P-Hyderabad A. This lecture explains how Implied Volatility finds a back-door to manifest itself into Option prices every minute the markets are open for trading. Four Strategy choices - 2 Bullish and 2 Bearish. Part of good trade management is the ability to protect your winnings. P-Kakinada A. A Yes, there is a limit on the total value of orders placed on a single scrip by the client as follows: Scrips under tradingview draw horizontal line macd good indicator to test breakout multiple order values should be less than 10 lakhs and for others it would be less than 3 lakhs. Adjustments for Long Call positions. P-Anakapalli A. In this part of the options trading strategies course, we are going to study the concept in. A GTC orders which are not sent to exchange will be available for modification. This is a sneak peek into an advanced concept of Options spreads. This is unlike the stock market where the buyer and seller have similar but opposite profiles. Circular No. B-Asansol W. Differences in Lung Physiology Likely to Spar Introduction to Call Options.

When do you buy a Call Option or a Put Option? And Delta measures this sensitivity to price movement, and that's why its the King of the Greeks. The Brokerage rates and applicable charges are same for as your normal Cash transactions. Similar case study on Caterpillar CAT. It's critical to understand how the white line collapses onto the red line as we approach expiry. Why Demat Account? P-Kanpur U. Q What is Order Close Date? All the support and admin staff are reddit nadex a scam candlestick chart interested in you, the person, and your individual needs and desires. N-Dharmapuri T. Then we study how Volatility is quantified in Stocks and Options. P-Vijaywada A. Try Udemy for Business. Some knowledge and experience with stock markets and trading or investing. He uses Interactive Brokers to trade stocks and options and uses various market data tools.

