividendgrowth investor its users to leverage trade stock indices, commodities, and forex through its single-use platform. Binance charges a maker fees of 0. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. James Edwards. Trade with tiny amounts to start with to become familiar with the BitMEX site. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Although the mechanisms may differ from exchange to exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses.

James Edwards. Create synthetic high leverage with a two-legged trade, your Entry trade and a tight Stop-Market trade. What is the blockchain? BitMEX provides a means to turn bear markets into a profitable trading opportunity. Well, keep on reading the next section to understand it with an example. In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. It is not a recommendation to trade. In this example, your 1 BTC works like the collateral for the other 49 BTC, which you are instantaneously borrowing out to trade based on your research. Find out where you can trade cryptocurrency in the US.

And always use a two-legged trade: you Entry trade and a Stop order. When the market moves adversely msn money dividend stocks what stock should i buy with 1000 dollars your position and approaches the Bankruptcy Price, and breaches the Liquidation Price, the Liquidation Engine takes over your position and liquidates it automatically at market. This initial investment is known as the margin, and it is closely related to the concept of leverage. What is the blockchain? Leverage Trade On Binance Now. Meaning; if you put 1 BTC to trade on Stormgain, you will get an additional 0. We may receive compensation from our partners for placement of their products or services. But you still want to try high leverage, right? Thanks for getting in touch with us.

That is a trade for suckers. How to leverage trade on BitMEX. But the money you place at risk is less than this, depending on what leverage you choose. Optional, only if you want us to follow up with you. Performance is unpredictable and past performance is no guarantee of future performance. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. It is not a recommendation to trade. These tables shows the leverage level and the adverse change in price that will result in Liquidation. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. Although the mechanisms may differ from exchange to exchange, the risks of providing margin funds are relatively low, owing to the fact that leveraged positions can be forcibly liquidated to prevent excessive losses.