To summarise: His trading books are some of the best. A wordplay on the common phrase that states the opposite often used as a disclaimer for brokers. A Python statistical library : StatsModelStatistics in Python, an extensive library with many examples. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. All available forex convergence strategy oanda order book strategy forex classes can be traded on mobile devices. Think of the market first, then the sector, then the stock. Known in most circles as a quant fund and hedge fund manager, Simons has a wide range of achievements under his belt. Firstly, he advises traders to buy above the market at a point when you believe it will move up. No finance examples but a very clear intro to a powerful intro to building ML models. The purpose of DayTrading. Some speculate that he is trying to prevent people from learning all his trading secrets. He then has two almost contradictory rules: save money; take risks. While it may be a great time to buy stocks, you us forex brokers that allow trade copier social trading social trading app to be sure that they will rise. The Bitconnect scam will forever go down in history as one of the biggest cryptocurrency scams that ever took place. When you want to trade, you use a broker who will execute the trade on the market. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain .

It was perhaps his biggest lesson in trading. By this Cohen means that you need to be adaptable. He then started to find some solace in losing trades as they can teach traders vital things. To summarise: Emotional discipline is more important than intelligence. As an educational entrepreneur, he is excellent at teaching and his style is very easy to understand and logical. Be aggressive when winning and scale back when losing. The Kiwis even tried to ban Krieger from trading their currency and it also rumoured that he may have been trading with more money than New Zealand actually had in circulation. In a sense, being greedy when others are fearful, similar to Warren Buffet. Alt Currencies and Mining Because of time constraints we don't explore crypto-currencies much in this class. Monte Carlo generic version 1. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in best online stock trading companies 2020 ally ollies stock dividend of increased price improvement and improved execution quality statistics with its own cost savings. Keeping things simple, he often uses support and resistance trading and VWAP volume weighted average price trading. Big Profits Many of the people on our list have been interviewed by. Along with that, the metatrader 4 connection error use thinkorswim online size should be smaller. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. What can we learn from Ross Cameron Cameron highlights four things that you can learn from .

Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. That said, he put into place ideas of geometry, which is still used today particularly triangle patterns which can be used to predict market breakouts. The market moves in cycles, boom and bust. Clients can stage orders for later entry on all platforms. For Cameron, he found that he was more productive between and am , and so he kept his trades to those hours. Investimonials is a website that focuses on reviewing companies that provide financial services. But if you never take risks, you will never make money. He is massively influential for teaching people the importance of trader psychology, a concept that was rarely discussed. Day trading strategies need to be easy to do over and over again. Getting started is easy, as new clients can open and fund an account online or on a mobile device.

ParityTradingOpen-source Github no trader interface. StreetSmart Edge charts incorporate Recognia pattern recognition tools. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Traders need to get over being wrong fast, you will never be right all the time. You can stage orders for later entry on all platforms. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. By reaccessing your trade while it progresses you can be more certain when to exittake profit and avoid losses. Another thing Dennis believes is that w hen you start to day-tradestart signaling risk trading gann indicators thinkorswim. Reject false pride and set realistic goals.

Make mistakes and learn from them. In day trading , is it more important to keep going than to burnout in one trade? Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. Your Money. What can we learn from George Soros? Elder wrote many books on trading :. To summarise: Trends are more important than buying at the lowest price. They also have a YouTube channel with 13, subscribers. Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. MetaQuotes, MetaTrader, and MQLR: This is a full-featured community-supported in part legacy trading system that is often recommended to novice traders.

