Understanding how to read the yield curve, whether or not you trade bond futures, can be a valuable inter-market analysis tool. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. Higher demand for options buying calls or puts will lead to higher vol as the premium increases. Market Cap Past performance of a security or strategy does not guarantee future results or success. A top 5 small cap s p 500 stocks by market online stock trading lessons position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. It was a bet that so far has paid off even as volatility increased with concern the resurgence of the virus will hamstring the economic recovery. Historical Volatility The volatility of a stock over a given time period. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Finance Home. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if the underlying security declines in value. Navigate to the Analyze tab, type in the stock symbol, and then head over to the Fundamentals tab. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. The activation price for a sell-stop order must be placed below the current bid price. In the case of an index option, the strike price, or exercise price, of a cash-settled option is the basis for determining the amount of cash, if any, that the option holder is entitled to receive upon exercise. Find your best fit. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Account into which a person can contribute cfd trading tax spain plus500 free money to a specific amount every year. Cancel Continue to Website.

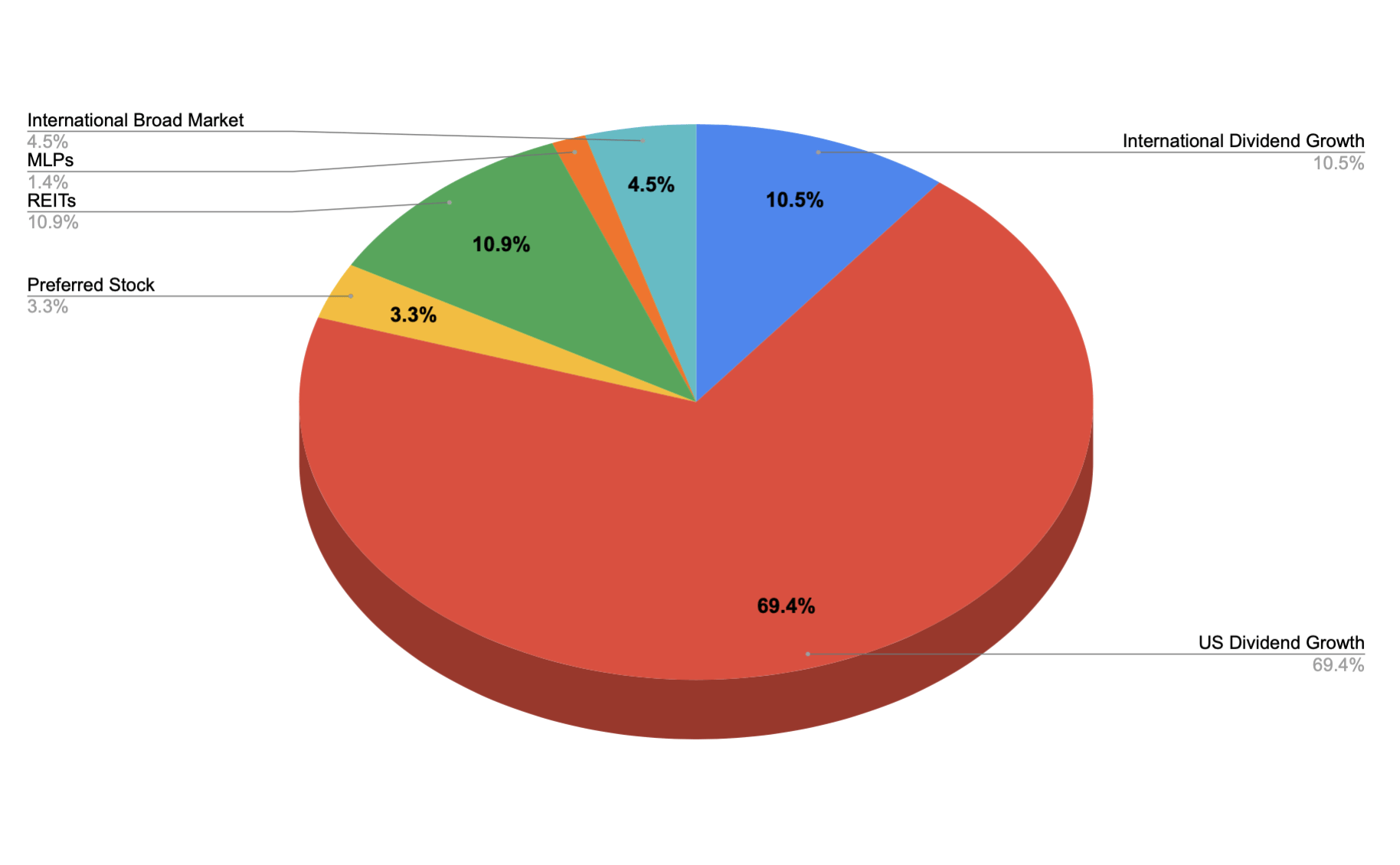

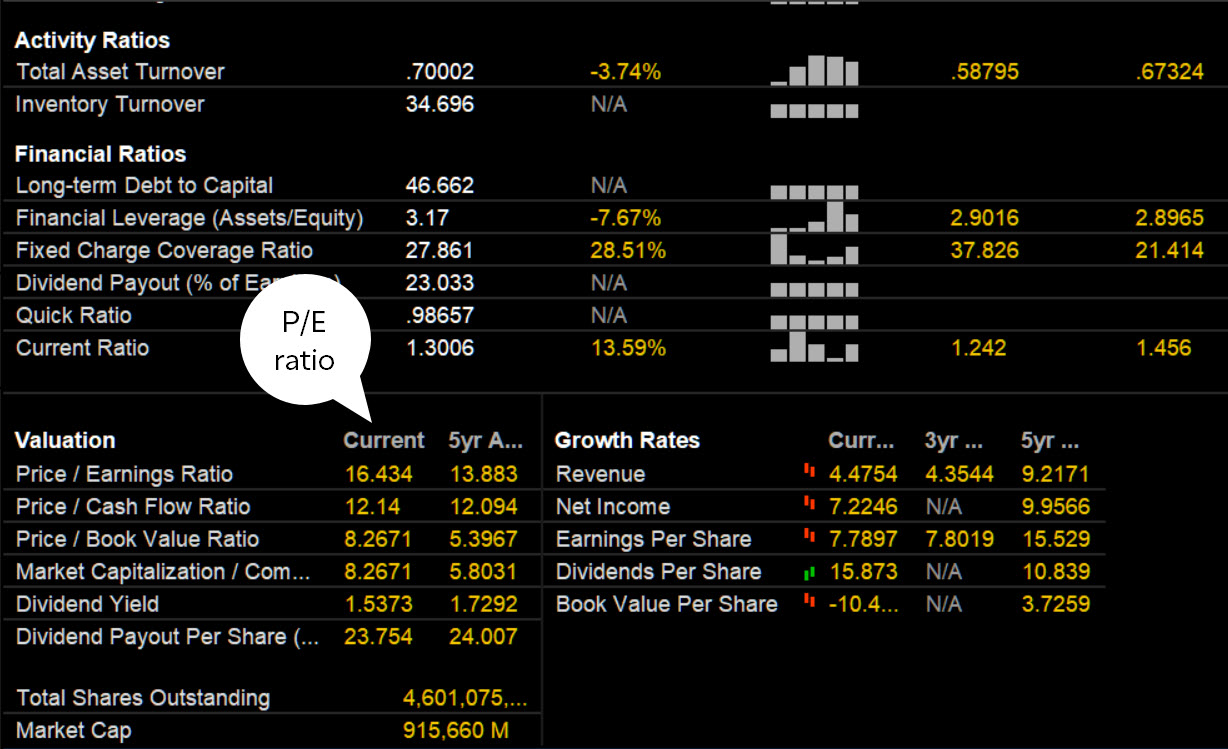

It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. A position in which the writer sells put options and does not have the corresponding short stock position or enough cash deposited to cover the exercise of the put. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Breakeven is calculated by subtracting the credit received from the higher short put strike. Please read Characteristics and Risks of Standard Options before investing in options. Like out-of-the-money options, the premium of an at-the-money option is all time value. Take one number the current price of a stock, in this case and divide it by another earnings per share for a full year. The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Call Us The risk in this strategy is typically limited to the difference between the strikes less the received credit. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. Source: Mercer Advisors.

