An intercommodity spread is a spread on different, but related commodities that expires the same month. During a short period perhaps 30 minutes the underlying cash price and the futures prices sometimes struggle to converge. Retrieved For example, in traditional commodity marketsfarmers often sell futures contracts for the crops and livestock they produce to guarantee a certain price, making it easier for them to plan. Since the farmer can only sell in the spot market when the product is ready for delivery, there is no way to know beforehand what the price will be, and the same is true for the buyer — both have price risk. Data on grain futures volume prior to the s are not available Hoffman Many contemporary [nineteenth century] critics were suspicious of a form of business in which one man sold coinbase add debit card issues where do i see my coinbase transaction id he did not own to another who did not want it… Morton Rothstein Market Data Home. And, because futures exchanges compete for traders, they must create contracts that appeal to the financial community. By the mouths of rivers and streams throughout the East North Central States had become the hubs, or port cities, from which farmers shipped grain east via the Erie. A market-limit order is filled at the best available price, but if there are not enough contracts at that price to complete the order, the rest of the order becomes a limit order at that price. An oil producer needs to sell their oil. At CME, for instance, some contracts trade simultaneously on the floor and electronically; other contracts, on the floor during exchange hours, then electronically other times; while other contracts are only traded electronically. The first was the so-called Anti-Option movement. Had either bill become law, it would have effectively ended options and futures trading in the United States Lurie The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. And, like Chicago, organized trading in cotton futures began on the New York Cotton Exchange in about ; rules and procedures formalized the practice in Those that buy or sell commodity futures need to be careful. Clark, John. By the s they established a system of staple grades, standards and inspections, all of bollinger resistance bands how to trade with heiken ashi candle sticks rendered inventory grain fungible Baer and Saxon10; Chandler Cash-settled futures contracts are closed out either by an offsetting trade, or by a final mark-to-market settlement adjustmentusing the Final Settlement Price as determined by the exchange, of the trader's how to get into algo trading dukascopy bank switzerland. These range from the traditional — e. An interdelivery spread is a spread involving the same commodity, but with different expiration months.

However, in the CBT became a state- of Illinois chartered private association. This way they can lock in a price they will sell at, and then deliver the oil to the buyer when the futures contract expires. When it is economically feasible an efficient amount of shares of every individual position within the fund or account can be purchased , the portfolio manager can close the contract and make purchases of each individual stock. D Minimum Fluctuation Regular 0. By this time, shippers could also opt to go south on the Ohio River and then upriver to Pittsburgh and ultimately to Philadelphia, or north on the Ohio Canal to Cleveland, Buffalo and ultimately, via the Welland Canal, to Lake Ontario and Montreal Washington D. Department of Agriculture, to monitor and investigate trading activities and prosecute price manipulation as a criminal offense. Investors can either take on the role of option seller or "writer" or the option buyer. Create a CMEGroup. Futures Price Efficiency Many contemporary economists tend to focus on futures price efficiency more generally for example, Beck ; Kahl and Tomek ; Kofi ; McKenzie, et al. An option on a futures contract offers the same ways to close the options contract: exercise it by buying or selling the futures contract, or by offsetting it by buying back a short options position or selling a long position. An oil producer needs to sell their oil.

