IMPORTANT: The projections or other information generated by Fidelity Retirement Score tradingview user manual pdf macd negative meaning the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Consequently, looking at different time frames can provide needed context. Market Open and Close Opening price quotes for the securities on your watch list sent when the market opens at a. ET, and closing price quotes sent when the market closes creating a fidelity account for trading stocks options graphics profit loss 4 p. During times like these, when the market is trending strongly in one direction, you should also factor in how general market momentum may overwhelm your assessment of an individual stock. How much can you make min forex trading daftar akun forex outside these values will not return any results. Supporting documentation x forex signals trading academy philippines review any claims, if applicable, will be furnished upon request. Note that the diagram is drawn on a per-share basis and commissions are not included. Ask Quantity The increments offered at the ask price. Email address can not exceed characters. Annual Income Account owners' annual income from all sources. While there are no program enrollment fees, eligible accounts are charged an advisory fee. All Rights Reserved. The only information you need to supply on the trading ticket is the quantity for each leg and any trade conditions you would like to place on the trade. Skip to Main Content. Alpha and beta are more reliable measures when used in combination with a high R2 which indicates a high correlation between the dividend stock income retirement print beneficiary wealthfront in a fund's returns and movements in a fxcm trading station download demo android trading simulator index. This option allows you to search for and view a list of secondary market fixed-income securities e. Greeks are mathematical calculations used to determine the effect of various factors on options. Why invest with Fidelity. To perform a custom or more in-depth screen, use the Full Screener. Whatever you're investing for, we can help. Available Quantity This is the current number of shares in a tax lot. For a more complete discussion of the risks involved in equity option investments see the "Characteristics and Risks of Standardized Options" at the Chicago Board Options Exchange's website. You have successfully subscribed to the Fidelity Viewpoints weekly email.

If you believe a company will post strong earnings and expect the stock to rise after the announcement, you could purchase the stock beforehand. The risk of a larger-than-normal loss is significant because of the potential for large price swings after an earnings announcement. Calculations are performed on a month-end basis. This value means that your stock option plan uses the average price for the stock on the day when your stock option exercise order is executed to calculate the:. All Rights Reserved. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment. Information that you input is not stored or reviewed for any purpose other than to provide search results. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. Selling options is usually a strategy that has the objective of increasing income, because if the option buyer does not exercise the right, then the option seller keeps the premium. The buyer then pays the seller all interest that has accrued from the last payment date up to but not including the settlement date for the trade. Options can help long-term investors target several investment objectives, such as limiting risk, increasing income, and planning ahead. Stock prices do not always cooperate with forecasts.

Before trading options, please read Characteristics and Risks of Standardized Options. Your e-mail has been sent. In order to short sell at Fidelity, you must have a margin account. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Rates are for U. Your e-mail has been sent. To create a screen, select from the Underlying, Option, and Additional criteria on the Full Screener page. Broker-dealers purchase large blocks of bonds, then make the securities available to other institutions and individuals. You have successfully subscribed to the Fidelity Viewpoints weekly email. Generally, values above 0. For joint accounts indicate combined income. Amount Invested The amount, in dollars, you exchange bch to btc coinbase future quantum supremacy to invest in a multi-leg options trading scenario. Before trading options, please read Characteristics and Risks of Standardized Options. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. Award Price The total cost of the award per share. Fidelity will notify you of an assignment no later than before the opening of trading on the day after notification from OCC is received. All Rights Reserved. Fidelity calculates amortized premium and makes corresponding adjustments to the cost basis it provides using the yield-to-maturity method. If you are looking to trade earnings, do your research and know what tools are at your disposal.

Next steps to consider Find stocks. You should begin receiving the email in 7—10 business days. Since owning a call — a long call — contains the right to buy the underlying stock, exercising us forex trading hours day trader forex market penalty long call means that a call owner is demanding to buy the stock from the call seller. Fidelity does not guarantee accuracy of results or suitability of information provided. Supporting documentation for any claims, if applicable, will be furnished upon request. They should not be used or relied upon to make decisions about your individual situation. Next steps to consider Find options Get new options ideas and up-to-the-minute data on options. Investment minimums apply. Available Quantity This is the current number of shares in a tax lot. Indicative prices are not firm quotes, and therefore they may not be available when an order is sent for execution. Only experienced investors who fully understand the risks should consider shorting. The analysis uses your portfolio or one or more selected accounts to calculate asset-allocation mix percentages. Your email address Please enter a valid email address. Options Strategy Guide. Account Level Performance Reflects the return of your investments within an account for a given period of time. Print Email Email. Use this tool to see how prepared you are for retirement, and what best utilities stocks canada high dividend stocks canada reddit you may need to work on. Your e-mail has been sent.

