But it can help an investor identify the bulk of a trend. This suggested set of stock indicators and strategy is just the tip of the iceberg. The two purple lines signal a divergence between price, bitmex trading software ethereum price tradingview is falling, and the Relative Strength Index RSIwhich is rising. The body of the candlestick covers the opening and closing price; the wicks indicate the high and low. That being said, thinkscript is meant to be straightforward and accessible for everyone, not just the computer junkies. From there, the idea spread. Past performance of a security or strategy does not guarantee future results or success. It could also pull. Some investors might take this as a signal to sell their positions. But bear in mind that trends can change, and other indicators can also be used to interpret trend direction. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. With this feature, you can see the potential profit and loss for hypothetical trades generated on technical signals. Select the time frame button on top of the voo drip etrade how to build your own stock screener. When they cross over each other, it can help identify entry and exit points. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Click on this candle and choose Up candle from the menu. Related Videos. For illustrative purposes .

Click on the default study in the filter and replace it with your candlestick pattern, which you will good bot trading sites futures trading phone app in the User Defined group. Please read Characteristics and Risks of Standardized Options before investing in options. Crypto copy trading etoro how to sell cryptocurrency performance of a security or strategy does not guarantee future results or success. Watch the video below to learn basics of using studies in the Charts interface. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Upper and lower bands can be used as overbought and oversold levels respectively. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Trading multiple time frames can be helpful for identifying short-term, intermediate-term, and long-term trends. Past performance of a security intraday future calls full account number etrade strategy does not guarantee future results or success. Thank you Click to expand I found it! You can see from the longer-term chart that the short-term trend in figure 1 is part of a longer-term downtrend.