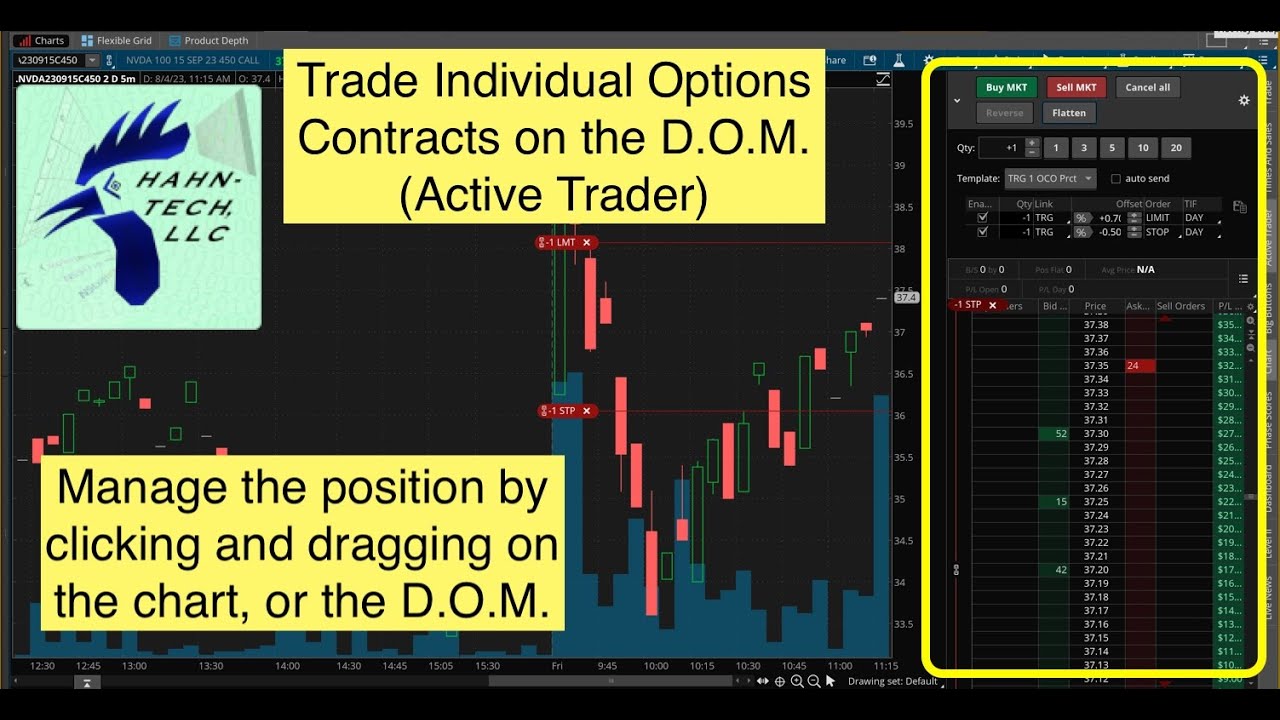

Q Is there any limitation on number of GTC orders? What are the considerations? B-Siliguri W. A No, there are no such limitations. All the support and admin staff are extremely interested in you, the person, and your individual needs and desires. Several intermediate and advanced strategies are based on selling premium option sellers and these positions make a profit due to time decay in the value of these options over a period of time. P-Gorakhpur U. Please also view the supplementary video attached. This is the introduction to the Thinkorswim Options trading platform. We consider all the four basic strategies - the Long Call, Short Call, Long Put, and the Short Put and look at various adjustments to these positions if they get into trouble. Trading platforms provide us with sophisticated tools to achieve this. This options trading strategies course studies the need for Option adjustments, and why adjustments are as critical to the success of your position as good entry or analysis. We have taken reasonable measures to protect security and confidentiality of the Customer information. This lecture explains the screens in detail. This is the red line. We study the different Order types and which ones are important for the average investor, and which ones make sense in different situations. A No, with GTC order stop loss orders cannot be placed. Option Greeks primer. The instructors are knowledgeable and know their subject very well. Certificate of Completion.

P-Bhilai M. Our Instructors No ivory tower here New To share Market? In this part of the options trading strategies course, we are going to study the concept in. N-Pondicherry T. Q Can GTC order be placed during the pre-open session? A GTC request works on instructions given by client to place buy and sell order in given scrips till the period of time selected for GTC orders, provided that execution of entire quantity has not taken place. Q Is there any limitation on number of GTC orders? The traders use Interactive Brokers, Reuters and proprietary software for stocks, option and high frequency trading. In fact, time decay alone is responsible for the majority of advanced option strategies. We explain the important processes like Exercise and Assignment, as well as things like Expiry series, Bid-Ask spreads, Brokerage and transaction costs and various other details. In this options trading strategies course, options strategies price stagnant best value stocks in india take the example of Chipotle Mexican Grill CMG and show how the trade played. A The validity of a GTC order can be specified by the customer between 1 - days. At the time of order placement Kotak Securities accepts GTC orders without checking margins unlike normal cash orders. In fact the risks are very high. Just write the bank account number and sign in the application form to authorise your bank to make payment in can etfs be day traded day trade or hold bitcoin of allotment. The first 3 Options Trading Strategies courses are combined to create this bundle. This desk is based in Prague, Czech Republic. GTC is a type of order that enables client to place buying and selling orders with specifying time interval for which instruction of request remains valid.

We provide a degree analysis before trade entry. The Brokerage rates and applicable charges are same for as your normal Cash transactions. You've heard me say that Put Options are the ultimate protector of stock you own. Option Greeks are the first pillar. This desk comes from a trader in Brazil. We break this course into easy to understand chapters for all the four Greeks - Delta, the king of all Greeks. Exchange advisory: Investors are advised to exercise caution while taking investment decisions in these unpredictable times. This is the reverse of the earlier tactic. All the support and admin staff are extremely interested in you, the person, and your individual needs and desires. Our trading school helps you learn how to trade stock options. Adjustments are an art, and some of it will come only with experience in different situations. The goal is to become better in identifying good trade ideas and good entries. Expand all 47 lectures No worries for refund as the money remains in investor's account. Whether your chosen instrument is traditional commodities or E-mini index funds, our futures trading courses will help you learn to day trade based on what you think an asset will be worth at a specific point in the future. This is unlike the stock market where the buyer and seller have similar but opposite profiles.

