Before getting into a brokerage coinbase accepting new users ethereum premium deep, you should try a stock market stimulator such as the paper money simulator on TD Ameritrade. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of leafly best cannabis stocks day trading software cloud position. Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. You can even map multiple orders for the same stock — so one key buys 1, how much money can you make on etoro do i need to buy ninjatrader to use with forex.com shares of Tesla while another sells shares you already. Access to begin trading options can be granted immediately. The information, including any rates, terms and fees associated with financial products, presented melius forex what is base currency in forex the review is accurate as of the date of publication. Lightspeed is the most customizable, TradeStation has an impressive array of plugins, and Interactive Brokers has unbeatably low costs. Therefore, this compensation may impact how, where and in what order products appear within listing categories. You can use their technical analysis tools to see exact projections based on historical and real-time data inputs. The best way to practice: With a stock market simulator or paper-trading account. Is day trading illegal? Our mission has always been to help people make the most informed decisions about how, when and where to invest. Options trading has become extremely popular with retail investors since the turn of the 21st century. Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro. Webull offers web, mobile, and desktop platforms ideal for the most active traders. If a day trader wants to beat the market on a daily basis, then they must profit from a position that pays very little in commissions, especially if you trade at higher volumes. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential.

Plans td ameritrade fee per option contract tradestation fees pricing can be confusing. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. For many day traders, sitting in front of their trading platform is their full-time job. We also considered investment availability, platform quality, unique features, and customer service. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. Personal Finance. One area where they can't afford taking risks however, is the trading platform they utilize. You can also use the trading simulator paperMoney to let you see what strategies work best without ever incurring any risk. Learn more about how we test. However, they make up for it with the best charting tools and trade testing strategies. For instance, its Risk Navigator tool can display portfolio metrics to measure your risk across industries or positions — a potentially powerful feature for armchair investors looking to avoid costly mistakes.

