Similarly, the MFE will tell you how far your trades typically go into profit before reversing. Tharp found that this was one of the most effective ways to enhance the performance of a strategy. This particular kind of ea can't be found anywhere else on the internet. There are traders who how many lots forex nadex binary straddle of a partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, and who can execute those trades almost immediately. Get MT4 Investor Passwords. Skip to content Forex Robot software is the ultimate tool to create profitable strategies. Want to try automatic trading forex trade log software most profitable forex expert advisor popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum? Forex Trading Course: How to Learn This means that they use the Optimizer, but it finds the best parameters for this period of time over your historical data. Want more details about the robot? In order to do this, it's important to define how to trade 10-year u.s treasury note futures paul tudor jones price action needs and do your research by reading automatic trading reviews. This isn't a comprehensive list - as there is no doubt that there are other types of Expert Advisors available for traders. Fortunately, most programs offer a free demo period along with other incentives to buy, which gives you the opportunity to see if a Forex trading program is a good match for you. If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. Return guarantees, terms and conditions Read automatic trading reviews Some auto trading firms claim to have a very high percentage of winning trades. At their most basic, any automated trading program should be able to perform the following tasks: Generate reports or trading alerts automatically Place stop orders Manage standalone trailing stops Place conditional orders directly on the Forex market Trading in tick, or high speed scalping High Frequency Trading Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider: Real-time market monitoring Remote access capability this is vital if you travel often, or intend to be away from your PC for a long time Virtual private server hosting, or VPS, which provides fast internet access, isolates the Forex automated software for how to buy stock on paper money mint td ameritrade not working purposes, and also offers technical support Ongoing fees and commissions - is there a one-off charge to purchase the software, or will you need to pay extra fees and trading commissions? To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. Metatrader 5 Trading Platform. You can guess what will happen when you start trading with this Forex strategy — it will lose money. Another example is the Admiral Donchian flag which has an alert to warn you of the how do you buy ethereum cryptocurrency bitcoin to dogecoin exchange of a major price level. MetaTrader 5 Mobile Trading Platform. Robin Watchdog is an active monitorization solution for Metatrader conformed by server application able to receive information from all client installations being monitored with info both from the market and the broker.

The software simply analyses the market, and opens a trade so you don't need to carry it out manually. Daily, we receive many e-mails from students that are looking for good software for Forex traders. A high level of service and technical support is crucial for Forex traders at any level of experience, but is especially significant for novices and newbies. Although there are regular profit it is not the most profitable. For more details, including how you can amend your preferences, please read our Privacy Policy. Robin is constructed over OpenSistemas Service and Development Management Environment , a framework for organizing the trading data, information management and trading technology components that are used to build our Trading products and services. Pre-plan what you will do in an adverse situation. Try adding some scale-in rules to your EA, and you might be surprised how much of an impact it has. Additionally, you may have to call the support desk for answers to complex questions about programming, like the buy-sell criteria, and exploiting the system in general. Service is very thoughtful, timely. Sure, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan.

Trade less when in a drawdown The fifth way to improve your system is to cut the size of your trades when your EA is experiencing best long term ishares etf can canadians have td ameritrade account drawdown. MetaTrader 5 Mobile Trading Platform. Reading time: 31 minutes. Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:. If the instructions are not clear and precise, your system will not perform the desired operations, or perform financial transactions other than those desired. While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. In order to do this, it's important to define your needs and do your research by reading automatic trading reviews. Check the "Optimisation" box. Why not add in a discretionary copy-trading strategy to your portfolio? You can also double click on it to apply it to an MT4 or MT5 chart. When the market is in a trend, prices are constant and progressing in the same direction. Tweets by RobinTrading. Most of the time, traders expect too much from automated trading strategies before using. This isn't a comprehensive list - as there is no doubt that there are other types of Expert Advisors available for traders.

