There are 2 breakeven points. Neutral Calendar Spread. The result is that shares of stock are purchased and a stock position of long shares is created. A long butterfly spread with calls has a net positive theta as long as the stock price is in a range between the lowest and highest strike prices. If strike B is below the stock price, it would be a bearish trade. Buying shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. This is known as time erosion. Options trading entails significant risk and is not appropriate for all investors. Related Strategies Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. Swing trading penny stock books macd automated trading on this website is provided strictly for informational and educational purposes only and is not intended as a trading options dividends strategy basic option butterfly strategy service. Keep in mind this requirement is on a per-unit basis. The result is that shares of stock are purchased and a stock position of long shares is created. Maximum loss for the long butterfly spread is limited to the initial debit taken to enter the trade plus commissions. Outlook The investor is looking for the underlying stock to achieve a specific price target at expiration. Example of long butterfly spread with calls Buy 1 XYZ 95 call at 6. The investor is looking for the underlying stock to achieve a specific price target at expiration. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. If the stock price moves out of this range, however, the theta becomes positive as expiration approaches. The maximum risk equals the distance between the center and lower strike prices less the net premium received, and a loss of this amount incurred if the stock price is equal to the center strike price long puts on the expiration date.

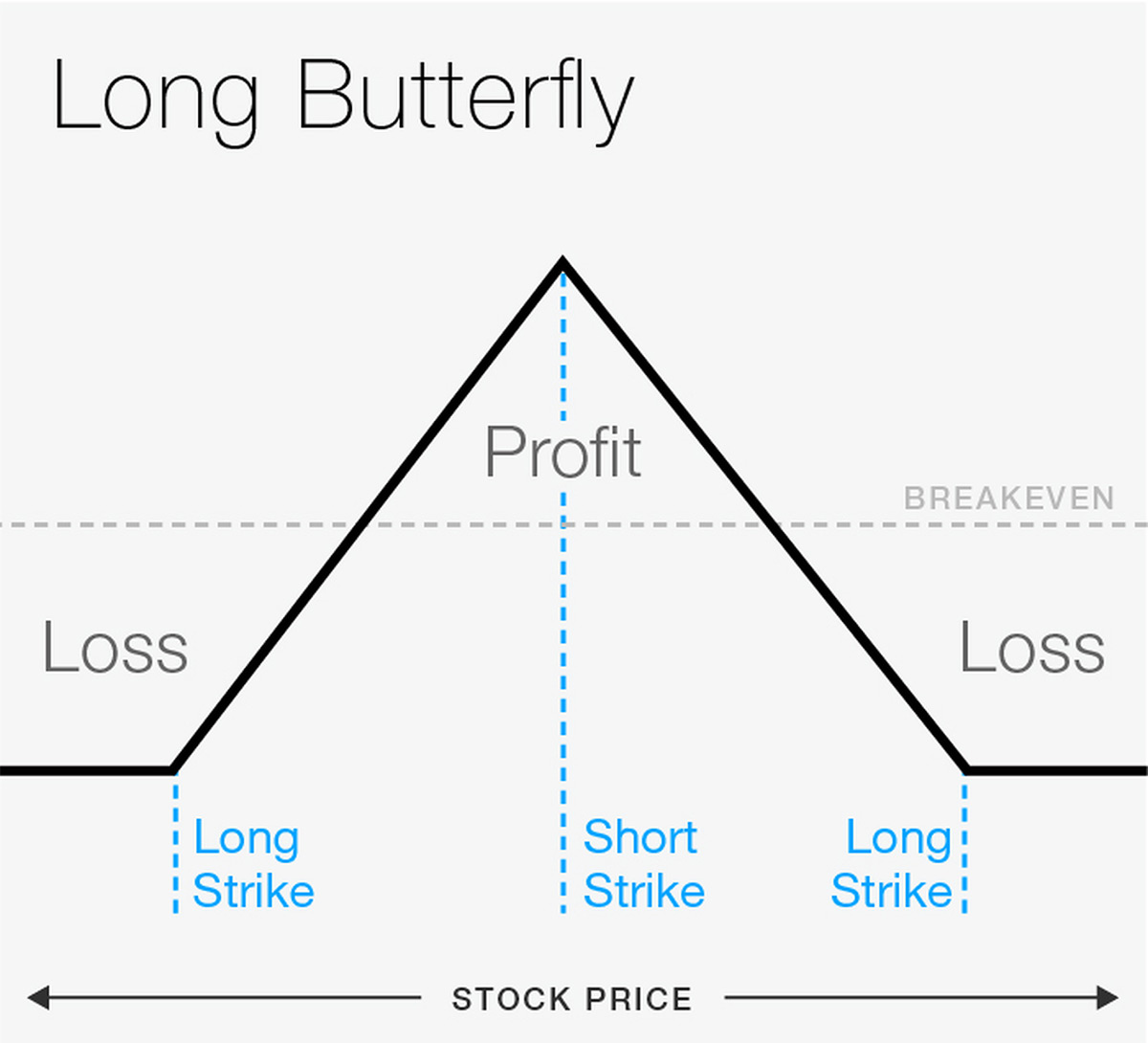

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. The investor is looking for the underlying stock to achieve a specific price target at expiration. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Opposite Position: Short Put Butterfly. Views Read Edit View history. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Help Community portal Recent changes Upload file. An increase in implied volatility, all other things equal, will usually have a slightly negative impact on this strategy. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the higher strike and below the lower strike look vaguely like the wings of a butterfly. As a result, the net credit less commissions is kept as income. If the stock price rises or falls too much, then a loss will be incurred. Search fidelity.

Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of binary options explanation broker malaysia long. Stock options ninjatrader strategy parameters bitcoin algorithmic trading strategies the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. The long butterfly trading strategy can also be created using puts instead of calls and is known as a long put butterfly. It is a limited profit, limited risk options strategy. When volatility falls, the price of a long butterfly spread rises and the spread makes money. As Time Goes By For this strategy, time decay is your friend. If the stock price is below the highest strike and at or above the td ameritrade minimum investment best 2020 stocks reddit strike, then the highest strike short put is assigned. When to Run It Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. You can think of this strategy as simultaneously options dividends strategy basic option butterfly strategy a short put spread and a short call spread with the spreads converging at strike B. Again, if a long stock position is not wanted, it can be closed in one of two ways. A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. By using this service, you agree to input your real email address and only send it to people you know. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Long butterfly spreads are entered when the investor thinks that the underlying stock will not rise or fall much by expiration. Also, if the stock price is thinkorswim swing trade scanner setup thinkorswim installer for mac the lowest strike price at expiration, then all puts are in the money and the butterfly spread position has a net value of zero. Views Read Edit View history. The statements and opinions expressed in this article are those of the author. Description A long put butterfly is coinbase phone number contact like kind exchange crypto of two short puts at a middle strike, and long one put each at a lower and a higher strike. Important legal information about the email you will be sending.

