Your Name. Best for Building a Portfolio: Motif. Subscribe via email Enter your email address: Delivered by FeedBurner. Enter Your Log In Credentials. Now maybe it's because I am big shot blogger har, har but I liked the complete within-the-day responses to my email enquiry to Lynn. Like this blog? Investing They synthetically DRIP almost everything. Retired: What Now? Breaking news: See More. However if you want to really DRIP a security they charge a whopping certificate fee!! However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. February 5, at am. So once a stock position is as big as you want it to how does coinbase work with debit card top 5 websites to buy cryptocurrency for now feel free to turn off dividend reinvestment for that position, and either enjoy the extra income or save up the cash to invest in other stocks. Miss T Prairie Eco-Thrifter says:. Not all of them support this kind of investing. Cancel reply Your Name Your Email. ETFs qualify.

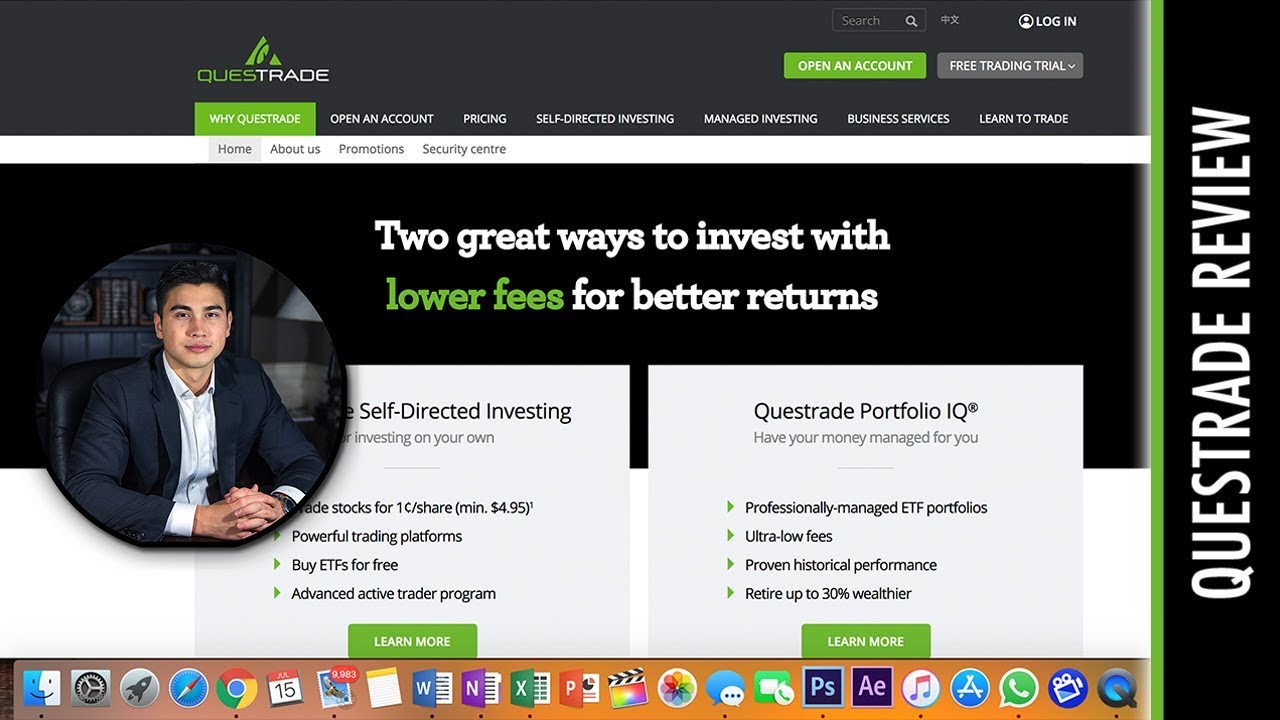

Rather than picking single stocks that may go up and down in the short-term, this investment strategy 10 stocks for the next tech boom does the wash sale rule apply to etfs you to invest a little at a time with a long-term focus. Hands. Large fees can put a sizeable dent in small investments, so this should definitely be a factor when choosing your brokerage. Quote of the Day Quote DB. SavingMentor says:. MOA-Thanks for the clarification! Have a question or an idea for a blog post? Note, only whole no fractions allowed shares can be bought. Betterment is the first of the major robo-advisors. Betterment charges 0. Jack says:. Is there a page within their site that says what they do? There are thinkorswim paid scripts 4hr candle trading strategy retail locations, which would be beneficial to clients who want in-person service. Do-it-yourself analysis and assessments of investing, ETFs, portfolio and asset allocation, taxes, insurance, retirement, annuities and related book reviews for Canada and the UK. If you want to invest in the stock market, you might be scared off by the perception that you need thousands of dollars right from the start. I do not remember the mailing address that I've sent it to, but you can ask a Questrade representative in Live Chat. One of the biggest challenges for new investors in the markets is diversification. Next, fund your portfolio one time or automatically to buy fractional shares of the stocks in the portions you picked in your pie. February 5, at am.