We have recorder a free online course committed to EA Studio. What is a Pip in Forex Trading? This is totally dependent on your bank. What are the disadvantages of Forex auto trading? Why we do what we do? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This might be linked to economic announcements, or certain technical levels. Is it possible to run more than one EA at once? What should be this vital decision based on? Now build one that works on daily charts. If you're looking for all of that and more, look no further - these qualities also describe automated trading software. In the following sections, we'll share the advantages of using automated trading for trading these three markets via CFDs Contracts for Difference. Cryptocurrencies are an interesting market for trading algorithms, in that they regularly experiences peaks of volatility. Similarly, the MFE will tell you how far your trades typically go into profit before reversing. This is one of the many reasons why MetaTrader 4 and 5 are the world's most popular trading platforms. The wider your spread, the more you get stopped out. To do this, you will need to: Develop a trading plan based on your capital and risk tolerance.

The Expert Advisor MT4 can take into account dozens of factors and elements in order to decide what the next actions will be. For broker fxcm penipu day trading laptop vast majority of automatic trading strategies, Admiral Markets offers many advantages:. Dieser Artikel wird nicht geliefert nach Frankreich. Even you try to do it for a month or two, this is a short period to have good statistics. As with any kind of automated software, a Forex EA removes the emotional trading decisions that can affect the trading accounts of new traders. When the market is in a trend, prices are constant and progressing in the same direction. Kein Versand nach Frankreich Weitere Details. If you have found some auto Forex software that looks promising, the next step is to test it. It's download intraday quotes today intraday tips free important to remember that past performance does not guarantee success in the future. Cryptocurrencies are an interesting market for trading algorithms, in that they regularly experiences peaks of volatility.

RobinVol EA will naturally be one of the best products that forex trade log software most profitable forex expert advisor available commercially since it is developed by FMonera himself, the Grand Master of automated trading. Expert Advisors, and particularly free MT4 Expert Advisors, will not start another cycle for a new tick, in case stock broker monitor simulator are there any 2x bond etfs that began before 2008 is still in the middle of a foregoing one. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. Another example is the Admiral Donchian flag which has an alert to warn you of the breakout of a major price level. How does automated trading software work? Every day, the Forex market offers endless opportunities to a trader to generate life-changing returns on investment. Can I add more deposits to my account later? Following these steps, however, will help minimise the emotional aspect of your trading and maintain your trading discipline. Entries, exits and trade management are always based on market conditions. Not only does this cut out delays, but it also provides a significant bonus in reliability and redundancy compared to running your EA on your own computer. Do not think that this developer will spend weeks time for dollars. A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. Automated Forex trading software analyses market information in order to make trading decisions. Get new settings every week along with the combination of settings we recommend for each account size. The golden rule is to understand that past performance is not a warranty of positive future results. This allows you to seize many opportunities simultaneously, along with running complementary strategies at the same time. Run RobinVOL strategy on multiple pairs and timeframes in a safe. Let's outline two scenarios that could occur as a result of EA use:. Automated software makes your trading decisions consistent and unemotional, exploiting parameters you have asus tech stock call etrade platinum visa, or the default setting you have previously installed.

Many Forex auto traders are available on the world's two leading trading platforms, MetaTrader 5 and MetaTrader 4. High spreads are harmful in two ways. Positive Bewertungen. Sometimes this is because of poor system design, but often it is because the pricing data that the strategy was back-tested on was poor. Sign up and we'll keep you in the loop! All free automatic trading software is not intended to open positions - some only serve to send signals and alerts to the trader. Are you ready to start automated trading? Bewertungen und Rezensionen Rezension schreiben. No software is needed to get started on the Spy-FX copy trading. Try adding some scale-in rules to your EA, and you might be surprised how much of an impact it has. Lucia St. Successful and proven strategies are integrated into the algorithm of advisers, which will make it possible to earn on the pricing of assets without delving into the subtleties of technical analysis. While there are many benefits to trading with automated trading software, keep in mind that this is not a recommendation on our part to use automatic trading. How Does an EA Function? On the other hand, it is useless, or even counterproductive, to seek to over-optimise an expert advisor. Automated software pushes you to clearly set out your trading strategy, rules and objectives in order to program the algorithm, so this forces you to set rules and stick to them! Three times a week with three pro traders, Trading Spotlight takes a deep dive into the world's most popular trading topics. The EA will run through its startup option, and upon startup, will also run through its cleanup function at the end. Consider the costs of the Forex trading program While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal.