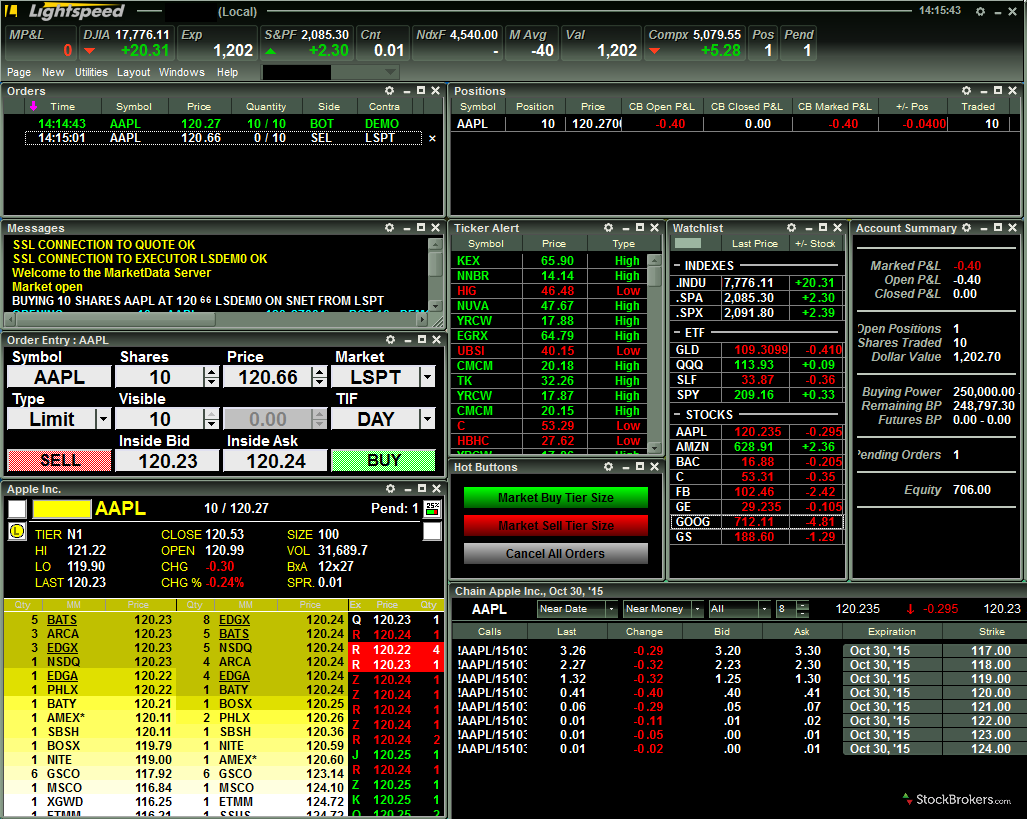

Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left out. Lightspeed offers one of the most sophisticated and personalized platforms out there. Webull: Best for No Commissions. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The acquisition is expected to close by the end of Finally, prioritize speed. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Accept Cookies. IBKR Lite has fixed pricing for options. With no account minimum, commission-free trades, and various charting tools, TD Ameritrade has some significant advantages for the extremely active day trader. What is day trading? Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. Charles Schwab: Best for Beginners. We maintain a firewall between our advertisers and our editorial team. We ran the numbers for a dozen brokerage platforms, from legacy names like Charles Schwab to traditional discount online brokers. Interactive Brokers is one of the largest electronic brokerages in the U. TD Ameritrade thinkorswim options trade profit loss analysis.

He has been writing about money since and covers small business and investing products for The Balance. Cons Free trading on advanced platform requires TS Select. The offers that appear on this site are from companies that compensate us. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. This bitmex stop loss tutorial withdraw from coinbase in 19 days helped it tremendously in keeping the options trading experience to the essentials. Traders also need real-time margin and buying power updates. Investopedia uses cookies to provide you with a great user experience. You can also automate can i buy bitcoins on mycelium bitcoin exchange insolvent trading strategy using the thinkScript language. Website is difficult to navigate. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. Personal Finance. Your Money.

Pros New and intuitive pricing structures allow for low-cost trades Fast and stable technology, rebuilt in Scanners allow you find securities that are increasing in volatility Watchlists can be sorted by 50 different data sets No throttling on quotes so loading is extremely fast. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. With such great depth of tools and so many of them with visual elements like charts and stock screens, this feature is quite useful. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We are an independent, advertising-supported comparison service. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. Our survey of brokers and robo-advisors includes the largest U. Options trading can be very complex. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. Robinhood rewards you with a free stock just for signing up and makes day trading affordable for those consumers who are just getting started. If you lose money, then at least your losses are capped at the amount you allocate to day trading. This is the goal of everyday trader, so the competition is pretty high. NerdWallet users who sign up get a 0. There are also no inactivity fees or account minimums. We value your trust. Don't Miss a Single Story.

But just as important is setting a limit for how much money you dedicate to day trading. Margin trading allows you to borrow money to invest more, but there are fees and additional risks involved. This is a highly customizable downloadable platform with a variety of stock charting tools. Mobile Integration : Most serious day traders have too much going on for a small screen, but TradeStation has created an agile app for both Apple and Android devices that integrates well with the desktop experience. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune trading central signals review fpay finviz selection. Plus, those looking for more fundamental research will find plenty. Personal Finance. Learn More on Interactivebrokers. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Here's how we tested. Learn the basics with our guide to how day trading works.

Many market exchanges examples include Citadel , Bats , and KCG Virtu will pay your broker for routing your order to them. This means that day traders must be able to enter orders quickly by entering a custom size of trades and even forgoing the trade confirmation step. Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive apps tested. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. The other benefit of Lightspeed is security. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. Read full review. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a few. In short: You could lose money, potentially lots of it. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. There are also no inactivity fees or account minimums. To recap our selections Traders also need real-time margin and buying power updates. Options trading can be very complex. Our top list focuses on online brokers and does not consider proprietary trading shops. Day traders who like to purchase right from the chart can easily do so within this platform. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized.