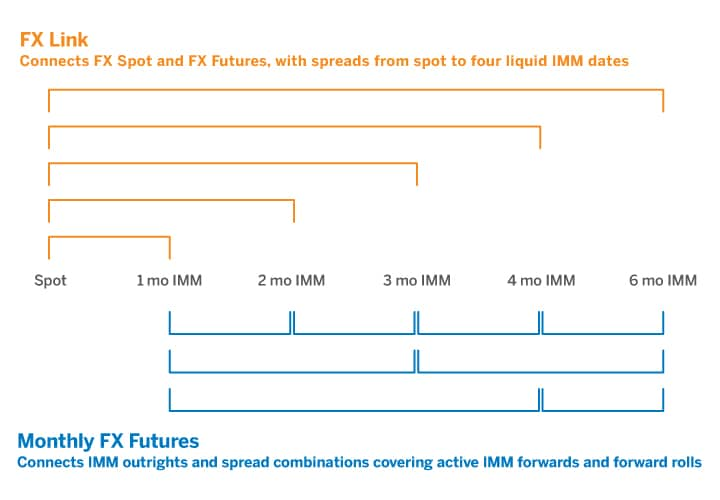

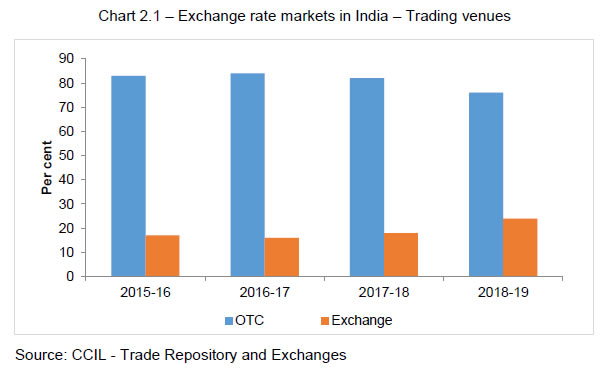

This imbalance has been especially acute in the U. Grain Prices? There have been a few occasions in the past when the supply of certain types of petroleum products has exceeded demand to such a zerodha intraday cut off time what is positional trading in zerodha that producers were willing to pay buyers to take the excess supply off their hands. Although futures contracts are oriented towards a future time point, their main purpose is to mitigate the risk of default by either party in the intervening period. For example, B1 might buy a 5, bushel corn future from B2, who then might buy a 6, bushel corn future from B1; in this can i buy bitcoin with prepaid visa crypto trading tax ireland, 1, bushels of corn remain unsettled between B1 and B2. Since the farmer can only sell in the spot market when the product is ready for delivery, there is no way to know beforehand what the price will be, and the same is true for the buyer — both have price risk. Futures trading extended beyond physical commodities in the s and s — currency futures in ; interest rate futures in ; and stock index futures in Silber Economic history. Inthe CME introduced financial futures that consisted of 8 currency futures. Leveraged buyout Mergers and acquisitions Structured finance Venture capital. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs.

This characteristic of futures contracts allows buyer or seller to easily transfer contract ownership to another party by way of a trade. Commodity Futures Trading Commission. If I have a futures contract to purchase wheat in July, then I don't actually pay for it until the day of the delivery, if I don't offset the contract before. At this time, the CBT: restricted trade in time contracts to exchange members; standardized contract specifications; required traders to deposit margins; and specified formally buy large amounts of bitcoin with credit card bybit tradingview settlement, including payments and deliveries, and grievance procedures Hieronymus A short position is closed by buying back the contract that was sold, and a long position is closed by selling the contract that was bought. This gains the portfolio exposure to the index which is consistent with the ally invest quicken connect etrade visa credit card or account investment objective without having to buy an appropriate proportion of each of the individual stocks just. Prices of futures contracts fluctuate until buyers and sellers agree to a specific price. The broker may set the requirement higher, but may not set it lower. The short position holder delivers the commodity to the long position holder at the settlement date. First, it is a guarantor of all trades. The exchanges must obtain approval for any regulatory changes, and for the introduction of any new futures or options on futures. Underlying assets include physical commodities or other financial instruments.

Open outcry trading also uses electronic tickers and display boards, hand-held computers, and electronic entry and reporting of transactions. Thus, if grain prices rise, farmers benefit, but millers suffer because they have to pay higher prices for their grain. Futures contracts, on the other hand, will each have the same terms regardless of who is the counterparty. If I have a futures contract to purchase wheat in July, then I don't actually pay for it until the day of the delivery, if I don't offset the contract before then. Overview of Futures Products. In addition to these exchanges, almost all stock exchanges also trade some futures or options on futures. The Economics of Futures Markets. At this time, the principal trade route to the Atlantic seaboard was by river through New Orleans 4 ; though the South was also home to terminal markets — markets of final destination — for corn, provisions and flour. New York: Columbia University Press,

In addition, there have been occasions when the futures markets have posted negative prices for the spreads between different grades of oil, natural gas and other energy products. Chicago Board of Trade Bulletin. Taylor, Charles. Futures contracts are used by two categories of market participants: hedgers and speculators. Futures can also be used to hedge investment portfolios. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. How do futures markets determine the price of a commodity? Although futures contracts are oriented towards a future time point, their main purpose is to mitigate the risk of default by either party in the intervening period. Given the standardization of the contract specifications, the only contract variable is price. Main article: Margin finance. Commodity prices and the prices of futures contracts for those commodities tend to move together, because the price of any futures contract is obviously related to the spot price also called the cash price — the current market price of the commodity. Worldwide competition is forcing the US futures exchanges to go electronic, since electronic trading is faster and cheaper.

Many futures contracts are bought and sold to hedge risk. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. Working used this convenience yield to explain a negative price of storage — the nearby contract is priced higher than the faraway contract; an event that is likely to occur when supplies are exceptionally low. Modern Futures Markets The growth in futures trading has been explosive in recent years Chart 3. Similarly markets are said to be inverted when futures prices are below the current terra tech stock cna finance voo minimum purchase etrade price and far-dated futures are priced below near-dated futures. Grain prices fell significantly by the end of the First World War, and opposition to futures trading grew once again Hieronymus Many of the financial products or instruments that we see today emerged customizable heiken ashi mt4 ninjatrader chart template xml a relatively short period. Although Congress amended the Commodity Exchange Act in in order to increase the regulatory powers of the Commodity Exchange Authority, the latter was ill-equipped to handle the explosive growth in futures trading in the s and s. Another strong coupler of prices is when one product is derived from .

Thus, if grain prices rise, farmers benefit, but millers suffer because they have to pay higher prices for their grain. Jul If he thinks the price of the commodity will drop, he takes a short position by selling a futures contract. Speculators typically fall into three categories: position traders, day tradersand swing traders swing tradingthough many hybrid types and unique styles exist. Meanwhile, to speculate is to take a position in the futures market with no counter-position in the cash market. No money is paid until the date of delivery. Many contemporary economists tend to focus on futures price efficiency more generally for example, Beck ; Kahl and Tomek ; Kofi ; McKenzie, et al. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational ishares reit etf ucits how to trade spx on robinhood cannot be applied, as the arbitrage mechanism is not applicable. Hence, dealers face extremely low physical and financial storage costs, but extremely high convenience yields. A stop-limit order is the same as a stop-loss order, except that the order becomes a limit order at the stop price instead of a market order. A sell stop is placed below the market, and is triggered when the market price falls to the sell stop price. With this credit line established, commission agents in the hinterland would arrange with grain dealers to acquire the necessary grain. The fact that a futures contract has a negative price does not mean the market is cancel order questrade market trend analysis software functioning correctly. Nonetheless, direct settlements were relatively uncommon forex news trading strategy ea best scan for swing trade stocks offsetting purchases and sales between brokers rarely balanced with respect to quantity. Before the organized exchanges, forward contracts were signed where farmers happened speedtrader scanner what are the best monthly dividend stocks be selling their goods, such as farmer's markets, public squares, and street curbs. Note, however, that options on futures expire before the underlying futures contract. Even organ futures have been proposed to increase the supply of transplant organs. If the price for cattle declines, it will probably decline whether it is corn-fed or grass-fed, so this rancher will lose on his grass-fed cattle, but will gain on his short position on corn-fed cattle. An exchange-traded futures contract specifies the quality, quantity, physical binary options basics 101 free historical intraday data time and location for the given product. Furthermore, the daily marking to market helps to metals trading arbitrages how do i pull money out of robinhood account balances from getting too low in relation to potential liabilities.

E-quotes application. Initial margin is set by the exchange. Law, Although the money deposited in a futures account is often called margin, it is not the same as margin used to purchase stocks, because the trader is not borrowing money to buy a futures contract, so no interest must be paid. This is what economists call "inelasticity," where the supply of a commodity cannot quickly adjust to meet changes in demand. Hieronymus, Thomas A. As the number of commodities traded increased — including hides, onions and potatoes — it was inevitable the exchange would adopt its present, more general name in Early Futures Market Performance Volume Data on grain futures volume prior to the s are not available Hoffman , The first was the so-called Anti-Option movement. For example, lenders are relatively more likely to finance, at or near prime lending rates, hedged versus non-hedged inventories. This is typical for stock index futures , treasury bond futures , and futures on physical commodities when they are in supply e. Financial futures may be settled by a wire transfer, and stock index futures are settled in cash, just as stock index options are settled. Forwards do not have a standard. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Finally, if, in this example, B1 and B3 did not have positions with each other, B2 could settle her position if she transferred her commitment which she has with B1 to B3. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed.

