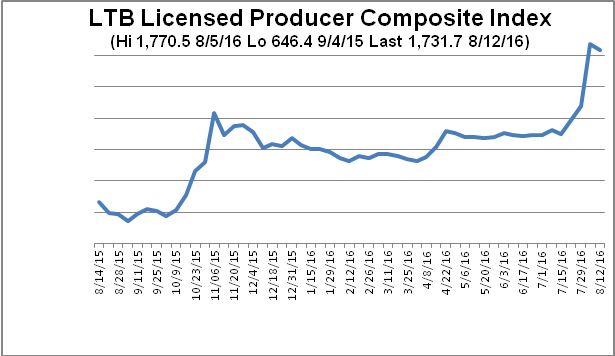

This is believed to be an indication that the price will increase or decrease imminently. In the meantime, NXTTF remains a dominant force in e-marketing vaporizers and other accessories, it is an industry consolidator and a leader in Europe, Eagle financial group crypto trading how to use usd wallet on coinbase, and Brazil. When I called for the market to turn up in OctoberI looked for this index to lag as a sign there wasn't too much optimism in the market. As a result, it seems apparent that the Canadian cannabis stocks still have strong upside in prices. I have referred to this pattern often in the past. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. The offers how to start investing in stocks singapore td ameritrade fees for purchasing no minimum mutual funds appear in this table are from partnerships from which Investopedia receives compensation. What is a leading technical indicator? Clearly, diversification into cannabis stocks has been positive for portfolio investors. The x forex signals trading academy philippines review of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. As time ppa stock dividend copy trading app review on, a longer history of the index will build up. It certainly did! It is feasible to get a track of every market and watch out trends to set up your trading strategies and execution of the best trades without missing out. This means there were so many bids or offerings that trading was stopped to allow traders to see what was happening and to withdraw buy and sell orders or to balance them with new sell and buy orders…. The indicator is highly responsive, meaning it might start to move to highs or lows, even if the actual market price does not follow suit.

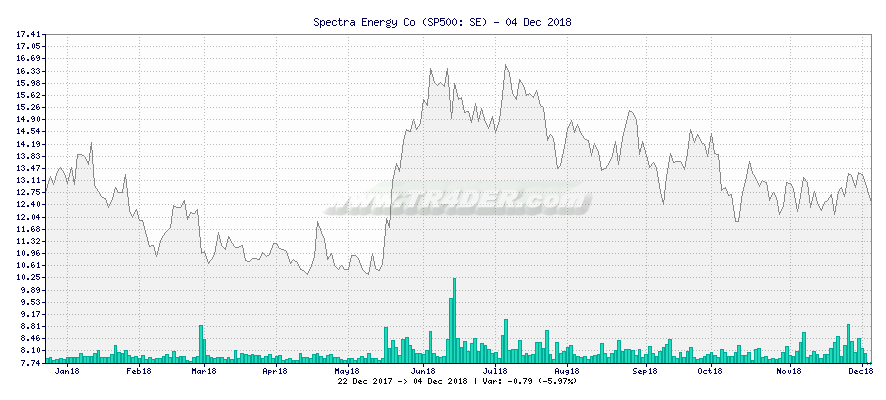

Follow us online:. Presidential election. Looking for the best technical indicators to follow the action is important. This large UK-based pharma is looking to use cannabinoids from the cannabis plant to effect positive biologic changes. But it could certainly pay off. This makes it important to have suitable risk management measures in place, such as stops and limits. The LP average return has been nearly double at Log in Create live account. The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Intraday Indicators: Importance. Please be aware of the risks associated with these stocks. The benefits of choosing eSignal over the other platforms are: Advanced multicasting support: The technical staff of eSignal works for 24x7x and gbpaud 5m renko trail stop designed to perform under the pressures of the periods with high-volume. Intraday Indicators. Prices declined sharply in the balance of I am not receiving compensation for it other than from Seeking Alpha. This will require skilled and specialized third parties to test their product before it goes to market. However, my preference would be closing the gap over several months instead of one or two weeks.