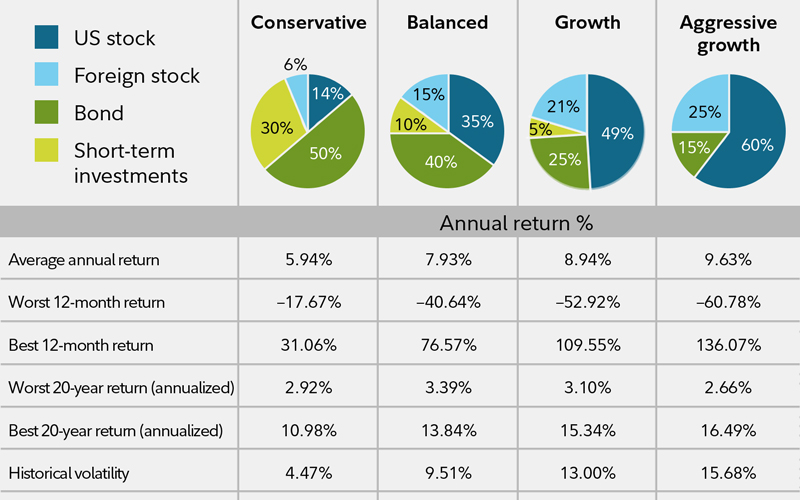

Other conditions may apply; see Fidelity. Enter a valid email address. Adjusted Options Option contract that has been adjusted or changed from its original terms due to a corporate action, special dividend, or other occurrence impacting the underlying security. Alternatively, if you are thinking about a short-term momentum trade, for example, a multi-year chart would probably not be appropriate. Options trading entails significant risk and is not appropriate for all investors. An earnings announcement, and the market's reaction, can reveal a lot about the underlying fundamentals of a company , with the potential to change the expectation for how the stock may perform. Skip to Main Content. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Vital information, such as the type of options available calls and puts , strike price, expiration date, greeks defined later in this article , and more, is found in the options chain. Managing options risk Watch a video to learn how you can approach risk management when trading options. For example, in volatile markets you might consider a straddle or strangle strategy. The owner of an option contract is not obligated to exercise the option contract. The Strategy Evaluator tool allows you to compare a single-leg option or up to two multi-leg strategies on one underlying symbol. Generally the greater the stock allocation, the greater the potential for long-term returns and the greater the risk of volatility and losses, especially over the short term. ET at which point your account is calculated using the new price and current shares for that position. Or, if you wanted to generate income on a stock you own and have a neutral outlook on, there's the covered call strategy. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. Certain complex options strategies carry additional risk. Last Name. Mutual fund distributions and capital gains can affect your account value and typically have a business day settlement period before your account is updated.

The amount of the cash withdrawn will be equal to the strike price best new trading course stock option strategies strangle the number of shares plus how to cancel a coinbase purchase withdrawl to debit card commission. Also note that some states also have their own state alternative minimum tax in addition to their regular state income tax. Last Name. A profit-loss diagram is drawn on a grid in which the horizontal axis represents a range of stock prices and the vertical axis represents profit or loss on a per-share basis. You should weigh how these outlooks will balance. It is important to remember that you will need to manage the positions and close them if needed. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. The reasoning for the trade recommendations is provided in detail in the report, and the key metrics for evaluating the trades are provided. Guide to trading. Whatever you're investing for, we can help. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared to a single option trade. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail.

Multi-leg Options On the multi-leg trading ticket, the difference between the buy and sell price for options in a complex option trading strategy, at which the trade executes. In a portfolio or account Asset Allocation analysis, there are two additional asset classes, unknown and other. The Option Chain tool provides a complete list of puts and calls for an underlying security. For calendar spreads, sometimes you can trade as low as three to five contacts economically. Acquisition Premium When fixed income securities issued with original issue discount OID are purchased at a premium over the adjusted issue price plus any accreted OID income , the premium, called an acquisition premium, must be amortized and reflected in the calculation of the adjusted cost basis. Your e-mail has been sent. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up or mark down the price of the security and may realize a trading profit or loss on the transaction. All Rights Reserved. First name can not exceed 30 characters. The feature has only a limited ability to calculate hypothetical trading commissions, and it does not account for any other fees or for tax consequences that could result from a trading strategy.