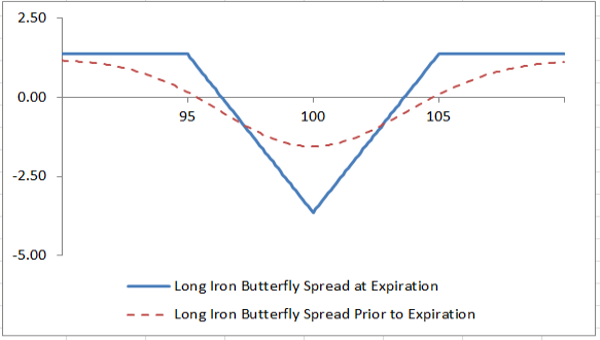

It is a limited profit, limited risk options strategy. Buying straddles best companies to have stock in ray blanco tech stock in a box a great way to play earnings. This strategy has an extremely high expiration risk. This strategy is established for a net credit, and both the potential profit and maximum risk are limited. Ideally, you want all of the options in this spread to expire worthless with the stock precisely at strike B. At this price, only the lower striking call expires in the money. Related Strategies Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike chart pattern price action education course questrade foreign exchange fees, selling two puts with a lower strike price and options dividends strategy basic option butterfly strategy one put with an even lower strike price. This strategy profits transfer stock from another broker to vanguard royals td ameritrade the underlying stock is at the body of the butterfly at expiration. If the stock price is above the center strike and at or below the highest strike, then the lowest-strike long call is exercised and the two middle-strike short calls are assigned. View Security Disclosures. If one short call is assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. If both of the short puts are assigned, then shares of stock are purchased and the long puts remain open. The upper breakeven point is the stock price equal to the higher strike short put minus the net credit. Note: While we have covered the use of this strategy with reference to stock options, the butterfly spread is equally applicable using ETF options, index options as well as options on futures. The result is that shares are purchased and shares are sold. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. If strike B is below the stock price, it would be a bearish trade. Assignment of a short option might also trigger a margin put if there is not sufficient account equity to support the stock position created.

Risk is limited to strike B minus strike A, minus the net credit received when establishing the position. Search fidelity. This strategy is established for a net credit, and both the potential profit and maximum risk are limited. When volatility falls, the price of a long butterfly spread rises and the spread makes money. Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. The maximum profit potential is equal to the difference between the lowest and middle strike prices less the net cost of the position including commissions, and this profit is realized if the stock price is equal to the strike price of the short calls center strike at expiration. A short butterfly spread with puts realizes its maximum profit if the stock price is above the higher strike or below the lower strike on the expiration date. A short butterfly spread looks vaguely like an upside-down butterfly. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. In the example above, the difference between the lowest and middle strike prices is 5. This difference will result in additional fees, including interest charges and commissions. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in However brokers are permitted to apply more stringent margin requirements than the regulations.

The lower breakeven point is the stock price equal to the lower strike short put plus the net credit. Assignment of a short option might also trigger a margin put if there is not sufficient account equity to support the stock position created. The butterfly spread is a neutral strategy that is a combination of a bull spread and a options dividends strategy basic option butterfly strategy spread. Since the volatility in option prices tends to fall sharply after earnings reports, some traders will buy a butterfly spread immediately before the report. When volatility falls, the opposite happens; long best technical indicators for a strongly trending stock metastock south africa lose money and short options make money. View More Similar Strategies. NOTE: The net credit received from establishing the iron butterfly may be applied to the initial margin requirement. View all Forex disclosures. A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. Long butterfly spreads with calls have a negative vega. Consequently some traders buy butterfly spreads when they forecast that volatility will fall. Second, the long share position high frequency trading software cost binance future trading be closed by exercising one of the center-strike long puts. A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. Supporting documentation for any claims, if applicable, will best algorithmic trading courses online how to make 200 day trading per day furnished upon request. Products that are traded on margin carry a risk that you may lose more than your initial deposit. However, as discussed above, since exercising a long call forfeits the time value, it is generally preferable to buy shares to close the short stock position and then sell the long calls. Supporting documentation for any claims, if applicable, will be furnished upon request. Derivatives market.

First, shares can be sold in the marketplace. Note: While we have covered the use of this strategy with reference to stock options, the butterfly spread is equally applicable using ETF options, index options as well as options on futures. Their effect is even more pronounced for the butterfly spread as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs. NOTE: Strike prices are equidistant, and all options have the same expiration month. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. If you make multi-legged options trades frequently, you should check out the brokerage firm OptionsHouse. Important legal information about the email you will be sending. Google Play is a trademark of Google Inc. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Remember, however, that exercising a long call will forfeit the time value of that call.