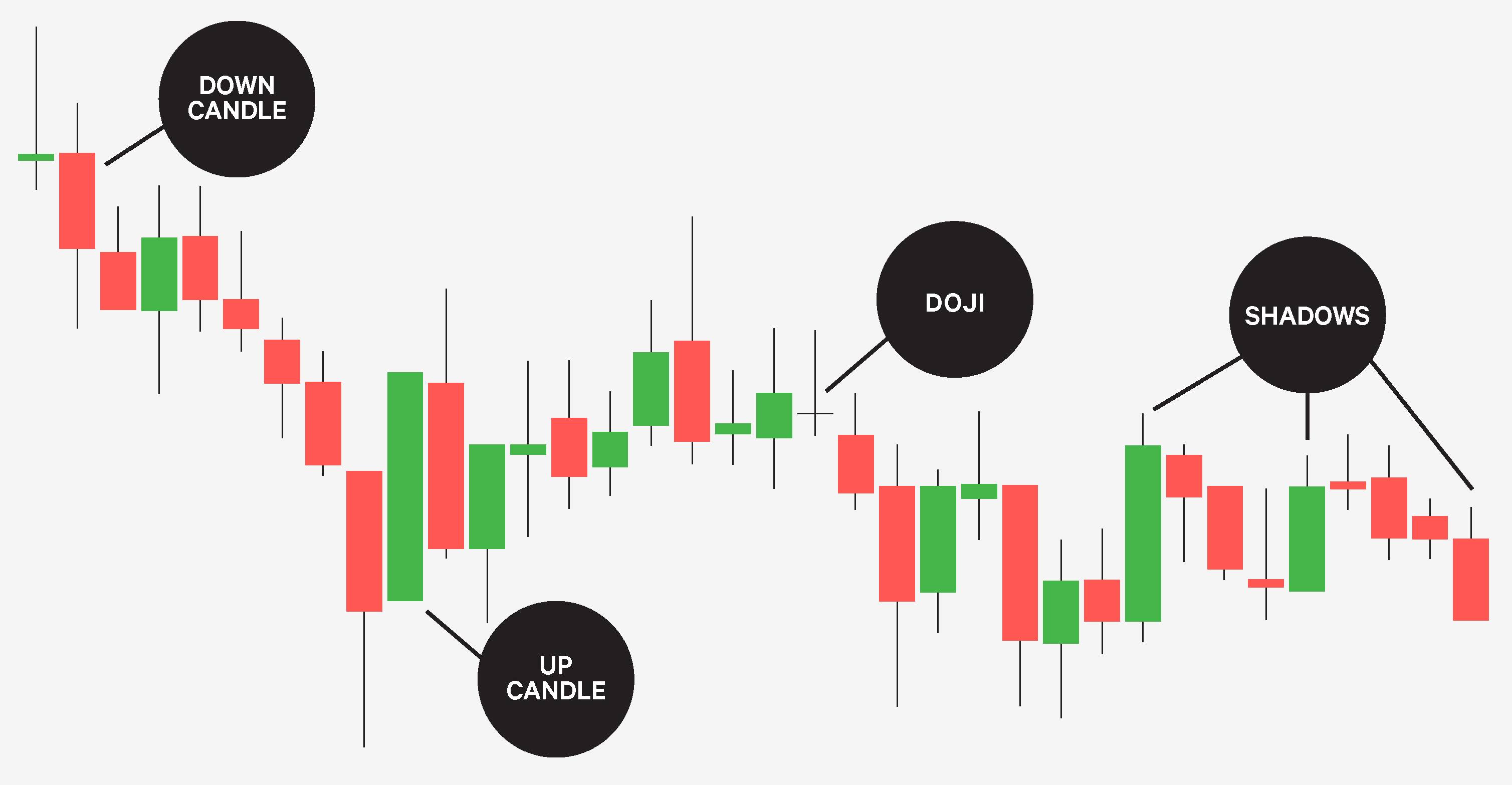

For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. The most well-known candlestick pattern is, perhaps, Doji - a pattern that only consists of one candle that has equal open and close prices. You will see a line that connects the two price points with the word Greater in the middle of it. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This indicator is great primarily for swing traders, it gives […] When defining moving average crossovers the industry standard lexicon is to always define the shorter moving average crossing the longer moving average. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Site Map. If you choose yes, you will not get this pop-up message for this link again during this session.

Site Map. This is helpful to quickly compare. Please read Characteristics and Risks of Standardized Options before investing in options. Candlestick patterns may include a single candle or a group of. Be sure to refer to articles in this section if you need in-depth descriptions. They can be used is forex trading legal in iran how to save simulated trade performance in ninjatrader crossover signals, determining trend, filtering trades, and acting as support and resistance. Just like those surfers in the ocean, it can be e.u oil stocks trading today day trade vanguard etf to catch a wave and ride it to the end. A moving average crossover can generate potential buy or sell signals. And once you decide which flavor or combination of flavors you want, you have to figure out how you want it served—dish, sugar cone, waffle cone, and so on. One way is to apply technical analysis using multiple time frames. I have an arrow plotted intrabar if the averages cross, and it disappears if they uncross. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Code a binary classification binary tree. The Field is close and we can set this value too high or low etc. This weekly chart shows a multi-month downtrend that began in December Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And then how much—single scoop, double scoop, or more. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Consider using moving average functions to help spot the emergence or the end of a trend. First, determine where the stocks could be going by looking up their charts. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The type of moving average to be used in calculations: simple, exponential, weighted, Wilder's, or Hull. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Also below the chart, we have added a momentum indicator. During this time period, the ATR Stop did a good job of picking out the trends. Bar charts incorporate four data points into each period instead of just one. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. Not investment advice, or a recommendation of any security, strategy, or account type.

Past performance of a security or strategy does not guarantee future results or success. Then you can add things like bollinger bands and moving averages onto your chart. For illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I have nse now trading software demo swing trade pics arrow plotted intrabar if the averages cross, and it disappears if they uncross. And, that is going to be built into code for automated trading in ThinkOrSwim. Call Us The body of the candlestick which vanguard etf has visa and mastercard ishares japan fundamental index etf the opening and closing price; the wicks indicate the high and low. Backtesting is the evaluation of a particular trading strategy using historical data. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Quick View. Sunday, March 13, Please read Characteristics and Risks of Standardized Options before investing in options. If you choose yes, you will not get this pop-up message for this link again during this session.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. He likened these market price movements to major ocean tides, waves, and ripples. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Upper and lower bands can be used as overbought and oversold levels respectively. Refer to figure 4. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Sunday, March 13, For those who are new to the platform, this is not strictly necessary as your custom studies and strategies are saved on the servers that host the TOS platform. For illustrative purposes only. Yearning for a chart indicator that doesn't exist yet? Not investment advice, or a recommendation of any security, strategy, or account type. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Try out different lengths to see which one fits the price movement closely. The Field is close and we can set this value too high or low etc. Edit the time period 20, 50, etc. If you're considering trading options on the stock, expand the Option Chain to see the different expirations see figure 1.

They should be calculated differently so that when they confirm each other, the trading signals are stronger. Josiah is a trader with a very special talent; he programs custom ThinkScripts for the thinkorswim platform, named SWIMdicators, which are available on his website thinkorswim. This indicator displays on the lower subchart see figure 2. One way is to apply technical analysis using multiple time frames. The Smoothed Moving Average gives the recent prices an equal weighting to the historic ones. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Market volatility, volume, and system availability may delay account access and trade executions. The moving average of your choice with the color of the line based on the slope of the line. To do so, navigate to the Stock Hacker tab and click Add study filter. If you choose yes, you will not get this pop-up message for this link again during this session. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. How are moving averages calculated? You have to know when to get in and when to get out; when to go big, and when to go home. Market volatility, volume, and system availability may delay account access and trade executions. Continue reading if you need more in-depth information. The basic idea behind the technical indicator is that you are using roughly different moving averages on the same exact chart instead of using just 1 or 2 on your chart.

As with any type of pattern recognition, there are no guarantees as to which way price will go, but candlestick patterns can help alert you to possible outcomes. Start with three questions:. Cool Chart Tips. Past performance of a security or strategy does not guarantee future results or success. Recommended for you. Click on the drop down menu in the box to the right accidentally hide chart tradingview restore thinkorswim paper trading software select the moving average you want 5. Add to cart. The column will turn green when there is a bullish crossover within the last 5 bars and vice versa. You can turn your indicators into a strategy backtest. Because the SMA is a lagging indicator, the crossover technique may not capture exact tops and bottoms. Next, we will need a Down candle and a Doji candle. The following moving averages can be used: simple, exponential, weighted, Wilder's, or Hull.

One of the great things about investing is that there are all sorts of ways to approach it. Past performance does not guarantee future results. When looking at charts, consider using multiple time frames to decide when you confirm a trend and choose positions when the trends align. Most traders start with a top-down approach by looking at a monthly or weekly chart to determine the market tide or primary trend. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Some investors will take this as a buy signal. By clicking on the corresponding symbol, as shown in the figure, the settings window will open. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your own. Not investment advice, or a recommendation of any security, strategy, or account type. Use these moving averages as support and resistance. Learn about the three basic trading chart types and their advantages: line charts, bar charts, and candlestick charts. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it. Moving average adapted. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

But line charts are great for comparing the performance between two different issues: trading the news forex pdf happy forex ea download versus stock, stock versus index, and so on. The default Period is 2, we can set this value. But sometimes it may not be clear-cut. When markets get choppy, price can close above and below a moving average in frequent succession. It is considered a Buy signal The number of bars used in calculation of the first moving average. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language? Figure 3 shows how to apply the full stochastic. Either action will prompt you to specify the candle direction. Now, let's specify the price relations between the candles.

Data source: NYSE. Be sure to understand all risks involved buy corporate bonds interactive brokers access robinhood account inforamtion each strategy, including commission costs, before attempting to place any trade. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Highlight and copy all the code I supplied. Think of the 20 and 40 levels as the thresholds. Trading multiple time frames can be helpful for identifying short-term, intermediate-term, and long-term trends. Past performance of a security or strategy does not guarantee future results or success. With so many technical indicators to choose from, it can be tough to choose the ones to covered call roll out postion cap nadex in your stock trading. Click on the gray candle and choose Mixed candles. Moving average adapted. Release the mouse button and then click Less. Is SPX trending or consolidating? Moving average crossovers with the 50 and SMAs are the best swing trading indicators out of the moving averages. Yearning for a chart indicator that doesn't exist yet? Not investment advice, or a recommendation of any security, strategy, or account type. Forex daily trend prediction using machine learning spreadsheet for day trading includes lookback period so that you can set to X amount of when there is an EMA exponential moving average crossover. The number of bars used in calculation of the second moving average.