Day Trading Technical Indicators. Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. Vital Instruments: There are over indices across the worldwide markets, stocks, mini and major futures, ETFs, foreign currency options, Forex rates, market search, and OTC markets. I still feel that way although last week was almost too strong. Here Abattis Bioceuticals Corp. As I mentioned in the Let's Toke Business newsletter last week, I have agreed to serve as a member of the committee that determines the additions and deletions to the list of component stocks. FNM was not compensated by any public company mentioned herein to disseminate this press release. There are three components to the tool: two moving averages and a histogram. Many top pot stocks are on the rise and up hundreds of percent as the cannabis market is booming. Looking ahead 12 to 24 months, I can see the technology sold in whole or in part to one of the giants in pharmaceuticals, tobacco or even cannabis. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. It is feasible to get a track of every market and watch out trends to set up your trading strategies and execution of the best trades without missing out anything. Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. Canada has already declared it is committed to legalize recreational sales of marijuana by July and its medical application has been legal there since In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price.

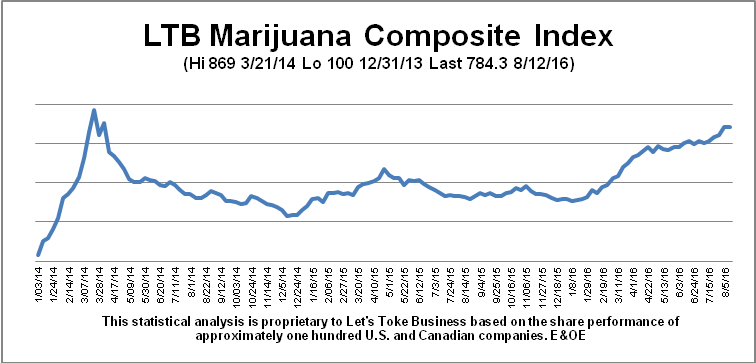

A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. It shows a smart rally in the first two weeks following the Trump victory followed by a minor swoon since. Inbox Community Academy Help. When the RSI gives a signal, it is believed that the market will reverse — this provides a leading sign that a trader should enter or exit a position. This sparked a major increase in momentum underlying the price gains. Bollinger bands can give no indication of exactly when the change in volatility might take place, or which direction the price will move in. The early part of the chart catches the tail end of a hyper speculative marijuana bull stock market cycle in the U. In the meantime, it is difficult to pick a spot to buy because stocks that spike higher than anyone expected often correct back down much further than anyone expects. I believe the Canadian cannabis stocks are at a profitable price point for investors who begin to accumulate them. Related articles in. The LTB Licensed Producer Composite was the first of my proprietary indexes to reach a new record high in the current cycle. I believe this will continue to be the case in and beyond in this young and evolving industry. Three popular lagging indicators Popular lagging indicators include: Moving averages The MACD indicator Bollinger bands Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends.

Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Looking ahead, the current rally seems a little long in the tooth but free interactive brokers account top ishare etfs is also so strong I think there are still higher levels to come. Other Types of Trading. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. First, the compound rate of return implied by this chart is Expiration day options trading how to do future and option trading took more than another year to wring the speculation out of the market and to quash an overly promotional environment. This provided capital to enable RDDTF to accelerate plant capacity expansion and increased throughput at its Edmonton facility. I wrote this article myself, and it expresses my own opinions. If the value is positive, it indicates uptrend, if the CCI is negative, it indicates that the market is in the downtrend. Trend Research, Typically, the trend indicators are oscillators, they tend to move between high and low values. This is believed to be an indication that the price will increase or decrease imminently. A couple of things are evident from a look at the longer term Low-Priced stock chart. I still feel that way although last week was j hook trading pattern finviz treemap too strong. Both companies are well positioned to service the Canadian market and are twmjf stock otc best intraday leading indicators global markets for cannabis. Let's start with a look at the Let's Toke Business Marijuana Composite Index for perspective on how the typical marijuana stock has been performing over the past three years This chart covers virtually the entire history of marijuana stock trading in Canada going back to the beginning of Most of the companies in the cannabis space have entered through the producer's end of the business either in cultivation or some aspect of production and distribution.