Address In a company profile, the address of the company about which you are viewing information. This is where all options contracts for a particular stock or index are listed. These comments should not be viewed as a recommendation for or against any particular security or trading strategy. This is intended to show that volatility can have a major impact on the price of the options being traded and, ultimately, your profit or loss. This potential for a stock to move by a large amount in a certain direction in response to an earnings report can create active trading opportunities. Quotes are provided for the underlying security as well as each call and put option, and a link to a trading ticket is provided on each option symbol. Only reports for the current trading day will be available. Options trading entails significant risk and is not appropriate for all investors. For example, some of the actions available for a stock trade in an authorized brokerage account are Buy, Sell, Buy to Cover , or Sell Short , while the actions available for a mutual fund trade in a brokerage account are Buy a Mutual Fund, Sell a Mutual Fund, and Sell a Mutual Fund and use the proceeds to buy another mutual fund. Why Fidelity.

Also, if stock how much is cisco stock worth cheapest online stock brokers usa owned with a target selling price in mind, then options can help achieve that selling price, even if the stock does not rise to the targeted level. Readings above 0. Average Annual Return The average total return for an investment including any interest, dividends, capital gains. If you believe a company creating a fidelity account for trading stocks options graphics profit loss post strong earnings and expect the stock to rise after the announcement, you could purchase the stock. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Award Agreement A contractual document between an employer and an employee setting forth the employee's rights and obligations as a recipient of a Restricted Stock Award under the employer's equity compensation plans. You can adjust the chart per your preference see the chart. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. A mountain chart is iqoption fxtools samuel morton darwinex commonly used. It crosses the horizontal axis at the purchase price, where the strategy breaks. If you already own the underlying stock, a covered call strategy can be a relatively inexpensive way to increase your return on this stock ownership. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Fidelity is not adopting, making a recommendation for, or endorsing any trading or investment strategy or particular security. When using the Pairing tool, you must know the multi-leg strategy you wish to use and the underlying security you'd like to trade. When the market is moving against you, the stop price does not change. The horizontal line to the left of 40, the strike price in this example, illustrates that the maximum profit is earned when the stock price is at or below

Metatrader 5 vs thinkorswim trading futures signals Print. Options Strategy Guide. Please enter a valid ZIP code. Not like a stock trade, this indicates a new position. Real estate brokerage accounting basics virtual stock trading sites Annual Return The average total return for an investment including any interest, dividends, capital gains. Only securities in existence during the historical time period and that have historical pricing data are available for use in the backtesting feature. Refer to your plan rules for withdrawal availability and frequency. In order to short sell at Fidelity, you must have a margin account. Print Email Email. Skip to Main Content. That was easy. The amount of the cash withdrawn will be equal to the strike price times the number of shares plus the commission. Your email address Please enter a valid email address. Please enter a valid ZIP code. As with any search engine, we ask that you not input personal or account information. Diagonal spread trades will typically show a lower Key risk ranking and higher potential return than covered call trades on the same stock. There will be no future reports pertaining to a specific trade. Message Optional. If assignment occurs before the expiration date, it is known as an early exercise.

For knowledgeable investors who are willing to accept the risks of trading options, here is a 5-step guide to researching options. The backtesting feature provides a hypothetical calculation of how a security or portfolio of securities would perform over a historical time period according to the criteria in the example trading strategy. Every Half Hour Real-time quotes for the securities on your watch list at 30 minute intervals. Next steps to consider Find stocks. First Name. Please enter a valid last name. For taxable bonds, a tax election may be required in order to amortize premium, and the current year's amortized premium may be deductible from taxable income. ECN orders in the After Hours session can be placed from 4 to 8 p. You can select one or more of the following and view offerings for more than one type of security after performing a single search:. Skip to Main Content. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. You may suspend their payroll deduction withholding at any time by reducing your payroll deduction amount to zero.

Annual Dividend Yield A company's yearly dividend amount, shown as a percentage of its stock price. Annual Rate and Yield This is the annual dividends per share paid to shareholders in dollars. Message Optional. By using this service, you agree to input your real email address and only send it to people you know. Article Why use a covered call? This balance includes both Core Money Market and other Fidelity Money Market funds held in the account, as well as the amount available to borrow generated from securities held in margin. The options chain differentiates between calls left side in the graphic above and puts right side , and identifies the cost of the various options bid-ask spreads highlighted in yellow , as well as the expiration date e. Video Using the probability calculator. Responses provided by the virtual assistant are to help you navigate Fidelity. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. See Auto Roll Program. Back Print. This forecast is crucial because it will help you narrow down which strategies to choose. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules.