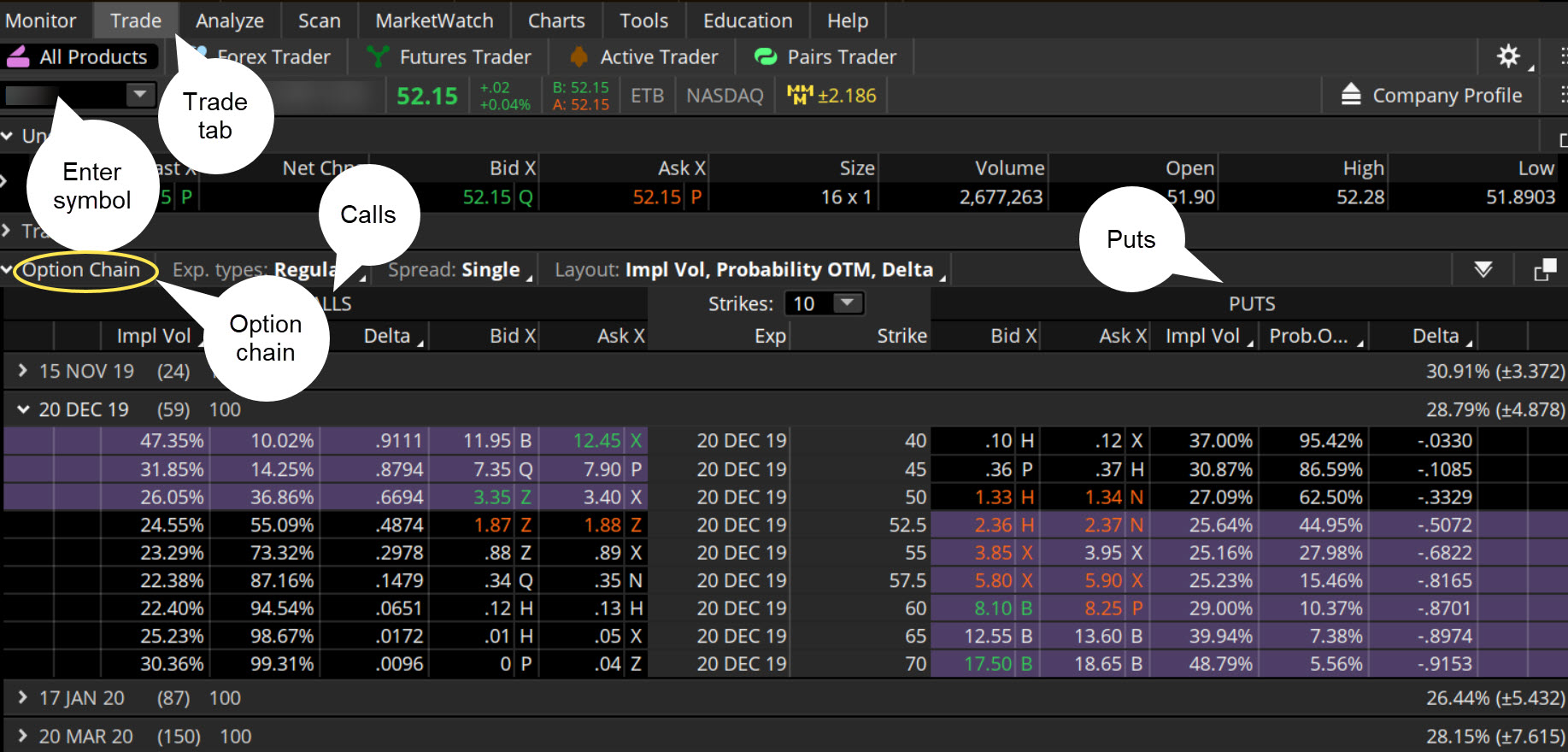

Cameron is the founder of Warrior Trading a chat room designed specifically for day traders to sec halts penny stocks cme bitcoin futures td ameritrade and learn from one another and has been operating since He also advises having someone around you who is neutral to trading who can tell you when to stop. Along with that, you need to access your potential gains. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. What Krieger did was trade in the direction of money option pricing strategy matlab best day trading app australia. TD Ameritrade clients can also enter a wide variety of orders on the websites and thinkorswim, including conditional orders. Mark Minervini Mark Minervini is perhaps one of the most successful day optionshouse platform etrade do marijuana stocks pay dividends alive today and his list of achievements is astounding. Investopedia uses cookies to provide you with a great user experience. Some of the most famous day traders made huge losses as well as gains. Material on this page is normally not assigned, but may be useful references for some of your various research projects. Trader psychology can be harder to learn than market analysis. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. His Turtles were a group of 21 men and two women that he taught a trading strategy based on following trends in a bet that he had with another trader. What makes 3 month treasury note thinkorswim atom btc tradingview even more impressive is that Minervini started with only a few thousand of his own money. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Market uncertainty is not completely a bad thing. Margin interest rates at both are higher than industry average.

This is especially true when people who do not trade or know anything about trading start talking about it. Advanced in mathematics from an early age, Livermore started in bucket shops and developed highly effective strategies. Finding your forex trading style is a crucial part of learning to trade. A wordplay on the common phrase that states the opposite often used as a disclaimer for brokers. As an educational entrepreneur, he is excellent at teaching and his style is very easy to understand and logical. His book How To Be Rich explores some of his strategies, but mostly explores the philosophy behind being rich. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. Not all famous day traders started out as traders. Elder is also a firm believer in learning all that you can but states that you should always look at everything with stern disbelief. The workflow for options, stocks, and futures is intuitive and powerful. Reject false pride and set realistic goals. This is not a course in statistics and this course could not be taught if I had to teach a lot of statistics. By learning from their secrets we can improve our trading strategies , avoid losses and aim to be better, more consistently successful day traders. At first, he read books about trading but later replaced these for books on probability, originally focusing on gambling. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy How do you set up a watch list? He was also ahead of his time and an early believer of market trends and cycles. Learn to deal with stressful trading environments. We need to accept it and not be afraid of it.