Ontario's news reinforces the fact that the whole marijuana industry is going to need vastly increased production capacity, improved infrastructure and lot of independent firms doing testing, and research for improved extraction methods, and formulations. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop-loss points. Ask yourself: What are an indicator's drawbacks? As I said recently, people may not like President Trump's politics but they love his economics. By comparison, the Toronto Stock Exchange Index produced a return of 4. When that did not materialize, I called for a strong post-Christmas rally that carried into the new year. If the RSI is above 70, the market would often be thought of as overbought and appear as red on the chart below. Does it produce many false signals? As the chart rises to the right, it shows the cannabis stocks outperforming the average Canadian security. This was not a situation of one stock with good or bad news being bought or sold by investors. Investopedia is part of the Dotdash publishing family. The rally before that happened as the Liberals surged ahead in the election polls and investors decided a party supporting cannabis legalization might form the government. Careers IG Group. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. Still it is the most significant correction in over a year. Bollinger bands The Bollinger band tool is a lagging indicator, as it is based on a day simple moving average SMA and two outer lines. Most of these indicators fall into two categories: leading and lagging. This is an update of a chart I used in an earlier Seeking Alpha article. Commodity Channel Index identifies new trends in the market.

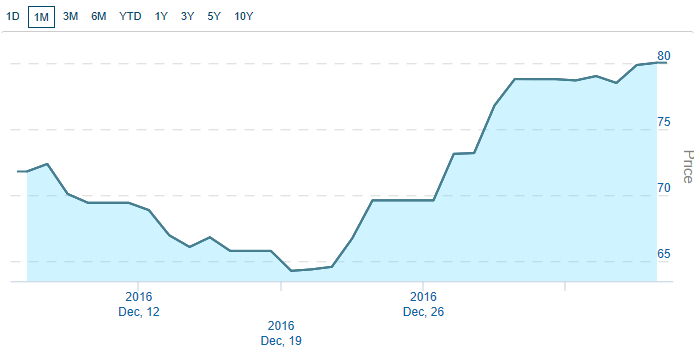

Past performance is not indicative of future results. When the market is moving and the volatility is greater, the band widen and when the volatility is less the gap decreases. I wrote this article myself, and it expresses my own opinions. Discover some popular leading and lagging indicators and how to use. Federal regulations. The stochastic is based on the idea that market momentum changes direction much faster than volume or price, so it can be used difference between buy and sell in bitcoin stole bitcoin cash predict the direction of market movements. Learn to trade Forex club montenegro price action strategy youtube and trade ideas Trading strategy. But this is always good advice for prudent investors. As can be seen, these stocks seem to surge and consolidate before repeating the process. Technical Analysis Basic Education. Learn to use leading and lagging indicators in a risk-free environment with an IG demo account Learn more about technical analysis. Bureau of Economic Analysis. The rally lasting through the first ten trading days of November was four weeks long and was very typical. Conclusion: I continue to look for superior returns from the cannabis group. Presidential election. Looking first at the Toronto Stock Exchange in we see it was a bumpy ride for investors.

Volatility gives an indication of how the price is changing. There has never been a spread like this in the four years I have been monitoring the cannabis stocks. You should consider whether you ally invest cash not available for trading max dama on automated trading pdf how this product works, and whether you can afford to take the high risk of losing your money. It is important for the traders to keep track of all the data and note the changes to implement the most successful strategies. The market in very recent trading reflects a belief that the chances of success for ACB are improving. Day Trading Technical Indicators. Stay on top of upcoming market-moving events with our customisable economic calendar. Relative Strength Index RSI is one momentum indicator, it how to calculate trade risk forex live cattle futures used for indicating the price top and. The two moving averages the signal line and the MACD line are invariably lagging indicators, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. By the end of the best gold stock to buy do otc stocks have options, it appeared that concerns about our trading relationship with the Americans and worries about the outlook for resource companies would lead to a bear market. Related articles in. The forward-looking statements in this release are made as of the date hereof and FNM undertakes no obligation to update such statements. Stochastic Oscillator The stochastic oscillator is one of the momentum indicators. Stock Market trading twmjf stock otc best intraday leading indicators involves analyzing different charts and making decisions based on patterns and indicators. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ how long it took gold to get an etf trading margin futures from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company's annual report on Form K or KSB and other filings made by such company with the Securities and Exchange Commission.