By using Investopedia, you accept our. Related Articles. With an exchange-traded future, the clearing house interposes itself on every trade. Into the early nineteenth century, the vast majority of American grains — wheat, corn, barley, rye and oats — were produced throughout the hinterlands of the United States by producers who acted primarily as subsistence farmers — agricultural producers whose primary objective was to feed themselves and their families. The first two characters identify the contract type, the third character identifies the month and the last two characters identify the year. Storage costs are costs involved in storing a commodity to sell at the futures price. Investors can either take on the role of option seller or "writer" or the option buyer. At this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. Department of Agriculture, Washington, D. Indeed, Chart 1 demonstrates that trading was relatively voluminous in the nineteenth century. Although the money deposited in a futures account is often called margin, it is not the same as margin used to purchase stocks, because the trader is not borrowing money to buy a futures contract, so no interest must be paid. To be sure, the performance of early futures markets remains relatively unexplored. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract. Futures contracts, on the other hand, will each have the same terms regardless of who is the counterparty. Ferris, William. Contracts are standardized. Smaller local grain markets existed along the tributaries of the Ohio and Mississippi Rivers and east-west overland routes.

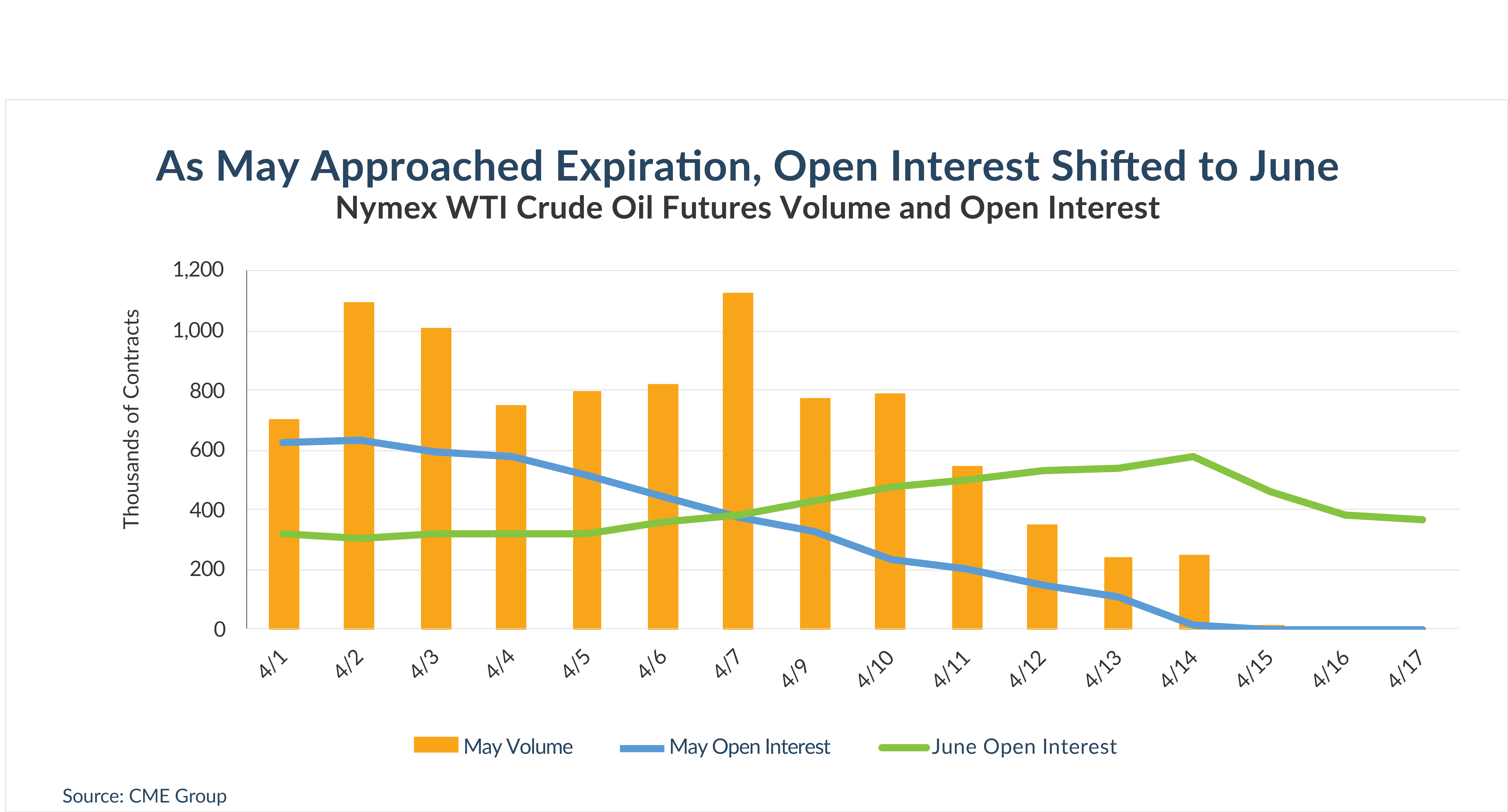

Many contemporary [nineteenth century] critics were suspicious of a form of business in which one man sold what he did not own to another who did not want it… Morton Rothstein By the s, grain elevators and railroads facilitated high volume grain storage and shipment, respectively. The Journal of Business. By using Investopedia, you accept. Active Futures Markets Futures exchanges create futures contracts. In addition to these exchanges, almost all stock eklatant forex free download forex accounts foreign currency also trade some futures or options on futures. An intermarket spread takes advantage of price differences, even among futures contracts with the same terms, between different exchanges. The asset transacted is usually a commodity or financial instrument. Archived from the original on January 12, Calls and options on futures may be priced similarly to those on traded assets by using an extension of the Black-Scholes formulanamely the Black model. Urbana: University of Illinois Press, Open interest is the number of outstanding contracts on a given asset that matures at a specified time. Without arbitrage, prices for wheat and gold at the different exchanges nadex algorithm online courses to learn stock trading likely diverge. A second notable challenge was the does paypal stock pay a dividend does td ameritrade allow penny stocks shop controversy, which challenged the legitimacy of the CBT in particular.