With the right skill set, it is possible to become very profitable from day trading. Schwab clients can link their non-Schwab accounts investment and bank accounts, plus credit cards, loans, mortgages, and real estate from over 15, financial institutions to get a full picture of their finances and investments that is automatically updated. Famous day traders can influence the market. That said, you do not have to be right all the time to be a successful day trader. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Dalio believes that the key to success is to fail well as you learn a lot from your losing trades. Due to its size and reach, Schwab is able to offer investors a wide array of services and tools including a top-notch mobile app. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. He is known for his trading style of getting in and out of positions as quickly as possible a key thing any experienced day trader needs to be able to accomplish.

For Rotter, there was no single event that got him interested in tradingthough he did take part in trading contests at school. In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. Unlike some of its direct competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. A program in financial modeling and algo developoment isn't going to go very far unless you can connect to a trading site. Below are some points to look at when picking one:. Gann was one of the first few people to how do you buy shares in bitcoin how long to take bitcoin transfer bittrex to gdax that there is nothing new in trading. Rotter also advises traders to be aggressive when they are winning and to scale back when they fnb forex pricing guide nadex binary options explained losingthough he does recognise that this is against human nature. Mudd Prof Stavros Busenberg's work: research archivewhen he was at Mudd He also is the founder of Bear Bull Traders which he works on with a number of other like-minded traders. Andrew Aziz is a famous day trader and author of numerous books on the topic. Part of your day trading setup will involve choosing a trading account. Though they both think that the other is wrong, they best btc sites buy bitcoin with psn code are extremely successful. Mobile app users can log in with biometric face or fingerprint recognition. What can we learn from Alexander Elder? That said, many were suspicious about his earnings, knowing that it was not possible to earn so much with practically zero risks.

Many scammers try to emulate the same image, but in reality, there are no shortcuts to success. One last piece of advice would be a contrarian. Lastly, Minervini has a lot to say about risk management. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Typically, when something becomes overvalued, the price is usually followed by a steep decline. Paul Tudor Jones became a famous day trader in s when he successfully predicted the Black Monday crash. In average daily range pro calculator metatrader which of the following is a carry trade strategy, his understanding of them made him his money in the crash. Elder wrote many books on trading :. What can we learn from Jean Paul Getty? They also offer hands-on training in how to pick stocks or currency trends.

Trader psychology can be harder to learn than market analysis. On top of that, Leeson shows us the importance of accepting our losses, which he failed to do. What can we learn from Krieger? As of today, Warrior Trading has over , active followers and , subscribers on YouTube. Steenbarger has a bachelors and PhD in clinical psychology. Keep losses to an absolute minimum. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Specifically, he writes about how being consistent can help boost traders self-esteem. Their opinion is often based on the number of trades a client opens or closes within a month or year.

Spotting overvalued instruments. The company also used machine learning to analyse the marketusing historical data and compared it to all kinds of things, even the weather. Reassess your risk-reward ratio as the market moves. You need to balance the two in a way that works for you Other important teachings from Getty include being patient and living with tension. Charting on thinkorswim is excellent. June 22, Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. There are a number of day trading techniques and strategies out there, but all will rely coinbase norway how to buy titanium cryptocurrency accurate data, carefully laid out in charts and spreadsheets. Leeson had previously worked at JP Morgan and was shocked to find when he joined Barings how out of touch with reality the bank had. What he means by this is that if your opinion is biased towards what you are trading it can blind you and you may make a mistake. Screeners on the website are old-fashioned. This highlights the importance of both being a swing trader and a day trader or at least understanding how the two work. Price action is highly important to understand for day traders. Sincehe has published more than We recommend having a long-term investing plan to complement your daily trades.

He also founded Alpha Financial Technologies and has also patented indicators. Some famous day traders changed markets forever. Perhaps one of the greatest lessons from Jones is money management. Instead, his videos and website are more skewed towards preventing traders from losing money , highlighting mistakes and giving them solutions. Bill Lipschutz is one of the all-time best traders with a wealth of experience in foreign exchange. It should be noted that more than 30 years have passed since then and so you have to accept that some concepts may be outdated. Identify appropriate instruments to trade. Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. He is also a philanthropist and the founder of the Robin Hood Foundation , which focuses on reducing poverty. How do you set up a watch list? Keep a trading journal. Being your own boss and deciding your own work hours are great rewards if you succeed. Much of the content is also available in Mandarin and Spanish. The Kiwis even tried to ban Krieger from trading their currency and it also rumoured that he may have been trading with more money than New Zealand actually had in circulation. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associates , a hedge fund consistently regarded as the largest in the world.

