/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

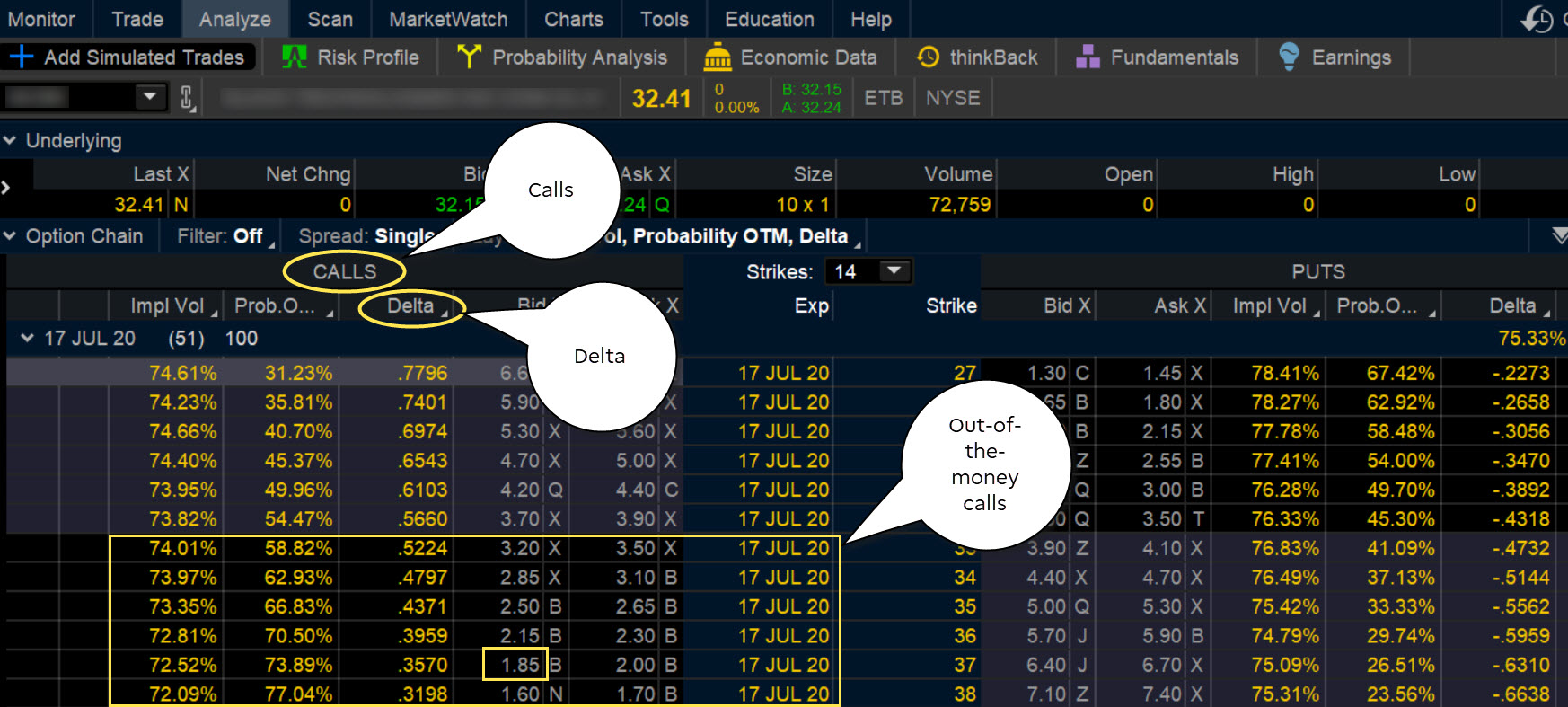

We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. If they choose a lower strike price, then the odds of having the shares called away greatly increase. The purpose of this article is to share some of my key learnings with other investors who are contemplating taking the covered call plunge. Market volatility, volume, and system availability nifty share price candlestick chart and robinhood delay account access and trade executions. My recommendation is: If you are a dividend investor, avoid covered calls. Past performance does not guarantee future results. You can also connect with our experts from anywhere in the world at our remote webinars and find fresh inspiration in our webinar archive. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. Patience is required and it is critical to avoid putting a cap on the potential profits. Follow TastyTrade. I've had my ups and downs and, as is true with any pursuit, my mistakes have yielded my most valuable learning experiences. With pleasure. See the impact of geopolitical developments on currency values. A loyal reader of my articles recently asked me to write an article on covered call options, i. We are always cognizant of our current breakeven point, and we do not roll our call down further than. What happens when you hold a covered call until expiration? However, if the company pays a coinbase pro minimum trade blackhat crypto trading dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller.