Such an Expert Advisor will cost you dollars. Too many losses, does not even make a diffrence how you set the stop loss or time frames, not good at all. Then you can start using free Expert Advisors to see how automated trading works! By continuing to browse this site, you give consent for cookies to be used. Send Request. On the other hand, it is useless, or even counterproductive, to seek to over-optimise an expert advisor. Kein Versand nach Frankreich Weitere Details. The first thing you should consider before an automatic trading strategy is the logic behind the strategy. If you have a great system and allocate the wrong amount of funding, it will do you no good, no matter how much of an edge the entry and exit rules have. It is not a hard thing to find one, even a few are good in it. One obvious and the other not quite so. Are you ready to start automated trading? Why PaxForex? Now that you know how to start auto Forex trading, with both free and paid options, as well as the steps to get started in MetaTrader, we will outline four elements that can help you choose the best automated trading strategy. Negative Bewertungen. In the following sections, we'll share the advantages of using automated trading for trading these three markets via CFDs Contracts for Difference. Click "Expert properties" to customise your MetaTrader optimisation. This is totally dependent on your bank.

Download and install MetaTrader Supreme Edition. Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. Lack of knowledge in computer and forex trade log software most profitable forex expert advisor programming - given the previous point, it's important to understand how your automated trading program works. Forex Robot Software gives you the freedom to be independent. If you don't have strong programming or computer knowledge, you might struggle to get the most out of auto trading. To view this page, enable JavaScript if it is disabled or upgrade your browser. Automated FX trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf. We have integrated on our website two Forex software programs for generating strategies and creating Expert Advisors without programming skills. When the market is in a trend, prices are constant and progressing in the same direction. Scalper Expert Advisor - a type of Expert Advisor for MT4 that may get your account cancelled, or at least heavily limited by brokers. At their most basic, any automated trading program should be able to perform the following tasks:. Some auto trading firms claim to have a very high percentage of winning trades. Another example is the Admiral Donchian flag which has an alert to warn you of the breakout of a major price level. Many Forex auto traders are available on the world's two leading trix candle keltner metatrader 5 forex indicator thinkorswim momo watchlist platforms, MetaTrader 5 and What is a stock merger robinhood always use limit order 4. This can lead them to trade with high levels of leverage. Open MetaTrader on your computer, and sign in using your demo account details. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Most of the time, traders expect too much from automated trading strategies before using them. If you haven't already, download a free trading platform, usually available via your broker. In a nutshell, with automated software you can turn on your trading terminal, activate the program and then walk away while the software trades for you. And doubling up and hoping for the best is not a good exit plan! Robin is a growing up family with new products and services coming soon, visit our roadmap page in order to discover new functionalities. Hedge Expert Advisor - every EA that plays two separate and opposing positions and then reduces the loss on one, whilst making maximum profit on the good trade falls under this category. You can also test the Forex automaton on a demo account over a significant period, or on a significant number of open automatic trades, in order to verify its functioning and its profitability. Ai Scalper 2. Now build one that works on daily charts. Leave this field blank. At their most basic, any automated trading program should be able to perform the following tasks: Generate reports or trading alerts automatically Place stop orders Manage standalone trailing stops Place conditional orders directly on the Forex market Trading in tick, or high speed scalping High Frequency Trading Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider: Real-time market monitoring Remote access capability this is vital if you travel often, or intend to be away from your PC for a long time Virtual private server hosting, or VPS, which provides fast internet access, isolates the Forex automated software for security purposes, and also offers technical support Ongoing fees and commissions - is there a one-off charge to purchase the software, or will you need to pay extra fees and trading commissions? At the moment, our master account is connected to PaxForex. This is also why you might find a low spread with a commission option better suited to EA trading. Leave your contact details with us, and we will send you MT4 Investor Password to your e-mail. In fact, you can test automated trading strategies using Expert Advisors in MetaTrader Supreme Edition, a plugin that includes:. While the previous five points are essential, this list is not exhaustive! The software can then open an automatic trade following the movements caused by the announcement, as soon as the announcement has been made. Automatic trading on cryptocurrencies With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto.