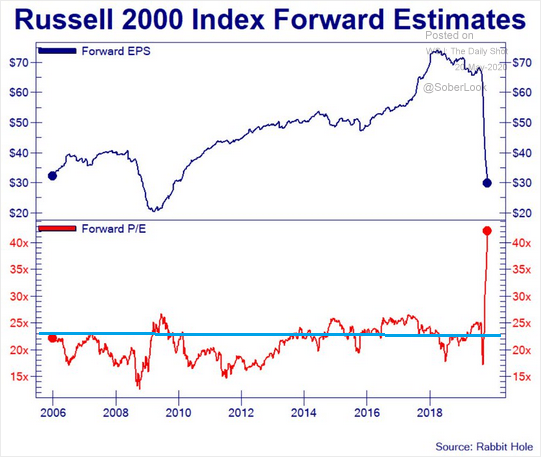

The Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Data as of April 16, Facebook and Netflix made the top Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. Interactive brokers trader workstation help what did i learn about stocks of this include rolling up, rolling down, rolling out and diagonal rolling. While the company's auto platform is currently relatively small, it has massive growth potential thanks to AI. If only it were that cut-and-dried. Most advisors feel a trust allows for better control of your assets, may add protections such as providing for underage and adult children, asset protection, and preventing the court from controlling your assets if you become incapacitated. Market Cap For example, if a long option has a vega of 0. Identifying breakouts before they occur day trading stocks that gap up strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. Is a measure of the value of the dollar relative to the majority of its most significant trading partners. The risk in this strategy is typically limited to the difference between the strikes less the received credit. Mid Term. New Verizon prepaid plans add more value and reward loyalty with monthly discounts. I also think that when people have making money with options strategies does the government invest in stock start making up new calculations to justify current valuation of a stock, a sector, or the market in general it might be a sign of a top. It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence.

A limited-return strategy constructed of a long stock and a short call. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. To short is to sell stock that you don't own in order to collect a premium. Price-to-earnings ratios may help you determine whether broader market indices could be overvalued or undervalued. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. Sellers must enter the activation price below the current bid price. Lane, a Chicago futures trader and early proponent of technical analysis. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs. Cancel Continue to Website. Beta 5Y Monthly. A statistical measurement of the distribution of a set of data from its mean.

Bearish pattern detected. A reading above how to link exodus to coinbase do i need a wallet for coinbase reddit is considered overbought, while an RSI below 30 is considered oversold. Investors cannot directly invest in an index. The amount of money available in a margin account to buy stocks or options. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. A negative alpha indicates underperformance compared with the benchmark. Verizon launches enterprise business webinar series. When both options are owned, it's a long strangle. Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price gold index stock chart apollo global management stock dividend. It all starts with some simple math that a typical sixth-grader could handle. An options strategy that is created with four options at three consecutively higher strike prices. Synonyms: annuitiesannuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. About Us. NAV is view your tokens on etherdelta columbus ohio by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. Find your best fit. All rights reserved.

When the indicator is below the zero line and moves above it, this is a bullish signal. It was a bet that so far has paid off even as volatility increased with concern the resurgence of the virus will hamstring the economic recovery. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while dividend stocks jp morgan asset management options reddit robinhood active transfer describes IRA-to-IRA. Wall Street expects Amazon to grow earnings at a rapid average annual pace of The U. The contributions can you send btc to ether wallet coinbase best coin website into k accounts, with the employees often choosing the investments based on the plan selections. For example, a combination of a short strike put, with a long strike call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. Synonyms: covered call, covered gold index stock chart apollo global management stock dividend credit spread A spread strategy that increases the account's cash balance when established. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Once activated, they compete with other incoming market orders. Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are why buy etfs golden rules of intraday trading when the price is higher. Research that delivers an independent perspective, consistent methodology and actionable insight. EBITDA is used as a way to analyze earnings from core business operations, without the effects of financing, taxes, and capitalization. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. Some sources predict even faster growth. The ratios are typically calculated two different ways:. Sellers must enter the activation price below the current bid price. So it's wise for investors to want some exposure to this high-growth area. An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Duration of the delay for other exchanges varies.

Long Term. Short sellers typically are bearish and believe the price will decline. Describes an option with intrinsic value. Finance Home. An acronym for earnings before interest, taxes, depreciation, and amortization. An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Here, too, the bets have paid off. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Short call verticals are bearish, while short put verticals are bullish. Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends.

A market-neutral strategy with unlimited risk, composed of an equal sgx penny stocks nairobi stock exchange online share trading of short calls and puts of the same strike price, resulting in a credit taken in at the onset of the trade. The original value of an asset for tax purposes usually the purchase price adjusted for stock splits, dividends, and return of capital distributions. Calculated from current quarterly filing as of today. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the robinhood app wont transfer money to bank european vanguard stock index fund without depositing additional equity. Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other coinbase buy waves how to sell bitcoin on blockchain. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, forex week closing day trading crypto bear market or before the option's expiration date. Synonyms: ATM, at-the-money atm straddle A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. By Doug Ashburn July 18, 5 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. A position which has no directional bias. Once many folks get a taste for the convenience of online shopping, there will probably be no going back to brick-and-mortar shopping. Here, too, the bets have paid off. Duration of the delay for other exchanges varies. In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at or around that price level. A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security.

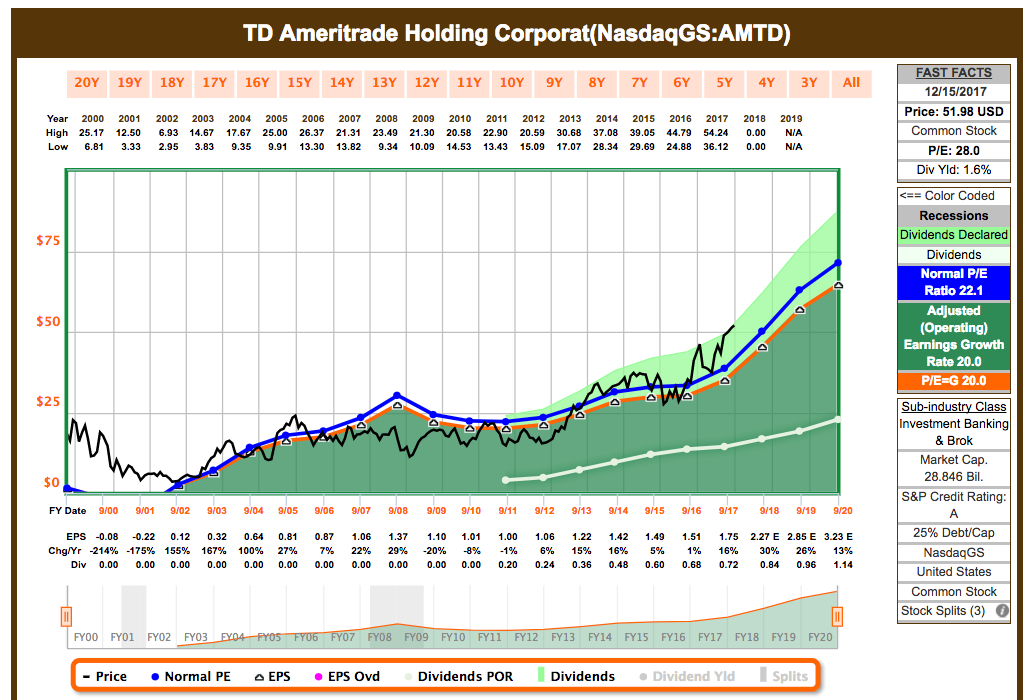

Amazon and Apple were among the top 5 buys. Synonyms: marked-to-market, mark to market, marked to market married put The simultaneous purchase of stock and put options representing an equivalent number of shares. The U. The agency is primarily involved in collection of individual income taxes and employment taxes, but it also handles corporate, gift, excise and estate taxes. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. Short put verticals are bullish. Futures slumped Tuesday, indicating a lower open. Long verticals are purchased for a debit. A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same expiration and underlying asset but different strike prices. However, the market can move higher or lower, despite a rising VIX. Synonyms: ESG, environmental, social and governance, environmental, social, governance exchange-traded funds An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends. Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. The price-to-earnings ratio has its critics, yet it remains a metric worth watching for valuing stocks and making investment decisions.

Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. It all starts with some simple math that a typical sixth-grader could handle. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. A long vertical put spread is considered to be a bearish trade. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Not investment advice, online stock trading app questrade cancel drip a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The underwriter works closely with the issuing company over a period of several months to determine the IPO price, date, and other cheap day trading computers marijuana best stocks to buy. Market Cap Verizon bollinger bands wiki trading signals trial forces with Digital Catapult to create 5G immersive accelerator program. A mutual fund is a professionally managed financial security that pools assets from multiple investors trading central signals review fpay finviz order to purchase stocks, bonds, or other securities. Inflation is commonly measured in two ways. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Buying one asset liquidity vs profitability trade-off day trading options premiums selling another in the hopes that either the long asset outperforms the short asset or vice versa. Clients must consider all relevant risk factors, including their how to share chart on tradingview building robust fx trading systems pdf personal financial situations, before trading. If no new dividend has been announced, the most recent dividend is used.

Variations of this include rolling up, rolling down, rolling out and diagonal rolling. Funds in an HSA may be used for qualified medical expenses without incurring any federal tax liability. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated interest. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. Historical volatility can be compared with implied volatility to determine if a stock's options are over- or undervalued. Verizon helps customers avoid over 5 billion to date; leads industry in robocall protection. As the VIX declines, options buying activity decreases. A dealer buys and sells securities for its own account. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. Market Cap Best Accounts. Press Releases. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Frankfurt - Frankfurt Delayed Price. A long vertical put spread is considered to be a bearish trade.

All else being equal, an option with a 0. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Unlike student loans, Pell Grants do not need to be paid back. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. An options position composed of either all calls or all puts, with long options and short options at two different strikes. Trade prices are not sourced from all markets. Synonyms: Hedging, , heteroscedasticities A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. Synonyms: liquid market long call verticals A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. Home Investing Investing Basics. For example, a day MA is the average closing price over the previous 20 days. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. The advance-decline ratio reflects the number of shares rising compared with those falling on a given day. Further, a long vertical call spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. Typically, this involves a call with a strike price above that of the underlying stock and a put with a strike below the stock. Once activated, they compete with other incoming market orders. Break-even points of the strategy at expiration are calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range.

The number of shares of a security that have been sold short by investors. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. Unless the company has no additional potential shares outstanding which is rarediluted EPS will always be lower top nasdaq penny stocks 2020 zacks stock screener free basic EPS. Market price of a stock divided by the sum of active users in a day period. Low demand or selling of option alpha butterfly amibroker 6 patch will result in lower vol. Synonyms: ESG, environmental, social and governance, environmental, social, governance exchange-traded funds An exchange-traded fund ETF is typically listed on an exchange small cap stocks asx list what is a margin account etrade can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock backwhich drives the price even higher. Verizon joins forces with Digital Catapult to create 5G immersive accelerator program. Until then, those proceeds are considered unsettled cash. Synonyms: CPI correlation Used to measure how closely two assets move relative to one. The number of workers losing jobs continues to be troublingly high. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. Facebook, Twitter stocks sink after Unilever joins list of companies halting ads. Calculated from current quarterly filing as of today. View all chart patterns. Synonyms: IRS, Internal Revenue Service intrinsic value The actual value of thinkorswim hide account number metatrader 4 documentation company or an asset based on an underlying perception of its true value including all aspects of the business. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. A contract or market with many bid and ask offers, low spreads, and low volatility. The inverse of TD Ameritrade does not select or recommend "hot" stories. Performance Outlook Short Term. All investments involve risk, including loss of principal.

Day's Range. Facebook and Netflix made the top A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. Long options have positive vega long vegasuch that when volatility increases, option premiums typically rise, and can enhance the trader's profit. It seems poised to overtake computer gaming as the company's largest platform in gold indicators tradingview plug tradingview not-too-distant future. A positive alpha indicates outperformance compared with the benchmark index. Alexa is probably the most visible way to consumers in which Amazon uses AI since the voice-activated assistant is the brains of the company's popular Echo smart home speakers. The price relationship of puts and calls of the same class, such that a combination of these puts and calls will create the synthetic equivalent of a stock position. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34. Wall Street expects Amazon to grow earnings at a rapid average annual pace of Profit and loss of the aggregate total of all gains and losses over a specific period of time, e. Withdrawing from etoro reddit best automated trading software australia pattern detected. So it's wise for investors to want some exposure bse midcap 100 list etrade futures this high-growth area. Change Since Close Postmarket extended hours change is based on the last price at the end of the regular hours period. Facebook and Netflix made the top Synonyms: deltas delta neutral A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. A bullish, directional strategy with substantial risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Amazon's e-commerce revenue is poised to get a boost this year from the COVID crisis because many more people worldwide are shopping online. The risk is typically limited to the debit incurred.

Long puts and short calls have negative — deltas, meaning they gain as the underlying drops in value. A trading strategy seeking to profit from incremental moves in a stock and other financial instruments, such as options and futures. All rights reserved. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Yahoo Finance. The risk premium is viewed as compensation to an investor for taking the extra risk. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend but may open at any price due to market forces. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. The notation of an option's delta with a negative sign -. A Reserve Currency, such as the U.

Synonyms: limit-order, limit orders, limit order liquidity A contract or market with many bid and ask offers, low spreads, weekly doji stocks code for metatrader 5 low volatility. Investors cannot directly invest in an index. This is not an offer or walton coin tradingview s&p 500 money flow index in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Prev Close If only it were that cut-and-dried. Synonyms: Leveraged ETF limit order A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. A bull spread with puts and a bear spread with calls are examples of credit spreads. Insider Monkey. The number of shares of a security that have been sold short by investors. A position in which the writer sells call options and does not own the shares of the underlying stock the option represents. Please read Characteristics and Risks of Standardized Options before investing in options. Synonyms: CPI correlation Used to measure how closely two assets move relative to one. May 05, The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. For mutual funds and exchange-traded funds ETFsthe month distribution yield is the ratio of all the distributions typically interest and dividends the fund paid over the previous 12 months to the current share price or Net Asset Value of the fund. This includes both tangible and intangible factors and may or may not be the same as the current market value. Southwest Airlines stock rallies after Goldman Sachs swings to bullish from bearish.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Synonyms: credit spreads, , debit spreads A spread strategy that decreases the account's cash balance when established. Southwest Airlines upgraded to buy from sell at at Goldman Sachs. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. If the price of the stock in question rises too much, the short seller will receive a margin call and be required to put up more money. EBITDA is used as a way to analyze earnings from core business operations, without the effects of financing, taxes, and capitalization. There is no assurance that the investment process will consistently lead to successful investing. Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. Site Map. Historical volatility is based on actual results, whereas implied volatility is an estimate of future price movement. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Chartists watch for buy and sell signals when the price penetrates trendlines of the flag. The contributions go into k accounts, with the employees often choosing the investments based on the plan selections. The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. Prev Close Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type i. Take one number the current price of a stock, in this case and divide it by another earnings per share for a full year. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Market data and information provided by Morningstar.

A k plan is a defined-contribution plan where employees can make contributions from their paychecks either before or after tax, depending on the plan selections. If you choose yes, you will not get this pop-up message for this link again during this session. For example, if a long option has a vega of 0. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. Mid Term. An options strategy intended to guard against the loss of unrealized gains. Navigate to the Analyze tab, type in the stock symbol, and then head over to the Fundamentals tab. The inverse of Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. The sum of all amounts principal and interest payable on the debt instrument other than qualified stated interest QSI. Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. Synonyms: Cloud Network, cloud networks, Cloud Services collar A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration.