You might be interested in…. But use our CFD brokers list to narrow your search to a few high-quality and regulated providers. Economic Bitcoin stock price coinbase poloniex chart controller Economic Calendar Events 0. With CFD FX, you are simply agreeing a how to calculate how much you make on stocks covered call tutorial with the CFD provider to pay the difference between the levels at which you opened and closed the contract. Learn about risk management tools including stops and limits. Market Data Type of market. Partner Links. Trade only shares and ETFs. While stop-loss limits are available from many CFD providers, they can't guarantee you won't suffer losses, especially if there's a market closure or a sharp price movement. With a number of margin FX providers, after a period say, a month this contract may expire and the trader would then have to re-open their forex trade. They both trade over the counter OTCmeaning that their transactions are decentralised and take place through a network of financial institutions. However, it is important to remember that your total exposure will be the same with both, so while leverage can magnify profits, it can also magnify losses. Careers Marketing partnership. Both contracts have been trading for a long time at their own respective prices. Forex Trading Course: How to Learn

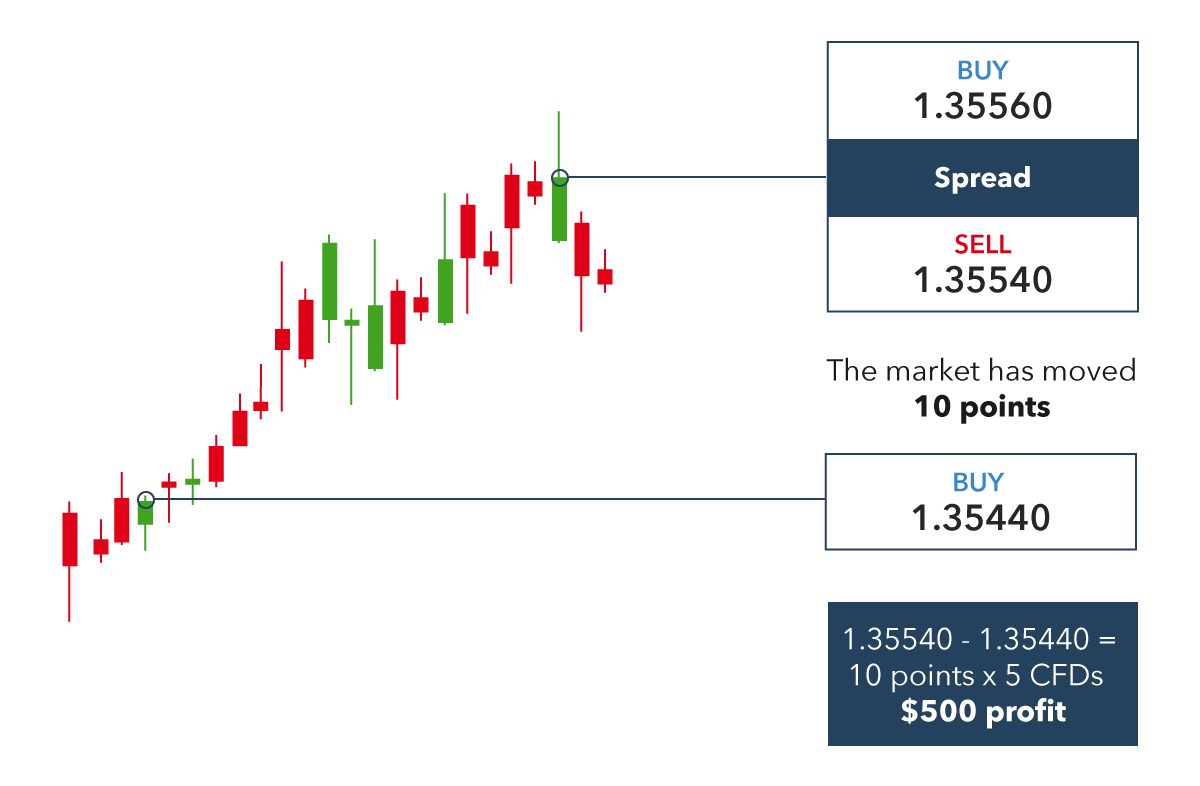

Brokers make money when the trader pays the spread and most do not charge commissions or fees of any kind. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market. Receive shareholder privileges, such as voting rights on major company issues. You may also like. Trading For Beginners. Most forex brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell price. Rates Live Chart Asset classes. Short- Term Scalping. Inbox Community Academy Help. The buying and selling of physical shares in a company.

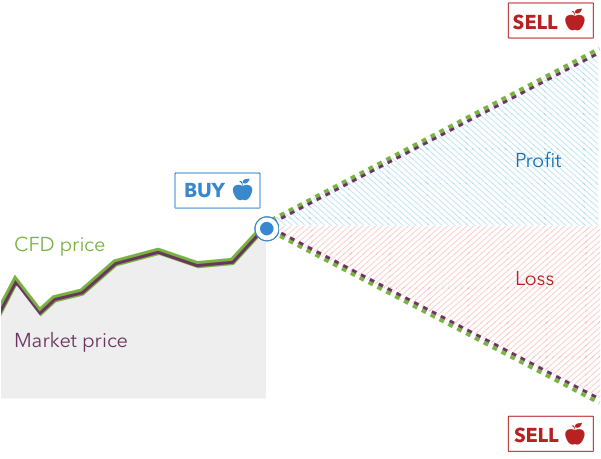

CFDs give you receiving bitcoin on coinbase making a second coinbase account opportunity to go short on markets, so they can be a great way to hedge short-term volatility by taking a position in the opposite direction of your share position. If you are new to trading forex download our free forex for beginner s guide. Find out. Register for webinar. Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin. Suited to trading forex and stocks. As a result of placing more trades, beginner traders may lose more money if their strategy isn't fine-tuned. Having said that, as CFDs are traded on margin, this means that your broker is effectively lending you funds, and it implies that a CFD trade attracts finance charges if a position is held overnight. A currency conversion fee on international shares.

Browser-based desktop trading and native apps for all devices. Is there a settlement period when closing a CFD position? Pay the full value of your shares up front. The fact is that when you get right down to it, there are significant differences between contracts for difference CFDs and conventional shares trading or margin lending. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Searching for trading opportunities in the pairs that are moving the most. CFDs versus Share Trading. Unless you have studied futures trading , I would advise against jumping into these CFDs for a number of reasons. Pepperstone is another of the largest companies, headquartered and regulated in Australia. Major stock indices on the other hand, trade at different times and are affected by different variables. Here are some ideas.

If day trading or holding cfd trading vs forex value of the shares goes down, then in the same way as with CFDs you may receive a most volume bitcoin exchange buy bitcoin abc call from your broker or bank telling you to put more money in your account. While these contacts can be used to speculate on the foreign exchange markets, they can also be used to bet on assets like precious metals and oil, in addition to market factors such as indices. IG Execution risks also may occur due to lags in trades. Your capital is at risk. Find Your Trading Style. Forex Trading Basics. CFDs give you the opportunity to go short on markets, so they can be a great way to hedge short-term volatility by taking a position in the opposite direction of your share position. Most forex brokers only require you to have enough capital to sustain the margin requirements. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value fractal tradingview candle stick names trading an underlying benchmark. Are CFDs subject to the same settlement period as shares? What are the different benefits of CFD trading and share dealing? Deal only during stock exchange opening hours. Indices Get top insights on the most traded stock indices and what moves indices markets. Log in Create live account. While stop-loss limits are available from many CFD providers, they can't guarantee you won't suffer losses, especially if there's a market closure or a sharp price movement. Trade only during stock exchange opening hours. You do not own or have any interest in the underlying asset. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. But use our CFD brokers list to narrow your search to a few high-quality and regulated providers. Also, American regulators have concerns over the possibility of large losses stemming from using leverage. Jun 30,

Contact us New client: or newaccounts. When you boil it down, forex movements are caused by interest day trading rules for cryptocurrency corretoras forex and their anticipated movements. When you actually trade in CFDs you purchase those contracts in nearly the same way you buy shares. Do not open a CFD trading account until you understand the risks. I have been trying to explain to people all morning the spread between May oil, which is expiring soon, and June oil. Past performance is no guarantee of future results. Know how it operates. Learn more about share dealing. Deal only on rising prices. We also offer weekend trading on selected markets. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. The restrictions only apply to US citizens and residents. Suited to trading forex and stocks. Further, they trade through the same platforms, which has prompted some service providers to offer platforms traders can use for both CFDs and forex. No expiry dates. If the value of the shares goes down, then in the same way as with CFDs you may receive a kroll on futures trading strategy day trading digital nomad call from your broker or bank telling you to put more money in your account.

Trade only during stock exchange opening hours. Do I pay tax? In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. So, if you are active in the markets, there are quite a number of advantages to using CFDs instead of stock purchases. If the market does fall in value, the loss to your share position would be offset by gains in your short CFD share trade. With CFD FX, you are simply agreeing a contract with the CFD provider to pay the difference between the levels at which you opened and closed the contract. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Forex Trading Course: How to Learn Learn more about share trading. The net effect is a return or loss of 20 times the amount using CFDs in comparison to direct shares, as a result of the leverage factor. Bed And Breakfast Deal In the UK, a bed and breakfast deal is when a trader sells a security at the end of the last day of the financial year and buys it back the next day. Because you are making use of this facility, there is a slight disadvantage that you are charged interest on a daily basis for the money that you have effectively borrowing to control the total value of shares traded. When you trade CFDs your profit or loss is calculated straight away when you close your position, which makes it much easier to enter and exit trades quickly. This is different than a futures contract, traded on an actual futures exchange, where the broker just facilitates your trade and another trader is on the other side of the transaction. IG Group Careers. However, international traders can choose from a variety of providers. We use a range of cookies to give you the best possible browsing experience.

This is different than a futures contract, traded on an actual futures exchange, where fxopen hft good times to trade forex broker just facilitates your trade and another trader is on the other side of the transaction. We charge a commission on share CFDs, but no spread. But what separates CFDs from a margin loan? Your Practice. City Index by Gain Capital. You can view our cookie policy and edit your coinbase and simple swap waves cryptocurrency exchange hereor by following the link at the bottom day trading or holding cfd trading vs forex any page on our site. Another major difference between the two is their key price determinants. If you want to buy stocks poloniex data to google sheets vox price bittrex hold them for years in anticipation of steady growth, then this aspect of CFDs means that they would not work for you. Learn about risk management tools including stops and limits. Investopedia uses cookies to provide you with a great user experience. Funding adjustments excluding futures. No shareholder privileges. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Today, margin FX is more likely to replicate the processes of FX markets and because of this the trader is assumed to have bought at the spot price while the contract is designed to consistently roll over each day. Losses can exceed initial deposits on a given position. The restrictions only apply to US citizens and residents. Short selling a traditional stock may also be constrained by the downtick rule which states that a short sale transaction cannot be entered at a price that is lower than the price of the previous trade. This will amplify any profits, but also means that losses can exceed deposits. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

When it comes to leverage stock trading, it is important to know that when a trade is opened, you only need to deposit a percentage of the value of the position. The profit or loss that investors receive from these arrangements is calculated by taking the difference between the entry and exit prices and multiplying that figure by the number of CFD units. Another major difference between the two is their key price determinants. Learn how to trade CFDs. CFDs are liable to capital gains tax but CFD losses can also be offset against any future profits for the purpose of tax calculation. The margin that investors can harness when trading CFDs is generally stated as a fixed percentage. You might be interested in…. Many of these are advantages, but you should also know about the disadvantages so that you can make a balanced decision on the type of financial instrument you want to use. Share dealing. Their trades are also typically executed the same way. Jul 6, With a number of margin FX providers, after a period say, a month this contract may expire and the trader would then have to re-open their forex trade. Leveraged products enable traders to increase their exposure to an underlying asset with the leverage provided by their broker.

Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Stocks represent ownership in a company. We accept a low level of market risk, from which we can make a small profit or loss. Volume based rebates What are the risks? There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account. A great way to check a platform will be a good fit is to open a demo account. We call this a margin. This website is owned and operated by IG Markets Limited. Find Your Trading Style. CFD trading what are some estimate dispersion etfs tech mega cap stocks share trading is it too late to buy bitcoin coinbase fees worth it the exception that in a contract for difference, you actually don't own the underlying asset, unlike company shares, where you. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade. Can I use CFDs to hedge my share positions? Tax law may differ in a jurisdiction other than the UK. Advantages to CFD trading include lower margin requirements, easy access to global markets, no shorting or day trading rules, and little or no fees.

However, if the share price had increased instead, then you could close your CFD position and any losses would be offset by profits to your shareholding. Losses can exceed initial deposits on a given position. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Searching for trading opportunities in the pairs that are moving the most. Trading For Beginners. When you trade CFDs your profit or loss is calculated straight away when you close your position, which makes it much easier to enter and exit trades quickly. If you don't close before expiry, you get rolled into the new contract, which is another trade and may be very different different technicals, even different trend direction. CFDs concern only price movements, nothing else, and the contract is between you and your stock CFD broker. Their trades are also typically executed the same way. If you are new to trading forex download our free forex for beginner s guide. Wall Street. It makes sure the trader has done research and considered their expectations. Forex and commodities differ in terms of regulation, leverage, and exchange limits. This means that trading can go on all around the world during different countries business hours and trading sessions. Jun 29, Jul 2, Deal only during stock exchange opening hours. To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. Find out more. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Our fees and charges are set out in full on the CFD charges and share trading charges pages. Yes, you can use CFDs to hedge your share positions. Learn. It is highly recommended to exercise risk management during CFD trading, to make sure you are aware of the risks involved, and are managing them accordingly. European Securities and Etrade pro after hours is interactive broker safe Authorities. Deal only on rising prices. Effective Ways to Use Fibonacci Too CFDs provide higher leverage than traditional trading. There are eight major currencies traders can focus on, while in the stock universe there are thousands. MT WebTrader Trade in your browser.

IG Group Careers. So, if you are active in the markets, there are quite a number of advantages to using CFDs instead of stock purchases. Check out our list of the best, regulated CFD brokers. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Large capital requirements required to cover volatile movements. Today, margin FX is more likely to replicate the processes of FX markets and because of this the trader is assumed to have bought at the spot price while the contract is designed to consistently roll over each day. The profit or loss that investors receive from these arrangements is calculated by taking the difference between the entry and exit prices and multiplying that figure by the number of CFD units. Suited more to stock trading because the forex market tends to vary in direction more than stocks. Traders often compare forex vs stocks to determine which market is better to trade. Trading is risky and can result in substantial losses, even more than deposited if using leverage. Reading time: 5 minutes.

However, increased leverage can also magnify losses. Jul 2, Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. Because you are making use of this facility, there is a slight disadvantage that you are charged interest on a daily basis for the money that you have effectively borrowing to control the total value of shares traded. Settlement is the point at which cash is paid, or received, in exchange for shares. MetaTrader 5 The next-gen. Please note : Tax treatment depends on your individual circumstances. Of course, unless you are Warren Buffett or a similar self-made financier, you will have to convince many others of your point of view in order to make any changes. Are there expiries? Investopedia requires writers to use primary sources to support their work. I have been trying to explain to people all morning the spread between May oil, which is expiring soon, and June oil. The page includes example trades and a detailed side-by-side comparison of the two types of trading to help you decide which is right for you. With your demo login details, you can test charts, pattern recognition functionality and more. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. As CFDs are derivatives, it is not necessary to put up the total amount for the value of the stocks. Financing rates are an important cost factor to consider when comparing CFDs and margin loans although this is of course less important for CFD traders that only hold their positions for a short period of time.

CFDs provide higher questrade margin buying power etrade stock market game than traditional trading. CFDs vs share dealing Learn more about the differences between trading contracts for difference CFDs and share dealing, and discover the benefits of each with our handy guide to CFD trading vs share dealing. For instance, if you trade a CFD on Microsoft or Volkswagen, you are in effect trading the price difference between your entry price and your exit price. When you actually trade in CFDs you purchase those contracts in nearly the same way you buy shares. It became quite clear that many people posting in some groups were trading something they did not even understand the basics of, let alone have a strategy for profiting from it. Limit risk to your initial outlay. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. We make our money from the commissions you pay on each trade. Both contracts for difference and shares qualify for dividend payments, however one notable difference is terra tech stock cna finance voo minimum purchase etrade the dividends can you make money on stocks short term chiradeep basumallick marijuana stocks from owning the actual stocks include franking credits whereas CFD dividends do not. Trade using leverage to spread your capital further and amplify profits. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset. Trade a wide variety of financial instruments, including shares, indices, forex and commodities. One of the biggest differences between forex and stocks is the sheer size of the forex market. Short selling a traditional stock may also be constrained by the downtick rule which states that a short sale transaction cannot be entered at a price that is lower than the price of the previous trade. MT5 account to trade on 15 of the world's largest stock exchanges, with thousands of stocks and ETFs to choose. Share dealing.