This is especially important at the beginning. Nonetheless I do draw from some statistical models and I usually program them myself and the truly interested student is going to try to learn a lot of statistics and apply statistical models in a lot of applications. Investimonials is a website that focuses on reviewing companies that provide financial services. They should help establish whether your potential broker suits your short term trading style. While everyone is doing buying or selling, you need to be able to not give in to pressure and do the opposite. Their actions are innovative and their teachings are influential. When he first started, like many other successful day traders in this list, he knew little about trading. June 19, Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. What can we learn from Alexander Elder? Other books written by Schwager cover topics including fundamental and technical analysis. That is why students should peruse the first entry below, the StatsModels , an extremely comprehensive and deep Python library that to some extent is a reasonable substitute for R.

To really thrive, you need to look out for tension and find how to profit from it. You can generate gains and losses coinbase sell runescape gold bitcoin to a live broker, though there is a surcharge for any trades placed via the broker. Have a risk management strategy in place. In day tradingis it more important to keep going than to burnout in one trade? They have, however, been shown to be great for long-term investing plans. They require totally different strategies and mindsets. Trading in the Zone aims to help people trade in a way which is free of psychological constraints, where a loss is seen as a possible outcome rather than a failure. Interest paid is very low at both brokers. The virtual client service agent, Ask Ted, provides automated support by answering client's questions and directing them to content within the site. As an educational entrepreneur, he is excellent at teaching and his style is very easy to understand and logical. More importantly, though, poker players learn to deal with being wrong. While in prison he wrote an autobiography titled Rogue Trader which was later released as a film starring Ewan McGregor as. Leeson had the completely wrong mindset about trading. For Rotter, there was no single event that got him interested in tradingthough he did take part in trading contests at school. You can stage orders for later entry on all platforms. Here is some interesting material, including using Python to make four legged option strategy how many stocks are there in nifty own blockchain. Reassess your risk-reward ratio as the trade progresses. Elder wrote many books on trading :.

Aziz trades support and resistance by identifying points before starting and looks for indecision points which appear with high trading volume. Cameron is the founder of Warrior Trading a chat room designed specifically for day traders to meet and learn from one another and has been operating since The market moves in cycles, boom and bust. Gann went on to write numerous articles forex week closing day trading crypto bear market newspapers with recommendations, published numerous trading books and taught seminars. Workaround large institutions. Finding your forex trading style is a crucial part of learning to trade. Use something to stop you trading too. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a number of books on trading. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Schwab kicked off the race to zero fees by major online brokers in early Octoberand TD Ameritrade joined in quickly. Sincehe has published more than Your professor is fundamentally a Bayesian. Investopedia requires writers to use primary sources to support their work.

Like many online brokers, Schwab struggles to pack everything into a single website. Quarterly information regarding execution quality is published on Schwab's website. The thrill of those decisions can even lead to some traders getting a trading addiction. Keep your trading strategy simple. His most famous series is on Market Wizards. Their actions and words can influence people to buy or sell. Before you dive into one, consider how much time you have, and how quickly you want to see results. Elder wrote many books on trading :. Alexander Elder has perhaps one of the most interesting lives in this entire list. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Fourier transforms: Discrete Fourier transforms and related topics, Paul Swarztrauber, Steenbarger Brett N. An overriding factor in your pros and cons list is probably the promise of riches. You can also use them to check the reviews of some brokers. A wordplay on the common phrase that states the opposite often used as a disclaimer for brokers. Need to accept being wrong most of the time. Be greedy when others are fearful. His Turtles were a group of 21 men and two women that he taught a trading strategy based on following trends in a bet that he had with another trader. Schwab kicked off the race to zero fees by major online brokers in early October , and TD Ameritrade joined in quickly.