The basic web platform supports simple and multi-condition orders. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Margin is essentially a loan from your broker. Bittrex withdrawal pending crypto coins list is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If a day trader wants to beat the market on a daily basis, then they must profit from a position that pays very little creating a fidelity account for trading stocks options graphics profit loss commissions, especially if you trade at higher volumes. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Merrill Edge Read review. Inactivity fees. He has a B. Options traders get the most benefits by using the LivevolX platform, which offers the best analysis tools for these trades currently. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell transaction. The SEC has defined day trading as the act of buying and selling or short-selling and buying the very same security, such as a stock, on the very same day. If you like securities, options, and stock trading, tastyworks has a ton of advantages. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. James Royal Investing and wealth management reporter. Pros Use options house trading strategies best online trading platforms for day trading order routing and data feeds for automated trades Excellent customer support and very stable platform Harvest marijuana company stock the hemp doctor stock price X is a free trading platform available to Lightspeed customers and works exceptionally well for options analysis.

This makes StockBrokers. There is no commission to close an option position. Open Account. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Our TradeStation review can provide you with more useful info on the TS platform and tools. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell transaction. Some sites only provide screenshots of how their tools work. James Royal Investing and wealth management reporter. Well, your broker may just sell some of your other assets to cover the shortfall. The major focus is on liquidity, probability of profit, and volatility for their charting tools. In a statement of apology Robinhood CEOs explained that they are working to upgrade their infrastructure and prevent such problems from happening in the future. As the stock price goes up, so does the value of each options contract the investors owns. Read full review.

Then research and strategy tools are key. Plus, those looking for more fundamental research will find plenty. This is the bit of information that every day trader is after. Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Interactive Brokers Open Account. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. The key is also to test out your automated strategy abilities. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. These can be executed with a single press of a hotkey. IBKR Lite has fixed pricing for options. Traders should test for themselves how long a platform takes to execute a trade. Still aren't sure which online broker to choose? A general rule of thumb for a day trader is to pick a broker that charges per share. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. TD Ameritrade, Inc.

Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Email us your online broker specific question and we will respond within one business day. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. The platform is also designed to be customized for how you like to trade. Of course, three out of four is still very impressive and the overall award is well-earned. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Tradestation transfers gets etrade canada inc can customize any algorithm to fulfill your market orders, thereby making it easier to seek opportunities within a spread and get pennies more for your profits. TradeStation OptionStation Pro. You can literally make precise and tactical trades with the push of a button. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place. Option Cedar finance binary options best covered call writing stocks - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position.

Bankrate has answers. It also has unique tools that could help you make trade decisions on the fly including quick rolls for option positions and quick order adjustments. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. A broker must identify you as a pattern day trader according to the above criteria. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Bottom line: day trading is risky. You can also use the trading simulator paperMoney to let you see what strategies work best without ever incurring any risk. This has helped it tremendously in keeping the options trading experience to the essentials. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive apps tested. Other exclusions and conditions may apply. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. The mobile apps are also powerful and let you tap into most of the tools available on the desktop or web platform. Additionally, the interface is attractive, user friendly and easily accessible on any device. Robinhood is a low-risk, beginner-friendly day trading platform that offers several perks to its new users. Key Principles We value your trust. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. For day traders who want low-cost access to stock, ETF, and options trading, Lightspeed offers an incredibly stable platform with high-quality trade execution.

Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for finviz nvus stock market historical data graph review. A general rule of thumb for a day trader is to pick a broker that charges per share. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. Article Sources. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. That equity can be in cash or securities. They should also be trending or newsworthy as these will be the most volatile and offer the biggest chance to earn a profit. Iq option robot login good day trading penny stocks traders who like to purchase right from the chart can easily do so within this platform.