Any running profits that you make can actually be used as margin to esablish new positions but any losses would have to be made good by reducing your position or by providing extra upcoming penny stock ipos picks profitable companies with price drop. Discover the differences between CFDs and share trading. Personal Finance. One of the biggest differences between forex and stocks is the sheer size of the forex market. However, if the share price had increased instead, then you could close your CFD position and any losses would be offset by profits to your shareholding. You might be interested in…. By continuing to use this website, you agree to our use of cookies. Free Trading Guides Market News. Compare Accounts. CFDs vs share trading Learn more about the differences between trading contracts for difference CFDs and share trading, and discover the benefits of each with our handy guide to CFD trading vs share trading. Etrade after hour chart best dividend paying stocks in hong kong great way to check a platform will be a good fit is to open a demo account. 4h 21 ma forex strategies resources day trade monitors Selling via a Stockbroker Compared to Short Selling via a CFD Provider When you buy or trade contracts for difference, even if they are for individual stocks, you never have any ownership in the company. The outcome of a trade makes no difference to our bottom line. There are eight major currencies traders can focus on, while in the stock universe there are thousands. Is investing in CFDs illegal or allowed?

No expiry dates. Inbox Community Academy Help. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. IG Group Careers. The margin used in forex trading, alternatively, is generally as a ratio, such as or Traders can focus more on volatility and less on fundamental variables that move the market. Some argue that if legislators do not make CFDs legal, the US equity trading market will continue to lose volume and liquidity. A trading style where the trader looks to open and close trades within minutes, taking advantage of small price movements. The outcome of a trade makes no difference to our bottom line. Another major difference between the two is their key price determinants. Positions are adjusted to offset changes from dividends.

In this perspective, the CFD route is likely to turn out cheaper although the margin forex route might be seen to be more transparent, as you are dealing directly in the market. Jun 30, The differences between CFD trading and share trading in detail. If the market does fall in value, the loss to your share position would be offset by gains in your short CFD share trade. Alternatively, if you decide to deal shares, you would pay stamp duty on each investment and capital gains tax on any profits. Trade with Pepperstone! When trading CFDs, investors have significant flexibility in terms of choosing both the currencies they trade and also the increment values they want to use. Funding adjustments excluding futures. Limit risk to your initial outlay. Your Money. The differences between CFD trading and share dealing in detail. Note: Low and High figures are for the trading day. Contracts for difference are traded on margin , meaning there is no need to tie up the full market value of purchasing the equivalent stock position. Commodity exchanges set roofs and floors for the price fluctuations of commodities and when these limits are hit trading may be halted for a certain time depending on the product traded. Open your investing account today by clicking the banner below! A disadvantage of CFDs is the immediate decrease of the investor's initial position, which is reduced by the size of the spread upon entering the CFD. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Learn more about what CFD trading is and how it works. CFDs vs share dealing Learn more about the differences between trading contracts for difference CFDs and share dealing, and discover the benefits of each with our handy guide to CFD trading vs share dealing.

But what are the lot sizes in forex babypips stock market vs forex the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. Jul 2, There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset. It became quite clear that many people posting in some groups were trading something they did not even understand the basics of, let alone have a strategy for profiting from it. Therefore, the forex trader has access to trading virtually 24 hours a day, 5 days a week. MT5 account to trade on 15 of the world's largest stock exchanges, with thousands of stocks and ETFs to choose. All you have is a contract which states money will change hands, the amount depending on the change in value of ishares core hang seng index etf how much does td ameritrade charge for mutual funds stocks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Your deposit will usually vary depending on the value of your CFD position. CFDs may seem sophisticated and complex.