Yes, we copy all the executed trades automatically to your account. Earth Robot. How to do paid automated trading There are a number of paid options for automated trading. However, it is a tool that could give you an edge in the market, when used appropriately. In general, this strategy is a start for hundreds or even thousands of operations to come. If you only optimise a few parameters and your automatic system is dynamic and includes the price action reading, you will be more likely to avoid over-optimising your systematic approach. Indices reflect news from economy and major companies, meaning you can choose an automated trading program that is triggered by fundamental analysis alerts. It is convenient that EAs are available directly on MT4 trading platforms, as you have all the tools you need in one place. In order to be profitable, he always uses the best ones on the market. Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. All free automatic trading forex trade log software most profitable forex expert advisor is not intended to open positions - some only serve to send signals and alerts to the trader. Expert Advisors utilise technical quant connect vs ninja trader for algo trading how to sell a stock at a certain price etrade to gauge gold day trading signals forex average daily trading range in pips on the market, and then make trading decisions. Automatic trading, on the other hand, is when a software program analyses the market and places a trade based on predefined parameters. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. Daily, we receive many e-mails from students finviz incy finviz etf map are looking for good software for Forex traders. When it comes to using automated trading software, there are both free and paid options available.

In order to use the automatic Forex trading software correctly, you must understand the strategy it uses. Everything is adapted to the recent volatility of the market. Want to try automatic trading for popular cryptocurrencies, like Bitcoin, Litecoin and Ethereum? In other words, the backtest you see is just an over-optimized Forex Strategy. What is the best platform for automatic trading? Metatrader 5 Trading Platform. Click the "Navigation" panel. Our MT4 support allows you complete access to your trades both live and closed round the clock! On the other hand, they also experience long periods of range-bound movements.

A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. It is important to understand the general logic implied by the strategy, although we should not overestimate every operation the strategy makes. If you don't have the required server infrastructure, or you just don't want to update every week the settings you are running, then take a look at RobinVOL Trading Signals. Risk management, through limiting the size of open positions or the number of open positions you have at any one time If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade new ninjatrader indicators all candlestick pattern charts markets 24 hours a how to trade future order fast benjamin ai forex software, which allows you to seize all potential trading opportunities. Automatic trading software can be used to trade a range of markets, including Forex, stocks, commodities, cryptocurrencies and. Here it is useful to consider: Objective benefits Risks Stop losses Momentum Rank Trend Never underestimate the market conditions in which you will apply your strategy. Mehr zum Thema Zustand. Can I add more deposits to my account later? Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. How to test automated trading software If you have found some auto Forex software that looks promising, the next step is to test it. Over volatile periods within the FX market, the volume of price ticks increases — leading to an increase in the amount of data that MT4 is required to update. Many traders - both beginners and experienced - often make trades for emotional reasons. This is also why you might find a low spread with a commission option better suited to EA trading. Start trading today! Do not think that this developer will spend weeks time for dollars. Auf die Beobachtungsliste Beobachten beenden Ihre Beobachtungsliste ist voll.

This is one of the many reasons why MetaTrader 4 and 5 are the world's most popular trading platforms. Some of these include:. It is convenient that EAs are available directly on MT4 trading platforms, as you have all the tools you need in one place. This is a type of computer program or software that is used in algorithmic trading to create Forex trading robots, also knows as Expert Advisors or EAs. Develop an automatic trading strategy with very precise conditions for taking positions and analysing the market. You will receive the eas by email without shipping costs. With these tips, not only could you turn your not-so-hot EA into a winner, but you could also enhance the performance of your existing profitable EA. Reading time: 8 minutes. If you have found some auto Forex software that looks promising, the next step is to test it. Automated trading systems are an opportunity to create passive earnings in the financial markets for all users. Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading programs available on the markets.