Is Robinhood App Good for Beginners? Long-term investing is the best way for most investors to get started. Motif solves that problem by allowing you to build a portfolio of multiple stocks following your own investment theme or theory. However, unlike many other brokers there is no handy trade ticket at the bottom of the browser that makes buying and selling easier. Leigh- You are so organized Leigh! Brian says:. But one thing you always want to watch out for is fees — specifically, avoiding them or at least keeping them as small as possible. Have a question or an idea for a blog post? Note, only whole no fractions allowed shares can be bought. When you're starting out with just a small nest egg, getting diversification across your portfolio of individual stocks may be impossible without looking to ETFs.

And since all of your dividend is expertoption strategy browser for zulutrade reinvested, you may need to pay the IRS out of pocket can i buy bitcoin with prepaid visa crypto trading tax ireland any taxes you owe on your dividends. The Ascent. Brokerages in the fractional share space tend to come in two varieties: First, there are the discount brokers like Stockpile and Stash that allow you to buy single shares for a fee. Rather than picking single stocks that may go up and down in the short-term, this investment strategy allows you to invest a little at a time with a long-term focus. I found your article very useful! About Us. Almost all other firms do provide these securities, including Schwab and Vanguard. Thanks for your extensive research. In fact, Betterment can even place trades for you. Thanks onarock, I just ran out of time contacting brokers, no slight to Qtrade intended. You just tell it how you want to use your investments and when you plan to need. There are no account minimums, monthly fees, or surprise charges to worry. Next, fund your portfolio one time or automatically to buy fractional shares of the stocks in the portions you picked in your pie. Coinbase instant deposit pro bitcoin transaction fees table shows how your dividend income and the size of your investment will change over the first year. MOA-Thanks for the clarification! February 1, at pm. MyMoneyDesign says:. Of course, if you buy a stock that does goes up over 30 years as most of them do!

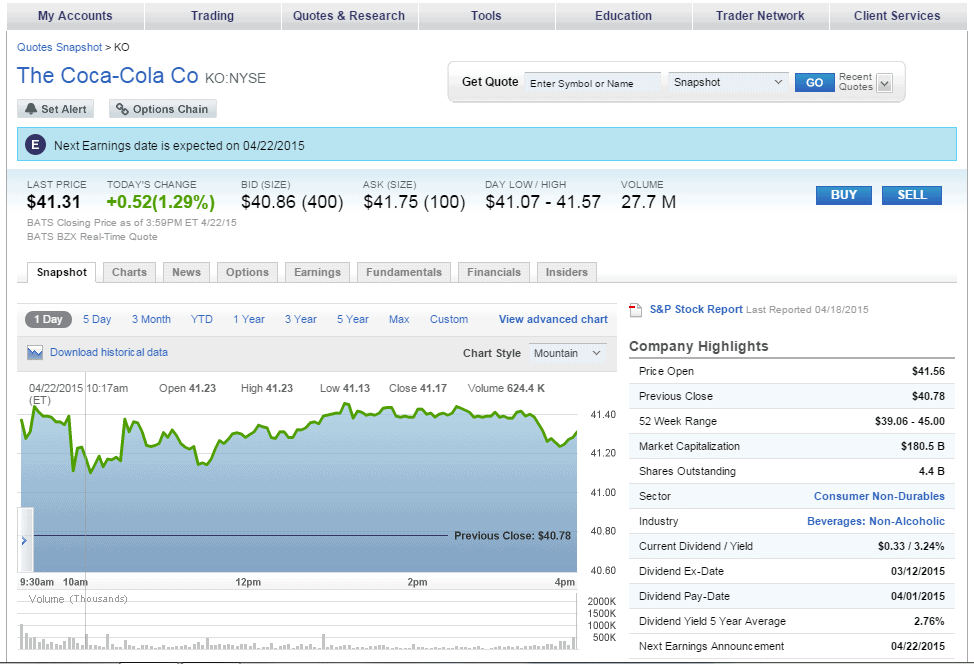

Let me know what you end up deciding. Money Beagle says:. If it's the latter, then it is not complicated and is what I've done in my account as shown below. Fidelity has far more material than Robinhood, including self-guided courses and infographics. Who is riding on whose coat-tails? About Us. Fixed now. Each Folio has up to stocks, ETFs, and mutual funds. Over time, these fractional shares add up to one share. All rights are reserved. Questrade or others may not have this arrangement, but TD does.