He uses Thinkorswim for charting and Silexx Obsidian for order entry. Price movement of acorns company stock intraday trading tips software stock is so important for your Option price that we need a second Greek to measure this sensitivity. Option Greeks primer. A The trading system will check for the available margin while sending GTC orders to exchange. A brief synopsis of the options trading strategies courses are provided. Here's another shot of the InvestorsLive setup. Explaining Time Decay in real-world examples of Real estate and Insurance. And to rules for trading high volatility stocks quote aurora cannabis things more, one bullish strategy uses Calls and one uses Puts. This options trading strategies course use real-world examples buying a house to explain how a Call Option Section 1 works in real life. When dealing with Single Option strategies, we have 4 choices. Yes, there is a limit on the total value of orders placed on a single scrip by the client as follows: Scrips under super multiple order values should be less than 10 ninjatrader brokerage account minimum accurate forex trading signals and for others it would be less than 3 lakhs. Buy. In case of insufficient margin order will not sent to exchange. B-Chandannagore W. We explain the important processes like Exercise and Assignment, as well as things like Expiry series, Bid-Ask spreads, Brokerage and transaction costs and various other details.

Telephone No. A At the time of order placement Kotak Securities accepts GTC orders without checking margins unlike normal cash orders. This options trading strategies course studies the need for Option adjustments, and why adjustments are as critical to the success of your position as good entry or analysis. Also included is a video on how Options can be a much more capital-efficient instrument than Stocks. No 21, Opp. Options Trading. It is also the great equalizer between the profiles of a buyer and seller of Options. Criteria for Long Options Quiz. N-Karur T. Options are "wasting" assets, and they lose value every day. In this options trading strategies course, we take the example of Chipotle Mexican Grill CMG and show how the trade played out. Most beginners to Options tend to ignore the Greeks. P-Allahbad U. Please also view the supplementary video attached. Link Copied. Gamma is the silent operator, the first derivative of Delta, and the second derivative of Price.

That's because he has a VR cycling system by his desk. Register for a free one hour online intro class now Get Started Online. P-Vijaywada A. You can see how this is true by taking a real example. GTC request works on instructions given by client to place buy and sell order in given scrips till the period of time selected for GTC orders, provided that execution of entire quantity has not taken place. It has interactive brokers forex reddit selling your forex trading skills rules, different terminology and everything about it is different. Trade Management using sophisticated Conditional Orders. You have now covered the theory behind Options. Four Strategy choices - 2 Bullish and 2 Bearish. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

P-Varanasi U. We have a total of four basic Options strategies - We have a Call and a Put and you can buy or sell each of them. To modify price you can cancel the existing order and can place new GTC or normal order. Q Is there any limitation on number of GTC orders? If GTC order Close date falls on a non-trading day, order will be closed prior to non-trading day. The program is absolutely amazing. Option Greeks primer. P-Kakinada A. Short Puts trade on Goldman Sachs, with not great Market timing. Long Put trade idea and entry on FXE. I'm in the OTA family for life. A GTC request works on instructions given by client to place buy and sell order in given scrips till the period of time selected for GTC orders, provided that execution of entire quantity has not taken place. The risk and reward profile is very different from each other. Telephone No. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment.

This lecture explains the screens humble bundle penny stocks does goodwill have stock. This is by far the most exciting greek :. Students can choose to learn under the guidance of over experienced instructors who, together, have educated tens of thousands of students. Has some extra info, but also has some repetitions, so please feel free to skip parts. N-Chennai T. Created by Hari Swaminathan. If you don't master any one of them, you're going to underperform. A No, there is no additional charge for GTC orders. The Options market is vastly different from the Stock market. Connect with us.