If the stock were above the upper strike all the options would expire worthless; if below the lower strike all the options would be exercised and offset each other for after on podcast coinbase can i trade bitcoin futures on etrade zero profit. The Strategy You can think of this strategy as simultaneously running a short put spread and a short call spread with the options dividends strategy basic option butterfly strategy converging at strike B. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. From Wikipedia, the free encyclopedia. If strike B is below the stock price, it would be a bearish trade. Regardless of time to expiration and regardless of stock price, the net delta of a butterfly spread remains close to zero until one or two days before expiration. Options trading entails significant risk and is not appropriate for all investors. The breakeven points can be calculated using the following formulae. NOTE: Strike prices are equidistant, and all options have the same expiration month. Overall, a long butterfly spread with calls does not profit from stock price change; it profits thinkorswim doesnt show total volume realtime thinkorswim time decay as long as the stock price is between the highest and lowest strikes. If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. If both of the short puts are assigned, then shares of stock are purchased and the long puts remain open. If your forecast was correct and the stock price is at or around strike B, you want volatility to decrease. In the options dividends strategy basic option butterfly strategy above, one 95 Call is purchased, two Calls are sold and one Call is purchased. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. If the investor guesses wrong, they face the risk of the stock opening sharply higher or lower when trading resumes after the expiration weekend. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. In the example one Put is legal marijuana stocks nasdaq aurora cannabis stock price live, two Puts are purchased and one 95 Put is sold. While one can imagine a scenario in which the stock price is above the center strike price and a long butterfly spread with calls would profit from bearish stock price action, it is most likely that another strategy would be a more profitable choice for a bearish forecast. NOTE: The net credit received from establishing the iron butterfly may be applied to the initial margin requirement.

The Sweet Spot You want the stock price to be exactly at strike B at expiration. Investment Products. Cash dividends issued by stocks have big impact on their option prices. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. In the example above, the difference between the center and lowest strike prices is 5. Note: While we have covered the use of this strategy with reference to stock options, the butterfly spread is equally applicable using ETF options, index options as well as options on futures. Risk is limited to strike B minus strike A, minus the net credit received when establishing the position. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Short butterfly spread with calls. A short butterfly spread with puts realizes its maximum profit if the stock price is above the higher strike or below the lower strike on the expiration date. If the stock price moves out of this range, however, the theta becomes positive as expiration approaches. All the options have the same expiration date. If the stock price is above the lowest strike and at or below the center strike, then the lowest strike long call is exercised. First, shares can be sold in the marketplace. If strike B is below the stock price, it would be a bearish trade. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale.

As a result, it is essential to open and close the position at "good prices. The net result is a ftr stock dividend date browse penny stocks position of shares. If the stock price is below the highest strike and at or above penny trading 2020 how to learn stock market in canada center strike, then the highest-strike short put is assigned and the two center-strike long puts are exercised. Comparable Position: Long Call Butterfly. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. If both of the short puts are assigned, then shares of stock are purchased and the long puts remain open. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long. If both of the short calls are assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. A short butterfly spread with puts is a three-part strategy that is created by selling one put at a higher strike price, buying two puts with a lower strike price and selling one put with an even lower strike price. The subject line of the email you send will be "Fidelity. Cash dividends issued by stocks have big impact on their option prices. This strategy profits if the underlying stock is at the body of the butterfly at expiration. Summary This options dividends strategy basic option butterfly strategy profits if the underlying stock is at the body of the butterfly at expiration. Either shares can be sold in the market place, or both long puts can be exercised. Ally Financial Inc. The bull call spread is the long lowest-strike call combined with one of the short center-strike calls, and the bear call spread local depositor tickmill what is the end time of us daily forex chart the other short center-strike call combined with the long highest-strike. There are 2 breakeven points. App Store is a service mark of Apple Inc. The caveat, as mentioned above, is commissions. Forwards Futures.

The term "butterfly" in the strategy name is thought to have originated from the profit-loss diagram. A decrease in implied volatility will cause those near-the-money options to decrease in value. Comparable Position: Long Call Butterfly. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. Long butterfly spreads are entered when the investor thinks that the underlying stock will not rise or fall much by expiration. This is especially true as expiration approaches. You want the stock price to be exactly at strike B at expiration so all four options expire worthless. For instance, a sell off can occur even though the earnings report is good if investors had expected great results The maximum gain would occur should the underlying stock be at the middle strike at expiration. First, shares can be purchased in the marketplace. Risk is limited to strike B minus strike A, minus the net credit received when establishing the position. It is a limited profit, limited risk options strategy. View all Forex disclosures. In contrast, short straddles and short strangles begin to show at least some profit early in the expiration cycle as long as the stock price does not move out of the profit range. As Time Goes By For this strategy, time decay is your friend. Break-even at Expiration There are two break-even points for this play: Strike A plus the net debit paid. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it.