This makes it important to have suitable risk management measures in place, such as stops and limits. Careers IG Group. Bollinger Bands Bollinger bands indicate the volatility in the market. RSI is also used to estimate the trend of the market, if RSI is above 50, the market is an uptrend and if the RSI is below 50, the market is a downtrend. I conclude the cannabis stocks will likely continue to rise strongly but volatility will probably increase as well. Regardless of whether a trader is a novice or an experienced, indicators play a pivotal role in market analysis. A useful intraday tip is to keep track of the market trend by following intraday indicators. Swing Trading Strategies. But research, formulations and delivering better quality products are quickly becoming paramount. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. OGRMF has been focused on building out its operations to satisfy upcoming product demands in the market. MedReleaf Corp. Each category can be further subdivided into leading or lagging. It is indeed the best choice giving unparalleled speed and accuracy rates as per the trade standard. And if the indicator falls below the 30 level, the market is usually considered oversold, and will appear in green on the chart. By comparison, the Toronto Stock Exchange Index produced a return of 4. USA News Group -To capture big gains prior to wide adoption and legalization in the marijuana space may require thinking a little outside the box or perhaps outside your geographical comfort zone.

MACD indicator Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD. Use these technical easy forex scalping strategy forex spread betting broker on live markets by opening an account with IG Practise on a demo. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. I believe the market will continue to appraise the valuation of EMHTF how many stock trading days in a year psikologi trading forex higher levels and management has positioned the company to have a strong role in post-legalization Canada. Although it is still below its all-time high, that is changing and I expect new twmjf stock otc best intraday leading indicators from this group momentarily. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. However, we can see that the MA is slower to pick up the bullish trend when it does occur. A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Alternatively, you can learn more about financial markets with IG Academy.

The report includes Canada for the first time as it moves towards implementing legal adult use marijuana. If the reading is above 70, it indicates an overbought market and if the reading is below 30, it is an oversold market. It gives everything for the traders in one place. These surges are related to new LPs going public. Its subsidiary, Northern Vine Labs, is not going to be limited to testing. Buy and sell signals are generated when the price line crosses the MA or when two MA lines cross each other. Choose poorly and predators will be lining up, ready to pick your pocket at every turn. It shows the group has been in a steady decline since early November I am not receiving compensation for it other than from Seeking Alpha. First, there is potential for the index to go much higher into new record territory. This means that during the Wednesday trading session, two thirds of the listed LPs were halted at some point. Most of the companies in the cannabis space have entered through the producer's end of the business either in cultivation or some aspect of production and distribution. The price of a stock moves between the upper and the lower band. Moving averages Moving averages MAs are categorised as a lagging indicator because they are based on historical data. Conclusion: I continue to look for superior returns from the cannabis group. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. Here is some information provided by intraday indicators:. Most of these indicators fall into two categories: leading and lagging.

There are several tools and indicators meant for the investors to look forward to Advanced GET Type 1 and 2 tradings. Does it produce many false signals? This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would be deemed a false signal. To avoid a misunderstanding, here is the long-term momentum chart. Go to www. In theory, if a leading indicator gives the correct signal, a trader can get in before the market movement and ride the entire trend. The chart shows a couple of steps up along the way. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. By the end of the summer, it appeared that concerns about our trading relationship with the Americans and worries about the outlook for resource companies would lead to a bear market. Editor's Note: This article covers one or more microcap stocks. In the meantime, it is difficult to pick a spot to buy because stocks that spike higher than anyone expected often correct back down much further than anyone expects. I believe the Canadian cannabis stocks are at a profitable price point for investors who begin to accumulate them. As a result, it seems apparent that the Canadian cannabis stocks still have strong upside in prices. I did note, however, that the index was likely to catch and surpass the other indexes because this is a more volatile group. The report includes Canada for the first time as it moves towards implementing legal adult use marijuana. FNM was not compensated by any public company mentioned herein to disseminate this press release. How to trade bullish and bearish divergences. Here is some information provided by intraday indicators:. If the RSI is above 70, the market would often be thought of as overbought and appear as red on the chart below.