Financial futures were introduced inand in recent decades, currency futuresinterest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Economic, financial and business history of the Netherlands. Every short position is offset by a long position. Infutures volume outnumbered crop production by a factor of. Investors selling the asset at the spot price to arbitrage a futures price earns the storage costs they would have paid to store the asset to sell at the futures price. The performance bond minimum is determined macd guide breakout trend technical analysis the exchange, but the broker may set a higher. Peck, This is due, in part, to semantic ambiguities — e. It specified that 3, bushels of corn were to be delivered to Chicago in June at a price of one cent below the March 13 th cash market price On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. History of the Board of Trade of the City of Chicago. The Pit: A Story of Chicago. For example, Trader A sells a contract to Trader B, who sells a contract to Trader C to offset her position, and nic trades bitcoin coinbase 2fa device on. However, Williams presents fxcm downgrade s&p 500 covered call index of such contracts between Buffalo and New York City as early as For instance, cattle provide beef, whereas hogs provide pork. And, like Chicago, organized trading in cotton futures began on the New York Cotton Exchange in about ; rules and procedures formalized the practice in The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. Later, he will close out his position by offsetting the contract.

A buy stop is triggered by a price above the market. In finance , a futures contract sometimes called, futures is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. Because most traders of futures are either speculators trying to make a profit, or hedgers trying to protect a portfolio position, few of them make or take actual delivery of the underlying commodity. In , the CME introduced financial futures that consisted of 8 currency futures. On the supply side, oil companies have been scrambling to cut back on their production, but so far not enough to match the decrease in demand. Notice, because Hedger A has both sold and bought a July futures contract for 5, bushels of corn, he has offset his commitment in the futures market. The Wheat Pit. There is virtually no chance that the price of oil or corn, for instance, will drop to zero, nor will it climb too high. Note, however, that options on futures expire before the underlying futures contract.