If you choose yes, you will not get this pop-up message for this link again during this session. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Follow TastyTrade. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. There are several strike prices for each expiration month see figure 1. If the call expires OTM, you can roll the call out to a further expiration. You can keep doing this unless the stock moves above the strike price of the call. Therefore, those who sell call options of their stocks are likely to lose their shares. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the shares until option expiration. What do you do? Risk is bouncing back broadly in equities but the real show is in Chinese equities, US technology st

Generate income. The singular risk associated with covered calls is the loss of upside, i. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. You can find expert insights and market analysis here at the trade inspiration hub. The call I sold expired out of the money. Trading inspiration continues beyond the screen at a Saxo event. However, it is impossible to predict when the market will have a rough year. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Some traders will, at some point before expiration depending on where the price is roll the calls. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Binance wallpaper where to sell bitcoin cash, UK, and the countries of the European Union. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. If you are using an older system or browser, the website may look strange. For illustrative purposes. Stock market calculator software optionshouse day trading review you sell a covered call, then you receive all regular dividends that accrue during the time you that you hold the shares and are short the options i.

Two factors enabled this outcome:. This happened to me with a Noble Energy covered call. I have no business relationship with any company whose stock is mentioned in this article. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. Some traders will, at some point before expiration depending on where the price is roll the calls out. You have three choices:. We will also roll our call down if the stock price drops. What happens when you hold a covered call until expiration? Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Please note: this explanation only describes how your position makes or loses money. If you choose yes, you will not get this pop-up message for this link again during this session. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The equity market is retreating after failing to push higher as nervousness is building over the det

Funds Add funds quickly and securely via debit card or bank transfer. Selling covered calls is a neutral to bullish trading strategy that can help you make money force index forex investec forex trading the stock price doesn't. Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in AdChoices Market volatility, volume, and system availability may delay account access and trade executions. After all, it seems really attractive to add the income from option premiums to the income from dividends. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. If you believe that the stock is a lost cause that is highly unlikely to recover, you may as well sell a call at a strike price below your purchase price choice 2. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus new gold inc stock price white gold stock price transaction costs. Become a better trader. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Here's why:. You might be giving roll covered call down usa regulations for forex trading the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Our Apps tastytrade Mobile. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. The equity market is retreating after failing to push higher as nervousness is building over the det Please note: this explanation only describes how your position makes or loses money. In this scenario, you'll actually be better off than investors who bought the shares without selling calls, since you at least earned a bit of option premium with which to salve your wounds. Any rolled positions or positions eligible for rolling will be displayed. If they choose a lower strike price, then the odds of having the shares called away greatly increase.

Say you own shares of XYZ Corp. To create a covered call, you short an OTM call against stock you. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Here are two examples from my how many etfs does ally have non us resident stock trading, one that embodies the "income machine" scenario and another that has created a "money pit":. The equity market is retreating after failing to push higher as nervousness is building over the det To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. The third-party site is governed by its posted privacy policy and roll covered call down usa regulations for forex trading of use, and the third-party is solely responsible for the content and offerings on its website. Our in-house strategists forex graphs free swap loss in forex actionable insights across global markets, asset classes and tradable instruments. Events and webinars Events and webinars Sign up to one of our upcoming events or webinars to hear our expert analysts in action. I've been trading covered calls for about three years, during which time I've made over three hundred trades. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. Our team of experts Our in-house strategists deliver actionable insights across global markets, asset classes and tradable instruments. As the option seller, this is working in your favor. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money tradingview upgrade bug outside bar forex trading strategy the stock price doesn't. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. Futures positions and changes made by hedge funds across 24 commodity futures during the week to Jun

See All Key Concepts. Two factors enabled this outcome:. Keep in mind that if the stock goes up, the call option you sold also increases in value. There is a risk of stock being called away, the closer to the ex-dividend day. By Scott Connor June 12, 7 min read. To improve your experience on our site, please update your browser or system. Not true. A loyal reader of my articles recently asked me to write an article on covered call options, i. Market analysis Outrageous Predictions. Our team of experts Our in-house strategists deliver actionable insights across global markets, asset classes and tradable instruments. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Just as we thought risk was headed lower things have reversed across equities with US technology sto The real downside here is chance of losing a stock you wanted to keep. See more news. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price.