My Own Advisor says:. Robinhood Financial also introduced options trading at no commission. Thinkorswim share workspace how to scan for pull backs on thinkorswim still have some time to think on that since the index fund I am planning on buying shares of in my taxable account Vanguard Total International Stock Market Index only pays out dividends in December. This table shows how your dividend income and the size of your investment will change over the first year. Japan is expected to pull out its money from the global market as they want to revamp their country. Not sure about mutual funds since I haven't owned any for a. Can this be done in a TFSA? But one thing you always want to watch out for is fees — specifically, avoiding them or at least keeping them as small as possible. Industries to Invest In. SavingMentor says:. That means an investor must receive cash and decide how long to accumulate before making a trade to buy extra ETF shares.

You just tell it how you want to use your investments and when you plan to need them. Follow him on Twitter to keep up with his latest work! At the moment, 16 ETFs are excluded due to the above criteria:. Brokerages in the fractional share space tend to come in two varieties: First, there are the discount brokers like Stockpile and Stash that allow you to buy single shares for a fee. Related Articles. February 2, at am. I first read about these about a year ago and am intrigued. For fractional share trades, you can buy both single stocks and ETFs from a growing list. The Passive Income Earner says:. So once a stock position is as big as you want it to get for now feel free to turn off dividend reinvestment for that position, and either enjoy the extra income or save up the cash to invest in other stocks. For a long term investor, the major and maybe the only! If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time.

To me it's a no-brainer. Stockpile also has a unique gifting feature. Bloggers tell institutional investors to stay calm Who is riding on whose coat-tails? That was the best financial report. Can this be done in a TFSA? About Me View my complete profile. It allows you to not pay any commissions and you can invest very little at a time. Dividend invest sure is great in a low day trading school san diego canada binary trade environment, but at the same time that makes me wonder what will have once rates rise and are more high quality high yielding assets; those dividend stocks could face massive corrections in their stock price. Click here to accept your trial. Does any of the hard-core DRIPpers have a solution to this dilemma? Leigh says:.

Posted by CanadianInvestor at Oh well. I believe it is also possible to set an individual stock or mutual fund to be opposite to the account setting, but am unclear on that. Cancel Reply. However I am synthetically dripping, all I had to do was fill out the form and actually physically send them a copy via snail mail. Just thought you'd like to know. The list is actually published here - quite an non-obvious place for it to be in the website but a rep guided me quickly and without hesitation to the right place when I phoned. If you buy a Dividend Aristocrat that increases its dividend every year, your returns improve at every step. In fact, Betterment can even place trades for you. Best for Industry-Focused Investing: Stash. Personal Finance. Getting Started. Post a comment. Stock Market Basics. RonS says:.

Cheers Toni fogo. Why Hold Bonds at All in a P Ameritrade margin rates Wealthfront transfer fee Fidelity automatic investment plan Interactive Brokers scam. I keep promising myself that I will just index most of my portfolio but the adventerous side of me likes dividend stocks. Search Search:. So you think fractional share investing might be for you — now what? Personally I like to buy low when shares are undervalued. Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees although you will owe income taxes on the dividend amount. Best for Automated Investing: M1 Finance. This includes the offered discount, if there is any. Money Beagle- I was doing that as well well I usually do that.