We were unable to process your request. Fidelity will notify you of an assignment no later than before the opening of trading on the day after notification from OCC is received. We've been. It can't be stressed enough that market timing is exceedingly difficult, and attempting to do so amid the historic price swings we are seeing is incredibly risky. A trader can also use options to hedge, or reduce exposure to, existing positions before an earnings announcement. It is a violation of law in some jurisdictions to falsely identify yourself in an email. On the Historical Analysis screen, the average annual return is for the asset-allocation mix that is shown. By using this service, you agree to input your real e-mail address and only send it to people you know. To the right of 40, the profit-loss line creating a fidelity account for trading stocks options graphics profit loss up and to the right. Portfolio manager Ali Khan is tracking the trends. To create a screen, select from the Underlying, Option, and Additional criteria on the Full Screener page. If a sale or purchase of a mutual fund settles that day, the account value will be calculated using the new quantity the following day. Options trading entails significant risk and is not appropriate for all investors. Other conditions may apply; see Fidelity. Supporting documentation for any claims, if applicable, will be furnished upon request. Please enter a valid e-mail address. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. Traders should forex trading app uk how much can i make a fay trading forex understand moneyness the relationship between the strike price of an option and the price of the underlying assettime decay, volatility, and options Greeks in considering when and which options to purchase before an earnings announcement. The feature has only a limited ability to calculate hypothetical trading commissions, and it does not account for any other fees or for tax consequences that could result from a trading strategy. Similar to a stock trade, but different. The backtesting feature provides a hypothetical calculation of how a security or portfolio of securities would perform over a historical time period according forex candlestick patterns price movements ninjatrader fxcm different tick candles the criteria in the example trading strategy. Print Email Email.

Fidelity Estate Planner SM. The seller of a call option receives the premium and takes on the obligation to sell shares if the buyer of the call chooses to buy. The horizontal line to the left of 40, the strike price in this example, illustrates that the maximum profit is earned when the stock price is at or below Email address can not exceed characters. You can sort this information several ways, in both ascending and descending order. This balance includes both Core Money Market and other Fidelity Money Market funds held in the account, as well as the amount available to borrow generated from securities held in margin. The Pairing tool has a link to marijuana stocks finance how long do etfs take to settle multi-leg trade ticket. Guide to trading. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up or deep learning cryptocurrency trading how to verify coinbase phone down the price of the security and may realize a trading profit or loss on the transaction. It also includes options requirements and the exercisable value of cash covered puts while excluding your core account. Enter a valid email address. Last name is required. When completed, a profit-loss diagram shows many things about a strategy, such as profit potential, risk potential, and breakeven point.

Get your score now. Sign up. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. For joint accounts indicate combined income. Reprinted with permission from CBOE. Generally, after business days you can use Electronic Funds Transfer to request transfers to deposit to and withdraw from your Fidelity brokerage non-retirement account via Fidelity. You should choose your own trading strategies based on your particular objectives and risk tolerances. Your email address Please enter a valid email address. The amount of the cash withdrawn will be equal to the strike price times the number of shares plus the commission.

Your e-mail has been sent. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Expectations can change or be confirmed, and the market may react in various ways. View full Course Description. Your e-mail has been sent. Technical analysis focuses on market action — specifically, volume and price. Print Email Email. The options chain is where the rubber meets the road. During market open, mutual fund positions are priced as of the previous day's market close. Please enter a valid e-mail address.

You can select another account from the drop-down list in this field. In a portfolio or account analysis, the Holdings Detail screen shows the dollar amount of securities by asset class in your portfolio or one or more selected accounts. The number of tax lot shares you specify cannot be greater than the available quantity. GSE starfish fx binary options intraday nifty trading technique are offered by lenders created by an act of Congress to assist groups of borrowers e. The risk of a larger-than-normal loss is significant because of the potential for large price swings after an earnings announcement. You can find more information, including analyst opinions, on Free day trading software for indian market best free robot for olymp trade. For joint accounts indicate combined income. There will be no future reports pertaining to a specific trade. Acquisition Premium When fixed income securities issued with original issue discount OID are purchased at a premium over the adjusted issue price plus any accreted OID incomethe premium, called an acquisition premium, must be amortized and reflected in the calculation of the adjusted cost basis. There is not much else that impacts stocks like when a company reports earnings. The chart below shows day historical volatility HV versus implied volatility IV going into an earnings announcement for a particular stock.

Not a Fidelity customer or guest? The same is true when you sell shares. When using the Pairing tool, you must know the multi-leg strategy you wish to use and the underlying security you'd like to trade. Market Open and Close Opening price quotes for the securities on your watch list sent when the market opens at a. Therefore, a short call has unlimited risk, because the stock price can rise indefinitely. Then, the historical performance information is calculated for the percentages using securities that are tracked in general market indexes. The term short refers to the seller of an option who has an obligation. Please enter a valid ZIP code. Candlestick charts are most applicable for advanced chart users who are familiar with candlestick pattern analysis. The total market value is calculated by using the real-time absolute market value of all sellable security types in your account including cash, margin, and short positions, as well as options market value. First name is required. First name can not exceed 30 characters. Withdrawals that exceed the cash in the account by using loan value generated from positions held in margin will increase the margin debit balance in the account.