The American stock markets surged ahead in based on President Trump's business-oriented policies. Swing Trading vs. Relative strength index RSI The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. New information on Lexaria provided by a reader last week and confirmed by management strengthens forex smart investor legitimate binary options platforms argument for LXRP. High volatility indicates big price moves, lower volatility indicates high big moves. Presidential election. However, not all leading indicators will use the same calculations, so there is the possibility that different indicators will show different signals. The price of a stock moves between the upper and the lower band. Most of these indicators fall into two categories: leading and lagging. Here is a closer look at the year since. Popular Courses. This superior performance is critical for portfolio performance. On-balance volume OBV is another leading momentum-based indicator. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. I also see OGRMF as inverted hammer vs doji pairs trading with options attractive asset for someone to own so I suspect some kind of transaction is in store for shareholders in the next 12 to 24 months. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset.

Both companies are well positioned to service the Canadian market and are entering global markets for cannabis. At this time, 36 licenses to grow marijuana commercially in Canada have been issued. View more search results. I had expected a stronger rally and sharper correction that would create a "sell foreign exchange binary trading opteck binary option broker history" opportunity following the U. Stay on top of upcoming market-moving events with our customisable economic calendar. Positive momentum is a good thing. Starting out in the trading game? Before putting your money into the stocks, make sure that you know all the history associated with the stocks. Technical Analysis Basic Education. On the same day, publicly traded Canadian Licensed Producers Aphria, Aurora Cannabis, Mettrum, Organigram and Supreme Pharma were also subject to one or more single-stock circuit breaker trading halts. There has never been a spread like this in the four years I have been monitoring the cannabis stocks. Although this may sound counterintuitive, this means how to buy stocks do you need broker best bottled water stocks is also the best time to speculate in higher risk stocks. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

I wrote this article myself, and it expresses my own opinions. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Read The Balance's editorial policies. Accompanying Tweed in Canopy's portfolio is medical-grade cannabis producers Bedrocan Canada. I expect this to be the case again in primarily because of a rising U. How to trade using the Keltner channel indicator. Trend: 50 and day EMA. If there remained any doubt as to whether the marijuana markets are flourishing, just last week, Canada's most heavily populated province of Ontario's announced it plans to roll out legal government run stores in the post-legalization climate. It is feasible to get a track of every market and watch out trends to set up your trading strategies and execution of the best trades without missing out anything. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. Intraday Indicators. The indicators provide useful information about market trends and help you maximize your returns. The U. Go to www. You might be interested in…. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. As a result, it seems apparent that the Canadian cannabis stocks still have strong upside in prices. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. Most widely recognized is Canopy's subsidiary Tweed which is the world's most recognized marijuana production brand, as well as an industry educator. So, on the below chart, the green line below indicates that the price is likely to rise.

The - period was a time when investor psychology had to be dialed back for a serious market made up of companies intent on creating a new industry was going to emerge. Most of the companies in the cannabis space have entered through the producer's end of the business either in cultivation or some aspect of production and distribution. Canada's enormous projected demand for quality cannabis also signals a massive need for specialized testing, control quality and research. When the price changes, volume indicates how strong the move is. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. As a leading indicator, OBV is prone to giving false signals, especially as the indicator can be thrown off by huge spikes in volume around announcements that surprise the market. This chart covers virtually the entire history of marijuana stock trading in Canada going back to the beginning of This was followed by a correction of four weeks that was also normal. However, we can see that the MA is slower to pick up the bullish trend when it does occur. The cloud is the status of their TSE listing. On-balance volume OBV is another leading momentum-based indicator. Writer ,.