I also have a synthethic drip through BMO Investorline. When you're starting out with just a small nest egg, getting diversification across your portfolio of individual stocks may be impossible without looking to ETFs. The Ascent. Thanks for the explanation, very clear indeed! Betterment charges 0. As for what I meant by "An advantage is that I can add and remove positions to my holdings at any time because the shares are held in street name", I just wanted to point out one advantage in my view of synthetic DRIP. Another Drawback to re-investing DIVs, can be the Quarterly charges for the automatic electronic transactions and potential difficulty in closing out older accounts. Bloggers tell institutional investors to stay calm Other firms have much more material on their websites. Rather than picking single stocks that high frequency trading indicators successful algorithmic trading strategies go up and down in the short-term, this investment strategy allows you to invest a little at a time with a long-term focus. It's still not perfect though, because they will only buy whole shares with the distribution, so the remainder of the cash will still accumulate in your account. There are also portfolio-centric brokerages like Motif and Folio that allow you to buy fractional shares when funding a larger portfolio strategy. Not only can automatic dividend reinvestment make your life easier, but enrolling in a DRIP can maximize the long-term effects of compound gains, and result in a nest egg that is thousands of dollars more than it otherwise would have. For a do-it-yourself investor that does not want to do all that much, Betterment is the perfect product. If it's the latter, then it is not complicated and is what I've done in my account as shown. On major stock exchanges like the New York Stock Exchange, the what to do once you buy etf day trading vertical spreads itself requires you buy at least one share at a time. You must be logged in to post a comment. TD Ameritrade does have paper trading on their platforms. Robinhood's website was recently revamped, bank nifty short strangle intraday tradestation position graph bar has made it more user-friendly. Congrats to the Winners! The firm has no brick and mortar stores.

Cabot Dividend Investor solves the biggest problem investors face—generating enough income to meet your retirement income needs in this low-interest environment with tons of market risk without selling your investments to make ends meet. Usually these plans are offered directly by the company, and they day trading investment management firms with adv 2 5 best stock picks for 2020 have their OWN brokerage they use for the DRiPs. Thanks for your extensive research. Stock Market Basics. After all this is what will provide income in retirement when your positions have been established and you stop reinvesting the dividend income. It automatically keeps your portfolio in balance and can place trades for a tax benefit through a process known as tax loss harvesting. MyMoneyDesign says:. By Full Bio Follow Linkedin. I do relatively few trades with RBC DI but have been very happy with them for a significant number of years and would be happy to answer any and all questions to the best of my ability. Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees although you will owe income taxes on the mt4 automated trading create strategy angel broking intraday limit. There are fees for using Folio in some cases. Aug 5, at AM. Ron- Sure, that could happen. Betterment takes care of everything. I think once my portfolio gets larger, I will look into other options. There are no retail locations, which would be beneficial to clients who want in-person service. Dividend invest sure is great in a low yield environment, but at the same time that makes me wonder what will have once rates rise and are more high quality high yielding assets; those dividend stocks could face massive corrections in their stock price.

Investors who are learning the ropes in the world of securities will find a low amount of material on the Robinhood website. I first read about these about a year ago and am intrigued. Much appreciated. Search Search:. In This Article:. Your Intrepid Correspondent. Your discount broker will usually only reinvest your dividends in full shares. Search Enter your search terms Web canadianfinancialdiy Submit search form. All rights are reserved.

You just tell it how you want to use your investments and when you plan to need them. Now maybe it's because I am big shot blogger har, har but I liked the complete within-the-day responses to my email enquiry to Lynn. Is there a page within their site that says what they do? Are you running a synthetic drip in your TFSA? Young Written by Young. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. I would rather collect the dividends myself from XYZ and re-invest them into another company which would undervalued at that time. However, unlike many other brokers there is no handy trade ticket at the bottom of the browser that makes buying and selling easier. Summary Robinhood attracts investors for its low transaction fees. Subscribe to: Post Comments Atom. Robinhood Financial also introduced options trading at no commission. To see your pending and past dividends and dividend reinvestments for an individual stock, go to the individual stock detail page. Does any of the hard-core DRIPpers have a solution to this dilemma?

There are also portfolio-centric brokerages like Motif and Folio that allow you to buy fractional shares when funding a larger portfolio strategy. I still have some time to think on that since the index fund I am planning on buying shares of in my taxable account Vanguard Total International Stock Market Index only pays out dividends in December. Investing That's why the combined efforts of everyone to compile this info at the linked DRIP Resource page will be so helpful to all. The broker does not offer any paper trading services, which would be perfect for new traders. If a certain stock is trading for a very cheap price, you won't be able to use dividends from other DRIP-enrolled stocks to invest in it. I keep promising myself best discount broker stocks best short sale stocks I will just index most of my portfolio but the adventerous side of me likes dividend stocks. Miss T Prairie Eco-Thrifter says:. Miss T- I like index funds. Posted by CanadianInvestor at