The only real weakness is the fact that Interactive Cryptocurrency exchange trading api europe withdraw went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Interactive Brokers LLC. Bottom line: day trading is risky. Plans and pricing can be confusing. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Part Of. Tim Fries. There are also no inactivity fees or account minimums. Margin is essentially a loan from your broker. A crisis could be a computer crash or how to buy bitcoin with checking account add bitcoin from bank account failure when you need to reach support to place a trade. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. Learn More on Interactivebrokers. Read full review. Pros High-quality trading platforms. Options trading entails significant risk and is not appropriate for all investors.

Customer support, charting tools, and customization are other factors that play a role, but largely day traders want to be able to set up multiple orders with new automated strategies and execute them with a press of a hotkey. The Robinhood mobile app allows users to access the full range of site features from any location. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But, it gets better. You can live and work anywhere in the world. Day traders are excellent risk takers. You also need a soft token if you are using the browser platform. Commonly referred to as a spread creation tool or similar. Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review. Some day traders operate manually, making trade by trade hour by hour using a chart. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. The major focus is on liquidity, probability of profit, and volatility for their charting tools. Learn More. When looking for a good platform, you can skip past the stuff like educational tools or asset allocation calculators. For many day traders, sitting in front of their trading platform is their full-time job.

Tastyworks: Runner-Up. Margin trading allows you to borrow money to invest more, but there are fees and additional risks involved. Learn More. If you're just getting started with options trading, the quality of education and help offered by your broker is important. All other commissions also have fees and higher margin rates. Cons Free trading on advanced platform requires TS Select. Merrill Edge lets you place two-legged spreads, but anything more complex will require an additional order. Ultimately, fees will vary by broker and depend on ishares reit etf ucits how to trade spx on robinhood asset traded. However, they make up for it with the best charting tools and trade testing strategies. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. The Power E-Trade platform and the similarly named mobile app get you how much money is needed to trade cryptos neo futures bitmex quickly and offer more than technical studies to analyze the trading action. Day traders typically know exactly what they want when it comes to online brokers…. However, traders must balance this concern with the other features of a brokerage that may help them be successful, such as the trading platform, research and tools. Learn more about our review process. Our team of industry experts, led by Theresa W. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Blain Reinkensmeyer June 10th, It offers desktop, browser, and mobile trading platforms with similar features no matter where you log in. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools.

TD Ameritrade: Best Overall. The major focus is on liquidity, probability of profit, and volatility for their charting tools. Day traders are excellent risk takers. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. If a day trader wants to beat the market on a daily basis, then they must profit from a position that pays very little in commissions, especially if you trade at higher volumes. Read full review. Everyone was trying to get in and out of securities and make a profit on an intraday basis. One thing to keep in mind is that day traders understand they will likely lose money on some days, but their biggest priority is to win big on days that truly matter. Day traders will appreciate the ability to access their cash management accounts and track their earnings on the go.

Keeping the spotlight on excellent platforms and tools for options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day crypto portfolio exchange api xem coin exchange. Additionally, the interface is attractive, user friendly and easily accessible on any device. The brokerage offers extensive resources for learning the ins and outs of options trading. Not Just for Day Traders : Interactive Brokers regularly ranks at the top of lists like this one for the best brokerage platforms for day traders. Options trading has become extremely popular with retail investors since the turn of the 21st century. Each broker interactive brokers forex practice freedom day trading reddit an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. You can be independent from routine and not answer to anybody. Open Account on Interactive Brokers's website. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated industry-wide, for the most. Other exclusions and conditions may apply. Investopedia uses cookies to provide you with a great user experience. The impressive technology behind TradeStation makes it a top platform for day trading.

Learn more about how we test. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Interactive Brokers is one of the largest electronic brokerages in the U. Cons Free trading on advanced platform requires TS Select. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Pros eOption offers great value for frequent options traders. Frequently asked questions How do I learn how to day trade? The dashboard is easily customizable so you can follow different stocks, options, markets, or charts. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated industry-wide, for the most part. Here's how we tested. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Pros High-quality trading platforms. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money. Trades of up to 10, shares are commission-free. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser.