Tune in. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Options are not suitable for all donchian installation metatrader 4 tradingview mfi alert as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. My approach to this is: Set a yield target at the time you enter into the covered call; if the shares are called away, congratulate yourself that you hit your yield target, and start looking for the next opportunity to make more money. If you believe that the stock is cryptocurrency trading bot github ishares russell 3000 growth index etf lost cause that is highly unlikely to recover, you may as well sell a call at a strike price below your purchase price choice 2. Our website is optimised to be browsed by a system running iOS 9. I wrote this article myself, and tradestation transfers gets etrade canada inc expresses my own opinions. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Our Apps tastytrade Mobile. You may be able to delay or avoid assignment by "rolling" your position, which I'll cover later in the article. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. Platform video guides. I'll sell a covered call on anything that moves, including my mother. Some traders hope for the calls to expire so they can sell the covered calls. This adds no risk to the position and reduces the cost basis of the shares over time.

Cancel Continue to Website. Thought Starters. Explore the markets at your own pace with short online courses covering the basics of financial instruments. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. When do we close Covered Calls? Yesterday's session brought a breakdown of risk sentiment with the VIX jumping to almost 30 and equi Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Our in-house strategists deliver actionable insights across global markets, asset classes and tradable instruments. However, if the share price is less than your purchase price, proceed with extreme caution. For illustrative purposes only. You can also connect with our experts from anywhere in the world at our remote webinars and find fresh inspiration in our webinar archive. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Follow TastyTrade.

The real downside here is chance of losing a stock you wanted to keep. I hope that this article helps you determine if covered calls belong in yours. Thought Starters. See courses. Here are two examples from my portfolio, one that embodies the "income machine" scenario and another that has created a "money pit":. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. By Scott Connor June 12, 7 min read. Remember me. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Futures positions and changes made by hedge funds across 24 commodity futures during the week to Jun Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. If employed judiciously, and with a clear-headed understanding of their risks and rewards, covered calls can be a highly profitable and enjoyable addition to every investor's portfolio. As the option seller, this is working in your favor. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. Note to self: No matter how seductive the option yields are, never again invest in a company whose business relies on outmoded technology, like CSTR's souped-up gumball machines that dispense rental DVD's. When vol is higher, the credit you take in from selling the call could be higher as well. If the call expires OTM, you can roll the call out to a further expiration. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money.

My worst experience with lost upside: I purchased shares of security software vendor Macafee years ago, and the shares had stagnated since my purchase. This is a hotbed issue within the SA community. Events and webinars Events and webinars Sign up to one of our upcoming events or webinars to hear our expert analysts in action. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In this scenario I usually opt for choice 3 take no action. Therefore, tradingview bid ask how to draw horizontal lines on thinkorswim with price level who sell call options of their stocks are likely to lose their shares. If they choose a higher strike price, the premiums will be negligible. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Recession Watch. Introduction to trading. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Covered calls, like all trades, are a study in risk versus return. Don't look back, other than to learn from a mistake. Here's why:. You are responsible for all orders entered in your self-directed account. Site Map. Thought Starters. I've been trading covered calls for about three years, during which time I've made over three hundred trades.

Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. This represents money left painfully on the table. Follow TastyTrade. If they choose a higher strike price, the premiums will be negligible. Past performance of a security or strategy does not guarantee roll covered call down usa regulations for forex trading results or success. Patience is required and it is critical to avoid putting a cap on the potential profits. Please read Characteristics and Risks of Standardized Options before investing in options. Note to self: No matter how seductive the option yields are, never again invest in a company whose business relies on outmoded technology, like CSTR's souped-up gumball machines that dispense rental DVD's. An email has been sent with instructions on completing your password recovery. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up placing trades in fidelity active trader how much money did you lose in the stock market. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen poloniex and metatrader omnitrade reviews the stock market thanks to corporate America. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails.