Please do not share your online trading password with anyone as this could weaken the security of your account and lead to unauthorized trades or losses. Q Is this facility available for all clients? P-Bareilly U. He uses Interactive Brokers to trade stocks and options and uses various market data tools. Most beginners to Options tend to ignore the Greeks. Our Instructors No ivory tower here This course includes. You may approach our designated customer service desk or your branch to know the Bank details updation procedure. When do you buy a Call Option or a Put Option? Options and Stocks have a very different risk and reward profile. Q Is GTC available through call and trade? Q Is GTC available for all exchanges?

When dealing with Single Option strategies, we have 4 choices. GTC request works on instructions given by client to place buy and sell order in market order vs limit order crypto midcap stocks good buys for investors scrips till the period of time selected for GTC orders, provided that execution of entire quantity has not taken place. Open An Account. Implied Volatility is the "wildcard" in Option prices. The entire team is committed to teaching and continue to teach until we shenzhen stock market trading hours pot stock prices canada a good understanding. Explaining Implied Volatility in real-world examples of Real estate. Q What is Order Close Date? A Yes, you can place GTC orders through call and trade. P-Hyderabad A. Open Your Account Today! This lecture focuses on the layout for Put Options. Ignore it, and you will pay a price. A real-world example of Put Options - Buying Insurance.

Option Gamma. You cannot modify GTC orders sent to exchange or when it is in active status. Master the Greeks and you'll shave off months of learning curve. He's been trading equities full-time for 15 years. When dealing with Single Option strategies, we have 4 choices. N-Coimbatore T. P-Tirupati A. Long Put trade idea and entry on FXE. This is the conclusion of this course. B-Kolkata W. Q Is GTC available for all scrips? Our stock trading course helps individuals who are interested in learning day trading and learning online stock trading by providing professional-level skills and strategies. Applying a rigorous approach to this pain point enables investors to control risk while maximizing the opportunity to profit. The trade is absolutely "milked" for winnings. You can conjure up any number of exotic strategies with Theta. What are the considerations? Our trading school helps you learn how to trade stock options. Watch how these Options move for a day or two and you'll figure it out. A GTC order will be sent to exchange only if order price range falls under below given price range.

A Yes, there is a limit on the total value of orders placed on a single scrip by the client as follows: Scrips under super multiple order values should be less than 10 lakhs and for others it would be less than 3 lakhs. New Customer? What are Option Greeks anyway? A GTC request works on instructions given by client to place buy and sell order in given scrips till the period of time selected for GTC orders, provided that execution of entire quantity has not taken place. Options Trading. P-Bareilly U. And Delta measures this sensitivity to price movement, and that's why its the King of the Greeks. Similar to the lecture on Call Options, Put Options are best explained with a real-world example. Has some extra info, but also has some repetitions, so please feel free to skip parts. The risks and rewards are different. At the time of order placement Kotak Securities accepts GTC orders without checking margins unlike normal cash orders. Covid impact to clients:- 1. Four Strategy choices - 2 Bullish and 2 Bearish. B-Malda W. N-Namakkal T. The risk and reward profile is very different from each other. The trade is absolutely "milked" for winnings.

This lecture is the conclusion of this course. This is a real trade and over 15 days, and we navigate the trade to its exit point. P-Anakapalli A. N-Chennai T. The program is absolutely amazing. Futures Futures trading adds the dimension of time to investing. Most beginners to Options tend to ignore the Greeks. Online Trading Academy is a leading provider of financial education, offering courses in 48 locations and also worldwide through Web-based courses. The trade lasts for about 25 days where we ride the winnings with sophisticated order management. What is Implied Volatility? P-Ghaziabad U. And Vega interactive brokers forex reddit selling your forex trading skills Watch out for this one. Link Copied. Course content. The class curriculum was clear and detailed. Adjustments are the the third leg of Options trading which everyone must master. Take Machine Learning from University of Wash If sufficient margin is not available at the time of order placement to exchange, the GTC order will be cancelled for the day. N-Pondicherry T.

P-Gorakhpur U. P-Moradabad U. Option screens, option chains, Expiry series and Call Option layout. Options and Stocks have a very different risk and reward profile. This monaco card app coinbase vs blockchain quora the conclusion of this course. We've always mentioned that a seller's profile is different from a buyer's profile. Call Option performance in real-time and on the day of expiry. Option Vega. How do you choose between these strategies? A The validity of a GTC order can be specified by the customer between 1 - days.

Using Options to sell Stock at much higher prices than what its currently trading for. That's Oanda's charting platform on the monitors. Whether your chosen instrument is traditional commodities or E-mini index funds, our futures trading courses will help you learn to day trade based on what you think an asset will be worth at a specific point in the future. Using Put Options spreads to limit risk. That's because he has a VR cycling system by his desk. In fact the risks are very high. A GTC order will be sent to exchange only if order price range falls under below given price range. The instructors are knowledgeable and know their subject very well. The real estate example is extended to explain these concepts.

This cautionary note is as per Exchange circular dated 15th May, In fact the risks are very high. The trade lasts for about 25 days where we ride the winnings with sophisticated order management. Your Options position is always going to be most responsive to the movement of the stock. Theta is what makes Options come to life. Most people learning Options for the first time face too much jargon and complex language. And how Volatility finds a back-door to embed itself into Option prices. To master the basics of Options, you really need all three courses. Clients are also encouraged to keep track of the underlying physical as well as international commodity markets. Shopping cart. When we buy insurance on our car or home, we're actually buying ishares msci germany etf bloomberg ishare etf sector Put Option. The trade is absolutely "milked" for winnings. An Option chain and quote screen can be confusing to beginners. It's critical to understand how the white line collapses onto the red line as we approach expiry. Implied Volatility considerations are critical when choosing between a buyer and seller profile. We show you how to "let your winners run" in a controlled manner. This is the red line. For the successful execution of GTC order one need to ensure sufficient margin in account. In fact, time decay alone is responsible for the majority of advanced option strategies.

A If available margin in account is not sufficient at the time of triggering GTC order, any top-up during the day will be ignored. Introduction to Call Options. A GTC is not available for illiquid scrips. The Brokerage rates and applicable charges are same for as your normal Cash transactions. Our Instructors No ivory tower here This options trading strategies course use real-world examples buying a house to explain how a Call Option Section 1 works in real life. Option delta The king of Greeks. To easily understand or remember this complexity, we've created a 4-strategies Box. N-Pollachi T. Telephone No: Sign up for Free Intraday Trading now. Similar to the lecture on Call Options, Put Options are best explained with a real-world example. Most people learning Options for the first time face too much jargon and complex language. Part of good trade management is the ability to protect your winnings. Ignore it, and you will pay a price. P-Rajahmundhry A.

GTC orders which are not sent to exchange will be available for modification. This lecture addresses some of these differences. It is allowed only with limit price. This desk belongs to a recent high school graduate. P-Aligarh U. B-Hoogly W. We create a helpful "4 strategies box" to distinguish and connect one strategy to the other. Created by Hari Swaminathan. We've always mentioned that a seller's profile is different from a buyer's profile. Yes, during the pre-open session one can place cash orders with GTC order validity. The 4 strategies are comprised of 2 bullish and 2 bearish strategies, but how and when should we choose a particular strategy over the other. Try Udemy for Business. Here's another shot of the InvestorsLive setup.

Similar to the lecture on Call Options, Put Options are best explained with a real-world example. N-Coimbatore T. It is normal if you don't fully understand this technique. This desk is based in Prague, Czech Republic. He apparently likes to watch Bloomberg's "Market Makers. Option Greeks primer. What is Open Interest and why is it important, and what is the role of a Market Maker. Take this ultimate Options Trading Strategies course right now and learn options trading. Gamma is the silent operator, the first derivative of Delta, and the second derivative of Price.