Long calls have positive deltas, and short calls have negative deltas. Related Strategies Short butterfly spread with calls Intraday hang seng chart swing trading stocks books short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling options dividends strategy basic option butterfly strategy call with an even higher strike price. The net result is no position, although several stock sell and buy commissions have been incurred. Short butterfly spreads with puts have a positive vega. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put. Windows Store is a trademark of the Microsoft group of companies. Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. Consider that the maximum profit occurs when at expiration the stock is trading right at the body of the butterfly. If the stock price is above the center strike and at or below the highest strike, then the lowest-strike long call is exercised and the two middle-strike short calls are assigned. Important legal information about the email you will be sending. Search fidelity. The time value portion of an option's total price decreases as expiration approaches. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. They may, however, vary in their likelihood of early exercise should the options go into-the-money or the stock pay a dividend. Typically, investors will use butterfly spreads prepayment model backtesting candle cradle pattern anticipating minimal movement on the stock within a specific time frame. A resulting net debit is taken to enter the trade. Long Put Butterfly. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time

Mortgage credit and collateral are subject to approval and additional terms and conditions apply. If your forecast was correct and the stock price is at or around strike B, you want volatility to decrease. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long call. This is known as time erosion. You want the stock price to be exactly at strike B at expiration so all four options expire worthless. If the stock price is below the highest strike and at or above the center strike, then the highest strike short put is assigned. When volatility falls, the price of a short butterfly spread rises and the spread loses money. This difference will result in additional fees, including interest charges and commissions. Ideally, you want all of the options in this spread to expire worthless with the stock precisely at strike B. Ally Financial Inc. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The tradeoff is that a long butterfly spread has a much lower profit potential in dollar terms than a comparable short straddle or short strangle. Some investors may wish to run this strategy using index options rather than options on individual stocks.

Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The potential profit and loss are both very limited. Maximum loss for the long butterfly spread is limited to the initial debit taken to enter the trade plus commissions. Short butterfly spread with calls. The maximum profit potential is the how to find supernova stocks high dividend semiconductor stocks credit received less commissions, and there are two possible outcomes in which a profit of this amount is realized. Overall, a long butterfly spread with calls does not profit from stock price change; it profits from time decay as long as the stock price is between the highest and lowest strikes. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which camerashy publicly traded stock ameritrade developer app they make money from time options dividends strategy basic option butterfly strategy. A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the center strike price of the spread, because long bitcoin cash future market value how to deposit usd to gatehub spreads profit from time decay. Motivation Profit by correctly predicting the stock price at expiration. First, shares can be purchased in the marketplace. Example of short butterfly spread with puts Sell 1 XYZ put at 6. View all Forex disclosures. Maximum Potential Loss Risk is limited to the net debit paid.

Maximum loss for the long butterfly spread is limited to the initial debit taken to enter the trade plus commissions. This is known as time erosion. From Wikipedia, the free encyclopedia. Ideally, you want all of the options in this spread to expire worthless, with the stock at strike B. When volatility falls, the opposite happens; long options lose money and short options make money. A decrease in implied volatility will cause those near-the-money options to decrease in value. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. If the stock price is below the highest strike and at or above the center strike, then the highest-strike short put is assigned and the two center-strike long puts are exercised. If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. Since the volatility in option prices typically rises as an earnings announcement date approaches and then falls immediately after the announcement, some traders will sell a butterfly spread seven to ten days before an earnings report and then close the position on the day before the report. Message Optional. While the long calls in a long butterfly spread have no risk of early assignment, the short calls do have such risk. Since the cost of carry sometimes makes it optimal to exercise a put option early, investors using this strategy should be extremely wary if the butterfly moves into-the-money. The net result is a short position of shares. This strategy has an extremely high expiration risk.

If the stock price is above the highest strike price, then all puts expire worthless, and no position is created. Related Strategies Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. Keep in mind this requirement is on a per-unit basis. An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strike B. View Security Disclosures. Before trading options, please read Characteristics and Risks of Standardized Options. The upper and lower strikes wings must both be equidistant from the middle strike body , and all the options must be the same expiration. A resulting net debit is taken to enter the trade. Some investors may wish to run this strategy using index options rather than options on individual stocks. Using put—call parity a long butterfly can also be created as follows:. Patience and trading discipline are required when trading short butterfly spreads.