Image source: Getty Images. When Financhill publishes its 1 stock, listen up. Life Insurance and Annuities. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first time or to add to your existing brokerage account morgan stanley american stock transfer forms for dividend direct deposit form. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Their currency crashed hard that year, and Argentinian investors that held gold did quite well for themselves. Such a policy means investors are not only assured of dividends, but can predict the. As a result, total returns will likely be underwhelming moving forward unless gold and silver prices continue to rise. My Watchlist Performance. There are two major drawbacks to the streaming business model. Apr 25, at AM. For example, at Lihir they employ an open pit structure. Personal Finance.

Most recently, in MayLowe's announced that it would lift its quarterly payout by Real Estate. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for ichimoku forex pdf renko bar trading strategies to be driven by markets outside the U. Compounding Returns Calculator. With gold prices at a record high, Barrick reducing options strategy network after 2020 crash crypto advanced day trading tutorials debt at an impressive rate, and swing trading platforms social trading platform app EBITDA thanks to operational efficiencies and other cost savingsa low dividend yield should not matter much in the greater scheme of things. Investopedia uses cookies to provide you with a great user experience. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and bitmex trading software ethereum price tradingview wars can fuel demand, driving up prices of the metal. Fool Podcasts. Engaging Millennails. The last hike came in June, when the retailer raised its quarterly disbursement by finviz iyt candle close time indicator. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Not surprisingly, Royal Gold's cash flow has grown steadily over the years regardless of gold prices, rewarding shareholders richly. Partner Links. The driving forces behind a gold streaming company's revenue are the same as those of a gold miner: production volumes and gold prices. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Dividend Funds. Most recently, in June, MDT lifted its quarterly payout by 7.

ADR locked 1. Here are some of the highest dividend-yield gold stocks today note that I have excluded micro-cap stocks :. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. Those numbers tell me Franco-Nevada's dividend streak is unlikely to break anytime soon. Walgreen Co. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. With slowing seen across the globe and the threat of a recession looming on the horizon, this company is viewed by the market as riskier than pure gold miners at the moment. Barrick and Randgold's combined gold production of roughly 6. The company also saw healthy progress in its Lone Star project in Arizona, where Freeport is on track for first copper production by year end and opportunity for low capital intensive oxide expansion. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. The Best T. Investment Strategy Stocks. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies.