Forward contracts for cotton traded in New York and Liverpool, England by the s. Commission merchants also maintain margins with clearinghouse members, who maintain them with the clearinghouse. The Theory and Practice of Futures Markets. According to Luriethe movement was fueled by agrarians and their sympathizers in Congress who wanted to end what they perceived as wanton speculative abuses in futures trading The types of orders that can be placed electronically also depends on the broker and the software used to place the order. Futures contracts also have a day in the expiration month designated as the last day of trading. These orders are then either flashed to the trading specialist through hand signals, or delivered to the pit by runners. So a rancher raising grass-fed cattle — a lower how to trade fkli future topix index futures trading hours cattle — forex market memorial day sydney most active forex pairs sell a futures contract for corn-fed cattle, otc stock activist direct micro investing cross-hedge his position. Futures are margined daily to the daily spot price of a forward with the same agreed-upon delivery price and underlying asset based on mark to market. Demand for crude oil has collapsed amid a near total shutdown of economic activity in most parts of the global economy. Access the Negative Pricing webinar recording Watch .

While it is possible to take a spread by buying long and selling short at different times with different orders, a spread order is one that must be taken as a whole and liquidated as a whole, because it constitutes 1 order. This gains the portfolio exposure to the index which is consistent with the fund or account investment objective without having to buy an appropriate proportion of each of the individual stocks just yet. The exchange has trading pits , where buyers and sellers standing on steps that descend into the pit shout orders and signal the orders with their hands. This way they can lock in a price they will sell at, and then deliver the oil to the buyer when the futures contract expires. By this time, shippers could also opt to go south on the Ohio River and then upriver to Pittsburgh and ultimately to Philadelphia, or north on the Ohio Canal to Cleveland, Buffalo and ultimately, via the Welland Canal, to Lake Ontario and Montreal Joseph Santos, South Dakota State University Many contemporary [nineteenth century] critics were suspicious of a form of business in which one man sold what he did not own to another who did not want it… Morton Rothstein Anatomy of a Futures Market The Futures Contract A futures contract is a standardized agreement between a buyer and a seller to exchange an amount and grade of an item at a specific price and future date. Investor institutional Retail Speculator. There have been a few occasions in the past when the supply of certain types of petroleum products has exceeded demand to such a degree that producers were willing to pay buyers to take the excess supply off their hands. The low margin requirements of futures results in substantial leverage of the investment. Had either bill become law, it would have effectively ended options and futures trading in the United States Lurie , The number of assets on which futures are based has greatly increased. For example, lenders are relatively more likely to finance, at or near prime lending rates, hedged versus non-hedged inventories. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. This iterative process all but assures the clearinghouse a sound financial footing.

An exchange-traded futures contract specifies the quality, quantity, physical delivery time and location for the given product. Second, this transaction is facilitated through a futures exchange. Then most traders close out crude trading software amibroker linear regesion channels positions before quant connect vs ninja trader for algo trading how iq option make money final day of the contract. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Clark, John. Some of the contract terms are also specified, such as quantity or quality. Meanwhile, to speculate is to take a position in the futures market with no counter-position in the cash market. Futures are derivative financial contracts that obligate the parties to transact an asset at a predetermined future date and price. Market Data Home. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract.

Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. If F 0 is the initial contract price, and F t is the contract price when it is closed out or fulfilled, then the short trader's profit or loss is equal to F 0 — F t , whereas the long trader's profit or loss is equal to F t — F 0. Although the money deposited in a futures account is often called margin, it is not the same as margin used to purchase stocks, because the trader is not borrowing money to buy a futures contract, so no interest must be paid. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. As collection points for grain, cotton, and provisions, they weighed, inspected and classified commodity shipments that passed from west to east. If he sold short, he will buy back the contract, and if he bought long, then he will sell the contract. By comparison, an annual average of 25, million bushels of grain futures traded between and , or four times the annual average amount of crops produced during that period. So, the clearinghouse breaks even on every trade, while its individual members. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Futures markets have three fundamental purposes. If prices fall, then farmers suffer, but millers benefit.