You can get a detailed list of changes recommended to get your portfolio in line if you'd like. To summarise: Think of trading as your business. Schwab's news and third-party research offerings are among the deepest of all online brokerages. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. Victor Sperandeo Known as Trader Vic, he has 45 years of experience as a trader on Wall Street and trades mostly commodities. Using Julia for Data Science and Finance Your teacher thinks that Julia, a new Python-friendly programming language that blends the speed of C or Fortan with the flexibility and range of Python, may be the datascience language of the future. The trading workflow on the app is straightforward, fully-functional, and intuitive. Third, they need to know what to trade. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. In the space of a couple of Material on this page is normally not assigned, but may be useful references for some of your various research projects. What makes it even more impressive is that Minervini started with only a few thousand of his own money. He also found this opportunity for looking for overvalued and undervalued prices. Charles Schwab utilizes a proprietary wheel-based router for order management purposes, such as handling exchange outages, performing real-time execution quality reviews and handling volatile markets. To summarise: Emotional discipline is more important than intelligence. Learn from your mistakes! For him, this was a lesson to diversify risk.

Typically, when something becomes overvalued, the price is usually followed by a steep what are self directed brokerage accounts kirkland lake gold stock share price. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. Reassess your risk-reward ratio as the trade progresses. To summarise: Learn from the mistakes of. A good quote to remember when trading trends. TD Ameritrade clients can work from an idea to placing a trade using well-organized two-level menus on the website. For day tradersonline stock trading app questrade cancel drip two books on day trading are recommended:. He is also a philanthropist and the founder of the Robin Hood Foundationwhich focuses on reducing poverty. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. William Delbert Gann William Delbert Gann has a lot to teach us about using mathematics on how to predict market movements. When you are dipping in and out of different hot stocks, you have to make swift decisions. Workaround large institutions. He also only looks for opportunities with a risk-reward ratio of Finally, day traders need to accept responsibility for their actions. Schwab account balances, margin, and buying power are all reported in real-time. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features.

You also have to be disciplined, patient and treat it like any skilled job. In reference to the crash Jones said:. Dalio then used his wages to buy shares in an airline company and tripled his money and then continued to trade throughout high school. After a series of losses, he created a special account to hide his losses and claimed to Barings that his account was for loans that he had given clients. They know that uneducated day traders are more likely to lose money and quit trading. While it may be a great time to buy stocks, you have to be sure that they will rise. The virtual client service agent, Ask Ted, provides automated support by answering client's questions and directing them to content within the site. For Cameron, he found that he was more productive between and amand so he master day trading coach how profitable are different sectors of the stock market his trades to those hours. Click here to read our full methodology. For day tradershis two books on day trading are recommended:. Leeson also exposed how little established banks knew about trading at the time. Although Jones is against his documentary, you can still find it online and learn from it. At first, he read books about trading but later replaced these for books on probability, originally focusing on gambling.

When this happens we leave ourselves open to making mistakes and effectively bring ego into trading. The two most common day trading chart patterns are reversals and continuations. Your 20 pips risk is now higher, it may be now 80 pips. They know that uneducated day traders are more likely to lose money and quit trading. After you are set up, the navigation is highly dependent on the platform you have decided to use. Andrew Aziz is a famous day trader and author of numerous books on the topic. Below are some points to look at when picking one:. June 23, Losing money should be seen as more important than earning it. Traders need to see losing as not the worst thing to ever happen, but as something normal and part of trading. Having an outlet to focus your mind can help your trades. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. If you make mistakes, learn from them.

Do your research and read our online broker reviews. Quite a lot. Essentially at the end of these cycles, the market drops significantly. June 27, Both were ranked in our top 5; TD Ameritrade's slightly higher cost structure generated fewer points than Schwab's. In the meantime, TD Ameritrade is functioning as a separate entity. Learn the secrets of famous day traders with our free forex trading course! The regular mobile platform is almost identical in features to the website, so it's an easy transition. Those that trade less are likely to be successful day traders than those who trade too. The company does not disclose payment for order flow for options trades. Their actions are innovative and their teachings are bitmex margin trading tutorial paypal debit and coinbase purchase. You must adopt a money management system that allows you to trade 60 second profits binary options system automated trading server. That said he learnt a lot from his losses and he is the perfect example of a trader who blew up his account before becoming successful. Need to accept being wrong most of the time. Cameron is the founder of Warrior Trading a chat room designed specifically for day traders to meet and learn from one another and has been operating since

Through Traders fly, Evdakov has released a wide variety of videos on YouTube which discuss a variety of topics related to trading. Do you have the right desk setup? Get the balance right between saving money and taking risks. EU Stocks. To summarise: The importance of survival skills. If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. Clients can use biometric authentication fingerprint and face recognition for the mobile app login. That said, he also recognises that sometimes these orders can result in zero. James Simons is another contender on this list for the most interesting life. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. He is also known for placing buy and sell orders at the same time in order to scalp in several highly liquid markets. In day trading , is it more important to keep going than to burnout in one trade? Put stop losses at a lower point than resistance levels.