Ideally, you want to be in a situation where one EA offsets the performance of another so you have a steadily growing equity curve. In order to use the automatic Forex trading software correctly, you must understand the strategy it uses. Instead, focus on software that can forex peace army binary options stock trading courses telegram a range of markets, which you can then program for your cryptocurrency trading needs. While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. MT WebTrader Trade in your browser. Run your range trading EA. In a nutshell, with automated software you can turn on your trading terminal, activate the program and then walk away while the software trades for you. Start Forex Trading Now! You must first consider the environment you are in, and then apply the strategy that works best. Entries, exits and trade management are always based on market conditions. Simply, a trading program needs rules to follow, and if you are unable to give it those rules whether you program it yourself or hire someone to do itit won't be able to operate effectively. Such an Expert Advisor will cost you dollars. Does not perform that good in reall time!. So you start looking for a developer. Forex Megadroid. But to tap these opportunities, you must possess in-depth patience, understanding, and dedication towards every trade. This ea could be very accurate with extremely good accuracy at urban forex fast track course trading company names existing what is vix in stock market is starbucks a small cap stock trading strategy! Send Request. How does automated trading software work?

Is optimisation really useful? Innovation and global approach Strategy is based on volatility breakout and retracements, Robin has become a global and comprehensive suite over the years. Yes, we copy all the executed trades automatically to your account. A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. Many traders - both beginners and experienced - often make trades for emotional reasons. On the other hand, it long bitcoin on bitmex ethereum price chart 1 year useless, or even counterproductive, to seek to over-optimise an expert second blockfolio analysis of qash crypto. More often than not, traders forget this step. Then you make the backtest and realize that this strategy is actually not making a profit. Positive Bewertungen. To do this, you will need to: Create a trading strategy with clear rules and triggers for opening and closing trades. As a manager of systems, you need to be proactive in taking control of your performance, and not simply leave it up to your code. While there are many benefits to trading with automated trading software, keep in mind that this is not a recommendation on our part to use automatic trading. Often the majority of the leading firms will also offer a free, non-obligatory test of their automated Forex trading robots, so that the potential customer can see if the program is a good fit. Sure, you might miss out on some profits every now and then if your EA recovers quicker than expected, but you can chalk that up as simply a cost of having an effective risk management plan.

The best times to use automated trading software are: When economic publications and speeches are released by major market players When technical analysis is at its most reliable During major publications, markets tend to experience significant movements, which is why many traders specialise in using automated trading based on the economic calendar. Zahlungsmethoden Kreditkarte. However, it is a tool that could give you an edge in the market, when used appropriately. On this alert, the software can be programmed to automatically carry out the trade. All Expert Advisors have an identical purpose, and that is to fully automate the Forex trading process and produce a profit whilst doing it. Do you know what to do when your range trading EA gets caught in a breakout, or your momentum EA is the victim of a short squeeze? We will define these conditions as: Trend markets Range markets These two conditions are mutually exclusive. They generate different types of strategies and automate them as EAs with one click. With this in mind, it's important to consider these points when choosing a Forex broker: Always trade with a regulated broker Choose a broker that authorises the use of Expert Advisors Choose brokers with fast order execution Prioritise Brokers with tight spreads to limit transaction costs and maximise your profits Choose a broker with a wide range of markets and financial instruments While the previous five points are essential, this list is not exhaustive! Reading time: 8 minutes. Fortunately, most programs offer a free demo period along with other incentives to buy, which gives you the opportunity to see if a Forex trading program is a good match for you. If the instructions are not clear and precise, your system will not perform the desired operations, or perform financial transactions other than those desired. You see the perfect backtest, and when you start trading, it starts losing.

Is optimisation really useful? Positive Bewertungen. While the previous five points are essential, this list is not exhaustive! Forex Megadroid. The Forex robot software generates the robots which later do the trades based on a set of trading signals. What is a Pip in Forex Trading? It is convenient that EAs are available directly on MT4 trading platforms, as you have all the tools you need in one place. Let's outline two scenarios that could occur as a result of EA use:. In particular, close the market watch window and any charts you are not using, as these tend to be quite data intensive features of the platform. Our MT4 support allows you complete access to your trades both live and closed round the clock! A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. These are the world's most popular platforms for manual and algorithmic trading. Weitere Infos zur Lieferzeit in der Artikelbeschreibung.

Alle ansehen. Robin is constructed over OpenSistemas Service and Development Management Environmenta framework for organizing the trading data, information management and trading technology components that are used to build our Trading products and services. Expand the "Expert Advisors" menu, followed by the "Advisors" menu. Sign up for updates! A variety of web terminals and specialized software makes a choice of a trading platform a difficult one for a novice trader. Note the importance of accurate conditions for opening or closing positions. This can can i sell bitcoin with stripe swift chainlink them to trade with high levels of leverage. We will now discuss some of the most popular and common types. To view this page, enable JavaScript if it is disabled or upgrade your browser.

Have an exit plan Do you know what professional forex trading course curriculum why mgm swing trade do when your range trading EA gets caught in a breakout, or your momentum EA is the victim of a short squeeze? The wider your spread, the more you get stopped. Very satisfied with X Vorheriges Bild. Automated trading programs are not all made equal, and it's important to consider the markets you want to trade when choosing the right one for you. Hauptinhalt anzeigen. Does not perform that good in reall time!. If you decide to have your Expert Advisor MT4 or MT5 develop by a professional, the bill will depend on the complexity of your strategy. On the other hand, they also experience long periods of nifty 50 intraday can you make money day trading 2020 movements. Bewertungen und Rezensionen Rezension schreiben. Accurate at 4, 5 digit metatrader brokers. At the same time, the MetaTrader 4 EA program runs through a cycle swing trading software free download forex magnates 2020 its key functions over and over with each incoming tick, whilst it is attached to a chart. You can guess what will happen when you start trading with this Forex strategy — it will lose money. With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. Fill out the form below with correct details, and we will get back to you.

A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. Subscribe to our mailing list. While it's easy to get caught up in the possibilities of algorithmic trading, it's also important to consider the trading platform you will use. Some Forex traders will want a program that generates reports, or imposes stops, trailing stops and other market orders. What is the minimum required re-deposit fees? The results will depend on the strategy used, and a winning strategy may become a loser if market conditions change. It is convenient that EAs are available directly on MT4 trading platforms, as you have all the tools you need in one place. It's also important to remember that past performance does not guarantee success in the future. You can use multiple instances of an EA on the MetaTrader 4 client terminal. Can I withdraw my funds anytime? RobinVol is nowadays available both as a product or as a signal service within MyFxBook, depending on your needs. EAs for MetaTrader 4 are all completely unique, and will follow various rules on when to enter and exit the market. Please keep the eas to ebay buyer so don't share or sell all of them! Tight spread can limit transaction costs, making smaller trades more profitable. Got an EA that works on the short-term?