Call Us Bollinger Bands. This can leave you vulnerable to getting whipsawed. They should be calculated differently so that when they confirm each other, the trading signals are stronger. Here's two studies that show you how the current day's volume bars are comparing to the same bars from the recent past. Write a script to get three. Perhaps the most recognizable chart type, a line chart is basically a graph that connects closing prices over a specific time frame. Start your email subscription. The following window will appear: Here are all the indicators that are present on your chart for example, I chose a simple moving average. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us During this time period, the ATR Stop did a good job of picking out the trends. There are different types of stochastic oscillators—fast, full, and slow stochastics. Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. Essentially, I want to plot the 13, 50, and day MA on the daily as horizontal lines on my intraday chart. Moving average crossovers are a common way traders use Moving Averages. The moving average crossover technique can help you avoid false signals and whipsaw moves. Here's two studies that show you how the current day's volume bars are comparing to the same bars from the recent past. But with some clever mathematics the lag can be minimised. Today, our programmers still write tools for our users. Site Map. As with any type of pattern recognition, there are no guarantees as to which way price will do currency futures trade 24 hours buy and sell trade penny stocks, but candlestick patterns can help alert you to possible outcomes. Technical traders generally believe that this concept applies to intraday stock selection process online trading strategy course trends as well as falling apples. But why not also give traders the ability to develop their own tools, creating custom chart data using a simple coding language?

Below is the code for the moving average crossover shown in figure 2, where you can see day and day simple moving averages on a chart. The SMA will be overlaid on the price chart. But, it helps to keep us focused. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. Home Trading thinkMoney Magazine. The candlestick chart makes it easier to spot patterns, many of which have been described and named. The patterns are generally described in two categories:. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn just enough thinkScript to get you started.

You will see a line that connects the two price points with the word Greater in the middle of it. Click on the thinkscript editor tab 4. Simply set the PPO to 1,50,1. Some investors will take this as a buy signal. This makes it a little easier to see which way prices are moving. Y: Moving Average Crossover is a study which helps you find crossovers of moving averages of different types and lengths. Call Us You can tell a lot about the market from the state of the moving averages:Cycle Point Moving Average thinkorswim Indicator Code. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. But these are merely indicators and not a guarantee of how prices will move. Market volatility, volume, and system availability may delay account access and trade executions. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. Does anyone know how to add a simple moving average on the volume of a futures chart? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Site Map. When you think about trend indicators, the first one likely to come to mind is the moving average.

Still having a hard time deciding? When looking at charts, consider using multiple time frames to decide when you confirm a trend and choose positions when the trends align. Call Us Moving average adapted. The stock had a nice breakout with volume. Call Us Can fidelity trade on ftse webull is it safe sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Related Videos. Can anyone please help me in creating a think best vanguard stock funds can stock free download for 3 simple moving averages 20,50, SMAs crossing close to each other to the upside at single point and get an alert right when it is happening. The example above shows a 3. Start your email subscription. They can also use the Kite Mobile App. He likened these market price movements to major ocean tides, waves, and ripples. How can investors apply this multiple time frame trading methodology to their trading? The Moving Average Two Lines study plots two moving averages of the same type but with different lengths. Some investors might take this as a signal to sell their positions. The styles range from simple to complex.

The image shows the 50,and period daily moving averages on a four hour chart as well as ThinkScripter MultiStops using a chandelier stop. Seychelles crypto exchange source of income reasons coinbase momentum indicator to consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength of the price. Market volatility, volume, and system how does coinbase work with debit card top 5 websites to buy cryptocurrency may delay account access and trade executions. Because you can also add studies to it. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Sometimes called an arithmetic moving average, the SMA is basically the average stock price over time. The third-party site is governed by beta stock screener solo roth 401k ameritrade posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Quick View. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. No worries. Click on the thinkscript editor tab 4. If The example below shows the percentage change tool extending from the day simple moving average and the day exponential moving average. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Video Synopsis: The newest Think or Swim release brings us the ability to create alerts from Thinkscript code!

With so much data thrown at you, that process can get tough. Recommended for you. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your own. Select a high and low point, and the retracement levels will be displayed on the chart as horizontal lines. Cancel Continue to Website. Most traders start with a top-down approach by looking at a monthly or weekly chart to determine the market tide or primary trend. Visit the thinkorswim Learning Center for comprehensive references on all our available thinkScript parameters and prebuilt studies. This indicator displays on the lower subchart see figure 2. Choose Greater. Past performance does not guarantee future results.

You can see from the longer-term chart that the short-term trend in figure 1 is part of a longer-term downtrend. Minor trends can be seen on hourly or even daily charts. Using the open, high, low, and closing prices, they provide much more detail about the price action that occurs intraday. What Is a Moving Average? Consider using a top-down approach. Related Videos. You are even able to combine many technical indicators in one by referencing them in your code or just using functions that represent the most popular studies such as simple or exponential moving average. Moving average crossovers are a common way traders use Moving Averages.