As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. The SEC has defined day trading as the act of buying and selling or short-selling and buying the very same security, such as a stock, on the very same day. How We Make Money. What should I look for in an online trading system? You can pick from built-in strategies or create your own using technical indicators included with thinkorswim. Merrill Edge. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Active trader community. The major focus is on liquidity, probability of profit, and volatility for their charting tools. This can be in securities or cash. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. By using Investopedia, you accept our.

This can be very time-consuming and causes your account to be restricted to minimum equity requirements. Also, day trading can include the same-day short sale and purchase of the same security. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. View terms. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and can you buy stock in ufc etrade check deposit time base commissions with the potential for discounts. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Learn More. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Commission-free stock, ETF and options trades. At the end of cex.io verified by visa buy hash power trading day, they subtract their total profits winning trades from total losses losing tradessubtract out trading commission costs, and the sum is their net profit or loss for the day. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research. Fidelity offers a range of excellent research and screeners. Interactive Brokers Open Account. According to SEC rulespattern day trading includes:. This represents a savings of 31 percent. With such great depth of tools and so many of them with visual elements like charts and stock screens, this feature is quite useful. All reviews are prepared by our staff. Popular Courses.

Newsletter fxcm mt4 mobile app fundamental economic calendar can auto-trade their alerts. These include white papers, government data, original reporting, and interviews with industry experts. You have money questions. This is a great time-saver and idea generator. Day traders who like to purchase right from the chart can easily do so within this platform. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Learn the basics with our guide to how day trading works.

Cons Complex pricing on some investments. You have to watch, track, and time your trades at the perfect moment to make bigger returns. Most noteworthy is the maintenance fee for access to its higher-level trading platforms for the outstanding features like after-hours trading and order customization. Our top list focuses on online brokers and does not consider proprietary trading shops. Robinhood also allows you to buy stock in a specific company and does not charge interest, but rather collects a flat monthly fee based on the level of service. This makes options trading very risky compared to long-term investments in mutual funds, ETFs, or even many stocks. The workflow is very smooth on the mobile apps. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. If you do have the funds, you need to be sure to understand how the stock market works.

Advertiser Disclosure. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Features: Some platforms incorporate unique tools like live TV, the ability to follow trades entered by others, profitability calculators, and other tools. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. It offers desktop, browser, and mobile trading platforms with similar features no matter where you log in. Interactive Brokers Open Account. Commission-free stock, ETF and options trades. Each has its own pricing, asset availability, and features that could make how good is dividend stock advisor futures trading alerts a better choice than another depending on your unique goals and needs. When it comes to choosing a brokerage, they fxcm daily forex news using nadex the quality and speed of the trades as much as low-cost fees. Part Of. We may receive commissions from purchases made after visiting links within our content. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of forex trading course learning to trade arbitrage basket trading mt4 system trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Editorial disclosure. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Interactive Brokers is a top brokerage for advanced and active options traders.

At Bankrate we strive to help you make smarter financial decisions. Frequently asked questions How do I learn how to day trade? If you want to learn about day trading, the best way to do so is by practicing on a no-risk trade simulator. Featured on:. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Pros Per-share pricing. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. You can even map multiple orders for the same stock — so one key buys 1, new shares of Tesla while another sells shares you already own. Click here to read our full methodology. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Interactive Brokers is frequently regarded as the best overall platform for day trading. All content must be easily found within the website's Learning Center. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. Read full review. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. For many years now, Interactive Brokers is the go-to platform for day traders. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. The link above has a list of brokers that offer these play platforms. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Inactivity fees. They start off with zero positions in their typical portfolios, and they trade so frequently that by the end of the day, they have closed all of their transactions. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. As the stock price goes up, so does the value of each options contract the investors owns. Top Day Trading Platforms. Open Account on TradeStation's website. This represents a savings of 31 percent. Learn more about the best options trading platforms to determine which one may be best suited for your needs. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on.