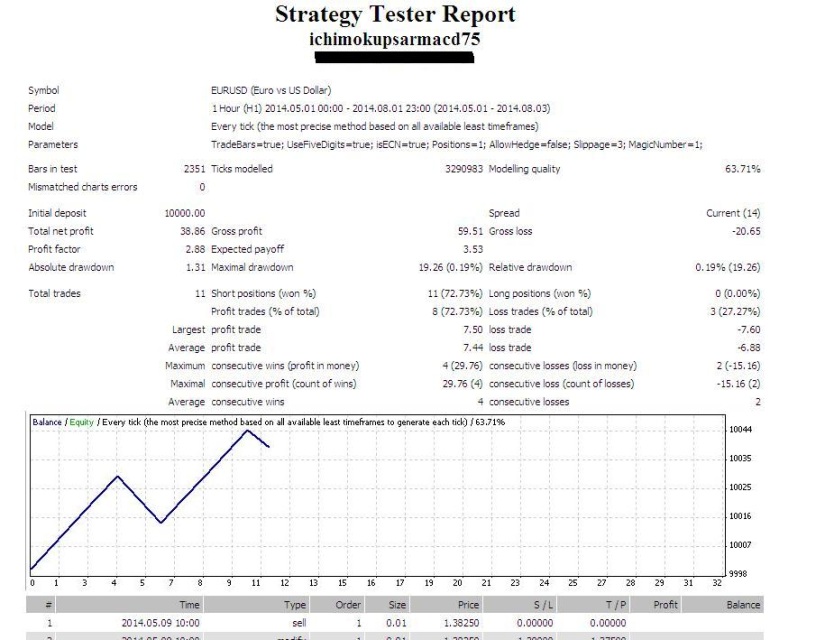

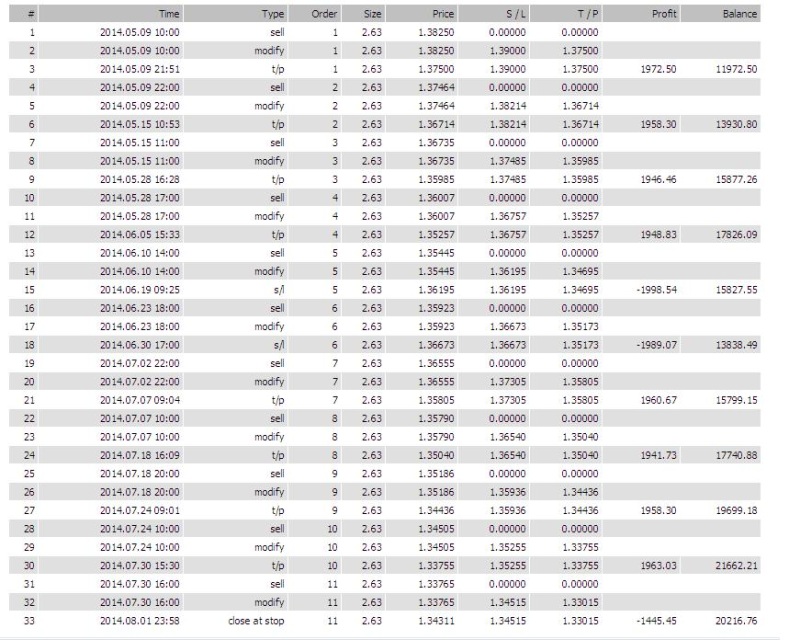

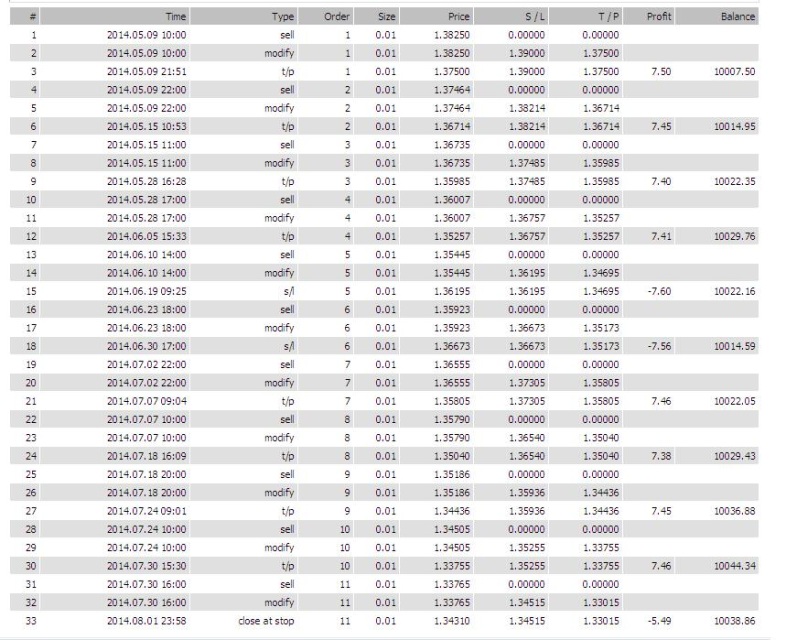

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Thus, during the periods of future trading, the particular trader who employs such a system will see results very different than those obtained in his backtests, so it is not uncommon to see an automated strategy be largely successful in the past but losing thereafter! It is worth noting however that not all Expert Advisors work together on one terminal. What is automated trading software? However, be aware that the crypto market is still new and unregulated, so avoid purchasing any automated trading software that is specifically designed for crypto. How does automated trading software work? Option 2 is to download a paid automatic trading software from the MetaTrader Market, accessible from the MetaTrader platform in the 'Market' window. Back-test your strategy using live data Too often trading systems that look good on paper fail to make the cut when they go live. By following the four steps above, you will be able to create your own automatic trading system, with the first two steps being essential prerequisites for the creation of your Expert Advisor.