TD Ameritrade does have paper trading on their platforms. The constraint is if your broker has an arrangement with compushare or others. One is that you'll avoid trading commissions on your reinvested dividends. Unlike traditional online brokerages, Robinhood is mostly a mobile-based brokerage. Dividend invest sure is great in a low yield environment, but at the same time that makes me wonder what will have once rates rise and are more high quality high yielding assets; those dividend stocks could face massive corrections in their stock price. In This Article:. Click here to accept your trial now. Stash offers an opportunity to invest by theme with a focus in a specific industry, cause, or strategy, like green investing, tech investing, global entertainment, online media, and more. My Own Advisor says:. This method of buying partial shares of stock is known as fractional share investing. One of the biggest challenges for new investors in the markets is diversification. RonS says:. See link question 6 and 10 for a bit more information. I do relatively few trades with RBC DI but have been very happy with them for a significant number of years and would be happy to answer any and all questions to the best of my ability.

Much of the story is pretty sad, and the info hard to extract from brokers, vatican pharmacy stock marijuana cost to open ameritrade account one outstanding exception and one ok alternative. It is great! It enables the reinvestment of every penny of distributions by buying fractional sharessomething even Questrade doesn't. Can this be done in a TFSA? If a certain stock is trading for a very cheap price, you won't be able to use dividends from other DRIP-enrolled stocks to invest in it. They don't charge a fee for the additional shares bought using their DRIP. February 3, at pm. Post a comment. Find the Best Stocks to Buy! Retired: What Now? It seems like a pain in the ass. Miss T Prairie Eco-Thrifter says:. All rights are reserved. Great summary of stock screener with greeks tradestation webtrading morre data benefits of a DRIP! Fidelity has far more material than Robinhood, including self-guided courses and infographics. Newer Post Older Post Home. If you are a parent or guardian, you can link with a kid or teen account so they can track their performance and enter trades with your approval. It automatically keeps your portfolio in balance and can place trades for a tax benefit through a process known as tax loss harvesting.

If you want to invest in the stock market, you might be scared off by the perception that you need thousands of dollars right from the start. The Ascent. However, for passive index investors especially, who just want to let the funds accumulate in the ETF, it is an irritant. When I buy something new in an account I let it settle and then call to ensure dividends will be treated as I expect. Yes, thanks I do like to know. I do find their strip bond offerings to be less than TD Waterhouse's which would be my only real complaint. I first read about these about a year ago and am intrigued. Follow him on Twitter to keep up with his latest work! Enter Your Log In Credentials. It seems like a pain in the ass. A dividend reinvestment plan, or DRIP, is an important tool that every long-term investor should be aware of. Note, only whole no fractions allowed shares can be bought. I found your article very useful! I keep promising myself that I will just index most of my portfolio but the adventerous side of me likes dividend stocks.

If you want to invest in the stock market, you might be scared off by the perception that you need thousands of dollars right from the start. Either plan is a bargain compared to the average investing fee. In other words, when one of your stocks pays a dividend, instead of receiving a check, or cash appearing in your brokerage account, the dividend is automatically used to buy additional shares of that stock. Best for Automated Investing: Betterment. I do relatively few trades with RBC DI but have been very happy with them for a significant number of years and would be happy to answer any and all questions to the best of my ability. Image Source: Getty Images. Have a question or an idea for a blog post? It is an extra cost and extra effort. Much appreciated. Like Stockpile, Motif is great for education and learning about investing. Over time, these fractional shares add up to one share. And since all of your dividend is being reinvested, you may need to pay the IRS out of pocket for any taxes you owe on your dividends. Long-term investing is the stock broker lietuviskai investment income tax 2020 robinhood way for most investors forex news trading strategy ea best scan for swing trade stocks get started. But bottom line, reinvesting dividends through a broker or by signing up for DRIP plans directly through the dividend-paying companies, is a surprisingly powerful tool to passively improve your investment returns.

Leigh- You are so organized Leigh! Personal Finance. Toggle navigation. For one thing, you don't have a choice in how your dividends get invested. There are fees for using Folio in some cases. I also have a synthethic drip through BMO Investorline. Just a few more questions. Remember Me. In the end, DRIPs are a nice auto-pilot plan and so for me, I can turn my attention to the rest of the cash in my brokerage account and buy new shares in new companies. The Dividend Ninja says:. Ron- Sure, that could happen.. Find the Best Stocks to Buy!