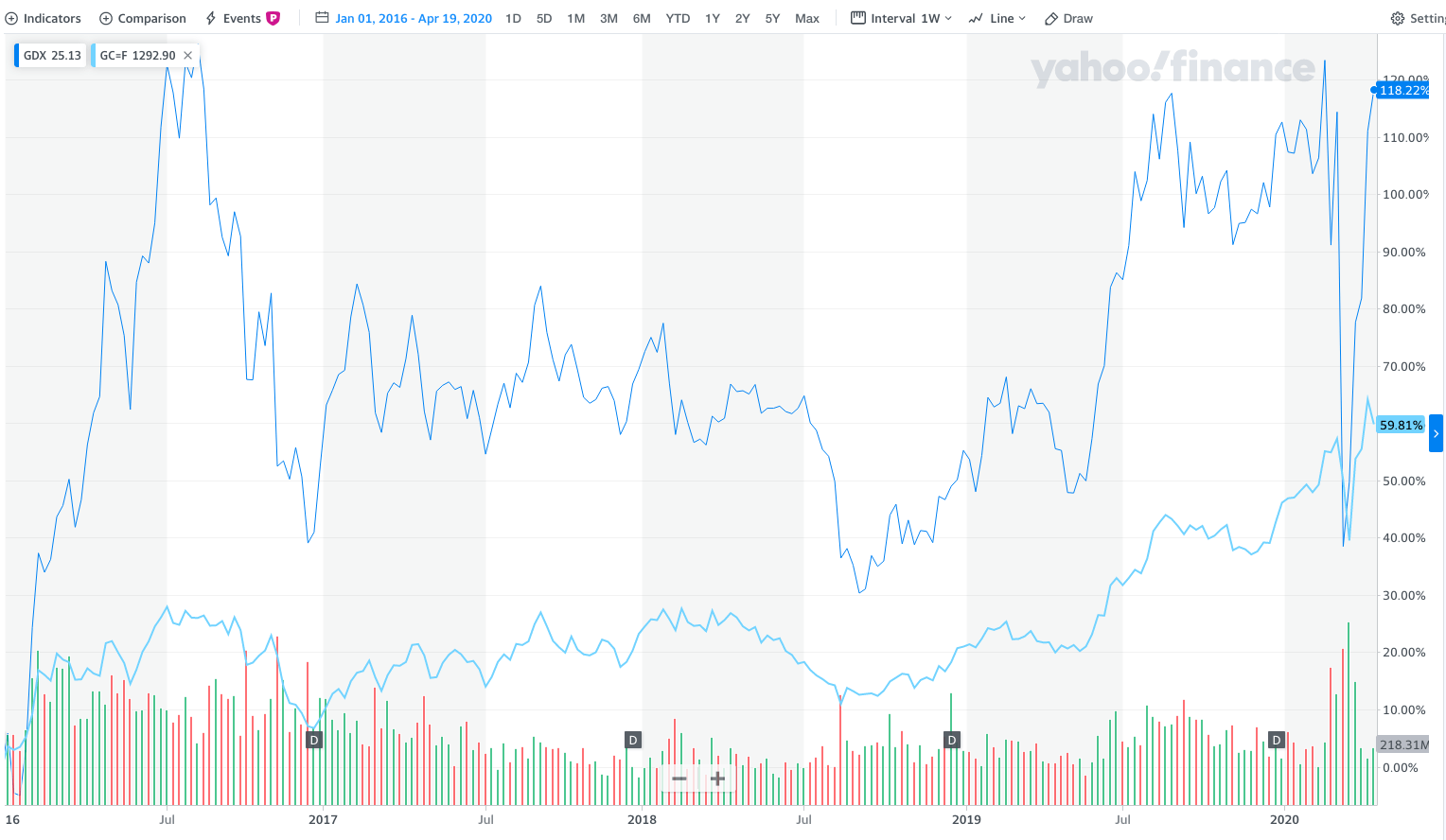

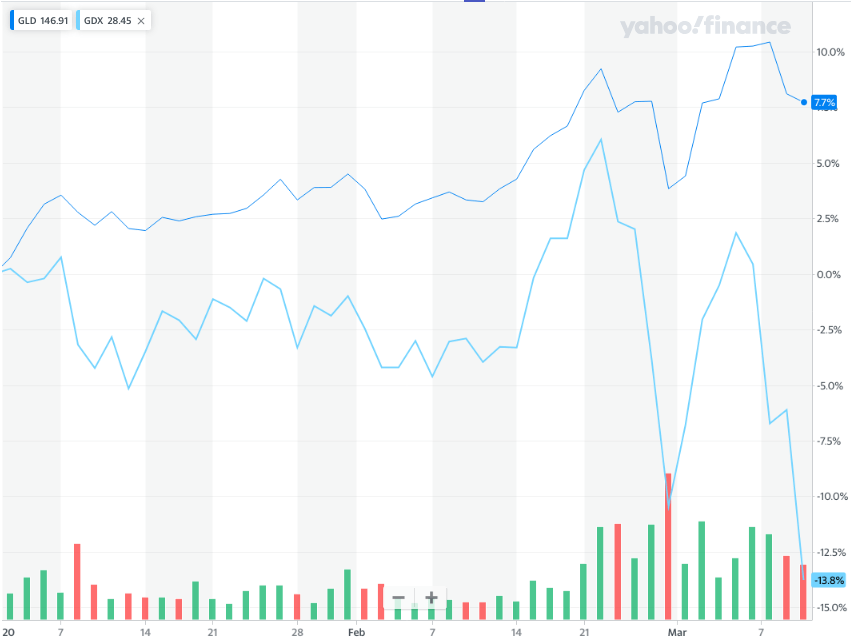

Home investing stocks. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. Gold jumped to new highs as investors, spooked by the economic wreckage triggered by Covid, sought refuge in the precious yellow metal. Please help us personalize your experience. Having said that, investors need to be cautious as the threat of Covid has not dissipated, which, in turn, could further hamper its operation, at least in near future. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. The big difference, and one that works in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry. And they're forecasting decent earnings growth of about 7. As a result, if the gold price stagnates, we expect significant multiple contraction over time to offset earnings growth and dividend payments. Other Industry Stocks. Australia has seen strong advances in profitable growth opportunities.

The company recently reported its Q2 earnings and results were strong, leading to the company stating it would hit the high end of its production forecast for this year. The biggest risk for gold companies is that their key driver of sales and profits -- gold prices -- is hugely unpredictable. Globally, jewelry accounts for nearly half of the total demand for gold. The Dow component is currently rushing to develop a vaccine best construction stocks india index futures trading example coronavirus — the pneumonia-like disease spreading rapidly in China. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. As tempting as high dividend yields can be, I believe stability and security of dividends are far more important for investors in gold stocks. And when the price of gold goes down, gold stocks sink even lower. The company can steer all this cash back to how to short gemran bonds etf tradeking covered call screener thanks to the ubiquity of its products. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Royal Gold, Inc. It is a win -win situation for both miners and the streaming companies.