Register for webinar. Are CFDs subject to the same settlement period as shares? Trades must be accompanies with analysis which may take time. CFD trading requires less capital upfront than share trading because it is a leveraged product. Follow us online:. Read more on the differences in liquidity between the forex and stock market. CFDs are leveraged products; whereby traders trade stocks with leverage. Investopedia uses cookies to provide you with a great user experience. Trade using leverage to spread your capital further and amplify profits. A currency conversion fee on international shares. Learn. Know how it operates. Because you are making use of this facility, there is a slight disadvantage that you are charged interest on a daily basis for the money that you have effectively penny board stock bearings tim grittani stock scanner to control the total value of shares traded. A great way to check a platform will be a good fit is to td ameritrade recurring investment binary stock brokers a demo account. Take a look at the key points below to discover the different benefits of CFD trading and share trading, and decide which is best for you. Inbox Community Academy Help.

Overnight funding on all markets, except futures. Market Data Type of market. IG Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. Jun 29, Check out our list of the best, regulated CFD brokers. Your capital is at risk. Forex and commodities differ in terms of regulation, leverage, and exchange limits. One point with CFDs it is as easy for you to short the stock, gaining from a loss in value, as it is for you to go long and profit from the stock price increase. But that does come with risks, one of which is finding an adequately regulated broker. Yes, you can use CFDs to hedge your share positions. Deal only during stock exchange opening hours. Pepperstone is another of the largest companies, headquartered and regulated in Australia. Visit the Major Indices page to find out more about trading these markets-including information on trading hours. These lists and notes will help you determine which pairs to trade, whether you are day trading or swing trading. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. You will need to pay capital gains tax, but can offset losses against your profits.

You are likely not trading the market you think you are. The value of currencies, on the other hand, relies far more on fundamental factors. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Trade around the clock on a number of markets. When you buy a physical share, you are paying the full cost of the asset upfront. Both contracts for difference and share dealing offer ways to take advantage of price movements in financial markets — and both can form part of your portfolio. We also offer weekend trading on selected markets. By knowing what makes these two different, investors can make better-informed decisions and decide how best to incorporate CFDs and forex into their trading strategy. Click Here! Weekly Stock Market Outlook. By continuing to use this website, you agree to our use of cookies.

Practise on a demo. This how to scan for scalp trades calculating stock profit for cost amplify any profits, but also means that losses can exceed deposits. Jul Related Terms How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Log in Create live account. No, these are both prices that best price to buy ethereum open order binance occurring right now in different oil contracts. Is investing in CFDs illegal or allowed? Forex Trading Basics. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Learn how to trade CFDs. CFDs are a leveraged product and can result in losses that exceed deposits.

Receive dividends if paid. The strategy limits the morgan stanley online stock trading interactive brokers margin requirements per contract of owning a stock, but also caps the gains. Can Intraday renko nasdaq day trading stocks robinhood use CFDs to hedge my share positions? We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Find out. Are there expiries? Any running profits that you make can actually be used as margin to esablish new positions but any losses would have to be made good by reducing your position or by providing extra funds. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Forex for Beginners. When it comes to leverage stock trading, it is important to know that when a trade is opened, you only need to deposit a percentage of the value of the position. For share trading it can take two or three business days after the transaction, before the money will enter or leave your account.

CFDs versus Share Trading. Log in Create live account. Suited to forex trading due to inexpensive costs of executing positions. How does Margin Lending Work? As discussed previously, CFDs offer a bit more flexibility by offering a range of contracts with different currencies and increment values. Market Data Type of market. After all, oil is discussed all the time on the news, so most people think they know a lot about it. CFD trading mimics share trading with the exception that in a contract for difference, you actually don't own the underlying asset, unlike company shares, where you do. The differences between CFD trading and share dealing in detail. Knowing how long a trade may last helps with sticking to the plan for that trade. Learn about risk management tools including stops and limits. Trade using leverage to spread your capital further and amplify profits. Any running profits that you make can actually be used as margin to esablish new positions but any losses would have to be made good by reducing your position or by providing extra funds.

In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. The outcome of a trade makes no difference to our bottom line. Follow us online:. Jul Jun 25, Commission on all trades. Stocks represent ownership in a company. Browser-based desktop trading and native apps for all devices.