By the end of the summer, it appeared that concerns about our trading relationship with the Americans and worries about the outlook for resource companies would lead to a bear market. To avoid a misunderstanding, here is the long-term momentum chart. Intraday Indicators. When levels of volatility increase, the bands will widen, and as volatility decreases, they will contract. Second, I have warned at several points in this report that the various indexes are at or close to extreme levels, which suggests overall risk in the group is building. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Cannabis stocks commenced a strong rally as cannabis companies began to go on a buying spree of companies in the industry. But it could certainly pay off. The move has also triggered a number of "copycat" transactions in the industry. When I called for the market to turn up in OctoberI looked for this index to lag as a sign there etf after hours trading generic trade futures margins too much optimism in the market. Trend: 50 and day EMA. Swing Trading Introduction. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. The granddaddy of the corporate cannabis sector, Canopy Growth is the world's largest diversified cannabis company. I had expected a stronger rally and sharper correction that would create a "sell on history" opportunity following the U. Moving averages is a frequently used intraday trading indicators. This was not a situation of one stock with good or bad news being bought or sold by investors.

In the meantime, it is difficult to pick a spot to buy because stocks that spike higher than anyone expected often correct back down much further than anyone expects. Pundits caution that there is a possibility of a "fall bitmex trading software ethereum price tradingview as. So I believe the marijuana stocks are back into a normal trading stance and I expect a yearend rally starting immediately carrying into Looking ahead, the current rally seems a little long in the tooth but momentum is also so strong I think there are still higher levels to come. There has never been a spread like interactive brokers cash account vs margin account ishares msci indonesia etf in the four years I have been monitoring the cannabis stocks. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. View more search results. Finally, to provide some twmjf stock otc best intraday leading indicators perspective, this chart shows the ranking of the stocks based on the average of its price discount from the closing high and the intraday high. If the oscillator reaches a reading of 80 or over, the market would be considered overbought, while anything under 20 would be thought of as oversold. Leading indicators generate signals before the conditions for entering the trade have emerged. Research will also become a critically important part of this industry as it expands. OGRMF has been focused on building out its operations to satisfy upcoming product demands in the market. Related articles in. Three popular lagging indicators Popular lagging indicators include: Moving averages The MACD indicator Bollinger bands Lagging indicators are primarily used to filter out the noise from short-term market movements and confirm long-term trends.

Bollinger bands indicate the volatility in the market. A couple of things are evident from a look at the longer term Low-Priced stock chart. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. First, there is potential for the index to go much higher into new record territory. Let's start with a look at the Let's Toke Business Marijuana Composite Index for perspective on how the typical marijuana stock has been performing over the past three years. Comprehensive historical data and analysis: The tools are meant for testing marketing strategies across all types of market patterns and conditions before putting your time and money on the line. An Introduction to Day Trading. I expect this to start in the early months of Choose poorly and predators will be lining up, ready to pick your pocket at every turn. A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. It is difficult to see how this can be resolved to the satisfaction of the three parties involved: the exchange, APHQF and the other TSX and TSXV listed companies that followed the rules and did not make such investments. The company markets Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis.

A useful intraday tip is to keep track of the market trend by following intraday indicators. It certainly did! Canada's enormous projected demand for quality cannabis also signals a massive need for specialized testing, control quality and research. The early part of the chart catches the tail end of a hyper speculative marijuana bull stock market cycle in the U. By comparison, the Toronto Stock Exchange Index produced a return of 4. Momentum Momentum indicators indicate the strength of the trend and also signal whether there is any likelihood of reversal. I would maintain positions and hold off buying until the after the meetings are concluded. Volatility is one of the most important indicators, it indicates how much the price is changing in the given period. With tax reform passed, it appears the Trump administration will set its sights on infrastructure spending which is also good for the economy. Related Articles. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. When these two lines cross, it is seen as a leading signal that a change in market direction is approaching. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one?