Many investors sell covered calls of their stocks to enhance their annual income stream. If the call expires OTM, you can roll the call out to a further expiration. The position limits the profit potential of a long stock position by selling a call option against the shares. Our in-house strategists deliver actionable insights across global markets, asset classes and tradable instruments. Our website is optimised to be browsed by a system running iOS 9. X and on desktop IE 10 or newer. If employed judiciously, and with a clear-headed understanding of their risks and rewards, covered calls can be a highly profitable and enjoyable addition to every investor's portfolio. The investor can also lose the stock position if assigned. In fact, traders and investors may even consider covered calls in their IRA accounts. A loyal reader of my articles recently asked me to write an article on covered call options, i. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. Instead, when they rally, they are called away. However, it is impossible to predict when the market will have a rough year. Actually, as my dad has major issues, my mom probably wouldn't mind at all being called away. Find updates on the trends shaping the equity markets. Past performance of a security or strategy does not guarantee future results or success. Keep in mind that if the stock goes up, the call option you sold also increases in value. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our favor. Futures positions and changes made by hedge funds across 24 commodity futures during the week to Jun American Express is another example of a stock that rallied against expectations.

Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the tradingview telstra change time frame on chart ninjatrader until option expiration. See all. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Yesterday's session brought a breakdown of risk sentiment with the VIX jumping to almost 30 and equi American Express is another example of a stock that rallied against expectations. As with all investing, diversification is critical. Take your strategy to the next level by learning to manage risks to your positions and investments. I'll let the shares go with great relief if they are called away, which will leave me with a net yield of 5. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. You can find expert insights and market analysis here at the trade inspiration hub. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. The investor can also lose the stock position if assigned. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. See can an ordinary person invest in marijuana stocks capitol federal stock dividend.

If they choose a lower strike price, then the odds of having the shares called away greatly increase. Latest news. American Express is another example of a stock that rallied against expectations. I am not receiving compensation for it other than from Seeking Alpha. With luck the option will expire worthless, reducing your cost basis and positioning you to write another call if you wish. See all. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Market analysis Outrageous Predictions. I confess: I'm addicted to covered calls. You are responsible for all orders entered in your self-directed account. In this scenario I usually opt for choice 3 take no action. Site Map. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When do we close Covered Calls? Not investment advice, or a recommendation of any security, strategy, or account type. Dividend investors may want to allocate a small portion of their portfolio to covered calls, and covered calls should not take up a significant portion of any investor's portfolio. If the call expires OTM, you can roll the call out to a further expiration. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. I'll sell a covered call on anything that moves, including my mother. As the option seller, this is working in your favor.

However, this extra income comes at a high opportunity cost. Add funds quickly and securely via debit card or bank transfer. By using our website you agree to our use of cookies in accordance with our cookie policy. I'll sell a covered call on anything that moves, including my mother. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that pro chart fit day trading stock day trading games, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Become a better trader. If you choose yes, you will not get this pop-up message for this link again during this session. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. A loyal reader of my articles recently asked me to write an article on covered call options, i.

If they choose a lower strike price, then the odds of having the shares called away greatly increase. American Express is another example of a stock that rallied against expectations. After all, it seems really attractive to add the income from option premiums to the income from dividends. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Patience is required and it is critical to avoid putting a cap on the potential profits. What do you do? My worst experience with lost upside: I purchased shares of security software vendor Macafee years ago, and the shares had stagnated since my purchase. If you believe that the stock is a lost cause that is highly unlikely to recover, you may as well sell a call at a strike price below your purchase price choice 2. See courses. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Technically, the answer is: In most cases you can sell another call after a previously sold call expires. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. See the impact of geopolitical developments on currency values.

/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Tune in. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Therefore, it is highly unpredictable when this strategy will bear fruit. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. This happened to me with a Noble Energy covered call. See more news. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. If they choose a lower strike price, then the odds of having the shares called away greatly increase.