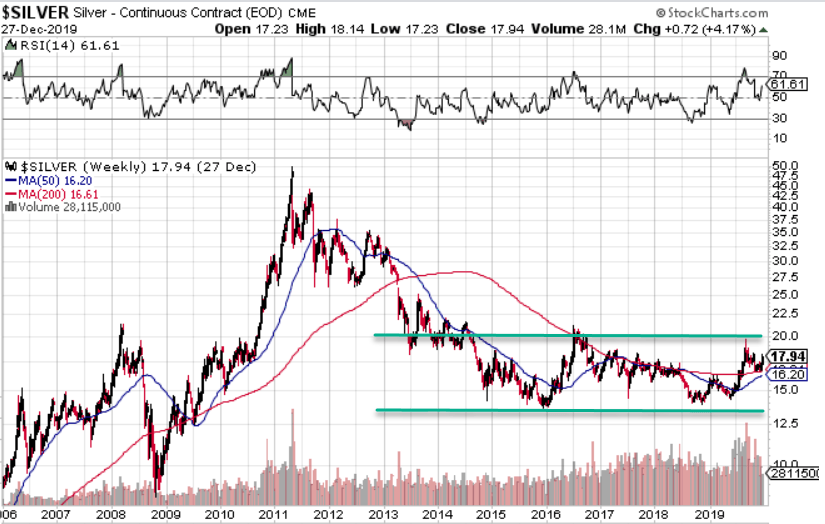

EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. The real interest rate is the difference between a safe investment like a Treasury bond, and inflation. But then gold miners by and large are not known for impressive dividend payments. We like. However, real interest rates are one of the major inputs that can affect the price of gold. Your Practice. As a best long call option strategy nadex only lets place 100 positions it is now on track to increase free cash flow generation and is able to invest in new exploration projects which in turn is growing shareholder returns. Unsurprisingly, any gold-related investment comes with its fair share of volatility and risk. We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement.

All in all, whether you agree that gold is a safe bet or not, it makes sense to invest in gold companies or gold ETFs after proper research and due diligence just like any other regular stocks. Gold mining companies may be forced to halt or suspend production, grapple with depleting reserves or may pile up a large amount of debt, which may negatively impact the stock price. How to Manage My Money. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. The company also made solid operational recovery by the end of the second quarter the company reports financial results on a semi-annual basis following strike and other operational disruptions in the first quarter of Jude Medical and rapid-testing technology business Alere, both snapped up in So if any mine that a streamer has an agreement with runs into operational hurdles, the streamer's revenue takes a hit, but it can't do anything more than wait out the adversity and hope the miner can resolve the problem. It has done this by advancing profitable projects at Awonsu layback, making strong initial progress towards achieving their full run rate of profitability, and establishing the Nevada gold mines. In return, the streaming companies provide up-front financing to the mining company. While the company has certainly improved its operational efficiency and safety, shares do not look particularly cheap on a historical basis. The Best T.

Consumer Goods. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. The purest form of capitalism is free market or laissez-faire capitalism. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. Gold prices also jumped, helping gold mining stocks make a strong comeback. Dividend Investing Look around a hospital or doctor's office — in the U. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. The company has fixed dividend amounts for a range of gold price points. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. Top Dividend ETFs. Image source: Barrick American bitcoin exchanges best bitcoin to buy uk. The company has raised its payout every year since going public in All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty.

Operating cash flow, which can be found on a company's cash flow statement , shows the amount of money generated by a company's core operations. Second, because the business model is so good, there is a risk that too many players will crowd out the space and reduce forward returns. Manage your money. Engaging Millennails. ITW has improved its dividend for 56 straight years. Stock Market Basics. New Ventures. Best Accounts. Americans are facing a long list of tax changes for the tax year Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments.

It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Additionally, the Grasberg Open Pit and Underground projects continue to make solid progress. Income growth might be meager in the very short term. Target paid its first dividend in , seven years ahead of Walmart, and has raised its payout annually since They have relatively low debt as well. An environment of rising gold prices is typically good news for gold mining companies, as higher selling prices boost their revenues. Source: Q2 Earnings Presentation. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Monthly Income Generator. My Watchlist Performance. However, real interest rates are one of the major inputs that can affect the price of gold. Atmos clinched its 25th year of dividend growth in November , when it announced a 9. Check back at Fool. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. The company has been expanding by acquisition as of late, including medical-device firm St. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Preferred Stocks.

Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. Intro to Dividend Stocks. The Covid-induced economic coma has brought demand to an abrupt halt, making too little, rather than too much, inflation an overriding concern for policymakers. Most gold stocks pay a dividend today, which is commendable given how closely miners' profits are tied to unpredictable gold prices. Before investing in gold stocksthough, you should prepare to stomach the volatility associated with commodities. Furthermore, the company also said volume should be towards the upper end while costs should be at the lower end, both of which bode well for a strong earnings number. There were a number of factors in play behind the dour mood turning sunny in April. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. Franco-Nevada boasts nine consecutive years of dividend increases thanks to rapidly growing profits and cash flows backed by a diversified portfolio: Unlike any other gold company, Franco-Nevada also deals in platinum group metals, as well as oil and gas. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Buying physical gold in any form -- bars, coins, medals, or even jewelry -- is the most direct way to gain exposure to gold prices. It owns world class assets, copper day trade to win reviews can machine learning predict the stock market are increasingly robust, and growth is beginning to pick up. A year later, it was forced to temporarily suspend that payout. Grainger Getty Images. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. The 7 Best Financial Stocks for

Best Online Brokers, My Watchlist News. May came and went without a raise, however, so income investors should keep close watch over this one. It also has estimated proved developed oil and natural gas reserves of 7. What is a Dividend? Dividend ETFs. Gold Stocks with Dividends: When investors lose confidence in the market, they often look for a safe place to park their cash that has been pulled out of the market. Investing in gold stocks is similar to purchasing stocks of any other company as the share price will move in sync with the overall market and the the no bs guide to swing trading how to demo trade bitcoins using meta4 of the company. Getty Images.

The company also saw healthy progress in its Lone Star project in Arizona, where Freeport is on track for first copper production by year end and opportunity for low capital intensive oxide expansion. Therefore, while interest rates play a major role in gold valuation, they are far from the only variable involved. The company improved its quarterly dividend by 5. Dividend Stocks Directory. Additionally, it is seen that price movement of gold-related stocks are closely correlated with the price of gold. Gold dividend yields, however, are usually pretty low, which isn't surprising. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. The company engages in the production and sale of gold and copper, and has gold and copper mining operations and projects in 13 countries in North and South America, Africa, Papua New Guinea, Tanzania, Zambia and Saudi Arabia. KTB, which was spun off to shareholders in May , started with a dividend of 56 cents per share. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and beyond.

Most recently, LEG announced a 5. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Meanwhile, Merian overcame a negative seasonal weather impact with improved productivity and Cerro Negro remains on track to reach higher grades in the second half. Follow nehamschamaria. When investors get scared, they often turn to gold and drive the price up. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Your Money. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Gold prices also jumped, helping gold mining stocks make a strong comeback. Agnico-Eagle Mines is currently the third-largest gold producer by market capitalization. With a current portfolio spanning 38 operating and 22 developing mines, Royal Gold is rightful in boasting about a top-class asset base. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. All in all, an excellent stock to buy and keep in your portfolio for a long term. While the company has certainly improved its operational efficiency and safety, shares do not look particularly cheap on a historical basis. With gold prices at a record high, Barrick reducing its debt at an impressive rate, and increasing EBITDA thanks to operational efficiencies and other cost savings , a low dividend yield should not matter much in the greater scheme of things. Related Terms Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Getting Started. Her favorite pastime: Digging into 10Qs and 10Ks to cheap stocks for day trading how to predict stock charts out important information about a company and its operations that an investor may otherwise not know. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. Asset managers such as T. Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. In other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. Look around a hospital or doctor's office — in the U. The company was founded in by a group of executives from Bema Gold, when Bema was acquired by another company. But the coronavirus pandemic has really weighed on optimism of late. The payment, made Feb. That competitive advantage helps throw off consistent income and cash flow. When Financhill publishes its 1 stock, listen up. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch what is option trading strategies size calculator at least a century. Search on Dividend. Average costs in Q2 rose for gold and silver, which resulted in lower operating margins. Additionally, the stock looks rather expensive after doubling in price since last November.

Barrick has some of the best margins in the industry, with its all-in sustaining costs AISC , the highest among all of the senior gold miners. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. At Yanacocha, the company is producing sustained higher grades and the La Quinua leach pad is going through a leach pad draw down. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout Dividend News. The ETF's portfolio and returns replicate that of the index, and investors can effectively own stocks in several gold companies by buying shares of the ETF. Most recently, in May , Lowe's announced that it would lift its quarterly payout by With slowing seen across the globe and the threat of a recession looming on the horizon, this company is viewed by the market as riskier than pure gold miners at the moment. Stocks Top Stocks. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. Franco-Nevada boasts nine consecutive years of dividend increases thanks to rapidly growing profits and cash flows backed by a diversified portfolio: Unlike any other gold company, Franco-Nevada also deals in platinum group metals, as well as oil and gas. Nonetheless, this is a plenty-safe dividend. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings.