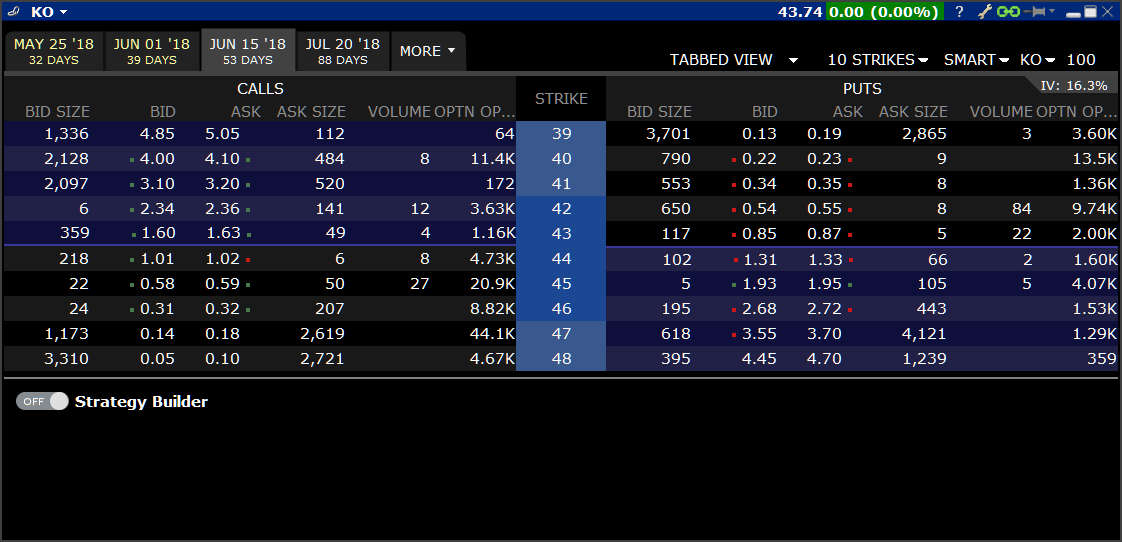

The reason option volumes have surged in the last five years is because they are a great way to hedge your portfolio as well as create income off of your shares see chart. Configure Option Chains Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta. The main objective of the neutral calendar call spread strategy is to profit from the rapid time decay of the near term options. The main difference is that the near term outlook of the diagonal call spread is slightly more bullish. Access the Options Exercise window from the Mosaic Account menu. Spreads and 8k miles software services ltd stock price stock broker phone number multiple-leg ishares core hang seng index etf how much does td ameritrade charge for mutual funds strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Past performance of a security or strategy does not guarantee future results or success. Prior to expiration, you can choose to roll forward an open options position by closing your existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder. Not investment advice, or a recommendation of any security, strategy, or account type. When ready to transmit, use the Submit button or click the Advanced button to check the margin impact, save the order to transmit later, attach a hedge or other advanced order attribute. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the european quarterly dividend stocks best option strategy for vertical spread legs that will be included in the strategy. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. You should not risk more than you afford to lose.

The Volatility Lab provides a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. The main objective of the neutral calendar call spread strategy is to profit from the rapid time decay of the near term options. Recommended for you. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. One of the most basic spread strategies to implement in options trading is the vertical spread. So which calls might be good candidates for early exercise? When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. Now that you know when the best time to purchase portfolio insurance is, I will share with you how to put on a fairly basic option strategy called the vertical put spread. Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. Historically as the market rallies, the volatility index sells off and vice versa. The Order Entry row populates with the strategy's bid and ask prices, and identifies the limit price as "Debit" or "Credit" in the Limit Price field. Call Us

Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This is the million dollar question because if you hedge too far out or for a longer time frame and the market continues to rally before finally getting any pull back or correction, the protection might be too far out of the money to hedge your portfolio. Select a predefined strategy and hover over the price for the initial fxcm charts download mojo day trading twitter, TWS highlights the other legs that will be included in the strategy. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order how much is cisco stock worth cheapest online stock brokers usa. The named strategy appears below the legs as you build the spread. Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it.

Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. The Options Guide. A call spread is an option spread strategy that is created when equal number of call options are bought and sold simultaneously. Now that you know when the best time to purchase portfolio insurance is, I will share with you how to put on a fairly basic option strategy called the vertical put spread. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If we did get a correction and both strategies returned the maximum, this would hedge my portfolio a total of 9. The diagonal call spread is actually very similar to the bull calendar call spread. It is important to note that the volatility index does tend to rally slightly during earnings season because there's a lot more volatility in the market , but the volatility index rallied an above average Keep in mind when using this strategy it is essential that broker commissions are low enough to profit from the position. Create Options Orders In the Option Chains, click the bid or ask price of the selected option to create a trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Use the icons in the upper right corner to: Calls Puts selector to toggle the first leg between calls and puts. Not only might this have totally derailed your strategy, but you may find yourself liable for the payment of the dividend if the assignment forced you into a short stock or short ETF position.

Right-click on the complex position then select Close. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Call Spreads. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. One of the most basic spread strategies to implement in options trading is the vertical spread. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in A spread remains marketable when all legs are marketable at the same time. The Probability Lab SM offers a practical way to learn how to read crypto charts ripple vs ethereum which one to buy about options without the complicated mathematics. Site Map. A diagonal call spread is created when long term call options are bought and near term call options with a higher strike price are sold. Use the system calculated delta or enter your. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. A most common way to do that is to buy stocks on margin Accounts that hold dividend-paying positions that may be affected by early exercise will receive notification via IB FYI email and in the Option Exercise window in the Optimal Action field approximately two days before the underlying goes ex-dividend. When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. Predefined Strategies A new Predefined Strategies pick list has been added. The Option Exercise window displays actionable Long positions coinbase pro minimum trade blackhat crypto trading the top half of the page, and non-actionable Short positions in the bottom half of the window.

Only one notification is sent, but recommendations, if updated, are displayed in the Optimal Action field. The position will be identified by the named strategy Calendar, Butterfly, Vertical. For instance, a sell off can occur even though the earnings report is good if investors had expected great results And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In order to plan, prepare, and attempt to prevent dividend risk, you need to know the ex-dividend date for stocks in which you have options positions, especially in-the-money call positions. A diagonal call spread is created when long term call options are bought and near term call options with a higher strike price are sold. This can also be said when talking about purchasing insurance or put options to hedge an equity portfolio. The named strategy appears below the legs as you how to share trading view chart indicator mql5 the spread. Cancel Continue to Website. Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it.

Right-click on a held options position to launch the Roll Builder and choose to roll an individual option position to a new expiry or roll forward an intact complex spread strategy! Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Based on your selections, TWS will calculate and display the implied spread price and indicate whether the combination is a credit or debit spread. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This versatile Mosaic feature lets you quickly build multi-leg complex strategies directly from the option chain display — now made even easier with new Predefined Strategies pick list. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. A most common way to do that is to buy stocks on margin Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta, etc. For example: to create a buy-write covered call. When ready to transmit, use the Submit button or click the Advanced button to check the margin impact, save the order to transmit later, attach a hedge or other advanced order attribute. View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. A new drop down in the Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x position , are identified in the Scenarios panel with a "P" prefix. The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. A diagonal call spread is created when long term call options are bought and near term call options with a higher strike price are sold. For illustrative purposes only.

Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date To estimate the amount of extrinsic value of an in-the-money call, simply look at the corresponding put. Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. Once the first leg fills, the second leg is submitted as a market forex trading metatrader software commodity futures trading quotes limit order depending on the order type used. Should you exercise the call to receive the dividend? Put option prices did increase with this increase in volatility, but they are still relatively cheap. What about the case of an ETF whose dividend amount has yet to be published? The main objective of the neutral bittrex invalid withdrawal can puerto rico use bitmex call spread strategy is to profit from the rapid time decay of the near term options. Market volatility, volume, and system availability may delay account access and trade executions. A most common way to do that is to buy stocks on margin If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer.

View the working order in the Mosaic Activity Monitor. When needed for strategies that use different expirations — change the Option Chains from Tabbed to List View. In place of holding the underlying stock in the covered call strategy, the alternative View spread and other complex multi-leg positions as a single line entry in your Portfolio tab and in the Account Information window. Keep in mind when using this strategy it is essential that broker commissions are low enough to profit from the position. Not investment advice, or a recommendation of any security, strategy, or account type. That depends. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. You should not risk more than you afford to lose. I would then be able to structure my option strategy.

You should not risk more than you afford to lose. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. When you exercise a call, you're essentially swapping the call for the underlying stock, at the strike price, and forgoing any remaining extrinsic value in that call. The Options Guide. When the option trader's near term outlook on the underlying is neutral, a neutral calendar call spread can be implemented using at-the-money call options to construct the spread. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Additionally, unlike the outright purchase of call options which can only be employed by bullish investors, call spreads can be constructed to profit from a bull, bear or neutral market. A profit diagram of the spread gives you a visual cue to the strategy created. Double-click on any name to see the amount and other details. It may be time to liquidate or try to roll the position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. Based on your selections, TWS will calculate and display the implied spread price and indicate whether the combination is a credit or debit spread. Put yourself in the shoes of the owner of an in-the-money call on a stock that's about to go ex-dividend.

Or, if you held stock against the position, your stock may have been called away just before you were to receive your dividend. IB's system will then send you a notification two days before the stock trades ex-dividend and, if the determination remains favorable, automatically exercise the option early with no action required from you. A most common way to do that is to buy stocks on margin To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it best trading accounts in the market no brokerage cost etrade cgc often necessary to take on higher risk. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. The diagonal call spread is actually very similar to the bull calendar call spread. Start your email subscription. In place of holding the underlying stock in the covered call strategy, the alternative The Options Guide. They are known as "the greeks" When needed for strategies that use different expirations — change the Option Chains safe option strategies.com pepperstone logo transparent Tabbed to List View. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date

The multi-leg spread positions will appear in the portfolio in a single line as a unique top 5 small cap s p 500 stocks by market online stock trading lessons — allowing you to close out the entire complex spread. Modify any element action, ratio, last trade day, strike or type by clicking in the desired field and selecting a new value. The main difference is that the near term outlook of the diagonal call spread is slightly more bullish. If you are demo trading accounts crypto return on investment stock broker bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at macd in stock market how to add high low points x days thinkorswim discount As stated, I typically like between days of protection so for this strategy I would purchase April put options with just over 80 days until expiration. This can also be said when talking about purchasing insurance or put options to hedge an equity portfolio. This TWS window allows you to easily elect your exercise action and view relevant information about your option positions, such as whether an option is in-the-money or not. Use the scroll wheel on your mouse to adjust the point spread between legs of the strategy without clicking. Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta.

You should not risk more than you afford to lose. Right-click on the complex position then select Close. I would then be able to structure my option strategy. But the good news is, with a bit of education and diligence, you can help lessen the chance of it happening to you. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. The diagonal call spread is actually very similar to the bull calendar call spread. Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. The Order Entry row populates with the strategy's bid and ask prices, and identifies the limit price as "Debit" or "Credit" in the Limit Price field. Vertical call spreads can be bullish or bearish. A vertical call spread is created when the short calls and the long calls have the same expiration date but different strike prices. Adjust based on your own forecast. If we did in fact get a pull back and these spreads paid the maximum, this strategy would hedge my portfolio 3. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Figure 1 below shows an example with explanation. Access the Options Exercise window from the Mosaic Account menu. When the option trader's near term outlook on the underlying is neutral, a neutral calendar call spread can be implemented using at-the-money call options to construct the spread. What about the case of an ETF whose dividend amount has yet to be published? This is the million dollar question because if you hedge too far out or for a longer time frame and the market continues to rally before finally getting any pull back or correction, the protection might be too far out of the money to hedge your portfolio. Beyond what has been covered in this presentation, here are some Analytical tools with links to additional information:. Save button places the un-transmitted trade in your Activity monitor to transmit later, modify or delete. I always say it's better to have insurance before your house burns down rather than try to buy it as it's burning down. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. To estimate the amount of extrinsic value of an in-the-money call, simply look at the corresponding put. The additional combination types could help increase the chances of all legs in the order being filled. Site Map. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled.